Key Insights

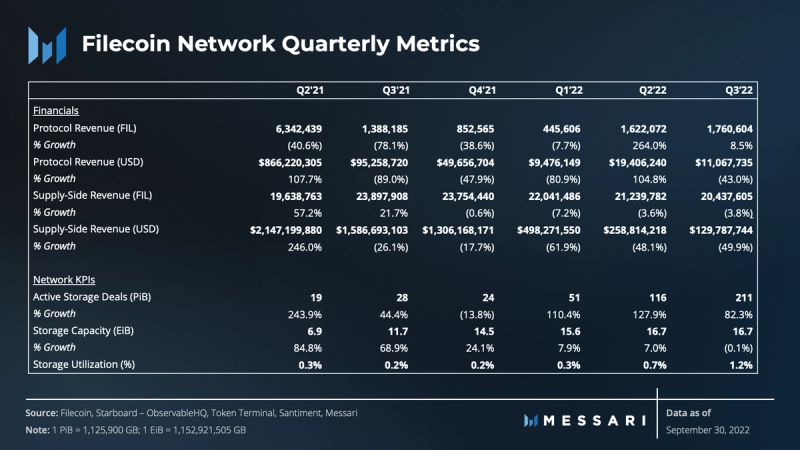

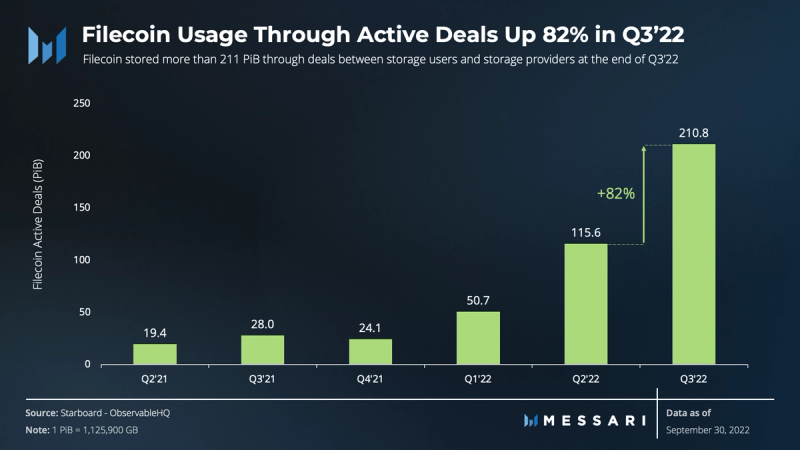

- Active storage on the Filecoin network continued its growth in Q3’22, up 82% QoQ.

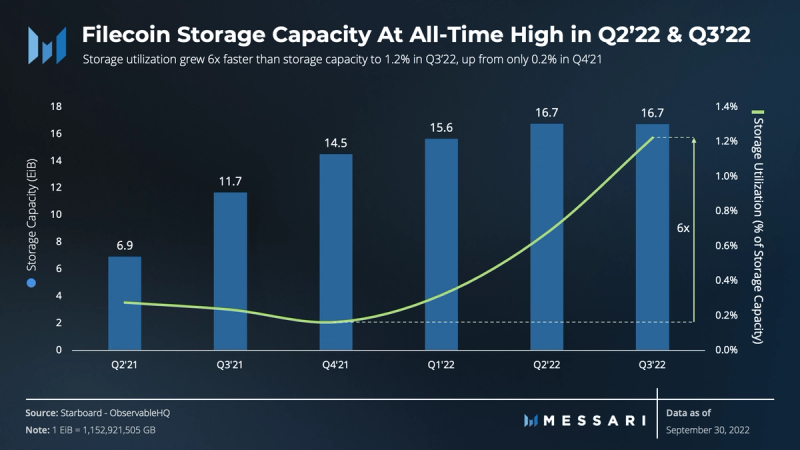

- While storage capacity remained at an all-time-high in Q3’22, storage utilization grew 6x faster than storage capacity during the past year.

- Protocol revenue grew 9% in FIL terms in Q3’22 (down 43% in USD terms).

- Driven by the reduction of reward issuance, total revenue earned by storage providers decreased 4% in FIL terms in Q3’22 (down 50% in USD terms).

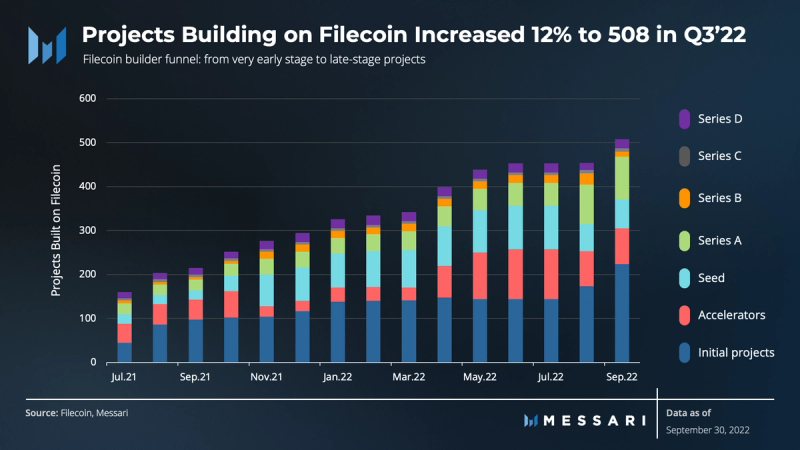

- The total number of projects building on Filecoin grew 12% in Q3’22, showing a healthy development of its ecosystem.

Primer on Filecoin

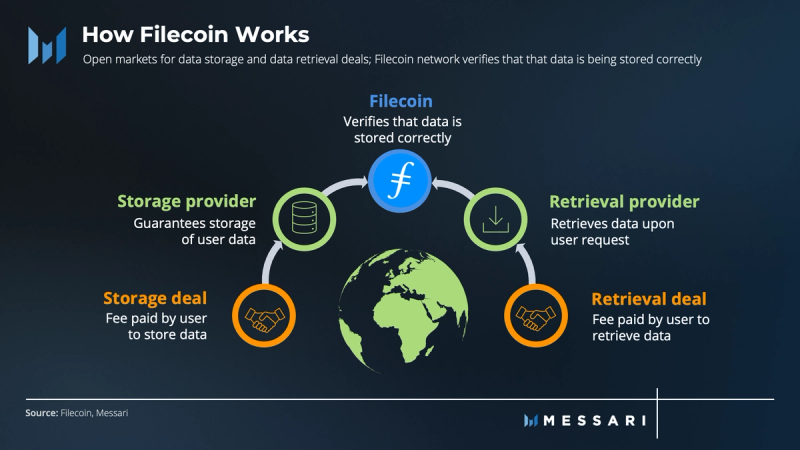

Relying on centralized data storage has a major shortcoming: it’s hard to systematically verify the integrity of the stored data. As it stands today, the Filecoin network is a peer-to-peer version of Amazon S3 that regularly verifies the storage of data. Filecoin uses storage deals priced based on supply and demand dynamics, instead of a fixed pricing structure.

A storage deal is like a contract with a service level agreement (SLA) — users pay fees to storage providers to store data for a specified duration. To keep data safe, Filecoin uses a cryptoeconomic incentive model that regularly verifies the storage with zero-knowledge proofs. To incentivize storage providers to participate in deals, Filecoin rewards them with the network’s native token (FIL). At the same time, storage providers are slashed if the data is unretrievable or if the storage fails.

To retrieve data, Filecoin users pay a retrieval provider to fetch the data. Unlike storage deals, which involve transactions on-chain, retrieval deals use payment channels to settle payments off-chain, resulting in faster retrieval.

Performance Analysis

The Filecoin blockchain is used by both the demand side (i.e., storage users) and the supply side (i.e., storage providers) of the network. Both storage users and storage providers generate revenue.

Revenue

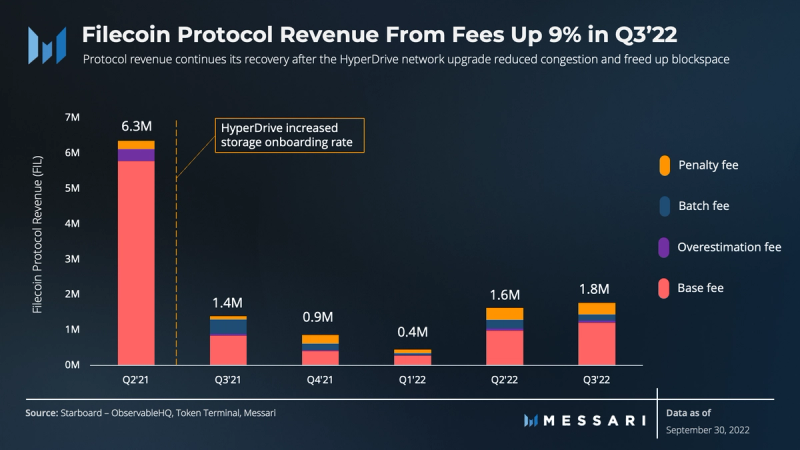

Filecoin’s revenue framework is similar to Ethereum’s because the gas system in its core protocol is based on EIP-1559. This gas system consists of network fees that are burned to compensate for the resources used. As per Messari’s revenue analysis, Filecoin’s protocol revenue represents the sum of:

- Base fees: required by any storage deal or proof; base fees are determined by message congestion on the network.

- Batch fees: used for adding storage capacity.

- Overestimation fees: required for optimizing gas usage.

- Penalty fees: collected for storage provider failures.

Protocol revenue grew 9% in Q3’22 to 1.8 million FIL. In USD terms, this corresponded to a 43% drop to $11 million from $19 million in Q2’22. Notably, Q3’22 is the first quarter with yearly growth (27% YoY) in FIL protocol revenue since the HyperDrive network upgrade in July 2021. By aggregating storage proofs, HyperDrive led to a 10-25x increase in storage onboarding rate. While the HyperDrive upgrade benefited network participants — by reducing congestion and freeing up blockspace — it also led to overall lower transaction fees. Hence, the HyperDrive upgrade hurt the protocol’s revenue over the past four quarters.

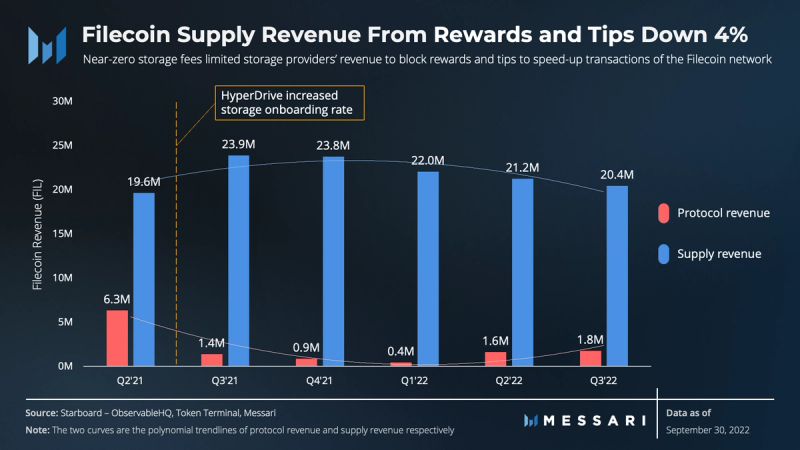

The only portion of Filecoin fees that isn’t burned by the protocol is the “tip” collected by block miners to speed up transactions on the supply side of the network. Therefore, this “tip” counts as supply-side revenue. Filecoin’s supply-side revenue consists of token rewards paid to storage providers (accounting for more than 99.97% of supply-side revenue in Q3’22), while “tips” accounted for a small portion only.

Supply-side revenue decreased 4% in FIL terms QoQ, driven by the reduction of reward issuance according to Filecoin’s reward minting mechanism. That is, a portion of rewards is released in line with the growth rate of Filecoin’s storage capacity. While the growth rate of onboarded storage capacity declined QoQ since Q3’21 (as per Filecoin Network Quarterly Metrics table), so did the supply-side revenue.

Notably, over the past three quarters, the successive drops in supply-side revenue corresponded to increases in protocol revenue. As the overall supply-side revenue from block rewards may continue its downward trend, Filecoin’s main goal is driving demand for its blockspace. More blockspace demand translates into higher transaction fees relative to today’s levels, and, in turn, into higher protocol revenue. This may be regarded from two perspectives:

- From a storage provider perspective: lower reward issuance may see storage providers leaning more heavily into storage deals to earn a higher relative share of rewards; simultaneously, storage providers may accrue revenue from avenues other than from storage deals, such as fees from retrievals, smart contract apps, or data-intensive services (e.g., decentralized computing).

- From a storage user perspective: near-zero storage fees may have encouraged increased usage of data storage through deals, as discussed in the Network Usage section below.

Network Usage

Filecoin’s network usage can be gauged by the amount of data stored in active deals between storage users and storage providers. Demand for Filecoin storage comes from both Web2- and Web3-specific storage deals.

Nearly 211 PiBs were stored on the Filecoin network through active deals at the end of Q3’22 — an 82% increase relative to the previous quarter. This positive growth trend has continued since Q4’21.

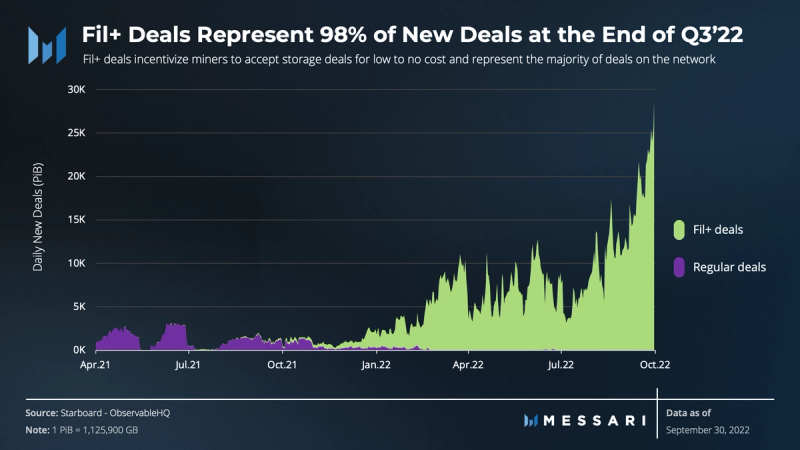

The Filecoin Plus (Fil+) program aims to incentivize the storage of real data and prevent the gaming of network rewards. Fil+ provides storage providers with increased rewards for participating in verified deals by increasing their probability to win block rewards over time. This has led providers to undercut other providers’ fees to compete for storage deals. In Q3’22, this led to storage being offered at little to no cost.

Since Q4’21, there has been a transition from Regular deals (unverified data deals) to predominantly Fil+ deals (verified data deals). This transition corresponded to a sustained upward trend in Fil+ deals, representing over 98% of all new deals in Q3’22. The flippening of Regular deals by Fil+ deals, coupled with the uptick in new deals, indicates that the Fil+ incentive mechanism and onboarding programs are succeeding in driving significant network utilization.

As per the end of Q3’22, a total of 138 clients have onboarded large datasets (e.g., datasets that exceed 100TiB in storage size). Clients range from New York City, the USC Shoah Foundation, to Web3 platforms such as OpenSea. Further notable efforts to onboard data into the Filecoin network include:

- UC Berkeley collaborating with Seal Storage for storing physics research.

- GenRAIT leveraging Estuary to store critical genomics data on Filecoin.

- Starling Labs research center storing sensitive digital records of human history.

- Eweison (China’s fastest growing host of photographs, illustrations, and vector files) using Filecoin for data preservation.

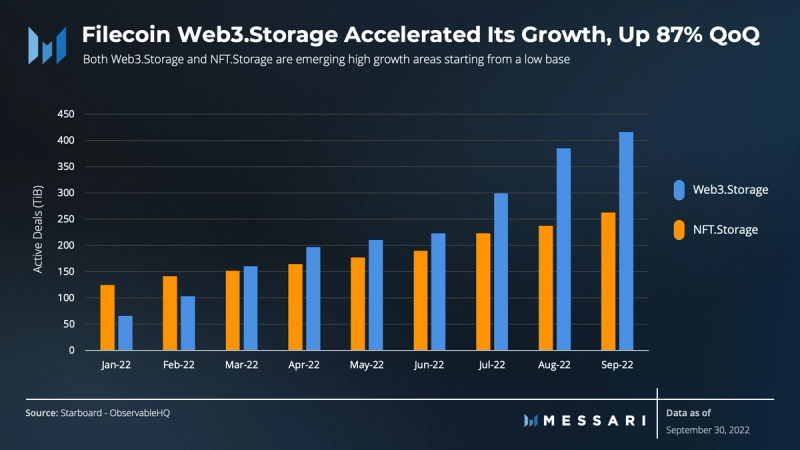

To further encourage usage, two services — NFT.Storage and Web3.Storage — provide simple user interfaces to end users and act as aggregators where data from multiple users is bundled and stored with a storage provider.

The NFT.Storage service provides a simple user interface for storing NFT content and metadata on Filecoin. The simplicity of the service attracted a wide range of users from individual artists to large marketplaces such as OpenSea, Rarible, MakersPlace, MagicEden, Holaplex, Jigstack, and Project Galaxy. Conversely, Web3.Storage simplifies storing and retrieving Web3 data for developers and end users of Filecoin. It aims to enable developers to use decentralized storage on their apps.

By participating in the Fil+ incentive program, both NFT.Storage and Web3.Storage are able to offer Filecoin storage at no additional charge to end-users. Overall, both services experienced significant growth in terms of active deal data in Q3’22 — NFT.Storage grew 38% QoQ, while Web3.Storage was up 87%.

This accelerated trend in usage growth must be put in the context of Filecoin’s supply of data storage capacity.

Network Supply

Block rewards incentivize storage providers to enter storage deals. The more deals storage providers are able to secure, the higher their relative share of block rewards. Storage providers compete on the open market to secure more deals at lower prices.

Regardless of the overall market downturn, Filecoin’s committed storage capacity has grown during the past five quarters to 16.7 EiB. However, Q3’22 saw a plateau in storage capacity after reaching its all-time-high in Q2’22. Simultaneously, the storage utilization relative to the total available storage capacity has steadily increased over the past quarters to 1.2% in Q3’22, up from only 0.2% in Q4’21. That is, although it began at a low starting base, usage grew 6x faster than capacity over the past year.

It remains to be seen to what extent Filecoin may continue shifting its focus from storage capacity to increasing utilization over the following quarters. As the Fil+ program enables acquiring new users and onboarding valuable datasets, it may serve as a base for developing monetizable use cases around data. In essence, Filecoin’s strategy appears to bootstrap storage to support the development of monetizable use cases around data in the future.

While the introduction of the Fil+ program has been a step forward in terms of both supply onboarding and demand generation, there is a concerted effort to incubate new businesses and use cases for building on Filecoin.

Ecosystem Overview

The Filecoin ecosystem has been actively developing a funnel of developers and builders through activities such as hackathons, accelerators, grants, mentorship, and growth support. The funnel is designed to help early-stage projects and teams develop enough to receive funding and investments.

Over 508 projects are currently being built on Filecoin, a 12% increase in Q3’22. A significant portion of the growth originated from initial projects, up to 223 in Q3’22 from 144 in the previous quarter.

The Filecoin ecosystem is channeled towards onboarding a large variety of use cases: from decentralized storage for NFTs, to music and video streaming, to metaverse and gaming. An overview of these use cases is available in Messari’s coverage of Filecoin’s ecosystem.

Qualitative Analysis

Key Events

The V16 Skyr upgrade represents the deployment of Milestone 1 (out of 2) of the Filecoin non-programmable WASM-based Filecoin Virtual Machine (FVM). Its completion on Jul. 6, 2022, marked the Filecoin network running its core logic atop of the FVM Milestone 1 code.

Milestone 2 aims to introduce programmability for both native FVM and EVM-compatible FVM. The completion of Milestone 2 is expected to enable the deployment of custom logic to the network. This would, in turn, make Filecoin both a data storage and a computation layer.

Infura infrastructure outage

Shared infrastructure provider Infura reported on its status page that its widespread outages led to two outages on the Filecoin Mainnet API on Sept. 14 and 26, 2022. Filecoin network restarted its operations within 38 and 64 minutes, respectively, following the outages.

Filecoin at Mainnet 2022

Protocol Labs, Filecoin Foundation, and members of the Filecoin Ecosystem teams met the Messari team during the annual Messari Mainnet conference in September 2022. As part of a 30-minute panel session, we explored Filecoin’s usage and current developments. Current efforts to simplify Filecoin usage are focused on a series of developer tools, as well as services such as NFT.Storage and Web3.Storage.

While Filecoin has been so far predominantly a marketplace for storing and retrieving large datasets, the FVM is expected to add smart automation of business logic to Filecoin. Two of the use cases discussed are perpetual data storage and decentralized computing. In line with this, Filecoin’s focus remains on FVM rollout.

A full list of Filecoin events can be accessed via Messari Intel.

Roadmap

The FVM aims to bring programmability and computation to Filecoin. The FVM roadmap includes:

- The launch of the FVM testnet in November 2022.

- The full FVM launch in Q1’23.

The FVM platform aims to be used by developers to create new use cases including on-chain voting and decentralized verifiable computation. These services combined with the addition of smart contracts should increase demand for blockspace.

While FVM is at the forefront of Filecoin development, Filecoin’s roadmap and direction include substantial improvements on the retrieval, off-chain computing, and scaling fronts. In addition to increasing the network’s storage capacity and utilization, the Ecosystem Working Group is focused on helping as many early-stage projects in the Filecoin ecosystem to translate into full-fledged businesses — i.e., advancing from initial stages all the way through Series D and beyond.

Closing Summary

Q3’22 marked an uptick in Filecoin usage, as active storage deals grew 82% QoQ. Despite the overall market downturn, storage capacity remained at its all-time-high. Simultaneously, storage utilization grew from 0.2% in Q4’21 to 1.2% in Q3’22. Although from a low starting base, utilization grew 6x faster than capacity over the past year. While decentralized storage is still in its early days, the Filecoin ecosystem continues to thrive, as over 500 projects are currently being built on Filecoin.

Further down the path, the successful rollout of Filecoin Virtual Machine could enable the next generation of apps beyond storage. Prominent examples include perpetual storage (similar to Arweave), undercollateralized loans to storage providers, and decentralized computing.

Should Filecoin continue to onboard demand, it stands a chance at being a prominent provider of decentralized storage and cloud services for Web3 and traditional apps. Filecoin must continue to prove its reliability as a storage provider and potentially become an enabler of a wide range of data-intensive services.