The latest report published by Chainalysis looks at the impact the Merge may have on the crypto world.

“The Merge” and the changing crypto industry

Chainalysis is by far one of the world’s leading on-chain data analysis companies.

That is why its recent article titled “How The Ethereum Merge May Impact the Crypto Ecosystem: On-chain Indicators to Watch,” cannot be ignored.

The analysis by Chainalysis takes into consideration several on-chain factors, and comes to the conclusion that overall the Merge could have major implications on the price of ETH and its attractiveness as a financial asset.

Moreover, these implications could in turn also affect staking, mining and institutional adoption of cryptocurrencies as a whole.

Chainalysis admits that it is impossible to predict exactly what will happen in the crypto markets, but the on-chain metrics mentioned in the article can help track the impact the Merge will have after it happens.

The first variable to keep in mind

The first metric to keep an eye on is staking on the new Beacon Chain.

In the past month it has not increased, a sign that preparations for the Merge have been underway for some time now. Indeed, it has not been increasing much since June, while from February to May there was a substantial increase, from 9.5 million to 12.7 million ETH.

Already now, the Beacon Chain is the largest blockchain in the world by total value in staking, with more than double the second largest and without yet having gone into full operation.

According to Chainalysis, post-Merge staking is expected to become even more attractive, so observing any significant increases in this metric will be used to understand whether the post-Merge is really producing benefits for ETH stakers or not.

However, it is worth remembering that ETH staked now are locked and not redeemable. So, perhaps we will have to wait until the time of unlocking to make a final judgement regarding the impact of the Merge on staking.

Chainalysis states that the changes due to the introduction of Proof-of-Stake should make ETH a more attractive asset to hold, and thus also to stake.

The relationship between whale address and level of staking

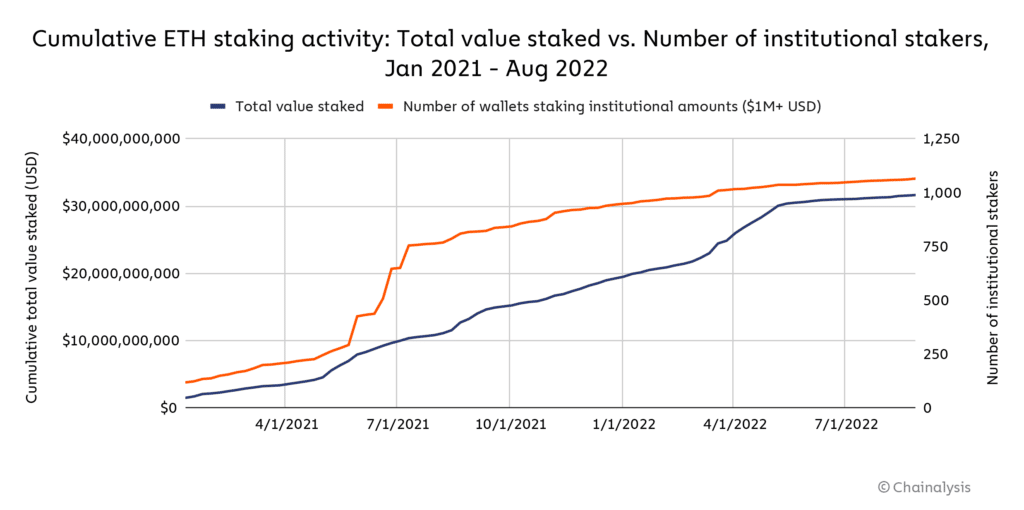

The second metric to keep an eye on is the number of whales staking, or Ethereum addresses that have more than $1 million of ETH in staking.

This metric really spiked between May and July last year, while growing less thereafter.

According to some forecasts, stakers can expect returns in ETH of 10% or 15% annually, without taking into account the potential increase in ETH value. Such yields could make ETH an attractive alternative even to classic bonds, for institutional investors.

Thus, it is expected that, if all goes as planned, large institutional stakers should increase.

Indeed, according to Chainalysis this could even lead to a decoupling of ETH’s price trend from that of other cryptocurrencies, precisely because it could be bought and staked as a bond-like asset.

Amount of hashrate employed on other PoW cryptocurrencies

The third metric is the hashrate of other cryptocurrencies that will continue to use PoW. It is hard to imagine that miners who can no longer mine ETH will flock to BTC, but it is also hard to imagine that they might move en masse to other cryptocurrencies.

In fact, 97% of the hashrate coming from GPUs to mine cryptocurrencies is currently allocated to ETH, and most likely the majority will simply dissipate.

Observing the three factors and the impact of the Merge on the entire market

By monitoring these metrics, it will not be possible to predict ETH price trends, but it will be possible to monitor the real impact that the Merge, and the post-Merge, will have on the crypto ecosystem as a whole.

The fact is that although all tests to date have yielded largely positive outcomes, a modicum of risk is still there. It’s not certain that everything will go smoothly, although it is likely that there will be no major problems, and the consequences of the Merge are still far from predictable.

Moreover, in the recondite event that the Merge goes wrong, or serious problems arise after the switch to PoS, the consequences on crypto markets could be very quick, so on-chain metrics also allow for virtually real-time monitoring.

Staking

ETH in staking may not decrease, perhaps for at least 12 months after the Merge, but if they do not increase it may not be a good sign. An immediate increase should not be expected, but once the process has fully come to a positive conclusion, a new increase above the stagnation of recent weeks could be expected.

Whale

As for whales, the trend will be even slower because it takes time before a major decision is made, such as allocating several million dollars on ETH in staking, but sooner or later it should happen.

Hashrate

Meanwhile, the hashrate will change right away, since in theory ETH mining should stop as soon as PoS is introduced as a consensus mechanism. Thus, already in the very first days after the Merge on 15 September it will be possible to observe whether the now former Ethereum miners will have moved to other PoW-based blockchains or not.

The Ethereum (ETH) price prediction

The price of ETH on the markets, on the other hand, could vary much faster, both because on the markets the impacts can also be almost immediate, and especially because investors and speculators always look only to the future, so they always try to anticipate the market’s own moves.

In this regard, it is worth noting that the price of ETH has already risen 73% from the mid-July lows, which confirms the hypothesis that investors and speculators have in fact already positively priced in the Merge.

For this reason, a rapid collapse could occur in the event of problems, but even in the event of success it is possible that at that point markets would stop pricing the Merge, once it occurs, generating perhaps downward volatility.

The current price of ETH is in line with that of late May, i.e., following the collapse due to the implosion of the Terra/Luna ecosystem. Thus, it may not even be considered particularly high. In the past few days, it has risen 6.5%, which is not at all abnormal in crypto markets, so much so that the current level could also be considered absolutely sustainable at this time.

It is possible that the price will also be impacted after the Merge by the staking itself, because it could generate additional demand beyond the current level.

The post How the Merge will impact the crypto world, according to Chainalysis appeared first on The Cryptonomist.