Ethereum’s correction continues for the 4th day in a row, hat the excitement about the upcoming Merge in September is beginning to slow down. That said, the mid-term structure of ETH remains somewhat bullish, although bears currently seem to have the upper hand.

Technical Analysis

By Grizzly

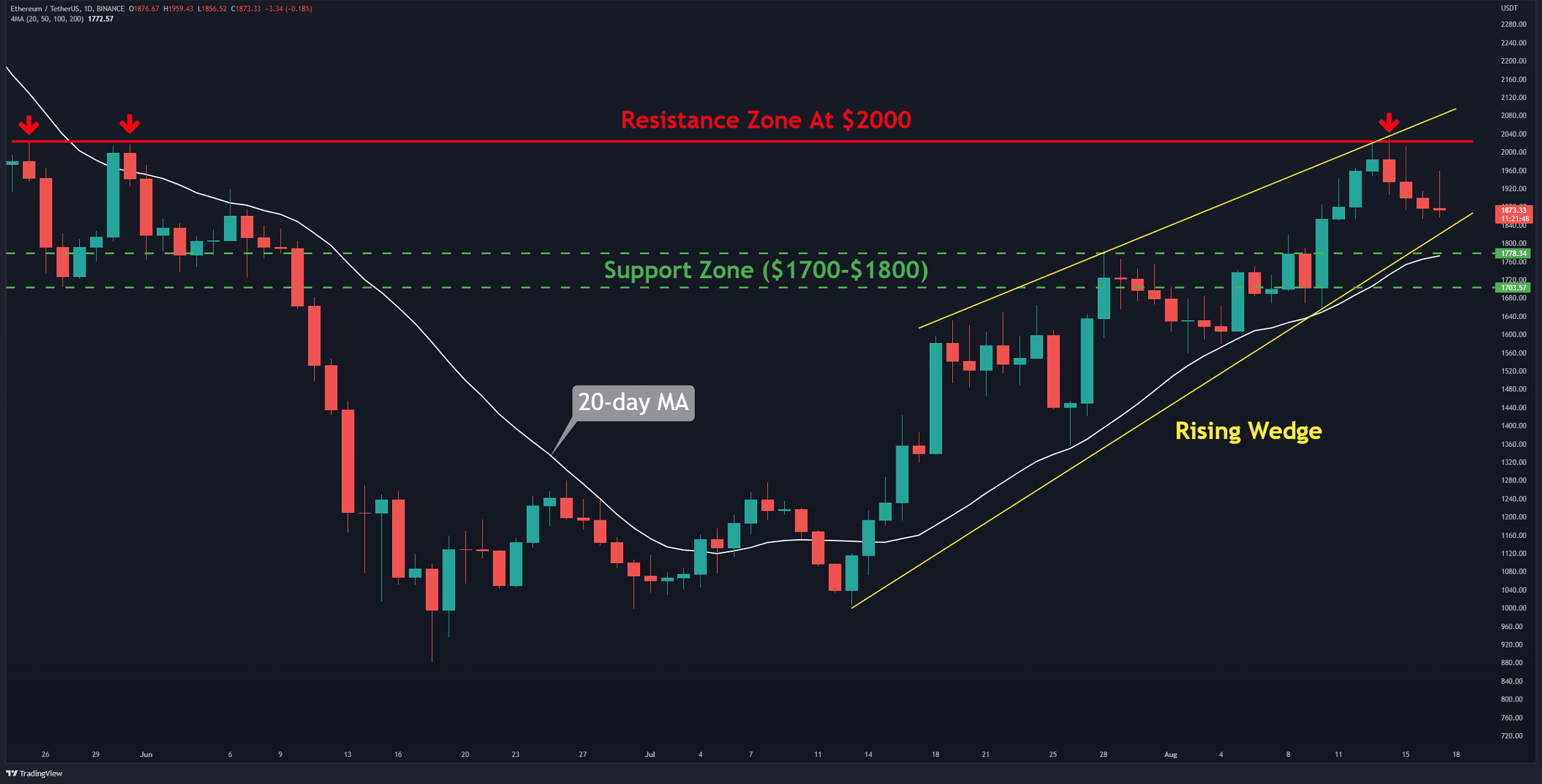

The Daily Chart

After 74 days, the bulls aspired once again on August 13 to reclaim $2,000 (in red) but were unsuccessful. Bears managed to barrel the price down about 8% from the recorded high of $2030 (at the time of this writing). This resulted in the price moving towards the support line of the rising wedge pattern, which is technically a bearish pattern.

The 20-day moving average line (in white) has also reached the critical support zone in the range of $1,700-$1,800. This suggests that solid support is forming there.

If the bulls are determined to resume the upward trend and retest the resistance at $2000, they should defend the mentioned zone. A break and close below it can trigger the formation of a bearish structure. In this case, the closest support is found at around $1,600.

Key Support Levels: $1800 & $1600

Key Resistance Levels: $2000 & $2200

Daily Moving Averages:

MA20: $1771

MA50: $1492

MA100: $1575

MA200: $2246

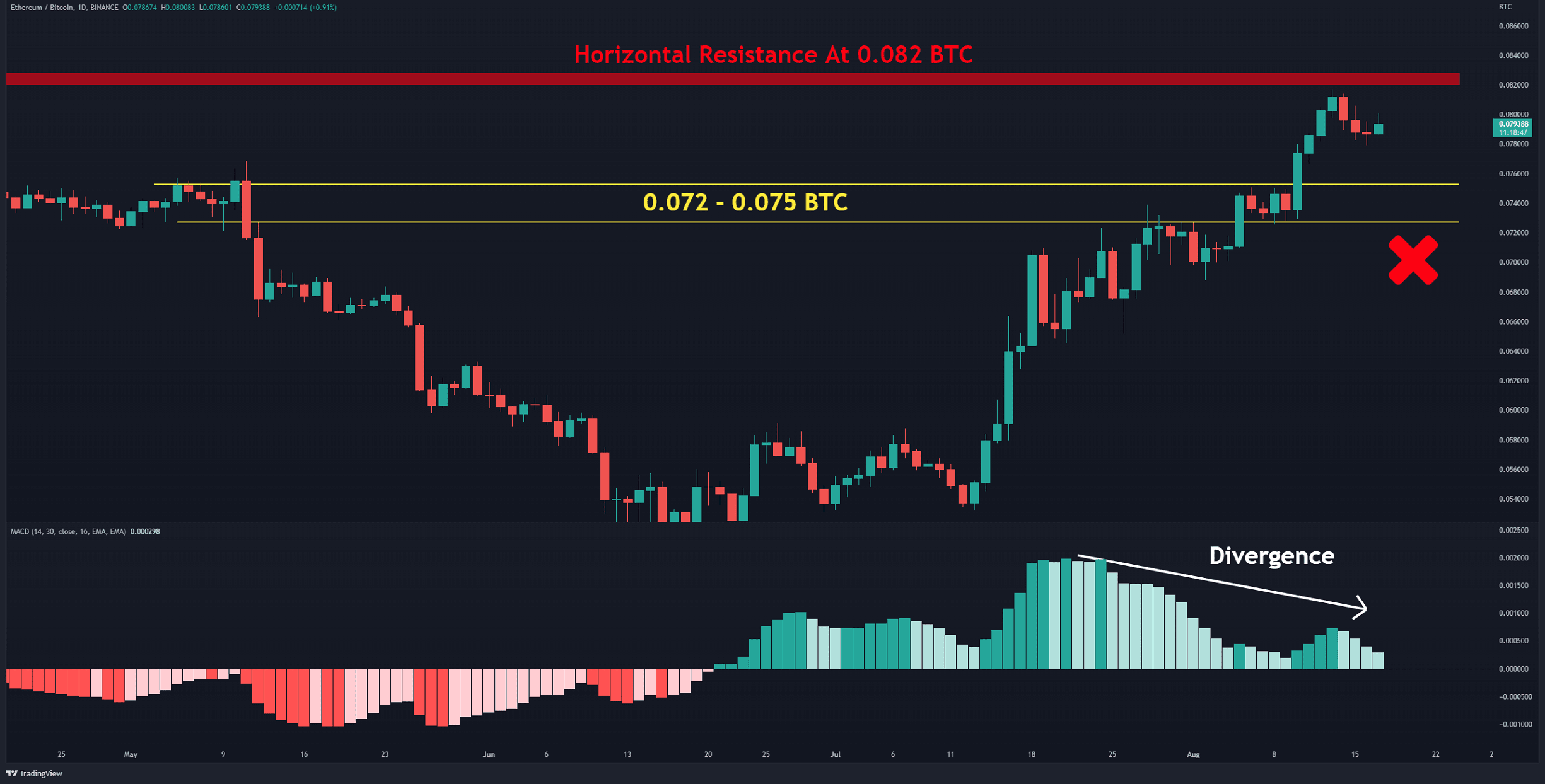

The ETH/BTC Chart

A divergence in the MACD indicator has appeared against Bitcoin. ETH experienced a short-term correction after hitting horizontal resistance at 0.082 BTC (in red). According to the formation of a green candle, it seems that investors are dumping their BTC for ETH.

The bullish view remains strong if the bulls can sustain the price above the support range at 0.072-0.075 BTC (in yellow). Conversely, if this level cracks, it will signal the start of a new downtrend with a target of 0.065 BTC. At the moment, the bulls are in control of this pair.

Key Support Levels: 0.0.75 & 0.065 BTC

Key Resistance Levels: 0.082 & 0.088 BTC

On-chain Analysis

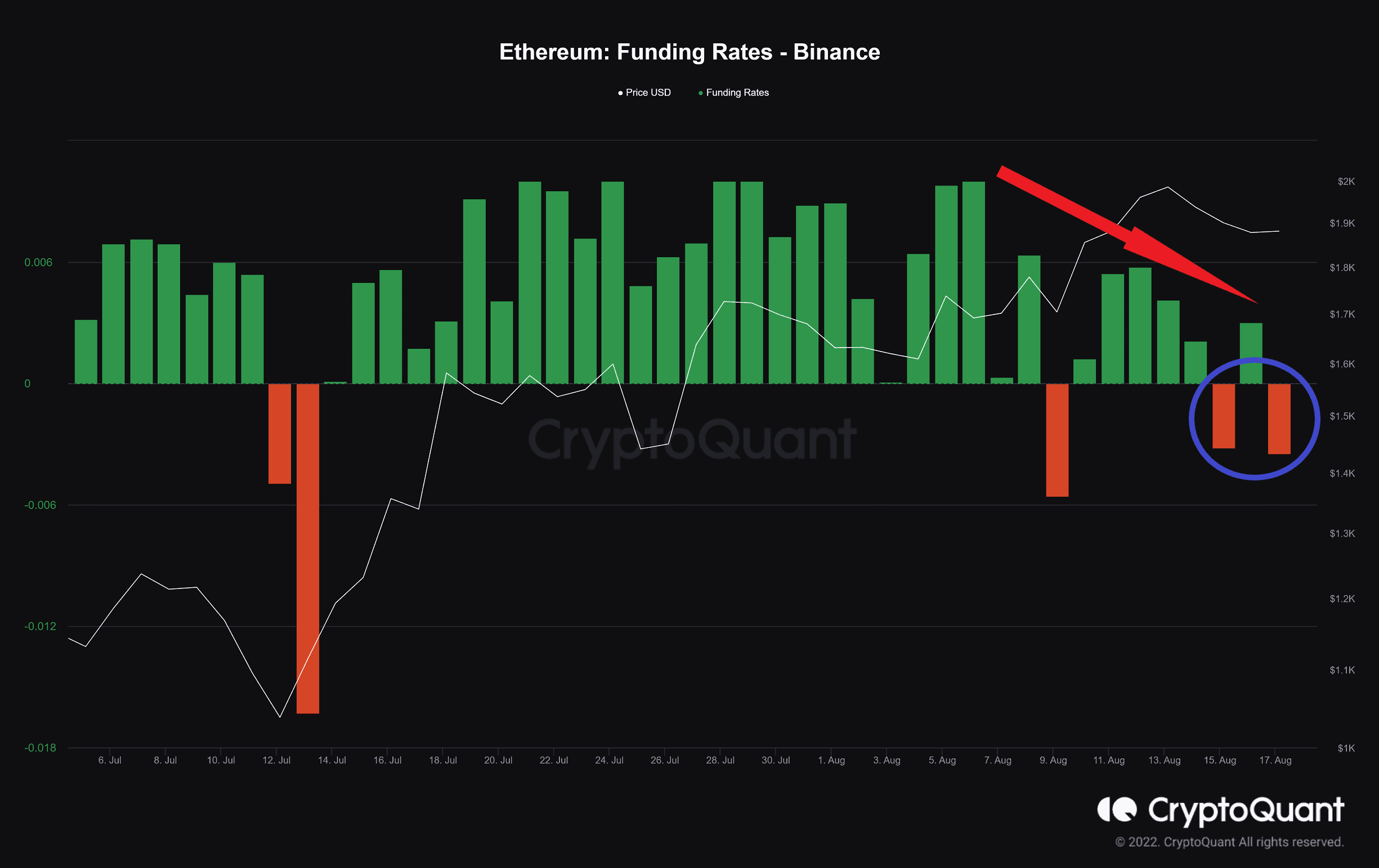

Funding Rates – Binance

Definition: Periodic payments to traders that are either long or short, based on the difference between perpetual contract markets and spot prices.

Positive funding rates indicate that long position traders are dominant and are willing to pay funding to short traders.

Negative funding rates indicate that short position traders are dominant and are willing to pay long traders.

After a long time, this funding rate was positive, and consecutive green histogram bars appeared on the chart. However, for a few days, red histogram bars have appeared in the funding rate of the Binance exchange, and where it is also decreasing. This shows that the bullish sentiment has become more fragile compared to the last two months. It must be considered that it has not yet reached the levels where it can be said that bearish sentiments dominate the derivatives market.

The post Is Ethereum Headed for $1,600 After a 4-Day 8% Correction? (ETH Price Analysis) appeared first on CryptoPotato.