SPONSORED POST*

More and more companies tend to become a part of decentralized finance and get some exposure to crypto. Some of them manage their crypto portfolios through a centralized exchange (CEX). Others, the front-line ventures, have turned to over-the-counter (OTC) trading. What makes them choose OTC and what are the pros and cons of such a decision? In this article we will compare some of the aspects of trading via regular exchanges vs. OTC liquidity providers, and will try to figure out why more and more companies bypass the “counter”.

- OTC crypto desks provide price stability and access to the deep aggregated liquidity

- CEXs have got momentum owing to simple and straightforward product for retail clients and convenient crypto custody for businesses

- DEXs are not suitable for institutional investors due to fact that they are not compliant with regulatory requirements

- FinchTrade offers hybrid liquidity sourcing model, providing all-in-one solution tailored to the needs of institutional clients

Many of the front line crypto-related players have opted for OTC trading desks. Others are still struggling to switch from exchanges due to manual trading processes of many OTC desks, limited number of available tokens or mistrust. Let’s have a look at the benefits and drawbacks if a company chooses trading with an OTC desk instead of a centralized crypto exchange.

OTC crypto desk

An OTC desk in the crypto world can be compared to an OTC broker in traditional finance, except they are rarely custodial. OTC liquidity providers function as financial intermediaries that facilitate customers to trade large trade sizes. OTCs also offer a more private and personalized service to institutions and high net-worth individuals who usually need significant liquidity and privacy.

The primary advantage of using an OTC desk is its ability to handle large trading volumes without price slippage – the difference between the expected price of a trade and the price executed. To have the ability to replicate similar to OTC provider’s aggregated liquidity, you will need to open accounts, develop and maintain connections to several exchanges, which requires substantial resources and, presumably, is not your core business. Moreover, OTC desks provide quotes for the entire order amount with immediate execution. In comparison, performing a large trade on a traditional cryptocurrency exchange will likely cause the asset price to change due to fragmented liquidity.

An OTC trading desk can perform large trades in this way due to the desk’s high liquidity and network of counterparties. The OTC liquidity provider can locate and negotiate the price for a certain size directly with prospective buyers and sellers. As a result, trades are not publicly listed so that the parties can maintain their privacy, and the asset’s price won’t be affected.

Another great advantage of an OTC crypto desk for crypto-related companies is convenient treasury management. For CEXs’ clients It is hard to get comparable prices and tight spreads: they see the price discovery for one particular venue only. To have more sources, it needs to become a client of more exchanges, thus, to go through a verification process with each of them. This problem usually comes second, as a company realizes it needs to pre-fund all of the positions on each exchange and in each asset. As many sources of prices you want, as many times more collateral you have to “freeze”. OTC desks provide clients, onboarded and pre-funded only once, with the ability to have aggregated prices from the whole market. This helps the capital efficiency a lot, which is crucial for all financial institutions and especially for start-ups.

Recent survey performed by PWC partnered with Finery Markets for the Crypto Trading Report 2022 showed that over 65% of participants are not satisfied with their current crypto trading setup

Swiss-based OTC crypto liquidity provider FinchTrade – is an example of how market infrastructure keeps evolving, offering solutions that work best for businesses in each and every case. FinchTrade provides institutional clients with aggregated liquidity, acting as a single-dealer gateway to the crypto market. Exchanges, wallets, VC and hedge funds, asset managers and many other types of crypto-related companies trade their favorable cryptocurrencies with FinchTrade, staying confident of the rates, volumes, execution and settlement.

OTC vs Exchanges

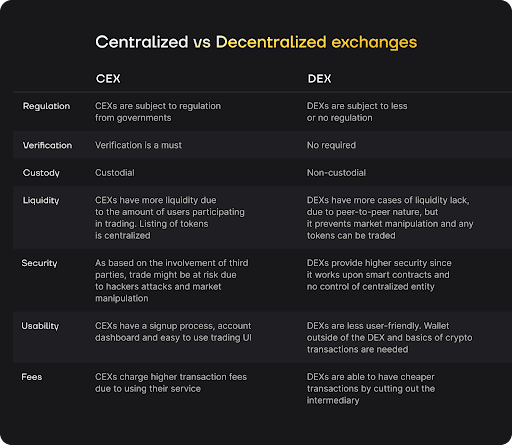

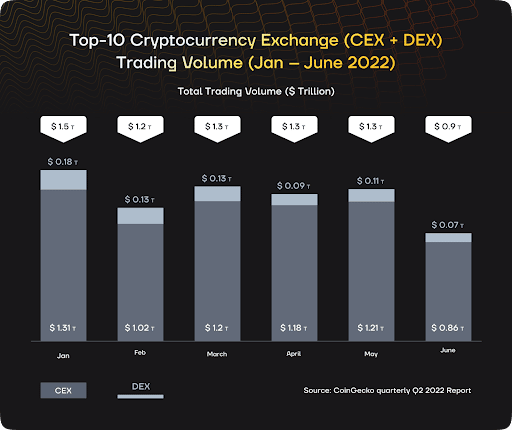

According to Forbes Advisor there are around 600 crypto exchanges now. Most of these exchanges are centralized. They are managed by one organization and provide clients from individuals to institutions with the ability to convert their fiat directly to crypto. All of the trades are performed in an open-order book manner, and the vast majority of cryptocurrency trades take place on CEXs. Another fundamentally different type of exchange is decentralized exchange (DEX). Instead of physical companies or individuals, self-executing smart contracts serve all processes. In a decentralized exchange each transaction happens directly on the blockchain (on-chain) without a third-party. Of course, these are not all of differences between CEXs and DEXs, so let’s refer to the table:

One of the concerns with CEXs is hacking. CEXs usually require to place clients’ assets to their custody before trading. As exchanges hold user funds, they are prime targets for cybercriminals. There are DEXs on the other side, where trading occurs directly between counterparties. DEXs are preferred by technologically experienced clients as they are non-custodial, so the funds are held under trading parties’ wallets without transferring them to 3rd parties as for centralized exchanges. This provides more security and trustworthiness. DEXs could be the option for businesses managing their crypto balances, but most of the DEXs avoid acting as a financial intermediary or counterparty and does not have to meet know-your-customer (KYC) or anti-money laundering (AML) standards because they operate autonomously. This is the reason why they are not suitable for institutional investors. On the other hand, the OTC crypto trading provides direct (on-chain) transactions between the wallets of trading parties and complying with regulatory requirements, enhancing security.

OTC vs CEXs

CEXs are the easiest way to buy or sell crypto and get crypto-fiat gateway when we talk about private investors and retail clients with their relatively small amounts. But if a trader wants to do some bigger sizes, there is no chance to determine the price on such a trade prior the execution, as liquidity on CEXs is fragmented and final price will differ not in favor of the trader. Slippage is not the point for OTC liquidity providers with the steady liquidity and predetermined prices for the entire trade block. The same time most OTC LPs have quite high transaction minimum thresholds, refusing to deal with small amounts due to costly transactions.

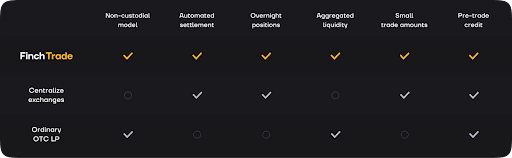

The difference between CEXs and OTC liquidity providers is significant. There are some pros and cons in both, mostly according to the type of the customers and their needs. Some bigger players aim for deep liquidity and instant execution, when smaller dealers choose simplicity and the ability to carry trades overnight. Fortunately, there is an OTC liquidity provider FinchTrade, that combines advantages of centralized and over-the-counter markets.

Let’s have a closer look at specifics, that make FinchTrade an attractive solution and allow to adjust the product to match perfectly to each unique case:

- Price stability – no slippage even for large volumes. Clients are able to see the final price for the entire trade block.

- Competitive rates – sourcing pricing from different providers – access to aggregated liquidity from the top-tier market makers and exchanges.

- High-velocity executions – all of the trades performed instantly, and making use of GUI or API integration is helping to keep it clear and simple.

- Settlement options – various settlement options in accordance with client’s needs, easy to manage through the users’ Web Cabinet. It also enables full control of your trading, assets and balances as well as margin requirements.

- No pre-funding within the credit line. FinchTrade offers 100 k no pre-funding limit. Clients can open long or short positions within this limit, and settle them after. Of course the limit can be extended with only up to 30% of margin.

- Streamlined automated onboarding process: KYC and AML/CFT checks and other paperwork need to be performed only once with your provider.

- Security and privacy. FinchTrade is your counterparty in every trade. Seamless KYT procedures ensure customers in every transaction. No public order-books, thus no market impact.

FinchTrade offers all-in-one individual solutions to all types of crypto-related companies, precisely created in line with their unique needs

Asset managers and investment funds can benefit from bespoke execution of large trades;

Neobanks and crypto-friendly payment processors make use of hedging solutions, providing convenient treasury management and capital efficiency;

Exchanges, serving retail clients and other actively trading crypto firms can easily fix the rate now and settle later, managing their exposures and staying on top of volatile crypto currencies.

FinchTrade’s product offering reflects the fast-paced market in every aspect, making OTC crypto trading friendly, secure and useful.

FinchTrade offers hybrid liquidity provision models designed to your specific needs

FinchTrade is Swiss-based institutional-grade cryptocurrency liquidity provider. It offers more than 30 major crypto-fiat pairs enabling it to add more of the clients’ interests. FinchTrade places technology at the center of its service, providing clients with bespoke automated experience of onboarding, trading and managing their flow. FinchTrade operates as a single-dealer platform for businesses, giving them access to the whole market of digital assets with steady aggregated liquidity, thus better rates, and various settlement options. FinchTrade is regulated by VQF and has all protective layers of security in place to keep clients fully compliant with regulations.

FinchTrade always uses an individual approach to each of the customers’ cases with assets, settlements, non-prefunding modeling, integrations and usability.

About the authors:

Ilia Drozdov, CFA, has a master degree in financial economics and is a co-founder of a fintech startup FinchTrade.

Gennady Pleshakov, B.S. in economics, International investments and capital markets specialist.

*This article has been paid. The Cryptonomist didn’t write the article nor has tested the platform.

The post Why FinchTrade is much more than an OTC trading desk appeared first on The Cryptonomist.