Key Insights

- The migration of over 30,000 subgraphs from the hosted service to The Graph’s decentralized network (mainnet) is ongoing.

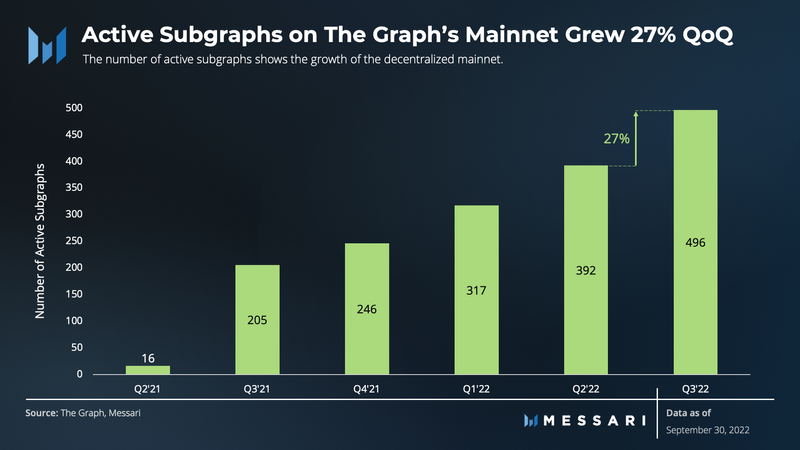

- As of Q3’22, 496 mainnet subgraphs were migrated, up 27% QoQ.

- The Graph’s ecosystem of active Indexers (+32%), Delegators (+10%), and Curators (+2%) continued to grow QoQ.

- In Q3’22, The Graph saw a 42% QoQ increase in GRT revenue from query fees; however, revenue from indexing rewards decreased 3% QoQ in GRT terms.

Primer on The Graph

The Graph is an indexing protocol that provides on-chain data from a wide spectrum of sources. It removes the need for application developers to build out complicated infrastructure to get on-chain data. Instead, using The Graph, data consumers (e.g., app developers) pay to query APIs of on-chain data — called “subgraphs” — via the GraphQL API.

To ensure the protocol runs correctly and efficiently, The Graph network incentivizes several key roles within its ecosystem of both technical and non-technical participants:

- Indexers process and store on-chain data from subgraphs. They usually have advanced technical know-how to operate nodes. In return, Indexers receive query fees and indexing rewards.

- Curators are economically incentivized to analyze and signal which subgraphs are valuable to index. Curators earn a portion of the query fees generated by a particular subgraph.

- Delegators may lack technical know-how or resources to index on-chain data; instead, they may delegate The Graph’s native token GRT to Indexers. In return, Delegators earn a portion of query fees and indexing rewards without running nodes themselves.

As of October 2022, only Ethereum is supported by The Graph’s decentralized protocol; over 30 networks are currently supported by The Graph’s hosted service on Ethereum, NEAR, Cosmos, and Arweave.

Performance Analysis

The Graph ecosystem revolves around the relationship between subgraph developers and data consumers (e.g., app developers) that pay to query subgraph data. The performance of The Graph network can be measured by the growth of active subgraphs, the network’s revenue in query fees, and the activity of Indexers, Delegators, and Curators.

Network Usage (Subgraphs)

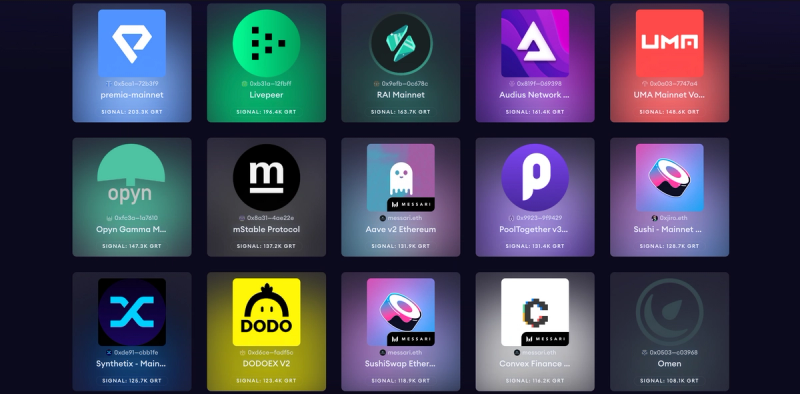

To bootstrap The Graph, a hosted service was initially created. The goal of this service is to host subgraphs as the protocol gradually transitions into its decentralized network (mainnet). The hosted service is free and consists of a large Indexer run by Edge & Node, the initial team behind The Graph. As of Q3’22, the hosted service supports over 30,000 subgraphs.

As of Q3’22, The Graph protocol is a hybrid of its hosted service and mainnet. The first subgraph launched on the mainnet in Q1’21. Since then, the number of subgraphs launched on the mainnet has grown steadily QoQ. Unlike the hosted service, the mainnet requires users to pay a fee per query. As of Sept. 30, 2022, there are 496 active subgraphs on the mainnet, which is a 27% increase QoQ; in addition, 100 subgraphs are in deployment as of end of Q3’22.

Source: The Graph Explorer

Over the next several quarters, the number of deployed subgraphs on The Graph network (mainnet) is expected to continue growing. The Graph community aims to migrate all subgraphs from the hosted service to its mainnet over time, as more chains are integrated with the decentralized network. This increase in mainnet subgraphs should facilitate growth among other key metrics of The Graph, ranging from ecosystem participation to the revenue generated from query fees.

Ecosystem Participation

Subgraphs provide an arena for both technical and non-technical ecosystem participants to interact symbiotically. Indexers operate Graph Nodes to process and store on-chain data. Data consumers can then query this data via GraphQL, an open-source language for The Graph’s APIs. Curators signal to Indexers which subgraphs are valuable to index. Curators may also often act as subgraph developers. Those ecosystem participants who lack the technical know-how or resources to index may choose to delegate GRT to Indexers. Staked GRT is required for indexing subgraphs. As Indexers receive more GRT via delegation, they increase their capacity to collect a larger portion of the indexing rewards.

The number of Indexers (+32%), Delegators (+10%), and Curators (+2%) continues to increase QoQ as more mainnet subgraphs are deployed. In particular, the growth of Indexers is critical to scaling The Graph’s network and reached an all-time high in Q3’22.

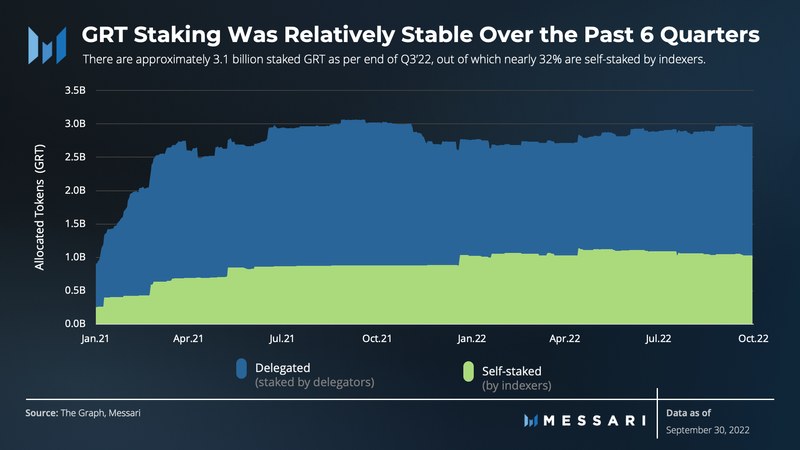

Indexers monetize their indexing and query processing services on The Graph’s query market by staking GRT. The minimum stake for an Indexer is currently set to 100,000 GRT (roughly $9,900 as of Sep. 30, 2022). On top of this minimum Indexers can also receive delegated stake from other users. Delegators can increase their total stake above an Indexer’s personal stake, up to a 16x multiplier of an Indexer’s stake.

While all 340 Indexers allocate or have allocated their own stake towards their subgraphs to earn staking rewards, 219 are actively staking GRT (i.e., are active) as of the end of Q3’22, up 32% QoQ. This growth in active indexers could be explained by Indexers anticipating the migration of more subgraphs to the mainnet, which would lead to more indexing opportunities.

Network Revenue

The GRT token follows theStake-for-Access model, also known as a work token model. Participants in The Graph’s ecosystem earn revenue in GRT by performing work in the form of indexing and querying services on the mainnet. Both services require GRT to be staked. Indexers’ stake comprises their own GRT tokens (i.e., self-stake) and GRT delegated towards them (i.e., delegated stake).

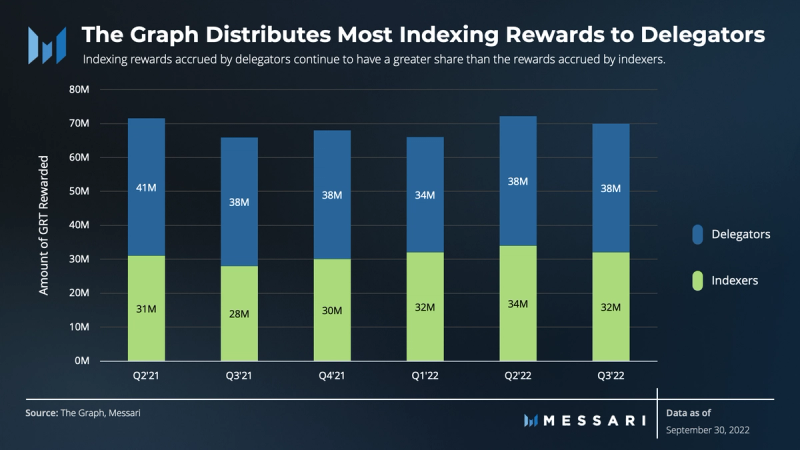

The two main sources of revenue on The Graph are inflationary indexing rewards and query fees paid by end users. Revenue from both indexing rewards and query fees is funneled through Indexers who then distribute it to Delegators and Curators.

Every Indexer is free to define their own individual cut of query fees and indexing rewards, based on the supply-and-demand dynamics of the open marketplace. According to this individual cut, each Indexer then distributes the revenue as follows: query fees are shared with Curators, whereas both indexing rewards and query fees are shared with Delegators.

Source: The Graph: Choosing Indexers

As per the above example, if an Indexer set the query fee cut to 15.2%, their Delegators would receive the remaining 84.8% of the fee revenue. While Delegators’ stake cannot be slashed, there are several aspects that need to be taken into account by Delegators when staking their GRT with Indexers. These aspects relate to:

- Indexer choice, i.e., choosing effective Indexers with the most optimal reward payouts

- Unbonding period, i.e., no GRT transfers or rewards are possible within a 28-day window after undelegation

- Delegation tax of 0.5%, i.e., calculating how long it takes to earn back the 0.5% tax on delegation.

Indexing Rewards

Indexing rewards come from a 3% annual inflation in the GRT supply. They are distributed to staked Indexers in return for providing indexing and querying services on the open marketplace.

While the GRT distributed as indexing rewards in Q3’22 decreased 6%, it remained flat for Delegators on a QoQ basis. Notably, over the past six quarters, Delegators received more indexing rewards than Indexers themselves. In Q3’22 alone, Delegators were rewarded over 38 million GRT, which is approximately 54% of the total indexing rewards distributed.

Delegators have staked 2 billion GRT as per end of Q3’22, i.e. 63% of the total of 3.2 billion GRT staked on The Graph. Since July 2021, the total GRT staked was relatively constant between 2.7 and 3.2 billion GRT. Relative to the circulating supply, the percentage of GRT staked decreased from 64% in July 2021 to nearly 41% in September 2022. Simultaneously, the number of active Indexers continuously increased over the past four quarters. As more subgraphs are deployed to The Graph mainnet, smaller Indexers can provide indexing and querying services on the open marketplace.

Because the growth of Indexers is so critical to scaling the network, The Graph incentivizes more Indexers to participate in the network by making node operations economically sustainable.

Query Fees (Network Usage Fees)

While the bulk of Indexer earnings come from rewards, the second source of network revenue comes from query fees. Data consumers (e.g., app developers) pay query fees for Indexers to fetch and organize data for them. Query fees are determined by market demand and distributed to Curators, Indexers, and Delegators. That is, not only do Indexers and Delegators benefit from query fees, but so do Curators.

While query fee cuts generally stayed flat for individual Indexers, total revenue from query fees increased 42% in GRT terms QoQ (up 3% in USD terms). With more subgraphs migrating to the mainnet, query fee activity should continue to increase.

Qualitative Analysis

Amid the overall market downturn and the troubling global macroeconomic environment in Q3’22, The Graph community continued to steadily develop its ecosystem through five working groups: data & APIs, SNARK Force, The Graph protocol economics, network operations, and Indexer experience. Q3’22 Core Devs Calls (August 2022 and September 2022) maintained discussions about rolling updates from the five working groups. Q3’22 had several noteworthy events.

Wave 6 Grants: On Jul. 28, 2022, The Graph Foundation announced Wave 6 grants, which allocated $849,000 for protocol improvements. The grants were awarded to the following categories:

- Protocol R&D: $400,000

- Tooling: $52,000

- Dapps & Subgraphs: $77,000

- Community Building: $320,000.

Migration Infrastructure Providers (MIPs): On Aug. 25, 2022, The Graph Foundation announced the latest incentivization program for Indexers. The MIPs program has allocated 0.75% of the GRT supply (75 million GRT), with 0.5% going to Indexers who contribute to bootstrapping the network and 0.25% allocated to migration grants for subgraph developers using multichain subgraphs. The MIPs program formally begins on Sept. 20, 2022, and will conclude at the end of Q1’23. Gnosis Chain will be the first chain after Ethereum supported on the decentralized network. New chains to be supported on the testnet will be announced throughout the MIPs program. The journey to becoming an Indexer on the mainnet is summarized below.

Source: The Graph Core Devs Call #15

Substreams Integration into Subgraphs: On Aug. 31, 2022, adding Substream support to Graph Node was discussed. The goal was to improve indexing and syncing speeds for subgraphs by up to 100x.Substreams add composable, high-throughput, parallelized pathways that feed data to subgraphs and end-user applications.

The Graph Arbitrum Deployment: Deployment of The Graph’s smart contracts to the Arbitrum One Layer 2 blockchain are presented in GIP-0037 and GIP-0034. The reasoning behind these proposals is that gradually moving to an L2 would benefit from gas savings, and Arbitrum represents the best candidate.

Graph Node: V0.28.0 was released on Sept. 27, 2022. This release introduces a new DB table for dynamic data sources. It includes experimental support for GraphQL API versioning. Changes in this release include various minor bug fixes and performance improvements.

A full list of The Graph events can be accessed via Messari Intel.

Closing Summary

The Graph is primarily focused on migrating from a hosted service to a decentralized network (mainnet). As of Q3’22, 496 mainnet subgraphs were successfully migrated. Notably, The Graph’s ecosystem of staked Indexers (+32%), Delegators (+10%), and Curators (+2%) continued to grow QoQ.

Simultaneously, The Graph saw a 42% increase in GRT revenue from query fees in Q3’22. Query fees should continue to increase, as over 30,000 hosted service subgraphs are migrated to The Graph Network’s mainnet in the coming quarters. This increase in volume may attract more key participants to the protocol as it drives profitability for existing ones. By adding more subgraphs, The Graph will continue to remove technical barriers for developers, ultimately leading to faster innovation across Web3.

Messari is a Core Subgraph Developer for The Graph and the recipient of a grant from The Graph Foundation. Author(s) may hold cryptocurrencies named in this report and each author is subject to Messari’s Code of Conduct and Insider Trading Policy. Additionally, employees are required to disclose their holdings, which is updated monthly and published here. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Messari does not guarantee the sequence, accuracy, completeness, or timeliness of any information provided in this report. Please see our Terms of Use for more information.

Let us know what you loved about the report, and what may be missing, or share any other feedback by filling out this short form.

Looking to dive deeper? Subscribe to Messari Pro. Messari Pro memberships provide access to daily crypto news and insights, exclusive long-form daily research, advanced screener, charting & watchlist features, and access to curated sets of charts and metrics. Learn more at messari.io/pro