The recent Bitcoin recovery had the majority of market participants hoping for a new bull market. However, after yesterday’s USA Consumer Price Index announcement, it seems like it was all another bull trap, and the market can still drop deeper.

Technical Analysis

By: Edris

The Daily Chart

As seen on the daily Chart, the price had rebounded from the $18K level and was moving towards the $24K resistance level. However, the 50-day and 100-day moving average lines, accompanied by the significant bearish trendline, halted the uptrend. As a result, the price was rejected impulsively around the $22K mark once it failed to break above these key dynamic resistance levels.

Currently, the market seems to be heading for the $18K support level once again. A potential bearish breakout from the key $18K level could initiate another free fall for the price, which would likely lead to Bitcoin to $15K.

The $20K is a very important psychological and technical level, and it’s currently providing the first line of imminent defense.

The 4-Hour Chart

On the 4-hour timeframe, the price broke above the $22K resistance level a few days ago but failed to hold above it and dropped back below fairly quickly.

The RSI indicator was hinting at a probable reversal, showing a huge bearish divergence as the price was making higher highs, but the momentum indicator failed to do the same.

The massive drop has paused at the $20K support level for now. However, the market structure looks bearish at the moment, and a breakdown below $20K seems probable.

In this case, the $18K area could be tested once again to determine whether Bitcoin would make a new lower low or not.

Sentiment Analysis

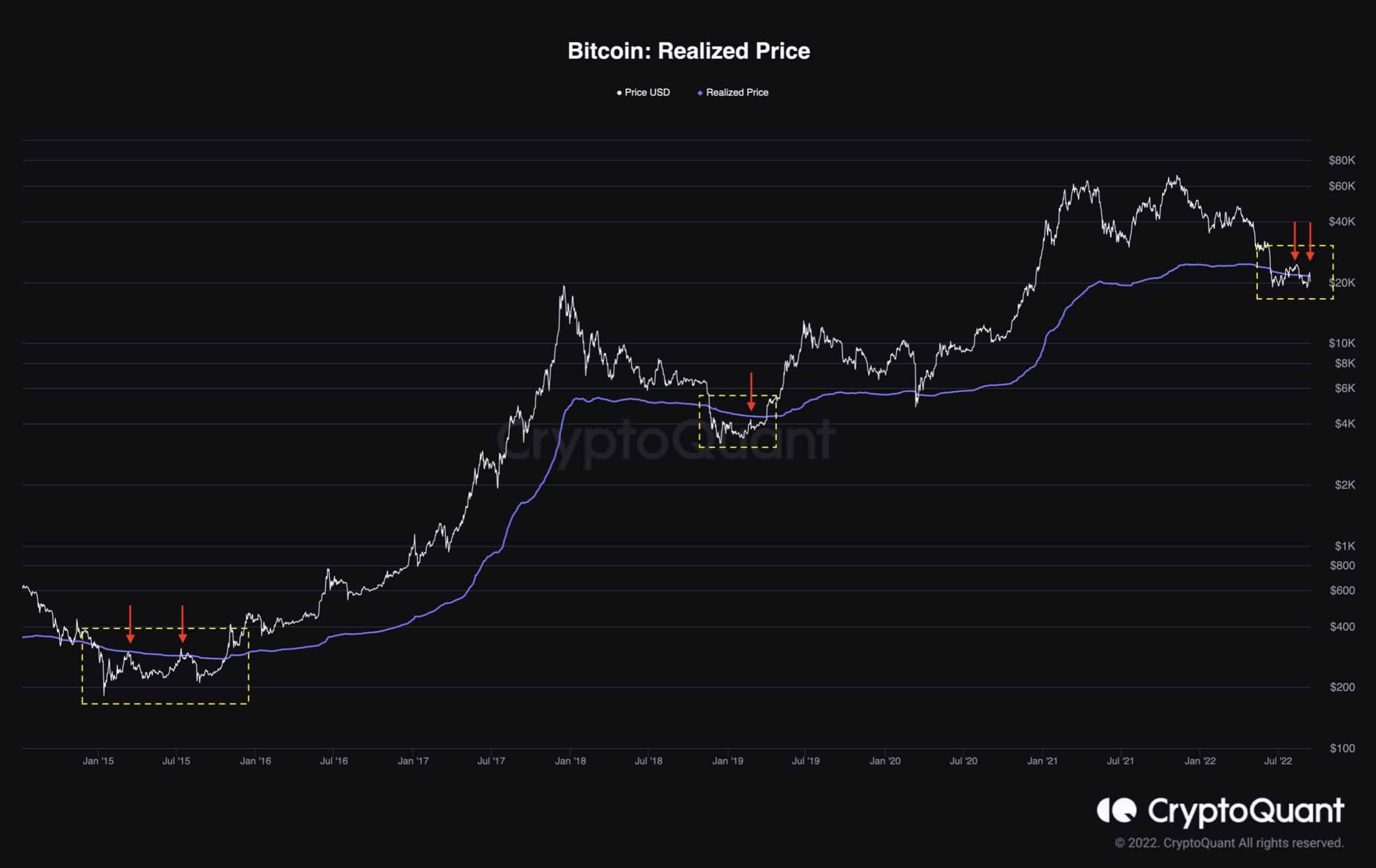

Bitcoin Realized Price

One of the best tools to identify whether Bitcoin is under or over-valued is the Realized Price metric. The current market price tends to stay above the realized price during bull markets and the first phase of a bear market.

On the contrary, during the last capitulation phase of a bear market, the market price tends to drop below the realized price for several months. During this period, many participants are holding at a loss and get tempted to sell their coins to avoid further losses. However, smart money usually meets the retail supply with sufficient demand and accumulates these under-valued coins below the realized price.

During the previous cycles, the end of a bear market and the beginning of a new long-term uptrend were indicated by the market price breaking above the realized price, a signal which has recently taken place.

However, it’s important to analyze other factors like the macroeconomic and geopolitical state of the world, as well as the futures market sentiment. These should be considered in order to have a more precise analysis.

The post Bitcoin Retraces Towards $20K But is the Pain Over? (BTC Price Analysis) appeared first on CryptoPotato.