After Ethereum’s switch to a proof-of-stake, the bears took control of the market. Investors have turned away from high-risk assets like equities and cryptocurrencies. The ETH weekly candle closed at $1,334 yesterday, which is a new low.

Technical Analysis

By Grizzly

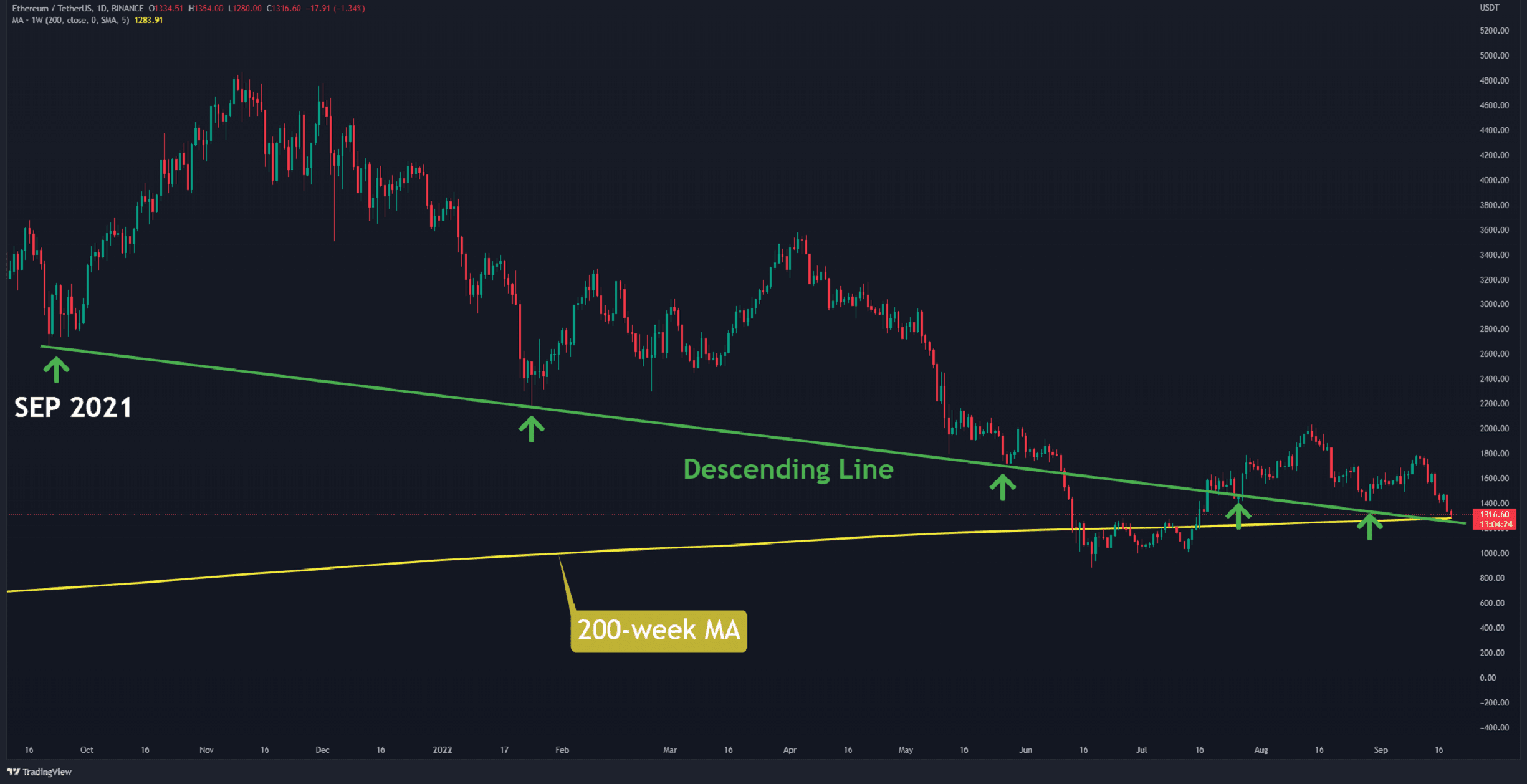

The Daily Chart

The price is currently down 27% from the high of $1,789 reached on September 11th. The lowest level touched in today’s session is $1,280, which is just above the 200-week moving average (in yellow).

Additionally, the cryptocurrency has once more met the one-year descending support line (in green), a level that has saved the price from dropping further. The chances of recovering from the crypto winter soon will be very slim if the bulls are unable to defend this pretty robust support.

If the price drops below $1,280, a retest of $1,000 becomes much more probable. As long as the chart doesn’t paint higher highs and higher lows, the bias remains negative.

Key Support Levels: $1280 & $1000

Key Resistance Levels: $1420 & $1700

Daily Moving Averages:

MA20: $1574

MA50: $1652

MA100: $1467

MA200: $2036

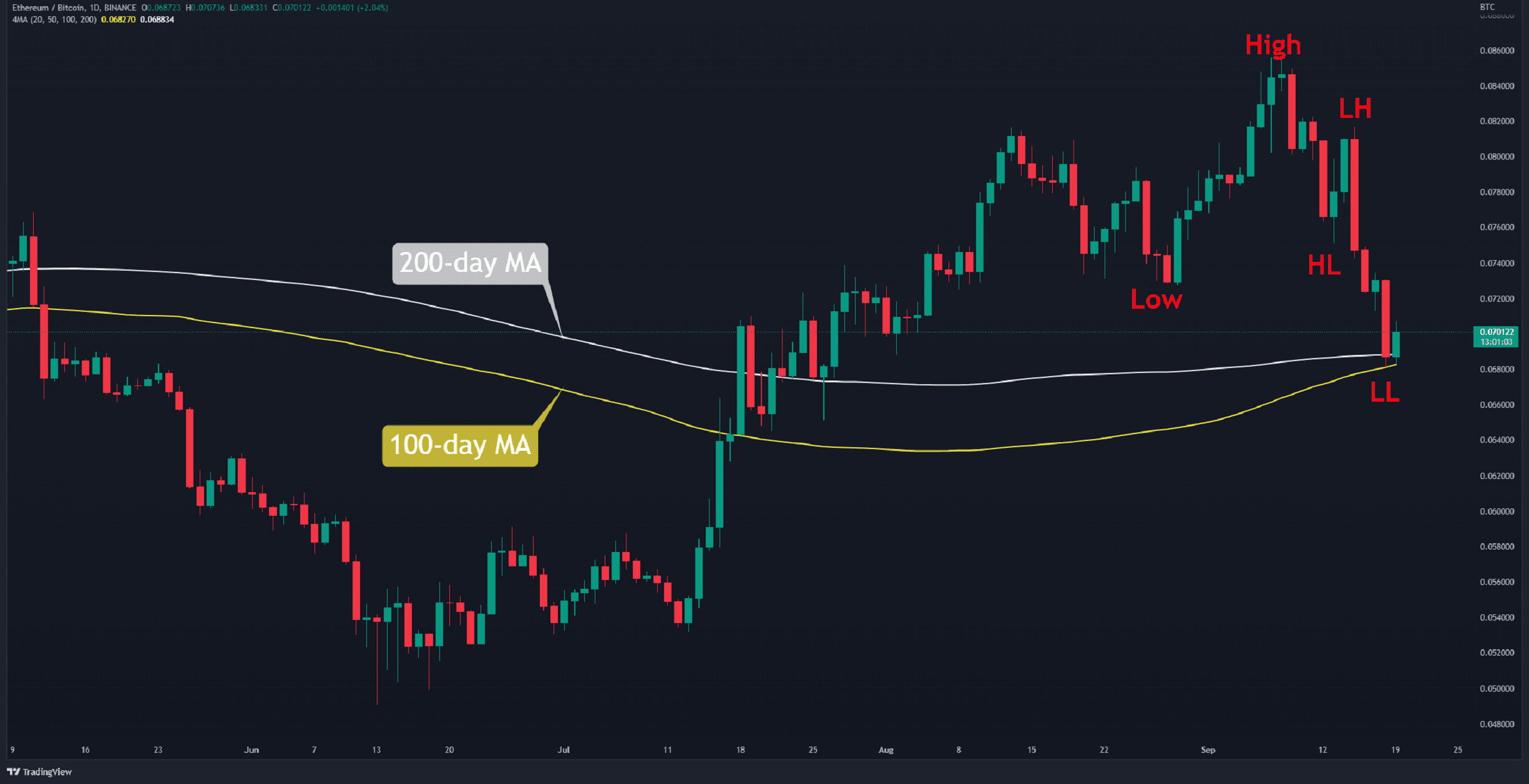

The ETH/BTC Chart

Against Bitcoin, the bears dragged the cryptocurrency below 0.072 BTC. The price has fallen by 20% in the last ten days, which is unprecedented in the overly bullish trend of the last three months.

Lower highs and lower lows came together to form the pattern, which is entirely bearish. At the moment, support is holding the price at 0.068 BTC, where the 100-day and 200-day moving average lines connect.

The latest drop can be considered a bear trap if the price recovers over 0.072 BTC. Otherwise, the next support levels are found at 0.065 BTC and 0.06 BTC.

Key Support Levels: 0.068 & 0.065 BTC

Key Resistance Levels: 0.072 & 0.08 BTC

The post ETH Charts a Fresh Weekly Low in a Crash Below $1,300 (Ethereum Price Analysis) appeared first on CryptoPotato.