Key Insights

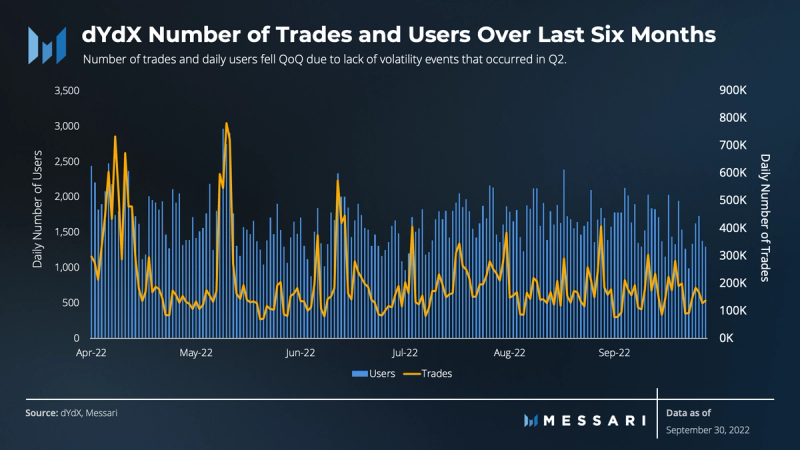

- Median usage on dYdX improved from Q2, while aggregate numbers fell largely due to fewer volatile events in Q3.

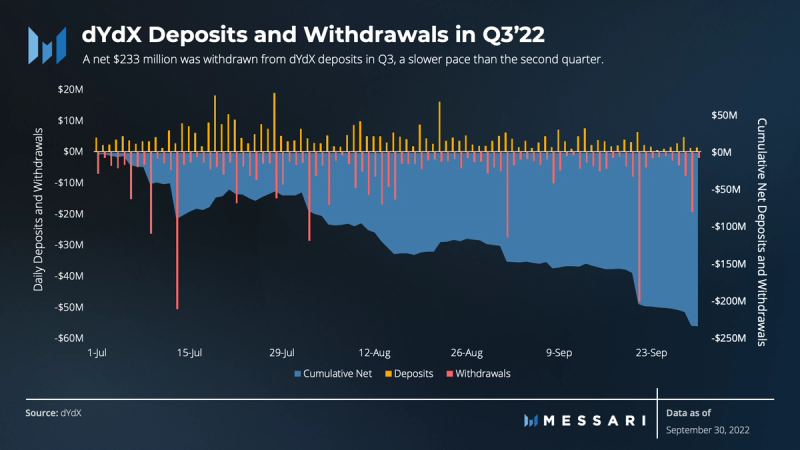

- Despite healthy user and volume activity, depositors continue to withdraw funds from dYdX. So far, this does not appear to be impacting liquidity and trading.

- Governance in the third quarter was focused on optimizing reward spend. Votes passed to wind down the liquidity staking module, increase the weight of volume in the LP rewards formula, reduce LP rewards to BTC and ETH markets from 40-20%, and reduce trading rewards.

- dYdX Chain Mainnet launch is expected for Q2 2023. As the protocol completes at least its fourth consecutive quarter of net expenses when comparing revenues to rewards, a new model using the token as an L1 token brings an opportunity to reset the protocol tokenomics, value accrual, and decentralization.

Primer on dYdX

dYdX protocol operates a derivatives exchange on the Layer-2 (L2) StarkEx network. The hybrid-decentralized exchange offers perpetual futures contracts similar to the ones found on Binance, FTX, and other centralized exchanges. The protocol’s ultimate goal is to build a fully decentralized derivatives exchange where no single party, including the team itself, can claim authority over the protocol’s fundamental operations.

In the summer of 2017, Antonio Juliano, an ex-Coinbase engineer, founded dYdX. The protocol’s first two products, Expo and Solo, were built for margin trading on Ethereum. After seeing the explosion of perp trading on Bitmex in 2019, dYdX decided to become the first DeFi protocol to provide perp trading. The launch of perps for major tokens like BTC and ETH quickly grew in popularity among traders seeking to use margin. Ease of use was further improved with the addition of StarkEx L2 rollups in 2021.

In Q2 2022, dYdX announced a transition from StarkEx to its own native blockchain, called dYdX Chain, as part of its effort to fully decentralize.

Introduction

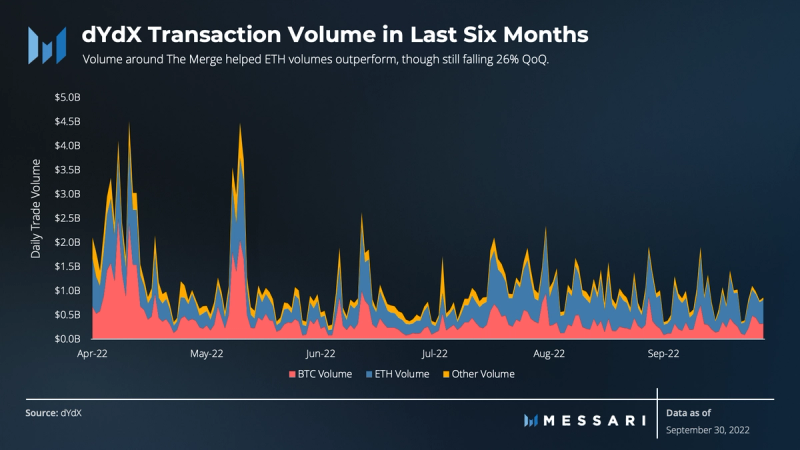

The third quarter lacked the fireworks of Q2, but The Merge was a significant event and certainly had an impact on quarterly numbers. Daily volumes and users on dYdX were as active in the third quarter as they were in the second, when measured on a median basis. Trading in ETH was a higher percentage than in previous quarters, as traders prepared for and in some cases tried to game the Ethereum hard fork. Despite healthy trader activity, dYdX continued to see large withdrawals from the network.

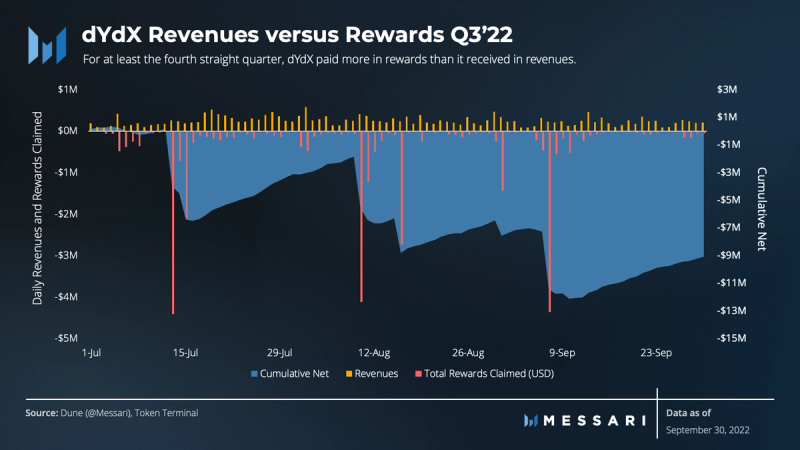

Governance efforts in the quarter focused on optimizing DYDX (the protocol’s native token) inflationary rewards. For another quarter, revenues produced by the protocol were outpaced by the USD value of tokens paid as incentives. Revenues currently accrue to dYdX Trading, not the community treasury, leaving the treasury with only DYDX tokens to fund initiatives.

The move to V4, announced in June, reached a milestone with the launch of the developer testnet. The launch of dYdX Chain is now expected in Q2 2023, creating a decentralized order book and improving alignment between tokenholders and the protocol.

Performance Analysis

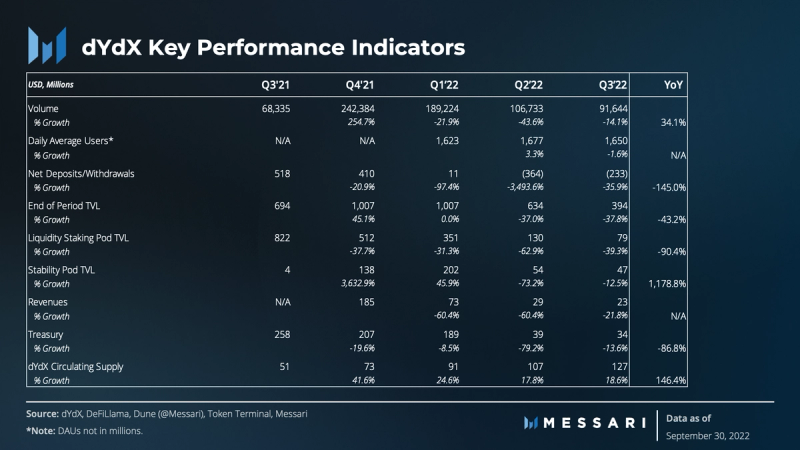

Revenues to dYdX trading fell 22%, from $29 million in Q2 to $22.6 million in Q3. Despite falling token prices, rewards paid (measured in USD after claiming) still surpassed revenues earned. The $9 million net cost was the smallest in the last four quarters. Spikes in rewards claimed are due to the epoch schedule that allows reward collection approximately every 28 days.

In Q3, volumes fell 14% to $91.6 billion. Q2 volumes were elevated by three large volume events in April, May, and June. Q3 had The Merge in September, which drove ETH volume share higher. Despite less total volume, the median daily volume on dYdX in Q3 was actually higher than Q2 by $115 million.

Similar to volumes, daily active users (DAUs) and the total number of trades were down in Q3. This likely is the result of fewer events. Network activity remained healthy with the median of both DAUs and the daily number of trades rising from Q2. dYdX had a median of 167,000 trades in Q3 and 1,667 DAUs.

Despite the healthy usage measured by trades and DAUs, dYdX continued to see withdrawals in Q3’22. After $362 million left the platform in Q2’22, $233 million was withdrawn in Q3. The timing of the larger withdrawal events doesn’t seem to align with rewards reductions but could be focused at the end of epochs.

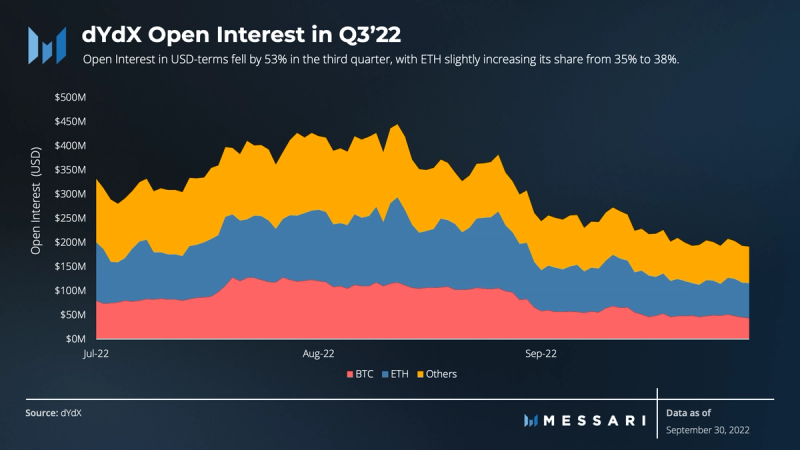

Pursuant to falling deposits, open interest (OI) on dYdX was cut in half in Q3. In contract terms, BTC OI fell 50%, while ETH fell 38%, holding up better. Other tokens fared much worse: SUSHI, SOL, LTC, EOS, and AVAX all saw OI fall 80% or more in token terms, while AAVE, DOGE, DOT, FIL, MATIC, MKR, and UNI fell by at least 70%. The only increase in OI was in ETC, up 59% in token terms in Q3.

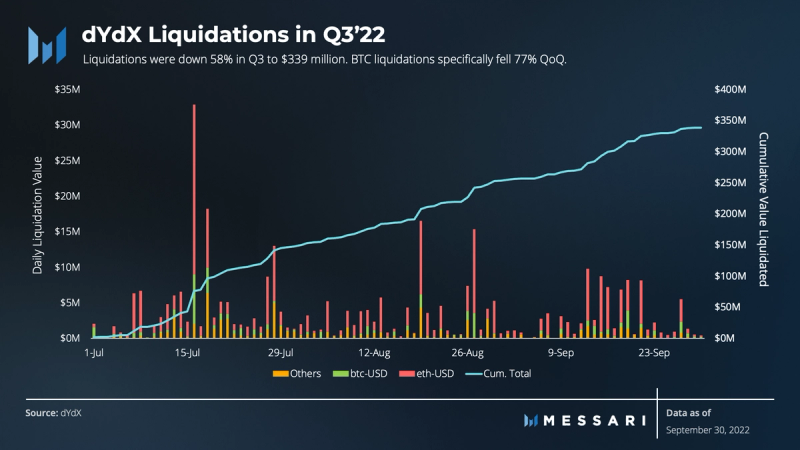

Less volatile markets meant fewer liquidations in Q3, and liquidated volume fell 58% to $340 million. Ethereum liquidations increased from 52% of liquidations in Q2 to 65% in Q3. Falling volatility in Bitcoin led to a 77% decline in liquidated volumes, BTC liquidations made up only 14% of total liquidated volumes in Q3.

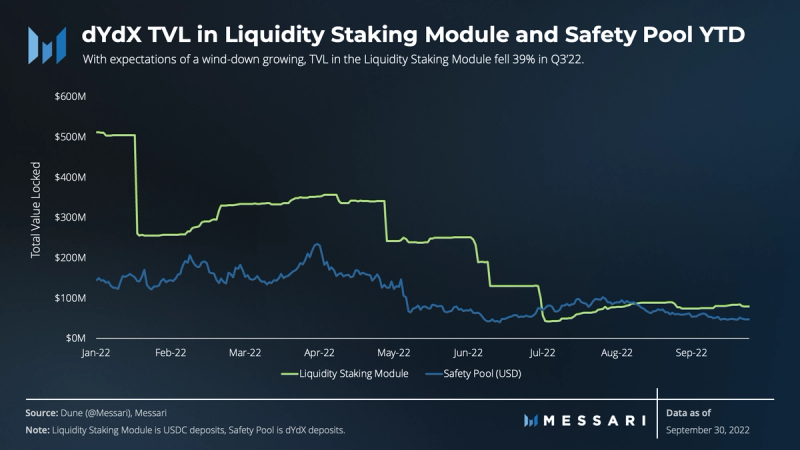

On July 2, a snapshot proposal was initiated to vote on winding down the liquidity staking module. Although forum discussions began in June, in the week following the Snapshot vote TVL in the module fell from $130 million to $42 million. This passed an on-chain vote that concluded on September 27. On October 29, a snapshot vote passed in favor of winding down the Safety Pool and sending the allocated DYDX tokens to the treasury. This still requires an on-chain vote for implementation.

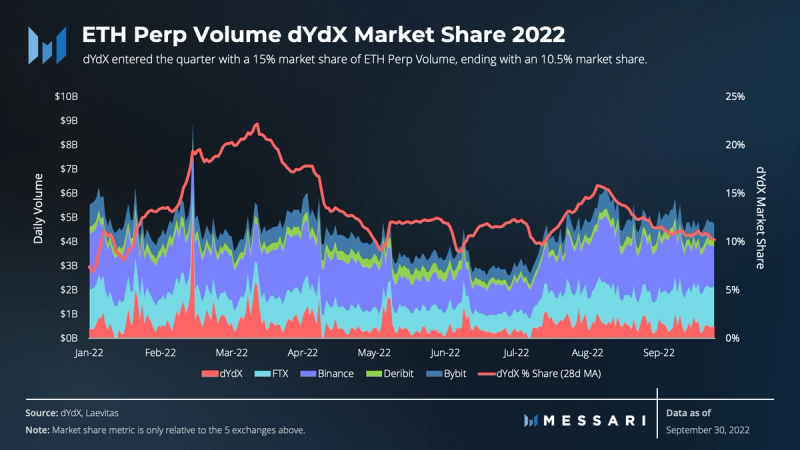

On-chain events in Q1 and Q2 led to a higher volume share for dYdX in the first half of 2022. One positive for the protocol is to see volume spikes at the end of epochs normalizing. This typically non-productive trading was incentivized via rewards. Amending the reward schedule appears to have had the desired effect.

ETH perp trading across these five exchanges increased 17% from $350 billion in Q2 to $420 billion in Q3. Heading into The Merge there was a popular trade to hedge ETH longs with a short position in perps either to hedge tech risk or to game the ETH POW fork. dYdX maintained a 10-15% share throughout the quarter, showing competitive funding rates with the largest CEXs.

Qualitative Analysis

Liquidity Staking Module

dYdX offered a Liquidity Staking Module (LSM) where anyone could deposit USDC that could be used by community-approved Market Makers as collateral to provide liquidity on dYdX. The stakers were rewarded with DYDX tokens. The Market Makers get access to cheap (zero-interest) capital that can only be used within the ecosystem. On September 27, the dYdX community voted in favor of winding down the borrowing pool by setting DYDX rewards associated with staking USDC to 0.

Though an appealing design, the Liquidity Staking Module does not appear to be an efficient allocation of resources for the protocol. Funded by dYdX Grants, Xenophon Labs released a research report on the LSM finding that “81% of the rewarded tokens have been given for USDC that was not lent to any market maker.” The issue is primarily that the amount of USDC staked is dependent on the price of dYdX, and the variability of available funding leads to very low utilization by Market Makers.

On July 6, the community voted to wind down the Borrowing Pool associated with the LSM and repurpose the remaining DYDX token rewards.

On July 31, Ryan Rodenbaugh of TrueFi posted a proposal on the forum to revamp the LSM utilizing TrueFi’s “Automated Line of Credit” (ALOC) product. Ideally, TrueFi’s floating-rate ALOC will charge variable interest depending on the utilization of the lending pools. These interest rates, largely USDC-based but also incentivized with some dYdX, should reduce the volatility of available capital and thus increase utilization. An important question, however, is at what rate will the Market Makers be willing to borrow?

Trading Rewards Equation

dYdX incentivizes usage on its exchange by rewarding trading with DYDX tokens to help compensate for fees paid. The previous version of the trading rewards formula included fees paid, open interest (OI), and stkDYDX (staked DYDX).

In March, new research demonstrated that the opportunity to gain rewards for large OI created a very large game space for farmers to earn dYdX without adding liquidity or paying fees. After an initial change to the rewards equation in April, reducing the weighting given to OI, the community voted to remove any reward attributed to larger open interest. The vote also reduced the total trading rewards per epoch by 25%.

OI has markedly fallen since these changes, but OI doesn’t necessarily impact liquidity. In fact, OI and volumes on the exchange do not appear to be highly correlated.

The reduction in overall rewards helps bolster the treasury and gives more dry powder for longer-term investments.

LP Rewards Equation

Managing token rewards was a main theme of the quarter, and rewards for Liquidity Providers were also addressed. The first change came in February, which reduced the threshold for LPs and opened up rewards to more providers. Then in May, at the behest of Wintermute (one of dYdX’s largest Market Makers), the community voted to add a volume factor to the LP rewards equation. This August, the community took that plan a step further. The August vote increased the weighting for the volume factor on all markets. Importantly, it increased the weight of BTC and ETH markets due to concerns that reducing the depth factor too much would have a negative impact on less liquid markets. To further balance that incentive, the community lowered the share of rewards that go to BTC and ETH markets from 20% each to 10% each, which now allows more rewards to go to other markets. These are the two deepest markets on the exchange and likely don’t need to spend as much to attract liquidity.

So far, the changes have reduced spending to attract depth without harming liquidity in general. As the DAO focuses on optimizing resources spent in the bear market, tweaking the rewards they offer to users is a key lever they are using.

Funding Grants V1.5

On July 15, the community voted to fund a second grants program to be enforced by Reverie. The initial proposal was for a 33% increase from $6 million to $8 million, while the token that makes up the treasury has fallen roughly 85% in value. After some discussion in the forums, the grants program was reduced to $5.5 million for the next 6 months.

The renewed grants program highlights dYdX’s process for decentralized management. The trustees of the dYdX Grants Program (DGP) make the funding decisions and execute them, while they outsource management and curation to Reverie. The community agrees to fund a central planner, Reverie, who executes on funding tools, research, and contributors. It is also an ode to the execution from the first grants program, as dYdX continues to align around their community values.

Final funding decisions are made by the trustees of the DGP. Despite receiving 65.5% of the vote, the Ambassadors program did not meet the 67% vote differential requirement for binding votes. The program offered community members the opportunity to join Burrows and work for the DAO in a part-time capacity. The Ambassador program was a decentralized alternative to applying for grant funding through Reverie, and it yielded many positive contributions.

dYdX Chain Update

On August 23, dYdX Trading published a blog updating the progress on V4. The major announcements were that Milestone 1, the launch of a developer testnet, was completed. Also, this update gave a timeline for the Mainnet launch, now expected in Q2 2023. Other plans include:

- Milestone 2: Internal Testnet – Q3 2022

- Milestone 3: Private Testnet – Q4 2022

- Milestone 4: Public Testnet – Q1 2023

The launch of the developer testnet includes completing the order book, matching-engine, and the margining system. As a first step, the team achieved 50 trades per second. There are many optimizations and improvements still to make, but this is positive progress on a major change for the protocol.

Conclusion

Traders continue to transact on the largest on-chain perps exchange, despite continued withdrawals from the protocol. Median daily volumes and users increased from Q2 to Q3. Rewards paid to traders and stakers were again greater than revenues paid to the protocol. The community used governance and voting to change all of the key rewards programs, shutting down the liquidity staking module and reducing trading rewards. The launch of dYdX Chain is now slated for Q2 2023. It presents an opportunity to decentralize the protocol further and better align tokenholders with users.

______________________________________________________________________

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by the dYdX Grants Program, a member of Protocol Services. All content was produced independently by the author(s) and any opinion, estimate, or probability does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. Paid membership in Protocol Services does not influence editorial decisions or content. Crypto projects may commission independent research through Protocol Services. For more details or to join the program, contact ps@messari.io. Author(s) may hold cryptocurrencies named in this report, and each author is subject to Messari’s Code of Conduct and Insider Trading Policy. Additionally, employees are required to disclose their holdings, which are updated monthly and published here. This report is meant for informational purposes only and should not be relied upon. This report is neither financial nor investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Nothing contained in this report is a recommendation or suggestion, directly or indirectly, to buy, sell, make, or hold any investment, loan, commodity, or security, or to undertake any investment or trading strategy with respect to any investment, loan, commodity, security, or any issuer. This report should not be construed as an offer to sell or the solicitation of an offer to buy any security or commodity. Messari does not guarantee the sequence, accuracy, completeness, or timeliness of any information provided in this report. Please see our Terms of Service for more information.