Key Insights

- Boba Network is a Layer-2 optimistic rollup scaling solution initially for Ethereum. It has since launched on Moonbeam, Avalanche, BNB, and Fantom.

- Boba has been on a downtrend in network activity since its Q4 2021 launch, but it has a new focus on blockchain gaming, NFTs, and metaverse.

- “Hybrid Compute” is a key feature that allows developers to leverage existing Web2 tooling for more powerful computation and data usage.

- Boba is positioning itself to be the solution for blockchain gaming across various L1s.

Primer on Boba Network

Boba Network (formerly OMG) is a L2 multichain scaling solution that launched on Ethereum in October 2021. During Q3 of 2022, Boba has launched on Moonbeam, Avalanche, BNB, and Fantom. As an optimistic rollup (OR) based on Optimism’s codebase, Boba offers:

- Reduced gas fees

- Increased transaction throughput

- L1 security guarantees

- EVM compatibility for smart contracts, such as NFTs

This network also has unique features that set it apart from other ORs and Optimism forks:

- Hybrid Compute – the ability to connect to off-chain APIs

- Multichain focus

- Fast Exit bridging to L1

- DAO governance

Boba’s combination of features — specifically Hybrid Compute — enables decentralized applications (dapps) to run at a fraction of the cost of L1 dapps, leverage off-chain computation via Web2 APIs, and provide the multichain solutions needed for blockchain gaming.

The Third Quarter Narrative

Boba has shifted its focus from general-purpose scaling to being a multichain solution for blockchain gaming. By settling into this niche, the network aims to regain adoption from users, developers, and protocols. Hybrid Compute is at the center of these plans.

Boba launched a mainnet L2 implementation on four different chains this quarter:

- Bobabeam (Moonbeam) on August 22

- Boba Avalanche on August 30

- Boba BNB on September 19

- Bobaopera (Fantom) on September 29

These moves made Boba the first-to-market L2 outside of the Ethereum ecosystem. With these integrations and partnerships, Boba has positioned itself to be the leading multichain scaling solution.

Hybrid Compute is a driving force behind Boba’s new partnerships. Blockchain gaming has high demands such as heavy computation, fast transactions, and access to APIs. Hybrid Compute solves all of these problems via access to Web2 infrastructure. Boba recently formed a partnership with EvoVerse, a 3D, play-to-earn, strategy game on Avalanche.

Performance Analysis

The quantitative data in this report is focused on the Ethereum implementation of Boba Network, unless stated otherwise. Implementations on other chains will be included in the analysis once more data is available.

Network Overview

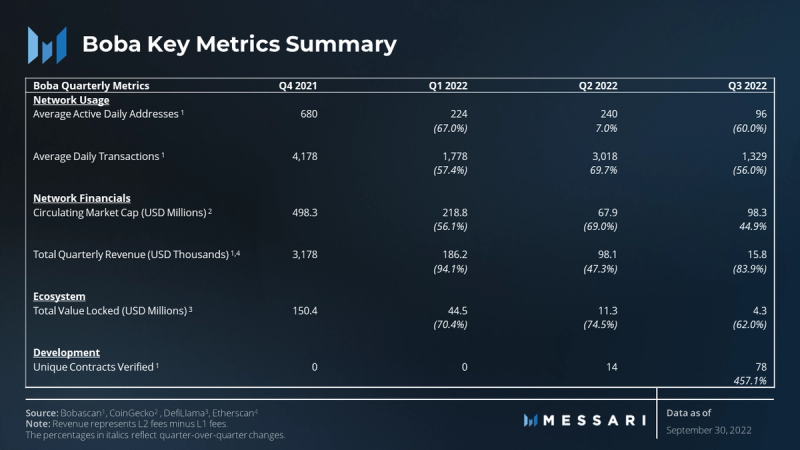

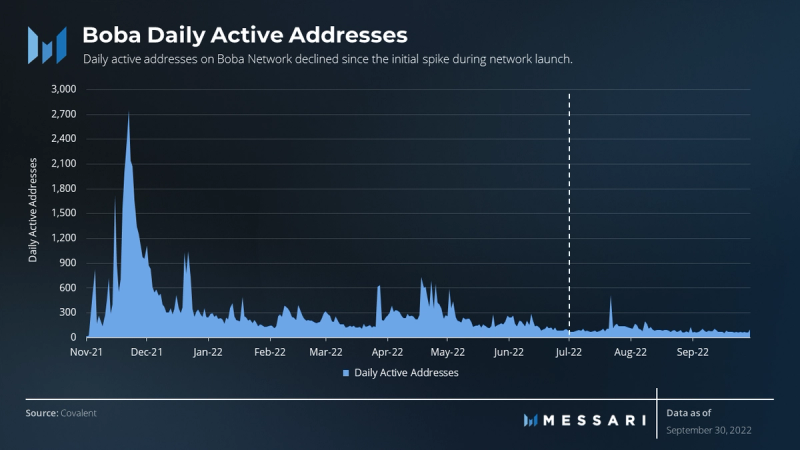

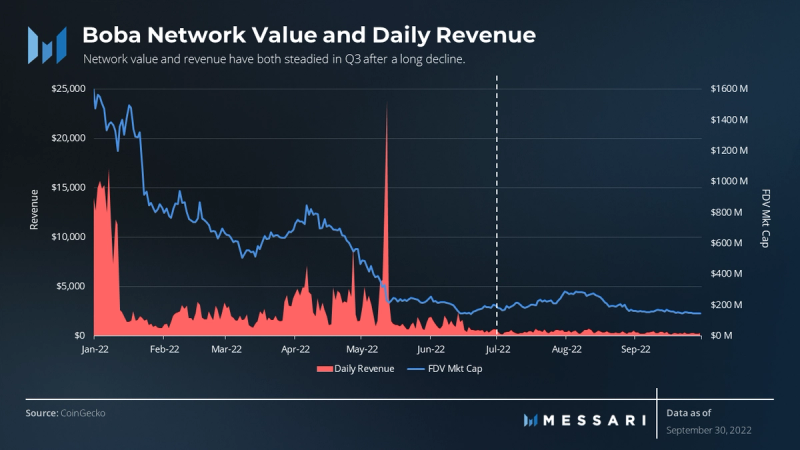

Most of Boba’s activity came when the network launched in Q4 2021. Since then, all network usage metrics have declined. On a positive note, circulating market cap did increase during Q3 2022. While the fully diluted market cap decreased, the 96% rise in circulating supply and relatively stable token price resulted in that 44.9% increase for circulating market cap. The token price’s relative resistance to the high inflation may be due to new announcements on the business development side, such as its integration with Avalanche.

As with other metrics, Q3 daily active addresses are an order of magnitude smaller than all-time-highs. During Q3, the increase in daily active addresses has leveled out around 100, and the total number of addresses on the network rests at almost 100,000.

On Boba’s other implementations:

- Boba Avalanche is averaging 24 daily active users.

- Bobabeam is averaging 11 daily active users.

- Boba BNB and Bobaopera don’t have enough data yet.

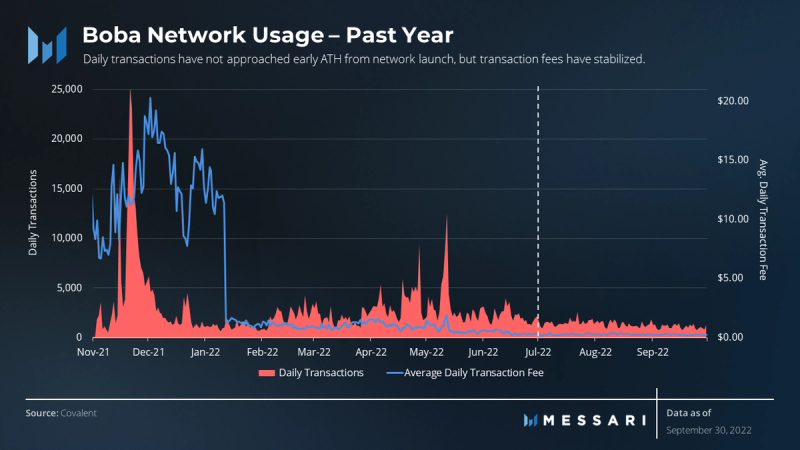

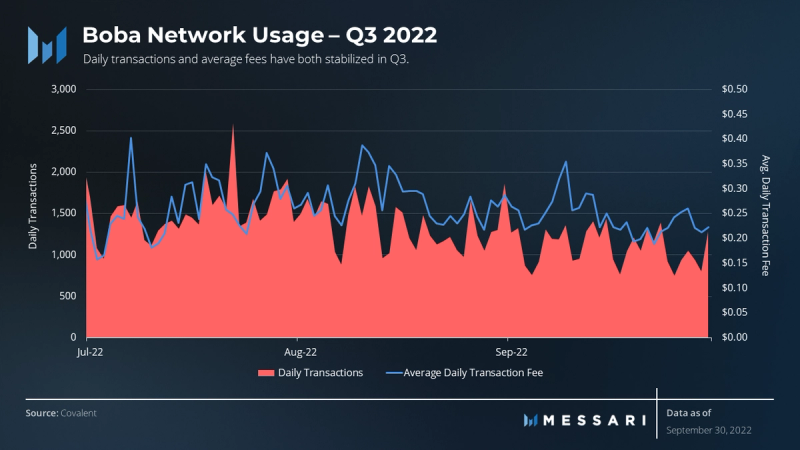

The average daily transaction fee stayed high due to high activity through January, which led to higher revenue and network value. Transaction fees lowered as activity decreased and have stayed extremely low. On the other hand, increased usage shows how rapidly revenue can increase as well. The spike in May was in reaction to the LUNA collapse, which triggered market-wide selloffs across networks including Boba.

Daily transactions on Boba found support in the 1,000-1,500 range during Q3. The average transaction fee also leveled off at around $0.25. Rollups batch transactions together before posting the data to mainnet. Batching transactions together means L1 fees are shared. Therefore, overall fees typically decrease as more transactions are included in any single batch.

Developer Overview

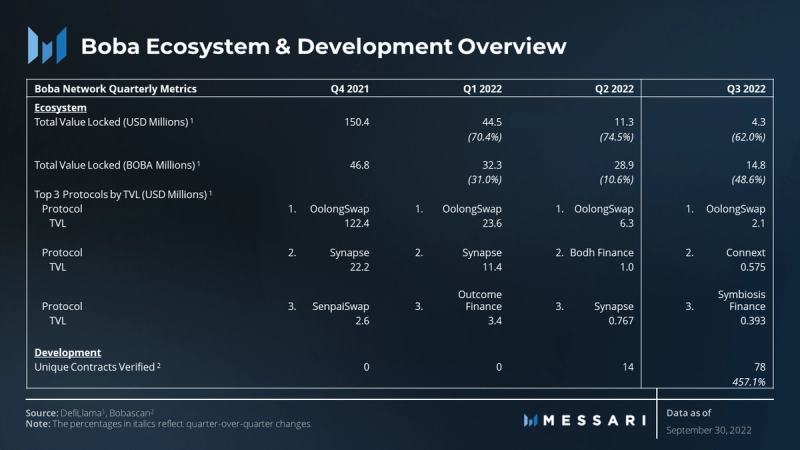

OolongSwap, the first native DEX on Boba, has maintained DeFi dominance by providing over 50% of Boba’s TVL throughout 2022. That dominance might get challenged as established DeFi protocols from other chains deploy on Boba — for example, SushiSwap launched on Boba at the end of Q3.

The number of unique contracts deployed on Boba is starting to grow, up over 400% QoQ from the 14 contracts it had in Q2. These new contracts are at least in part due to DEXs and other new DeFi protocols.

Ecosystem Value

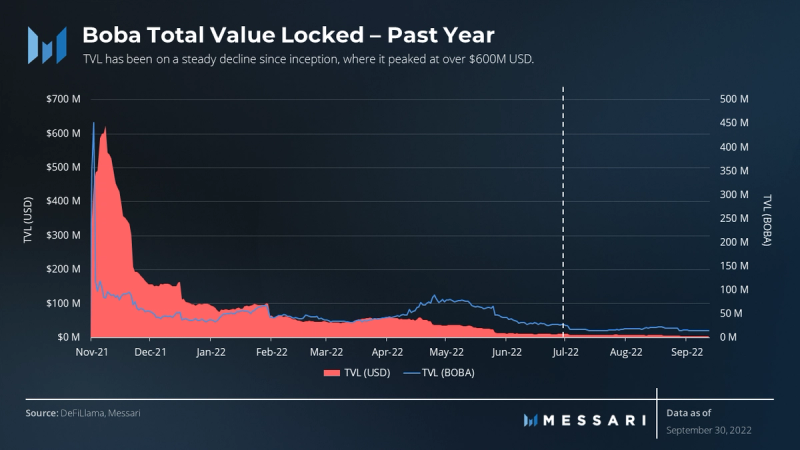

Boba’s TVL surged following the release of mainnet and the airdrop of the BOBA token to OMG tokenholders in November 2021. That surge proved to be unsustainable as TVL fell to record lows, followed by value leaving the ecosystem in the following weeks. TVL has been on a steady decline since that first spike, and the bearish 2022 market did the project no favors.

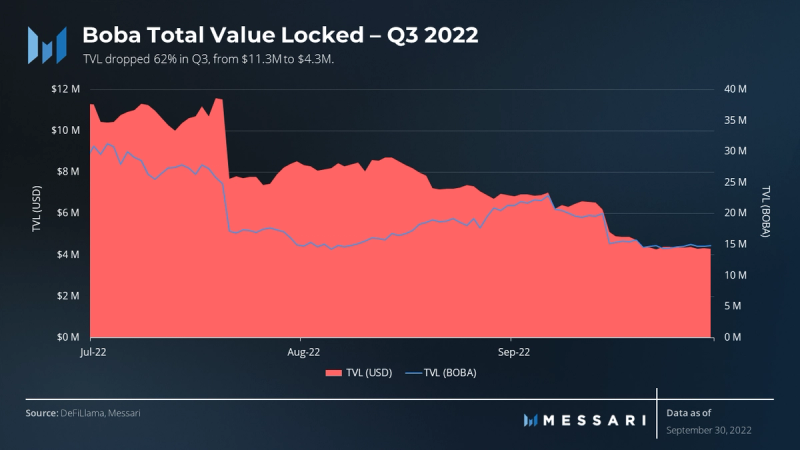

Zooming in on Q3 reveals a continued trend of declining TVL. TVL decreased by 62% in terms of USD in Q3, which is a slightly lower rate of decline compared to previous quarters. OolongSwap’s TVL decreased by a similar amount (66%), but it managed to maintain its ~50% TVL dominance. Some established DEXs such as Synapse decreased in TVL dominance, due to the growth in large protocols such as SushiSwap moving over from L1s.

Boba’s TVL success has largely been with native protocols. Network activity could increase with the continued development of native blockchain games such as Futuructa. GameFi is likely to be the next driver for TVL on Boba. The network plans to expand to even more L1s that are appealing to game developers. This direction aligns with the Hybrid Compute core feature, which provides on-chain access to APIs and other tools necessary for blockchain games.

BOBA Token, Staking, and Decentralization Overview

OMG to Boba

Boba Network was created as a rebranding of OMG Network when founder Alan Chiu of Enya Labs teamed up with the OMG Foundation. Boba was merged with the OMG community as BOBA tokens were airdropped 1:1 to OMG tokenholders on Nov. 19, 2021.

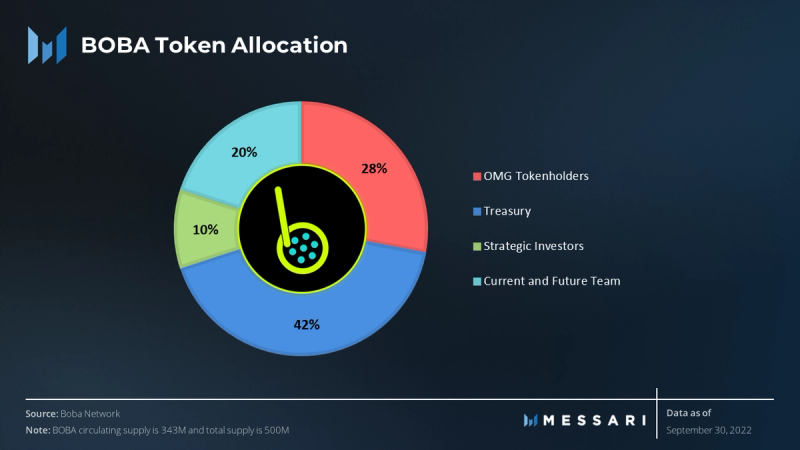

This airdrop represented 28% of the total BOBA token supply. Aside from gas and staking, BOBA is also the basis for voting on the Boba DAO, adding significance to the airdrop. Boba DAO proposals cover new features and other roadmap items.

As an Ethereum Layer-2 network, Boba transaction fees can be paid in Ether. It wasn’t until April 2022, after a DAO proposal passed, that users had the option to pay transaction fees in BOBA, which resulted in a 25% gas discount. Fees for Hybrid Compute calls are paid for in BOBA.

Today, the development of Boba Network is still maintained by the OMG Foundation, with Enya Labs being a core contributor. Enya Labs is responsible for bringing features to Boba such as “Fast Exit” to L1 and cross-chain bridging.

Staking

Stakers are given xBOBA tokens in exchange for their BOBA, allowing them to participate in DAO voting and governance. Boba DAO also controls the pools on L1 and L2 used for “Fast-Exit” transfers to L1.

Staking rewards are currently set at 3% and paid from the treasury. In the future when network fees stabilize, rewards will come from network transaction fees. At that time, rewards rates and fee sharing will be set by DAO proposals.

Boba’s engineering roadmap details its plans to implement veTokenomics — vote escrow tokenomics. This implementation would create veBOBA tokens and push financial and governance incentives for BOBA holders. Increased financial incentives and voting power will come at the cost of flexibility, as veTokens have to be locked for a long period of time.

Sequencers

Boba Network is currently fully centralized. The sole Sequencer node that orders and batches transactions to Ethereum mainnet is run by Boba Network. This centralization not only grants full control to Boba, but it also creates a centralized point of failure. Network funds could be frozen if the sole validator goes down. This will continue to be a risk for users until the roadmap item for escape hatches is realized.

Boba’s fraud proofs are still in development, and once they’re complete, the network will have the ability to decentralize. In the meantime, users can still run validator software and compute state roots locally — just not on-chain as a true Sequencer node.

Qualitative Analysis

Hybrid Compute

Blockchains are closed systems that cannot communicate with computers and functions outside of their ecosystem. Boba recognizes that having closed systems poses a problem for developers that want to off-load difficult computation or reference Web2 services.

Hybrid Compute allows developers to:

- Create advanced algorithms that are typically too expensive to run on-chain.

- Get millisecond response times.

- Generate random numbers and other resources that are risky to generate in decentralized computational environments.

- Access low-cost storage, image, and audio processing.

With Hybrid Compute, developers can leverage legacy Web2 systems and solutions to build higher quality blockchain games. Native games like Futuructa and games from new integrations such as Avalanche’s EvoVerse will soon benefit from these unique tools.

Fast Exit

Aside from classic OR exits, Boba offers swap-based rapid exits. Using liquidity pools, Boba can offer users near instant transfers between L2 and L1 due to the centralized setup. Users can add liquidity on either side: the L1 Fast Bridge Pool or the L2 Fast Bridge Pool. Because Boba has control over the sequence, it can safely transfer tokens to users on the other end without having to wait for finality on mainnet.

Fraud Proofs

Boba’s fraud proofs are not yet functional, which isn’t a problem because of the centralization of the project. That said, Boba will have to overcome this issue if they ever wish to decentralize the network. Currently, the non-functional fraud proofs pose a massive security risk if an invalid state root is somehow submitted. As it stands, the community can validate a state root with a fraud proof, but it’s ultimately up to Boba to act upon any errors.

DAO Governance

BOBA and xBOBA are used for voting on proposals in the Boba DAO. Any holder can propose and vote on governance updates. veTokenomics is a DAO proposal that was recently announced; the proposal does not yet have a voting date.

Engineering Roadmap

Aside from Hybrid Compute advancements, veTokenomics, and multichain scaling, Boba has plans in the next year for:

- Parallel transactions: executing transactions in parallel allows for a higher TPS.

- Account abstraction: abstracting child accounts from a single main account allows the main account to do things such as pay fees for its derived contract accounts.

- Escape hatches to L1: escape hatches offer greater security guarantees for users to remove funds from L2 without needing to rely on the Sequencer.

Competitive Analysis

Optimism and Arbitrum are two of Boba’s main competitors as a general-purpose OR (optimistic rollup). In fact, Boba is even based on Optimism’s source code. Optimism and Arbitrum have a massive head start over Boba in terms of adoption, as they boast $967 million and $1.05 billion in TVL, respectively, compared to Boba’s $4.3 million. The number of daily active addresses, protocols deployed, and unique contracts on Boba are similarly behind the competition.

With many ZKRs (zero-knowledge rollups) approaching mainnet, such as zkSync and Scroll, Boba’s “Fast Exit” will no longer offer an advantage. ORs typically take seven days for withdrawals, but ZKRs only take a few minutes and would match Boba’s speed.

Regarding L2s, Boba faces no established competitors in its gaming niche. Boba has already claimed its position as the first multichain L2 with its recent integrations, and it has more integrations on the way according to the roadmap. Future integrations with new L1s will improve liquidity and bring new users and builders to Boba.

Hybrid Compute offers access to Web2 APIs and services. Unlike decentralized oracle networks like Chainlink, which provide specific trustless approximations of truths, Hybrid Compute is more like a centralized pipe through which Boba can communicate with off-chain computers in real-time. Additionally, Boba is a full network that can offer blockchain games all the infrastructure they need, including oracle data.

Closing Summary

Boba Network is firmly behind some of the more established competition in terms of general-purpose scaling solutions, but it’s not taking the generalist approach. Emphasis on multichain scaling and enhancing Hybrid Compute are positioning Boba to be an attractive home for blockchain game developers, as seen in its new partnerships.

Although Boba has pursued a strategy of specialization in its offering, the protocol has continued its efforts to reach a large audience. Boba has just launched on four new chains and has plans for more. Boba’s new L2s (Moonbeam, Avalanche, BNB, and Fantom) share the features and functions of the original Ethereum L2. Although these L2 implementations are brand new, they will likely be large drivers of activity moving forward.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by Enya Labs, a member of Protocol Services. All content was produced independently by the author(s) and any opinion, estimate, or probability does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. Paid membership in Protocol Services does not influence editorial decisions or content. Crypto projects may commission independent research through Protocol Services. For more details or to join the program, contact ps@messari.io. Author(s) may hold cryptocurrencies named in this report, and each author is subject to Messari’s Code of Conduct and Insider Trading Policy. Additionally, employees are required to disclose their holdings, which are updated monthly and published here. This report is meant for informational purposes only and should not be relied upon. This report is neither financial nor investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Nothing contained in this report is a recommendation or suggestion, directly or indirectly, to buy, sell, make, or hold any investment, loan, commodity, or security, or to undertake any investment or trading strategy with respect to any investment, loan, commodity, security, or any issuer. This report should not be construed as an offer to sell or the solicitation of an offer to buy any security or commodity. Messari does not guarantee the sequence, accuracy, completeness, or timeliness of any information provided in this report. Please see our Terms of Service for more information.

Looking to dive deeper? Subscribe to Messari Pro. Messari Pro memberships provide access to daily crypto news and insights, exclusive long-form daily research, advanced screener, charting & watchlist features, and access to curated sets of charts and metrics. Learn more at messari.io/pro.