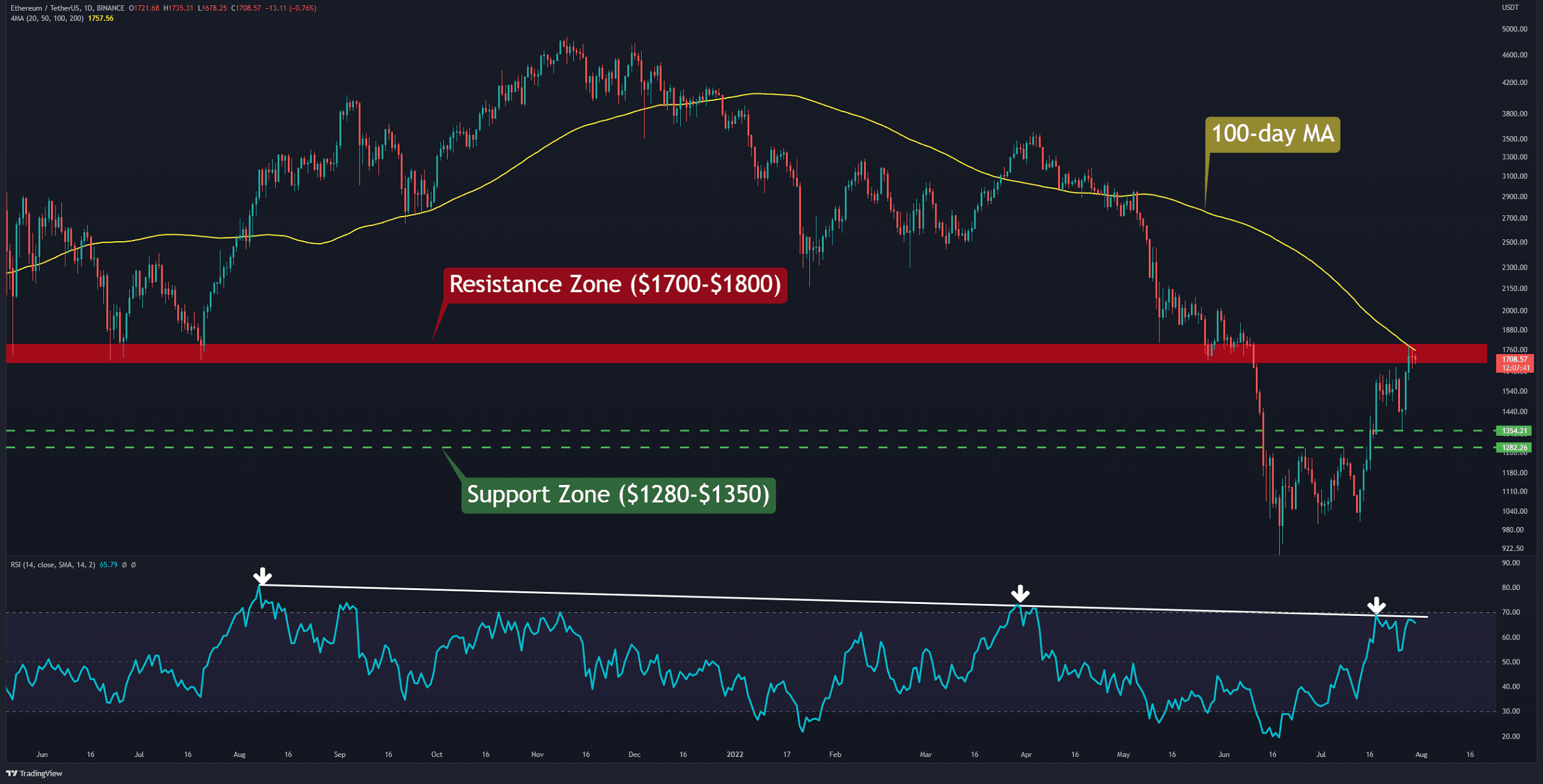

Ethereum saw a substantial 30% price increase over the past week. In the first attempt, after 50 days, the bulls could hit the overhead resistance zone in the range of $1,700 – $1,800 (in red).

At the same time, the Relative Strength Index (RSI) has reached a significant descending line (in white). If ETH can break above the 100-day moving average line (in yellow), ETH will extend the price action toward the key hurdle at $2170. In this case, the RSI is expected to gain momentum above 70.

On the other hand, if the bears push the price below $1,500, it is likely to see a retest of $1,350 because ETH’s previous rebound off this level makes it a critical support level to watch.

Key Support Levels: $1500 & $1350

Key Resistance Levels: $1800 & $2170

Daily Moving Averages:

MA20: $1448

MA50: $1279

MA100: $1757

MA200: $2344

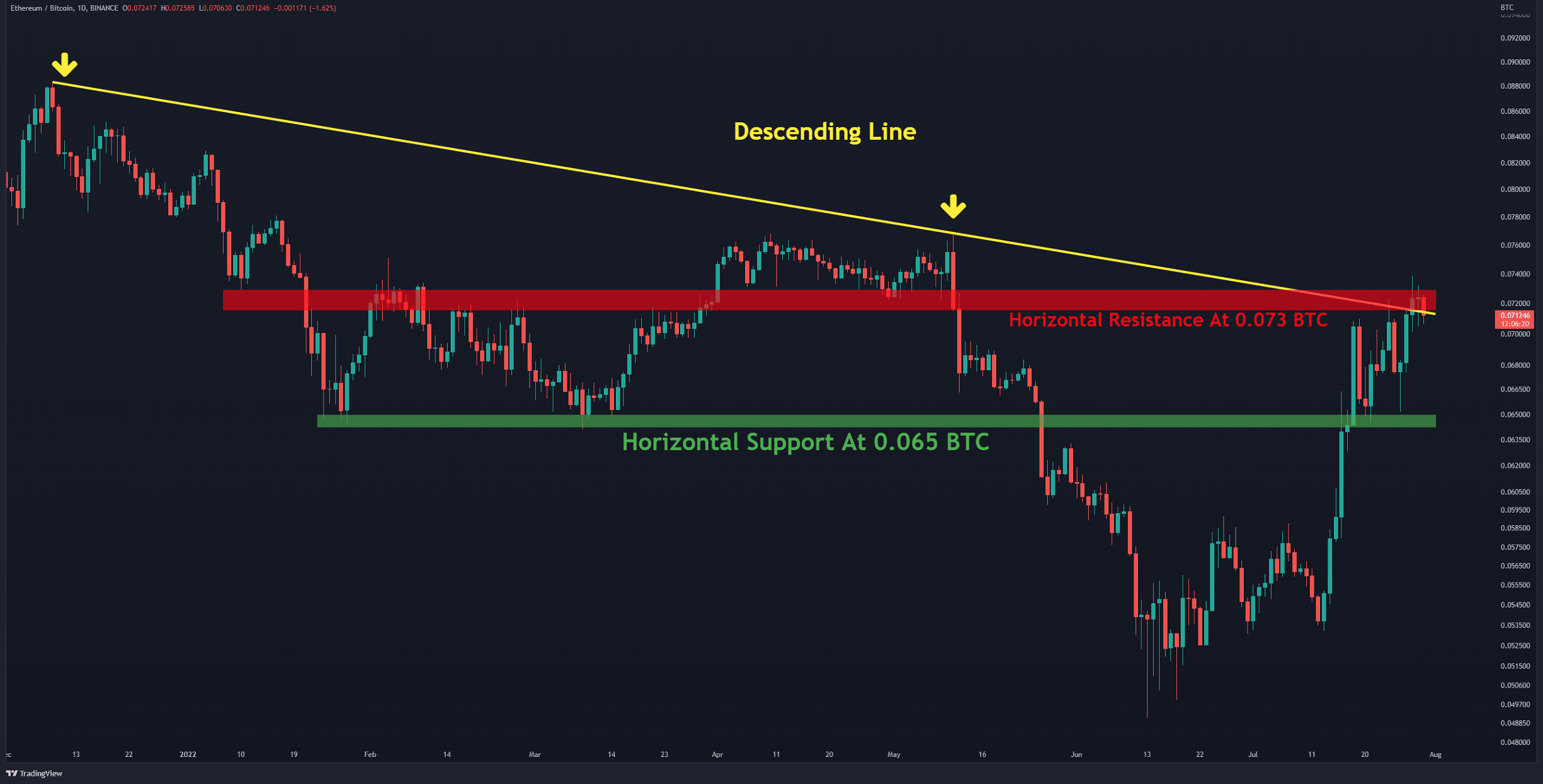

The ETH/BTC Chart:

Against Bitcoin, the bulls failed again to break the critical resistance zone at the descending line (in yellow) and the horizontal resistance at 0.073 BTC (in red).

This caused a fake breakout to appear in the chart for now. The current bullish momentum could sustain longer if the bulls defend the horizontal support at 0.065 and do not allow the price to close below it.

Key Support Levels: 0.065 & 0.06 BTC

Key Resistance Levels: 0.073 & 0.078 BTC

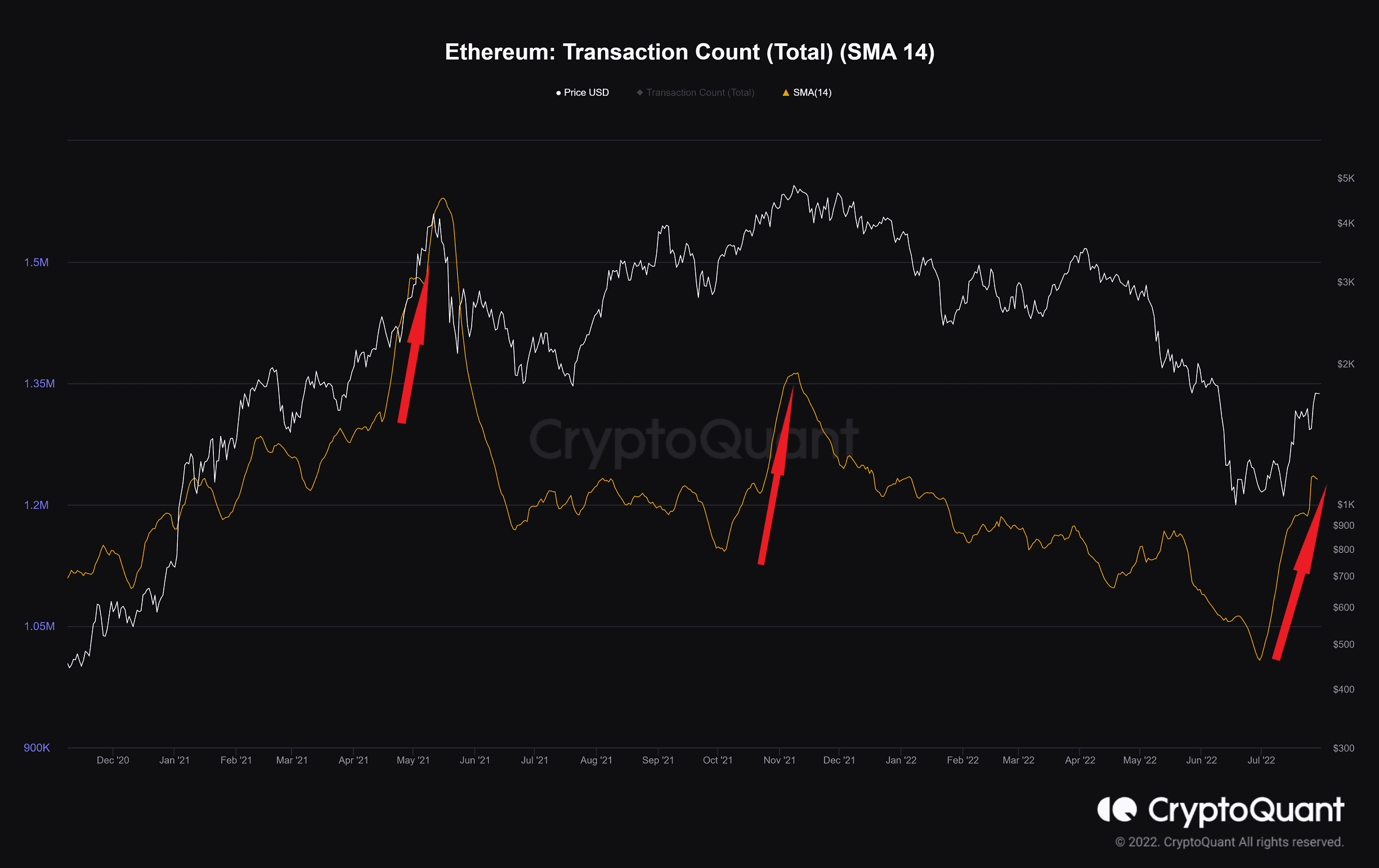

On-chain Analysis: Transaction Count (Total, SMA 14)

Definition: The total number of transactions where a transfer of tokens has been executed.

When the price increase is accompanied by an increase in the number of transactions on the network (on-chain activity), it is interpreted as a healthy trend.

However, the key is that the high slope in this metric has often occurred at the tops. It seems that Ethereum’s on-chain data has undergone many changes as the Merge event approaches. Considering the recession and macro situation, we must wait and see how crypto will cope.