In the last several years, dozens of NFT marketplaces have emerged targeting different segments of users and promising improvements to the OpenSea paradigm with various features and commission/pricing models.

The differences are much more than landing-page deep. These marketplaces aim to build communities around themselves with their distinct characteristics. Which one is the best fit for you?

NFT marketplaces in-depth comparison

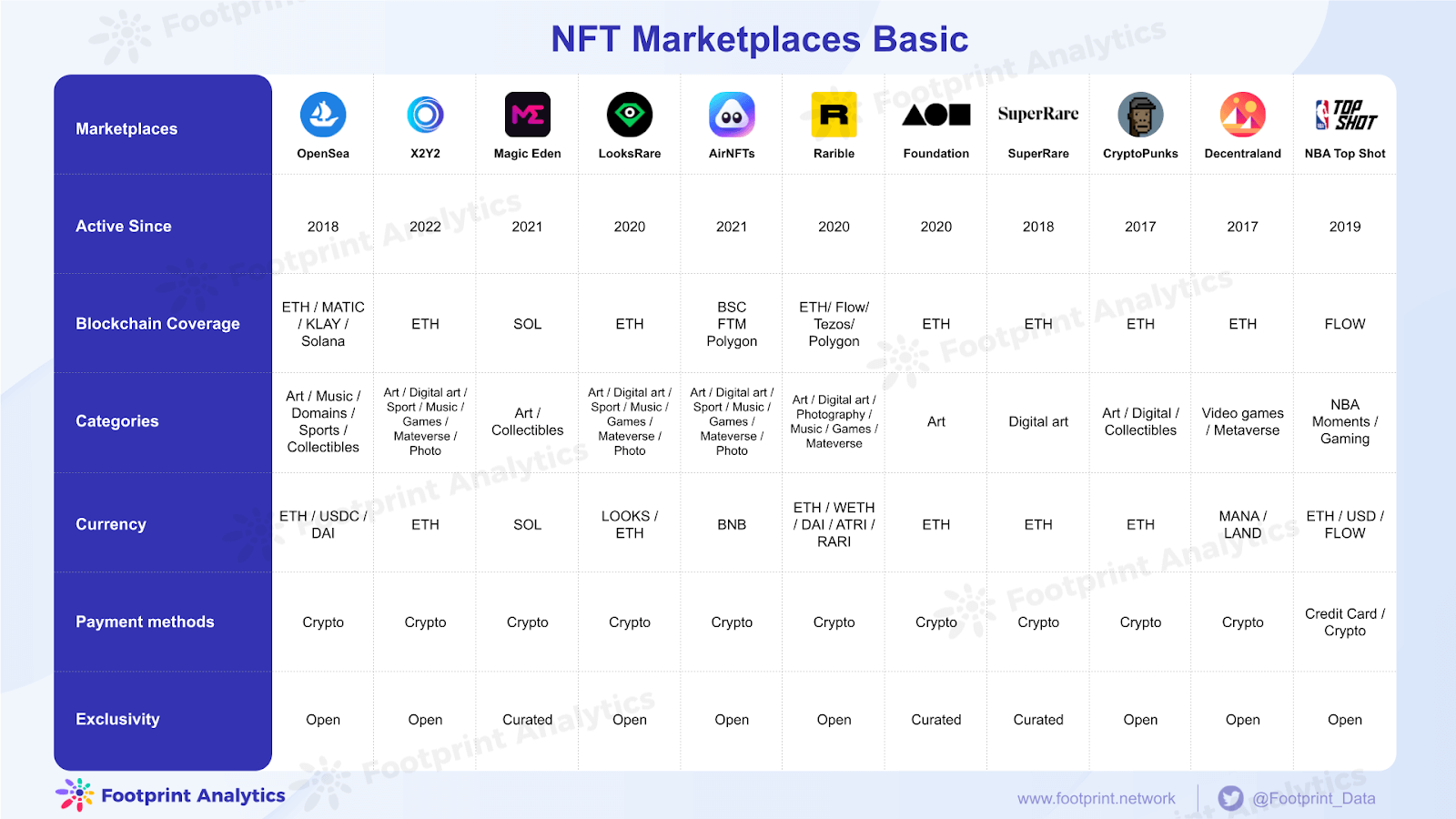

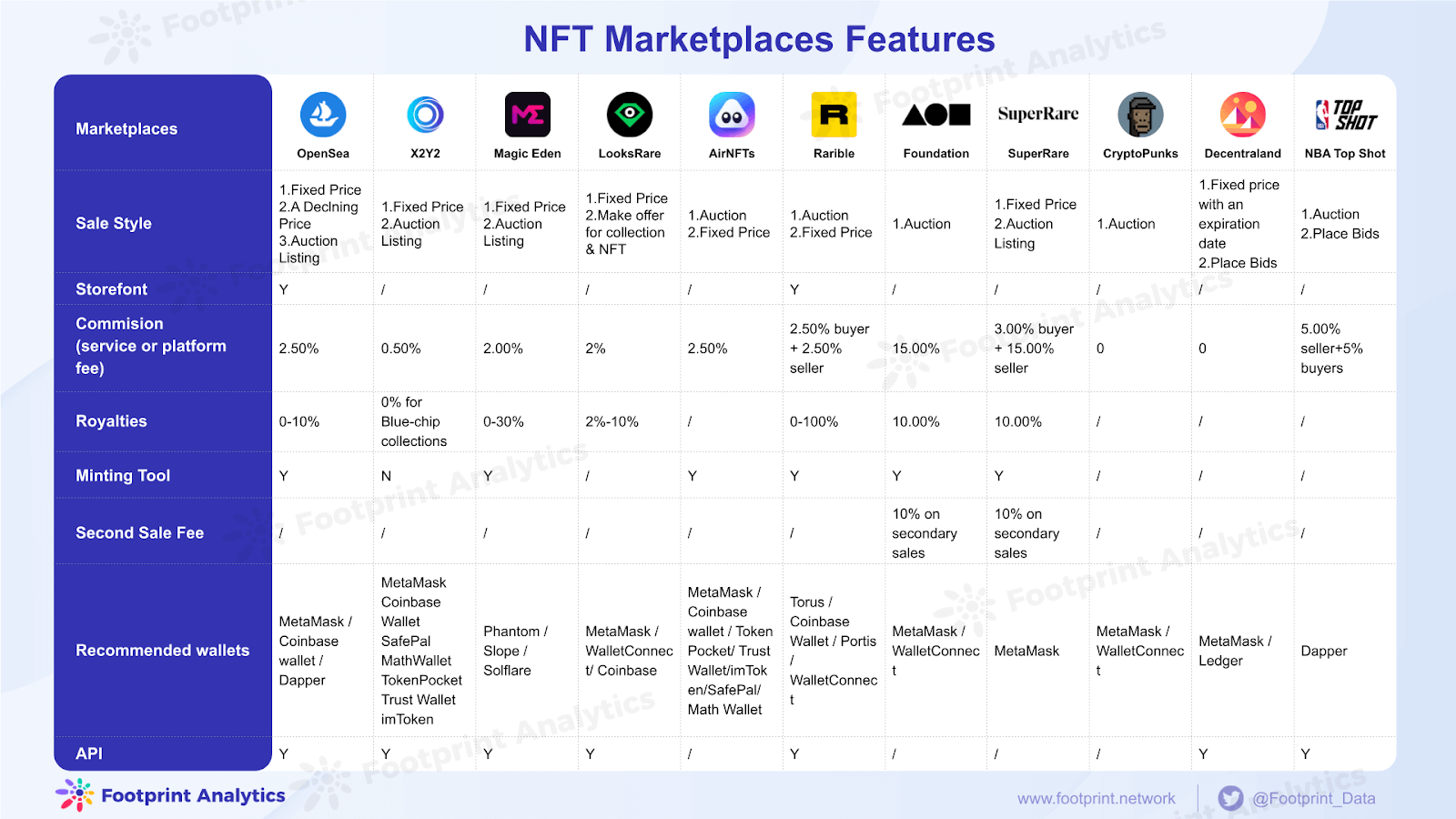

Footprint Analytics conducted extensive research on 11 mainstream NFT trading platforms to see how they differentiate themselves. Here are the results:

Top 5 NFT Marketplaces

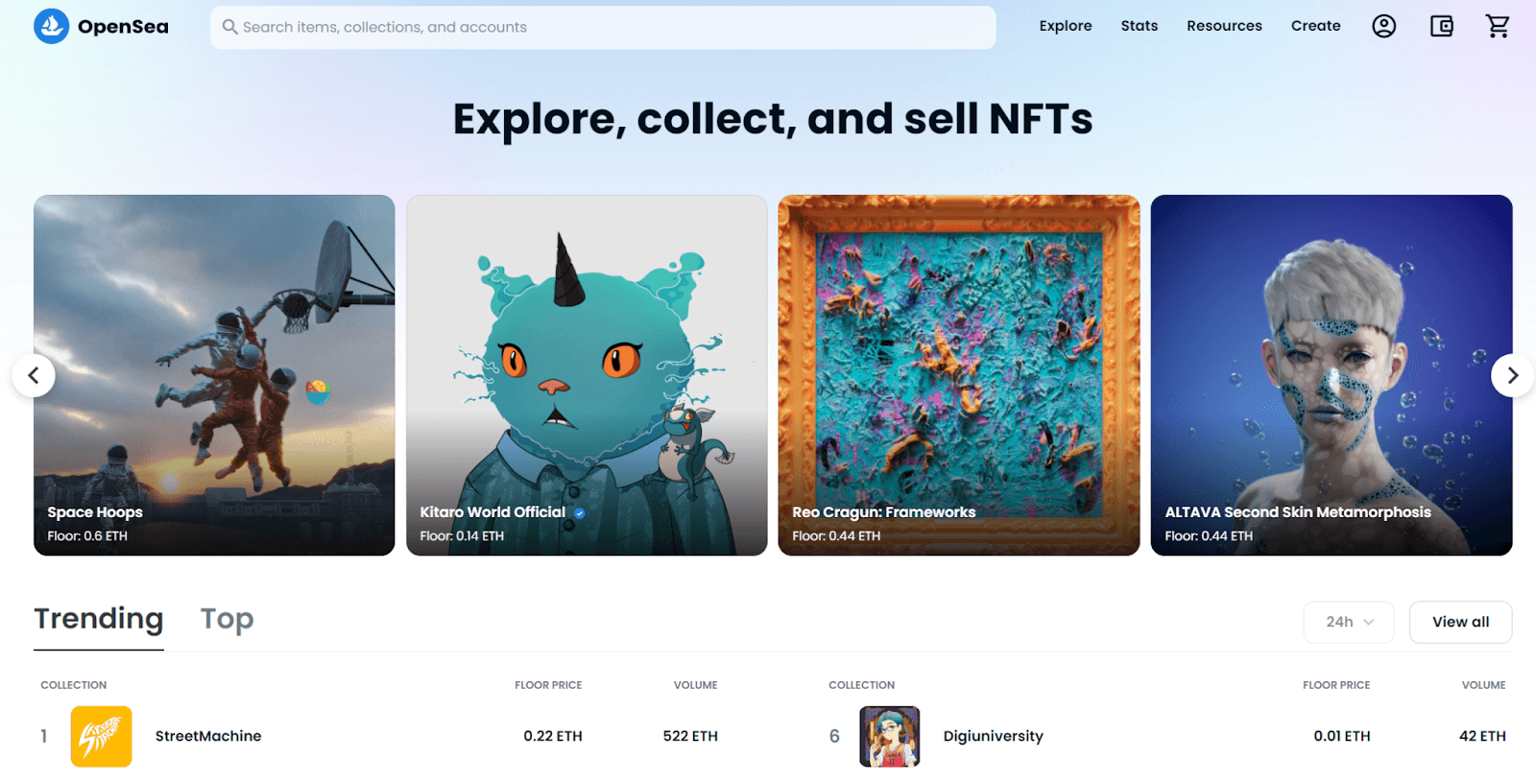

OpenSea

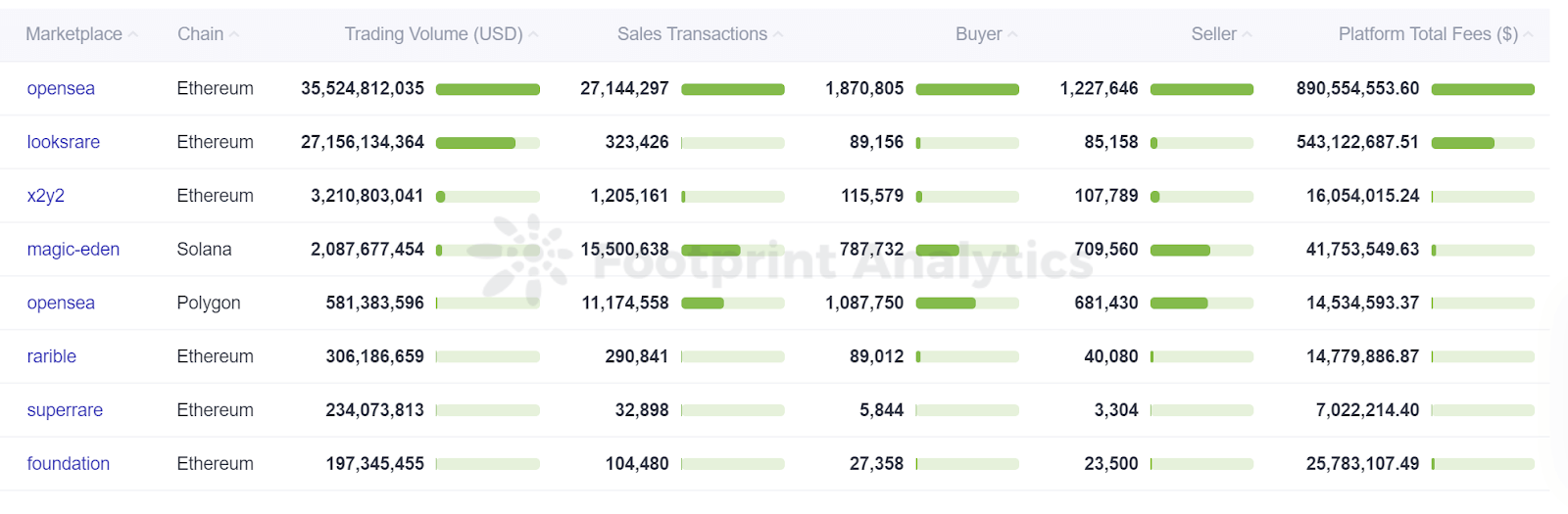

OpenSea is currently the largest and most popular NFT marketplace. As the chart above shows, it has a total trading volume of over $35.5 billion as of Oct. 8. The platform allows users to mint, buy, and sell a variety of NFTs, including digital assets of collectibles, artworks, virtual worlds, in-game items, and GIFs.

OpenSea focuses on trading on Ethereum and uses Ethereum’s smart contracts.

Users can quickly browse through popular and noteworthy emerging work on the homepage. In addition, users can set up an account and create NFT in minutes for free. These features make OpenSea a beginner-friendly platform.

However, OpenSea charges 2.5% per transaction, which is higher than some of its competitors. X2Y2 charges 0.5%, while LooksRare and Magic Eden charge 2%.

OpenSea is also one of the only NFT marketplaces (besides Rarible) with a dedicated mobile app.

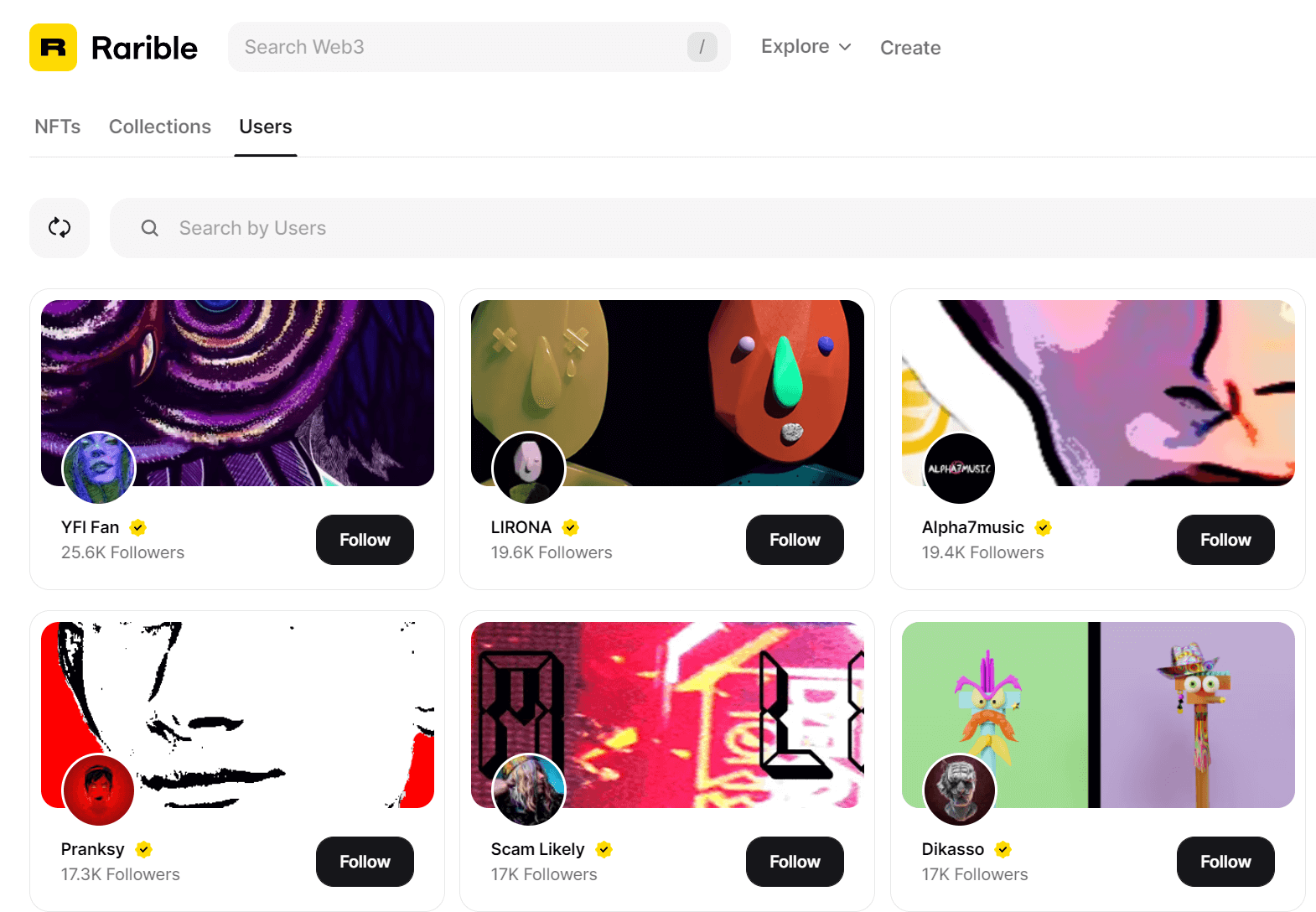

Rarible

Rarible was launched in Russia in early 2020 and differentiates itself from OpenSea by setting out to give users and creators more control and governance over the platform.

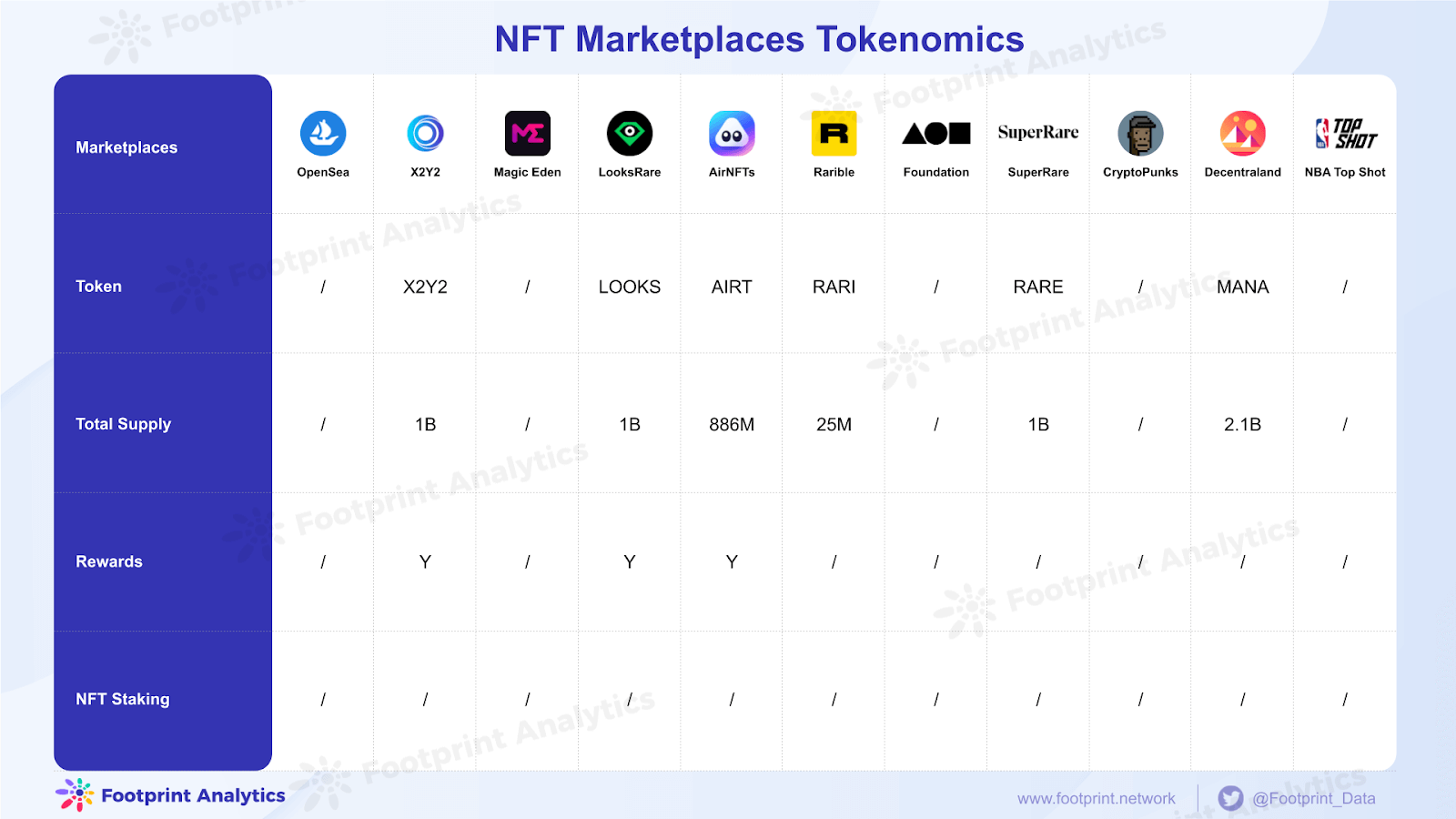

- Rarible has its own token, RARI, which can be used to buy and sell NFTs on the platform, and token holders can vote on changes to the company’s policies.

- While OpenSea just provides a marketplace to buy and sell digital assets, Rarible tries to create a space where creators have a say in how the platform is managed.

- OpenSea only charges the buyer 2.5%, while Rarible charges the same 2.5% to both buyers and sellers.

SuperRare

SuperRare positions itself as a slightly more high-end alternative to Rarible, whose interface bombards you with a dizzying array of flashing GIFs, while SuperRare has a more streamlined, artistic look.

The platform is a closed community with active social feeds and editorial pages with artist profiles. If an artist wants to be on the platform, they must submit an application to join SuperRare as a creator. It usually takes several months for an application to be approved, and once approved, your artwork will gain more value.

A 15% fee is charged for each sale, while a 3% transaction fixed fee is paid by the buyer.

SuperRare may be a good choice for users looking for higher-end NFT art.

Foundation

Foundation, like SuperRare, is a closed marketplace platform. It is run by a select group of artists and an invite by a current artist is required to list work.

NFTs on Foundation tend to be more expensive on average than on other platforms and retain their value longer.

When selling NFTs on Foundation, the artist receives 85% and the platform receives a 15% commission.

Decentraland

Decentraland allows users to create, own and trade virtual land, and landowners can use their virtual land to create experiences, games, and applications that other users can access.

Like Rarible, it issues a native digital currency, MANA, which also gives each MANA holder the right to vote in the Decentraland DAO. Decentraland is popular with its users because of its focus on user ownership, which, unlike other virtual worlds, is owned by its users.

How to choose the right NFT marketplace

When choosing an NFT marketplace platform, ask these 4 questions:

- How long has the platform been around? Although the length of establishment is not a decisive factor, the longer it has been around, the more stable it’s likely to be.

- What does the data say about the marketplace? Platform-related data includes the number of collections. If this is small, then it is difficult to find a specific NFT. Low liquidity sporadic changes to the number of buyers and sellers can make purchasing or buying NFTs at a fair price more difficult.

- How often are listings updated? See whether the marketplace is regularly updated—you want to quickly see the latest and best NFT work.

- Can I pay for things with the available methods? Some marketplaces now offer direct credit card purchasing of in-platform crypto onramps, which most require you to have a crypto wallet.

This piece is contributed by the Footprint Analytics community.

The Footprint Community is a place where data and crypto enthusiasts worldwide help each other understand and gain insights about Web3, the metaverse, DeFi, GameFi, or any other area of the fledgling world of blockchain. Here you’ll find active, diverse voices supporting each other and driving the community forward.

Footprint Website: https://www.footprint.network

Discord: https://discord.gg/3HYaR6USM7

Twitter: https://twitter.com/Footprint_Data

Sept. 2022, Vincy

Data Source: Footprint Analytics – NFT Marketplaces Analysis

The post NFT Marketplace Comparison | Quick Guide appeared first on CryptoSlate.