The biggest news in the cryptoverse for Oct. 20 includes the British Pound’s increasing volatility that is nearing Bitcoin’s, the unprofitable Q3 for Bitcoin miners, and FTX CEO Sam Bankman-Fried’s thoughts on crypto regulations and Hodlonaut’s victory against Craig Wright.

Bitcoin volatility stabilizes as the Pound’s soars higher

After the recent market movements of the British Pound, it becomes almost as volatile as Bitcoin (BTC).

In recent weeks, the Pound recorded an increase in volatility against the U.S. dollar, while Bitcoin has been moving in a narrow band between $18,100 and $20,500 since mid-September.

Bitcoin mining remained unprofitable throughout Q3

In the third quarter of 2022, Bitcoin prices kept falling while the cost of mining increased, which gave miners a hard time.

The hash price decreased by 5% from $83.30/PH/day to $79.60/PH/day, the average industrial electricity cost increased by 25% from July 2021 to July 2022, and the price of hosting contracts increased.

Sam Bankman-Fried proposes standards for sanctions, licensing for DeFi protocols

FTX’s CEO Sam Bankman-Fried shared his opinions on crypto regulation via his Twitter account.

1) As promised:

My current thoughts on crypto regulation.https://t.co/O2nG1VrW1l

— SBF (@SBF_FTX) October 19, 2022

SBF said that the crypto industry should continue as an open economy that continues to offer P2P transfers and codes for free. However, he also argued that regulatory oversight is crucial for sustainable innovation.

He added that DeFi protocols hosting websites and marketing products targeting U.S. retail investors may need some KYC obligations and licensing.

Binance refutes claims it uses users’ tokens to vote

Uniswap’s founder Haydenz Adams said on Oct. 19 that Binance delegated 13 million UNI tokens that belonged to its users.

On Oct.20, Binance’s CEO Changpeng Zhao tweeted to say that Binance doesn’t vote with users’ tokens, while a spokesperson from Binance told CryptoSlate:

“Binance doesn’t vote with user’s tokens. In this case, there has been a misunderstanding of what has happened during the transfer of a large balance of UNI (around 4.6M) between wallets. We’re currently in discussions to improve the process to prevent further misunderstandings from happening again.”

‘Hodlonaut’ declares victory against Craig Wright in Norwegian defamation case

The lawsuit between Craig Wright, who claimed to be Bitcoin’s creator Satoshi Nakamoto, and Magnus Granath, also known as “Hodlonaut,” started on Sept. 12 and was finalized on Sept. 20 with Hodlonaut’s victory.

The embargo that prevented the result from being disclosed ended on Oct. 20, and Hodlonaut celebrated his triumph by sharing the news with his Twitter followers.

I won. Welcome to law.

— hodlonaut

(@hodlonaut) October 20, 2022

FatMan sounds the alarm on Ronaldinho-backed’ World Cup Inu’ crypto token

FatManTerra revealed suspicious tokenomics of the World Cup Inu token. Famous football player Ronaldinho tweeted on Oct. 19 to express that he was “delighted to be part of the World Cup Inu family.”

After examining the newly popular World Cup Inu token, FatManTerra shared his concerns about the 4% tax rate, saying that developers have already removed a significant sum from the tax pool. He finished his words by saying, “Please be careful; best to stay away.”

FDIC acting chairman wants stablecoins to be safer before integration into financial system

The Federal Deposit and Insurance Commission’s (FDIC) acting chairman Martin Gruenberg acknowledged the role of stablecoins for the economy by saying that if regulated, stablecoins would have the power to disrupt the existing banking system.

However, he also said that their current volatility prevents stablecoins from integrating with the current financial system.

South Africa deems cryptocurrency a ‘financial product’

South African financial regulator, The Financial Sector Conduct Authority (FSCA), classified all crypto assets as a financial product on Oct. 20. This recognition also subjected crypto assets to the same regulatory oversights as company shares, debt, and money-making instruments.

Research Highlight

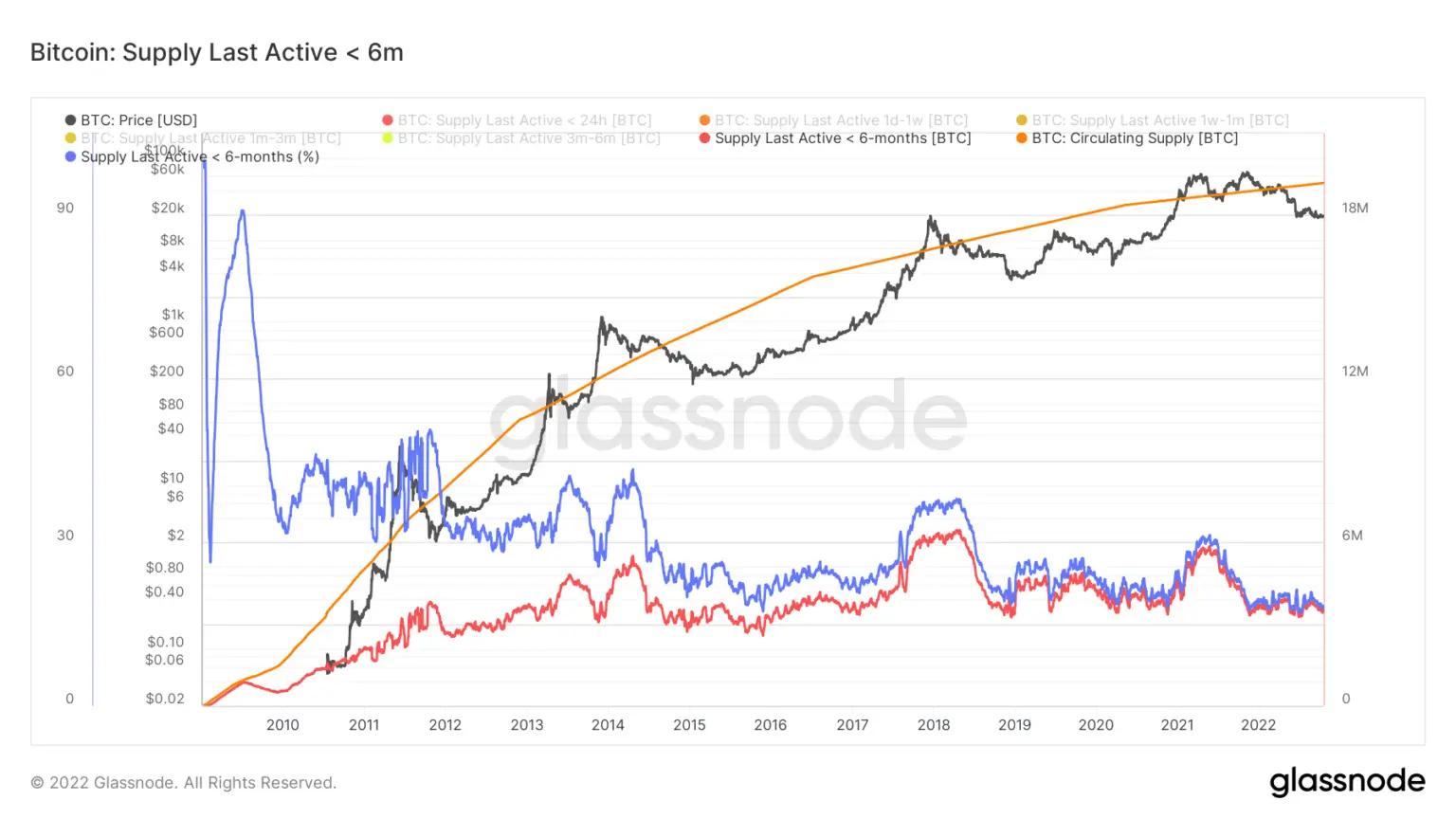

Research: Bitcoin’s on-chain data suggests market has hit the bottom

Investors holding Bitcoin for less than six months are referred to as “short-term holders.”

In previous bear markets, short-term holders were usually speculators who invested to profit from the expected price gains. However, current on-chain data shows that short-term holders are at the same point as in the previous bear market, which suggests that they lost faith in the ecosystem.

Judging by previous cycles, short-term holders’ behaviors indicate that the market is already near the bottom of this bear cycle,

News from around the Cryptoverse

Tether will be available in over 24,000 ATMs in Brazil

According to an announcement post by Tether, USDT will be available in over 24,000 crypto ATMs in Brazil on Nov.3. This expansion aims at including 34 million unbanked adults in Brazil into the financial system.

Binance acquires regulatory approval from Cyprus

On Oct.20, Binance announced that it received regulatory approval from Cyprus’ financial watchdog, Cyprus Securities and Exchange Commission (CySEC). The license is the fourth one Binance got from the European region.

Coinbase brings commission-free trading via non-USD currencies

Coinbase posted an article on its blog to announce that it will waive commission fees when buying or selling USDC via any fiat currencies to support the international adoption of USDC.

Japan eases rules for token vetting processes

Bloomberg reported today that Japan’s self-regulatory crypto body plans to make it easier to list virtual coins in December. The relaxation of the rules indicates that Japan is seeking to revitalize the crypto sector.

Lens integrates music NFTs

Lens Protocol’s founder Stani Kulechov announced via his Twitter account that Lens started to support music NFTs as content on Lenster, the company’s decentralized social media app.

Indian cricket legend steps into NFTs

India’s cricket legend Sachin Tendulkar dipped his toe into the NFT market by investing in Rario. The news was shared by the cricket team Rario’s Twitter account.

Crypto Market

Bitcoin (BTC) decreased by -0.74% to trade at $19,052 in the last 24 hours, while Ethereum (ETH) also fell by -0.78% to trade at $1,283.

Biggest Gainers (24h)

- Toncoin (TON): +13.35%

- Chain (XCN): +7.99%

- Aptos (APT): + 6.96%

Biggest Losers (24h)

- Quant (QNT): -9.79%

- Uniswap (UNI): -8.71%

- Axie Infinity (AXS): -8.52%

The post CryptoSlate Wrapped Daily: GBP volatility reaches Bitcoin’s, Hodlonaut wins against Craig Wright in defamation case appeared first on CryptoSlate.