State of Balancer Q3 2022

October 5, 2022

Key Insights

- The protocol continues to hum through the bear market. Despite reduced activity, there are still attractive yields for Liquidity Providers (LPs) when factoring in trading and incentives.

- The DAO transitioned to a Service Provider (SP) model in Q2’22. The funding for approved SPs came into full force in Q3’22. Managing these expenses versus earnings and the existing treasury needs to be a focus for the DAO going forward.

- The DAO is still battling over the optimization of vote escrow tokenomics. This quarter they implemented a new gauge framework to reduce spending incentives on micro-cap tokens and pools that aren’t generating revenue.

Primer on Balancer

Balancer is a DeFi automated market making protocol using novel self-balancing weighted pools. The protocol allows anyone to create a pool of assets with predefined weights in the pool. Balancer strives to be a platform for DAOs and other protocols to build tools that provide useful liquidity to their end users and products. The protocol is managed by the Balancer DAO community and currently supports Ethereum, Polygon, Arbitrum, and Optimism (managed by Beethoven X). Since launching V2 in August 2021, Balancer’s product line has expanded to include several types of unique liquidity pool constructions.

Introduction

Q3’22 saw subdued activity in the market but not on the Balancer forums. SP funding requests, veBAL alignment, and partnerships were all discussed. For traders and LPs, Balancer remains a hub for liquidity and attractive yield, especially on its more recently deployed Layer-2 instances.

The most exciting part of the roadmap will be the migration to generalized boosted pools, which allow any pool to utilize unused liquidity and lend on Aave for better yields. This DEX/lending hybrid increases utilization of capital and yield for LPs, making it more attractive to provide liquidity on Balancer.

Generalized boosted pools will also enable the DAO to earn more revenue. Part of the yield earned in boosted pools can be split with the DAO, with the fee currently set to start at 50%. This will both increase and diversify Balancer’s income stream.

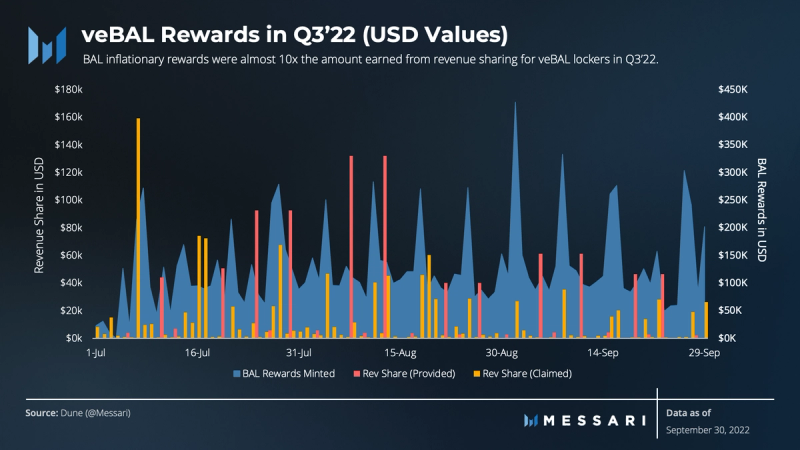

In the meantime, the DAO continues to debate how to best utilize vote escrow tokenomics (veTokenomics) to align voters and lockers with the DAO. Although veTokenomics allows for revenue sharing, the feature carries the risk of incentives being much higher than revenues, as is currently the case by about 10x. This dynamic can attract mercenary LPs whose primary objective is to collect incentive rewards rather than bring liquidity to a pool. The two ways to fight this are 1) to increase revenues and 2) to add guardrails and incentives that encourage voters to reward revenue generating pools.

Performance Analysis

Liquidity Provider Perspective

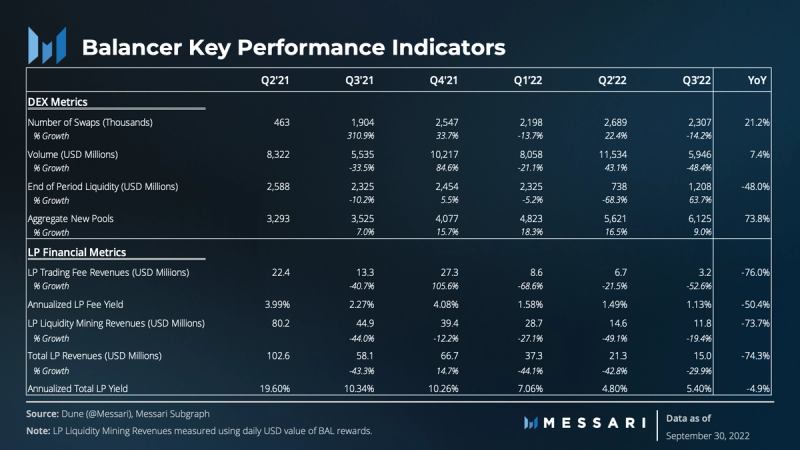

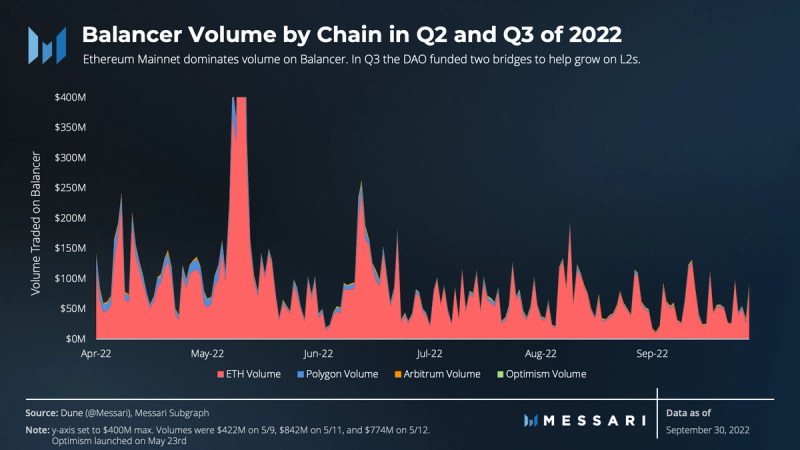

Volumes on Balancer fell almost 50% from Q2, down to $6 billion — levels last seen in Q3’21. Notably, 93% of volume was on Ethereum Mainnet, despite falling 45% from last quarter. The increase in share was due to falling volumes on Polygon, which dropped 78% QoQ. Volume on Arbitrum fell by 43%. The potential for an Arbitrum airdrop likely bolstered usage there. Balancer on Optimism launched on May 23, but daily average volume only fell 16% in Q3 from the June average.

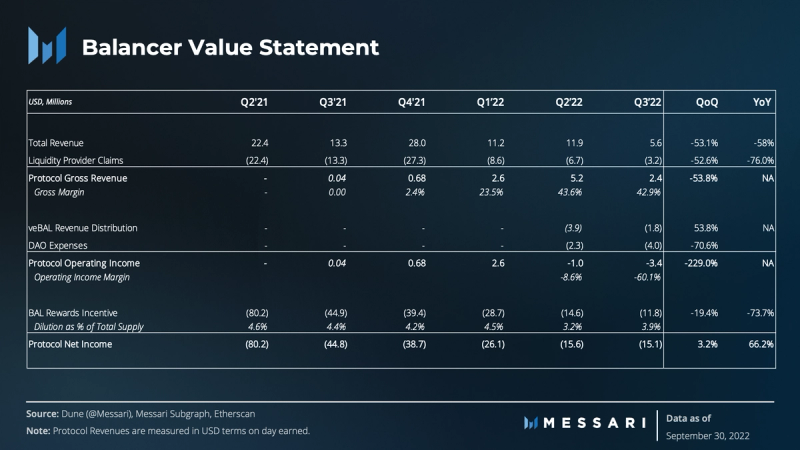

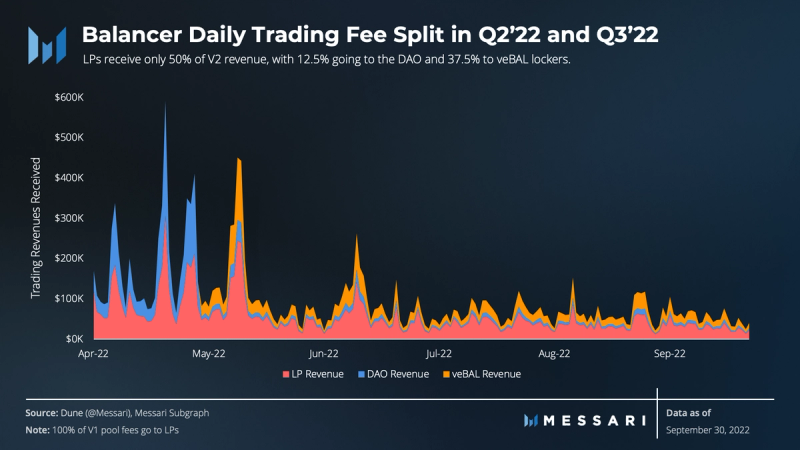

Lower volumes and token prices led to smaller revenues in the quarter. Across the board, revenues fell 53%. Paired with rising expenses, operating loss for Balancer increased in the quarter. Fewer new token launches also led to revenues from Liquidity Bootstrapping Pools (LBPs) falling 73%, from $1.1 million in Q2 to $320,000 in Q3.

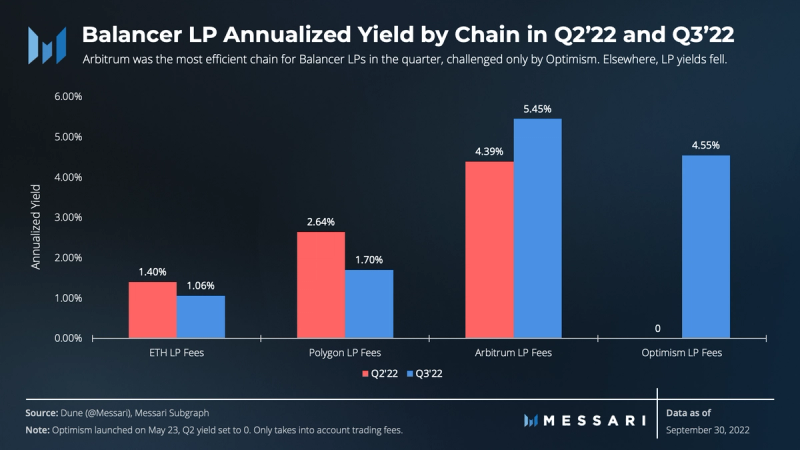

Balancer’s Arbitrum and Optimism instances offered the highest yield for LPs by chain on Balancer, excluding liquidity mining rewards. The expected drop of an Arbitrum token likely drove activity. Since the OP token dropped last quarter, rewards have continued into the third quarter.

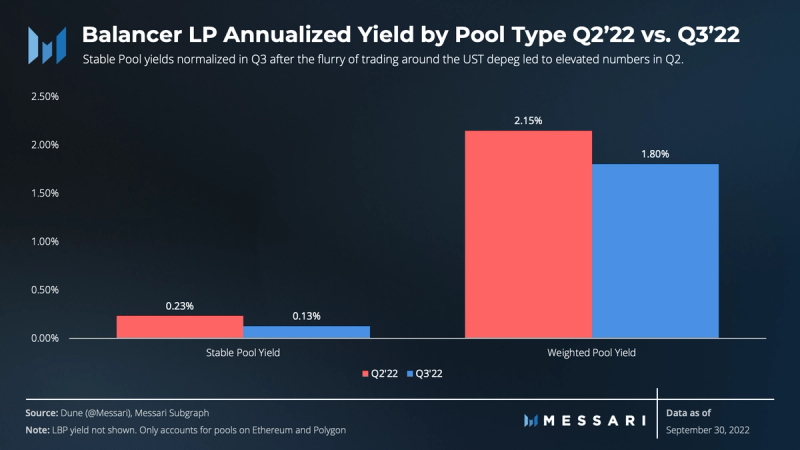

After Q2’s stablecoin frenzy, trading in stables and yields in stablecoin pools declined in Q3. Balancer’s largest stablecoin pool, the Aave Boosted pool, also suffered falling yields on the lending platform. As TVL actually increased on Balancer in the quarter, falling volumes greatly depressed trading yields.

The divergence between trading yields and TVL was likely remedied by Balancer’s BAL liquidity mining rewards. Total yield for LPs, including trading revenues and liquidity mining incentives, actually increased in the quarter from 4.8% to 5.4%.

Trader Perspective

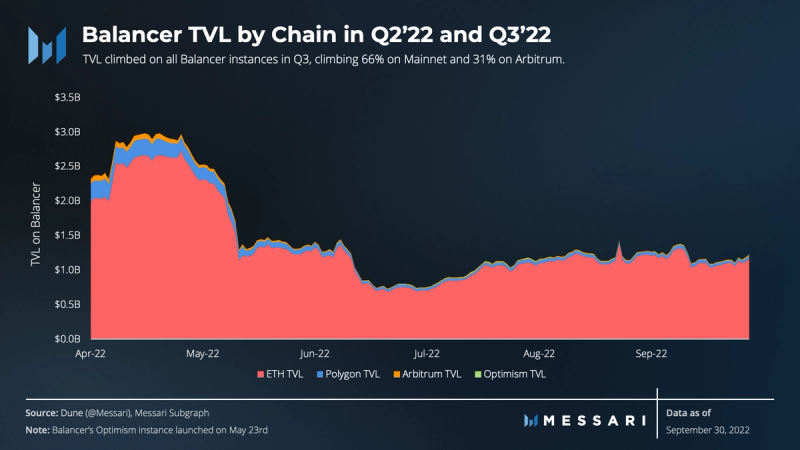

Despite falling volumes, Balancer was able to attract liquidity in Q3. TVL on Balancer jumped 64% in the quarter, leading peers. Ethereum TVL increased by 66%, while Polygon, Arbitrum, and Optimism increased by 18%, 31%, and 35%, respectively. Ethereum still dominates the total value locked on the Balancer protocol, as its share of protocol TVL rose from 93% at the end of Q2’22 to 95% at the end of Q3.

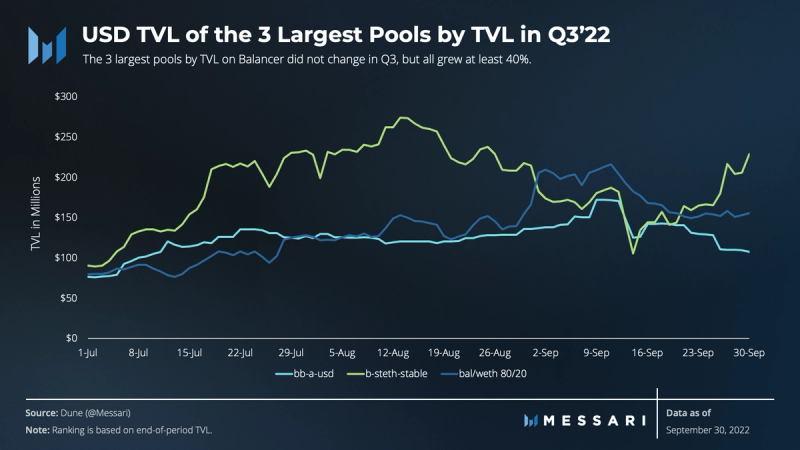

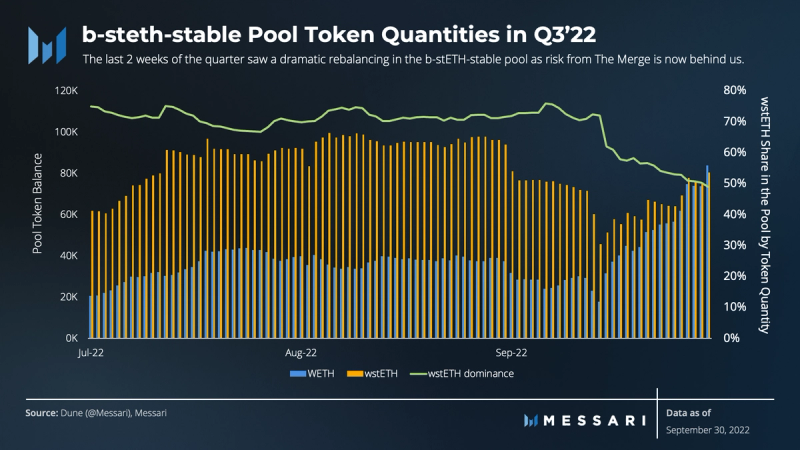

The wstETH/wETH stable pool TVL remained the largest at the end of the quarter, increasing its TVL by 61% to $229 million. The gain is reflective of ETH’s 26% rise from quarter-end and a doubling of the number of tokens in the pool. The b-steth-stable pool is a core pool on Balancer, allowing bribes on Hidden Hand to encourage veBAL voters to direct rewards to this pool.

The BAL/wETH 80/20 pool, which yields Balancer Pool Tokens that can be locked for governance rights, nearly doubled TVL in the quarter, ending with $156 million in TVL. In native token terms, the BAL/wETH 80/20 pool increased its wETH by 54% in the quarter and its BAL by 64%.

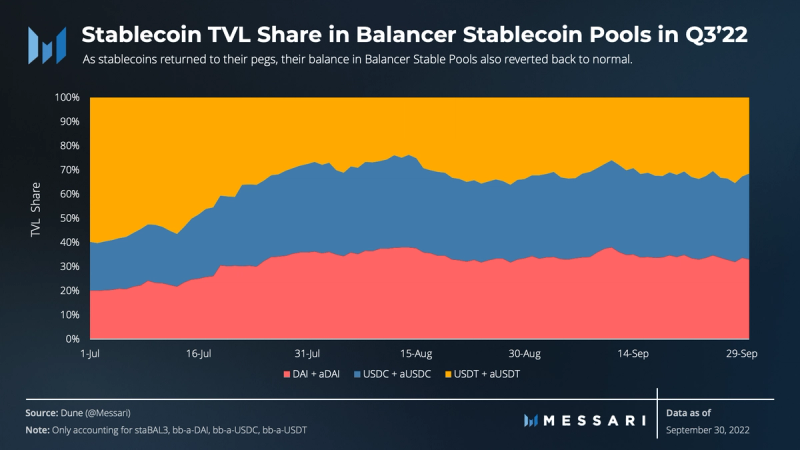

Currency fears at the end of Q2 led to a depegging in USDT. This caused an imbalance in Balancer’s Aave Boosted Stable pool, discussed last quarter. As the markets returned to equilibrium and the peg returned to one, so did USDT share rebalance in the boosted pool. bb-a-USD grew TVL by 41% in the quarter, balancing a 93% increase in the USDC linear pool and an 84% increase in the DAI linear pool with a decrease of 41% in the USDT linear pool.

Featured Pool Analysis

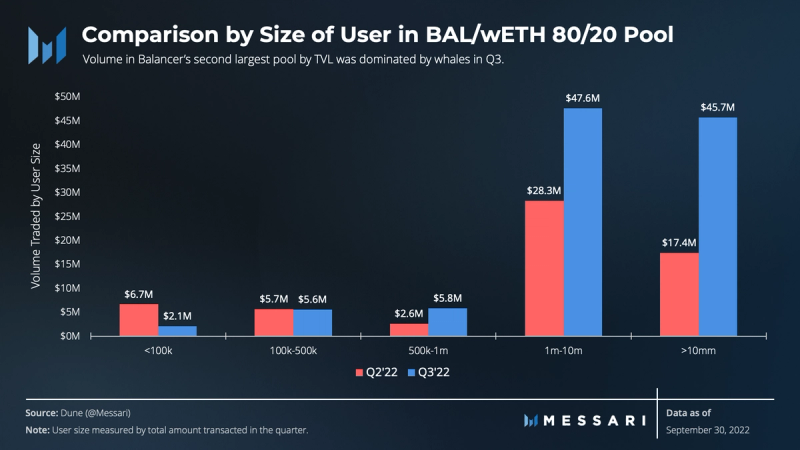

Diving into the pool data shows Balancer’s two largest pools in the quarter are mostly attracting large traders.

veBAL pool: BAL-wETH 80/20 Weighted Pool

TVL in Balancer’s second largest pool doubled, while volumes fell. Despite the yield reduction, the Balancer pool that yields governance tokens grew dramatically. The ability to direct rewards and the growth of Aura likely has had a big impact here.

While over 65% of volume in Q2’22 was by accounts who transacted more than $1 million in the pool in the quarter, activity was completely dominated by whales in the third quarter. Notably, 88% of volume was by wallets that transacted over $1 million in the pool in the quarter. If these are whales, combined with lower liquidity from BAL being locked in veBAL, it is likely to cause an increase in volatility. But so far, the volatility of BAL compared to ETH has stayed relatively constant.

An alternative argument is that bots are becoming more prevalent as the pool grows in size and volume. This idea is supported by volume being down roughly 20% in the quarter while the number of average daily unique users was up.

b-steth-stable Pool (wETH/wstETH)

Unlike the bb-a-USD imbalance, the b-steth-stable pool needed to wait for The Merge to move to a more balanced distribution. With the successful Merge of Ethereum and move to Proof-of-Stake, the liquidity premium on wstETH has fallen to near parity with wETH. In addition, wETH dominance fell from 75% to 49% at quarter’s end.

Revenues for LPs in the b-steth-stable pool almost entirely rely on bribes and BAL liquidity mining rewards. This will have to compensate the LPs for a loss of staked ETH yield once Balancer integrates the revenue split on yield-bearing pools, expected in Q4.

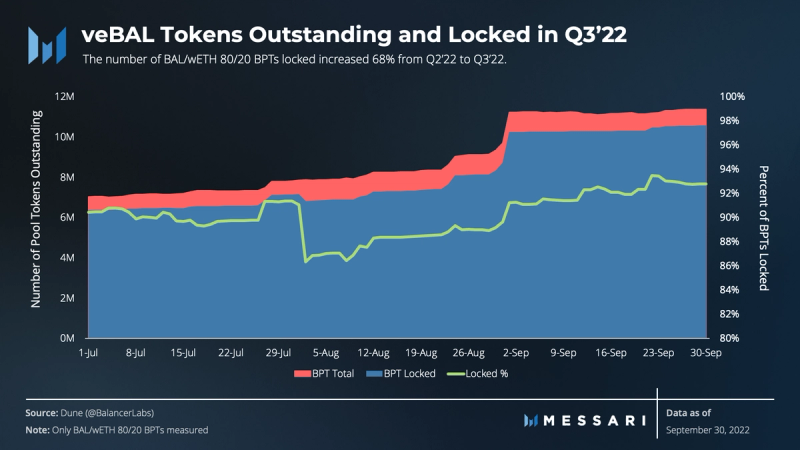

veBAL

The number of veBAL increased from 6.3 million at the end of Q2 to 10.6 million at the end of Q3. The percentage of available BAL-wETH 80/20 BPTs locked continues to climb, closing the quarter at 93%.

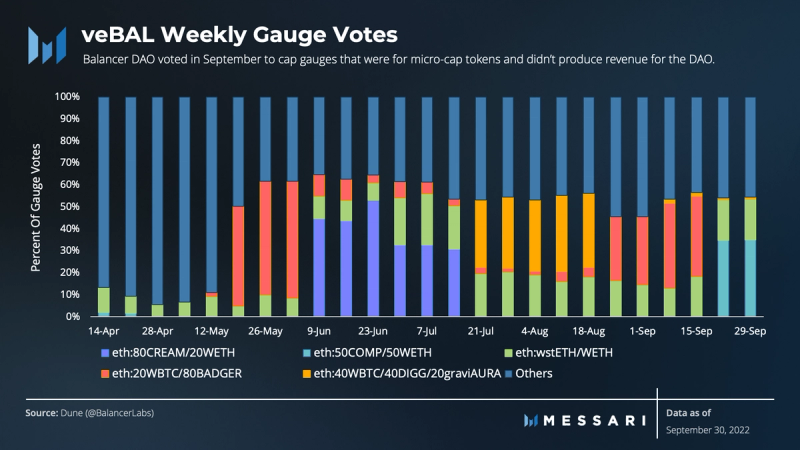

The gauge framework reduced the amount the Badger pool could receive to 2% of the liquidity mining rewards. This changed incentives on which pools to vote for (especially for LPs of the affected pools) and COMP/wETH appears to be an immediate beneficiary. Hidden Hand bribing of the wstETH/wETH pool is also driving rewards, achieving the goal of BIP-19, which was implemented in July. See more in the Qualitative Analysis for the DAO’s most recent implementation to align gauge votes with DAO revenues.

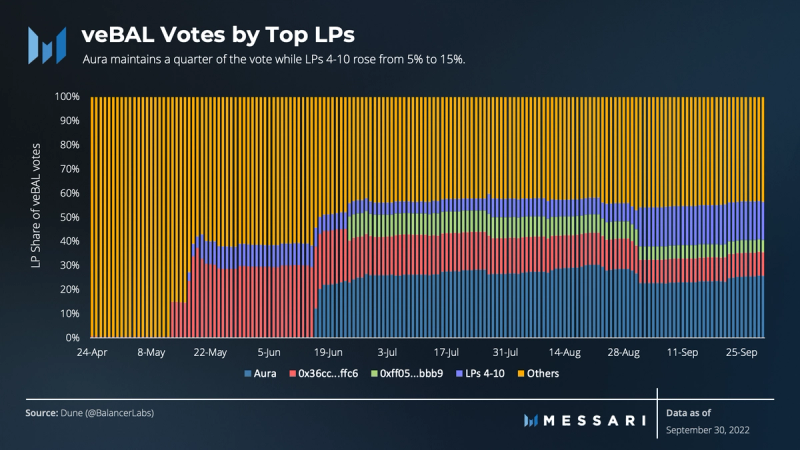

Voting concentration in the top 10 voters was flat at 44%. The largest two voters are Aura, which maintained a 26% share, and an unknown wallet, which fell from 17% to a 10% share. Aura works for Balancer similar to how Convex works for Curve: users can deposit Balancer Pool Tokens in Aura for voting power and veBAL rewards. The total number of votes increased roughly 73% from June 30 to Sep. 30, 2022.

Liquidity mining rewards continued to vastly outpace the earnings from protocol revenue share. veBAL lockers claimed over $1.1 million from their share of protocol revenues this quarter, while the protocol paid out over $11 million worth of BAL inflationary rewards. This disparity creates an incentive misalignment, where inflationary rewards trump revenue share rewards. As a result, pools and voters may participate in veBAL for the liquidity mining rewards without attracting TVL to revenue-generating pools. The DAO must manage this battle by keeping voters’ incentives aligned with DAO revenue even when the incentive value is significantly more than the reward.

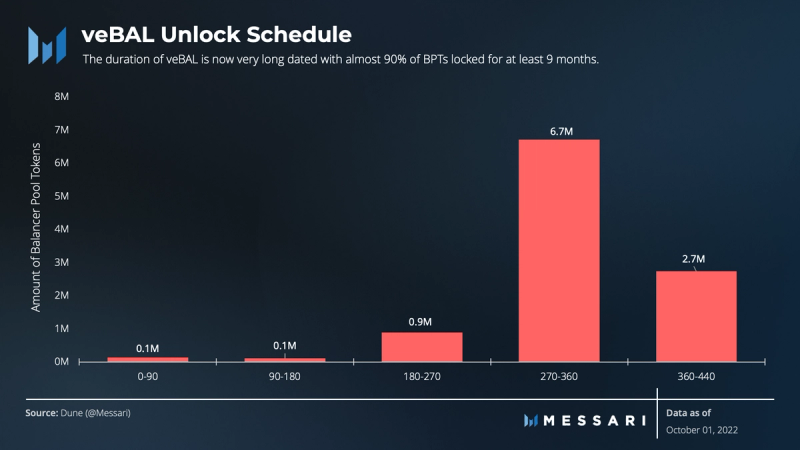

Lastly, tracking the upcoming unlocks from veBAL notifies of potential liquidity events for veBAL locked pool tokens and thus BAL (veBAL is a locked 80/20 BAL/wETH liquidity pool token). As of Oct. 1, 2022, 89.3% of the BPTs are locked for nine months or longer, and 98% are locked for at least six months. At current prices, that is roughly 21 million BAL or 40% of the circulating supply.

Treasury

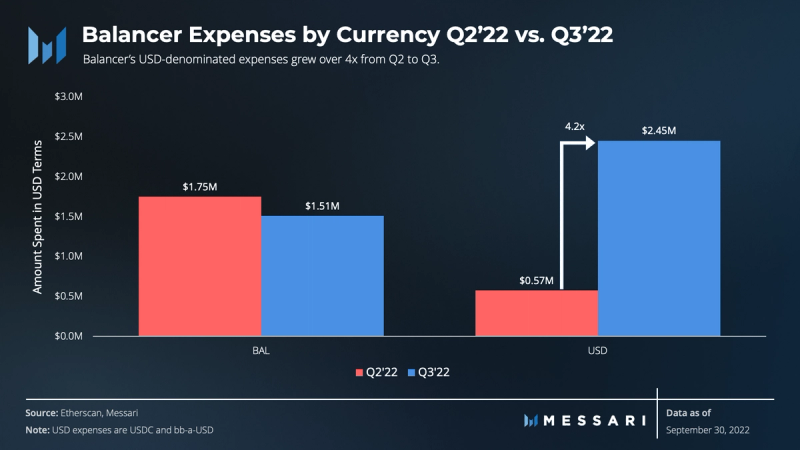

The DAO transitioned to a SP model in Q2 and those expenses were approved and sent in Q3. Last quarter, 75% of the DAO’s spending was in native tokens (BAL), but in Q3 the currency denomination of the DAO’s liabilities flipped to 61% USDC. Pending or recently passed proposals have significantly more spending in USDC, creating additional planning around treasury asset-liability management. It is worth noting that funding for some SPs in Q4 was paid at the end of Q3.

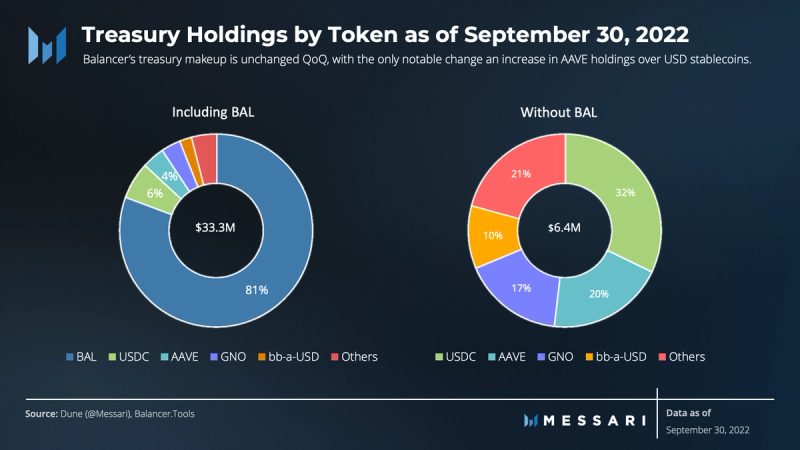

The DAO multisig remained extremely stable QoQ. In USD terms, the treasury fell less than 1%, and the non-BAL exposure is flat. The DAO did draw down some stablecoins, beginning the quarter with 4.4 million and ending with 2.8 million, spending over a third of its stables. The DAO earns its income predominantly in stablecoins and earned roughly $800,000 in Q3. Enabling boosted pool yield sharing with the DAO is expected to be a big boon to protocol earnings.

Qualitative Analysis

New Gauge Framework

A key question put to debate this quarter asked, what is the North Star for veBAL lockers?

veTokenomics is intended to be more aligned with incentives than typical pay-to-play token governance. veToken lockers receive a revenue share, governance rights, and the ability to direct liquidity mining rewards. If the token increases in value, the incentives to LPs are worth more — which attracts more liquidity, volume, and thus revenue — leading to greater alignment.

This dynamic carries the risk of enabling mercenary LPs whose primary objective is to earn incentive rewards rather than attract liquidity to a pool. In this scenario, they will both participate in governance and LP to a thinly used gauge, then vote for rewards to be given to their gauge. This is acutely prevalent with small cap tokens accumulated by whales.

While it is difficult to determine intention from outcome, operators really only care about the outcome. Ultimately, this conflict of interest results in a waste of incentives, contributing nothing to help grow the network.

For example, from its creation on May 24 until July 17, the CREAM/wETH gauge had received $1.55 million in BAL rewards while contributing ~$27,000 in revenues to the DAO, according to the forum.

As another example, on July 10 a new gauge was narrowly voted that included a token with a $2 million market cap (DIGG). In its second epoch, it received over 30% of the vote. The requisite volumes of this micro-cap pool would need to be exorbitant for the revenues to the DAO to justify the cost of the rewards paid to the pool.

These are clear examples of “unproductive” use of BAL incentives. Using the emergency DAO powers created in Q2’22, the DAO voted to kill the CREAM/wETH gauge. However, playing whack-a-mole with unproductive pools is a dangerous and tiresome game.

Recently, the DAO debated a new, quantitative framework to align liquidity mining rewards spent and revenues for the DAO/protocol. The framework caps rewards to 2% for pools that don’t meet a metric that combines market cap, weighting, and revenue to Balancer. It focuses incentives on larger cap tokens and core pools more likely to generate revenue for the DAO.

With over 150 comments on the forum post, this decision was beyond trivial. Over 80% of outstanding veBAL tokens were used to participate, with 58% of votes committing to the new gauge framework and effectively claiming protocol revenues to be the North Star for the DAO.

The change affected dozens of gauges and brought on more risks. The tradeoff here might be in deterring smaller cap tokens to launch and use Balancer to attract liquidity. The primary pushback, however, continues to revolve around trust. The DAO has now voted to change the rules of the game a few times. The upside is better alignment with protocol revenues. The downside is it makes it riskier to lock tokens when the rules of the game have changed so drastically.

The new gauge framework is far from Balancer DAO’s first attempt at managing its incentive spending. The gauge approval process acts as the first line of defense, only approving gauges that will bring value back to the DAO. The DAO has also created the Emergency DAO to protect from previous mercenaries. Lastly, the DAO is still waiting on the rollout of generalized boosted pools that will create more yield-generating pools that share revenues with the DAO.

Spending and Treasury Management

In Q2’22, Balancer DAO created a new Operating Framework that ended the existing subDAO structure in favor of hiring SPs. Effectively, the DAO will only have SPs hired by veBAL holders to execute specific roles and tasks.

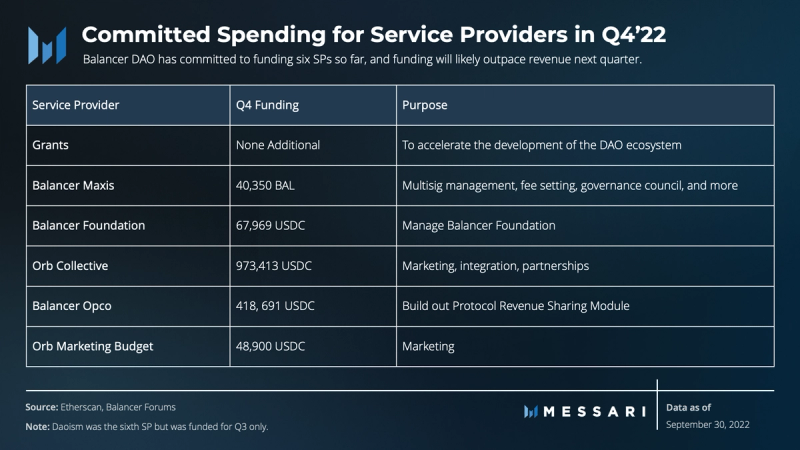

This setup puts the burden of resource management on each veBAL voter. So far, they have agreed to fund six SPs. The budget calls for roughly 1.6 million USDC per quarter and a more variable amount of BAL of at least 120,000 per quarter.

The matter at hand for the DAO is managing their treasury and assessing the value-add of each SP. Xeonus is one of the Balancer Maxis (an SP for Balancer) and has produced a State of the Balancer Treasury for the community for Q4. As of September 30, the treasury sits on 2.75 million USD stablecoins and 5 million BAL. Monthly income has dipped 53% to $200,000/month in Q3, down from $430,000/month in Q2. Simultaneously, spending has increased dramatically. The DAO spent $2.3 million in Q2, 75% in BAL. This quarter, spending ballooned almost 70% to $3.96 million, only 38% in BAL. Some of that spending was to fund SPs for the fourth quarter.

Some hope lies in increasing the runway from two expected upgrades. First, generalized boosted pools will allow any LP to create a boosted pool provided there is a yield-bearing token. Building on that, Balancer DAO will collect 50% of the fees earned from yield in boosted pools. Using Balancer’s largest pool as an example, the b-steth-stable pool has a TVL of $228 million. The max utilization on any day in the quarter was 13%. Assuming 60% of the pool could be deposited in Aave to earn a 2% yield, that brings $2.7 million in annual revenue to be split between LPs and the DAO. At a 50% split (the current expected setting), it would yield roughly $100,000 per month for the DAO. BIP-19, which bribes voters to send BAL incentives to yield-generating pools, is also designed to support this effect.

Assessing SP value is going to be very difficult without quantitative metrics that can be isolated to measure performance or return. Although Balancer could be treated like a start-up that runs at a loss as it bootstraps growth, its spending habits should still be called into question.

Currently Funded SPs:

- The Balancer Foundation is a traditional legal entity that is directed by the DAO. It was granted roughly $750,000 in funding for four quarters beginning Q2’22.

- The Balancer Maxis run operations for the DAO. They manage the multisigs, community channels, governance forums and process, and record keeping. The Balancer Maxis were funded for the third quarter with 32,925 BAL.

- The Orb Collective is much of the old Balancer Labs team that has created this new entity. Its main objectives are: partnerships, marketing, integrations, design, and people operations. Orb was granted roughly $4 million in funding for the 12 months from July 2022.

- Balancer OpCo is a subsidiary of the Foundation, mostly responsible for managing the front end of the Balancer protocol. It received ~$1.5 million in funding for one year of work.

- The Balancer Grants multisig was funded with 101,500 BAL and 60,000 USDC to pay contributors and sponsor grants for the protocol. After September 30, any remaining funds will be returned to the DAO.

- Daoism Systems is a group of builders who proposed taking over the task of executing on the protocol revenue sharing proposal from February. As the DAO aims to grow its ecosystem of developers, it committed 60,000 USDC and 7,000 BAL for roughly three months of work to complete this task.

Closing Summary

The Balancer protocol performed well this quarter, succeeding in attracting TVL to the network. Transactions and volumes slowed, hurting revenues. The veBAL experiment continues to experience growing pains. New additions like bribing core pools and gauge frameworks are attempting to align voters with revenue generating pools. The DAO is now in full swing on hiring service providers to execute specific tasks and operations, but managing costs will require more attention if revenues don’t meaningfully increase. The release of generalized boosted pools and DAO revenue sharing on yield is the next significant step on the roadmap.