Hedera aims to improve decentralized asset transfers. The platform runs on an innovative technology called direct acrylic graph (DAG), making it faster, cheaper, and more secure than older blockchain solutions.

Developers can build on Hedera powered by its native, energy-efficient token (HBAR). As a result, anyone who intends to use the protocol has to learn how to buy Hedera (HBAR).

In this guide, we will explore Hedera HBR and its investment viability and provide a detailed tutorial showing how to buy Hedera on Binance.

Where to HBAR Crypto

This section is our top picks of where and how to buy the HBAR Hedera Crypto token. We chose these based on our experience of using them and considered fees, security, payment options and reputation.

- Binance: Largest Crypto Exchange with Low Fees

- eToro: Easy to Use Platform With Social Trading

- Kucoin: Highly Regarded and Easy to Use for Beginners

- Gate: Solid Platform With Lots of Coins

Visit The Top Pick

eToro USA LLC; Investments are subject to market risk, including the possible loss of principal.

Binance: Reputable Exchange with High Liquidity

Binance: Reputable Exchange with High Liquidity

Binance is the largest cryptocurrency trading exchange in daily trade volumes. The exchange offers investors full access to trade over 600 crypto assets.

The renowned platform also features a well-detailed learning curve and advanced trading tools that support well-experienced traders and investors looking to learn how to buy different cryptos. Although Binance features a user-friendly interface that facilitates a great user experience, it is more suited for well-experienced traders.

Read: Our Full Binance Review Here

Binance has a minimum deposit of $10. This enables investors to kickstart their investing journey with low fees. Investors can also initiate deposits through seamless payment methods like wire transfers, credit/debit cards, peer-to-peer (P2P) payments, and other e-wallet solutions.

Binance deposits come with a fee that varies based on the payment method used. For instance, the global exchange charges a standard fee of up to 4.50% for all deposits made with a debit/credit card.

All investors enjoy very low fees when trading on Binance, as it charges a standard trading fee of 0.1%. For investors that buy using Binance token (BNB), a discount of 25% on trading fees will be applied.

In addition, investors can rest assured that their funds and data are well protected whenever they trade on Binance. The broker features top-notch security measures like two-factor authentication (2FA), cold storage to keep most coins, whitelisting, and advanced data encryption to protect funds and data. Binance functions effectively in over 100 countries and has a spin-off regulated platform (Binance.US) that tends to US-based traders and investors.

Pros

- Trading fees at 0.01%

- High liquidity

- Wide range of payment methods

- 600+ crypto assets in library

Cons

- Interface is suited for advanced traders

- US-based customers cannot trade most coins via its subsidiary

eToro: Easy to Use Platform

eToro: Easy to Use Platform

eToro is the one of the best exchanges to purchase crypto coins & tokens. It is one of the most popular social trading platforms in the investment space. This exchange gives traders and investors full access to trade over 78 crypto assets, including Bitcoin, Ethereum, and many more.

The broker’s user-friendly interface and simple layout is appealing to investors with no prior knowledge of crypto trading. To begin a trading journey on eToro, investors have to create an account. With a minimum deposit of as little as $10, US and UK-based investors can purchase tokens and other crypto assets seamlessly.

Investors also enjoy zero fees on all USD deposits, including debit card deposits. However, there is a standard fee charge of $5 on all withdrawals, a 1% flat fee for every completed trade on the platform, and a $10 inactivity fee charged monthly after an investor fails to trade for a year.

The broker offers seamless deposit methods that range from bank transfer and direct crypto deposits to debit/credit card and payment processors like PayPal. Although all USD deposits are fee-free, all bank transfer deposits have a fixed minimum of $500.

Another major feature that makes eToro stand out is its impressive CopyTrader feature. This integration enables novice investors to find well-experienced traders on the platform and copy their trade strategies to earn when they earn.

In terms of security, eToro scales to the top as it features two-factor authentication (2FA) protocol, advanced encryption, and masking technologies to secure all users accounts. eToro accepts users in over 140 countries and is regulated by top financial authorities like the U.S. Securities and Exchange Commission (SEC), Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CYSEC). The exchange is also registered with the Financial Industry Regulatory Authority (FINRA).

Pros

- Overall best social trading platform to buy

- User-friendly interface

- CopyTrader and CopyPortfolio

- Highly regulated broker

Cons

- Charges an inactivity fee

- Charges a withdrawal fee

eToro USA LLC; Investments are subject to market risk, including the possible loss of principal.

KuCoin: Exchange With Lots of Listings

KuCoin: Exchange With Lots of Listings

KuCoin is one of the world’s oldest and most popular crypto exchanges. The Seychelles-based broker is one of the most notable names in the market for traders who desire access to derivatives products to speculate in the market.

Currently, KuCoin provides access to over 600 cryptocurrencies. Besides trading and investing, the exchange allows investors to save, stake crypto, and even participate in Initial Exchange Offerings. With KuCoin, investors have an all-encompassing crypto hub.

Read: Our Full Kucoin Review Here

Like many brokers in its class, KuCoin could appear too overwhelming for beginners. The exchange is more suited for advanced traders who want to speculate and trade sophisticated products. So beginners might have some difficulty making use of it.

Despite this, investors could gain many benefits from trading with KuCoin. The broker has a low minimum balance of $5, with deposits available via major fiat currencies, peer-to-peer (P2P) transfers, and a few credit card options.

As for trading fees, KuCoin users pay 0.1% in fees. But the fees could decrease based on an investor’s 30-day trading volume and ownership of the company’s KCS token.

Security on KuCoin is also impressive. The system uses bank-level encryption and security infrastructures to protect users’ coins and data. KuCoin also has a specialized risk control department to enforce strict data usage policies.

Pros

- Discounts available on trading fees

- Extensive staking functionalities

- Quick P2P trading system

- Anonymous trading available

- Low minimum balance

Cons

- No bank deposit option

Gate.io: Solid Platform With Lots of Coins

Gate.io: Solid Platform With Lots of Coins

Gate.io is a cryptocurrency trading site that aims to offer its members an alternative to the exchanges currently dominating the market.

The site has been in operation since 2017 and aims to capture a portion of the cryptocurrency trading market by offering its users hassle free access to a number of hard to find coins and up and coming projects.

The site is also designed to help investors find specific information related to both their preferred coins and overall market trends.

Read: Our Full Gate.io Review Here

Trading mostly takes place on a web-based trading platform that is similar to most cryptocurrency exchanges. The site incorporates a number of functional features such as an order book, trading history, and charting.

Pros

- A wide range of currencies

- A low fee structure

- Simple registration process

- Functional platform with a mobile app available

Cons

- Unregulated

- The team is not very transparent

- No fiat currency transfers

What Is Hedera (HBAR)?

Since Bitcoin’s launch in 2009,  The term “blockchain” has gained traction in several media outlets. Although the innovative solution has been ground-breaking and led to the launch of several impressive decentralised solutions, it has struggled with some issues.

The term “blockchain” has gained traction in several media outlets. Although the innovative solution has been ground-breaking and led to the launch of several impressive decentralised solutions, it has struggled with some issues.

Hedera Hashgraph intends to solve what is now known as the blockchain trilemma of security, scalability, and decentralisation. The platform views its solution as a much better alternative to the blockchain as we know it. However, based on its operation, it is also a publicly distributed digital ledger. Instead of grouping transactions into a blockchain, it groups them using graphs.

Powered by what it terms direct acrylic graph (DAG), the protocol relies on the Hashgraph consensus algorithm. This developing technology supposedly allows the protocol to process transactions ten times faster than other blockchain solutions. It also comes with low latency. According to the development team, Hedera also has a 3 to 5-second block-finality capacity due to its 10,000 transaction per second (TPS) support.

In terms of security, the Hedera Hashgraph uses what it calls Asynchronous Byzantine Fault Tolerant (ABFT). The protocol has a much lower bandwidth consumption in terms of energy use, making it one of the few carbon-neutral solutions in the crypto space. According to data illustrated on its website, the amount of energy used per transaction is below 1KW/h.

In terms of security, the Hedera Hashgraph uses what it calls Asynchronous Byzantine Fault Tolerant (ABFT). The protocol has a much lower bandwidth consumption in terms of energy use, making it one of the few carbon-neutral solutions in the crypto space. According to data illustrated on its website, the amount of energy used per transaction is below 1KW/h.

Hedera is also low-cost as it allows developers and users to utilise its protocol for less than a dollar. The Hedera Governing Council sets the pricing, and the protocol is powered by the HBAR token responsible for computational resources, governance, and staking activities.

Also, the Hedera platform boasts of some impressive services; three of these services are predominant. The first is the token service. Users can mint and manage digital collectibles or non-fungible tokens (NFTs) for application payments and governance. Besides NFTs, the Hedera Token Service (HTS) also works for minting fungible items like tokenised assets.

Another service offered by the Hedera protocol is the consensus layer service. This allows users to generate immutable records that are verifiable, fairly ordered logs of events for blockchain applications and permissioned network systems. This way, developers can integrate a genuine log of events into their applications trustlessly, easily, and seamlessly.

The third service is the smart contract service which allows users to run Ethereum-native Solidity smart contracts. This makes it Ethereum Virtual Machine (EVM) compatible, meaning developers familiar with the Ethereum network can build and deploy applications with the programming language they are familiar with instead of going through another learning curve.

The third service is the smart contract service which allows users to run Ethereum-native Solidity smart contracts. This makes it Ethereum Virtual Machine (EVM) compatible, meaning developers familiar with the Ethereum network can build and deploy applications with the programming language they are familiar with instead of going through another learning curve.

How Does Hedera Work?

Hedera is majorly controlled by a group of over 50 multinational tech and financial firms called the Hedera Governing Council. The primary mission is to ensure the continued success of the Hedera protocol.

The pricing schedule for the protocol is another function they provide. This means they select how much fees users have to pay to use the platform. However, this body of trustees is more advisory in nature.

In its most basic setup, the Hedera protocol works in the this manner:

In its most basic setup, the Hedera protocol works in the this manner:

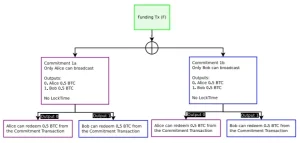

- Nodes on the Hedera platform share information via a ‘gossip’ system. This allows newly added info to be spread among all participating nodes on the network while maintaining resilience among all nodes.

- The information is shared, or ‘gossiped’, to all nodes, including those that have been offline. Given its graph system, the Hedera protocol does not require all nodes to be faultless for consensus to be reached; it is fault-tolerant.

- A data structure containing a bunch of transactions, a timestamp, a digital signature, and two hashes highlighting earlier gossiped hashes are created to share transactions with all participating nodes. This makes it easy for all nodes to know who executed a transaction and when it was executed while also learning which node found the transaction and when it was discovered. This is called a virtual voting system in the network.

Consensus is reached by each node mathematically verifying each transaction without consuming any unnecessary bandwidth. This is done by selecting a few ‘famous witnesses’: the initial nodes that received the transactions. The other nodes now compare the gossip forwarded to see if they pass the voting stage.

Is Hedera a Good Investment?

Wondering whether it is a smart idea to buy HBAR? Here are a few reasons Hedera could be a great buy:

High Scalability

Faster block-to-time finality is a highly debated concept in the crypto space. With technological advancements, more payment solutions are pushing users’ frontiers on transaction and confirmation speed. Bitcoin has largely failed in this aspect; it has not been able to increase its throughput due to its reliance on the competitive proof-of-work (PoW) algorithm.

Hedera is an answer in this aspect as it comes with an impressive yet stable 10,000 TPS for enterprise-grade transactions. This is a huge boost for the project as consumers look for more decentralised asset transfer solutions.

Governed by Top 50 Multinational Tech Corporations

While several crypto maximalists might paint this as a con of the Hedera project, this is a highly applauded system in an industry filled with questionable characters. Aside from Bitcoin and a few other prominent altcoins, several bad actors have defrauded investors of their funds, some intentionally while others because of a flawed security system.

Hedera’s governance by top financial and tech conglomerates means that experts from different industries can pool their ideas together to provide a highly secure, consumer-focused service that meets international standards.

Offering Multiple Services (Token, Consensus, File Storage)

Hedera is not just all about scalability alone. The platform also offers multiple services, including a token service for developing non-fungible tokens (NFTs), a consensus layer for gathering a verifiable log of events, and a decentralised file storage system. It is an all-in-one next-gen digital ledger protocol.

Lower Transaction Fee

Fees have been one of the issues surrounding PoW protocols. One of the victims of this algorithm is the highly robust Ethereum network. In peak transaction periods, Ether gas fees sometimes surge to over $200, making it unprofitable for retail users.

Hedera’s proof-of-stake (PoS) reliance allows it to post a lower transaction fee, below a dollar. With users able to get more done for less, Hedera is set for a breakout season.

Carbon Neutral

Carbon neutrality is also a major pro surrounding Hedera. PoW protocols have been accused of consuming more energy than entire countries in validating transactions. Hedera’s Hashgraph and ABFT system comes with a low bandwidth consumption that consumes as low as 0.00001kW/h in energy.

How to Buy Hedera on Binance

Wondering how to buy Hedera? Our top pick to buy the HBAR token is Binance. The exchange has built a strong reputation as the go-to spot for all digital asset trading activities. It also boasts the highest daily trading volume in the crypto industry.

Binance’s success is not only linked to its deep liquidity. The Bitcoin trading platform offers one of the lowest trading fees in the crypto market, multiple earning offerings, and a powerful trading interface. To learn how to buy Hedera on Binance in less than 10 minutes, follow these detailed steps:

Create Account

First, open an individual account on the Binance platform by tapping the ‘Register Now’ button. Insert an email address and a mobile number to proceed. A verification link and code would be sent to both the email address and submitted phone number.

First, open an individual account on the Binance platform by tapping the ‘Register Now’ button. Insert an email address and a mobile number to proceed. A verification link and code would be sent to both the email address and submitted phone number.

Verify ID

New users need to verify their ID to unlock Binance’s full suite of offerings. Tap on the profile icon and click on the ‘Verify’ button. Once there, upload a recent driver’s license copy and complete the face verification exercise to unlock the standard offering. Users must upload a proof of address for a more extensive verification exercise.

Deposit

Next, make a deposit. Tap on ‘Wallet’ and click on ‘Deposit’. Select ‘Cash’ and choose a regional currency of preference. Insert how much to deposit (Binance has a required minimum deposit of $10) and follow the on-screen prompts to complete funding the new account.

Buy HBAR

Once a deposit is completed, investors can initiate a purchasing order. To do this, type ‘HBAR’ into the search bar and click on the applicable trading pair. Tap on ‘Buy’ to open up the order page and insert how much of the digital asset to purchase. Once done, tap on ‘Buy HBAR’ to complete the process.

Once a deposit is completed, investors can initiate a purchasing order. To do this, type ‘HBAR’ into the search bar and click on the applicable trading pair. Tap on ‘Buy’ to open up the order page and insert how much of the digital asset to purchase. Once done, tap on ‘Buy HBAR’ to complete the process.

Hedera Wallets

Software Wallet

Hot wallets, also called software wallets, are one of the most popular cryptocurrency storage options. They are always online, hence the affiliation with the ‘hot’ tag. Investors can easily get a hot wallet once they open an account with a crypto exchange. This allows them to store and manage their private keys, which prove their ownership of their assets to the blockchain network. Hot wallets are usually more convenient for everyday crypto transactions and can be custodial or non-custodial.

A custody wallet is responsible for storing assets to an exchange or a third-party platform. The user only places an order for a transfer or receipt, and the exchange signs off on the transaction, much like the traditional banking system. Meanwhile, a non-custodial or self-custody wallet gives the full responsibility to the end-user.

Hot wallets are usually free, but they are largely considered less secure due to their constant internet connectivity. An instance of a hot wallet is the Binance Wallet.

Hardware Wallet

A Hardware wallet is a device which has been created to provide an extra layer of security when interacting with your various cryptocurrency wallets.

Normally you would use your private key to move funds, the problem is though, if your computer has been compromised with malware or a virus, it is possible for your private keys to be captured and used to steal your funds.

With a hardware wallet, the private keys are stored on the device and never exposed to your computer, which means even if you are infected with such a program your private keys will remain safe. These options are safest way to store your crypto if you have more than a small amount.

Popular examples of cold storage offerings are the Ledger and Trezor line of hardware wallet solutions, read our reviews:

Mobile wallet

A mobile wallet is essentially a hot wallet on a smartphone device. They offer users an even more convenient way to use their coins for daily activities. Mobile wallets store and manage users’ private keys while enabling them to pay for things they love with their digital assets.

These wallets are usually free and always online for transactions to be processed. Popular mobile wallets are eToro Money Wallet and Coinbase Wallet.

Desktop wallet

A desktop wallet is a PC version of a hot wallet. It is essentially software that an investor downloads into their personal computer or laptop for easy interaction with their digital coins. They also offer a browser extension which allows users to interact using an extension instead of downloading the entire software. Desktop wallets are also hack-prone due to their online nature. A popular example is the Exodus Wallet.

Paper Wallet

The paper wallet is arguably the oldest form of crypto wallet. They are no longer common in the modern crypto industry. It contains users’ public and private keys. The paper wallet is the least secure type of wallet as it can easily be lost, stolen, or torched.

Conclusion

Hedera Hashgraph considers itself the next level of distributed ledger system with its ability to scale, secure, and decentralise cost-efficiently.

Interested investors can easily buy into the project using the Binance exchange. The platform has garnered a solid reputation in the cryptocurrency market and provides deep liquidity and minimal trading fees. Its Earn program also allows users to put their digital assets to work to earn passive income.

Hedera FAQs

What exchanges sell HBAR?

Several top crypto trading platforms support the purchase and sales of HBAR. However, our recommended exchange is Binance. New users need to open an account and verify their ID to use Binance. Once the deposit for the token is confirmed, users can place a sales order for the token on the Spot trading function and either transfer the stablecoin to their bank account for a $15 fee or directly trade it on the Binance peer-to-peer (P2P) platform for zero fees.

How do I buy HBAR coins?

Buying HBAR is quite easy to do. The only thing that investors have to do is sign up for an account on our preferred platform, Binance. Upload a copy of a recent driver’s license, deposit a minimum amount of $10, and buy HBAR coins via the Spot trading option.

Can I buy HBAR on Binance?

Yes, Binance currently supports the trading of HBAR tokens. New users can easily create an account on Binance and fill in their email address and mobile number. Then upload a copy of their drivers’ license and complete the face verification process before depositing the stated minimum of $10. From there, investors can make purchase.

Will Hedera be on Coinbase?

For now, the Hedera protocol is not currently listed on the Coinbase platform. However they have announced via a blog post that they will be listing it soon.

Can you buy HBAR on Coinbase pro?

Currently, Coinbase is phasing out its Coinbase Pro platform. The advanced trading platform does not support the trading of Hedera on its exchange.

The post Where to Buy Hedera (HBAR) Crypto: Beginner’s Guide appeared first on Blockonomi.