Bitcoin Analysis

Bitcoin’s price confirmed a rejection again at the $19,891 level on Monday and bearishly engulfed the daily timescale. When Monday’s candle was printed, BTC’s price was -$297.9.

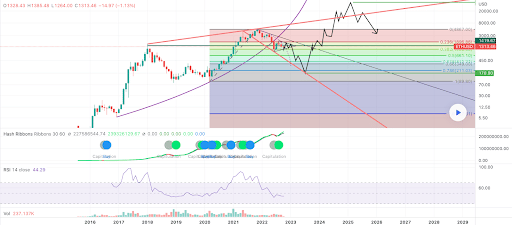

Today’s first chart of emphasis is the BTC/USD 1W chart by BTC-XLM. BTC’s price is trading between the 0 fibonacci level [$17,868.01] and 0.618 [$49,360.97], at the time of writing.

The chartist posits that BTC’s price is in a similar position to the last bear market and that fear, uncertainty, and doubt are also being met by the market with similar convictions as back then.

The targets above to the upside for bullish market participants are 0.618 and 1 [$68,827.49].

Conversely, the primary target for bearish BTC traders is the 0 fibonacci level.

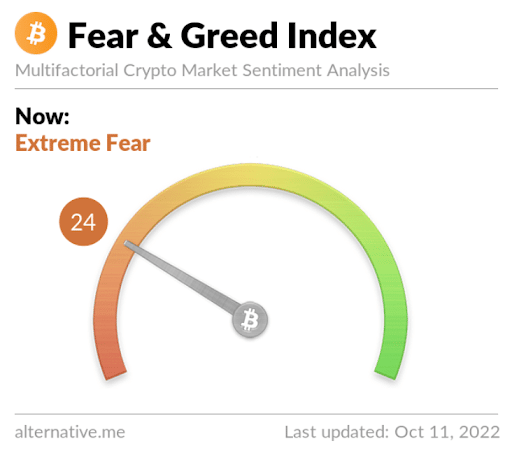

The Fear and Greed Index is 24 Extreme Fear and is +2 from Monday’s reading of 22 Extreme Fear.

Bitcoin’s Moving Averages: 5-Day [$19,856.28], 20-Day [$19,543.39], 50-Day [$20,932.59], 100-Day [$22,357.27], 200-Day [$31,104.26], Year to Date [$31,178.49].

BTC’s 24 hour price range is $19,020.3-$19,525 and its 7 day price range is $19,020.3-$20,420.51. Bitcoin’s 52 week price range is $17,611-$69,044.

The price of Bitcoin on this date last year was $57,468.

The average price of BTC for the last 30 days is $19,783.7 and its +0.01% over the same time frame.

Bitcoin’s price [-1.53%] closed its daily candle worth $19,192.5 on Monday and in red figures for the fifth time in six days.

Ethereum Analysis

Ether’s price continued to suffer from a dearth of bullish bidders during Monday’s trading session and ETH’s price concluded the day’s session -$32.36.

The second chart we’re delving into today is the ETH/USD 1M chart below by TheCheartBreaker. ETH’s price is trading between the 0.382 fib level [$1,058.96] and 0.236 [$1,896.88], at the time of writing.

On the monthly time frame bullish Ether market participants want to regain the 0.236 firstly with a secondary target again challenging ETH’s ATH of $4,867 on the Kraken chart.

For bearish traders, their aim is further capitulation from bulls and more downside – they’ve targets of 0.382, 0.5 [$661.10], 0.618 [$412.72], 0.66 [$349.00], 0.786 [$211.03], and 1 [$89.80].

Ether’s Moving Averages: 5-Day [$1,343.60], 20-Day [$1,375.21], 50-Day [$1,567.18], 100-Day [$1,500.22], 200-Day [$2,179.28], Year to Date [$2,186.98].

ETH’s 24 hour price range is $1,282.39-$1,338 and its 7 day price range is $1,282.39-$1,383.46. Ether’s 52 week price range is $883.62-$4,878.

The price of ETH on this date in 2021 was $3,545.08.

The average price of ETH for the last 30 days is $1,407.53 and its -19.49% over the same stretch.

Ether’s price [-2.45%] closed its daily trading session on Monday valued at $1,291.06 and back in red digits for the third time over four days.

Algorand Analysis

Algorand’s price also fell victim to sellers on Monday and concluded its trading session -$0.0176.

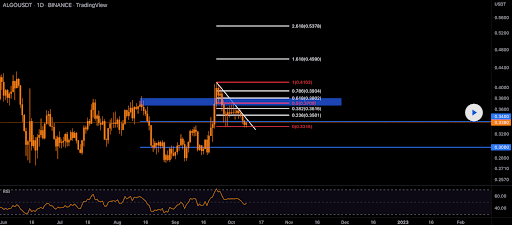

The third chart we’re analyzing today is the ALGO/USDT 1D chart below from MonoCoinSignal.

Those expecting ALGO’s price to break out to the upside have targets of 0 [$0.3315], 0.236 [$0.3501], 0.382 [$0.3616], 0.5 [$0.3709], 0.618 [$0.3802], 0.786 [$0.3934], 1 [$0.4103], 1.618 [$0.4590], and 2.618 [$0.5378].

Bullish ALGO market participants are trying to hold their ground with the RSI on the daily timescale below showing negative continuation.

Bearish traders want to push ALGO’s price lower today and confirm the breakdown below the 0 fib level before a potential retest of its 12-month low of $0.2753.

Algorand’s Moving Averages: 5-Day [$0.345], 20-Day [$0.337], 50-Day [$0.328], 100-Day [$0.336], 200-Day [$0.599], Year to Date [$0.605].

Algorand’s 24 hour price range is $0.3141-$0.3401 and its 7 day price range is $0.3141-$0.3595. ALGO’s 52 week price range is $0.2753-$2.85.

Algorand’s price on this date last year was $1.71.

The average price of ALGO over the last 30 days is $0.3396 and its +7.47% for the same period.

Algorand’s price [-5.19%] closed its daily candle on Monday worth $0.3213 and in red figures for the fifth time over the last six trading sessions.

The post Bitcoin (19k), Ethereum (1.2k), Algorand Price Analyses appeared first on The Cryptonomist.