Key Insights

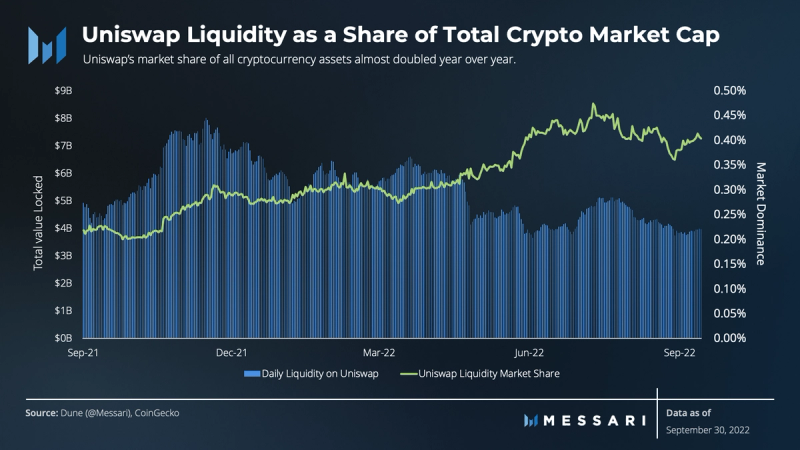

- The protocol continues to attract liquidity despite falling prices. The market share of assets held in Uniswap pools doubled YoY as investors sought opportunities to profit on their core assets.

- Several important milestones were executed through governance, including the creation of the Uniswap Foundation and the launch of a one basis point (bps) fee tier on optimism.

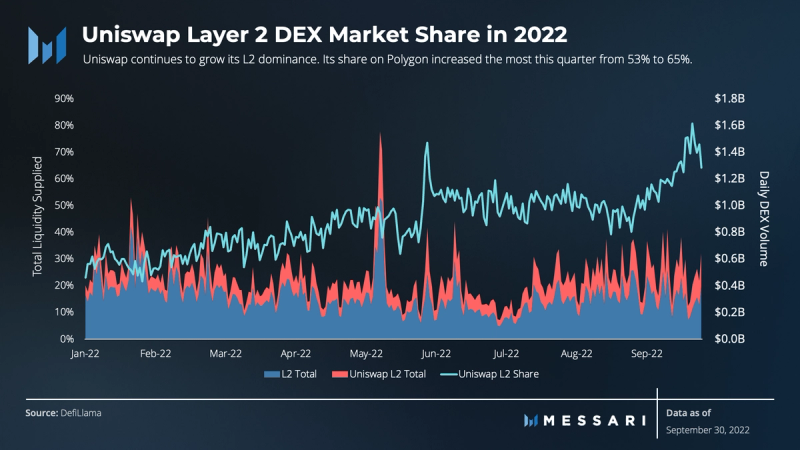

- As DEX volumes across Ethereum scaling solutions continue to grow, Uniswap is well positioned to maintain its market leader rank. For the third straight quarter, the protocol increased its market share dominance and accounted for 65% of all volumes.

Primer on Uniswap

Uniswap is an automated market making protocol that facilitates the trading of tokens on the Ethereum network and on its scaling solutions, namely Optimism, Arbitrum, and Polygon. The protocol is recognized as a pioneer among decentralized exchanges (DEXs), first for its popularization of the X*Y=K constant product pricing curve of pooled liquidity in V2 and subsequently for its concentrated liquidity and staggered trading fee features in V3. The constant product pricing curve has since been implemented in many other DEXs across the industry. The concentrated liquidity model and fee tiers continue to remain relatively unique to Uniswap.

Performance Analysis

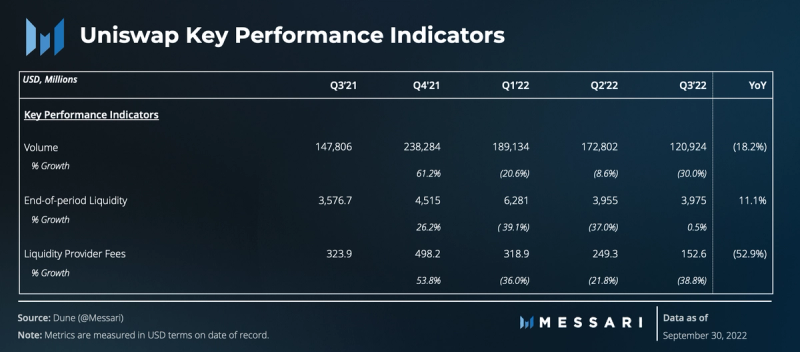

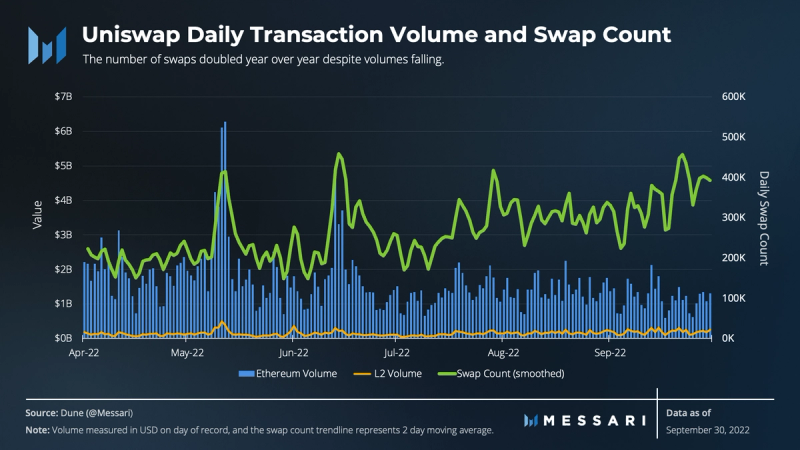

Despite a 32% increase in swaps, total trading volumes fell 30% in Q3. The decline was isolated to Uniswap on Ethereum. Volume on Optimism increased 67%, and both Arbitrum and Polygon increased by ~7%. Volume on Optimism will likely increase again in the near future as 1 million OP airdrop tokens were claimed by the Uniswap Grants Program (UGP) on September 7. At the time of writing, there has been no official announcement on how the OP tokens will be distributed, but a UGP proposal in May detailed a plan to allocate 80% of the tokens to incentivizing liquidity on Optimism’s instance of Uniswap V3.

The total value of liquidity supplied on Uniswap remained stable in Q3 while the total cryptocurrency market cap increased by 5%. Liquidity on Uniswap nearly doubled its share of the total crypto market cap over the last year and settled at 0.4% market dominance as of the end of Q3. This net gain in market share highlights Uniswap’s ability to attract liquidity, especially as general crypto prices fall along with trading volumes and fees.

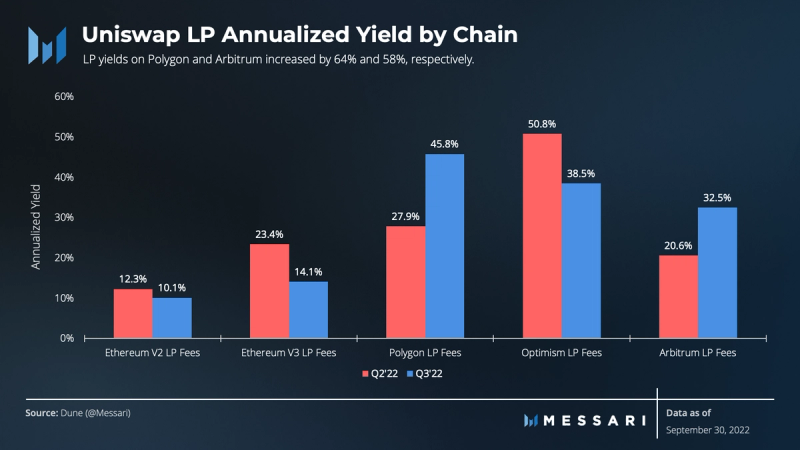

Uniswap pools on Polygon and Optimism collectively offered the highest return on assets for liquidity providers in Q3, excluding liquidity mining rewards. Despite a 67% increase in volumes on Optimism, overall yields decreased 24%. The decline was due to a 23% increase in average daily liquidity coupled with a 15% increase in the share of volumes flowing through the lower 1 bps and 5 bps pools.

Q3 yields on Uniswap’s Polygon and Arbitrum instances increased 64% and 58%, respectively. Polygon’s outperformance is attributed to a 6% increase in volume in addition to a 38% decrease in liquidity, while Arbitrum’s performance is attributed to a 7% increase in volume and a 7% decrease in liquidity.

Arbitrum achieved similar results even with a smaller liquidity reduction than Optimism because the instance of Uniswap on Arbitrum does not have a 1 bps fee tier yet. Therefore, it takes less volume to produce the same yields seen on other Uniswap instances. Additionally, one of the most traded pairs on Arbitrum is ETH/GMX, which has 30 bps and 100 bps pools. The pools only accounted for 13% of the volume in Q3 but generated 43% of the LP fees.

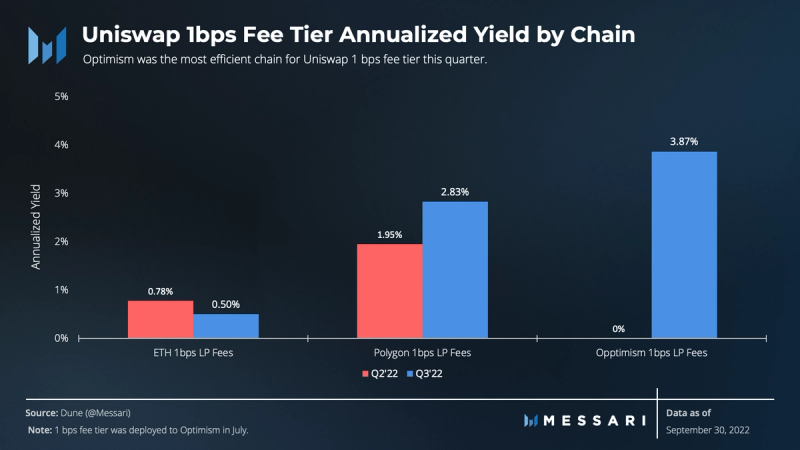

The goal of Uniswap’s 1 bps fee tier is to attract stablecoin liquidity to the protocol. Following the deployment of 1 bps pools on Polygon in April, Uniswap deployed them to Optimism in July and attracted an average of $2.6 million in daily liquidity.

The 1 bps pools on Polygon yielded higher returns when compared to Q2. The higher returns were due to a 33% reduction in daily liquidity rather than increased volumes which remained stable QoQ. Lastly, 1 bps pools on Ethereum also had relatively stable volumes, but yields fell as daily liquidity increased 34% or $364 million in the quarter.

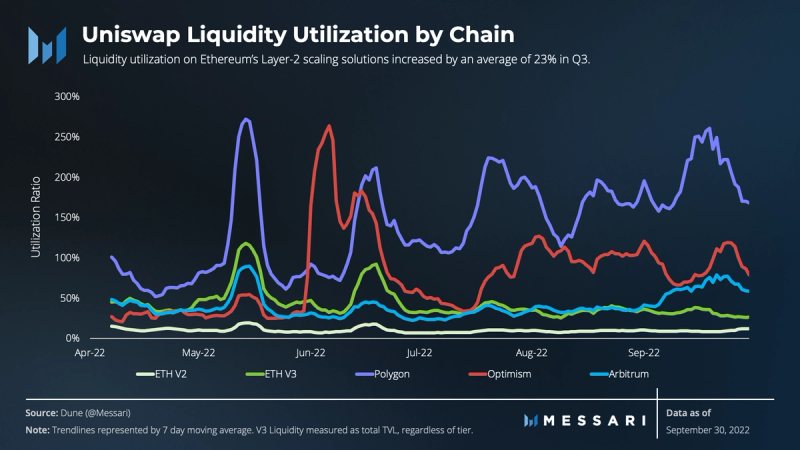

Achieving capital efficiency is hard, and measuring it isn’t any easier. Uniswap V3 uses multiple fee tiers and concentrates liquidity within a custom price range, which individualizes price curves and makes it difficult to calculate Uniswap’s liquidity utilization.

In an attempt to standardize performance, utilization was calculated as the total volume of V3 pools in a given day divided by total liquidity supplied across all V3 pools. When compared to Q2, utilization for Uniswap V3 increased by an average of 23% across the three Ethereum (Layer-2) scaling solutions. Polygon led the way with a 37% increase, followed by a 19% increase on Optimism and a 12% increase on Arbitrum. On Ethereum, V3 utilization decreased from 51% to 34% as trading volumes dropped $44 billion and the average daily liquidity supplied increased $64 million.

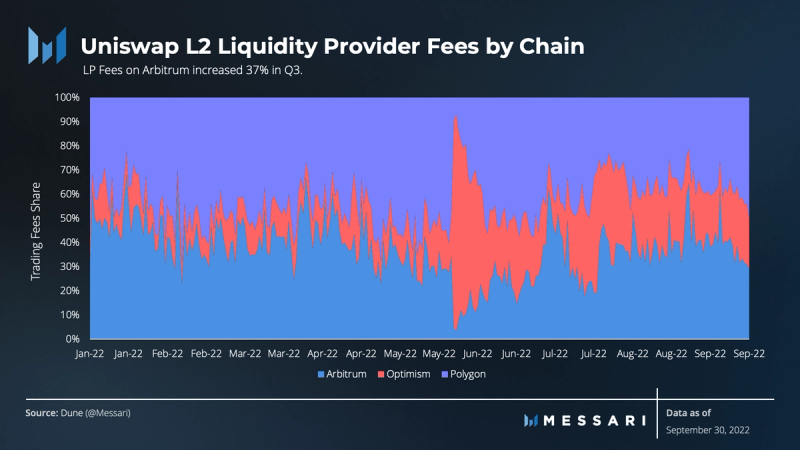

LP fees increased 37% on Abitrum in Q3, and fees on Optimism remained flat following a 176% increase in Q2. In total, LP fees were fairly distributed throughout the quarter, with LPs on Arbitrum and Polygon both receiving ~37% and Optimism LPs receiving 25%.

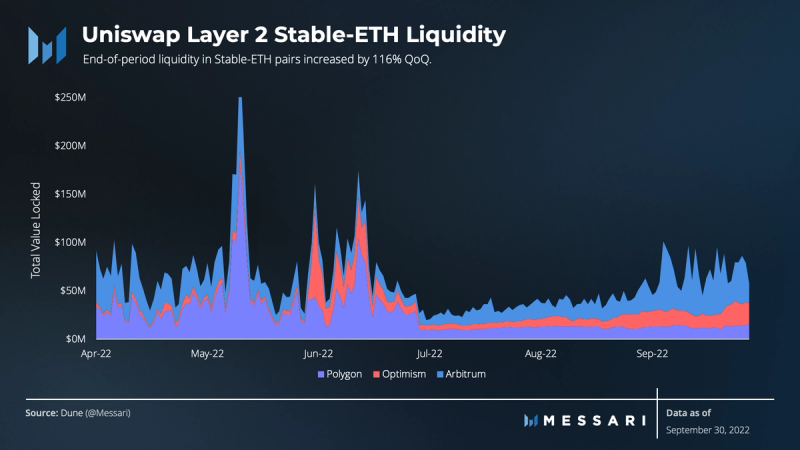

End-of-period liquidity for the three major Stable-ETH pairs (USDC-ETH, DAI-ETH, and USDT-ETH) on Uniswap’s Layer-2 instances more than doubled in Q3 and accounted for 59% of total volumes. In total, 47% of the volume came from Polygon and accounted for 49% of the total volume traded on Polygon’s instance of Uniswap.

Qualitative Analysis

Multichain Future

Uniswap’s progression into a multichain future continues in Q3 as it has attracted more than 65% of all DEX volumes on Layer-2 chains. Additionally, Uniswap V3 was deployed on the Celo blockchain in July, and just two months later, sentiment votes were held in which 99.99% of voters were in favor of also deploying V3 on zkSync and Aurora. If the proposal passes, Aurora plans to incentivize Uniswap users by allocating $5 million to a liquidity mining campaign and long-term protocol development.

The Uniswap Foundation

The Uniswap community also expanded internally as Uniswap Governance passed a $74 million proposal to create the Uniswap Foundation (UF). UF is an independent entity whose mission is to support the decentralized growth and sustainability of the Uniswap Protocol and its ecosystem. The results showed that 99.8% of the on-chain votes were in favor of the proposal, with more than 50% of those favorable votes coming from the likes of a16z, Variant Fund, ConsenSys, Robert Leshner of Compound, Gauntlet, and Uniswap Grants committee member John Palmer.

Of the $74 million, $14 million will cover a three year operating budget of a team of 12. The remaining $60 million is to expand the Uniswap Grants Program (UGP). The Uniswap Foundation also received 2.5 million UNI tokens via the Franchiser smart contract to participate in governance. The Franchiser smart contract allows these tokens to be revoked by the Uniswap DAO at any time and limits their use to governance.

As of quarter end, Uniswap Foundation completed its first wave of 14 grants totaling $1.8 million. Approximately $1.6 million of this first wave was awarded to GFX Labs for the crafting of Uniswap Diamond. Uniswap Diamond aims to increase Uniswap’s market share against leading centralized exchanges in user experience and data. It will create an open-source API and SDK to fetch live and historical data, as well as a professional trading interface with centralized exchange features such as LP tooling and market and limit orders.

Fee Switch

The fee switch has long been one of the most discussed topics within the Uniswap community. At present, 100% of trading fees are split by LPs based on their contribution to liquidity reserves. The fee switch refers to a portion of these fees being diverted to the Uniswap DAO treasury as a protocol fee.

In August, a 120-day pilot for activating the fee switch went to a Consensus Check on Snapshot where 99.99% of voters voted “Yes” in favor of the pilot. Per the proposal, the pilot would be tested on the following three pairs in which 10% of the respective liquidity provider fee would go to the Uniswap DAO treasury:

- DAI-ETH: 0.05% LP fee

- ETH-USDT: 0.3% LP fee

- USDC-ETH: 1.0% LP fee

The proposed pilot aims to quantify how LPs will re-deploy their liquidity provisioning in response to the fee switch. If the pilot makes it through the final stage of the governance process and the implementation is considered a success by the Uniswap community, the next major decision for Uniswap governance would be to decide how the protocol fees are utilized. The term “fee switch” does not create any expectation that protocol fees will be paid out to UNI tokenholders, but instead gives tokenholders new tools to leverage in furthering the growth and mission of the protocol.

In Q3’22, the three pairs accounted for 4.34% of the total volume traded. At the proposed 10% fee split, the pairs would have generated more than $850,000 for the Uniswap DAO treasury.

Closing Summary

The Uniswap protocol performed well this quarter despite lower volumes and revenues on Ethereum. Increasing swap counts, market share, and deployments on Layer-2 solutions have sparked excitement within the Uniswap community. With the newly formed Uniswap Foundation and fee switch on the horizon, the road ahead looks bright for the leading decentralized exchange.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form.

Author(s) may hold cryptocurrencies named in this report, and each author is subject to Messari’s Code of Conduct and Insider Trading Policy. Additionally, employees are required to disclose their holdings, which is updated monthly and published here. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Messari does not guarantee the sequence, accuracy, completeness, or timeliness of any information provided in this report. Please see our Terms of Use for more information.