Key Insights

- Everscale is a Layer-1 blockchain launched by community members and developers based on the whitepaper and open-source code of Telegram’s Telegram Open Network (TON).

- Everscale’s code has since been re-written, and the protocol is now distinct from the original TON code and design.

- Without the initial vision or central entity driving Everscale, the community struggled in its first year and a half to successfully deploy funds to grow an ecosystem.

- The Everscale Foundation and DeFi Alliance emerged to oversee the network’s growth strategy.

- In the near future, core development teams plan to implement a unique consensus mechanism detailed in Everscale’s whitepaper, which will allow the network to further scale via shards and threads without sacrificing network security.

Like many alternative Layer-1s (alt-L1s), Everscale aims to improve upon drawbacks in Ethereum’s existing architecture. It uses a combination of data sharding (via “workchains”) and execution sharding (via “threads”) to scale its network.

Everscale began as a community effort to revive Telegram Open Network (TON), a project led by Telegram that was discontinued due to regulatory issues. Everscale initially struggled to execute its vision without a centralized entity overseeing its development and ecosystem growth. To that end, the Everscale Foundation and DeFi Alliance emerged in late 2021.

In the next few quarters, Everscale’s development teams aim to implement several key features, including a new consensus mechanism and a messaging protocol that will enable secure data and execution sharding at scale. Everscale’s grassroots background and sharding technology combine to make it a unique alt-L1 that aims to capture the growing blockchain gaming and stablecoin market share.

Background

In 2017, co-founders of leading messaging service Telegram, Pavel and Nikolai Durov, announced their plans to launch a blockchain platform called Telegram Open Network. In 2018, Telegram raised $1.7 billion from two private sales of TON’s native token GRAM. However, before its planned launch in late 2019, the SEC litigated Telegram. The 2020 settlement mandated Telegram to return funds to its investors and pay a $18.5 million penalty. Telegram subsequently ended the project.

Although Telegram could not continue TON development, the published whitepaper and open-source code allowed other groups to do so. In mid-2020, one such group formed consisting of community members and developers led by TON Labs, a startup that worked with Telegram on the original TON blockchain. The group launched Free TON, which was rebranded to Everscale (EVER) in late 2021 as the project’s code and community shifted away from TON’s original design.

Technology

Network Architecture

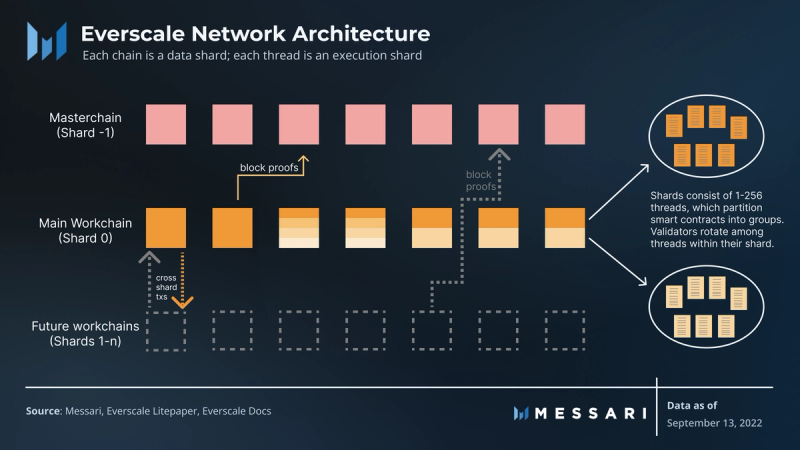

The Everscale network is split into data shards called “workchains.” Each election cycle, the global set of validators rotate and are assigned to a workchain. Validators store data and process transactions only for their assigned workchain. As long as validators download blocks of other workchains and update their state based on the changes that occurred, all workchains can run in conjunction.

Currently there are two workchains: the master workchain (“masterchain”) and the main workchain. The masterchain provides a layer of security for all workchains, as all workchain block proofs are posted to the masterchain. The masterchain also assigns validators to workchains through elections.

The main workchain consists of user-facing smart contracts. More work chains can be added, up to the current practical maximum of several hundred. Each workchain can have its own configuration parameters, virtual machines, and native currency. Ultimately, workchain customization and flexibility allow developers to strike the desired balance between security and performance.

Each workchain is split into execution shards called “threads.” Threads contain partitions of the chain’s total set of smart contracts and accounts. Validators rotate through assigned threads and carry out execution only for transactions in their thread. The amount of threads adjusts dynamically based on network load, from 1 to 256 threads. The multithreading approach allows for parallel execution of smart contracts by subgroups of the validator set that share the same data.

Consensus Mechanism

Everscale is a Proof-of-Stake blockchain that uses a Byzantine Fault Tolerance (BFT) consensus mechanism. BFT would require at least one-third of validators to collude to halt the chain and two-thirds to corrupt the chain. These security guarantees are sufficient for a blockchain without sharding, where the total validator set performs consensus together.

But in Everscale, consensus is carried out by subsets of the total validator set. As the number of shards and threads increases, the number of validators securing each decreases, making a network attack more viable. Thus, to continue adding shards and threads while remaining secure, Everscale is transitioning to a new consensus mechanism called Soft Majority Fault Tolerance (SMFT).

In SMFT, blocks are validated not only by all validators of that thread, but also by a random amount of validators from another thread within the same shard. Validators are chosen randomly for security. When validators verify a block, they must submit their approval or disapproval to the masterchain. If at least one validator does not approve of a block, then all validators within the shard must check it. If it is indeed a faulty block, the validator who created the block and all validators who approved it are slashed. Since one random validator is enough to prevent a malicious block, the total number of validators performing consensus can be low. This structure helps time to finality while still remaining secure.

Validator Elections and Requirements

Everscale can support up to 4,000 validators, with a maximum of several hundred on the masterchain. Validators are assigned to a workchain based on elections that occur every 18 hours. For each period, Everscale’s elector smart contract maximizes the total EVER staked while ensuring that the difference between the lowest and highest amount staked is not greater than 3x. This dynamic ensures that network power is spread out among validators rather than dominated by a few large stakers. The global minimum staking requirement is 10,000 EVER ($761 at current prices); however, due to the 3x parameter, the lowest staked is often much higher. Everscale validators also need to meet the system’s hardware requirements.

Computation

Everscale’s masterchain and main workchain use a unique virtual machine called the TON Virtual Machine (TVM). It compiles code written in Solidity, C, and C++. The TVM allows for some of Everscale’s unique features like distributed programming and supports zk-SNARK implementation. The planned launch for zk-SNARKs this year was canceled due to regulatory uncertainty over privacy technology.

Operating System

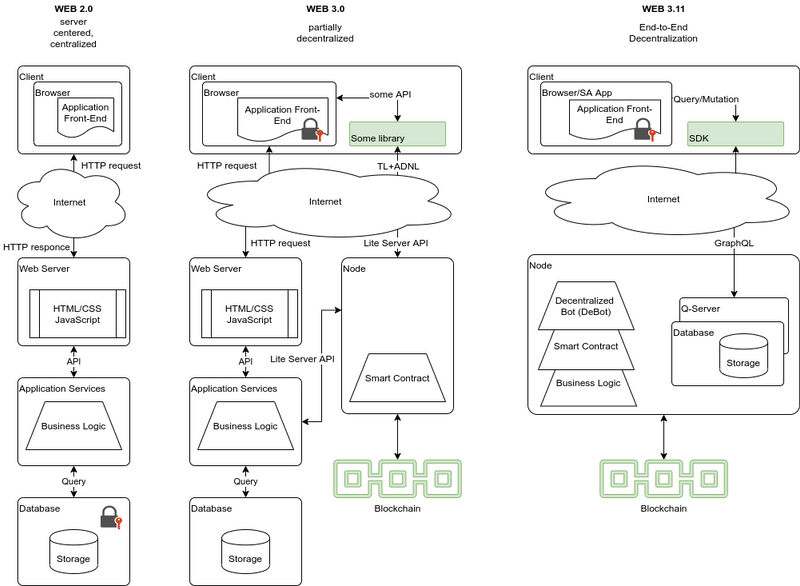

Source: Everscale Docs

Everscale has its own operating system called Ever OS. Ever OS provides an intermediary between a user or developer and the Everscale blockchain. It is designed around the goal of end-to-end decentralization from the consensus to the user experience level. Ever OS stores the user interface within smart contracts in the form of a Decentralized Bot (DeBot), rather than relying on web servers.

Peripheral Workchains

Peripheral workchains provide resources that Ever OS can use, similar to how a computer’s system can connect to external resources like a printer or hard drive. Just like with processing workchains, each peripheral workchain has its own validator set. At the time of writing, no peripheral workchains are live. The first one set to launch is DriveChain, which will be a decentralized storage device for Ever OS.

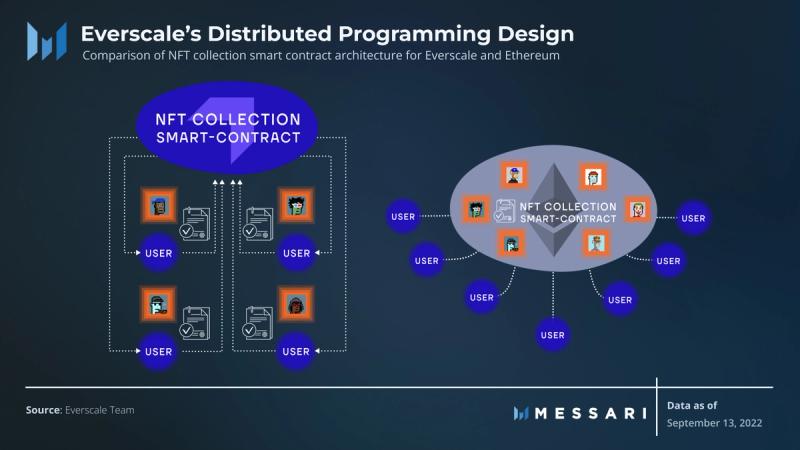

Distributed Programming

Blockchains are limited by the amount of data a validator has to store. As more activity occurs on the network, validators have to pay more to store all the information, which can limit validator participation and reduce decentralization. Additionally, users compete with each other through gas fees to store their data on a blockchain. Ethereum’s approach to handling state bloat has some security and centralization risks, thus Everscale takes another approach.

On Everscale each entity, balance, or trading pair has its own small smart contract deployed to it. Each smart contract pays a storage fee to keep its data in the state. The storage fee depends on the size of the data and how long users want to store it. If the contract runs out of money to pay the fee, the contract is deleted — first with the possibility of recovery, then completely. Thus, users can choose to not store small or meaningless transactions if they no longer want to pay for the storage. This approach frees up storage space for more important data and allows users to only pay for their own storage.

Tokenomics and Governance

Everscale’s native token EVER is used for network security (through validator staking), transaction and data storage fees, and governance.

History

Originally, five billion EVER tokens (at the time called TON Crystal) were minted with 0.5% annual inflation. The token currently has an infinite supply, although there are plans to end inflation and cap the supply at the end of 2022. As a decentralized blockchain with no leading team, the entire initial distribution went to three treasury wallets as follows:

- Referral Treasury (85%): provides funds for partnerships and adoption initiatives

- Developer Treasury (10%): provides funds for community developers

- Validator Treasury (5%): provides funds to bootstrap validator adoption

All three treasuries are multisig wallets requiring 12 out of 22 signatures. The Referral treasury mostly distributed funds through sub-governance groups. Community members formed 15 sub-governance groups and held “contests,” where the leaders acted as jurors who scored submissions in their group’s contests. Winning submissions received funds from the Referral treasury.

This token distribution system suffered from a lack of oversight and accountability. There were several alleged instances of jurors funding their own submissions. Even with well-intentioned jurors, many winning submissions lacked further incentive to continue developing their idea or project because all reward money was paid up-front.

In Q4’21, several forum posts called for the end of sub-governance groups and contests. Everscale whitepaper author Mitja Goroshevsky wrote in a post that “Sub-governances were an experiment that failed miserably.” The community agreed, and all sub-governance groups except three (DevEx, Formal Verification, and Cryptography) returned their funds to the treasury and ceased activity. Afterward, the Referral treasury burned three billion tokens. In total, sub-governance groups distributed over 50 million EVER, around 2.5% of the current total supply.

Current State

All governance now occurs through a larger DAO where all tokenholders vote rather than relying on a select number of jurors. Users can stake their EVER in Ever DAO without a lock-up period to vote using wrapped EVER (wEVER). The proposal threshold is 100,000 wEVER, and the voting quorum is 5 million wEVER. Currently there are 186 active voting addresses, which have deposited a combined 17 million EVER.

Voting power is rather top-heavy at the moment — the top eight voters combine for almost 90% of the total voting power. There are plans to create a liquid staked EVER token (stEVER). stEVER will allow validators and users who have staked their EVER to participate in governance, which should greatly increase participation rates.

On top of EverDAO, several groups have emerged to further the ecosystem, mainly the Everscale Foundation and the Everscale DeFi Alliance. The structure now more closely resembles that of other blockchains, with each group funded by the treasury wallets. The Foundation, which officially launched at the beginning of September 2022, aims to further Everscale through partnerships, education, and marketing. Its wallet currently holds 50 million EVER.

The DeFi Alliance is a consortium of teams and companies focused on growing Everscale through business development, liquidity provision, managing exchange listings, and partnerships. It received 107 million EVER initially and an additional 280 million EVER for selling at a discount with 24 month lockups to private investors (“Crystal Hands Program”). So far, it has sold about 45 million EVER, and the remaining 235 million is still unallocated. The DeFi Alliance also runs Everscale’s grants program, to which it is currently offering 15 million EVER in funding.

To wrap up, the total EVER supply is just over 2 billion. Due to the 3 billion token burn, annual inflation is now about 1.28%, with newly minted tokens going to validators in proportion to their stake. The three treasury wallets hold a combined 692 million EVER. Since launch, treasury wallets have distributed the following EVER:

- 394 million for boosting yield to incentive users to stake to validators.

- 297 million to recruit initial validators.

- 280 million for the Crystal Hands Program.

- 145 million to initial members to reward and incentivize development and partnerships, 55% of which went to EverX (previously TON Labs). There are 170 million tokens still vesting from the treasury wallet to EverX. A recent governance proposal amended the vesting schedule to release tokens depending on EVER’s market-cap rank.

- 142 million to later partnerships, 75% of which went to the DeFi Alliance. Just as with EverX, there are 170 million tokens still vesting from the treasury wallet to the DeFi Alliance, which will be released based on the newly approved vesting schedule.

- 52 million to sub-governance groups.

- 50 million to the Foundation.

Current State of the Everscale Network and Ecosystem

Network Activity

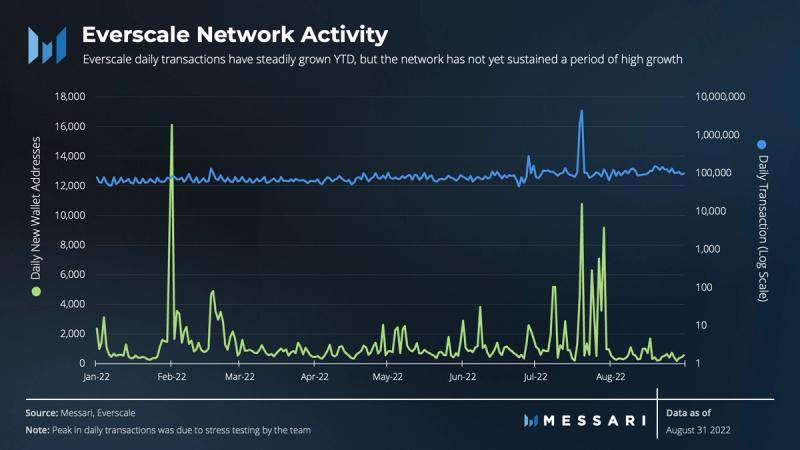

Network activity has remained fairly steady this year, and daily transaction count is typically around 100,000. The large spike in daily transactions in July 2022 was due to network load testing. However, about 27% of total transactions come from one smart contract that handles validator staking, elections, and rewards. On average, Everscale has about 1,300 new addresses a day. Everscale’s circulating market cap currently ranks 251st among all cryptocurrencies, which is a slight improvement from the beginning of the year (264th).

Staking and Decentralization

There are currently 204 validators who stake a combined 134 million EVER ($10 million at current prices). There are 100 masterchain validators and 104 workchain validators. No validator controls over 0.75% of the network. Users can stake their EVER to validators through the Ever Surf wallet interface. At the moment users are staking 43 million EVER to validators, earning an APR ranging from 6–11%.

Ecosystem

DeFi

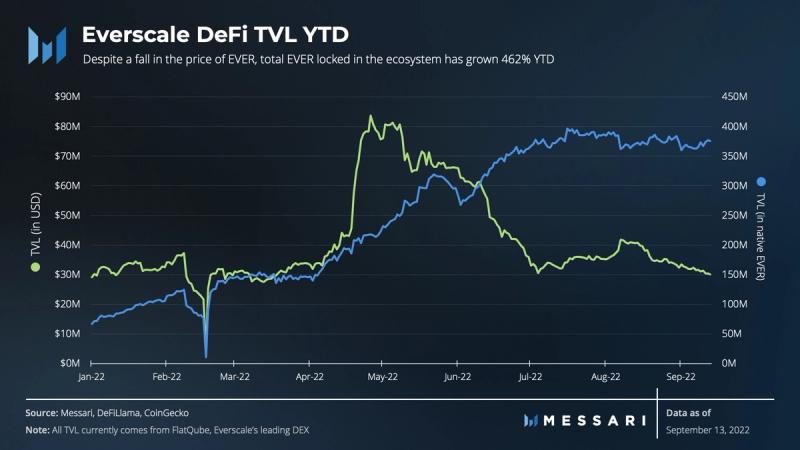

Everscale’s DeFi ecosystem is relatively new. Its leading decentralized exchange (DEX) is FlatQube, which launched in Q1’22. FlatQube is a constant product automated market maker (AMM), with swap, pool, and farm features. It currently has $29 million total value locked (TVL). At the beginning of Q3’22, a yield-farming optimizer built on top of FlatQube, Black INK, launched. FlatQube is developed by Broxus, one of the leading developer teams in the ecosystem. Broxus also developed Octus Bridge, Ever Wallet, wEVER, and Everscan.

Octus Bridge provides token and arbitrary data bridging between Everscale, Ethereum, BNB Chain, Fantom, Polygon, Avalanche, and Milkomeda. Broxus is working on adding an integration with Solana. So far, Octus Bridge has transferred $174 million worth of tokens.

FlatQube, Black INK, and EverLend all launched their own token through EverStart. EverStart is a multichain launchpad that allows users to participate in token launches on Everscale via Everscale, Ethereum, BNB Chain, Polygon, and Fantom.

Users can track their portfolio and view analytics across Everscale’s DeFi protocols, governance platforms, and staking pools on dashboard Snipa.finance.

As far as upcoming projects, EverLend will be Everscale’s first lending protocol. It is currently under development. EverX is developing central-limit order-book (CLOB) Flex, which will launch in September.

NFT and Gaming

Everscale’s NFT and gaming ecosystems are also both relatively new. Everscale’s premier NFT marketplace is Grandbazar, which won an NFT marketplace contest at the beginning of Q3’21. There are over 250 NFT collections listed on Grandbazar, and they have done a combined $17,000 in volume.

Recently, a group of Everscale developers and community members released both an NFT and gaming SDK. The SDKs include features such as NFT issuance and burning, in-game marketplaces, land tokenization, and more. The SDKs will allow other developers to more easily build NFT and gaming projects on Everscale.

Roadmap

Technical Improvements

There are several key technical features from Everscale’s whitepaper that are planned to launch in the next several quarters.

One of the major items on Everscale’s technical roadmaps is the switch to the SMFT-based consensus mechanism, as mentioned earlier. SMFT has been open source for several months and is now in the testing phase.

In addition, the Everscale development teams plan to launch the Reliable External Messaging Protocol (REMP). Once validators accept a message from a user, REMP guarantees that message is included in a block in the order it was received. Tracking the order prevents front-running attacks, where the re-ordering of users’ transactions allows someone else to collect arbitrage. Because there is no re-organizing in the message queue, users can be sure of how their transaction will be executed. Thus, messages can be considered finalized with a very high probability within 0.2 seconds. REMP also has built in DDoS protection by banning users who spam messages that fail upon execution for ever-increasing periods of time. Along with the SMFT-based consensus mechanism, REMP’s code has been written and it is close to launch.

In Q4’22, the development teams plan to launch DriveChain, a decentralized on-chain storage workchain for Ever OS. DriveChain will consist of smart contracts optimized for the storage of large objects. Use cases include storing NFT images and old states of other workchains. The chain uses random sampling to ensure validators are storing the data. Additionally, quasi-random bits are included in the data files to fill up the entire storage space, ensuring that validators use all their disk space correctly. These random bits are then replaced with actual data files when necessary.

Growth Strategy

While the core development teams work on implementing technical improvements, the Everscale Foundation and DeFi Alliance plan to grow the ecosystem and cultivate partnerships. The two groups have a combined 55 million EVER ready to deploy and will be able to draw from the 692 million EVER in the treasury wallets for further funding.

At the beginning of 2022, the DeFi Alliance identified CBDCs and stablecoins as an attractive avenue for growth. They have already partnered with DA5, a remittance operator in the Philippines, and are currently working to build other joint ventures.

Summary

Everscale has come a long way since it launched as Free TON. It has a growing DeFi ecosystem with tens of millions in TVL and averages about 100,000 daily transactions. It now has several large third-party groups in the Foundation and DeFi Alliance that can more efficiently deploy funds for growth than the original sub-governance system.

However, Everscale still has a long way to go in order to catch up with other alt-L1s. As it stands, the Everscale blockchain lacks many of its whitepaper’s key features, including the SMFT-based consensus mechanism, REMP, and peripheral workchains. Although the ecosystem will likely benefit from the structure of the Foundation and DeFi Alliance, these nascent organizations are still figuring out the best ways to incentivize growth.

If the development and growth teams are both able to execute, then Everscale could be an alt-L1 on the rise. Once SMFT, REMP, and DriveChain are implemented, Everscale will certainly have an impressive core technological stack. But this alone will not be enough to attract new users and developers. For this to happen, the Foundation and DeFi Alliance need to develop strong partnerships and invest efficiently in the ecosystem, which they are now well-positioned to do.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form.

This report was commissioned by Everscale, a member of Protocol Services. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. Paid membership in Protocol Services does not influence editorial decisions or content. Author(s) may hold cryptocurrencies named in this report.

Crypto projects can commission independent research through Protocol Services. For more details or to join the program, contact ps@messari.io.

This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. The past performance of any asset is not indicative of future results. Please see our terms of use for more information.