The State of Optimism Governance is an effort to expand upon a previous forum post on Optimism Governance. It is a formal, recurring report to provide transparency and analysis following each Season of the Optimism Governance Fund. Inspired by Optimism’s culture, which emphasizes public goods, we have released these reports at no cost (as a public good).

Key Insights

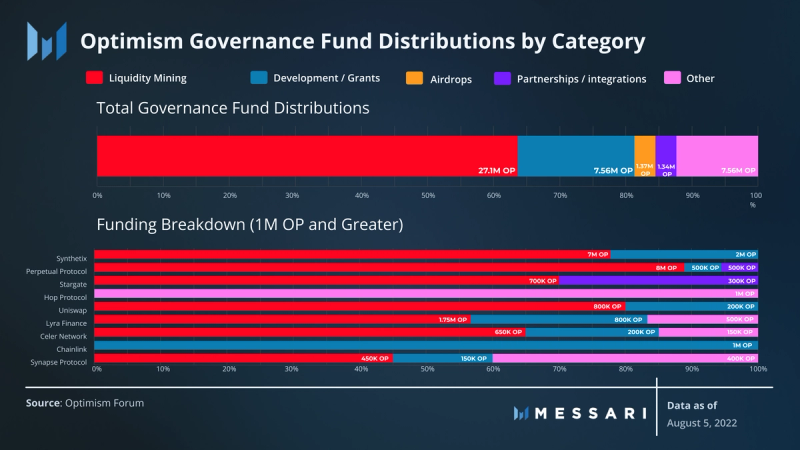

- The Optimism Token House has distributed 42 million OP through the Governance Fund across sustainable growth projects on the Optimism Network.

- Over 60% of the funds distributed were allocated towards liquidity incentive programs, which dramatically increased the amount of Total Value Locked (TVL) on the network but has not yet led to a meaningful increase in transactions and sequencer revenue.

- Optimism will look to evolve the Governance Fund process for Season 2 by introducing Governance Committees, adjusting quorum requirements, and further refining the fund’s purpose to target the migration of layer-1 applications and attract value-aligned builders.

Introduction

The Optimism Token launched on Jun. 1, 2022, marking the beginning of the Optimism Collective and an ambitious vision of governance experimentation. A core component of the Optimism Collective is the Token House Governance Fund, a fund directed by OP token holders to incentivize the sustainable growth of projects in the Optimism ecosystem. In its first season, the Governance Fund successfully distributed 42 million OP and had varying impacts on the Optimism network’s core metrics. This report dives into the governance activity within the Token House in Season 1, touching on power dynamics, governance funding, and Optimism’s planned improvements for Season 2.

Governance Overview

Bicameral Governance Structure

Optimism governance is a collaborative effort between the Optimism Foundation and the Optimism Collective. The Optimism Collective is bicameral, dividing governance matters equally between the Token House and the Citizens’ House.

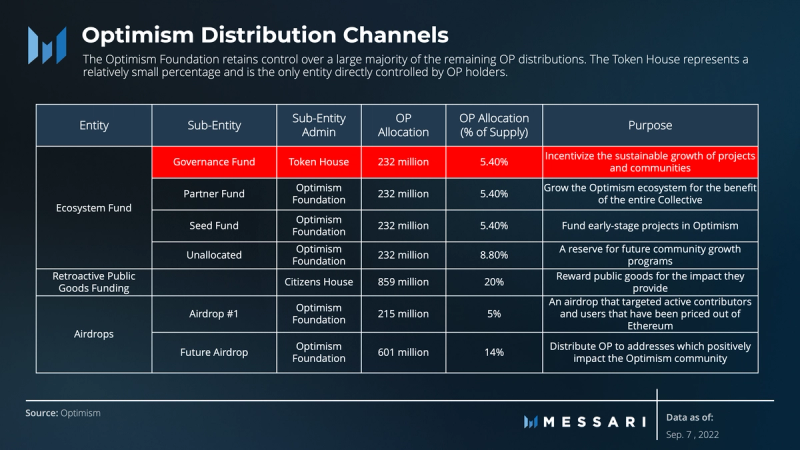

The Token House

The Token House’s mission is to govern project incentives, protocol upgrades, and treasury funds. It was launched with Airdrop #1 in June 2022, which consisted of ~215 million OP and is governed by OP holders. 5.4% of the total OP supply (~232 million OP) has been allocated to the Governance Fund to be distributed to the Optimism Ecosystem.

In Season 1, there was limited documentation and guidance from the Foundation regarding the Governance Fund’s goals and purpose. Optimism recently clarified the Governance Fund’s purpose and objectives, which will enter Season 2 from Sep. 8, 2022, through Nov. 9, 2022.

Purpose

The Governance Fund aims to incentivize the sustainable growth of projects and communities in the Optimism ecosystem. All funding is meant to come with growth-related deliverables. The Governance Fund is not expected to fund public goods without an expectation of future work, as the Citizens’ House will be responsible for retroactively funding public goods when launched.

Goals

The near-term goals for the Governance Fund are to target Layer-1 applications with a product-market fit. This goal seeks to encourage established builders and applications on Ethereum to migrate to Optimism. The second near-term goal for the Governance Fund is to grow the population of value-aligned builders. Optimism wants to incentivize proven builders and developers to launch their applications on Optimism to be a hub for innovation.

The Citizens’ House

The Citizens’ House has yet to be launched but will initially comprise top contributors in the Optimism ecosystem. The Optimism Foundation will select the initial Citizens and award Citizenship via Soulbound NFTs. Members of the Citizens’ House will be responsible for retroactively distributing protocol-generated revenue to public goods serving the Optimism Ecosystem. The vision for the Citizens’ House is to create a flywheel effect where revenue generated by the Sequencer is distributed by citizens to retroactively fund public goods. This should increase demand for Optimism’s public goods, which should, in turn, drive more demand for Optimism block space, thus generating more revenue for the Sequencer.

Token House Governance Process

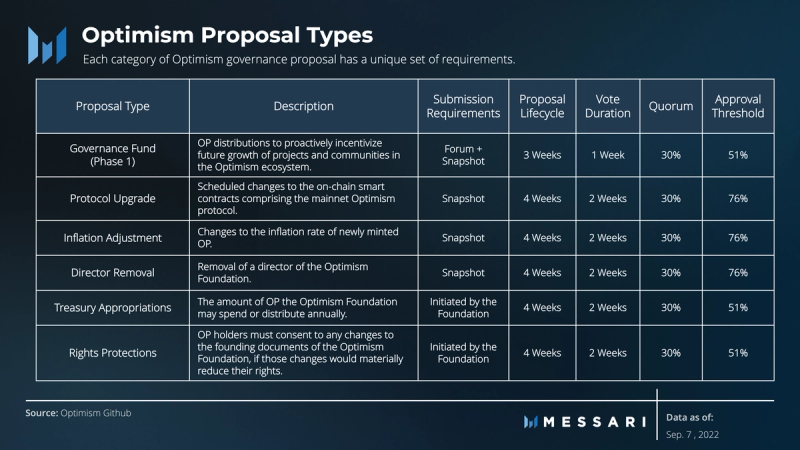

The Optimism Governance Process for the Token House allows community members to enact changes to the Optimism protocol using several predetermined proposal types. Delegates play a significant role in the Optimism governance process and serve as shepherds of the proposal lifecycle. There are six major proposal types, although each will follow a similar process through Optimism governance.

Week 1: Community Feedback & Temperature Check – [Draft Stage]

A proposal is created when a community member introduces an idea on the Optimism Governance Forum or Discord. Once posted, the community will provide feedback, discuss, and debate the idea(s).

Week 2: Delegate Feedback – [Review Stage]

Once a proposal has been discussed by the community, Token House delegates are responsible for providing feedback on proposals that have met the requirements outlined in the Proposal Template. For a proposal to move forward to Week 3, two delegates with over 0.5% of the current votable OP supply must give explicit approval in the discussion thread.

Week 3: Voting – [Snapshot Vote]

In Week 3, all delegates (and self-delegates) can vote on Optimism’s Snapshot Space. Each proposal type will be subject to a different quorum and approval threshold. Governance Funding proposals are considered ‘passed’ when they meet a quorum of 30% of the votable OP and a 51% approval threshold.

After voting has concluded, the Optimism Foundation facilitates the administration of the proposal. Failed proposals may be reworked and added in the next voting cycle, specifying any notable changes made to the proposal.

Process Adjustments for Season 2

Each Voting Roundup Thread will need to display the total OP votable supply.

- During the Review phase (Week 2), delegates may not approve their own proposals to move the proposal forward to Week 3.

- During the Review phase, all proposals must receive explicit delegate approval. Without explicit delegate approval, proposals will not move to a Snapshot vote.

- The quorum has increased from 10% to 30% for all proposals.

- The approval threshold for protocol upgrades has been adjusted from 51% to 76%.

The Token House Power Dynamics

Delegates

During Season 1, delegates played an essential role in the review and approval of DAO Governance Fund applications. Under the previous review system, delegates with over 0.5% of delegated voting power were expected to review all governance funding proposals. Each application required the direct endorsement of at least two delegates to proceed. This dependency on delegates created a laborious workflow, resulting in unpaid delegates working extensively to review each governance proposal. Further, the feedback was sometimes controversial. In one notable case, Lido DAO’s application was denied after failing to gain interest from delegates other than ScaleWeb3 and Polynya. In contrast, Rocket Pool’s application succeeded with near unanimous support from all major delegates.

In Season 2, Optimism will look to address this issue of delegate burnout via the introduction of committees. Season 1 proposals were left up to a vague process requiring delegate engagement before Snapshot voting selection. Now a committee will meet to discuss the proposal’s merits and ultimately make clear recommendations on if and when a proposal is ready to submit. If a proposal is deemed not ready for submission, the committees will guide applicants on increasing the clarity of their proposals.

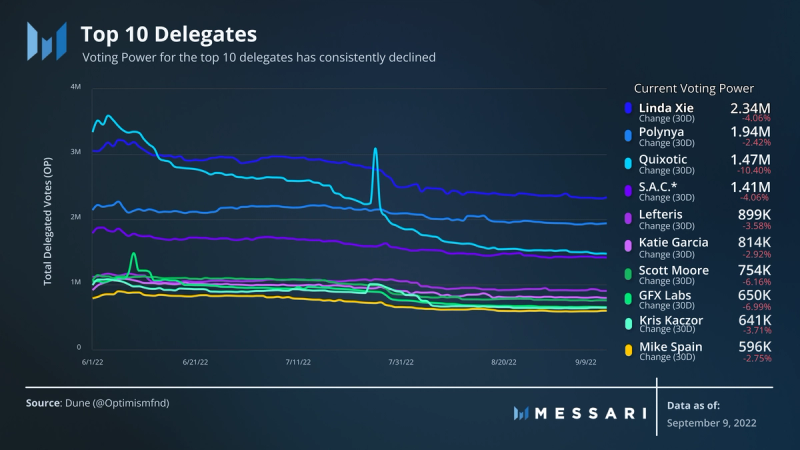

The Current Delegate Landscape

The Optimism delegate landscape has seen some notable swings in power. Once responsible for 59% of the total delegated voting power, the top ten delegates have fallen below half of the total delegated voting power market share, with control of just 48% of the total voting power. Every top ten delegate has lost voting power over the past 30 days.

As the voting power of the most significant delegates decreases, a few notable delegates have gained traction at the expense of others. Two delegates with notable traction include Nick Tong (50.45%) and Blockchain at Berkeley (30.4%). The redistribution of voting power from whales to smaller voters is an encouraging signal for the decentralization of Optimism governance.

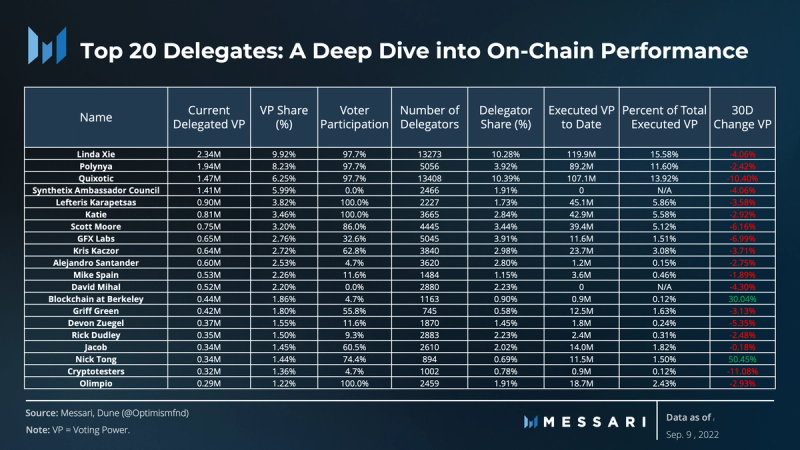

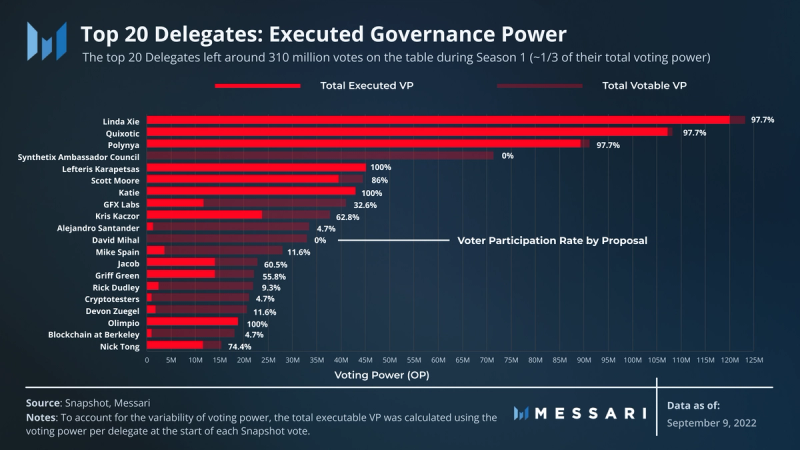

Despite holding significant voting power, the current top 20 delegates failed to use over one-third of their total voting power in Season 1. While many delegates participated across the Optimism governance forums and actively used their delegated voting power, participation varied dramatically.

The typical participation rate (x votes cast / y proposals) fails to account for a delegate’s impact when their vote is cast. An alternative representation of delegate participation is displayed in the amount of governance power a given delegate executed (vote utilization) compared to the total number of votes they had the opportunity to cast. For example, if a new contributor becomes involved with the Optimism ecosystem, their voting participation rate would begin at zero. If this individual gained 1 million delegated votes on day one of contributing and had perfect participation over the subsequent 20 proposals, they would still be facing a 30% participation rate. If participation is gauged by vote utilization, the results will show this contributor at a 100% participation rate, having executed 100% of all possible votes.

Token House Committees

The Token House Committees were announced following the end of Governance Funding Season 1 and are the most recent example of Optimism governance experimentation. During Season 1, delegates took on most of the work in vetting and approving applications. The goal of committees is to create working groups to alleviate the workload taken on by delegates in Season 1. For Governance Funding Season 2, there will be four committees dividing up the work related to funding proposals in the Token House. The committees voted in by OP holders consist of two DeFi committees, a tooling and infrastructure committee, and an NFT and gaming committee. Each committee will comprise one leader and four reviewers, and the Governance Fund will be used for compensation at a rate of $10,000 per month for each committee (in OP). At the end of Season 2, an additional $10,00 per committee ($40,000) will be divided amongst all committees based on relative workload.

Despite the initial intention of committees to decrease delegate workloads, nearly all committees are composed of current delegates. Without financial incentives for delegates not involved with committees, there could be a participation drop-off if 20 delegates are paid via committees and the remaining delegates are not. A member of the Optimism Foundation addressed this concern, stating that it was “To address concerns around drop-off in the non-committee delegate participation, the Optimism Foundation will track this data and re-evaluate the structure of committees if we see a meaningful decrease.” As of Sep. 8, 2022, the 20 committee members combined voting power makes up around 32.9% of all votable OP. The DeFi committee (Group A) made up 17.5% of all voteable OP.

Proposal Analysis

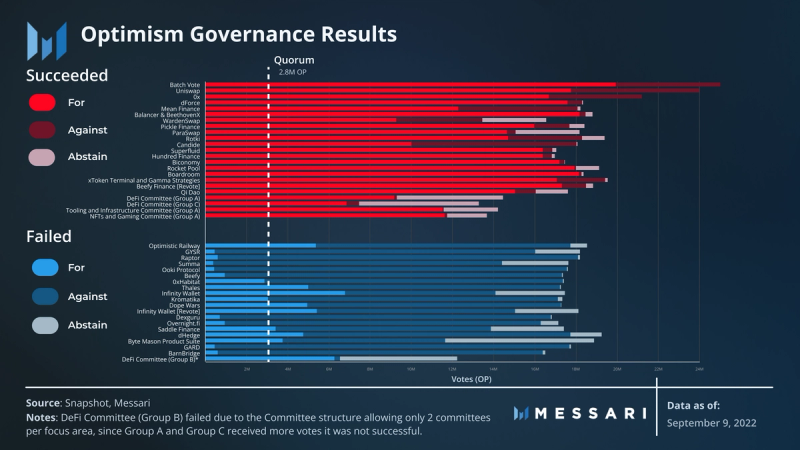

Optimism’s governance still exists in a largely nascent state. So far, the Token House has voted exclusively on Governance Funding proposals. Governance Fund votes have existed across four cycles, with the overall process broken down as follows.

Analyzing the Effectiveness of the Governance Fund

The Optimism Governance Fund’s stated purpose is to incentivize the growth of projects and communities in the Optimism ecosystem. The Governance Fund has distributed 42 million OP tokens to projects in the Optimism ecosystem over four voting cycles. The Optimism Collective Flywheel, as mentioned earlier, is important to understand to assess the efficacy of OP incentives. The flywheel depends on public goods driving demand for block space, effectively increasing Sequencer revenue, which is returned and distributed to public goods.

To evaluate the effects of incentives on the OP ecosystem, we’ll observe some ecosystem metrics and attempt to contextualize the role of the OP incentives in the Optimism Foundation’s user adoption strategy.

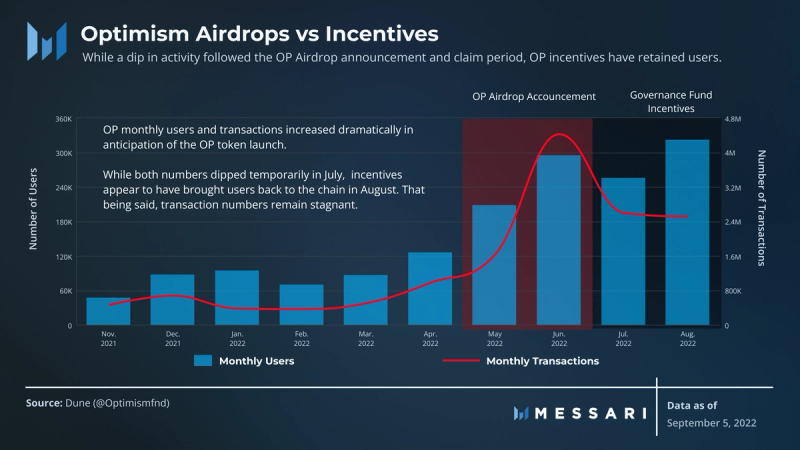

Transactions and User Volume

When observing the growth of users and transactions, it’s clear that the preceding airdrop farming increased both the number of users and the number of transactions on Optimism. While both metrics took a dive following the peak of airdrop activity in June, on a monthly time frame, the introduction of OP incentive programs appears to align with an increase in activity on the network. Whether users will stay on Optimism following the end of these programs remains to be seen, but thus far, it would appear that users are willing to stick around as long as they are incentivized to do so.

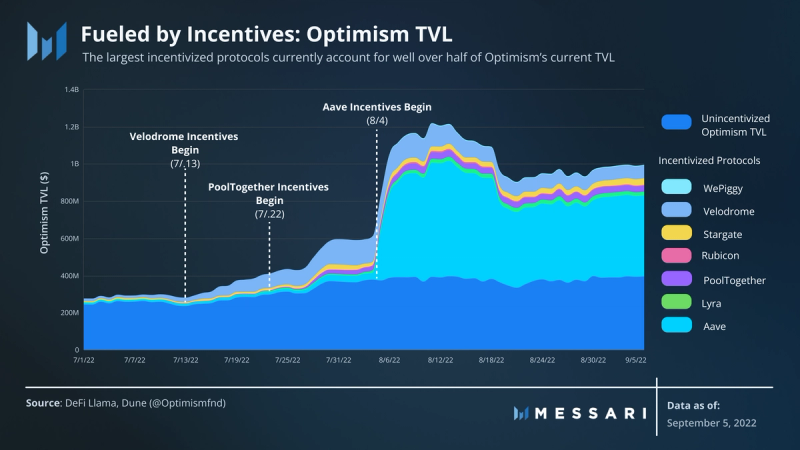

Total Value Locked (TVL)

To date, OP incentives have arguably been the most successful in attracting liquidity to the OP network’s ecosystem. This is unsurprising, given that 60% of the OP distributed was explicitly earmarked for liquidity mining (LM) purposes. DeFi protocols that launched LM programs have seen dramatic rises in the amount of value locked. For example, Aave has seen a net TVL increase of nearly $318.6 million. Velodrome, another notable beneficiary, has gone from a little over $4 million to over $68 million in TVL since its incentives began in July. As incentive programs continue to roll out, liquidity mining should continue to draw capital to the Optimism chain. Over 20 million OP is queued to release through notable protocols such as Synthetix, Uniswap, Hop, Chainlink, and Beethoven X.

Many community members, users, and project founders rely on TVL to measure the performance of incentives. While TVL is a valuable indicator of investor faith in a protocol and attainable yield, it directly represents the dollar value held on the network. TVL can effectively display how much voting weight was attracted due to incentives from the funding event but does not guarantee that these users are actively transacting. However, unless the TVL translates into transaction fees, it does not contribute to the sustainability of governance funding. For example, if users are bridging to Optimism and depositing into Aave, TVL will increase in the short term, but as incentives taper off, one would expect TVL to follow.

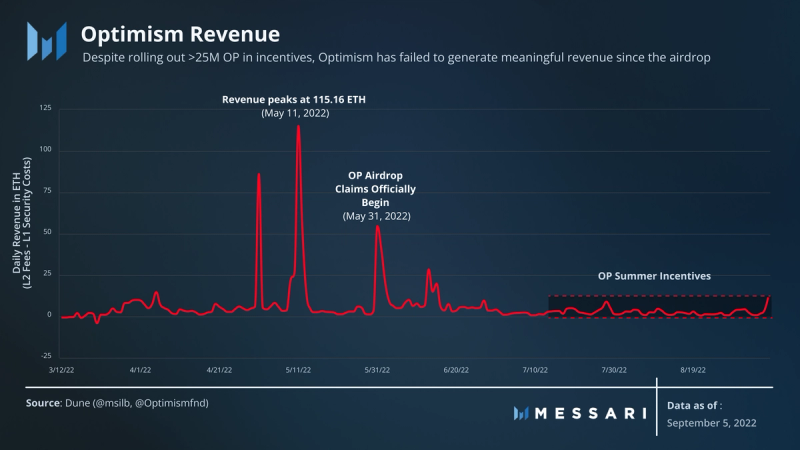

Revenue

To date, the Optimism community has voted to invest around $50 million worth of OP into the growth of the protocol via the Governance Fund. While investments in future Optimism growth, the funds immediately impacted the number of users and dramatically on the TVL of incentivized protocols. Yet from a strategic standpoint, the goal of the Governance Fund should bootstrap the Optimism Collective flywheel. Since the overall health of the flywheel depends on fees, measuring success through TVL or user growth may not be sufficient to measure the program’s success.

Optimism’s Sequencer revenue has consistently ranged below 20 ETH per day. While a few spikes have occurred, most notably during short periods in anticipation of the OP airdrop, the protocol’s fee system has largely remained stagnant since July 2022. Despite significant increases in TVL and users, the financial rewards of OP incentives appear to be largely absent. That being said, the OP Governance Fund is a long-term investment focusing on establishing traction, confidence, and capital in the ecosystem. If the Governance Fund incentivizes a level of infrastructure (public goods) that will bring significant volumes of users to Optimism, this should translate to increased protocol revenue in the future.

New Proposal Objectives for Season 2

While Optimism has not published evaluation metrics for governance fund spending, the Optimism Foundation outlined its goals for Season 2 funding. The Governance Fund’s previous focus (in both perception and results) on liquidity mining and incentives seems to be shifting slightly towards builders. The sentiment has been echoed on community Governance Calls, where Optimism Foundation representatives shared an explicit desire to see more developer funding in incoming proposals.

Governance Analysis

The Token House’s launch and successful execution of Season 1 have generated excitement within the Optimism community. Optimism’s emphasis on public goods funding as a cornerstone of its governance experimentation sets an atmosphere ripe for innovation while remaining positive-sum. A comprehensive analysis of Optimism’s governance cannot be thoroughly conducted without all major pieces being launched and operational.

Where Optimism Governance Excels

Despite the Token House still being in its early stages, one can acknowledge its organization. Delegates have contributed a lot of time, feedback, and experiences to mold the Token House into a productive unit of the Optimism Collective. The initial organization of individuals is typically a gradual process as individual contributors need to assess their skills relative to the task. However, the Token House contributors appear to be excelling in self-organization and committed to a positive-sum output.

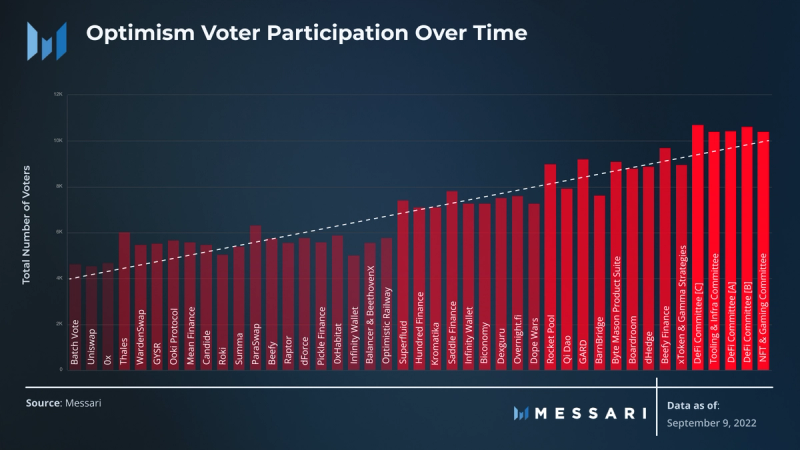

The ability to self-organize is no small feat, but it is even harder to do so while also growing the number of active contributors. Active contributor growth is displayed in the number of voters on each proposal, which has steadily increased since Airdrop #1. The total number of voters on the first proposal, Governance Fund Phase 0 – Batch Vote, reached 4,621. The most recent proposal for DeFi Committee C reached 10,571 voters – the largest number of voters on a proposal. It would be hard to conclude that the growth in active voters cannot at least somewhat be attributed to the strong leadership that has emerged from delegates in the Token House.

The outlining of a clear goal and purpose for the Token House was a welcomed addition. During Season 1, a clear goal was not easily identifiable outside the initial post in the Optimism governance documentation. Having a purpose with near-term goals should be extremely helpful for voters to make educated decisions on funding projects.

Areas for Improvement

While the Token House has been off to a strong start, there are still areas that need to be addressed. Committees may aim to provide a deeper layer of vetting and insight into Governance Funding proposals, and the raised quorum is an excellent addition. However, there is still no failsafe to discourage malicious activity in the Governance Funding process. The current fail-safe simply relies on the Optimism Foundation to not distribute funds to any party acting maliciously, even if that vote has passed.

The latter is just one example of the Token House’s dependence on the Foundation. For the most part, the Foundation’s oversight of the process is considered reasonable. There are many OP tokens at stake, and there is not yet a mechanism or process in place for the Token House to directly distribute these funds.

An effective way for the Token House to carry out Governance Funding initiatives independently could be on-chain governance (which is currently not established). This mechanism would rely on smart contracts to distribute funds, assuming there are enough votes in favor of doing so. However, if the Token House were to implement an on-chain governance model today, there would likely be additional, larger concerns. Examples include the concentration of voting power and the ability for funded projects to self-delegate tokens to ultimately self-fund their project. While developing an on-chain mechanism for Governance Funding would be ideal long-term, the development would require engineering resources and time to complete. The fact remains that Optimism Collective is not capture-resistant in its current state.

In the short term, the Token House could improve by formulating a better, more in-depth process. An example of this would be a standard set of KPIs for projects requesting funding and increased transparency from funded parties (i.e., quarterly reporting). The need for increased accountability regarding Governance Fund recipients has already been displayed in Season 1.

Quality participation ranks among the top issues in governance today. Compensating high-context contributors is the elephant in the room that nobody is addressing, and committees are the Optimism Foundation’s first attempt to incentivize effective decision-making. Yet the committee structure is limited as it only rewards a select group of delegates. In the meantime, while a roadmap for comprehensive delegate compensation has been teased, it’s unclear whether an interest in future delegate payments will result in satisfactory engagement.

Roadmap

Citizens’ House

The final puzzle piece to the Optimism Collective, and possibly the most anticipated, is the Citizens’ House. Since the original Optimism Collective announcement, there have been no additional details released regarding the responsibilities of the Citizen’s House and its roadmap. The Citizens’ House will likely remain the most anticipated up until its release, as only then will the Optimism Collective flywheel be in full effect.

Retroactive Public Goods Funding

The Optimism team is no stranger to public goods funding, so it should be no surprise that the Optimistic Vision places massive emphasis on this. The Optimistic Vision outlines the phrase impact = profit as a North Star and the goal of dispelling the myth that ‘public goods cannot be profitable.’ Retroactive Public Goods Funding (RPGF) and the resulting additions this funding will bring to the ecosystem remains highly anticipated.

Airdrop #2

The OP token allocation breakdown indicates that 19% (~816 million OP) of the total OP supply has been earmarked for User Airdrops. In comparison, only 5% (~214 million OP) of the total supply was airdropped in Airdrop #1. The Optimism Foundation will determine how the remaining 14% (~601 million OP) will be distributed in future airdrops. Token distribution details have not yet been announced. It is worth noting that the eligibility criteria for Airdrop #1 were not limited to activities or users on Optimism. The Optimism Foundation will likely not shy away from airdropping OP to users participating in activities on the Ethereum mainnet if the Foundation believes that the Optimism ecosystem will benefit from including these users.

Conclusion

As Optimism moves to Season 2, DAOs looking to receive funding will face a new process, a more democratic distribution of governance power, and a clear precedent of a successful proposal. However, the efficacy of the Governance Fund as an institution in boosting the Optimism Collective flywheel remains to be seen. As future incentive programs roll out, critics of the Governance Fund will be looking for meaningful changes in revenue, transactions, and the retention of users beyond the expected growth in the TVL of incentivized protocols.

The operations of Optimism governance have addressed significant headwinds in delegate fatigue with paid committees. With many delegates participating, it’s unclear how effectively the committee structure will manage delegate fatigue and whether unpaid representatives will face discouragement in future participation.