2022 has been quite painful for investors, with most assets dumping hard. The cryptocurrency industry is no different. Bitcoin, for example, is down by about 70% since its peak in November 2021.

Gold, however, is often touted as the preferred hedging choice in times of uncertainty, high inflation, wars, etc. As such, one would assume that it has been this year’s top performer. Its price movements for the past seven months portray a different story.

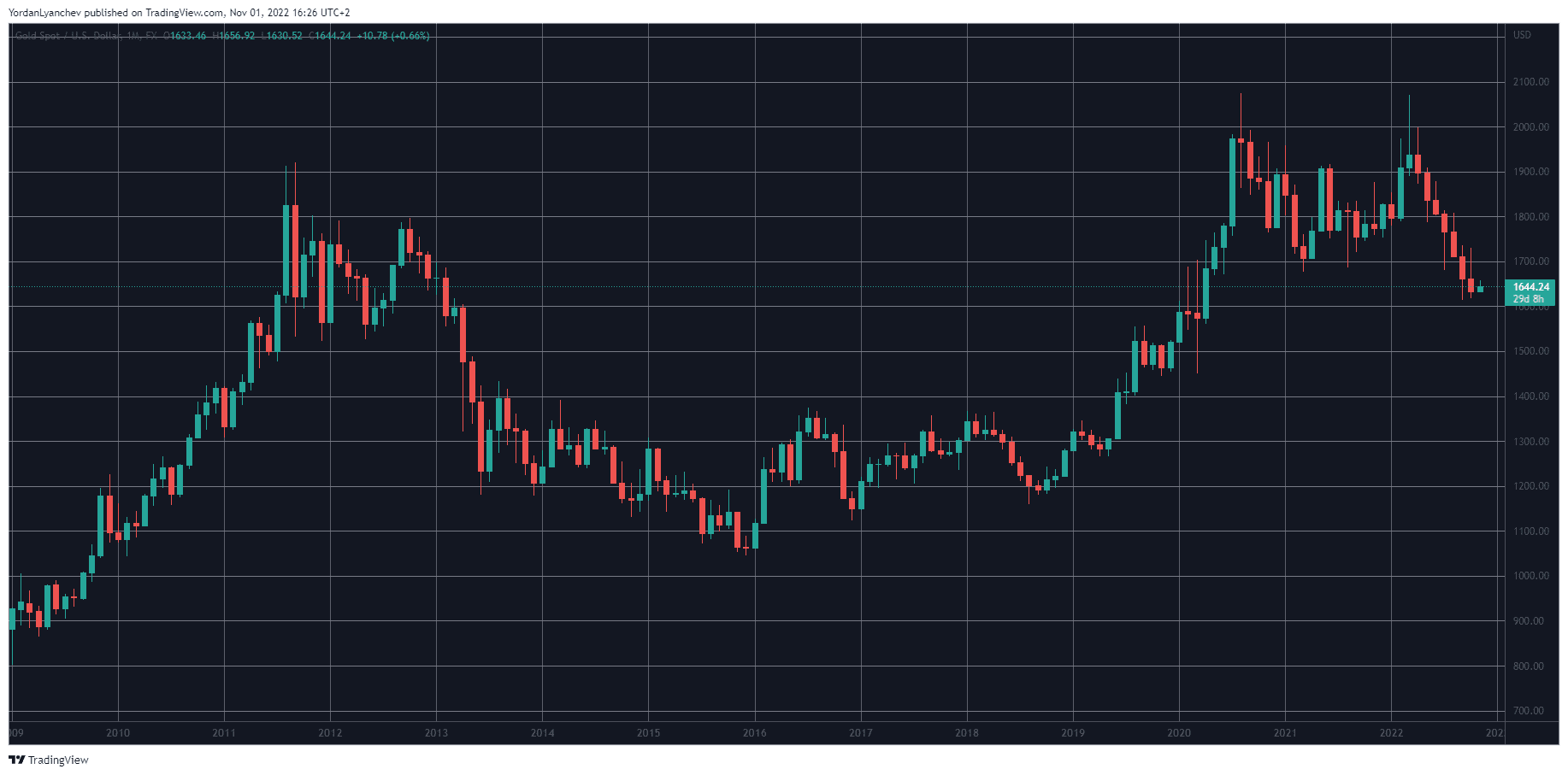

Gold’s 7-Month Red Streak

The ideology that the precious metal is among the best hedge tools against inflation has been running for years, given the asset’s long history. Looking at its chart against the dollar, one can see such merit, especially after the removal of the gold standard.

But has something changed lately? There’s no doubt that the world is going through tough times as of now, with a war raging in Eastern Europe, inflation rates skyrocketing to multi-decade highs, short supply of certain goods, scares of harsh winter, and even potential electricity regimes in some well-developed countries.

This should set up the perfect conditions for the asset that is supposed to protect in these times of uncertainty, right? And this was certainly the case up until March of this year when XAU/USD reached a local peak of almost $2,100 per ounce.

However, the landscape started to change then as the US and other countries decided to battle inflation by raising the interest rates. Instead of going further north, gold reversed its trajectory and entered its longest-recorded negative streak – seven consecutive months closing lower than the previous one.

The precious metal ended October at $1,630 – or a decline of over 22% since the peak in March, which is perhaps why some analysts have been questioning gold’s status as an inflation hedge.

It’s worth noting that esteemed magazines such as Forbes have warned in the past that the metal serves as an “effective inflation hedge” but only “over an extremely long time horizon of more than a century.” Given the average lifespan data ranging from 60.4 years to 84.9, who has the time to wait for over a century?

So, Is Bitcoin’s Performance So Bad?

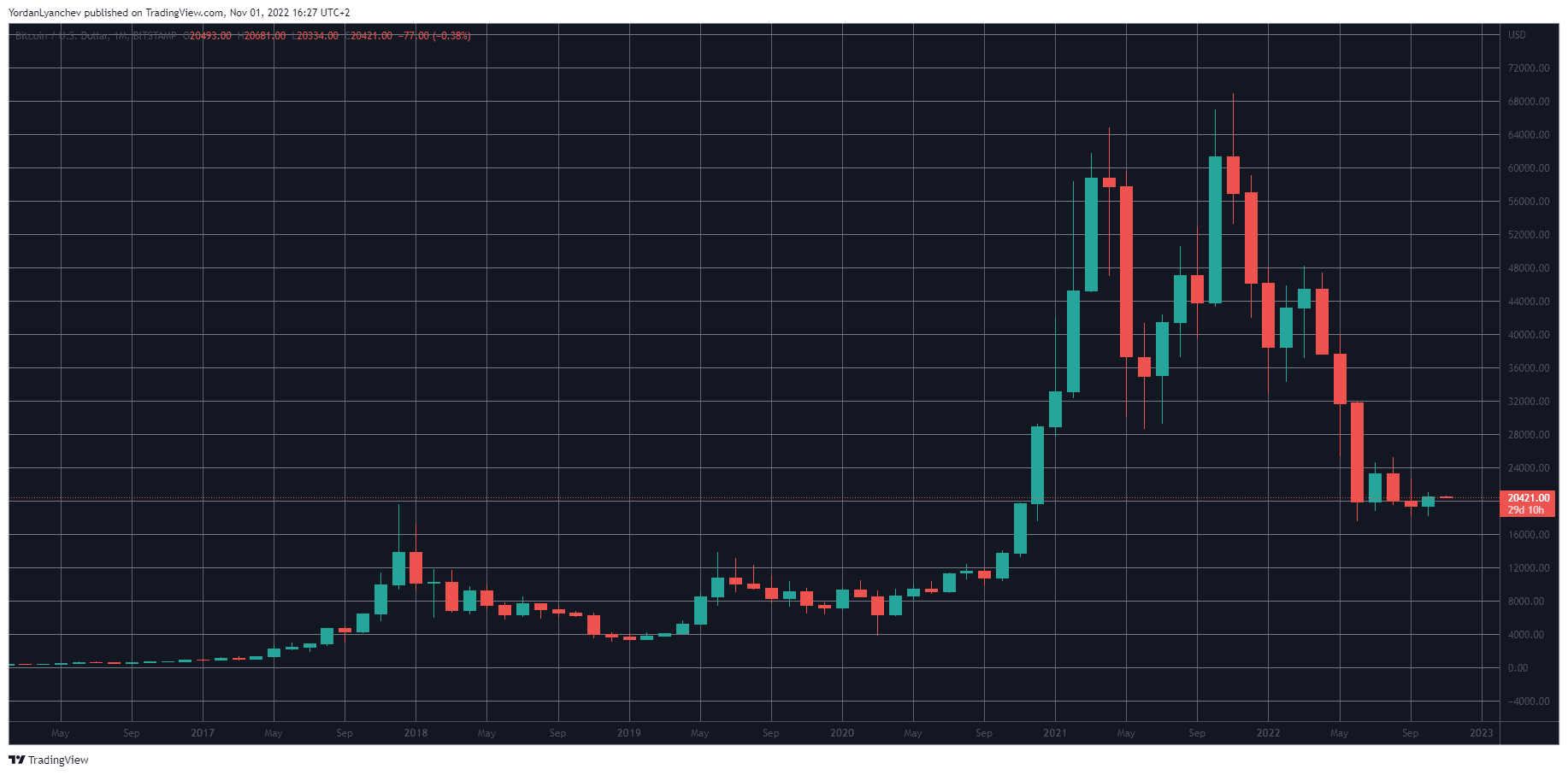

Bitcoin proponents have compared it to gold ever since its establishment over a dozen years ago due to some similarities, such as the limited supply. But they have also claimed that BTC is a better option since it’s digital, has a pre-programmed supply of 21M coins ever to exist, doesn’t need a central authority to run, etc.

However, bitcoin’s price movements seemed more correlated with other riskier assets for the past few years, and it skyrocketed to an all-time high of $69,000 last November. US stocks were also flying high at this time.

The question was what would happen when the world’s central banks inevitably halted their free-money monetary policies, which went on for over a year. And that’s exactly what occurred in 2022, as mentioned above.

Bitcoin’s price expansion was also stopped. The asset started losing value fast and currently trades at around $20,000. This means it’s down by 71% since last November and 51% year-to-date.

These percentages are a lot bigger than gold’s depreciation since the start of the year and its peak. Nevertheless, gold is supposed to be more stable. Additionally, BTC’s longest-negative monthly streak during the year is for “just” three months.

But let’s dial back and focus on another chart. Bitcoin traded at $14,000 two years ago on November 1st, while gold was at $1,875. Meaning one is clearly up and the other down.

In fact, gold’s current price against the dollar is precisely the same as it was in February 2013, even though the greenback has lost a lot of its buying power since then. BTC, on the other hand, traded at $15 (yes, $15, not $15K) at that point.

Ultimately, the data above tells us that the short-term performance of traditionally more stable assets like gold could be as poor as BTC’s. However, one should really look at the big picture and decide for himself if he/she can wait for a century.

The post Longest Negative Streak for Gold After 7 Monthly Red Candles appeared first on CryptoPotato.