This week researchers from the Bank of Canada published the central bank’s Financial System Review which highlights five key statistics tethered to Canadian bitcoin owners. According to the Bank of Canada’s metrics, 13% of Canadians own the leading crypto asset bitcoin, and “most Canadians are aware of bitcoin.”

Bank of Canada’s Financial System Review Highlights Bitcoin Ownership Among Canadians

On October 12, 2022, the Bank of Canada published the financial institution’s Financial System Review, which highlights some key points tied to the crypto asset ecosystem. A blog post specifically discussing the crypto asset industry and markets, in general, written by Daniela Balutel, Walter Engert, Christopher Henry, Kim Huynh, and Marcel Voia explains that “large price corrections are the most common incident reported by crypto asset owners.”

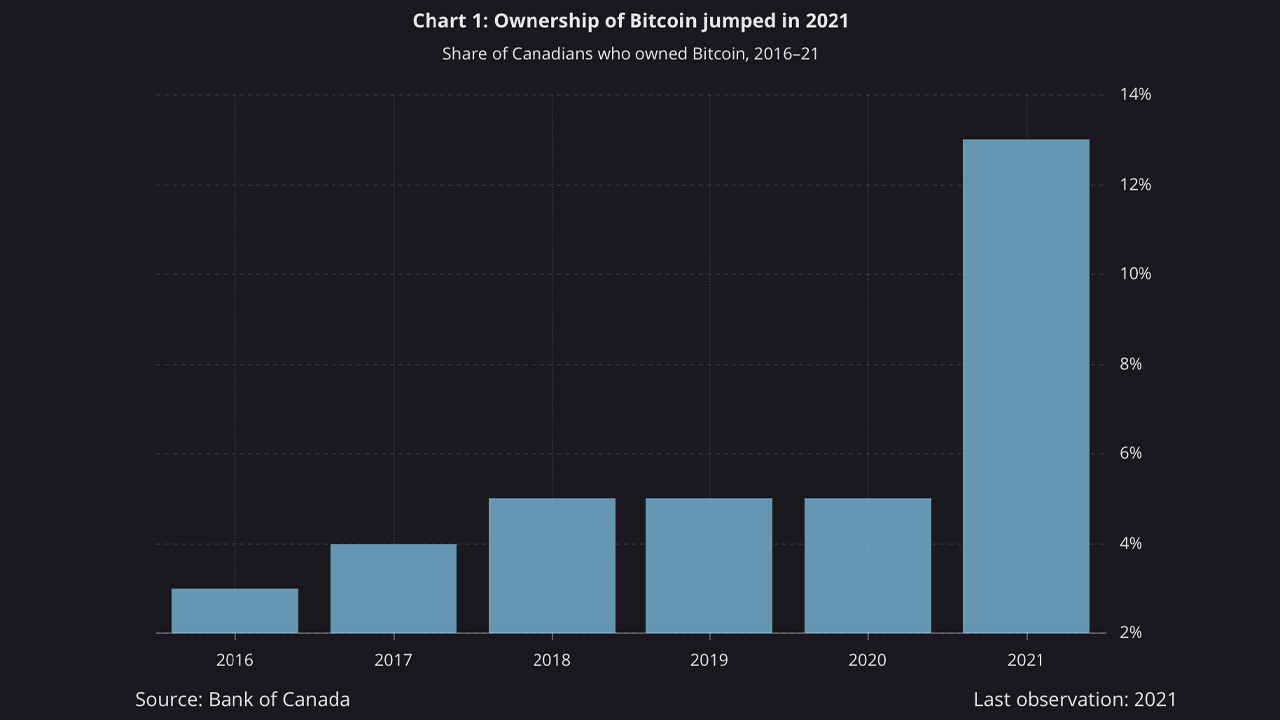

Furthermore, the five researchers added that “bitcoin ownership among Canadians increased sharply in 2021.” “The share of Canadians owning bitcoin rose from 5% in 2018–20 to 13% in 2021,” the Bank of Canada’s blog post notes. “This increase occurred following widespread increases in the savings and wealth of Canadians during the pandemic.”

While previous studies and this year’s Financial System Review shows most residents from Canada have heard the term “bitcoin,” the level of understanding is split. Despite this fact, Canada’s central bank “found that 40% of bitcoin owners in 2021 showed a low level of bitcoin knowledge, which is a higher percentage than in previous years.”

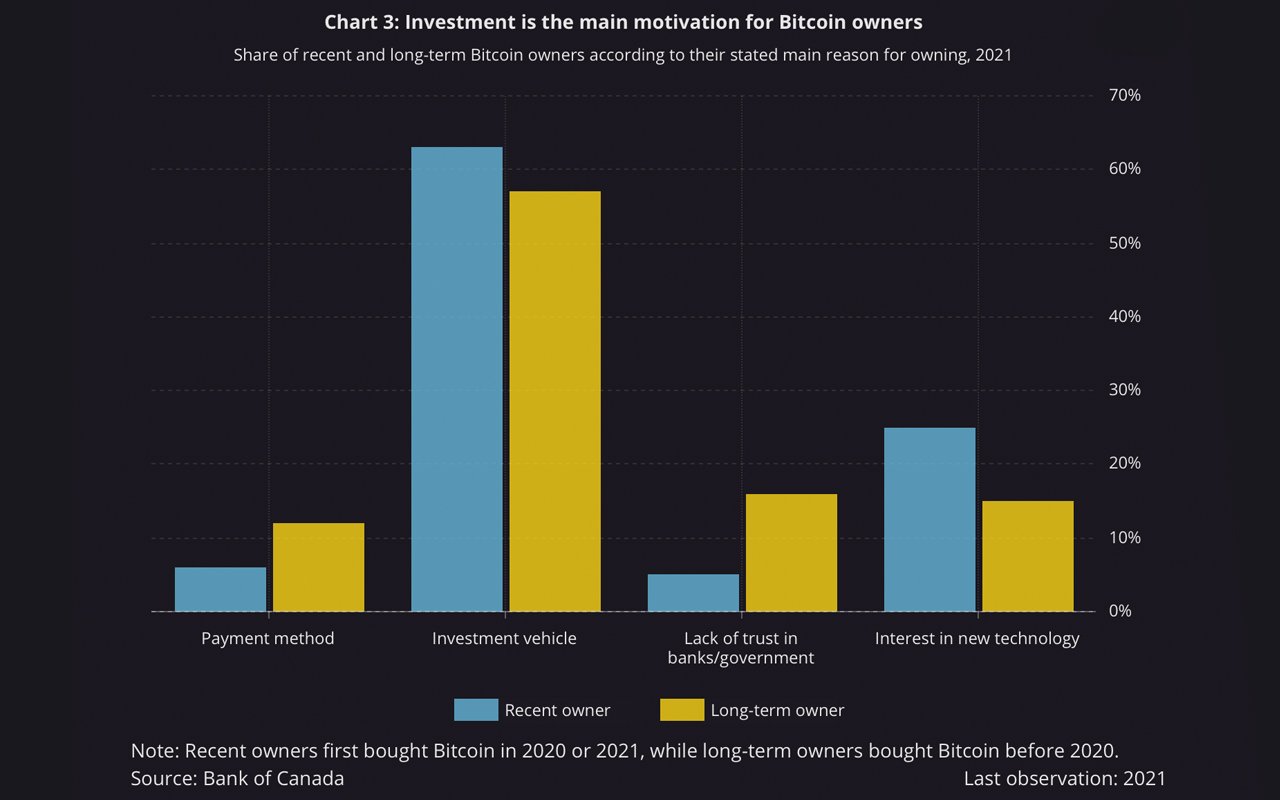

The biggest reason for owning BTC, out of four different reasons including a lack of trust in government, an investment vehicle, interest in new technology, and a payment method, was for investment vehicle purposes.

Additionally, in 2021, 25% of crypto owners reported that they lost money due to large price fluctuations, which was up 18% since 2019. 9% have had transaction issues, 11% lost complete access to their cryptocurrency wallet, and 7% reported that their crypto assets were stolen.

Another key metric the Bank of Canada discovered was the fact that most Canadian bitcoin owners hold small fractions. The median amount was less than CAD$500 worth of crypto and 70% of Canadian bitcoin owners held less than CAD$5K worth.

What do you think about the Bank of Canada’s findings concerning Canadian bitcoin owners in 2021? Let us know what you think about this subject in the comments section below.