Key Insights

- The growth in DeFi Kingdoms users on Harmony in previous quarters shed light on the potential for GameFi applications. To that end, Harmony will look to expand on that recent success by making strategic investments in gaming studios and upcoming games while building out an SDK to create a smooth experience for the next cohort of GameFi developers.

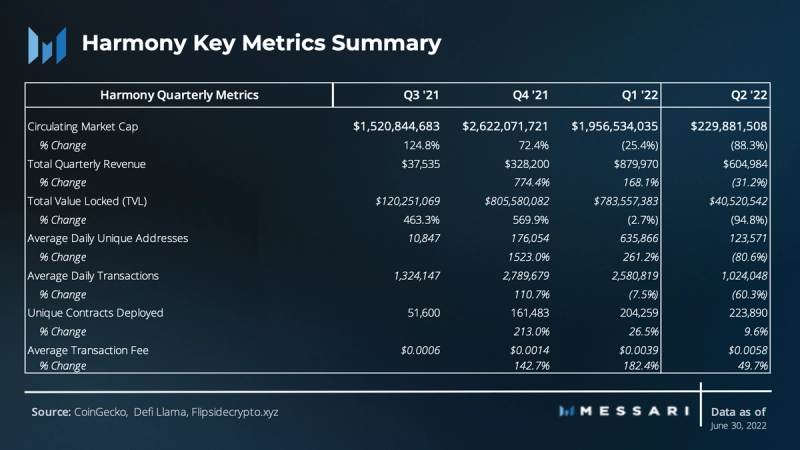

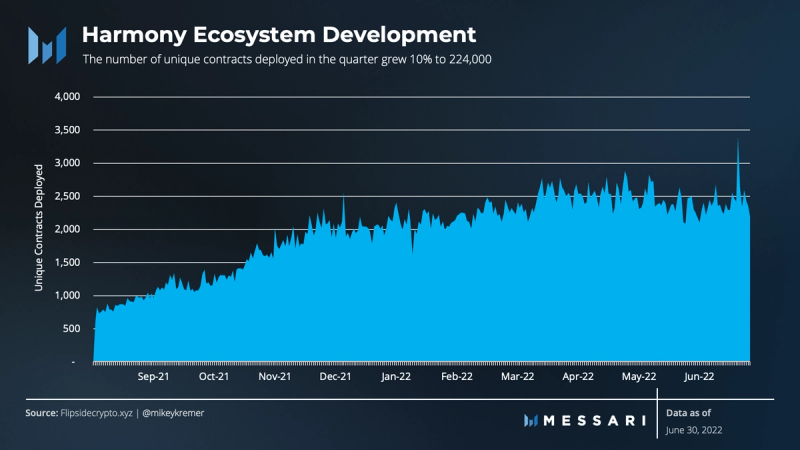

- While overall network activity witnessed a decrease this quarter in line with the broader market, unique contract deployments to the network continued its upward trend with an increase of 9.6% compared to the previous quarter.

- In response to arbitrage bots congesting the network with spam transactions, Harmony deployed a code fix which resulted in a significant decline in network congestion.

- Improvements were made around RPC connectivity issues, with Ankr releasing its RPC aggregator and Harmony releasing Elastic RPC which will increase RPC connection reliability.

- The Harmony Horizon Bridge was exploited in late June, with the attackers draining $100 million from the bridge. Harmony has put forth a reimbursement proposal which will be put to vote on Aug. 1, 2022.

A Primer on Harmony

Harmony is an Ethereum Virtual Machine (EVM)-compatible Effective Proof-of-Stake (EPoS) smart contract platform for decentralized applications. It uses the Fast Byzantine Fault Tolerance (FBFT) consensus mechanism and a random state sharding technique that separates a chain into segments. Each segment processes transactions and stores data in parallel, thus increasing transaction throughput and speed. Harmony also utilizes a Verifiable Random Function (VRF) and Verifiable Delay Function (VDF) to ensure secured randomness when validators are assigned to shards, preventing the possibility of a “single shard attack.” Harmony currently consists of 1,000 nodes across four shards, which work to produce new blocks every two seconds with finality.

Performance Analysis

Network Overview

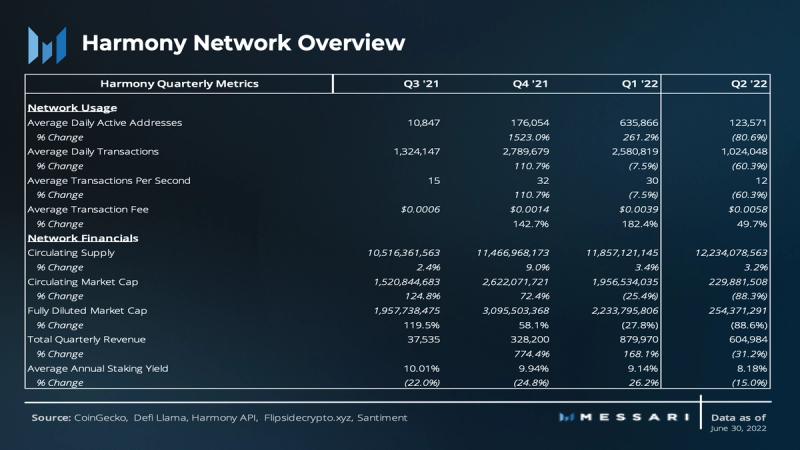

Harmony experienced a decline in overall network usage and financial performance in line with the overall market downturn. Its quarterly revenue dropped by 31% relative to its all-time-high experienced in the previous quarter. Daily active addresses and transaction counts were also down 80% and 60%, respectively. In addition, Harmony implemented a hard fork upgrade to improve user experience by removing spam bots and transactions, which could have caused the metrics to fall even further.

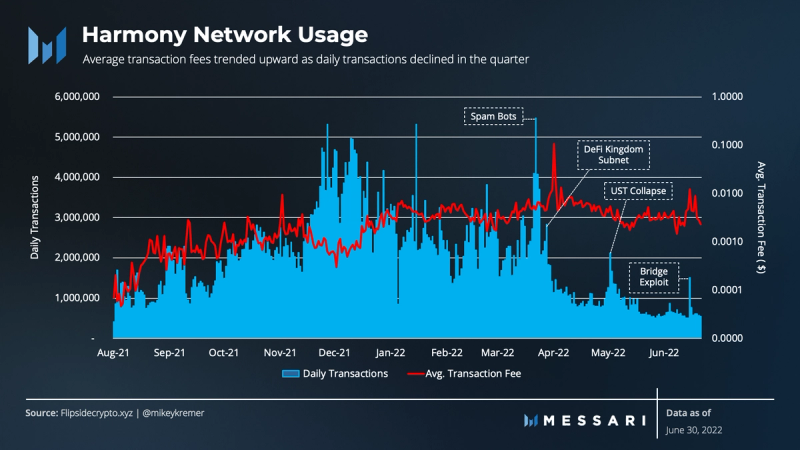

In early April, Harmony acknowledged feedback from the community regarding prolonged transaction times. After investigation, it was found that arbitrage bots were spamming the network with backrunning transactions, causing slower block times. Harmony responded to this issue by applying an upgrade to the network which reorchestrated the logic for determining transaction ordering. Now that transactions are deterministically ordered based on timestamps, the network has seen a decrease in spam activity.

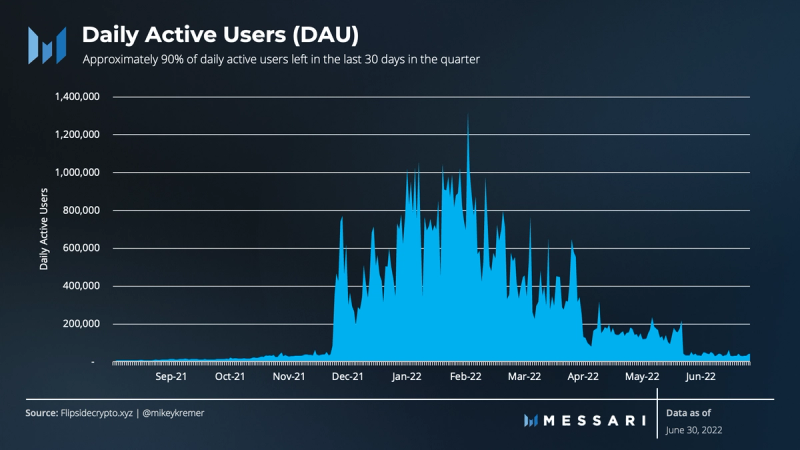

In previous quarters, the rise of the popular DeFi Kingdoms game on Harmony led to large increases in daily active users (DAU). However, beginning in Q2’22 (in absolute terms), the daily active users (DAU) saw a sharp decrease, dropping to an average of 124,000 DAU. The drop in DAU is consistent with overall market conditions and other smart contract platforms, but it was also exacerbated by DeFi Kingdoms launching a subnet on the Avalanche network and the targeted effort to reduce arbitrage activity on the network. DAU has since settled to approximately 299,000 in June, down 23% from May.

Network usage had several spikes in previous quarters. Daily transaction counts crossed the 5 million mark multiple times, largely due to the aforementioned bot activity and a growing user base around DeFi Kingdoms. Since the transaction ordering upgrade was applied this quarter, network activity has been on an overall downward trend, and the current levels are more reflective of the true user count.

Transaction fees saw a slight upward trend following the $100 million Horizon Bridge exploit on June 23, 2022, with 2.4x more transactions on the network compared to the daily average. The increase in activity drove the average transaction fees up to over four times the 7-day average, but the network maintained a relatively low average transaction fee of $0.0058.

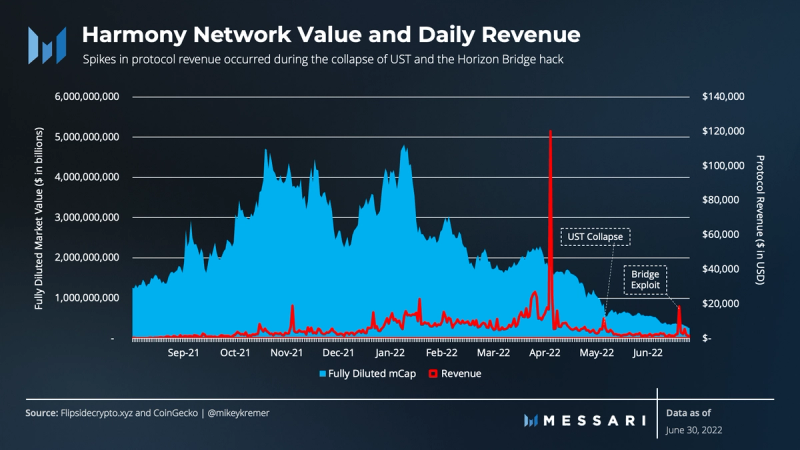

Corresponding with a decline in network activity, total revenue also declined in the quarter. In Q2’22, Harmony generated $605,000 in protocol revenue, down 31% from the all-time high of $880,000 in the prior period. Approximately 20% of total revenue generated in the quarter took place on April 10, 2022, due to the average gas price spiking to $0.10. The spike appears to have been an anomaly, as prices fell back to sub $0.01 the following day and have since mostly stabilized.

Additionally, the revenue spikes in early May and towards the end of June corresponded to the liquidity crisis caused by UST’s collapse and the announcement of the Horizon Bridge hack. In the six days that led into the UST depeg and a few days following the bridge hack, gas costs increased, resulting in approximately 8% of the protocol’s Q2 revenue.

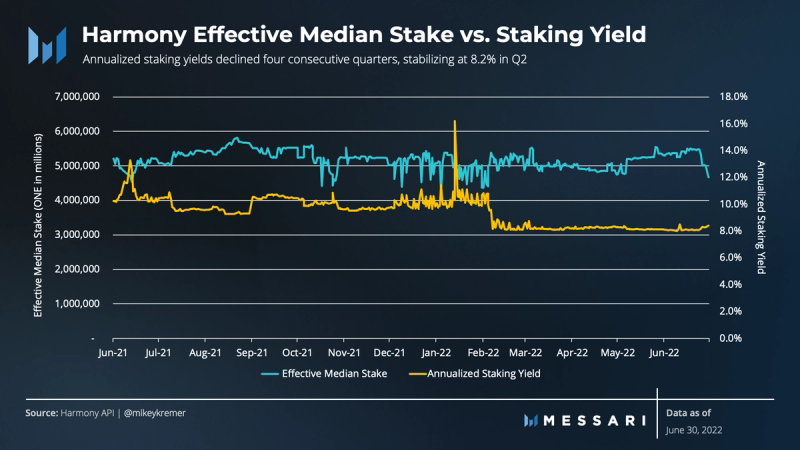

Harmony’s EPoS mechanism generates block rewards based on the effective median stake by all validators. The mechanism discourages an overconcentration of tokens with any node(s), improving decentralization and preventing a single-shard attack. It also yielded a relatively inverse relationship between the average effective median stake and the annualized staking yield.

Annualized staking yields fell to 8.2% as the median stake value generally trended upward over the quarter, consistent with the abovementioned inverse relationship. Although the average effective median stake in the quarter was 5.1 million ONE, it declined to 4.7 million at the end of the quarter following the Horizon Bridge exploit. Consequently, the drop in average effective median stake should progressively incentivize stakers to return, given the slight increase in staking yield at quarter end.

Harmony Ecosystem & Developer Overview

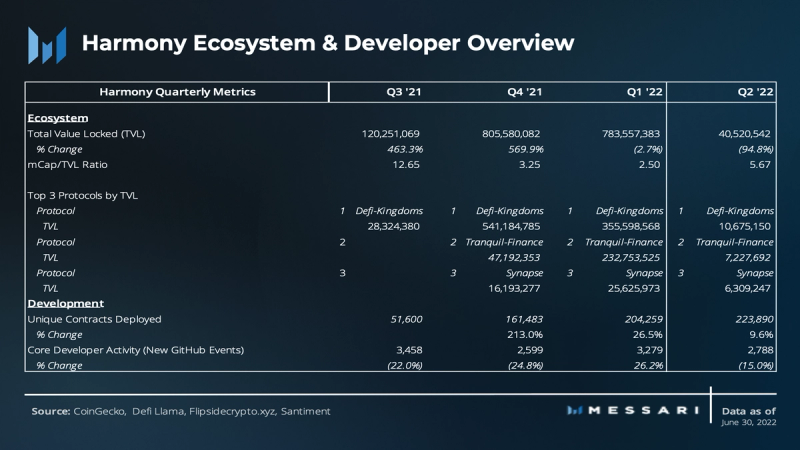

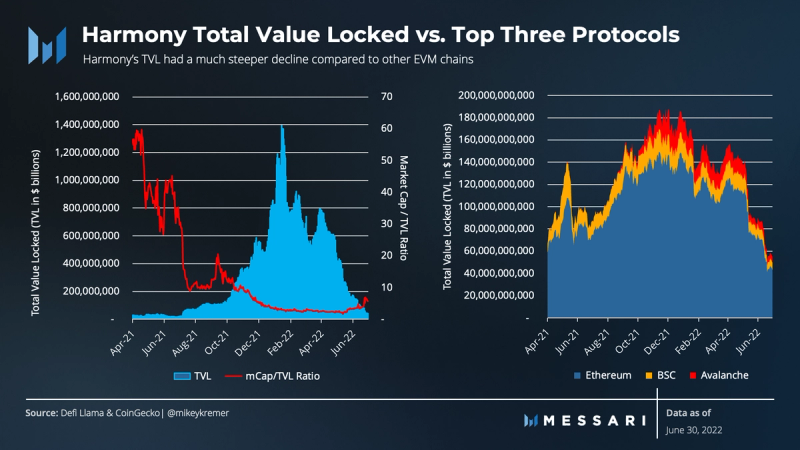

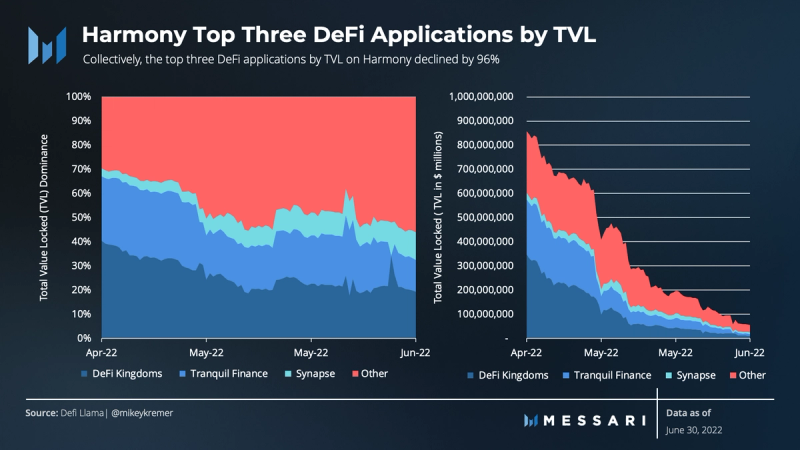

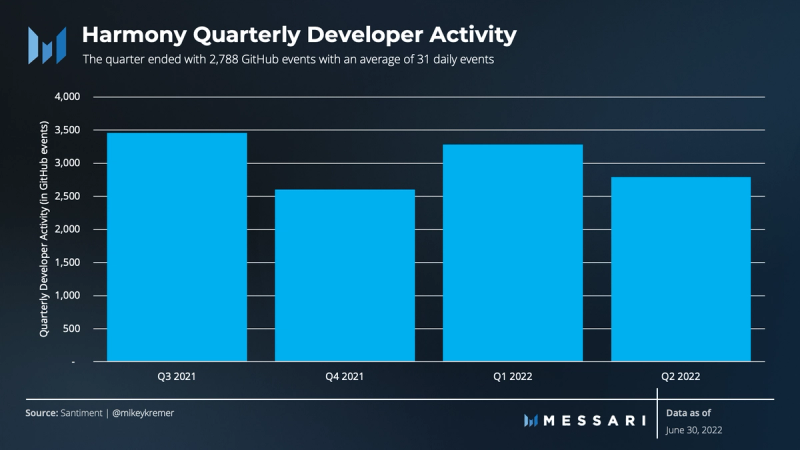

Harmony saw significant decreases in TVL across its top protocols, in accordance with similar smart contract platforms. The TVL drop was amplified by DeFi Kingdoms shedding ~96% of its TVL on the network as it transitioned over to its subnet on the Avalanche network. Overall core developer activity tracked well relative to previous quarters, with a 15% decrease QoQ but a 7% increase compared to Q4’21.

Despite the general downward trends across the board, unique contracts deployed grew 9.6% to 224,000, up from 204,000 in Q1’22. The consistent growth in contracts deployed over the last three quarters signals that decentralized applications are still healthy on Harmony.

Other EVM-compatible networks also experienced steep declines during the negative shift in market sentiment. The top three Layer-1 protocols (Ethereum, BNB Chain, and Avalanche) by TVL collectively lost 65% of TVL in Q2, declining from $154.9 billion to $54.9 billion. On a relative basis, Harmony’s TVL dropped even further due to DeFi Kingdom’s recent Avalanche Subnet launch and the Horizon Bridge hack.

DeFi Kingdoms (DFK) has been the flagship play-to-earn (P2E) game on Harmony, peaking in early Q1’22 with $901.4 million in TVL. By the end of Q2’22, DFK’s TVL plummeted 98.8% to $10.6 million, which was exacerbated by its recent launch on Avalanche. Total users on DFK declined by 33% in the quarter to 1.3 million users from 1.9 million. Additionally, the decline in total transactions was in line with users falling 34% to 17.0 million transactions from 25.8 million.

Overall, the total crypto market has shed approximately 60% of its market cap since the beginning of the year, resulting in cascading losses in TVL across most protocols. At the end of Q2’22, Harmony’s top three protocols had $24.2 million in TVL, which included DFK, Tranquil Finance, and Synapse Protocol.

Beyond DFK, Harmony has a broader vision for bringing GameFi to its network. By partnering with gaming studios and making strategic investments in upcoming games, Harmony will look to create an adoption flywheel by bringing profitable games to the network. These new games should attract more users and in turn, attract new developers.

In contrast to the steep declines across most key metrics, the number of unique contracts deployed grew by 10%, reaching 224,000 in Q2’22, compared to 204,000 in the prior period. New contracts deployed grew QoQ over the past year. Examples of new deployments in Q2 include the integration of DeFiato and Poly Network2. Despite overall network usage being down, decentralized applications and development continued to see growth on Harmony.

Notwithstanding the bearish market sentiment and downtrend in network usage, developer activity (measured in GitHub events) fell slightly by 15%. In Q2’22, there were 2,788 events, down from its yearly peak of 3,279 in Q1’22 and just slightly below the four-quarter average of 3,031.

Staking and Decentralization Overview

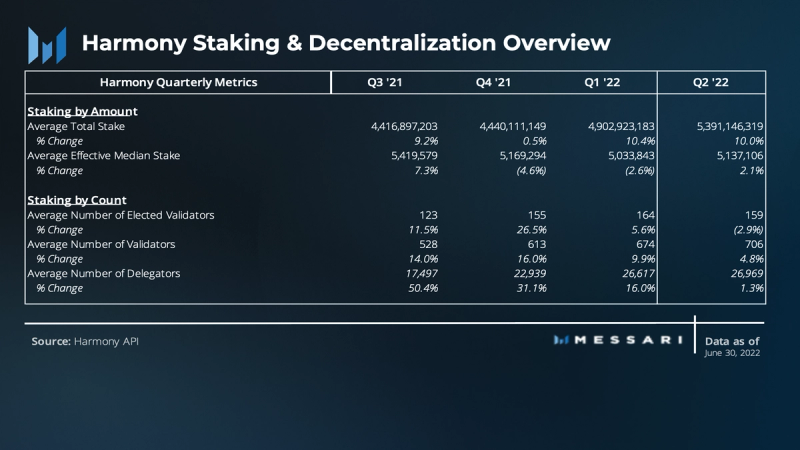

Staking rewards are given out based on the effective median stake of validators. When validators have a stake greater than this median, they are capped and cannot receive more rewards relative to their stake. When validators’ stake is less than the effective median stake, they are subsidized with rewards. This system incentivizes large operators to distribute their operations across multiple validators, which improves decentralization.

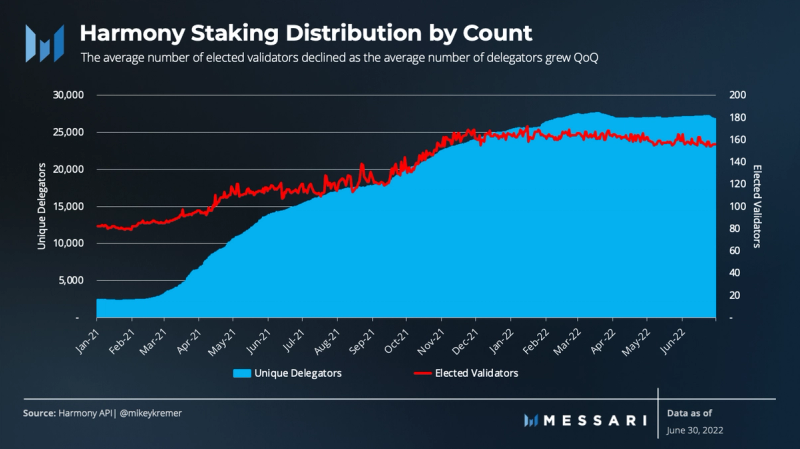

As of Q2’22, the network had over 700 validators, of which 159 elected validators secured the network. There were roughly 27,000 delegators and a total of 5.24 billion ONE tokens staked. Despite the market volatility since the beginning of the year, Harmony is actively improving its decentralization. The average number of validators increased in Q2. However, the average number of elected validators which is what secures the network fell by 3% to 159 validators.

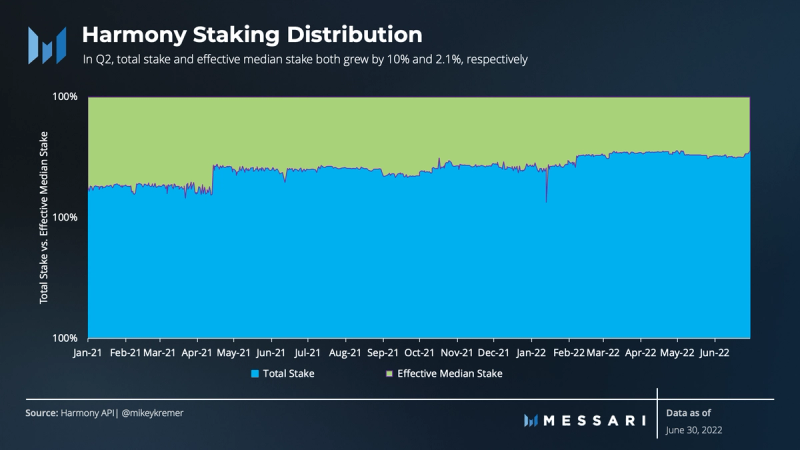

The total average stake (the total amount staked on the network by all validators) grew 10% to 5.39 billion ONE in the quarter. The average effective median stake, which is what block rewards are based on, was relatively flat over the quarter.

The decentralization of Harmony’s network improved since the end of 2021 as elected validators saw an increase. However, the average number of elected validators fell by 3% in Q2’22 to 159, down from 164 in Q1’22. Further, average unique delegators in the quarter remained flat, only growing 1.3% to 27,000.

Qualitative Analysis

Key Events

Horizon Bridge Hack

On June 23, 2022, Harmony’s Horizon Bridge, which connects the Ethereum and Harmony blockchains, suffered a malicious attack due to compromised private keys. The attacker(s) stole around $100 million worth of funds from the Ethereum side of the bridge, affecting around 50,000 wallet addresses. These assets were locked in a contract on Ethereum to allow their wrapped counterparts to be minted on Harmony. For the assets affected, their wrapped version on Harmony lost backing and value.

Harmony immediately launched an investigation, working alongside cybersecurity partners and notifying centralized exchanges and the FBI. Harmony offered $1 million and later $10 million to the attacker(s) to return the money in exchange for no legal charges. However, the attacker(s) has been moving the stolen funds through Tornado Cash, a protocol that breaks the on-chain link between destination and source addresses, making it virtually impossible to track. Because it is unlikely that the attacker(s) will return the funds, Harmony is finalizing several strategies to mitigate user losses. It will announce these strategies and allow the community to vote on them around the end of August.

RPC Additions

In Web3, a remote procedure call (RPC) allows websites, mobile apps, wallets, and other application types to communicate with the blockchain. In periods of high user activity, Harmony’s RPC has been overloaded, causing delayed or stuck transactions. Several custom RPCs have integrated with Harmony to spread out RPC congestion and provide relief. However, this approach requires users to manually switch the RPC in their wallet application in an attempt to find one that is working.

In May, crypto infrastructure provider Ankr released its RPC aggregator for Harmony. The aggregator automatically reroutes traffic through Ankr, Pocket Network, and Harmony’s nodes. As a result, users and developers reliably connect to the Harmony network without having to constantly make manual RPC changes.

In June, Harmony released Elastic RPC, an upgrade to their existing public RPC. Elastic RPC allows for a quicker, more automated management of the over 100 active nodes in Harmony’s infrastructure. The team is currently redirecting 50% of shard zero’s traffic through the Elastic RPC, with a full deployment expected in the near future.

Technical Protocol Updates

The following protocol updates were made in Q2’22 in order to improve performance and decentralization of the Harmony blockchain:

- Time-based ordering of transactions: Due to its low gas fees and high block gas limit, Harmony has been an attractive home for bots seeking arbitrage opportunities. Harmony’s random ordering of transactions in the mempool exacerbated network congestion caused by arbitrage bots. Since there was a random transaction order, arbitrage bots would spam transactions to increase their chance of successfully winning the arbitrage opportunity. In early April, the Harmony team deployed a fix by switching to time-based ordering of transactions, which reduced the spam transactions by over 90%.

- Mainnet Release V4.3.9: The Harmony blockchain hard-forked at epoch 999 in late May to upgrade to V4.3.9. The upgrade included several key features, most notably the implementation of HIP-16. This proposal from November 2021 sought to prevent validators from assigning all their keys to a single shard. Although it is highly unlikely, a few malicious validators could both assign all their keys to a single shard and take it over. Thus, the community voted to limit each validator to assigning at most 6.4% of their keys to one shard, removing the possibility of this attack vector and further decentralizing the network.

- iTokens: Harmony’s token standard mapped as a read-only ERC-721 token from Ethereum. To clarify, the ERC-721 status allows users to bridge NFT ownership without bridging the NFT token. This setup safeguards assets and fulfills the requirements of potential airdrops.

Ecosystem Integrations and Updates

Early in the quarter, Harmony integrated with DeFiato, a centralized DeFi platform that combines user-friendly features with access to various DeFi offerings. DeFiato will serve as a fiat on-ramp in the near future. Also, an integration with Covalent includes complete indexing of Harmony, increasing transparency for developers by giving access to rich, granular data.

Towards the end of April, Aave V3 rewards went live, giving users the ability to loan out their ONE tokens for rewards. Harmony’s campaign on Aave will run a 12 month campaign and provide up to $5 million in incentives for new users.

The integration with Router Protocol in June allows users to interact with Harmony and facilitate transactions to every blockchain that is currently integrated with Router’s mesh messaging. The DEX aggregator, OpenOcean, expanded to Harmony and gives users deeper liquidity by onboarding protocols like DeFi Kingdoms, Defira, and Synapse.

Challenges

At the moment, the biggest challenge Harmony faces is recovering from the Horizon Bridge exploit. Both options laid out in the proposed reimbursement plan involve the minting of new ONE tokens, which raised concerns from the community around inflationary issues. The protocol decided against leveraging the foundation treasury funds as a source for reimbursement, as this would likely hurt the network and its broader ecosystem in the long term.

Additionally, DeFi Kingdoms’ recent launch on Avalanche is a net negative for the protocol. Moving forward, Harmony will look to generate a new adoption flywheel by onboarding profitable GameFi applications, attracting a new user base, and thereby creating incentives for developers to create new experiences on the network.

Grants

In September 2021, Harmony launched a $300 million ecosystem fund. The fund included budgeting for grants, investments, DAOs, hackathons, bounties, events, contributors, and partners. In mid-June, Harmony announced that they would be pausing inbound grant applications, new DAO funding, and all event sponsorships in order to reduce operational costs during the market downturn.

Roadmap

Trustless Ethereum Bridge

The recent Horizon Bridge hack highlighted the need for a secure, trustless bridge. Instead of a multi-sig, the bridge will use cross-chain light clients, relayers, and prover full nodes. When a user locks (burns) their assets on Ethereum (Harmony), relayers send the block header of that transaction to a Harmony (Ethereum) light client who verifies proof of lock (burn). The user can then obtain a proof of lock or burn from a full node to receive their funds on the other side of the bridge. Harmony is aiming to launch the bridge early next year and will port the existing bridge and all assets over to the new one. Beyond improved security and decentralization, the trustless bridge will also be nearly five times cheaper to use.

Cross-Shard Communication

Harmony currently has four shards running consensus. Users are able to transfer Harmony’s ONE token across shards, but general cross-shard communication is not possible yet. Cross-shard communication enables smart contracts on different shards to interact with each other. Harmony has been working with Mutual Knowledge Systems (MuKn) to design such a system, which they expect to release late Q4. The solution will improve Harmony’s network performance and open up new application possibilities for developers.

Gaming

Harmony believes that on-chain gaming could bring millions of users to Web3. In Q2, they formed a plan on how to become winners in the Web3 gaming space. The plan focuses on partnering with gaming studios and publishers that have ready-to-launch titles. This past quarter, Harmony announced partnerships with Web3 gaming studios and publishers XYZZY, GM Frens, and Miracle Universe. Harmony is also establishing an SDK to help game developers easily integrate their game into Harmony. Lastly, Harmony is dedicating one of its four shards to gaming. The game shard (Shard One) will be free from the congestion of Shard zero but still connected through cross-shard communication.

1Wallet

Harmony is positioning the upcoming mobile 1Wallet by Timeless to become its flagship wallet. 1Wallet aims to provide a better user experience through its social features. Users will be able to chat with their friends, create multi sig via group chats, and send tokens and NFTs using contact names or QR codes. Instead of seed phrases, users will secure their wallets with Google Authenticator and a social recovery mechanism. This feature allows users to add friends or other devices as guardians who can unlock their wallet if they lose access — all while being enforced through smart contracts. The wallet is currently in beta testing, first on iOS and later on Android.

Closing Summary

Harmony was not immune to the substantial declines in valuation, network activity, TVL, and user confidence that swept across the crypto markets in Q2 2022. Although Harmony’s network usage did decline due to overall market conditions, there were also several other factors at play. The hard fork update successfully reduced spam activity, but it also resulted in less daily active users and transactions in the quarter. DFK’s recent migration over to the newly launched Avalanche subnet led to a material decline in users leaving Harmony’s network.

Perhaps the most impactful factor was the fallout from the subsequent Horizon Bridge exploit. Since $100 million was siphoned out of Harmony’s ecosystem, the protocol is left with the challenge of finding a way forward. The recent proposal to reimburse funds via token inflation is a step in the right direction, particularly for users who lost funds. However, should this move forward, the long-term inflationary and network effects could have some detrimental consequences.

Despite a downtrend across most metrics, Harmony experienced continued growth in unique contracts deployed. This area of resilience feeds the mantra of “bear markets are for building” and will be critical for the success of the protocol. In the quarter, Harmony continued to gain traction by creating new partnerships, implementing new integrations, and focusing on improving the user experience.

Let us know what you loved about the report and what may be missing, or share any other feedback by filling out this short form.

Looking to dive deeper? Subscribe to Messari Pro. Messari Pro memberships provide access to daily crypto news and insights, exclusive long-form daily research, advanced screener, charting & watchlist features, and access to curated sets of charts and metrics. Learn more at messari.io/pro

This report was commissioned by Harmony, a member of Protocol Services. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. Paid membership in Protocol Services does not influence editorial decisions or content. Author(s) may hold cryptocurrencies named in this report. Crypto projects can commission independent research through Protocol Services. For more details or to join the program, contact ps@messari.io. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. The past performance of any asset is not indicative of future results. Please see our terms of use for more information.