Key Insights

- Swell Network, currently in its guarded mainnet, is a permissionless, non-custodial Ethereum liquid staking protocol.

- Swell is the first service to integrate atomic deposits; allowing users to directly deposit ETH to their validator of choice — creating a defacto staking marketplace.

- In order to liquefy non-fungible stake, Swell mints and returns an NFT, swNFT, to depositors.

- swNFT is a container that holds swETH and information about the stake, yield and validator. swETH (non-rebasing) is returned 1:1 in terms of ETH deposited (principal).

- Swell has made tangible steps to becoming the first liquid staking service to incorporate Distributed Validator Technology (DVT), which will provide capital-efficient, permissionless entry into its validator set.

- There are also plans to provide in-dApp DeFi vaults and a white-labeling feature that will allow node operators to create their own front-end on top of the protocol.

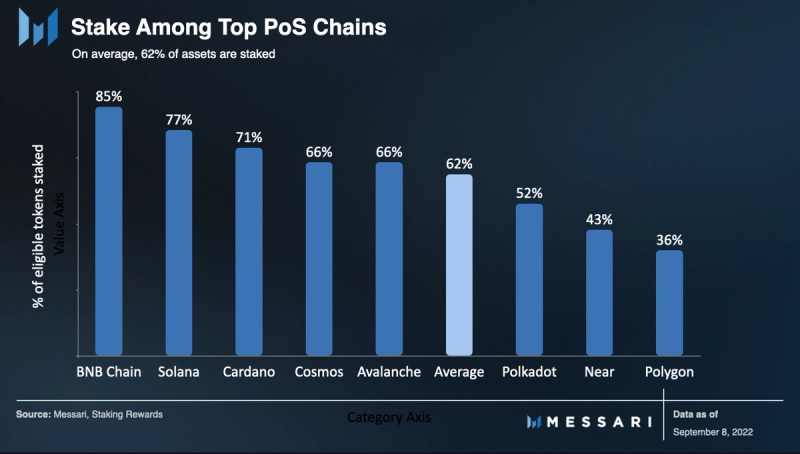

Ethereum’s transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS) has given ETH holders the opportunity to secure the Beacon Chain, Ethereum’s new central consensus hub. In exchange for locking (“staking”) their holdings as collateral to create new blocks, validators earn inflationary rewards. After the imminent Merge, rewards will also include priority fees and maximal extractable value (MEV), offering stakers an attractive 7–14% APY.

However, the large minimum capital requirements (32 ETH), technical complexity around the validation process, and extended lockup period (six months to one year after The Merge) stand in the way of ETH holders’ ability and willingness to stake. To address these user experience issues an entire industry called Staking-as-a-Service spawned.

The most popular implementation to-date has been non-custodial liquid staking, led by Lido and also serviced by alternatives such as Rocket Pool. While the current set of non-custodial liquid staking protocols have been successful, amassing over 34% of all staked ETH, they have left a lot of untested whitespace in terms of design and implementation.

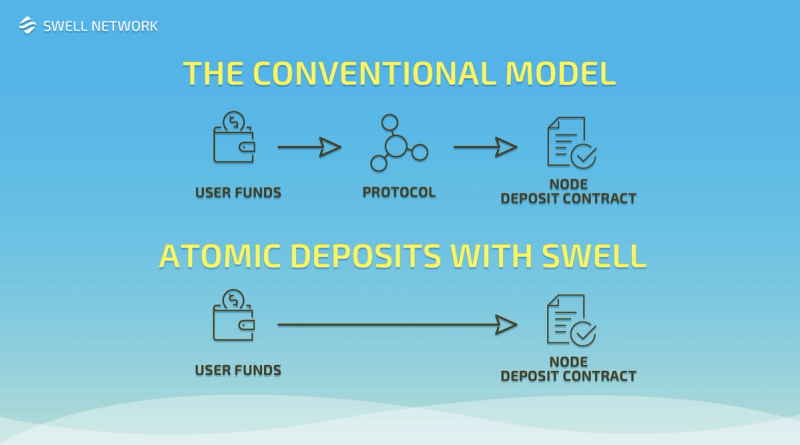

Waiting to launch in a competitive, network-effect driven space has its setbacks, but the late-mover advantage can be a powerful counterbalance. Swell Network, currently in its guarded mainnet, is a case-in-point. It has learned from non-custodial liquid staking incumbents and offers a novel way to stake and earn yield in Ethereum. The most significant difference is its integration of atomic deposits: allowing users to directly deposit ETH to their validator of choice and thus creating the first de facto staking marketplace.

Looking forward, in addition to offering in-dApp DeFi vaults (similar to Yearn), Swell has made tangible steps to becoming the first liquid staking service to incorporate Distributed Validator Technology (DVT). DVT will allow Swell to give its independent, permissionless node operators the same capital efficient entry into its validator set as its commercial, whitelisted operators.

Finally, Swell plans to build the rails to allow node operators to create their own front-end (‘white label’) on top of the protocol. If execution matches ambition, this could make Swell the staking marketplace of choice; facilitating relationships, allowing customizability and increasing decentralization for the Ethereum network as a whole.

Background

Swell’s proof of concept (V1) was launched in December 2020, shortly after the Beacon Chain.

In June 2022, Swell launched its private beta testnet for V2 on Kaleido and opened up its public testnet on Görli shortly thereafter. Around the same time, Swell closed its $3.75 million seed round led by Framework Ventures with participation from IOSG Ventures, Maven Capital, Apollo Capital, Mark Cuban, Fernando Martinelli (Balancer), and Ryan Sean Adams and David Hoffman (Bankless), among others.

In late August 2022, Swell V2 went live on Ethereum Mainnet using a guarded launch.

How Swell Works

Even at a very high level Swell operates quite differently from other Ethereum liquid staking protocols.

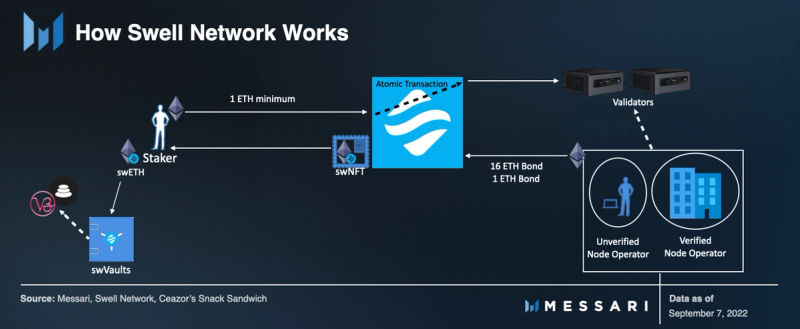

In its final state, Swell V2 will involve:

- Node operators, responsible for managing stake. They can either join permissionlessly (independent, 16 ETH collateral per validator) or through the whitelist (verified, 1 ETH collateral per validator).

- Atomic deposits, which allow users to stake directly with a node operator of choice. The minimum stake is 1 ETH.

- swNFT/swETH, minted and returned to depositors (stakers). swNFT is a container that can hold the swETH and information about the stake, yield, and validator. swETH (non-rebasing) is returned 1:1 in terms of ETH deposited (principal).

- The swETH can then be withdrawn and used in Swell’s in-dApp DeFi vaults and anywhere else the ERC-20 token is accepted.

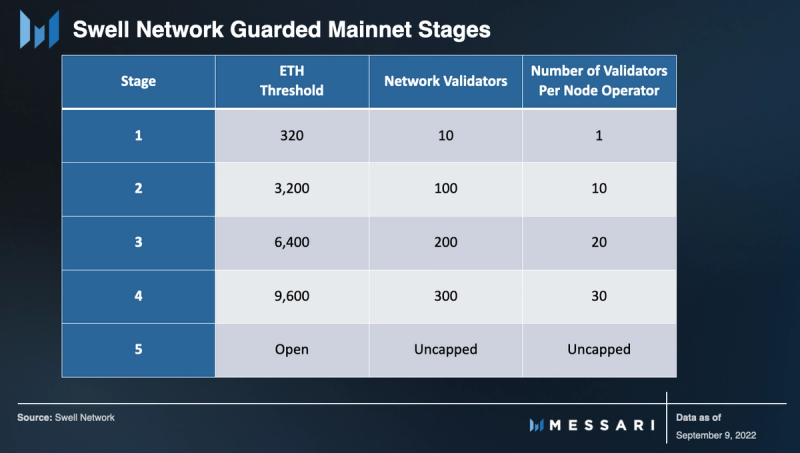

Swell’s guarded launch is occurring in five stages.

The protocol is currently in stage 1, with 242 ETH and 8 whitelisted node operators. Each stage’s completion is contingent on reaching its ETH threshold with everything continuing to function properly.

Node Operators

Swell’s node operator set is responsible for the actual staking. Swell will have two groups of node operators: verified (permissioned/whitelisted) and independent (permissionless).

During the guarded launch, validating is only open to verified node operators. These operators are generally expected to be commercial and experienced. They can apply to be whitelisted during an application round. The first (and so far only) whitelisting was conducted by the Swell core team, onboarding eight commercial node operators: InfStones, RockX, Smart Node Capital, DSRV, Blockscape, HashQuark, Stakely, and Kiln.

The application process evaluates prospective node operators based on their experience, performance, infrastructure (quality, diversity, and security), and potential to contribute to the DAO. There are also KYC checks and contractual agreements.

Once Swell fully launches, independent node operators will be able to permissionlessly join Swell’s platform. However, they will be required to post 16 ETH per validator as collateral in order to do so. There are plans to lower this requirement, as discussed further in the “Roadmap” section.

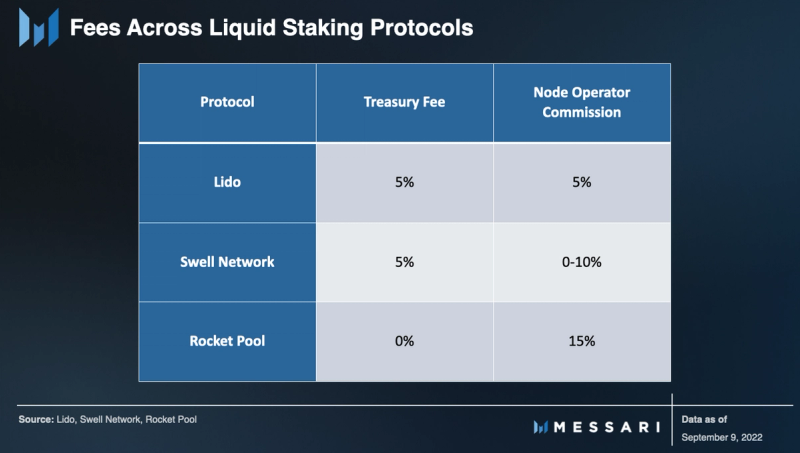

After joining, node operators set their own commission rate, which can range from 0–10%. Swell also currently levies a 5% protocol fee on staking rewards, which is directed to the DAO treasury and subject to DAO governance.

Node operators are also offered flexibility in terms of the client they run. After The Merge, node operators will have full control over how they redistribute priority fees and MEV rewards, since clients won’t have a configured fee recipient address. Swell also plans to eventually release a smoothing pool, similar to that of Rocket Pool.

While node operators can adjust their commission rate, the amount of additional yield sent to their designated Swell fee pool, and the way they display their performance (returns), they will be competing in an open marketplace. In theory, node operators that maximize transparency and returns while minimizing fees will attract the most stake.

Atomic Deposits, swNFT, and swETH

Since Swell uses atomic deposits, users delegate stake (a minimum of 1 ETH) directly into a Beacon Chain deposit contract of their choice. In other words, users can choose their node operator (based on profile, commission, and/or performance) and continue to track their deposit.

Source: Swell Network

In this model, the stake isn’t naturally fungible (i.e., liquid) since it’s tied to a particular node operator rather than a general staking pool (composed of many node operators). Swell has found a way to somewhat mitigate this by abstracting away the deposited ETH from the staking yield by using the swETH derivative and the swNFT.

Source: Swell Network

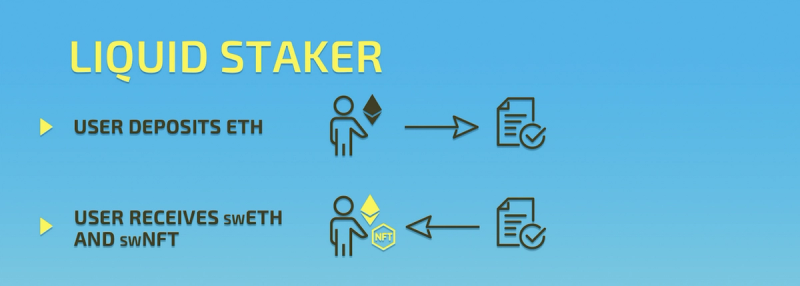

In exchange for depositing a stake, the contract mints and sends users swETH and a swNFT. swETH is a non-rebasing, ERC-20, liquid staking derivative token representing the principal stake. swETH is held within the swNFT. Liquid staking will remain disabled during the guarded launch, meaning swETH can’t be withdrawn from a swNFT. Once liquid staking (withdrawals) goes live, stakers will have the option to use swETH across DeFi. Node operators, however, will receive a soulbound (non-transferable) swNFT that represents their collateral.

In addition to being a container for swETH, the swNFT holds staking rewards (yield) and specific, non-fungible information about the stake. This information includes the delegated node operator, validator address, and a timestamp of when the deposit was staked.

A swNFT doesn’t actually receive yield (staking rewards). Instead the swNFT holds information about the stake, linking it to the yield earned by the initial ETH deposited to the node operator. The swNFT also continues to accrue yield even if it’s not holding any swETH. However, in order to actually receive the rewards (and principal), users need to burn the swNFT with the initial deposited swETH amount. Withdrawals are currently projected to be enabled 6–12 months after The Merge. In the period between the guarded mainnet and The Merge, the main source of liquidity for swETH will be secondary markets.

This model has some interesting implications for swETH and swNFT holders. For starters, the only way to earn staking rewards in this model is to acquire a swNFT since swETH acquired without a swNFT won’t accrue yield. The swNFT could also eventually be used across DeFi in different ways: as collateral, with interest rate protocols (e.g., Element Finance and Yield Protocol), by node operators to build their brand/relationship with stakers, and by Swell itself to gate access to certain features.

Roadmap

Improving Capital Efficiency

As mentioned, once permissionless staking is enabled, independent node operators will need to post 16 ETH in collateral, per validator, in order to join Swell’s operator set. However this is a bottleneck for onboarding independent validators/stake into the protocol and thus an issue for the decentralization of the Ethereum network as a whole.

Swell V3 will lower this requirement by leveraging Secret Shared Validators (SSV) technology, also known as Distributed Validator Technology (DVT). In particular, Swell will work with ssv.network, a DVT infrastructure protocol, to integrate SSV and bring the collateral requirement for independent operators down to 1 ETH (the same as verified).

Swell Vaults/DeFi Integrations

Aside from delegation, liquid staking also allows users to forgo the opportunity cost of having capital locked up. Instead, stakers can still keep and use at least some of their stake’s value. Swell will take this a step further with the introduction of Swell Vaults.

At first, the in-dApp vaults will be created by the Swell team and primarily serve to streamline and auto-compound yield and to create liquidity for swETH. Eventually, vault creation will become permissionless, allowing anyone to propose a strategy (similar to Yearn).

The second component of DeFi integrations will center around creating liquidity for swETH. Once swETH is withdrawable, Swell will launch swETH/ETH liquidity pools on Uniswap V3 and Balancer. In addition to running liquidity mining programs, the team plans to incentivize vlAURA/veBAL holders to increase LP yield (and thus liquidity).

Swell Network Token Generation

Swell has yet to launch its governance token, SWELL. In addition to governing the protocol (parameters and use of cash flows), SWELL will be used to incentivize node operators and liquidity pools for swETH/ETH.

There will be airdrops for early users, and seed round investors will have a three year vesting schedule.

White-Labeled Liquid Staking

Swell will seek to further augment customizability and the staker relationship for node operators by allowing them to create their own interface on top of Swell’s backend.

Competition

Within the non-custodial liquid staking space, Swell’s largest competitors are Lido and Rocket Pool. In many ways, Lido and Rocket Pool sit at opposite ends of the spectrum in terms of their offerings and approach.

Lido is the largest liquid staking provider, accounting for almost 31% of the roughly 13.5 million total ETH staking deposits and nearly 90% of all liquid staked ETH.

In large part, Lido’s aggressive expansion on Ethereum was made possible by its deposit model. Lido only uses a set of professional, whitelisted node operators from whom it requires no collateral. This model allows node operators to easily absorb large quantities of ETH. Additionally, the staking pool enables users to start earning yield as soon as they deposit to the platform (rather than waiting for entry via the Ethereum validator queue), ballooning Lido’s stake.

That’s the supply side. On the demand side, for stETH, Lido has integrations with nearly every major DeFi blue chip: Yearn, Curve, Aave, MakerDAO, Balancer, and many more. Lido has also consistently spent millions of LDO (Lido’s governance token) every month (2.5 million LDO in August, or roughly $6 million) to incentivize liquidity. The resultant network effects have created a powerful flywheel and driven more demand back to the staking service.

However, Lido has also received its fair share of criticism from the Ethereum community. Many see Lido as a threat to Ethereum’s decentralization. This concern starts with Lido’s relatively small, closed, institutional node operator set which is effectively gatekept by a committee of insiders (LNOSG). And even though LDO holders get the final say, LDO has very concentrated insider ownership

These critics tend to favor Rocket Pool, which has taken nearly the opposite approach. Launched almost a year after Lido, Rocket Pool prioritized decentralization, allowing permissionless entry into the validator set. The protocol secures stake through economic incentives rather than reputation or past performance. While Rocket Pool’s system has led to wider participation in the validation process, it has also created bottlenecks due to its capital inefficiency. Node operators are currently required to put up 16 ETH for each validator in addition to bonding RPL. This setup makes it a challenge to scale validators and thus absorb stake. As a result, Rocket Pool currently accounts for a little over 5% of liquid ETH staked and less than 2% of total ETH stake.

Swell has taken full advantage of the late-mover advantage by learning lessons from both of these protocols along with introducing its own novel solutions to the Staking-as-a-Service space.

Swell’s first major tactical move was to triangulate between Lido and Rocket Pool’s operator set strategies. By enabling both permissionless and whitelisted node operators, Swell allows for wider participation in the validation process (bolstering decentralization) while maintaining its ability to absorb staking demand. Also, Swell will smooth out the eventual transition to DVT by implementing permissionless validation from the get-go.

Swell also added a number of novel features — the most prominent of which is the atomic deposit. The first open, transparent marketplace for staking will provide a class of benefits to both stakers and node operators. Stakers will be able to decide which node operator to stake with (based on performance, commission, infrastructure, jurisdiction, or a number of other publicly listed features) and track their stake on-chain. Node operators will be able to customize their offering (e.g., priority fee/MEV distribution, commission, client, etc.), interface with customers (via the swNFT), and eventually even set up their own front end on top of Swell (“white label”). The tradeoff in this model is that losses (penalties and slashing) are not socialized across all users, instead they are split between the impacted validator and its depositors

The use of NFTs is also a first for a liquid staking protocol. This model ends up precluding the use of a yield-accruing receipt token (e.g., Rocket Pool’s rETH and Lido’s stETH). While this is a necessary trade-off, the use of NFTs will most likely widen the swETH:ETH discount due to lack of fungibility.

Swell’s other tradeoff is the need for a high minimum stake of 1 ETH, due to its lack of staking pools. Depending on ETH price appreciation, the 1 ETH minimum may lock out a significant amount of user in the future. Rocket Pool has a 0.01 ETH minimum, and Lido has no minimum.

Two other competitive advantages for Swell are Swell Vaults and the variable commission rate. The commission rate could become a big selling point, depending on where the protocol’s internal market pushes it.

The future staking ecosystem will likely have a place for each of these models and their unique offerings. The models will probably begin to converge, most notably in terms of permissionless node operation/capital efficiency. Rocket Pool is currently mulling over a formal proposal to reduce the required collateral to 8 ETH and to eventually even lower it to 4 ETH (along with an RPL bond).

Lido’s roadmap is even more competitive with Swell’s, as it is also looking to implement permissionless DVT. However, Swell seems to be much further along in the roadmap, with imminent (mainnet) permissionless validation and an already public DVT strategy/partnership with ssv.network.

Risks

Swell’s greatest risk is its late entry into the market. While Ethereum staking is still in its infancy, Lido and, to a lesser extent, Rocket Pool have already entrenched themselves in DeFi and the wider ecosystem. They have a powerful flywheel effect where the integrations and liquidity drive demand, which in turn drives more integrations and liquidity.

Swell has meaningfully differentiated itself and committed to incentivizing swETH liquidity and aggressively integrating with DeFi. However, the protocol will most likely need to execute seamlessly on one of its silver bullets in order to really tip the scales. If it succeeds, it could attract marginal ETH2 inflows and set off a competitive flywheel of its own.

One potential silver bullet that comes to mind is becoming the first project to successfully implement DVT – bringing the collateral requirement for independent operators down to 1 ETH. The unlocked capital efficiency could onboard a deluge of independent validators while increasing the decentralization of the Ethereum network. Beyond aligning with a central objective of the Ethereum network and community, DVT could also prove to be safer by splitting validation, trustlessly, between four operators.

Swell’s other silver bullet is building a very compelling staker–operator marketplace. This marketplace could benefit from external catalysts that would make operator information more valuable, such as jurisdictional regulatory enforcement/crackdowns. Another impetus could be operators converging around a meaningfully lower commission rate than the current industry standard. These examples would attract stake, but the shift could also come from a validator migration. Commercial operators could be meaningfully compelled by Swell’s flexibility or as an industry, decide to vertically integrate using Swell’s swNFT, and eventually its white label feature, to interface with customers.

However, the customization aspect (for node operators) is a double-edged sword. Not only could the aforementioned commission rates converge higher than the industry standard, but the node operators could also concenter on not sending priority fees/MEV to their fee pool. Even though it will be a transparent, competitive marketplace, the factors for determining a market’s equilibria are manifold and unknowable ahead of time.

Although Swell’s use of swNFT/swETH addresses its fungibility problem, the feature brings an additional risk vector to the protocol. As has been the case with stETH, the swETH/ETH pair on secondary markets could diverge considerably (from 1:1), even with withdrawals enabled, since swETH is only valuable as a staking derivative to those with positions in Swell (reducing its demand). This uncertainty could also discourage DeFi integrations (since it will be viewed as volatile collateral).

Closing Thoughts

While Swell’s novelty can project uncertainty, it can’t be accused of being undifferentiated.

With Ethereum staking at ~11% of circulating supply, the majority of growth has yet to come.

Swell is ramping up at the right time and it has a notable, one-of-a-kind core offering: an open, transparent marketplace for staking. It’s hard to know exactly how the liquid staking landscape will evolve over time, but Swell can certainly prove to be an attractive offering for both stakers and node operators.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form.

This report was commissioned by Swell Network, a member of Protocol Services. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. Paid membership in Protocol Services does not influence editorial decisions or content. Author(s) may hold cryptocurrencies named in this report.

Crypto projects can commission independent research through Protocol Services. For more details or to join the program, contact ps@messari.io.

This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. The past performance of any asset is not indicative of future results. Please see our terms of use for more information.