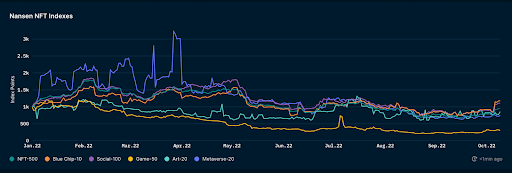

The NFT market has been falling down more and more, registering double-digit falls in USD year-to-date with Blue Chip collections in particular experiencing the least drawback in September 2022.

Revealing this data about non fungible tokens is a report that has been published by Nansen, an industry-leading blockchain data analytics platform.

The NFT market, similar to most global financial markets, has suffered from a sharp slowdown phase and rising inflation.

It has resulted in increased volatility across all categories of NFTs including the top 500 projects which reported a -20.6% loss as of 30th September 2022.

Gaming and Blue Chip NFT markets

Taking a deeper look at the sectors that are experiencing minor volatility, the report points to a -7.8% decrease in the top 10 Blue Chip NFT projects, as well as in social NFTs which were only down -7.9%.

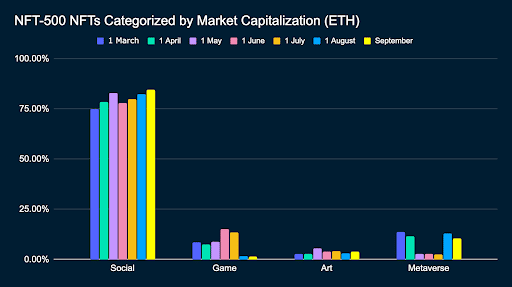

In the make-up of the NFT-500 (ETH) index, we see that the weighting of Social NFTs continues to increase in Q3.

Similarly, this was the case for Metaverse NFTs, although there was a slight decrease in weighting in the last month of Q3 (September). Art NFTs weighting remained relatively stable in the NFT-500 (ETH) index, with a slight increase in September. Lastly, Gaming NFTs dropped significantly in weighting for Q3, in line with its significant drop in market capitalization as an NFT sector.

But gaming NFT projects reported the worst performance with a decrease of -71.8%. However, the index also indicates that in the last 30 days of September, the market experienced a little increase.

The report further displays that Blue Chip NFTs remained the least volatile, and can be attributed to notable Blue Chip NFT sales such as BAYC #6388 – sold for 869.7 ETH, with a profit of 809 ETH, held for 377 days or CryptoPunks #3614 – sold for 275 ETH, with a profit of 265 ETH, in Q3 is a likely factor that contributed to the Blue Chip projects experiencing the least drawback year-to-date.

Compared to a previous analysis from Q2, the gaming and the art ecosystems have seen a decrease in overall growth.

The gaming sector saw the biggest drop in performance year-to-date when compared to other NFT fields.

In the last week of Q3, the weekly transactions and user counts were below all metrics. With Mints NFTs and OpenSea NFTs seeing a majority of the decline.

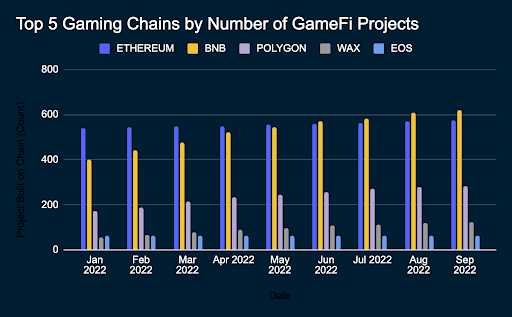

However, according to the analysis, Nansen’s scrutiny couldn’t ignore the fact that gaming NFTs are migrating to other chains, so this is why the Ethereum list is going down.

In fact, the report spotted an increase in GameFi related projects being built on chains such as BNB and Polygon.

Such a trend hints as a possible shift away from Gaming NFT projects being built on Ethereum, and moving to alternative chains instead.

Louisa Choe, Research Analyst at Nansen, said:

“Given the drop in NFT values and, thus, market capitalization, it is not surprising that the average spending per transaction on NFTs have dropped significantly since the start of 2022.

We can interpret that the NFT market participants remain cautious of the broad market conditions. However, more on-chain data is required to confirm this observation”.