Key Insights

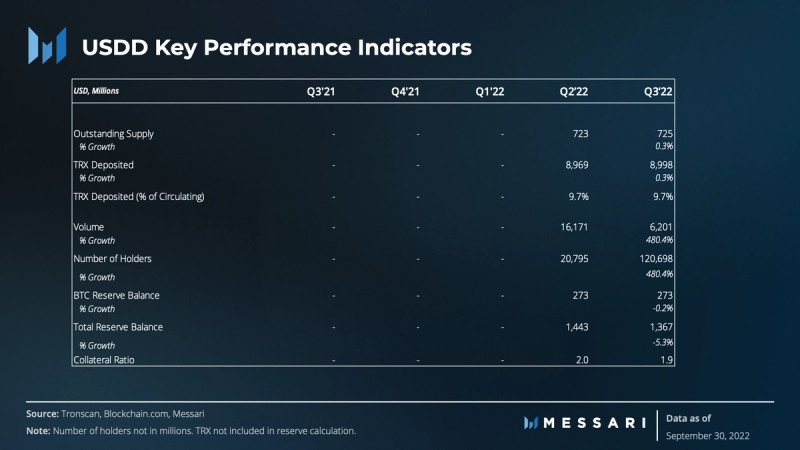

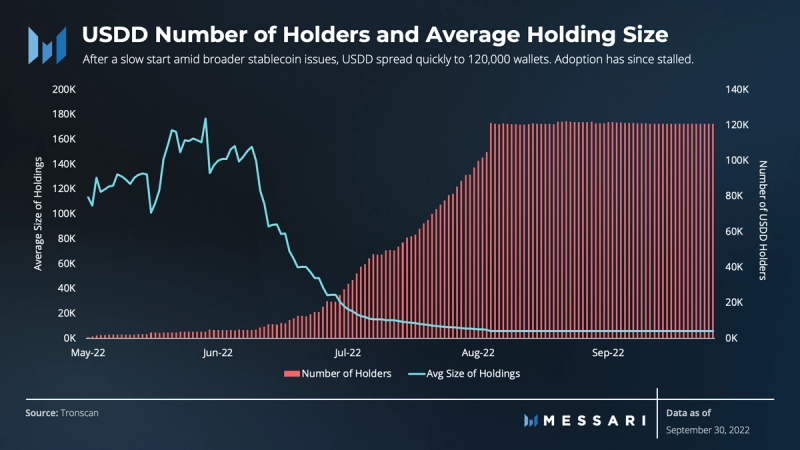

- After rapid adoption in Q2, supply growth stalled in Q3, increasing only 0.02% to 725 million. However, the number of wallets holding the currency increased nearly 5x.

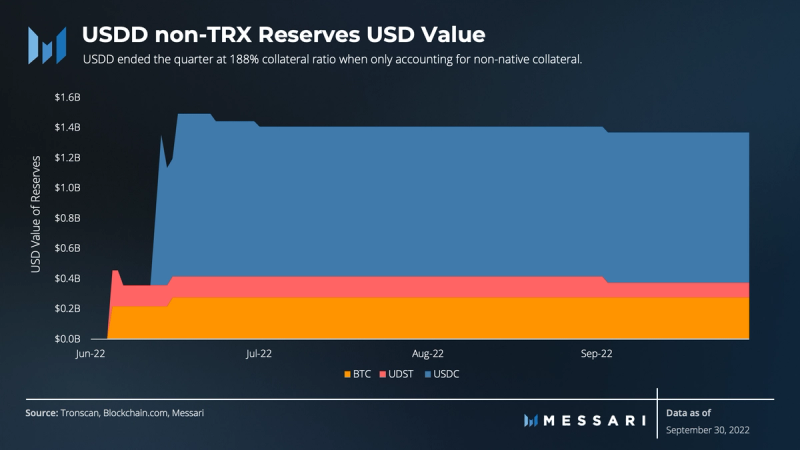

- The stablecoin remains well backed by non-native currencies BTC, USDC, and USDT with a collateral ratio of 1.9 at quarter’s end.

- After the UST collapse and stablecoin depegging in June, USDD maintained a tight peg and launched Peg Stability Module using USDT, USDC, TUSD, and USDJ.

Primer on USDD

USDD is an over-collateralized stablecoin that is issued by the TRON DAO Reserve (TDR), which is also the custodian. The TDR is made up of nine crypto-native institutions. USDD’s value is backed by the over-collateralization of crypto assets under the TDR, including BTC, USDT, USDC, and TRX. The peg is maintained through the Peg Stability Module (PSM) that allows 1:1 transfer of USDD for USDT, USDC, TUSD, and USDJ. The PSM’s USDD funding is controlled by the TRON DAO Reserve. USDD can be minted by the whitelisted institutions of the TDR by depositing TRX.

Introduction

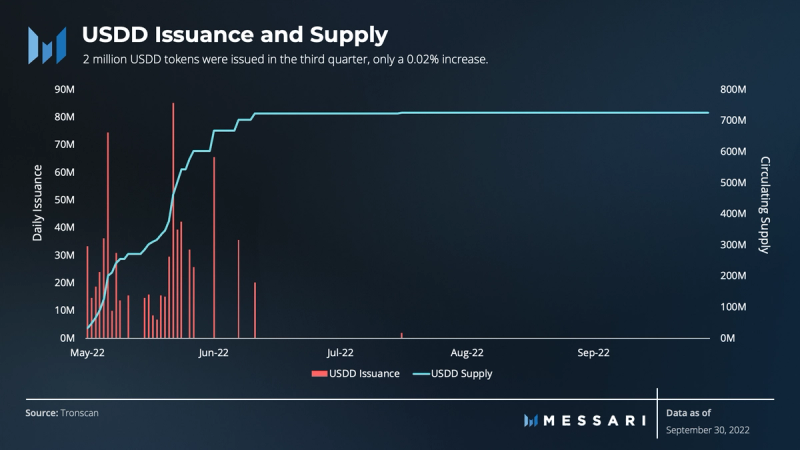

USDD launched in the beginning of May 2022, and prior to the collapse of UST, it saw substantial growth and adoption when measured by supply. Although Q2 brought some instability to USDD and other stablecoins, the third quarter has been much tamer for USDD.

After the UST depeg took most stablecoins below their peg in June, USDD regained its peg early in July and maintained a tight peg throughout the remainder of the quarter. Supply stagnated in Q3 as planned incentives of a 30% guaranteed rate were reconsidered following the collapse of LUNA. The best growth point in the quarter was the number of wallets holding USDD, which increased 5x. Increasing adoption is key for the stablecoin’s supply growth, which is needed to drive value to TRX holders.

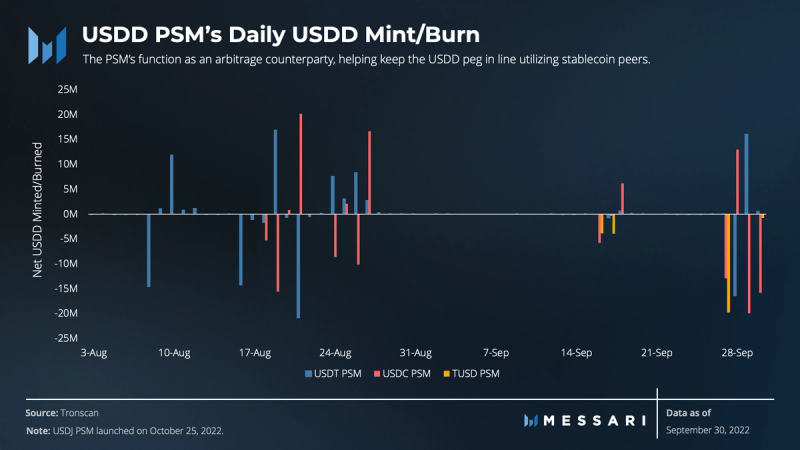

Reserves were relatively flat QoQ, staying around $1.4 billion or nearly 2x the value of USDD outstanding. USDD volumes also benefited from the launch of Peg Stability Module (PSM) that allows for the 1-for-1 transfer of USDD with USDT, USDC, TUSD, and USDJ in Q3. The PSM is currently funded with 200 million USDD.

Performance Analysis

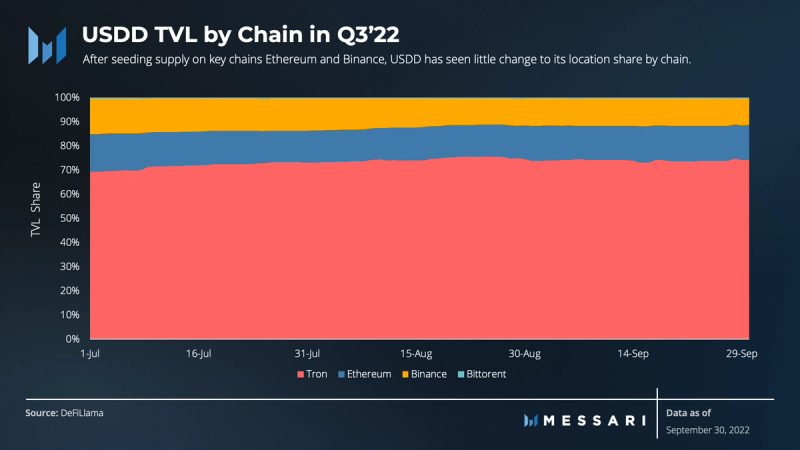

USDD Supply and TRX Deposit

USDD supply grew to over 725 million in its first five months. Almost all of that growth occurred in the first two months post-launch, with only a 0.2% increase in the third quarter. There is currently over 36 billion USDT on TRON, leaving a lot of room for growth for USDD. USDD has also expanded to Binance and Ethereum, but it is most likely to see demand grow on its native chain given yield opportunities on Sun.io and Sunswap, both native DEXs.

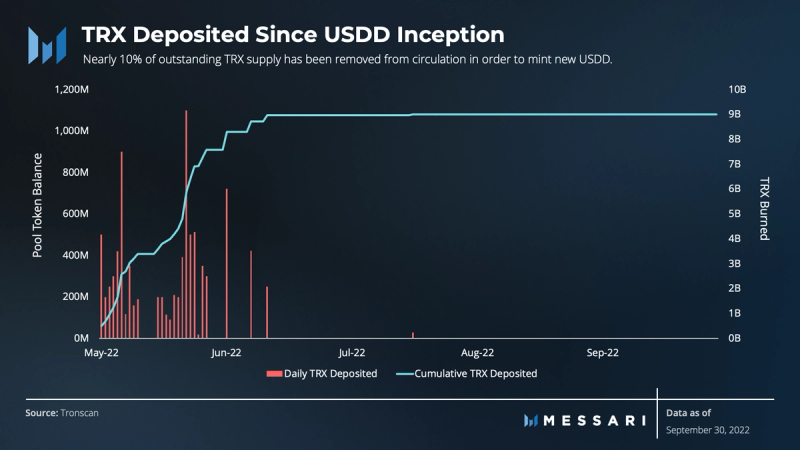

In order to mint new USDD, the TRON DAO Reserve must deposit an equivalent USD amount of TRX to back it. Nearly 9 billion TRX has been deposited in the first five months since the launch of USDD, totaling 9.7% of the circulating supply. TRX holders are likely the greatest beneficiaries of USDD adoption, given the potential reduction in circulating supply should adoption grow.

Reserve Balances

As of September 30, USDD appears sufficiently backed by its external basket of crypto collateral in the form of BTC, USDT, and USDC. The collateral is controlled by the TDR, and there is no hard-coded contract to sell the collateral to support the peg. Currently, all the stablecoin collateral in the reserve wallet is locked and earning yield in Justlend, the largest lending protocol on TRON by TVL.

TRX was not included as a collateral backing USDD because of the reflexive nature between the two. Currently, the TDR would likely be able to sell $725 million of TRX to back the outstanding USDD. However, it is unclear when the size of the stablecoin would be too big to source liquidity in its native token. Therefore, stablecoins and Bitcoin were used as collateral instead of TRX, as their demand is not tied to the supply of USDD.

On top of these non-native collateral types, the TDR has $120 million of TRX staked in reserve accounts for USDD. Including these tokens, the collateral ratio rises to 205% as of the end of the quarter.

Adoption

Adoption, as measured by the number of wallets holding USDD, had a strong increase in the first half of Q3. It leveled out at around 120,000 wallets. The average value held is around 6,000 USDD. For comparison, the USDT average wallet holding is 46 USDT.

At current numbers, USDD seems to be used more for yield opportunities than as a transfer currency. USDT transfers on TRON gained popularity last year while its fees remained nominal as gas costs on Ethereum made ETH fees only tenable for whales. Fees on TRON remain nominal, giving a clear value proposition for users looking to make small stablecoin transfers.

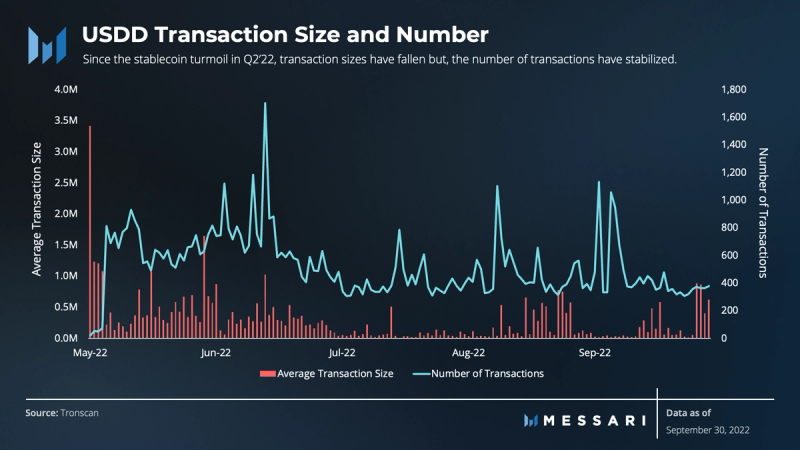

The cumulative volume of USDD traded in Q3 was over 6.2 billion. The average daily number of transactions found a floor of around 400 in Q3. If adoption picks up, these two datasets should diverge with more, smaller transactions on the network. The average size of a transaction in Q3 was over $160,000. Comparing total volume with that of USDT, USDD did over 6 billion while USDT nearly topped 650 billion.

Peg and Location

In Q2, stablecoins depegged across the spectrum after UST’s collapse. USDD also struggled to maintain its $1 peg for a few days, but by late July, its peg was restored. For the remainder of the quarter, it held a tight peg, with only occasional slippage events driving price deviations.

To maintain its peg, USDD primarily uses Peg Stability Module (PSM) where users can exchange 1 USDD for 1 USDC, USDT, TUSD, or USDJ on TRON. The TRON DAO Reserve can also mint or burn USDD in exchange for an equivalent amount of TRX.

The TRON DAO Reserve launched the Peg Stability Module in August and September to give users the opportunity to mint USDD for other stablecoins as well as to support the peg. First the USDT PSM launched on August 3, then USDC on August 18, and the TUSD PSM on September 6. Since then, the PSMs have done over 1 billion dollars in volume. The vault, which has USDD to fund the PSMs, has seen daily fluctuations in the 200 million USDD. This is the amount it was originally funded with, but on net, it is mostly unchanged.

As part of its push to grow adoption, USDD partnered with Multichain to get USDD liquidity on other chains. The preliminary uptake on Ethereum and Binance Chain was strong, attracting one quarter of the USDD supply. On both Layer-1s, the primary home for USDD is on exchanges Curve and Ellipses. Since launch, there has been little change to the adoption of USDD on other chains.

Qualitative Analysis

Monetary Policy

At launch, the plan for increasing adoption was to manage monetary policy through a guaranteed native interest rate. The plan was to give boosted USDD rewards to stakers in approved liquidity and lending pools.

However, the collapse of UST soon after launch showed some perils of this growth strategy. On May 31, Justin Sun wrote about lessons learned, namely that “inorganic and unsustainable growth is bad” and that “transparent over-collateralization is critical to preventing depegging.” He elaborated on how USDD would target more sustainable growth. The updated plan would cap new USDD to 2 billion in rewards in Phase I. Phase II would require a longer lock-up of USDD to receive rewards.

Perhaps because of market conditions, the result has not been 30% fixed yield for stakers. Currently, on Curve on Ethereum, users can receive roughly 9% APR for participating in the USDD+3CRV pool. On TRON, however, there are opportunities to earn yield into the 40% range on Sun.io, but they involve governance mining (a form of locked token governance).

Peg Stability Module

To improve its stategy for maintaining peg stability, TRON launched a USDT PSM on August 3. The PSM allows anyone to exchange USDT and USDD 1-for-1. The TRON DAO Reserve replenishes the Authorized Contract anytime it is signaled to by supply falling below 500 million. From the Authorized Contract they can fund the Safe Vault for the PSM. The PSM can then swap USDD for USDT and deposit the USDT into the Safe Vault. The USDT remains there as reserves for USDD backing. On August 18, the TDR added the USDC PSM, and on September 6, it added the TUSD PSM.

Driving Adoption

In favor of a native interest rate, the TRON DAO Reserve has been working with centralized exchanges (CEXs) to make trading free on USDD pairs. Users have been able to receive extra rewards from Huobi and Gate.io for holding, staking, and trading USDD.

As of October 7, USDD became the “authorized digital currency and medium of exchange in the Commonwealth of Dominica.” Although the Caribbean island has a small population, TRON has the opportunity to improve payment transfers and access to stablecoins for the community. They also agreed to develop and release a fan token, DMC, for Dominica.

Conclusion

USDD maintained a tight peg in the quieter third quarter and found a home in 100,000 new wallets. Aside from the new wallets, adoption froze in almost every other metric. Crypto’s bear market and the falling stablecoin balances are a difficult environment for any new, hybrid-model stablecoin to gain adoption.

The collapse of UST and the Terra/LUNA business model also puts USDD’s growth plans into question, which prompted an upgrade to the roadmap and follow-up answers to the community. On a positive note, the launch of PSM in Q3 should help maintain a peg and increase confidence in USDD’s stability. So far, the stablecoin remains comfortably over-collateralized by a basket of Bitcoin and other stablecoins.

______________________________________________________________________

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by the TRON, a member of Protocol Services. All content was produced independently by the author(s) and any opinion, estimate, or probability does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. Paid membership in Protocol Services does not influence editorial decisions or content. Crypto projects may commission independent research through Protocol Services. For more details or to join the program, contact ps@messari.io. Author(s) may hold cryptocurrencies named in this report, and each author is subject to Messari’s Code of Conduct and Insider Trading Policy. Additionally, employees are required to disclose their holdings, which are updated monthly and published here. This report is meant for informational purposes only and should not be relied upon. This report is neither financial nor investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Nothing contained in this report is a recommendation or suggestion, directly or indirectly, to buy, sell, make, or hold any investment, loan, commodity, or security, or to undertake any investment or trading strategy with respect to any investment, loan, commodity, security, or any issuer. This report should not be construed as an offer to sell or the solicitation of an offer to buy any security or commodity. Messari does not guarantee the sequence, accuracy, completeness, or timeliness of any information provided in this report. Please see our Terms of Service for more information.