Key Insights

- The bear market has not prevented BNB Chain from implementing core architectural solutions and strategies for expanding its ecosystem.

- During Q2, NFT markets, GameFi, and to some extent the Terra collapse, collectively brought more unique users to the BNB Chain ecosystem.

- The resulting user adoption and its deflationary fee-burning mechanism contributed to BNB Chain’s resilience and outperformance compared to its peer group during Q2.

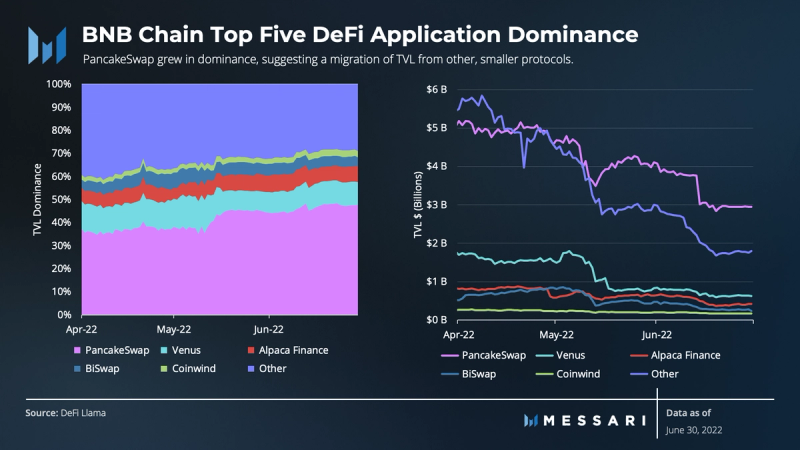

- An area of concern around the BNB Chain ecosystem is its concentration and dependence on PancakeSwap.

- BNB Smart Chain introduced more inactive validators (called “Candidates”) into the validator set over the quarter.

- BNB Chain will continue to invest in its ecosystem, develop its validator set, evolve its architecture, and deploy zk-rollups and sidechains over the coming months.

A Primer on BNB Chain

BNB Chain is a public, open-source blockchain that aims to deliver scalable smart contract support for decentralized applications. It seeks to accomplish this with a modular design and scaling solutions such as BNB ZkRolllup. The BNB Chain consists of a multichain framework — the BNB Smart Chain, the BNB Beacon Chain, and sidechains and rollups.

The Beacon Chain is the dedicated layer used for governance (staking and voting), and the BNB Smart Chain is the dedicated layer for Ethereum Virtual Machine (EVM) consensus and execution. The BNB Beacon Chain is primarily a trade matching engine for the Binance decentralized exchange (DEX) built on a peer-to-peer distributed system that utilizes Tendermint Byzantine Fault Tolerance (BFT) consensus. The BNB Smart Chain is based on a Proof of Staked Authority (PoSA) consensus mechanism and is powered by a network of 21 active validators. The BNB Sidechain framework is a recent development effort designed to create BNB Smart Chain-compatible sidechains. Plans also include the launch of zk-rollups for high-performance scaling, allowing sidechains to customize solutions.

As the first edition of quarterly coverage of BNB Chain, this report will highlight important developments over the prior year and the network’s most recent quarterly performance. A full appendix of data tables is available at the end of the report.

The Second Quarter Narrative

Following its explosive growth in 2021, the BNB Chain experienced continued growth in some areas but declines in others during Q1 2022. Volatility was prevalent across BNB Chain metrics as the bear market set in. Despite the market conditions, the network usage, financial performance, and network infrastructure stabilized by the first quarter’s end. While TVL declined across the DeFi ecosystem, BNB Chain’s growing NFT marketplace reached notable volumes, and the protocol began to see traction in the GameFi sector. As the first quarter came to a close, strategies to launch applications across several new sectors, including NFTs, GameFi, and Metaverse, were underway.

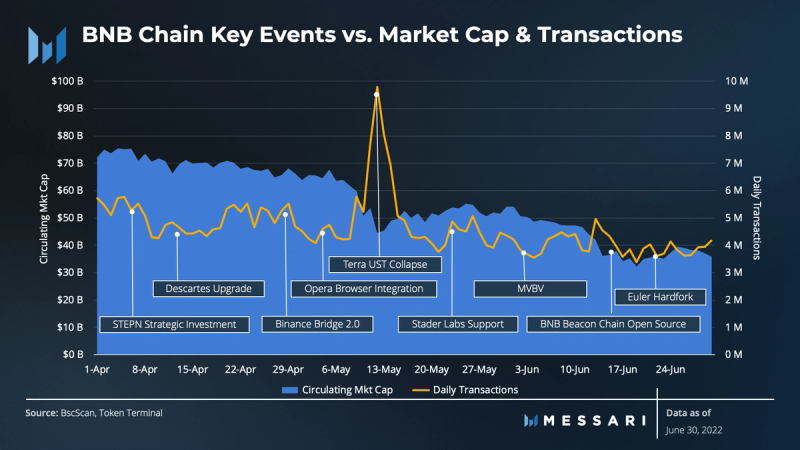

Q2, however, brought on a market-wide turmoil, and Layer-1 network activity declined dramatically across the space. Macro forces such as tightening monetary policy and the catastrophic collapse of the Terra ecosystem sent the market into freefall. BNB Chain and the rest of the space felt the impact of the calamity, as seen in the continued declines in financial and network usage metrics.

Ultimately, the bear market has not stopped BNB Chain from implementing core architectural solutions and strategies for expanding its ecosystem. In Q2, developers focused on enhancing the BNB Beacon Chain with the Descartes upgrade and furthering the liveness and robustness of the BNB Smart Chain with the Euler hard fork.

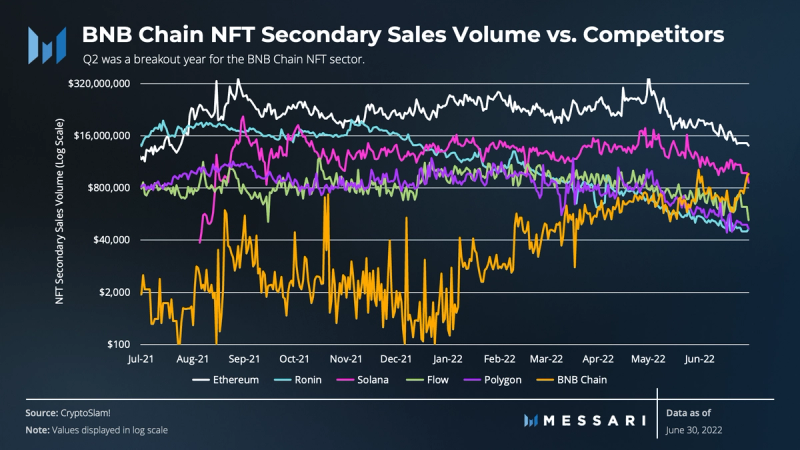

Unlike the lagging DeFi sector, Q2 was a breakout quarter for the BNB Chain NFT sector. Both NFT secondary sales volume and unique NFT buyers grew exponentially over the quarter. GameFi activity also continued its growth with the introduction of new GameFi applications. BNB Chain’s performance was also supported due to the increase in activity and new users during the Terra collapse.

Ultimately, DeFi, NFTs, GameFi, and to some extent the Terra collapse, collectively brought more unique users to the BNB Chain ecosystem. The resulting user adoption and its deflationary fee-burning mechanism contributed to BNB Chain’s resilience and outperformance of its peer group during Q2.

Performance Analysis

Network Overview

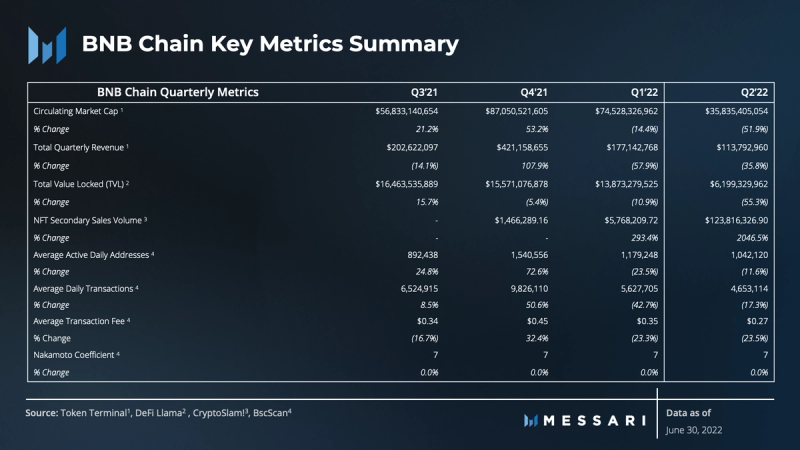

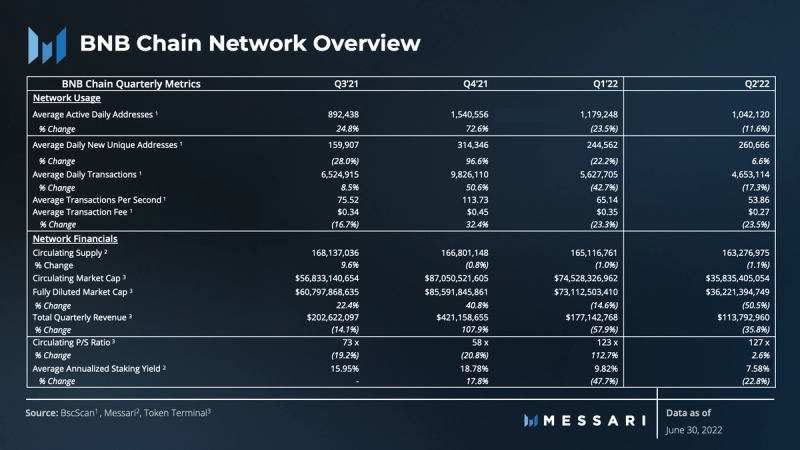

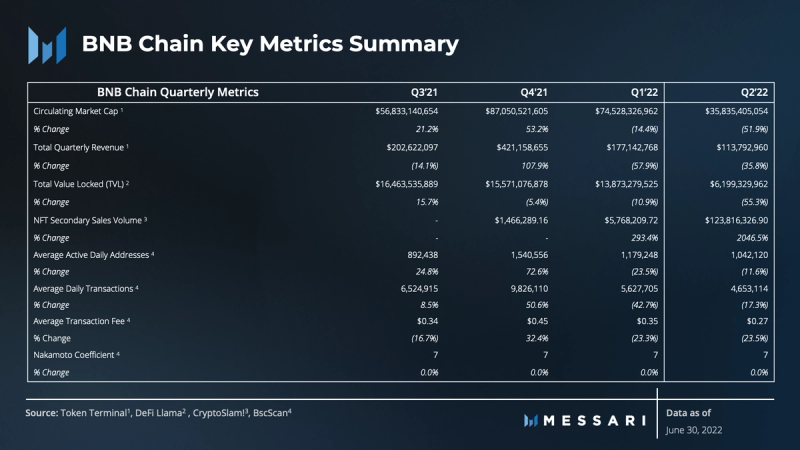

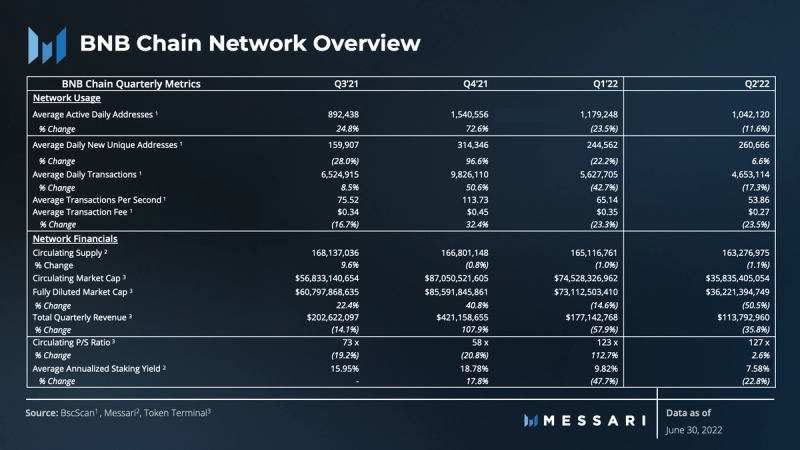

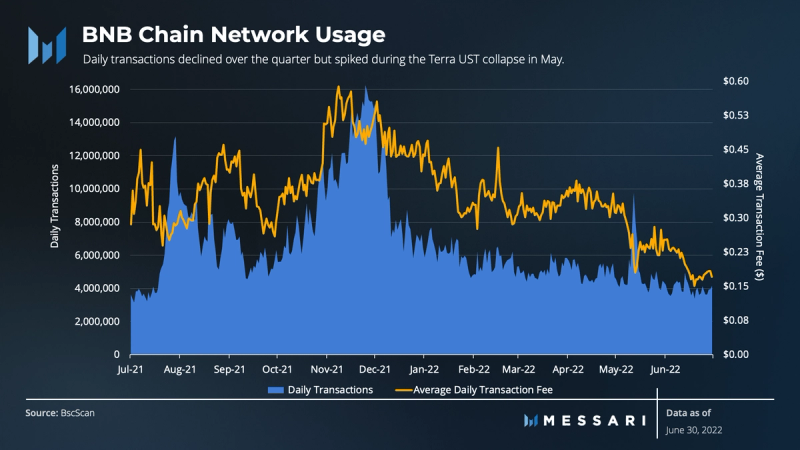

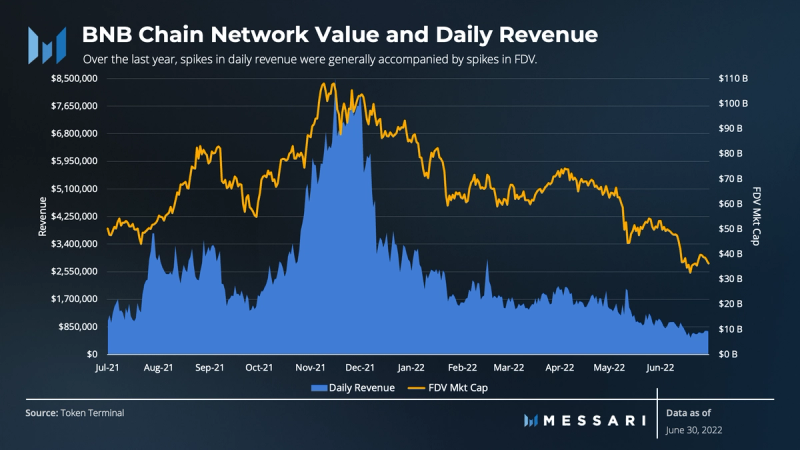

Despite all the new unique addresses, BNB Chain experienced declines in network usage and financial performance for the second consecutive quarter. While the market cap declined (-50.5%), the network did not experience as much of a decline in usage and revenue generation. Average daily transactions declined by 17.3%, while total revenue declined by 35.8%. Average transaction fees (-23.5%) declined in line with the decline in revenue. However, the price-to-sales (P/S) ratio stayed flat, with the ratio of price relative to revenue growing slightly from 123 to 127.

Another notable trend was the decline in the circulating supply of BNB. The BNB token has a deflationary burning mechanism that was recently upgraded. Initially, Binance used 20% of its quarterly profits to buy back and burn BNB, removing them from circulation. The quarterly burn was replaced with BNB Auto-Burn to provide greater transparency and predictability. By the end of June, over 36.8 million BNB had been burned since the burn program began in 2017. By the end of the burn function, 100 million BNB (i.e., 50% of the total supply) will be eliminated. Ultimately, the deflationary mechanism paired with transaction activity put upward pressure on the value of BNB and supported its value during a significant market-wide downturn over Q2.

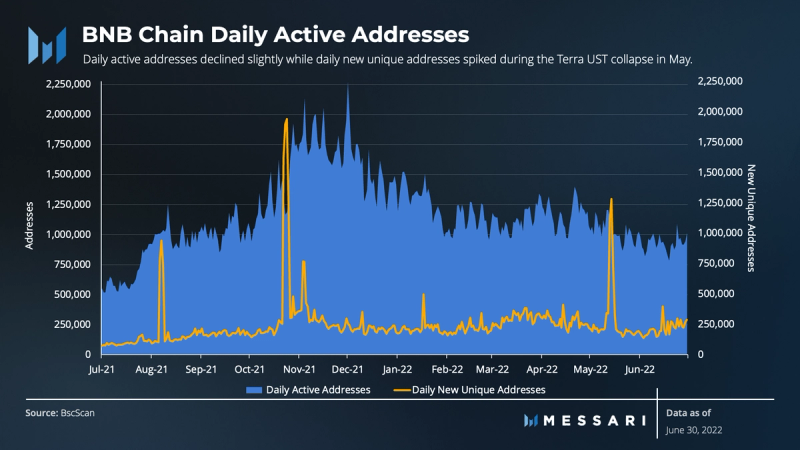

Daily active addresses slightly reversed course, with market sentiment driving address activity down from the all-time-highs seen at the end of the 2021 bull market. While on a downtrend over Q2, daily active addresses stabilized at an average of ~1 million per day during June. For perspective, this amount of address activity nearly doubles last year’s amount for the network.

Daily unique addresses are one of BNB Chain’s most outstanding metrics for the quarter. The average daily creation of new addresses over the quarter increased by 6.6%. Interestingly, the total quarterly increase was primarily due to an activity spike between May 11 and May 14. These dates coincide with Terra and UST’s collapse, likely suggesting that a notable number of Terra’s users migrated to BNB Chain.

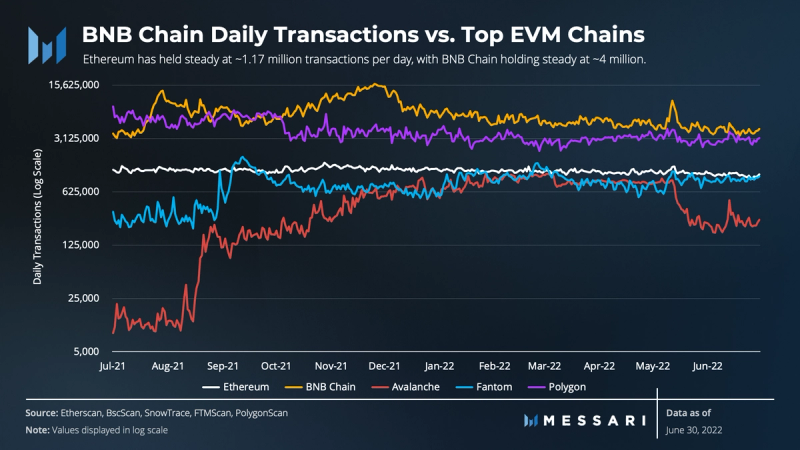

Similar to Q1, transaction activity on the network followed the pattern of daily active address activity. Overall, BNB Chain’s daily transactions also slightly reversed course. Despite a downward trend in Q2, daily transactions stabilized at around 4 million per day during June, similar to what the network processed one year ago.

Just like daily unique addresses, there was a spike in daily transactions between May 11 and May 14. This pattern supports the idea that users migrated from Terra to transact on BNB Chain. The spike also comes on the heels of the launch of Binance Bridge 2.0. The bridge may have allowed for more cross-chain bridging of assets on the Binance centralized exchange (CEX). The bridge may have made it easier for users to transact on the CEX during the middle of May.

The magnitude of unique addresses and transaction activity during May was much larger than what was seen on other networks. As reflected later in this report, BNB Chain experienced much more user activity during the middle of May compared to a peer group of top EVM chains. While other growth drivers, including NFT and GameFi activity, may have also contributed, Terra’s collapse appears to have positioned BNB Chain to outperform its peer group on several fronts.

BNB Chain burns a portion of transaction fees from the network’s circulating supply. Increasing scarcity creates value for all tokenholders rather than just compounding the balances of validators and delegators. Thus, while revenue may influence BNB Chain’s market value, the value of the token is supported by the burning mechanism.

The growth in daily transactions has generated more revenue and accrued more fundamental value to the network. Because fundamental usage and related metrics are such large factors in determining market value (i.e., network value), it is worth determining how statistically significant that relationship is.

Over the last year, spikes in daily revenue were generally accompanied by spikes in FDV. This correlation could indicate that the network is moving closer to fundamental value versus speculative value. If the relationship holds, revenue will significantly impact network value.

To that end, if BNB Chain technical and growth strategies succeed, fundamentals like transaction activity could improve, generating more fee burns and driving up network value.

Ecosystem & Developer Overview

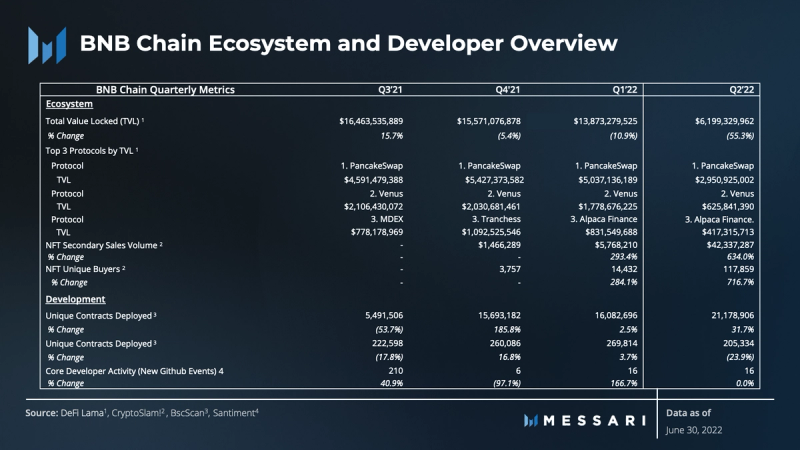

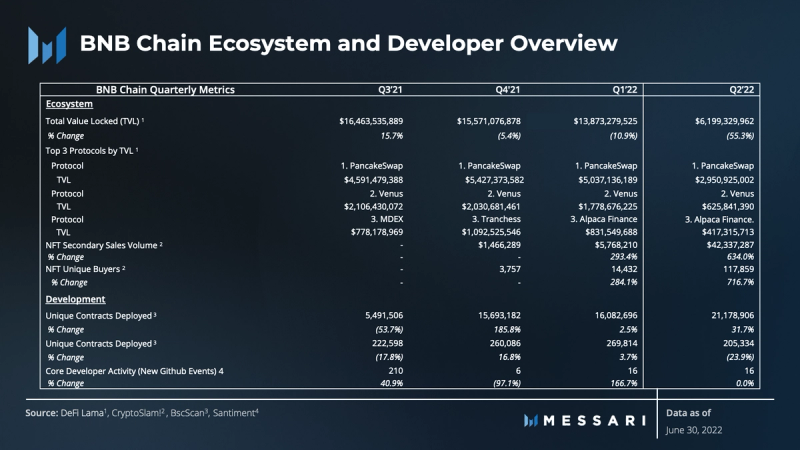

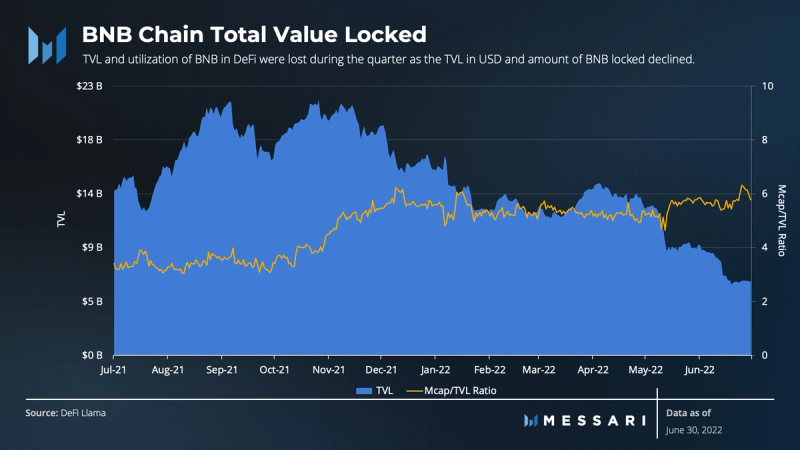

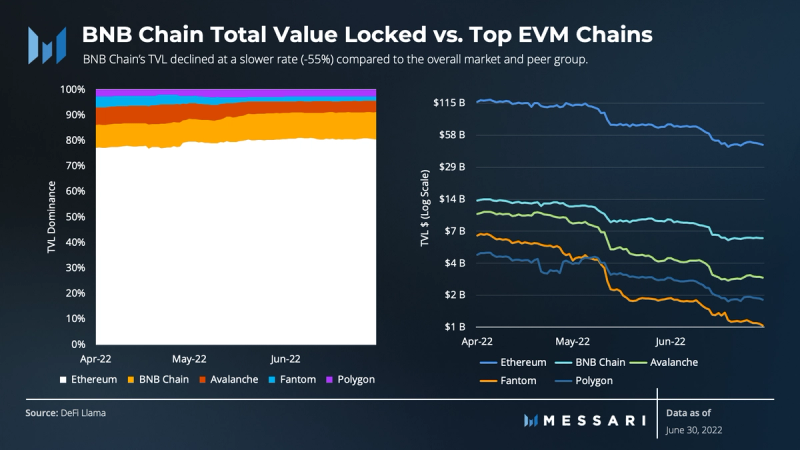

Despite ongoing investment programs, BNB Chain’s Q2 TVL fell roughly 55% in USD terms quarter-over-quarter (QoQ).

This downturn, however, was isolated to DeFi as BNB Chain’s nascent NFT and GameFi markets grew significantly QoQ. With massive increases in NFT secondary sales volume (634%) and unique NFT buyers (716%), BNB Chain NFT activity quickly grew to levels seen on popular chains like Solana and Flow.

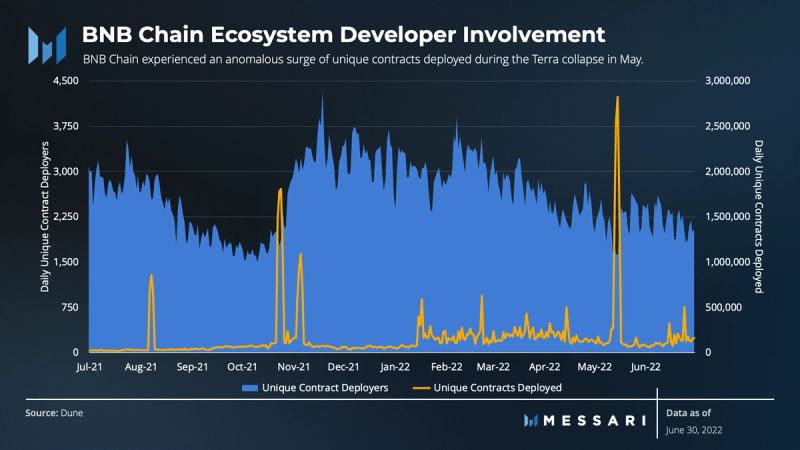

The total number of unique contracts deployed also bucked the downward trend, growing 31.7% over the quarter.

As TVL in USD decreased 55%, the amount of BNB locked in DeFi also decreased. The quarter began with ~14 million BNB locked in DeFi and finished with ~6 million, representing a ~55% decline. From this perspective, TVL and utility value were lost, and the decline in TVL stated in USD stayed in line with the decline in BNB price and the utilization of BNB locked in DeFi.

BNB Chain’s most prominent protocol, PancakeSwap, saw its TVL dip roughly in line with the entire BNB Chain DeFi ecosystem. At the same time, it grew in dominance, suggesting a migration of TVL from smaller protocols to PancakeSwap.

The BNB Chain ecosystem is heavily concentrated and dependent on PancakeSwap. Roughly 50% of BNB Chain’s DeFi TVL is in a single application. If PancakeSwap were to collapse due to an exploit or technical breakdown, it would significantly impact the BNB Chain ecosystem. In contrast, the “other” smaller protocols on Solana make up ~50% of the TVL across its ecosystem. The greater level of diversified TVL suggests a healthy distribution across applications, resulting in a mitigated ecosystem risk.

To that end, the BNB Chain community continues to implement growth strategies. The protocol has a $1 billion ecosystem fund to find, invest, and work with innovative projects in the DeFi space. The ecosystem continues to regularly launch DeFi protocols, as seen in Q2 launches like iZiSwap and Unbound Finance, and to make strategic investments in protocols like OpenLeverage.

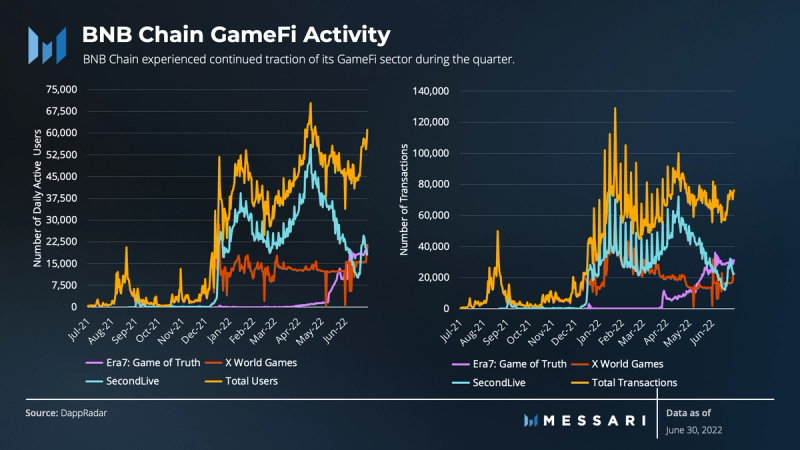

Q2 also marked the continued traction of BNB Chain’s GameFi sector. Recent gaming applications Era7: Game of Truth and X World Games experienced the most traction and stability over the quarter, according to the number of users and transactions.

Era7: Game of Truth, a metaverse-style trading card game (TCG), quickly grew to capture the most users over the quarter, growing from just a few hundred at the start of the quarter to over 20,000 users by the end. The total number of transactions and volume on the application followed a similar pattern.

X World Games has quickly become the fastest-growing crypto gaming platform in the BNB Chain ecosystem. It aims to usher traditional game developers into crypto by creating and providing the underlying blockchain framework to build on. The platform’s quarterly performance consisted of continued regular usage, growing its user base 70% over the quarter and 90% YTD.

Collectively, the top three GameFi applications on BNB Chain by the number of users and transactions have generated over 60,000 daily active users, up 35% QoQ. They also generated $14 million in volume, representing the total amount of incoming value to the application’s smart contracts. Unlike BNB Chain’s lagging DeFi sector, GameFi showed signs of strength during Q2.

Q2 developer activity in the BNB Chain ecosystem closely mirrors overall network activity. Here again, there was a massive, anomalous surge of unique contracts deployed in May (during the Terra collapse). The number of unique contracts deployed grew by 31.7% QoQ, while the number of unique contract deployers showed a considerable dropoff with a decline of 23.9%.

From May 13 to 17, there were 8.7 million contracts deployed. Roughly 8.4 million of those were deployed by the 1inch Chi Gastoken contract. Minting Chi Gastokens generated so many contracts because when the Gastokens are burned, the contracts self-destruct, which incurs a gas refund. Essentially, they “store” gas when fees are low, which resulted from declined market prices after Terra’s undoing. Ultimately, while many more new contracts were deployed over the quarter, they too were related to Terra’s downfall in May and were not the result of sustainable, fundamental developer activity.

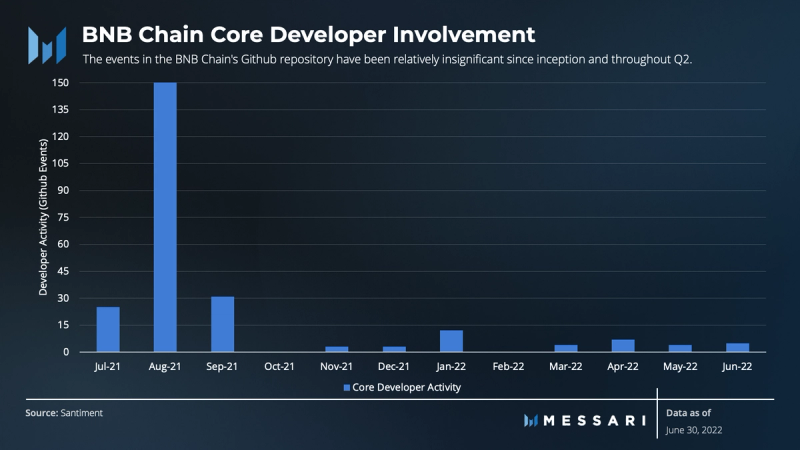

The events in BNB Chain’s GitHub repository have been relatively insignificant since inception and throughout Q2. However, the newly released technical roadmap includes core advancements that could change this trend in the future.

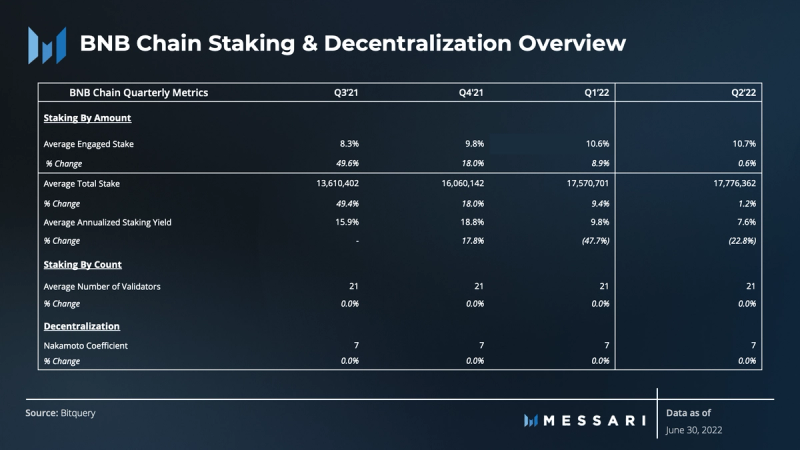

Staking and Decentralization Overview

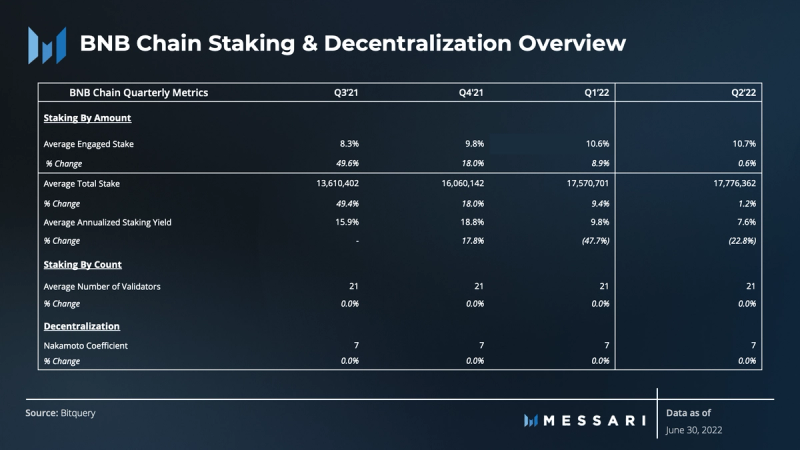

The security of staking networks like BNB Chain requires users to lock up the network’s native tokens and participate in validation duties. A distributed network of validators and active participants helps ensure the network functions as intended.

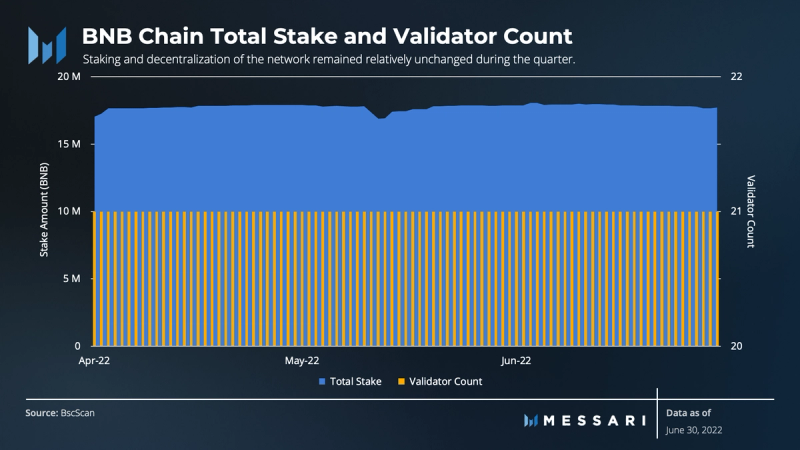

While the macroeconomic environment may have negatively impacted several BNB Chain metrics, the resulting volatility did not diminish the network’s stability. Staking and decentralization of the network remained relatively unchanged during the quarter.

The network infrastructure has remained steady with 21 active validators. Although BNB Chain’s level of decentralization has largely been criticized by much of the wider crypto community, the network has been able to process transactions quickly and cheaply with a smaller validator set.

Further, besides the 21 active validators, the BNB Smart Chain introduced more inactive validators (called “Candidates”) into the validator set over the quarter. This Euler hard fork was implemented to improve the network’s reliability and redundancy. Redundancy, in this case, means that 2 candidate validators and 19 active validators will be selected every hour to join the consensus.

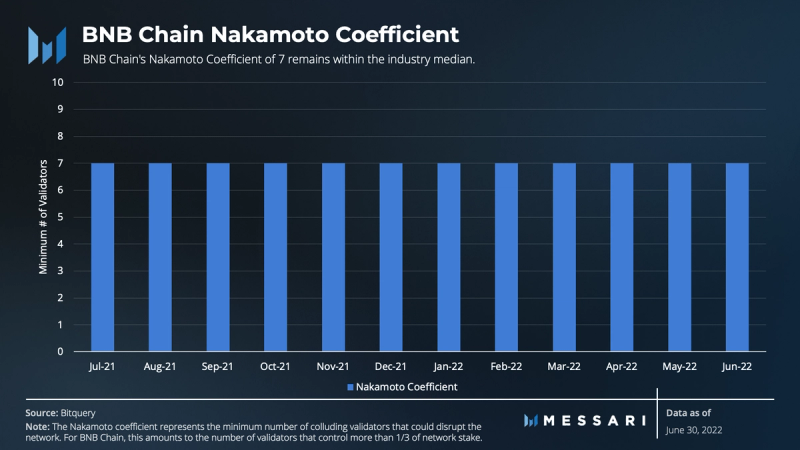

BNB Chain’s Nakamoto coefficient has been stable over the last year. Contrary to the prevailing belief, none of the network’s validators are run by Binance. The seven validators, including those run by independent third parties such as HashQuark and Certik, contribute to just under ~33% of the network’s total stake.

The criticisms about the small validator set require some context. BNB Chain is not an outlier concerning decentralization. BNB Chain’s Nakamoto coefficient of 7 is within the industry median. Nonetheless, BNB Chain is ensuring greater security and network reliability by expanding the validator set with the Euler hard fork.

Competitive Analysis

The Layer-1 smart contract sector has been competing for market share since the launch of viable Ethereum alternatives. The competition has led to different approaches to network architecture, strategies for going to market, and new use cases. Competitors are racing to be the fastest, cheapest, and most secure network while making a range of trade-offs due to the blockchain trilemma.

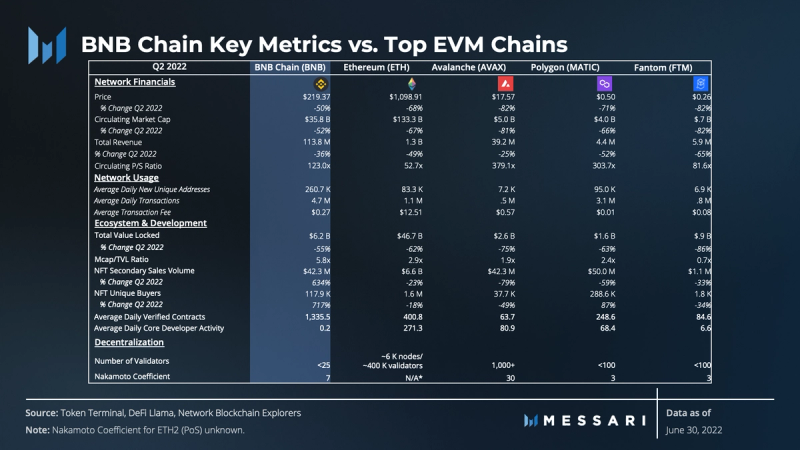

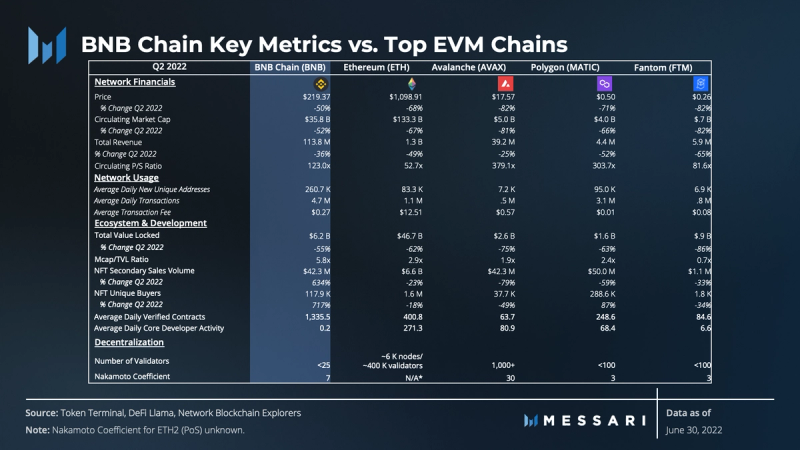

BNB Chain is an Ethereum alternative that has witnessed high growth since its inception. It has successfully maintained its position as one of the most valuable Layer-1 networks. Throughout Q2, BNB Chain’s key metrics held up compared to the top five EVM-compatible chains (including BNB Chain) by TVL and those with the largest number of DeFi protocols. This peer group was derived by simply grouping the EVM chains with the largest TVL and greatest number of DeFi protocols, seeing as today DeFi is the sector driving the majority of each network’s economic activity.

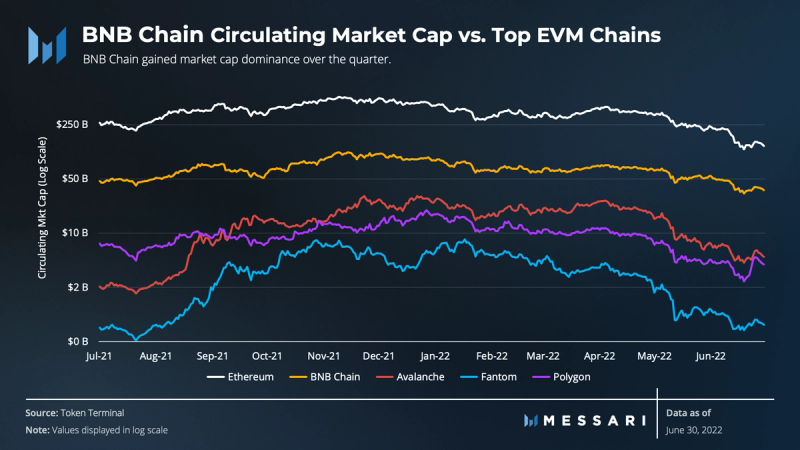

BNB Chain experienced the lowest decline in value in terms of market cap. As a result, BNB Chain gained market share over the quarter.

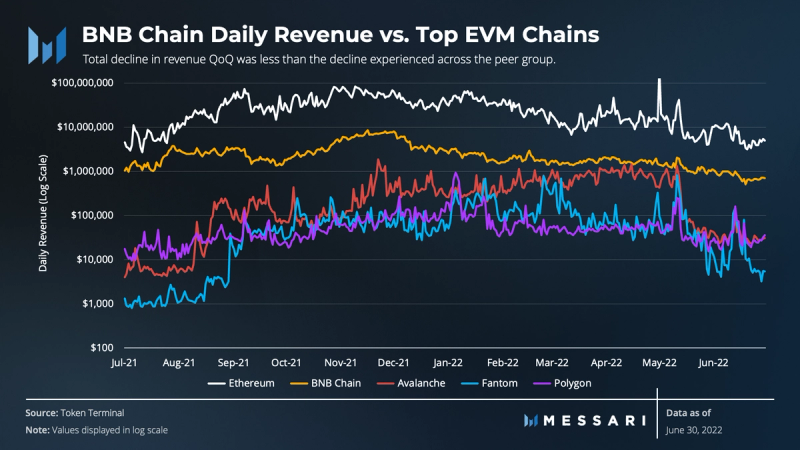

Similarly, BNB Chain’s daily revenue trended downward, though the total decline in revenue QoQ was less than the decline experienced across the peer group.

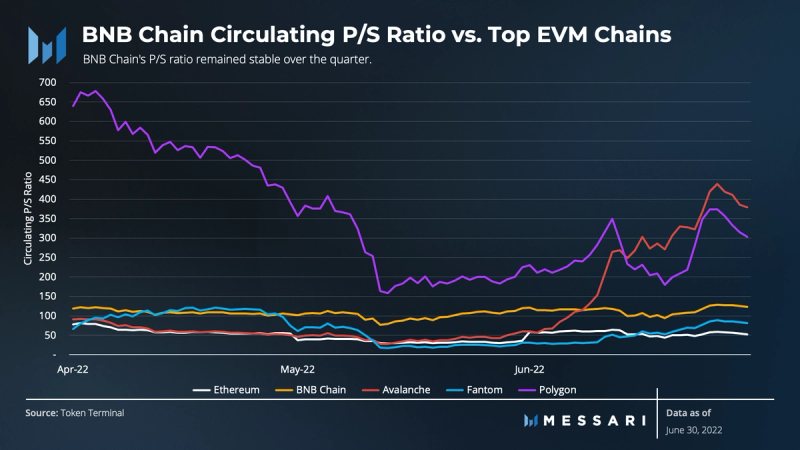

BNB Chain’s P/S ratio remained stable over the quarter, while other chains experienced mixed trends in this valuation metric. Polygon saw a material decline, while Avalanche increased significantly. On a relative basis, BNB Chain’s P/S ratio traded at a premium to Ethereum and Fantom but at a discount to Avalanche and Polygon.

BNB Chain has reached greater levels of daily transactions compared to Ethereum and Polygon. Ethereum has held steady at ~1.17 million transactions per day, with BNB Chain averaging ~4 million.

Q2 was a down quarter for the DeFi sector, which led to aggregate TVL decreasing from $228 billion to $75 billion, representing a 67% decline in USD terms. BNB Chain’s TVL declined at a slower rate (-55%) compared to the overall market and peer group. Some portion of BNB Chain’s decline in TVL may have come from its exposure to terraUSD and the interruption of Wormhole and Terra transfers.

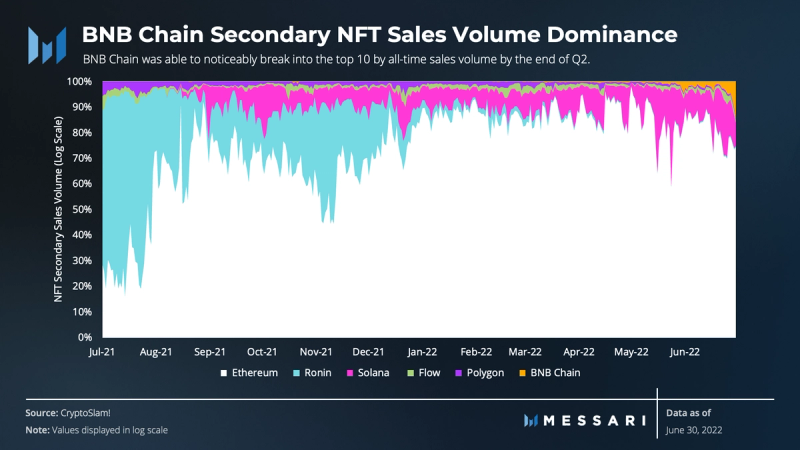

Unlike the lagging DeFi sector, 2022 has been a breakout year for the BNB Chain NFT sector. Both NFT secondary sales volume and unique NFT buyers have grown exponentially. BNB Chain has established a strong position relative to a peer group of the top five L1s by secondary NFT sales volume. It quickly surpassed Ronin, Flow, and Polygon in terms of daily sales volume during Q2. BNB Chain’s path to attracting unique buyers followed the same pattern as secondary sales.

Though Ethereum still dominates roughly 85% of the secondary NFT market, BNB Chain was able to noticeably capture sales volume at the end of Q2.

Compared to the peer group, BNB Chain outperformed across several financial, network, ecosystem, and development metrics over the quarter. As mentioned earlier, there was a noticeable spike in transaction count and revenue across each chain during the middle of May. The magnitude, however, appears to have been much more significant on BNB Chain. More transactions create more fees on BNB, boosting several key metrics. Factoring in the fee-burning mechanism with the spike in transactions, much of the outperformance in financial metrics may have come from the Terra collapse. Still, BNB Chain proved that its fundamentals were strong enough to attract users fleeing from Terra.

Qualitative Analysis

Key Events, Catalysts, and Strategies for Ecosystem Growth

Although BNB Chain outperformed its peer group, the network declined across most metrics, feeling the weight of the macroeconomic environment. While macro forces impacted many of BNB Chain’s metrics, expansion strategies were effective throughout Q2, and their success can be attributed to several key events, including:

- Binance Bridge 2.0

- Most Valuable Builder V (MVBV) Accelerator Program

- Several project launches and cross-chain integrations

- Technical advancements

- Continued developer campaigns and strategic investment

April 2022

The quarter began with the Descartes upgrade on mainnet. The hard fork included enhancements that reduce the block load by distributing only validator commission fees while storing all delegator rewards elsewhere. The reward distribution also seeks to be more efficient by adjusting an appropriate batch size to ensure the process can finish more quickly.

At the same time, Binance Labs announced its strategic investment in STEPN. STEPN is a Web3 move-and-earn app with GameFi and SocialFi elements. STEPN experienced significant growth during 2022, and by the middle of June, STEPN NFTs went live on Binance NFT Marketplace. At the same time, Corite, a crowdfunding platform for musicians, announced its partnership with Alan Walker and BNB Chain to utilize NFTs as a new mode for interacting with followers. The STEPN and Corite partnerships illustrate how BNB Chain continues to advance into new sectors emphasizing NFTs.

In addition to expanding BNB Chain’s footprint in the NFT space, user experience and cross-chain access improved. Binance Bridge 2.0 went live, supporting the bridging of assets on Binance.com. The bridge allows for the transfer of Ethereum-native tokens to BNB Chain and easier transfer from the CEX. The bridge should bring growth in the same way that other EVM Layer-1s acquire developers, users, and considerable market share from Ethereum-native token transfers. In addition to Binance Bridge 2.0, Celer Network partnered with BNB Chain to launch its Inter-chain Message SDK Framework, allowing developers to create cross-chain applications. The bridge and partnership with Celer are examples of BNB Chain’s cross-chain growth strategy.

Lastly, the Revelation Hackathon began its 50-day campaign to invest $10 million in bounties and projects across several categories, including DeFi, GameFi, NFT, and the metaverse. The winners were subsequently announced at the Revelation Summit in May.

May 2022

May followed with a slew of project launches and integrations. Opera Browser enabled its 350 million users to access BNB Chain-based applications on Android, iOS, and desktop versions of its browser. Liquid staking service provider Stader Labs also announced its support for BNB Chain. Stader Labs began its multichain staking service with Terra and has since supported other chains with the most recent being BNB Chain.

On the DeFi front, iZiSwap went live on BNB. iZiSwap is an enhanced DEX presented by iZUMi Finance, a multichain DeFi protocol offering Liquidity as a Service (LaaS). Unbound Finance, a yield optimization platform, announced its launch on BNB Chain. Both launches signal the expansion into DeFi and the potential for greater distribution of TVL beyond PancakeSwap.

May was rounded off with the BNB Revelation Summit. Recipients of the $10 million investment included InsureAce, Aquari, zkpayroll, Ark Rivals, Cryptosat, and Zecrey Protocol.

June 2022

The quarter came to a close with the launch of additional growth strategies and significant technological developments. BNB Chain announced the MVB V Accelerator Program to help projects develop working products. The program is a BNB-focused accelerator program between BNB Chain and Binance Labs. Incubation was set for July with a 6–8 week timeline.

Three sidechain pilot projects went under development during Q2: Cube, a metaverse-focused application; Project Galaxy, which is focused on bringing credentials to the blockchain; and Meta Apes, a gaming application. Each project began development and joined the Sidechain Framework (BAS) project as a partner.

Furthermore, the Republic of Palau will utilize BNB Chain to issue non-fungible tokens (NFTs) as identification cards to its digital residents. The NFT ID cards will include Know Your Customer (KYC) functions, access to digital banking, and verified on-chain signatures, allowing access to government-required services.

On the technical front, BNB Chain open-sourced the BNB Beacon Chain alongside the Binance decentralized exchange (DEX). It also opened its validator set, inviting external parties to become validators and play an essential role in governance. Finally, the Euler hard fork was activated on mainnet. It introduced the candidate validators onto the BNB Smart Chain to improve the reliability of the network.

Ecosystem Challenges

Q2 did not present any adverse outcomes stemming from technical challenges. BNB Chain successfully integrated the Binance Bridge 2.0, Descartes upgrade, and Euler hard fork. It also began piloting various BNB Sidechains.

In early June, Bloomberg reported that the SEC is investigating whether the BNB token is an unregistered security. As part of CoinDesk’s Consensus 2022 panel, CZ claimed that Binance regularly responds to questions from the SEC and that it meets with the agency regularly. It is important to note that the BNB Chain is a public blockchain separate from Binance. Although there are no confirmed legal proceedings, there may be regulatory risks and challenges ahead regarding the BNB token.

Aside from regulatory questions, the biggest challenge may be executing plans for BNB ZkRolllup. BNB ZkRolllup is a SNARK-based system that can prove the validity of transactions on a rollup blockchain that inherits security from the underlying BNB Smart Chain.

BNB ZkRolllup will be launched in various phases. Phase 1 will focus on leveraging BNB Smart Chain for security while bringing fast transaction speed, faster finality, and lower gas costs for end users. Additionally, the team hopes to make BNB assets interoperable between the BNB Smart Chain base chain and ZkRolllup. If the ZkRolllup system is compromised or user activity is censored, users can trigger a complete exit on the BNB Smart Chain layer to withdraw funds. Lastly, BNB ZkRolllup intends to support built-in instant automated marker maker (AMM) swaps and NFT support. The development of BNB ZkRolllup on BNB Chain will be one a significant challenge over the months ahead, but it is crucial to the evolution and competitiveness of the network.

The Road Ahead

During Q2, BNB Chain announced a 2022 technological roadmap with significant updates deployed on the mainnet before the end of this year.

Source: bnbchain.org

The road ahead for BNB Chain is focused on advancements to help users, projects, and developers connect to the BNB Chain community. The approach to success includes executing growth strategies to spur large-scale applications within the GameFi, SocialFi, and Metaverse sectors. It also includes implementing technical developments such as scaling solutions, boosting the throughput of BNB Chain, and expanding the validator set of the BNB Beacon Chain and BNB Smart Chain.

Most notably, the BNB community plans to expand the BNB Chain with L2-like solutions. Plans include the launch of zk-rollups for high-performance scaling and sidechains for more customizable blockchain solutions.

Further, intentional steps are being taken toward greater decentralization. The team has open-sourced the validator set of the Beacon Chain and continues to evaluate different approaches to both the election period and the elected validators of the BNB Smart Chain.

Collectively, BNB Chain plans to continue to evolve its network and grow its ecosystem. To do so, it will implement technical solutions and sidechains and utilize an ecosystem fund and accelerator program, among other strategies.

Closing Summary

In general, Layer-1 networks and cryptoassets had a challenging second quarter. Various macro forces dampened user activity and put downward pressure on networks. Despite these drawbacks, BNB Chain kept building. Developers focused on enhancing the BNB Beacon Chain with the Descartes upgrade and strengthening the BNB Smart Chain with the Euler hard fork in Q2.

Furthermore, the BNB Chain NFT sector experienced a breakout quarter in Q2, unlike the lagging DeFi sector. GameFi activity also grew with the introduction of new GameFi applications. Finally, network activity and the number of new users increased during Terra’s collapse, contributing to BNB Chain’s performance during the quarter.

BNB Chain could continue to serve as an alternative to Ethereum given its new use cases. With its evolving architecture and deployment of zk-rollups and sidechains, BNB Chain is positioned to provide additional value propositions to its large user base. If BNB Chain can successfully roll out its plans, the network could maintain its place in the Layer-1 race as one of the most valuable networks in the marketplace.

As it expands its user base with applications in new sectors such as NFTs, GameFi, and the Metaverse, there may be technical and regulatory challenges along the way. BNB Chain has a strategy that includes a technical roadmap, an ecosystem growth fund, and an accelerator program to mitigate such challenges.

Despite the volatile quarter, BNB Chain will continue to invest in its ecosystem, develop its validator set, evolve its architecture, and deploy zk-rollups and sidechains. In the months ahead, the BNB Chain community intends to drive further growth by connecting users and developers with its modular design and value propositions.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form.

Looking to dive deeper? Subscribe to Messari Pro. Messari Pro memberships provide access to daily crypto news and insights, exclusive long-form daily research, advanced screener, charting & watchlist features, and access to curated sets of charts and metrics. Learn more at messari.io/pro

This report was commissioned by BNB Chain, a member of Protocol Services. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. Paid membership in Protocol Services does not influence editorial decisions or content. Author(s) may hold cryptocurrencies named in this report. Crypto projects can commission independent research through Protocol Services. For more details or to join the program, contact ps@messari.io. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. The past performance of any asset is not indicative of future results. Please see our terms of use for more information.

Appendix