Key Insights

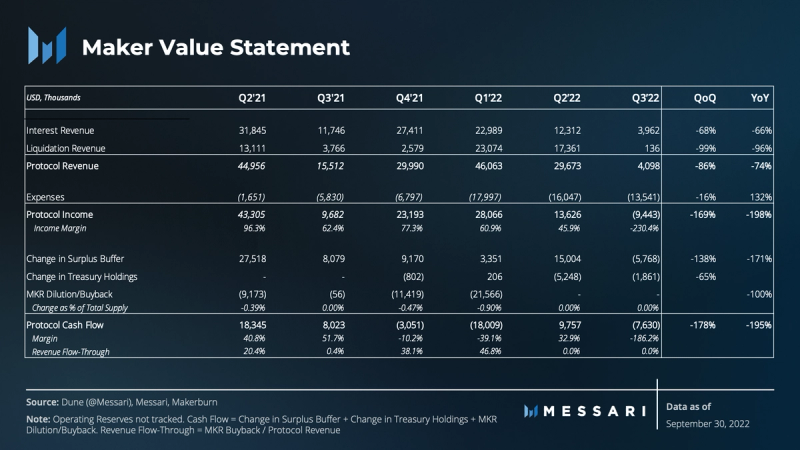

- In Q3’22, reduced loan demand and stable markets led to an 86% drop in revenues from $30 million in Q2 to $4 million in Q3. Expenses remain over $10 million per quarter, leading the DAO to withdraw from the surplus buffer.

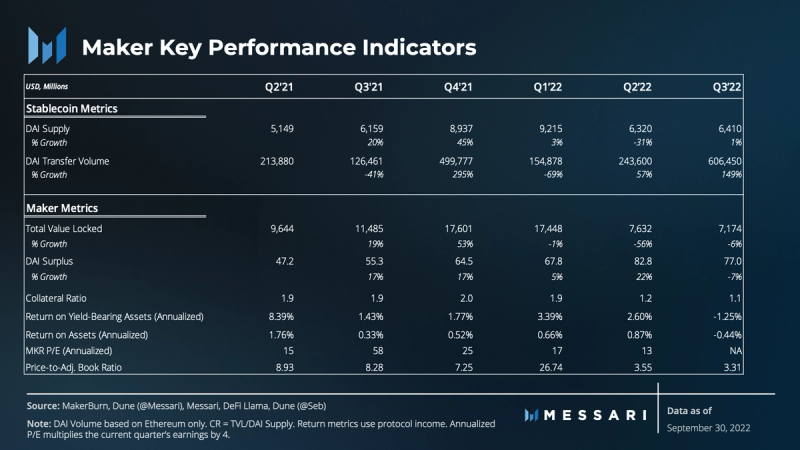

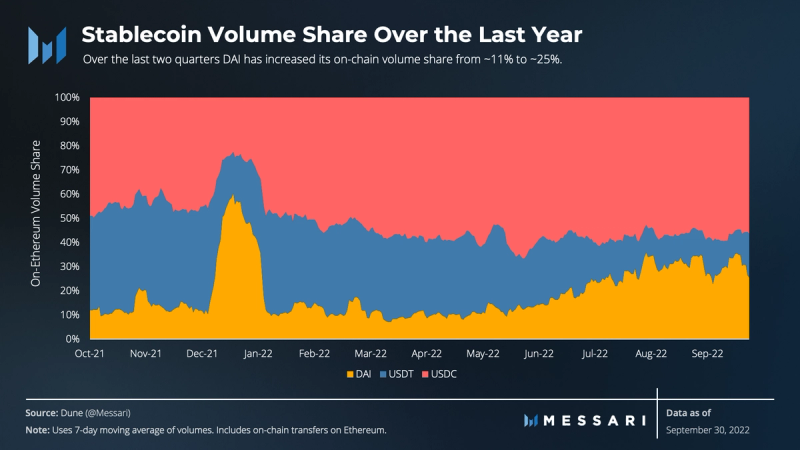

- DAI volumes increased faster than all of its peers, despite very few liquidations in the quarter. The increased liquidity on Uniswap V3 from G-UNI tokens and talk of depegging from the USD were likely primary drivers of the volume growth.

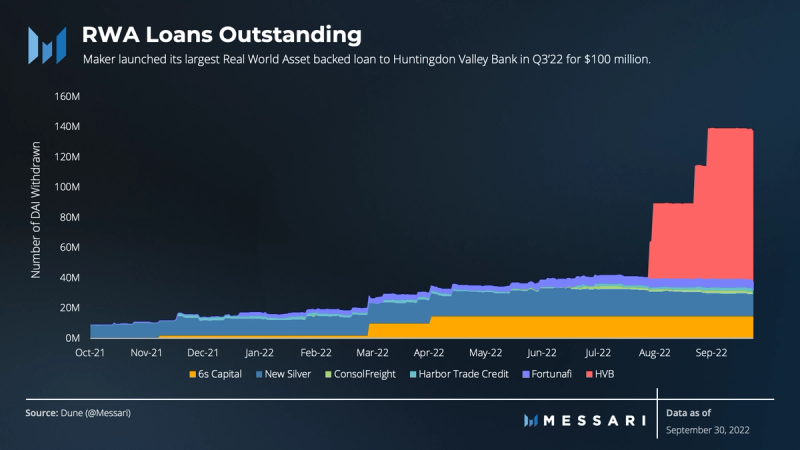

- Maker is seeking new revenue sources by turning to real-world assets (RWAs). This quarter, the HVB vault went live with a $100 million loan and discussions over a $500 million investment in U.S. Treasuries progressed.

A Primer on Maker

Maker is a peer-to-contract lending platform that enables overcollateralized loans by locking collateral in a smart contract and minting DAI, a stablecoin pegged to the U.S. dollar. MakerDAO determines which collateral types are accepted as well as their collateralization ratios and stability fees. Maker maintains DAI’s stability through a dynamic system of collateralized debt positions, autonomous feedback mechanisms, and incentives for external actors. DAI also uses Price Stability Modules that allow for a 1:1 swap of DAI with three approved stablecoins: USDC, USDP, and GUSD. Once generated, DAI can be freely sent to others, used as payments for goods and services, or held as long-term savings.

Introduction

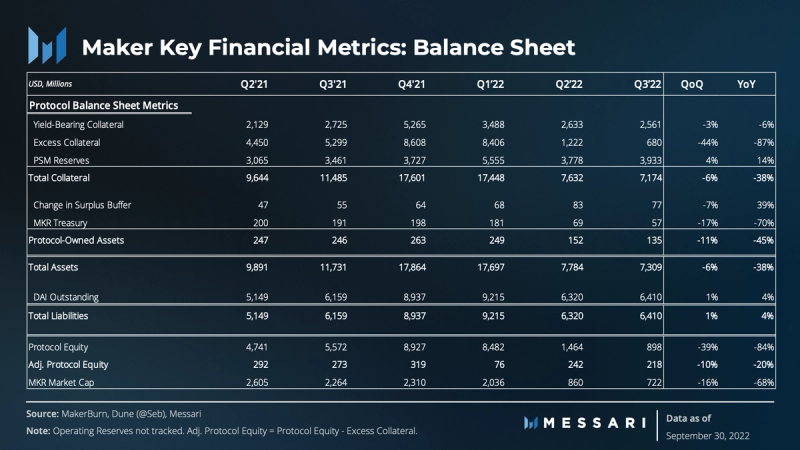

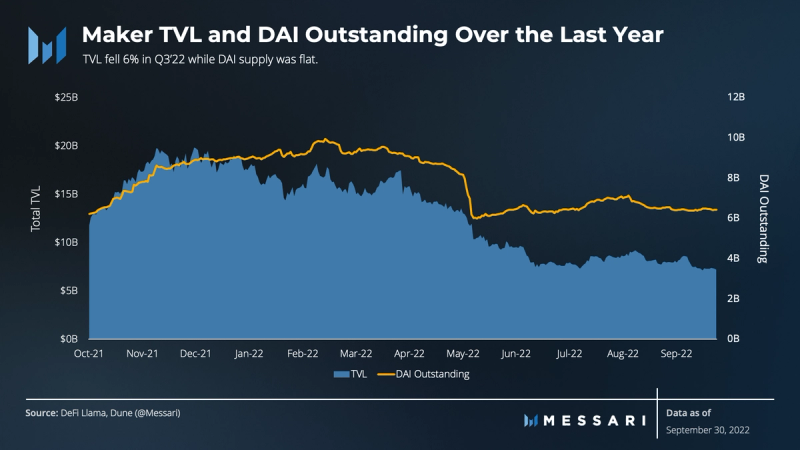

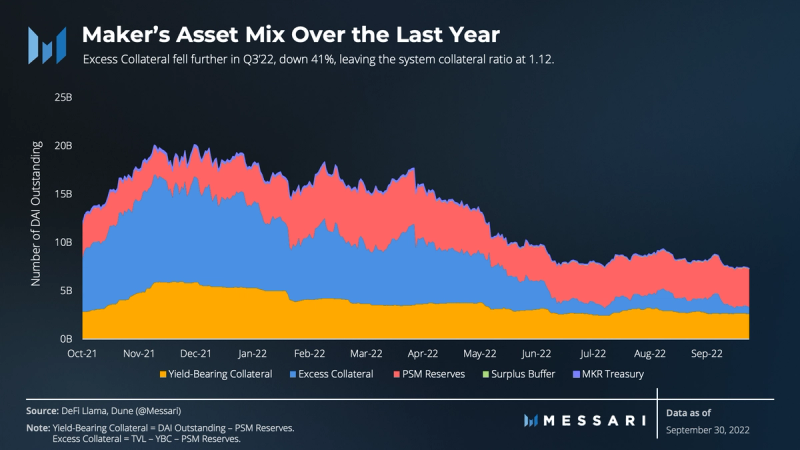

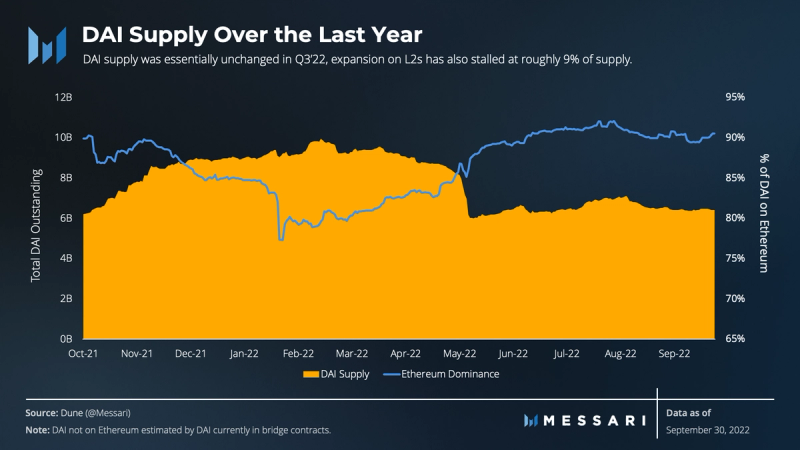

Demand for leverage did not return in Q3 after the system deleveraging in Q2. Yield-bearing collateral held steady while excess collateral continues to dwindle, leaving the network collateral ratio at all-time lows.

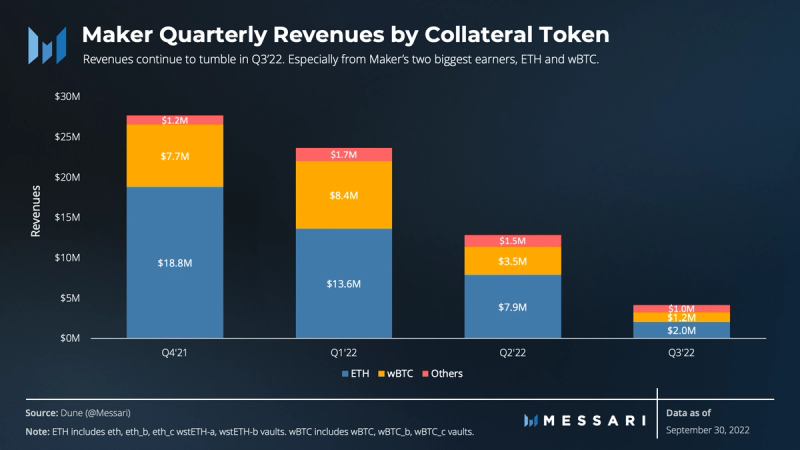

The fall in revenues was stark, down 86% in the quarter. Paired with inelastic expenses, Maker drew down some resources from the DAI surplus buffer to make payments in Q3. It was the protocol’s first negative income quarter since at least 2020.

DAI volumes of on-chain transfers on Ethereum increased again this quarter, jumping 149%. Activity on Uniswap has increased, likely due to the liquidity from G-UNI LP tokens. Elevated volumes around The Merge in September could also be reflective of farming, since USDC and USDT, which require their centralized parents to back the value of the stablecoins, are not backed on ETH Proof-of-Work while DAI would be.

MakerDAO is focused on three main fronts: long-term DAO structure, expanding DAI to be multichain, and increasing revenue streams. Rune Christensen, one of MakerDAO’s founders, shared the final pieces to his Endgame proposal. Developers continue to ship and build Maker-specific bridges for multichain DAI. USDC and Gemini both made proposals to utilize Maker’s PSM assets, while the DAO decided to greenlight a proposal to invest in U.S. Treasury bonds.

Performance Analysis

Maker Protocol

After the deleveraging in Q2, lingering uncertainty kept borrowers on the sidelines. In ETH terms, borrowing TVL fell nearly a quarter on Maker in Q3’22. Until crypto matures and borrowing demand is needed for more than just leveraged price exposure, demand for DAI will likely be left to RWA growth and macro forces.

The trends from Q2’22 continued to persist in Q3, though less severely. Excess collateral and yield-bearing collateral continued to fall, by 41% and 3%, respectively. The reduction in revenue and demand has started to bleed into reserves, as the surplus buffer and treasury fell by 7% and 18%, respectively. Maker shut off the MKR burn in Q2, sending all protocol income to the DAI buffer, which currently stands at $77 million.

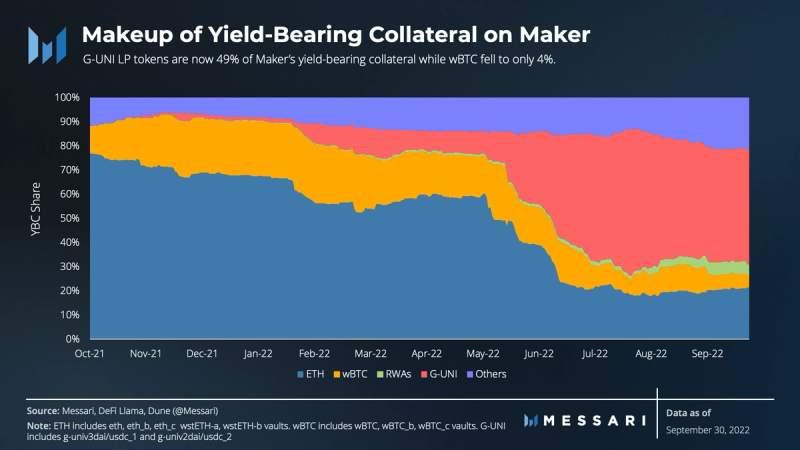

The growth of G-UNI LP tokens as collateral continued in Q3’22, increasing another 18%. The biggest increase was in RWAs, where the HVB loans went live to the tune of $100 million, increasing RWA as a collateral type by 336%. While ETH was flat, wrapped BTC collateral fell 34%. Only 2% of TVL on Maker is Bitcoin, its lowest since inception.

Almost a quarter of Maker’s revenue now comes from non-ETH or BTC based assets. Although diversification is good, the reason for the change is the collapse in revenue from ETH and BTC. Revenue from ETH-based assets fell 74%, from BTC-based assets 66%, and from all others it fell 36%.

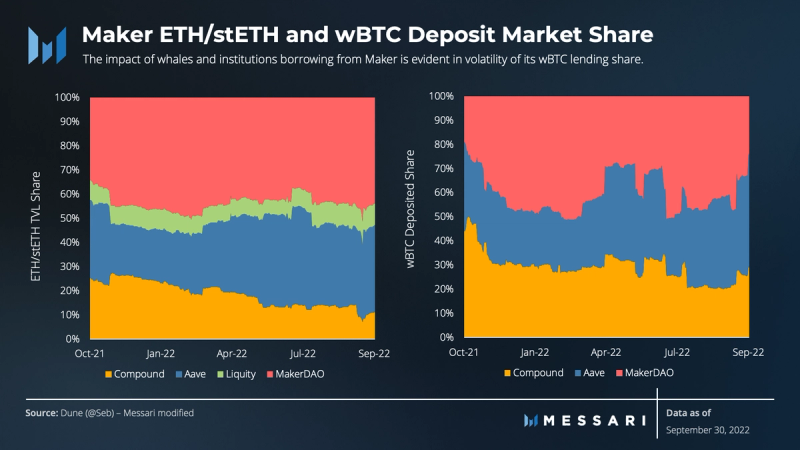

Maker returned to its one-year average ETH market share of 44%, mostly due to 30% and 37% decreases in borrowing from Aave and Compound, respectively. However, Maker lost half of their market share of wBTC loans in the quarter, falling from 49% to 24% at quarter’s end. The one-year average is 41%. The noise in Maker’s wBTC market share is reflective of its reliance on whale activity, along with some inopportune timing. The number of wBTC in the vault fell from ~63,000 on June 30 to ~40,000 on July 7. It then jumped from a low of ~14,000 on September 30 back to ~42,000 on October 1.

The launch of HVB’s $100 million collateral line has been a great success for the DAO so far. The third quarter also saw Harbor Trade Credit increase its borrowing 167%, from $1 million in Q2’22 to $2.67 million in Q3’22. New Silver was the only vault to shrink, falling 19% QoQ. Maker’s real-world assets now make up 12% of the protocol revenue despite only representing 2% of the TVL.

DAI Stablecoin

Despite the lack of demand for leverage, yield still incentivizes demand for DAI, which is achieved through G-UNI LP tokens continuing to bolster demand. This might be a good demand hack for DAI, given the DAI Savings Rate must come from earnings. The trade-off is DAI’s claim to being a decentralized stablecoin. However, given it’s over 60% backed by centralized stablecoins, it appears the DAO is leaning into this opportunity.

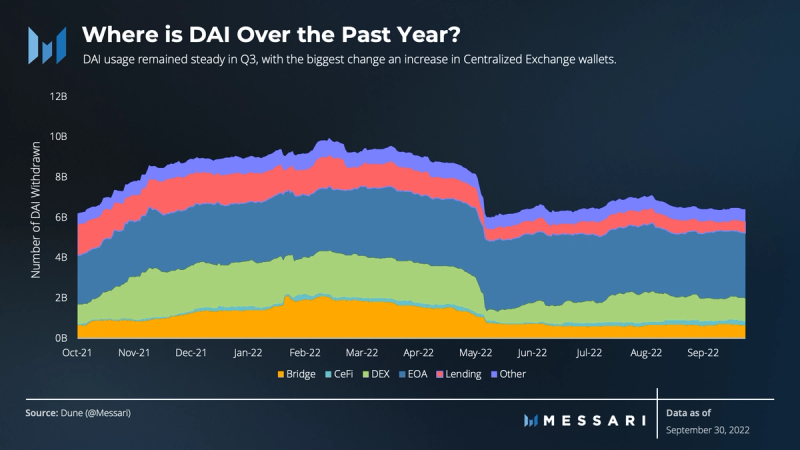

DAI’s usage saw some small changes, with a single-digit percent increase on lending platforms and a similar reduction in EOAs. Exchanges showed the greatest increase in holdings, with DEXs increasing DAI holdings by 14% and centralized exchanges increasing holdings by 37%. Unsurprisingly, the increase in TVL of G-UNI collateral (18%) is similar to the increase in DAI on DEXs.

Market share changes measured by supply were small. But on-chain volume share has been much more interesting the last two quarters, with DAI taking shares from USDT at a rapid clip. If this normalizes in Q4, it could be positioning ahead of The Merge into DAI that led to the share gains. However, the same could be said of USDC, which has maintained its share. USDT is historically used more for trading, and given the fall in market volumes, it is possible that is the cause for USDT’s on-chain volume reduction.

DAI’s volume was up 57% and 149% in Q2 and Q3, respectively. It is possible the increase in depth on Uni V3 that comes from the G-UNI LP token collateral is driving significant usage of DAI on Uniswap, the leading DEX in crypto. It is also worth noting that DAI’s highest volume day was August 29, when Rune posted the idea that Maker needs to free-float DAI.

Qualitative Analysis

Multichain DAI

L2s offer MakerDAO a significant growth vector while still inheriting the security of the Ethereum ecosystem. There are some risks involved in venturing out to L2s, but overall the community feels that the risks are outweighed by the opportunity cost of losing out in stablecoin market share on L2s.

Maker had already deployed a simple DAI bridge on Optimism, Arbitrum One, and Starknet. This past quarter the protocol launched one on Arbitrum Nova, with plans to deploy one for zkSync 2.0 in Q4.

In Q3’22, Maker implemented its Fast Withdrawals mechanism on Optimism and Arbitrum. This will allow users to securely withdraw from the two rollups without having to wait the seven day fraud period. Fast Withdrawals is planned to go live on Starknet in Q4’22.

The final phase of Maker’s Layer-2 bridging solution is Maker Teleport, allowing for DAI transfers between L2s. The latest roadmap aims to launch Maker Teleport at the end of Q1’23.

Having secure and quick Layer-2 DAI bridging will enable Maker to implement the Multi-Collateral DAI (MCD) protocol natively to L2s. This is tentatively planned to launch by the end of 2023.

New Revenue Streams

Real-World Assets (RWAs)

In Q3’22, the Huntingdon Valley Bank (HVB) and Societe Generale FORGE (SocGen) RWA Vaults officially went live. The HVB vault will bring a conservative net yield of 3% from loans originated by the regulated Pennsylvania bank to MakerDAO. The entirety of the 100 million DAI debt ceiling was drawn down throughout the quarter. The SocGen vault will mint DAI against digital covered bonds (OFH security tokens) that are backed by a pool of AAA-rated French home loans. The vault has a 30 million DAI debt ceiling; drawdowns have been delayed until Q4’22.

The next three RWA integrations likely to launch are Monetalis Clydesdale, bIBTA (Backed Finance Short-Term Bond ETF), and BlockTower Credit Vault.

- The Monetalis Clydesdale vault will invest up to 500 million USDC from the PSM into liquid bond strategies facilitated by intermediary Monetalis. Last quarter, MakerDAO voted to allocate 80% of the vault to short-term U.S. Treasuries and 20% to investment-grade corporate bonds.

- Swiss start-up Backed Finance proposes to tokenize short-term bond ETFs (bIBTA), sell them to market participants in a regulated and compliant manner, and create a mechanism for Maker to invest in the tokens. The exact mechanism has not been decided, but the idea is to create a permissionless Maker vault allowing users to deposit bIBTA in return for DAI.

- BlockTower Credit is the credit arm of BlockTower Capital, a blockchain investment firm. Its proposal to act as an arranger for a RWA vault with a 150 million DAI debt ceiling to fund senior secured, real-world credit assets tokenized via Centrifuge Tinlake passed a greenlight poll in August. BlockTower is committed to stake 30% of junior capital on every investment. Implementation is tentatively expected for mid-Q4’22.

PSM: Stablecoin Provider Partnerships

Centralized stablecoins account for 61% of DAI’s collateral via the Peg Stability Module (PSM). The PSM enforces DAI’s 1:1 backing with USD at the cost of being a completely decentralized and censorship-resistant currency. The OFAC sanctions on Tornado Cash and Circle’s subsequent compliance elevated concerns over relying on USDC and other centralized stablecoins for DAI’s peg. Beyond the regulatory risk, another negative of having such a large share of DAI collateral in stablecoins is that they do not earn any yield by default. This quarter there were several proposals from third parties looking to change that.

In early September, Coinbase proposed to custody 33% of the PSM’s USDC (about 1.6 billion tokens) in its Institutional Rewards program. If the vote passes in October, it will allow Maker to earn up to 1.5% yield (about $22.5 million annually) on the USDC that would otherwise be sitting idle, with the only additional risk being counterparty risk.

At the end of September, Gemini proposed an incentives program to increase adoption of Gemini USD (GUSD) within the PSM. The proposed program would last for three months, earning Maker a 1.25% yield on all GUSD in the PSM, with the condition that its average monthly balance on the last day of the month is above 100 million. Although this proposal offers a lower yield than Coinbase’s, it allows Maker to retain custody of the stablecoins in the PSM.

Endgame Proposal

Over the last two quarters, Rune has been sharing his vision for MakerDAO, which he has dubbed the “Endgame Plan.” In the last quarter, he fleshed out his ideas and began submitting formal proposals to be included in the October governance cycle.

Rune’s Endgame Plan aims to separate the Maker protocol and DAO into a Maker Core and MetaDAOs. The Maker Core is a stripped-down version of the current Maker protocol meant to never change. Initiatives that are more complex and risky, but can generate more revenue for Maker, are carried out by MetaDAOs. MetaDAOs have their own tokens and treasury, but the Core oversees MetaDAOs and ultimately has ownership of their treasury. Rune has designed a set of tokenomics aiming to create synergies between the Core and MetaDAOs.

The Endgame Plan consists of three phases that toggle three trade-offs of DAI decentralization and censorship-resistance, revenue-generating power, and maintaining a 1:1 USD peg. The first phase prioritizes generating revenue over censorship-resistance, onboarding RWA vaults, and investing in short-term bonds. Earned revenue will grow DAI’s buffer, allowing the protocol to begin to accumulate stETH. stETH will be accumulated in a Protocol-Owned Vault (POV), which is just a modified Maker Vault only accessible to the Maker protocol. The ultimate goal of the POV is to create a synthetic liquid staking ETH (ETHD). At first, ETHD will just be a wrapped version of Lido’s stETH, but then it will be a wrapped version of several liquid staked ETH tokens. Finally, it will be a fully synthetic liquid staking ETH.

If the regulatory environment becomes hostile enough, Maker will transition off RWAs (including centralized stablecoins via the PSM) beginning in the second phase and fully in the third phase. In doing so, DAI will likely have to free-float off a 1:1 peg to the USD. If Maker is forced to take this position, it will be crucial to have built up a large supply of decentralized collateral, thus the emphasis on accumulating stETH in the first phase. The ETHD POV will also be important in the later phases to better control the price of DAI through market buys and sells. Letting DAI free-float is a big risk, especially since it will likely do so by having an interest rate that is negative. However, Rune argues that it will be necessary due to potential future regulatory attacks.

Closing Summary

Despite being one of the oldest DAOs, Maker continues to innovate both on governance structure and network growth. The protocol had its least productive quarter from a revenue perspective in over two years, but the DAO remains very active. New initiatives like RWAs are growing and account for 12% of protocol revenues. Q4 looks to increase that number with new faults ready to be funded. The long-term future of Maker is also being worked out by its returning founder and the community. While revenues take a hit, OFAC sanctions bring centralization concerns to the forefront. Balancing these forces will be the challenge for Maker going forward.