Key Insights

- During Q3, BNB Chain’s mission toward adoption continued with advancements in network functionality.

- User activity reverted to longer-term averages and stabilized, indicating that the network may be reaching a foundational user base.

- Efforts continued to expand the ecosystem through strategic investments, liquid staking solutions, and incentives with Binance Account-Based (BAB) tokens.

- With the use of Soulbound Tokens (SBTs) and the deployment of ecosystem funds, BNB Chain’s position in the NFT and GameFi sectors should continue to strengthen.

- With the network incentivizing the growth of active validators and facilitating greater distribution of stake, expect decentralization to continue improving slowly.

- The network’s performance could also come under pressure as it continues its journey to greater decentralization.

Primer on BNB Chain

BNB Chain is a public, open-source blockchain that aims to deliver scalable smart contract support for decentralized applications. It seeks to accomplish this with a modular design and scaling solutions. The BNB Chain consists of a multichain framework — the BNB Smart Chain, Beacon Chain, BNB Sidechain, and BNB ZkRollup.

The Beacon Chain is the dedicated layer used for governance (staking and voting), and the BNB Smart Chain is the dedicated layer for Ethereum Virtual Machine (EVM) consensus and execution. The BNB Smart Chain is based on a Proof-of-Staked-Authority (PoSA) mechanism and is powered by a growing network of active validators. The BNB Sidechain framework is a recent development effort designed to create BNB Smart Chain-compatible sidechains. Plans also include the launch of zk-rollups for high-performance scaling, allowing sidechains to customize solutions.

The Third Quarter Narrative

In Q2, BNB Chain remained focused on connecting users, projects, and developers to its community despite unfavorable macroeconomic conditions. The approach included executing growth strategies to spur large-scale applications within the GameFi, SocialFi, and Metaverse sectors. As a result, the BNB Chain NFT sector experienced a breakout quarter, and GameFi generated initial traction. Q2 also included plans for implementing Layer-2-like scaling solutions and a series of network upgrades to boost network functionality and permissionlessly grow the validator set. At the end of Q2, it was expected that NFT, GameFi, and technical implementations would continue in Q3.

These expectations were met in Q3. The aftermath of the Terra collapse and the bear market highlighted the network’s foundational user base and ability to advance its strategy. BNB Chain’s mission toward adoption remained intact, as evidenced by expanding the ecosystem through strategic investments, liquid staking solutions, and incentives with Binance Account-Based (BAB) tokens. BNB Chain continued to advance its network functionality with the launch of the zkBNB testnet and a series of subsequent network upgrades, such as the Gibbs upgrade and Godel Hardfork. In addition to enhanced functionality, the upgrades led to staking on the BNB Smart Chain and a more extensive validator set. As a follow-up to the State of BNB Chain Q2 2022 report, this report will dive into the quantitative performance over the quarter and the qualitative evidence that BNB Chain is continuing to execute its roadmap and progress through adverse market conditions.

*Subsequent events, such as the recent BSC Token Hub exploit, will be covered in the State of BNB Chain Q4 2022 report.

Performance Analysis

Network and Financial Overview

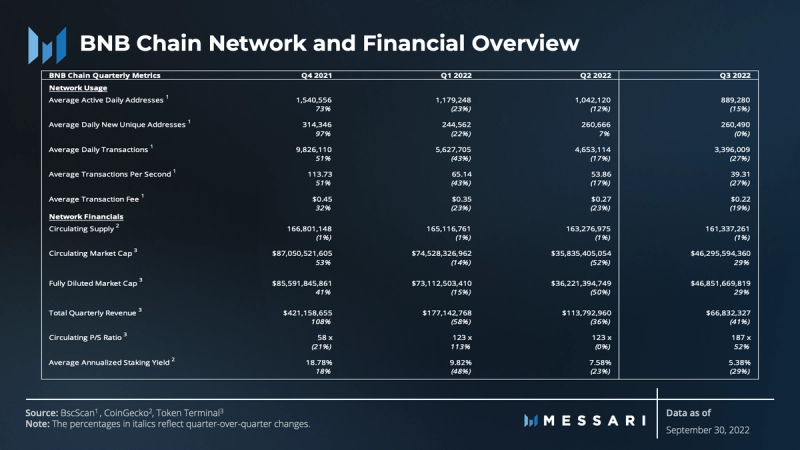

User activity, measured by average daily active addresses, new unique addresses, and daily transactions, was flat to down quarter-over-quarter (QoQ). Despite the decline in user activity, financial performance was mixed. Average transaction fees decreased, which contributed to less revenue generation, while the market cap (i.e., network value) increased over the quarter.

The circulating supply of BNB continued to decline as a result of the BNB token-burning mechanism. By the end of September, over 38 million BNB had been burned since the burn program began in 2017.

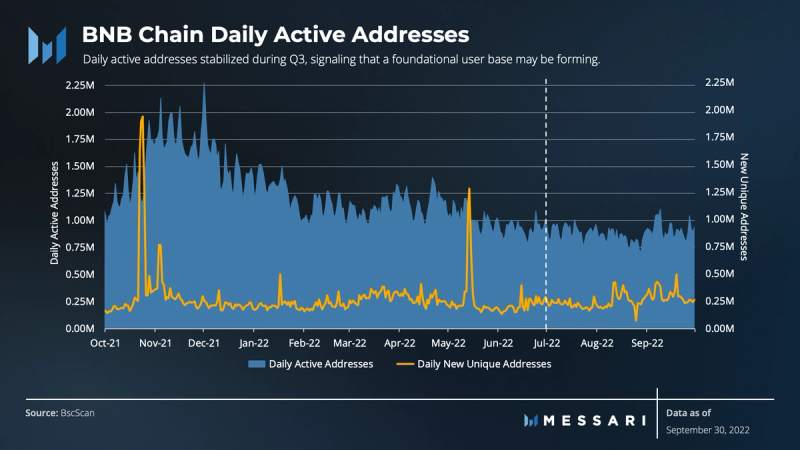

Daily active addresses continued to reverse course. While on a downtrend QoQ, daily active addresses are still up compared to last year. The metric averaged ~1 million per day over the first three quarters of 2022, but over the first three quarters of 2021, it was 584,000 per day. The Q3 2022 average is a ~70% growth over the same period just a year prior.

It also appears the activity reached an inflection point at the end of August. The downward trend, followed by an inflection point while also outpacing longer-term averages, may suggest a foundational user base is forming.

Evidence of reaching a foundational user base was further provided by the average daily unique address activity, which was flat QoQ. In Q2, the metric spiked primarily due to the significant number of Terra users migrating to BNB Chain. Because the Terra collapse was an extraordinary event, it did not necessarily drive a sustainable foundational user base. However, BNB Chain managed to maintain a similar level of new unique addresses without any such event, thus pointing toward a foundation user base.

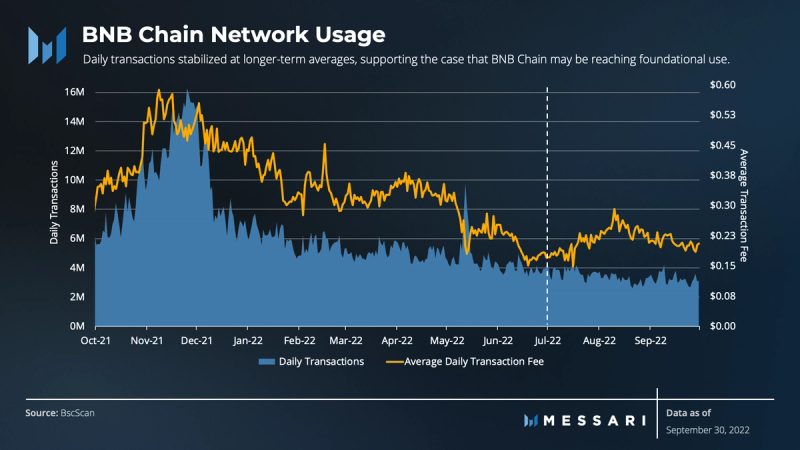

Average daily transaction activity on the network followed a similar pattern of daily active address activity. Overall, BNB Chain’s average daily transactions also reversed course (-27%). While on a downtrend QoQ, daily transaction activity averaged ~4.6 million per day over the first three quarters of 2022. For perspective, the average over the first three quarters of 2021 was ~4.7 million per day. The average seen through Q3 2022 represents a slight decline (-2%) over the same period a year prior. It also represents reaching 2021 average transactions, which includes some potential noise generated during the end of the bull market. Collectively, this may indicate a sustainable level of user activity.

A foundation of users and transaction activity would drive reliable revenue and value accrual to the network. Even so, it is difficult to determine the exact nature of the relationship between revenue and network value. Is network value driven predominantly by more users and transactions or by higher transaction fees? Or is it driven by a deflationary mechanism? Ideally, more users and transactions, albeit with lower transaction fees, would drive revenue upwards and represent fundamental value accrual. This situation would be more sustainable than value coming from revenue driven by higher transaction fees or speculative value.

To that end, BNB Chain’s revenue and network value continue to be correlated, as the volatility and daily revenue trends are generally accompanied by movements in network value.

While revenue declined by 41% over the quarter, partly due to a decline in average transaction fees (-19%), the network value increased by 29%. For perspective, fully diluted value (FDV) was 300 times the total quarterly revenue at the end of Q2 compared to 700 times at the end of Q3. From a valuation perspective, this relationship is also in line with the increase in the P/S ratio.

Part of the increase in value may have come from burning a portion of transaction fees from the network’s circulating supply. However, only ~1% of the circulating supply was burned QoQ.

Therefore, the increase in value came from either speculation or other sources, such as the Binance CEX or other off-chain users driving demand for the BNB token.

Ecosystem & Developer Overview

Nonetheless, it still stands that fundamentals like user and transaction activity could generate more revenue and, therefore, network value. This value accrual would also be enhanced by a deflationary mechanism in BNB Chain’s case. The factors driving BNB chain’s fundamental activity include its ecosystem, developer engagement, and growth strategy.

DeFi

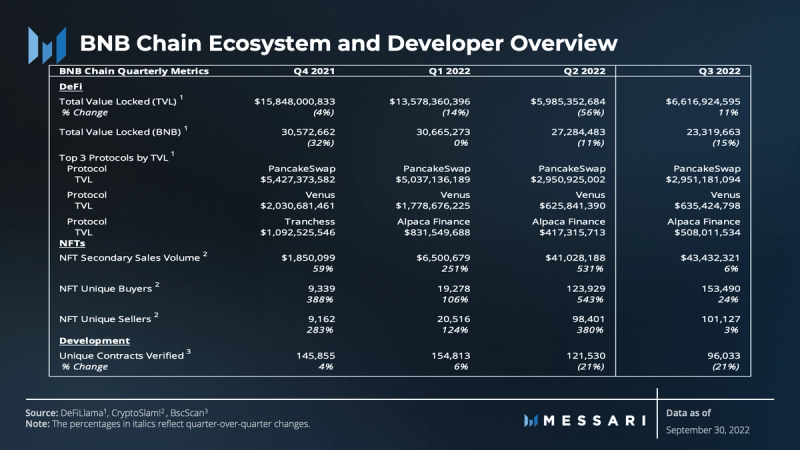

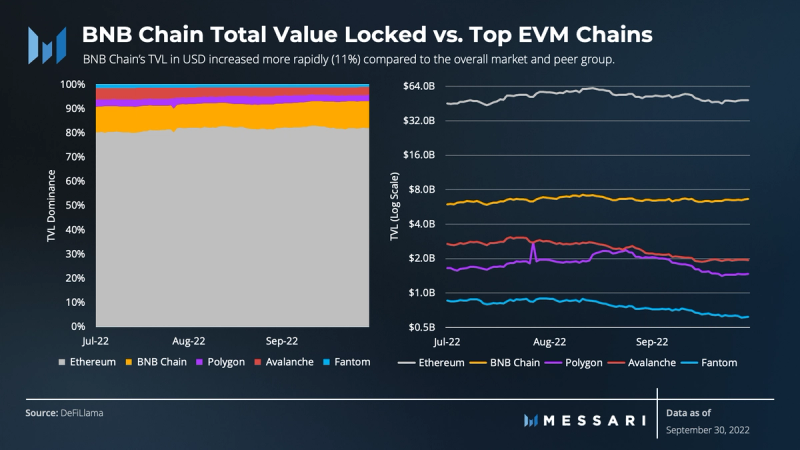

BNB Chain was one of the only Layer-1s to experience a USD increase in TVL during Q3. Its TVL grew roughly 11% in USD terms but declined 15% in BNB terms. This difference suggests that the USD price appreciation of BNB drove the increase in TVL and that assets besides BNB were used across DeFi.

A significant component contributing to the USD increase in TVL was Wrapped BNB (WBNB) and several liquid staking solutions.

During Q3, BNB Chain implemented liquid staking with three platforms: Ankr, Stader, and pStake. Towards the end of August, liquid staking accelerated, primarily on Ankr. The TVL on Ankr grew from $6 million to ~$100 million over the quarter. While the protocol fills a growing demand for liquid staking, it also inflates the TVL represented in USD.

For example, TVL is initially counted by the BNB staked on Ankr. The BNB staked on Ankr essentially frees up capital by creating another new asset (e.g., WBNB) of equal value that can be used to generate yield on another protocol. If the new asset is deployed on another protocol, TVL is also counted there, thereby increasing its overall TVL. This essentially equates to double-counting TVL. It’s just important to recognize that changes in TVL aren’t always the result of the pure use of a native token such as BNB. In addition, liquid staking allows for user flexibility and can be used to bootstrap a DeFi protocol’s liquidity.

In aggregate, 406,000 BNB was staked across the three staking platforms at the end of Q3. In other words, roughly 0.25% of the total supply of BNB, or about $117 million, was used to open up more use and liquidity across the ecosystem.

BNB Chain’s most prominent protocol, PancakeSwap, was flat in terms of TVL, liquidity, and volume QoQ. At the same time, PancakeSwap dominance declined, suggesting that much of the liquid staking activity was redirected and TVL mostly grew in smaller or younger protocols.

However, the shift in dominance can be seen as a positive indicator for BNB Chain. BNB Chain TVL has always been heavily concentrated in PancakeSwap, which holds roughly 45% of BNB Chain’s DeFi TVL. If the application were to collapse due to an exploit or technical breakdown, it could significantly hamper the BNB Chain ecosystem.

To that end, the BNB Chain community continues to implement strategies to grow and diversify TVL across DeFi, such as introducing liquid staking. During Q3, liquid staking allowed TVL to flow into and bootstrap new protocols like Wombat Exchange and Helio Protocol. Both of these DeFi protocols experienced significant growth over the quarter, contributing to greater diversification of TVL across the ecosystem.

Source: bnbchain.org

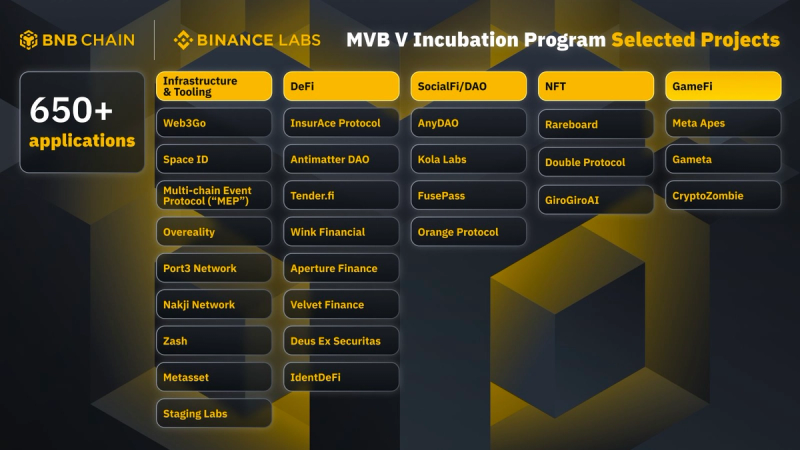

Further, BNB Chain continues to utilize its $1 billion ecosystem fund to find, invest, and work with innovative projects in the DeFi space. BNB Chain also announced the MVB V Accelerator Program at the end of Q2 to help projects develop working products. In Q3, 27 projects were selected to join the accelerator program out of more than 650 applicants. Several of the selected projects were DeFi related, but also developing applications beyond DeFi, especially in BNB Chain’s growing NFT and GameFi sectors.

NFTs

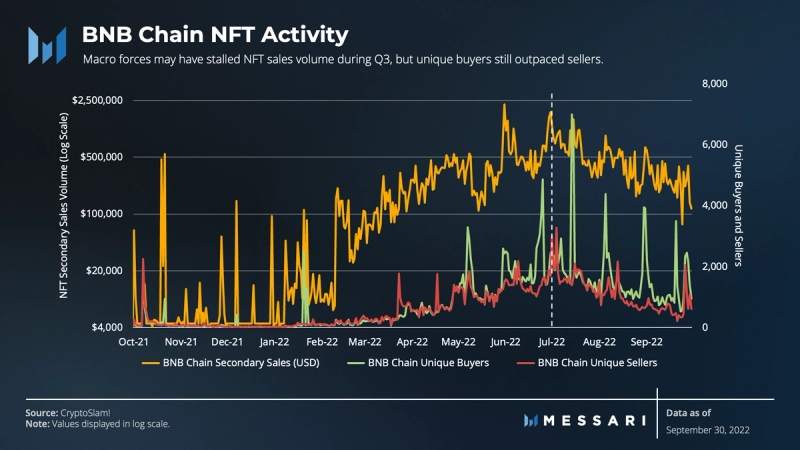

While on a downtrend, total NFT secondary sales volume increased by 6% QoQ. Macro forces may have stalled sales volume during Q3, but unique buyers still outpaced sellers.

Examples driving current and potential future growth of NFT activity on BNB Chain can be attributed to:

- The success of the Element NFT Marketplace.

- The development of the NFT aggregator Rareboard.

- NFT collection sales through Corite.

- The LiveArtX Global 100 joint initiative.

- Strategic investments from the ecosystem growth fund and accelerator program.

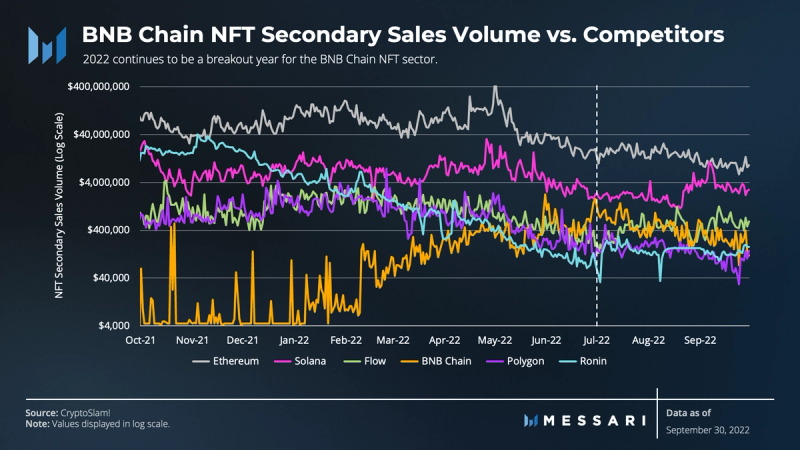

Ultimately, BNB Chain’s strategy and position in the NFT sector are strengthening. It continues to be a breakout year for the BNB Chain NFT sector, and the sector has established a strong position relative to a peer group of the top L1s by total secondary NFT sales volume.

GameFi

GameFi is clearly on the cusp of catalyzing a wave of activity across the crypto space. It is also clear that networks like Ethereum, BNB Chain, Solana, Avalanche, and others are strategically moving towards growing GameFi ecosystems.

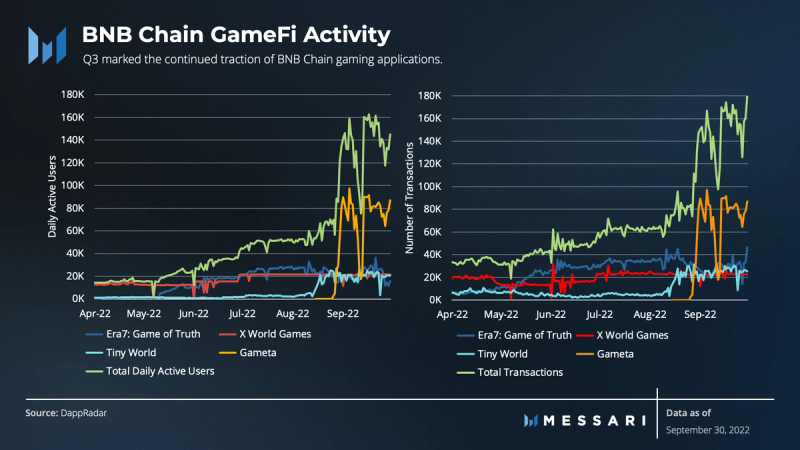

Q3 marked the continued traction of BNB Chain gaming applications like “Era7: Game of Truth” and “X World Games.” It also drew users to “Tiny Worlds” and new games like “Gameta,” “Monsterra,” and a slew of other new games. As such, the number of daily active users and transaction activity stemming from the GameFi ecosystem continue to trend upwards.

Just as liquid staking brought activity to the DeFi sector, the introduction of BNB Chain’s first Soulbound Token (SBT) brought activity to the GameFi sector. SBTs are non-transferable tokens. This brings a sense of accountability, whereby the tokens represent relevant Web3 credentials that can always be attributed to a certain address.

The first SBT launched in Q3 was the Binance Account-Based (BAB) token. BAB, in effect, certifies a user’s verified status on Binance and is available for use by third-party protocols. The token can only be revoked or canceled by the user in question, as it is a unique token that can only be minted upon completion of Know Your Customer (KYC) standards.

Throughout Q3, many exclusive benefits were offered to BAB tokenholders, many of which were offered in the GameFi space. These incentives drew users to games, including “X World Games” and “Tiny Worlds,” to name a few. The BAB token and its incentives were evident in the activity witnessed across the GameFi ecosystem.

Ultimately, BNB Chain’s strategy and position in the GameFi sector is strong. With the use of SBTs and the continued deployment of the ecosystem growth fund and accelerator program, GameFi can be expected to continue to flourish on BNB Chain.

Development

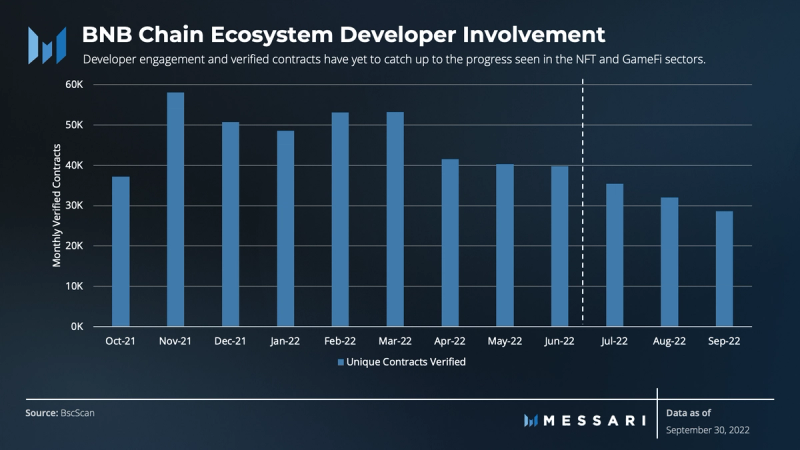

Developer engagement measured by unique smart contract verifications has yet to catch up to the progress seen in the NFT and GameFi sectors. Smart contract verification is triggered by the developer to translate the code into a higher-level language. This measure followed a similar pattern to active address and transaction activity metrics QoQ, with the quarterly total down 21%.

In previous reports, core developer involvement was measured by data sources tracking the events in the BNB Chain GitHub repository. The data indicated that core development was insignificant over the last several quarters.

However, the current data sources on developer data are imperfect as they exist today. Not all commits are created equal. Data sources work by primitively measuring GitHub events across different repos, resulting in an incomplete picture of core developer activity.

With the recently released technical roadmap that includes advancements regarding core developer activity, future reports will aim to evaluate that activity with more reliable data sources and methodology to surface an accurate measure.

Staking and Decentralization Overview

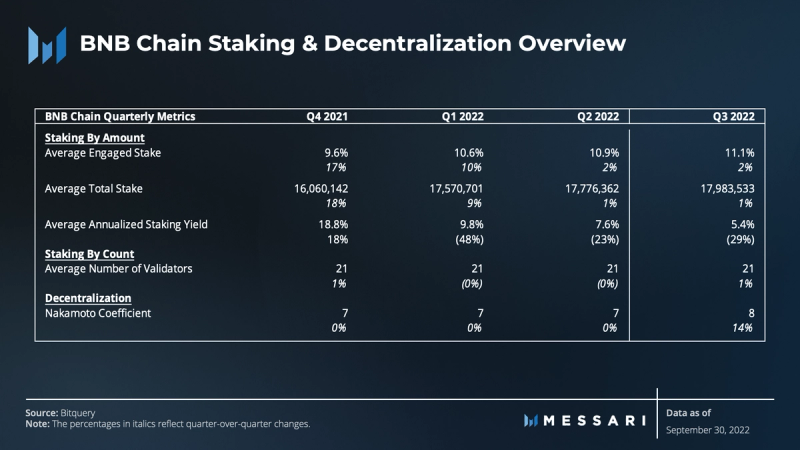

Staking and decentralization of the network remain stable despite coming off a volatile Q2. The average engaged stake (voting power stake divided by total supply) on BNB Chain held steady at ~11% over the last year. This stability mitigates network value volatility to some extent.

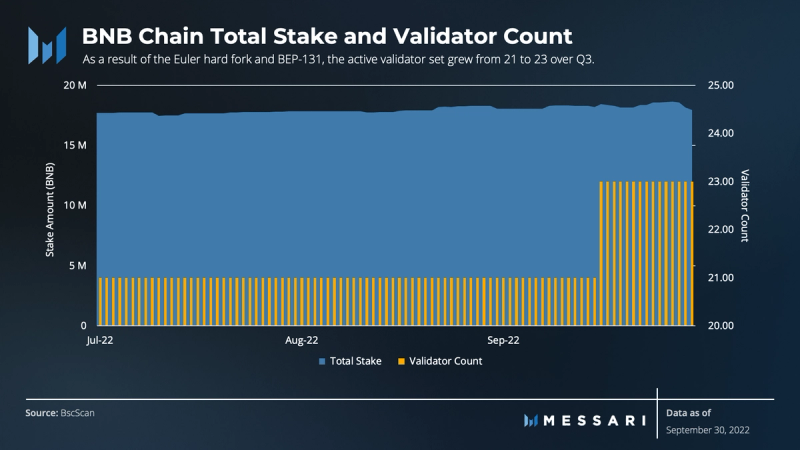

While the average total stake amount was relatively unchanged, implementations to further decentralize and increase censorship resistance of the network began to unfold by the end of Q3. BNB Chain continued the progress experienced in the Euler Hardfork and BEP-131 from Q2. BEP-131 introduced candidate validators onto BNB Smart Chain to improve the robustness of the network. As a result, the active validator set grew from 21 to 23 over Q3.

In Q3, the Gibbs upgrade and BEP-153 were released to build on Q2’s efforts. This release enables staking support on the BNB Smart Chain via a new staking system contract. BEP-131 and 153 will collectively continue to facilitate the growth of the active validator set and enable more network participation, thereby catalyzing the greater distribution of stake.

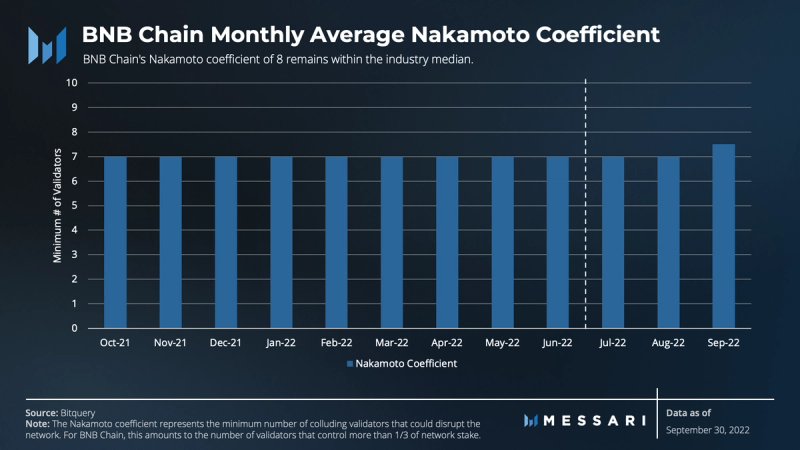

BNB Chain’s average Nakamoto coefficient has been stable over the last year before increasing to 8 at the end of Q3. Contrary to the prevailing belief, none of the network’s validators are run by Binance. Eight validators, including those run by independent third parties such as HashQuark and Certik, contribute to just under ~33% of the network’s total stake.

Despite the criticisms about the small validator set, BNB Chain is not an outlier concerning decentralization. Its Nakamoto coefficient of 8 is within the industry median. Nonetheless, BNB Chain should continue to improve its decentralization as it implements greater security and network reliability by expanding the validator set and distribution of stake.

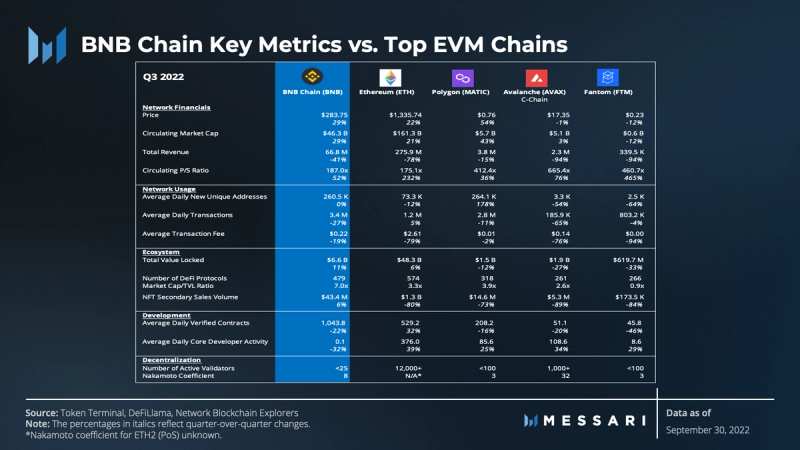

Competitive Analysis

BNB Chain is an Ethereum alternative that has witnessed high growth since its inception. It has successfully maintained its position as one of the most valuable Layer-1 networks. Throughout Q3, BNB Chain’s key metrics held up well compared to the top five EVM-compatible chains. This peer group was derived by simply grouping the EVM chains with the largest TVL and the largest number of DeFi protocols.

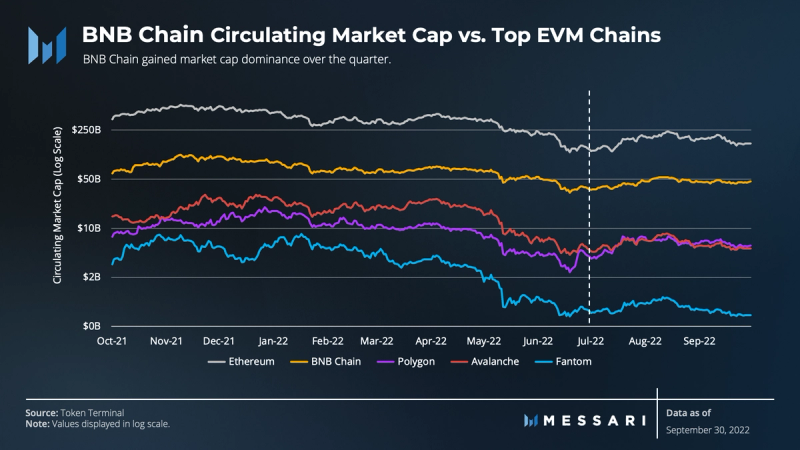

BNB Chain’s valuation moved up steadily throughout the quarter. Market cap dominance was regained by Ethereum, BNB Chain, and Polygon over the quarter as each experienced double-digit percentage point increases. In terms of value accrual, Fantom continued to struggle.

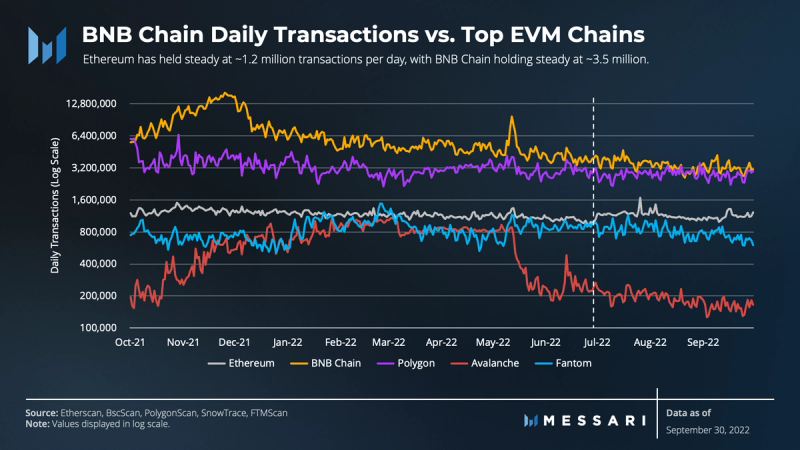

With the decrease in average transaction fees and daily transactions, BNB Chain’s daily revenue trended downward. The peer group (minus Ethereum) experienced a similar revenue trend due to lower average transaction fees as well as daily transactions. Interestingly, Ethereum transactions were up on average, but transaction fees declined QoQ, putting downward pressure on the protocol’s revenue.

Over the quarter, BNB Chain’s P/S ratio increased slower than most of the peer group. The change in P/S gauges a protocol’s revenue and gives a sense of the number and cost of transactions processed. Because BNB Chain’s change in value was up and its transaction activity put downward pressure on revenue, BNB became slightly more expensive per unit of revenue compared to Ethereum.

While on a downtrend over the quarter, BNB Chain reached a higher foundational level of daily transactions than Ethereum and Polygon. Ethereum held steady at ~1.2 million transactions per day, but BNB Chain averaged ~3.5 million.

Q3 was flat for the crypto DeFi market, with aggregate TVL beginning and ending with ~$54 billion in USD terms. As mentioned, BNB Chain was one of only a few Layer-1s that experienced a USD increase in TVL. Its TVL grew in USD terms but declined 15% in BNB terms. This outcome suggests that the USD price appreciation of BNB drove the increase in TVL and that new assets like WBNB were used across DeFi.

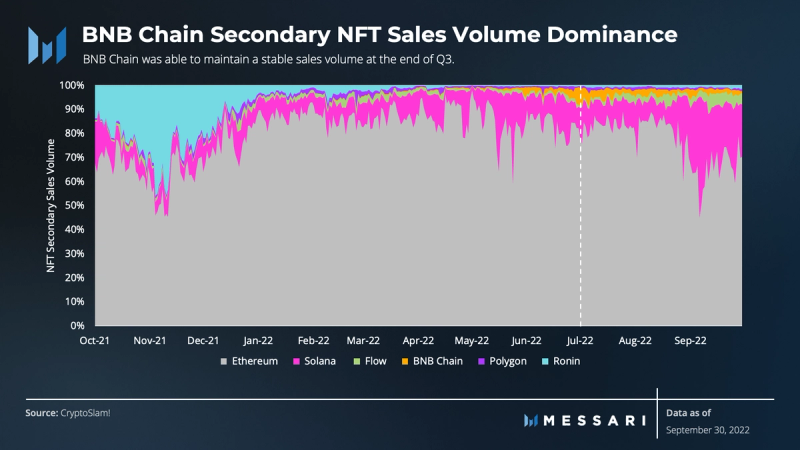

2022 continues to be a breakout year for the BNB Chain NFT sector. Both NFT secondary sales volume and unique NFT buyers have grown exponentially. BNB Chain quickly surpassed Ronin, Flow, and Polygon in terms of daily sales volume during Q3. BNB Chain’s path to attracting unique buyers followed the same pattern as secondary sales.

Though Ethereum still dominates roughly 80% of the secondary NFT market, BNB Chain maintained a stable level of sales volume at the end of Q3.

Qualitative Analysis

Key Events, Catalysts, and Strategies for Ecosystem Growth

Though adverse market conditions continued, BNB Chain’s expansion strategies and network upgrades pushed forward throughout Q3. Upgrades like Euler and Gibbs expanded the validator set and facilitated greater distribution of stake. Growth funds, accelerator program resources, and SBT incentives were aimed at the NFT and GameFi space.

Aside from these efforts, other aspects of the BNB Chain strategy extended beyond broadening network infrastructure, DeFi, NFTs, and GameFi. Throughout Q3, there were auxiliary catalysts and strategies at play. While not mutually exclusive, they can be generalized into four key areas:

- Technical — Improve functionality.

- User experience — Captivate users with greater user accessibility and experience.

- Ecosystem expansion — Grow with new use cases, including social applications and public goods.

- Community — Acquire developers and drive adoption through community building.

Technical

During Q2, BNB Chain announced a technological roadmap with significant updates deployed on mainnet. Beyond the efforts regarding furthering decentralization, other updates were aimed at faster transactions, extra capacity, sidechain development, and zk-rollup technology.

To those ends, the team made progress during Q3. Version 1.1.12 of the BNB Chain client was released in July. The performance release contained features that improved network capacity with two types of nodes to make full use of different storage. It also enabled a new flag to prune undesired block data to save space.

Further, the team shared details about BNB ZkRollup, a “trustless and scaling solution for BSC.” After months of testing, the zkBNB testnet went live and was open-sourced during Q3.

Further, the Godel hard fork activation block arrived in September. This upgrade removed DEX features from the BNB Beacon Chain to free up compute power. It also allowed developers to focus on improving security, increasing future compute, and introducing new governance capabilities.

User Experience

In addition to making the network more functional, Q3 centered around developing ways to improve user and developer experience. On the developer side, NodeReal announced support for BNB Chain. It is a developer platform that also offers infrastructure services and toolkits for Ethereum, Polygon, Optimism, and Aptos.

On the user side, Space ID announced it closed its seed round led by Binance Labs to bring .bnb domain name services to the BNB Chain ecosystem.

Ecosystem Expansion

Clearly, the DeFi sector received a spark from liquid staking, and the NFT and GameFi sectors were catapulted forward with strategic investment and incentives. However, alternative avenues for ecosystem growth were also pursued over the quarter.

In September, the BNB Chain community announced a concerted effort to prioritize the buildout of “Public Goods.” Public Goods are a series of products and services used by most participants of the ecosystem. They are seen as required building blocks at the protocol layer, such as decentralized storage, cross-chain bridging, identity solutions, or wallets. The development of Public Goods on the BNB Chain may catalyze more fundamental network usage and ecosystem growth in the future.

Other avenues include building in the SocialFi space. A number of SocialFi applications, such as Any DAO and Orange Protocol, were also chosen as part of the MVB V Incubation Program. Further, Hooked Protocol, a Web3 social protocol building a connection network to spark Web3 social engagement, made its debut and experienced traction at the end of Q3.

Further, BNB Chain and Google Cloud announced their collaboration to accelerate the growth of Web3. The strategic partnership will enable early-stage Web3 and blockchain startups to develop and scale sustainable innovations across new vectors.

Community

Technical innovation and ecosystem expansion require community. BNB Chain continues to implement strategies for strengthening its community, kicking off two key initiatives in Q3.

BNB Chain announced its collaboration with Platzi, one of Latin America’s largest online learning communities, to help students learn the skills needed for Web3 development.

Another was the launch of the BNB Chain Advocates Program. The program aims to build a bridge between creators and opinion leaders across social networks to the BNB Chain.

Ecosystem Challenges and The Road Ahead

Q3 did not present any adverse outcomes stemming from technical challenges. Rather than putting out fires, BNB Chain’s team spent its time successfully integrating several upgrades per the 2022 technical roadmap.

Source: bnbchain.org

BNB Chain continues to be focused on advancements to help users, projects, and developers connect to the BNB Chain community. The approach to success includes:

- Executing growth strategies and implementing technical developments such as scaling solutions.

- Boosting throughput.

- Expanding the validator set.

As is the case across the crypto sphere, implementing ZK technology may be the most significant challenge for BNB Chain and its plans for BNB ZkRollup. The BNB Chain community plans to expand the network with L2-like solutions. These include the launch of zk-rollups for high-performance scaling and sidechains for more customizable blockchain solutions.

Intentional steps continue to be taken toward greater decentralization. The team open-sourced the validator set of the Beacon Chain and continues to evaluate different approaches to both the election period and the elected validators of the BNB Smart Chain.

As is the case for all decentralized networks, further decentralization can come with growing pains. To that end, the performance of the network could come under pressure. With that in mind, BNB Chain selected Verichains as a security partner to audit BSC major mainnet updates beginning with BEP-153, BEP-131, and BEP-126.

Closing Summary

During Q3, user activity reverted to longer-term averages and stabilized after a point of inflection. This type of user behavior amid a bear market may indicate that BNB Chain is reaching a foundational user base.

Despite continued headwinds, the network’s mission toward adoption continued. BNB Chain continued to improve its network functionality with the launch of the zkBNB testnet and a series of network upgrades. The upgrades also led to staking on the BNB Smart Chain and a more extensive validator set.

Efforts continued to expand the ecosystem through strategic investment, liquid staking solutions, and incentives with Binance Account-Based (BAB) tokens. The liquid staking solutions contributed significantly to the USD growth in DeFi. The resulting growth contributed to greater diversification of TVL across the ecosystem.

BNB Chain’s position in the NFT sector is strengthening. It continues to be a breakout year for the network’s NFT sector. The network’s position in the GameFi sector is also strong. With the use of SBTs and deployment of the ecosystem growth fund and accelerator program, GameFi on BNB Chain should be well-positioned to continue to flourish.

With the network incentivizing the growth of active validators and facilitating greater distribution of stake, decentralization of the BNB Chain can be expected to continue improving.

Challenges still lie ahead, with ZK technology being one of the most difficult. The network’s performance could also come under pressure as it continues its journey to greater decentralization.

Nonetheless, BNB Chain has strong technical plans and a solid strategy to grow its ecosystem across sectors old and new. If it can successfully execute, the network could maintain its place in the Layer-1 race as one of the most valuable networks in the marketplace.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form.

This report was commissioned by BNB Chain, a member of Protocol Services. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. Paid membership in Protocol Services does not influence editorial decisions or content. Author(s) may hold cryptocurrencies named in this report. Crypto projects can commission independent research through Protocol Services. For more details or to join the program, contact ps@messari.io. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. The past performance of any asset is not indicative of future results. Please see our terms of use for more information.