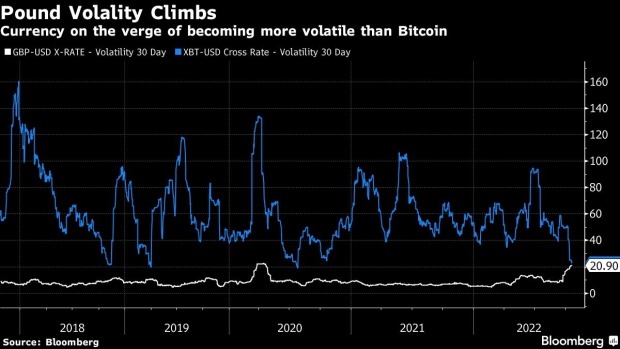

In what appears to be a stark role reversal, Bitcoin is now becoming less volatile money than Britain’s national currency.

- According to data provided by Bloomberg, the 30-day volatility of the British pound against the U.S. dollar has soared over the past month.

- Meanwhile, Bitcoin’s volatility has declined substantially since June, and again since the start of October. This has brought each currency’s volatility to a roughly equal point.

- Bitcoin went down as one of the best-performing assets in the previous quarter – simply by staying relatively flat while stocks and commodities continued to fall.

- The pound experienced turbulent volatility at the end of September, almost declining to parity with the U.S. dollar. At the same time, trading volume for the BTC / GBP trading pair soared – an emerging trend among collapsing currencies.

- Global bond markets are also showing heightened volatility against Bitcoin, despite the former’s reputation for safety and dependability, and the latter’s reputation as a risk asset.

- In Britain’s case, the Bank of England has now returned to temporary quantitative easing to curb instability in its bond market, which nearly caused a “Lehman moment” in September.

- Many central banks – including former Fed chair Ben Bernanke – have previously denied that Bitcoin could constitute a form of money, largely due to being too volatile.

- Sweden’s central bank presented a similar argument in May: “The price of Bitcoin has had a high degree of volatility and is thus a relatively poor preserver,” it explained over Twitter.

The post Bitcoin Unstable? Check Out the British Pound appeared first on CryptoPotato.