Arthur Hayes – the co-founder and former CEO of one of the most popular cryptocurrency derivatives exchanges (BitMEX) – has laid out some thoughts on Ethereum’s Merge.

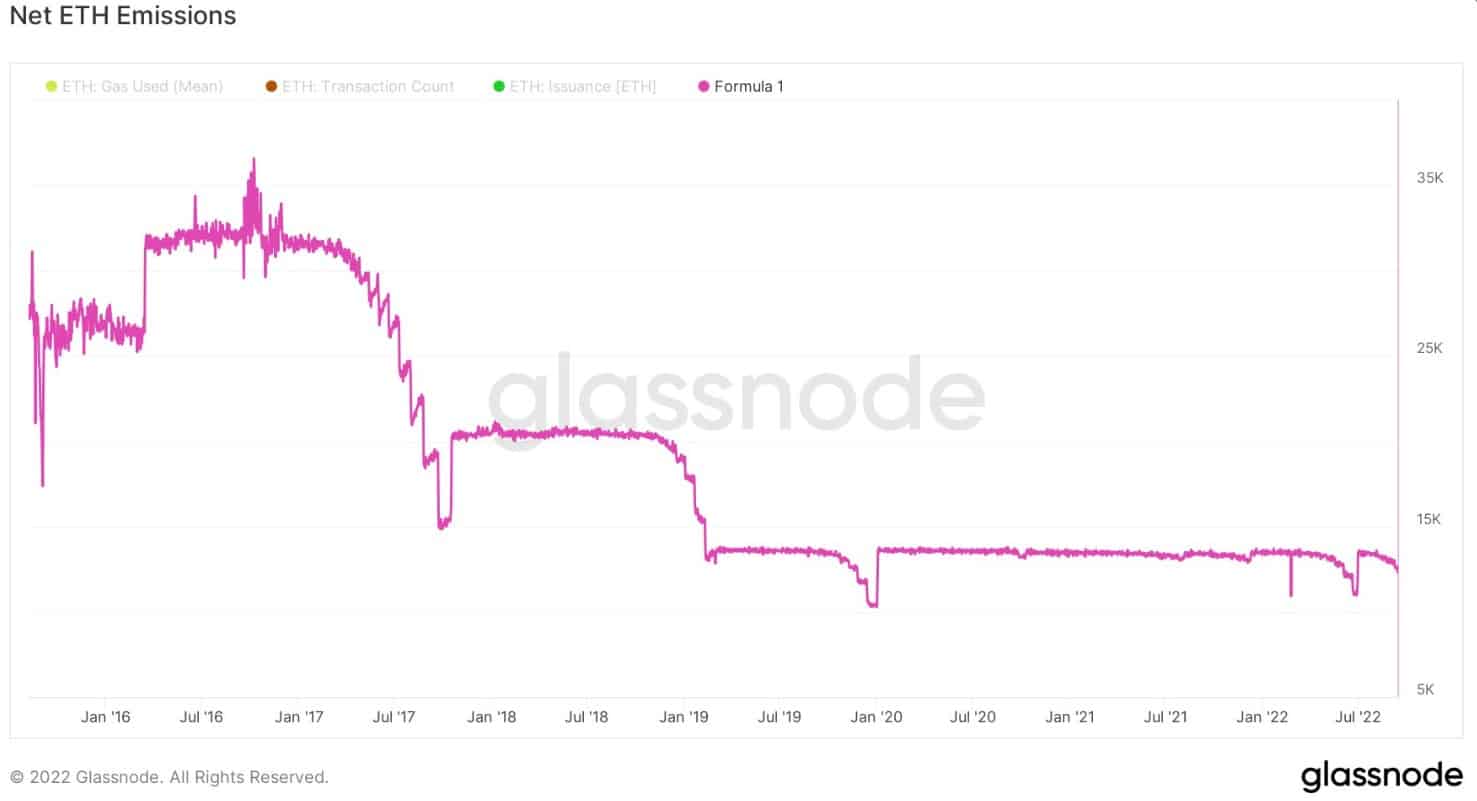

In a recent tweet, Hayes argued that the only thing that matters (price-wise, seemingly), for ETH after the Merge is its net issuance.

- To those unaware, Ethereum’s transition from proof-of-work to proof-of-stake introduced a dramatic shift in the cryptocurrency’s issuance model.

- The summarized calculations of ETH’s issuance following the Merge was given by the Ethereum Foundation itself:

ETH Issuance TLDR

-Mining rewrds approximately 13,000 ETH/day pre-merge

-Staking rewards approximately 1,600 ETH/day pre-merge

After the Merge, only the 1,600 ETH per day will remain, dropping total new ETH issuance by approximately 90%

The burn: At an average gas price of at least 16 gwei, at least 1,600 ETH is burned every day, which effectively brings net ETH inflation to zero or less post-merge.

- Commenting on the matter, Hayes said that the Net ETH Emissions chart is the only one that matters after the Merge.

- The former BitMEX CEO also argued that the continuous decrease in ETH’s net emissions is what’s likely to bring the next bull market, albeit phrased slightly differently.

- However, it’s worth noting that the change in the supply dynamics is likely to take some time. At the time of this writing, the supply after the Merge has actually increased.

The post This Is the Only Chart That Matters Post-Merge, Argues Arthur Hayes appeared first on CryptoPotato.