Bitcoin Analysis

Bitcoin’s price rallied $572 on Monday and bulls are again trying to regain BTC’s all-time high from 2017 of $19,891.

We’re starting our price analyses this Tuesday with the BTC/USD 1W chart below from kadirski. BTC’s price is trading between the 1 fibonacci level [$17,695.37] and 0.786 [$28,697.01], at the time of writing.

The chartist makes the case that Bitcoin could be preparing to buck the macro market’s price action and break out of its nine month bear market.

They suggest that the downtrend on the RSI [Relative Strength Index] is about to turn to the upside and note that the MACD is at the same log it was at during the depths of the 2015 and 2018 bear market. The chartist also implies that bullish divergence on the daily and weekly time frame could spell the end of the pain that bullish BTC market participants have been suffering from for many months.

Bullish traders however need to hold support at the 1 fib level to reverse course to the upside and break the 0.786 [$28,697.01] to begin the ascent. The targets above the 0.786 are 0.618 [$37,333.81], 0.5 [$43,400.14], 0.382 [$49,466.47], 0.236 [$56,972.26].

Bearish Bitcoin traders want to push BTC’s price below the 1 fib level which will usher in a new 12-month low for the asset and further pain for bullish market participants.

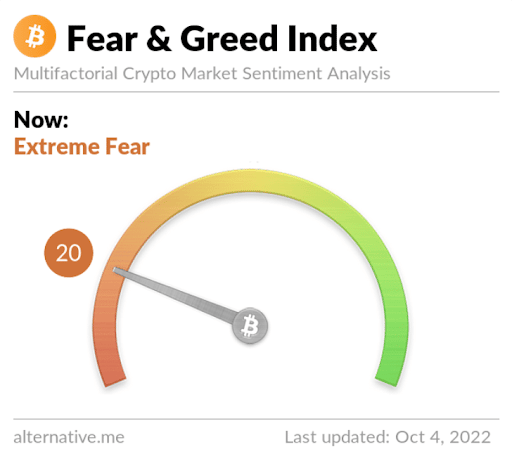

The Fear and Greed Index is 20 Extreme Fear and is -4 from Monday’s reading of 24 Extreme Fear.

Bitcoin’s Moving Averages: 5-Day [$19,391.68], 20-Day [$19,642.4], 50-Day [$21,238.84], 100-Day [$22,841.72], 200-Day [$31,778.96], Year to Date [$31,466.33].

BTC’s 24 hour price range is $18,980-$19,708 and its 7 day price range is $18,548.96-$20,296.07. Bitcoin’s 52 week price range is $17,611-$69,044.

The price of Bitcoin on this date last year was $49,252.

The average price of BTC for the last 30 days is $19,739.9 and its -3.5% over the same period.

Bitcoin’s price [+3.00%] closed its daily candle worth $19,638 on Monday and bulls snapped three consecutive days of selling pressure from bears.

Ethereum Analysis

Ether’s price outperformed Bitcoin’s price on Monday and it rallied more than 3% for its daily session. When traders wrapped-up trading for the day, ETH’s price was +$47.88.

The second chart on our agenda today is the ETH/USD 4HR chart by FXCM. ETH’s price is trading between the 0.00% fib level [$1,220.00] and 23.60% [$1,354.49], at the time of writing.

The $1,400 level is a major level of inflection for Ether’s price historically and bulls want to regain the 23.60% fib level and then the 38.20% fib level [$1,437.69] soon if they wish to put an end to ETH’s recent slide. Above the 38.20% fib level are targets on the 4HR time frame of 50.00% [$1,504.93], and 100.00% [$1,789.86].

Conversely, bearish ETH traders that foresee further downside on the crypto industry’s second ranked asset by market cap, want to break the 0.00% fib level before sending Ether’s price back down to retest triple digits.

Ether’s Moving Averages: 5-Day [$1,332.32], 20-Day [$1,454.67], 50-Day [$1,594.63], 100-Day [$1,532.85], 200-Day [$2,239.08], Year to Date [$2,208.46].

ETH’s 24 hour price range is $1,263.04-$1,329.9 and its 7 day price range is $1,263.04-$1,393.48. Ether’s 52 week price range is $883.62-$4,878.

The price of ETH on this date in 2021 was $3,383.17.

The average price of ETH for the last 30 days is $1,463.79 and its -16.5% over the same duration.

Ether’s price [+3.75%] closed its daily candle on Monday valued at $1,323.4 and in green figures for the first time in five days.

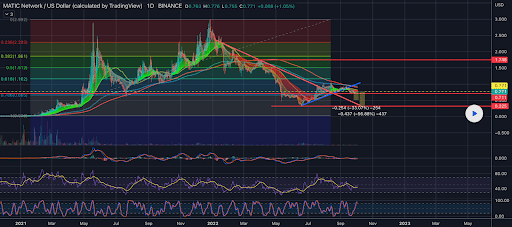

Matic Analysis

Matic’s price made its all-time high more than a month and a half after Bitcoin did during the last bull market and its price has also yet to recover. Matic’s price lost 89.14% of its value from peak to trough and is -72.9% from its ATH of $2.92, at the time of writing. When traders settled up on Monday, Matic was up nearly 5% and +$0.037.

The third chart we’re looking over today is the MATIC/USD 1D chart below from CryptoFallen. We can see below that Matic’s price is stuck between the 0.786 [$0.665] and 0.618 [$1.16], at the time of writing.

Bullish Matic traders are seeking to again reclaim territory above the 0.618 followed by targets of 0.5 [$[$1.51], 0.382 [$1.86], 0.236 [$2.29].

At variance with bullish traders are those shorting Matic’s market still and looking to send Matic’s price to fresh bear market lows yet. For them to be successful they’ll need to break the 0.786 and again retest Matic’s 12-month low of $0.317.

Matic’s Moving Averages: 5-Day [$0.76], 20-Day [$0.80], 50-Day [$0.84], 100-Day [$0.72], Year to Date [$0.88].

Polygon’s 24 hour price range is $0.754-$0.807 and its 7 day price range is $0.716-$0.807. Matic’s 52 week price range is $0.317-$2.92.

Polygon’s price on this date last year was $1.27.

The average price of MATIC over the last 30 days is $0.81 and its -10.75% over the same stretch.

Matic’s price [+4.90%] closed its daily session worth $0.80 on Monday and in green digits for the first time over the last three days.

The post Bitcoin (19k), Ethereum (1.3k), Matic Price Analyses appeared first on The Cryptonomist.