The release of the latest data regarding US inflation has shaken both traditional and crypto markets, with Solana (SOL) giving up $30 support.

The performance of major stock indexes and high-capitalization cryptocurrencies

Shaky week for financial markets with cryptocurrencies trying to buck the trend despite yesterday’s slide on Thursday that brought prices back to test last quarter’s supports.

It was one of the craziest days in years for mainstream financial markets yesterday.

The S&P 500’s main index sank below 3,500 points, the lowest level in two years, before triggering a full-bodied rebound of more than 100 points bringing itself back above 3,700 points before the close of the session.

A tougher octave for the Nasdaq Technology Index struggling to recover from Monday’s opening levels.

Yesterday’s plunge sent prices plummeting to July 2020 levels, reawakening the bull and setting up the best daily rise (+2.2%) since early August.

Little hope for gold, which erases all the performance of the 1st week of the month setting out to close the week in the red (-2%). Yesterday’s tensions did not spare the precious metal pushing prices to late September levels below $1,650/oz.

In the last 9 sessions only once, on Wednesday, 12 October, did daily prices manage to close in the positive.

The crypto sector is doing better, continuing to show signs of recovery, albeit with difficulty. Barring dangerous weekend shocks, for Bitcoin and Ethereum a positive close would put Bitcoin and Ethereum on track for a third consecutive week upwards, for the first time since November 2021.

But that is not the case for all the others with most blue chips losing since Monday’s open.

Prominent among the worst is the double-digit collapse of Cardano (ADA) down more than 10% on a weekly basis. Yesterday’s shakeout sent prices below US$0.500, a level abandoned in February last year.

Solana (SOL) price analysis

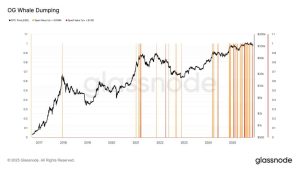

Although with half the losses, a difficult week for Solana (SOL), which is currently losing more than 5% since Monday’s opening. Yesterday’s tensions dangerously pushed SOL’s price back below US$30 for the first time since June before bouncing back above US$31 by the end of the day. A level that is easily maintained even in this early part of the day on Friday.

Since the end of August, the $30 USD threshold has been tested several times making prices bounce upward each time. A rebound that so far is showing more of a pride defense for the bulls than a real bulwark level from which to restart.

It is necessary to recover the $40 USD threshold to chase away any bearish ghost. And it is necessary to do so as soon as possible! Technically, the repeated testing of support indicates a desire to stress the level’s defense before striking the decisive blow of a breakout.

Analysis of the queen of crypto, Bitcoin (BTC)

Yesterday, having seen prices fall back close to $18,000, and by a few handfuls of dollars below the mid-September lows, raised fears of blowing up the defenses of the bullish players who fired all available ammunition to keep prices from collapsing to the year’s lows recorded in mid-June, in the $17,650 area.

Successful defense with prices returned in this early part of the day on Friday to within a step of $20,000 USD.

At the moment, the rebound is to be contextualized as a rebound or reaction move after having struck the blow against the dangerous bear paws.

In fact, if we widen the chart to recent weeks, the price of Bitcoin (BTC) continues to remain caged inside the sideways channel that has seen prices ping-pong bounce at the bottom in the $18,500-$18,000 area and at the top above $20,500 USD since early September.

With volatility seemingly beginning to awaken from a hibernation that has lasted since last June, it is good to raise our guard more.

Yesterday the bear failed in its attempt to give a jolt by breaking the lower part of the channel. I would not rule out a redemption of the bull although it will be better to reload so as not to risk the knockout blow with a return below $18,000.

The performance of Ethereum (ETH)

Despite yesterday’s shocks, Ethereum (ETH) is again on its way to closing 7 boring days this week. Setting the weekly linear chart we will have a nearly horizontal line showing that between the opening and closing weekly prices there is a difference of no more than 200 points.

This is a clear sign of the flat calm that accompanies volatility at its lowest level in 5 months.

There is also a little movement for trading volumes on a weekly basis at the lowest levels since last April.

All this should not let our guard down. The prolonged period that cages prices inside a very narrow channel usually anticipates a price explosion.

The post Trading: how are Solana, Bitcoin and Ethereum performing appeared first on The Cryptonomist.