Key Insights

- Compound III launched in Q3, offering a single borrowable asset across five deployments: WETH, WBTC, COMP, UNI, and LINK.

- Loan activity saw an uptick for the first time in three quarters, indicating a shift in market sentiment.

- Outstanding loans and deposits experienced robust growth in DAI and USDC markets, whereas most other markets declined.

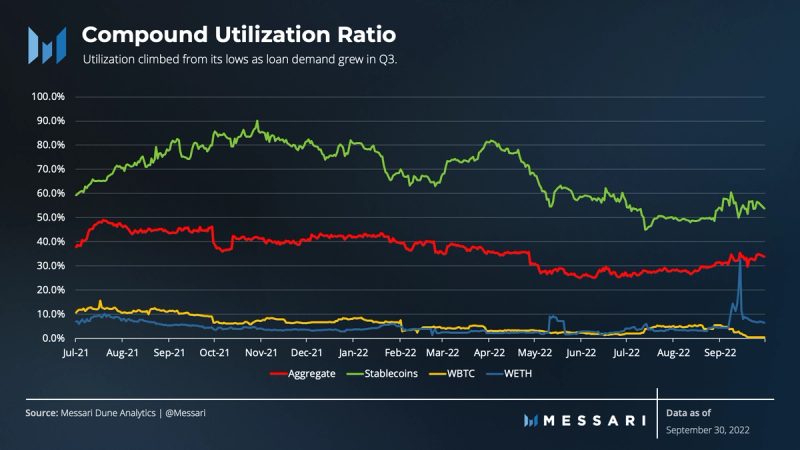

- Utilization improved substantially, slowly returning to the levels of UST (now USTC) and Celsius before their collapse.

Primer on Compound

Launched in September 2018, Compound is a leading interest rate protocol that enables users to permissionlessly borrow and lend assets from a pool of collateral. The interest rates for these assets are set algorithmically using an interest rate model based on the proportion of assets lent out. This is known as the utilization ratio. Compound launched its V2 protocol in May 2019, introducing additional assets, individual risk models, and smart contract gateways for each asset, among other features. In April 2020, Compound replaced the protocol administrator with community governance, empowering COMP tokenholders to take control of the protocol. In June 2020, Compound began distributing COMP to users via a pioneering liquidity mining program. The program reserves 42% of the total COMP supply to users over the next four years. On Aug. 25, 2022, the highly anticipated Compound III went live.

Performance Analysis

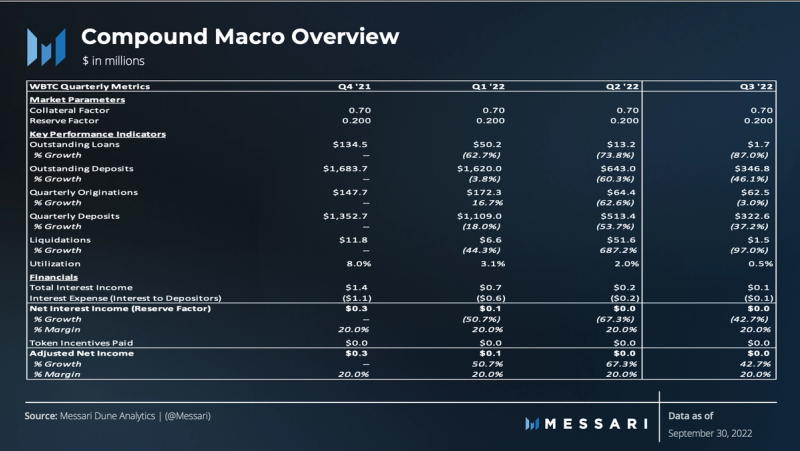

Macro Overview of Compound Markets

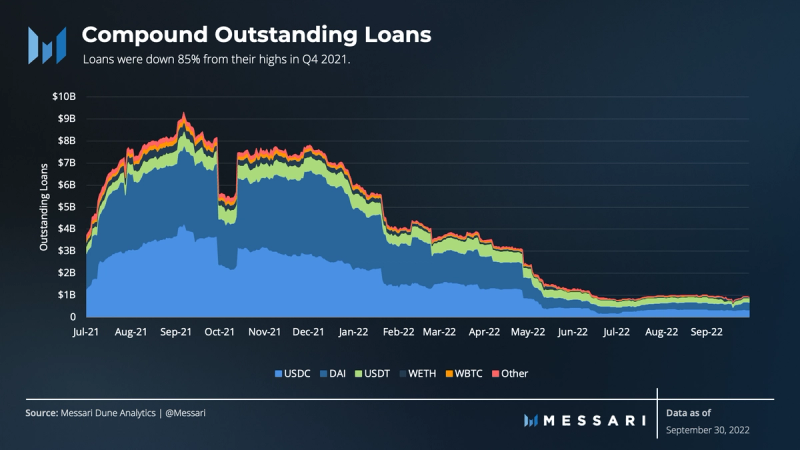

Deleveraging events in H1 2022 sent shockwaves through the market, but they appear to have settled as outstanding loans found a floor. On average, there were $914 million in loans outstanding in Q3. The quarter ended with $922 million in loans, down 14% QoQ but slightly above the average.

Consistent with prior periods, loans denominated in stablecoins continued to be preferred over other assets, representing 94% of outstanding loans.

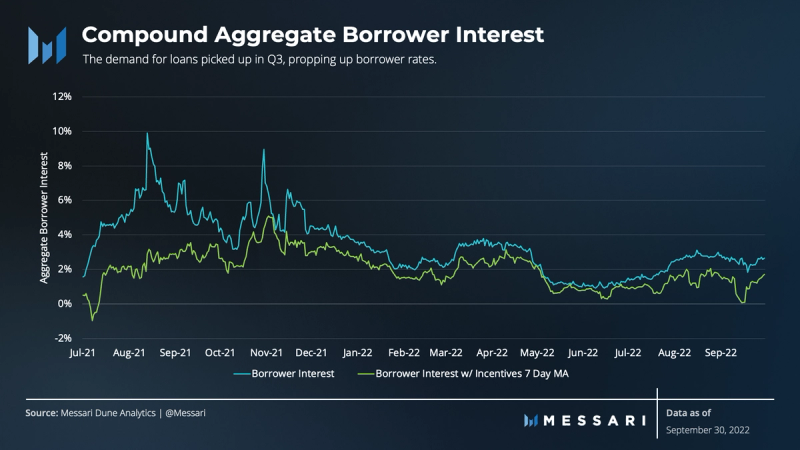

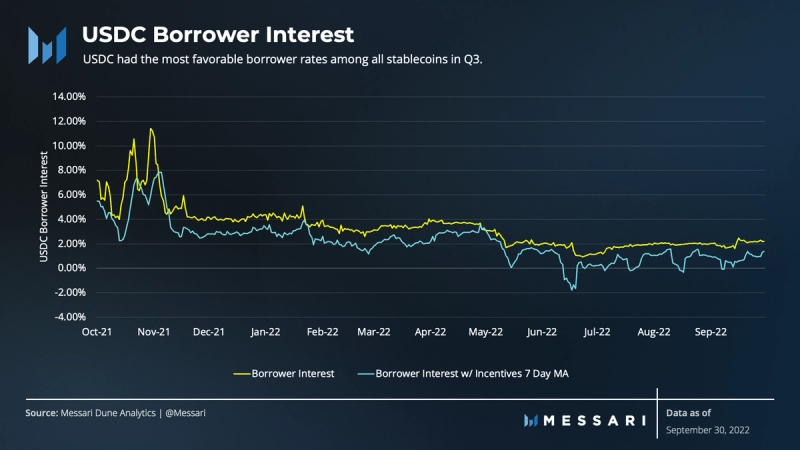

The cost of borrowing fluctuated in the first half of the year in correlation with the shift in loan demand. Aggregate borrowing rates have rebounded from their lows in June, approaching YTD highs. The average annualized borrower rate grew to 2.31% in Q3 (up by 22.2%).

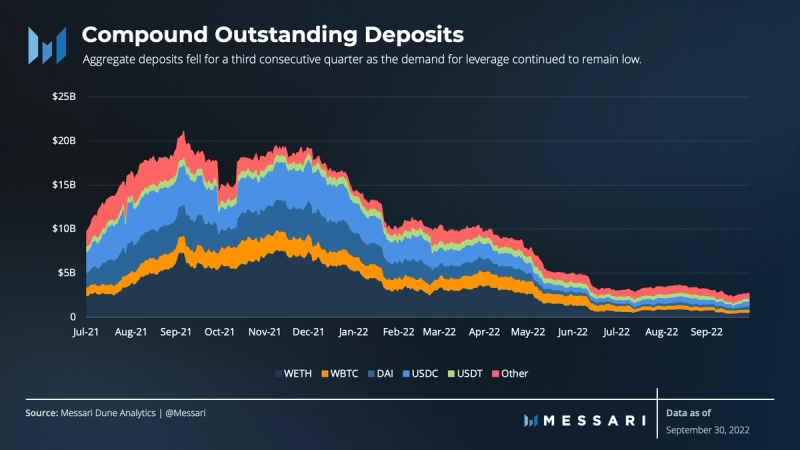

The demand for liquidity declined further, causing the flow of outstanding deposits to stabilize. Total deposits outstanding fell (-8%) to $2.7 billion in Q3. This applied downward pressure on depositor rates as the appetite for leverage waned.

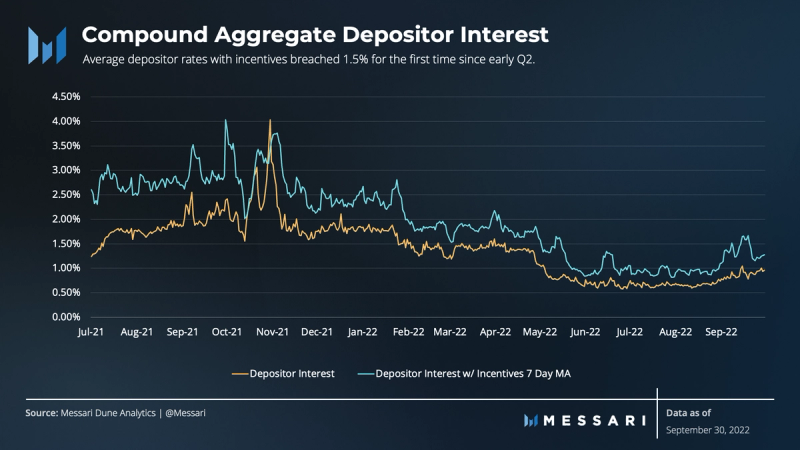

As a result of less demand for liquidity, aggregate annualized depositor rates fell to new lows (0.60%) in August before ending the quarter at around 1%. Until the market shifts and the demand for liquidity increases, these low rates are expected to persist.

Compound’s aggregate utilization ratio has declined rapidly since 2021, but saw the first improvement QoQ. In Q3, the average utilization ratio was 29.7% compared to 29.6% in the prior quarter. Overall, aggregate utilization improved, approaching the levels right before UST collapsed.

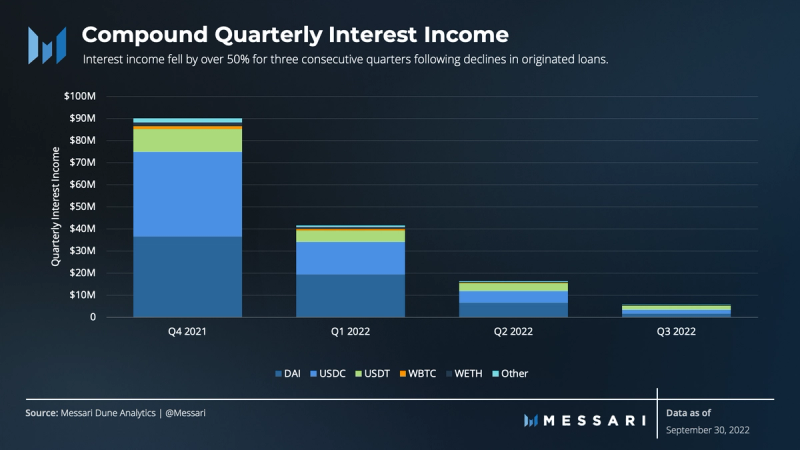

Interest income declined by 65% in Q3, following a 60% decline in the prior quarter. Although there was a $111 million increase in outstanding loans, most were denominated in DAI and USDC. Loans in USDT, however, declined by 32%. Borrowing rates were most competitive for loans in USDT during 2022, which was the primary driver of interest income in Q3. WBTC and WETH interest income accounted for less than 8% of the total and was mainly unchanged QoQ.

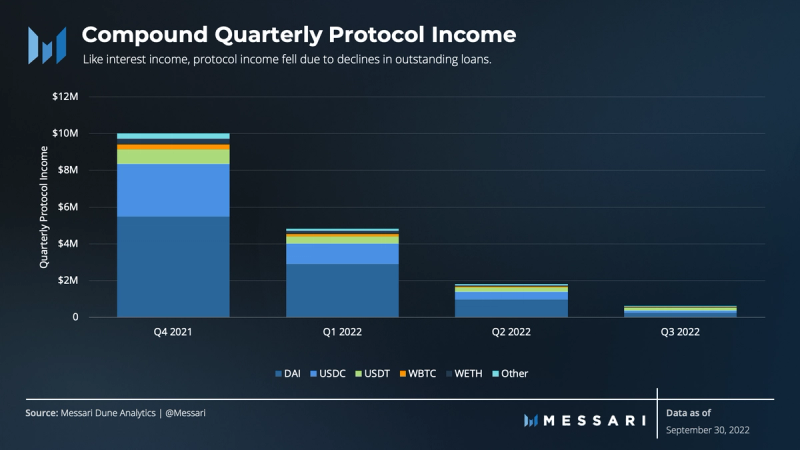

Protocol income fell 66% from $2 million to $0.6 million in Q3. As with interest income, DAI, USDC, and USDT were the primary contributors to protocol income due to the sheer dominance of loan demand.

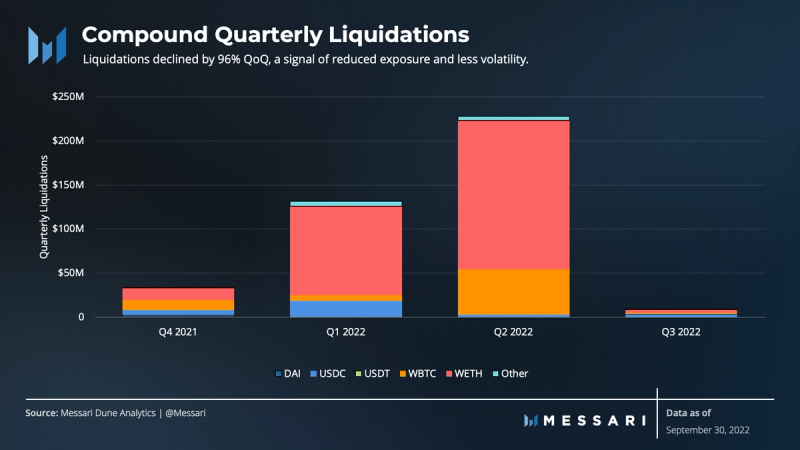

Liquidations on Compound hit 12-month highs in H1 2022 due to a massive liquidity crisis caused by the UST and centralized finance (CeFi) collapse. The liquidations followed market peaks at the end of Q4 2021, which brought a high appetite for leverage. The events in Q2 resulted in rapid liquidations as users panicked to reduce their exposure by unwinding their WBTC and WETH leveraged loan positions. Those events effectively thrust the market into crypto winter, where the demand for leverage reached new lows, evidenced by a decline in loans and deposits for Compound.

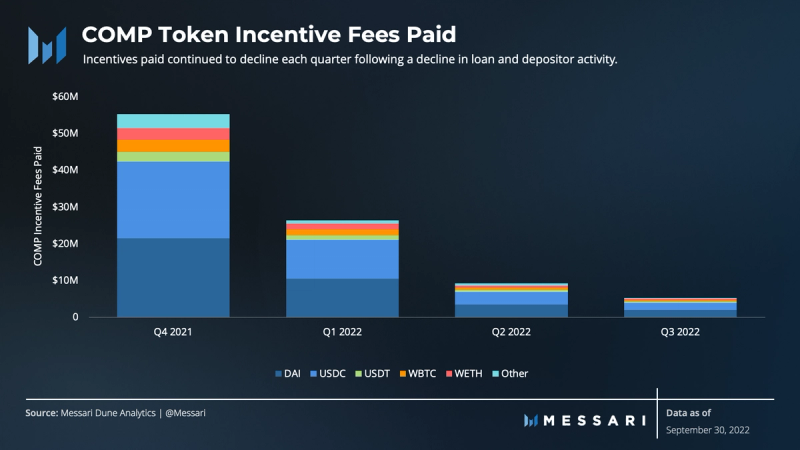

Since the release of Proposal 092, COMP incentives were cut in half and are expected to decline going forward. The further decline in loan and depositor activity accelerated the drop in incentives paid (-43% QoQ).

Micro Overview – Compound’s Five Largest Markets

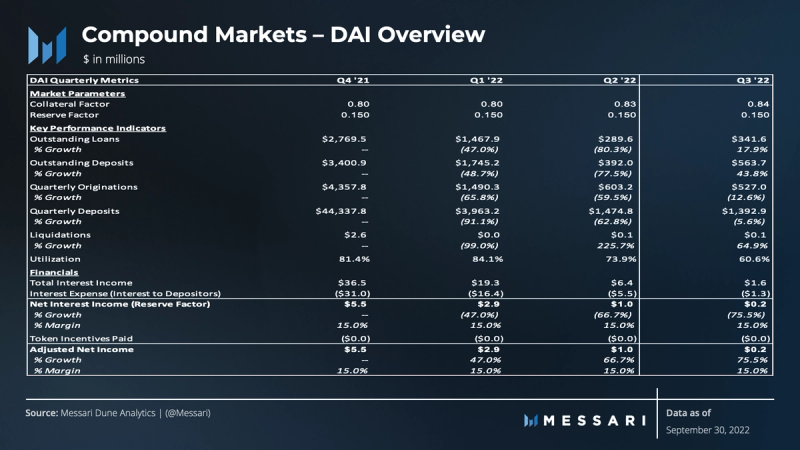

DAI continues to maintain dominance in outstanding loans on the protocol. DAI loans declined rapidly in the first half of 2022 but found their footing in Q3, growing 18% QoQ. In addition to the $52 million increase in outstanding loans, outstanding deposits grew by $171 million during the quarter, despite a ~100 basis point decline in DAI average depositor rates.

The growth in loans and deposits marks a significant shift in behavior, perhaps suggesting a change in user confidence in Q3. Interestingly, the resulting shift in user activity resulted in $55,000 in liquidations QoQ. Although the total interest income declined for the third quarter, the adjusted net income remained positive, growing 76% in Q3.

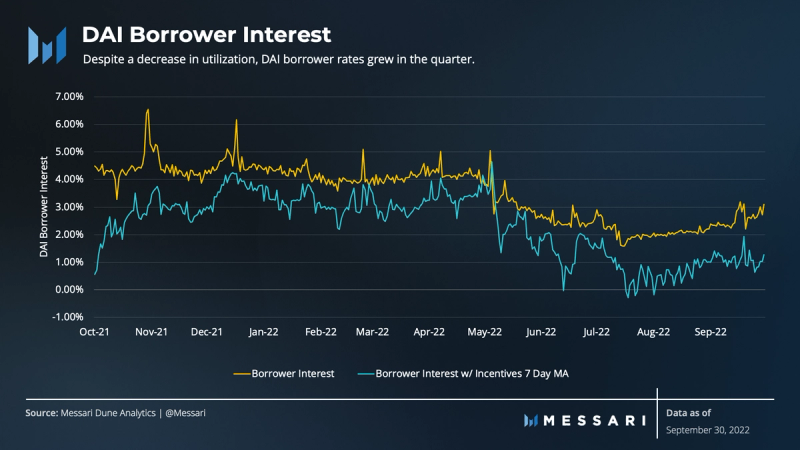

The utilization ratio fell to 61%, its lowest in over 18 months. The drop put downward pressure on depositor rates as borrowers’ demand for liquidity fell. As a result, loan demand and borrower rates came under downward pressure. Despite a decrease in utilization, the cost of borrowing DAI has effectively increased since the beginning of the quarter.

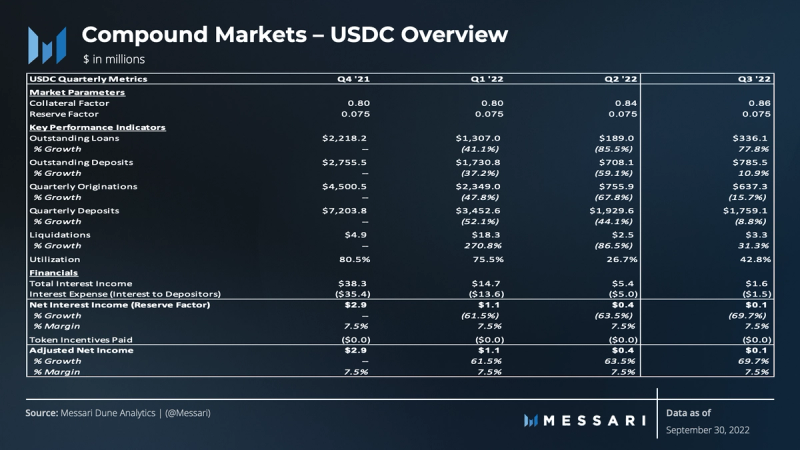

Despite having the lowest depositor rates, USDC continues its lead in outstanding deposits, growing by $77 million in Q3 following several quarters of declines. Loans denominated in USDC grew by nearly $150 million QoQ.

In Q3, USDC had $777,000 in liquidations which accounted for 37% of total liquidations on the protocol. The increase in the collateral factor, paired with some volatility, likely spurred liquidation growth during the quarter.

The cost of borrowing USDC on average was 1.93% in Q3, which is much lower than DAI and USDT during the same period. Borrowing rates hit highs of nearly 2.50% in Q3, similar to the average annualized rate of 2.52% in Q2. The growth in loans is strongly related to USDC’s low cost of borrowing relative to other assets.

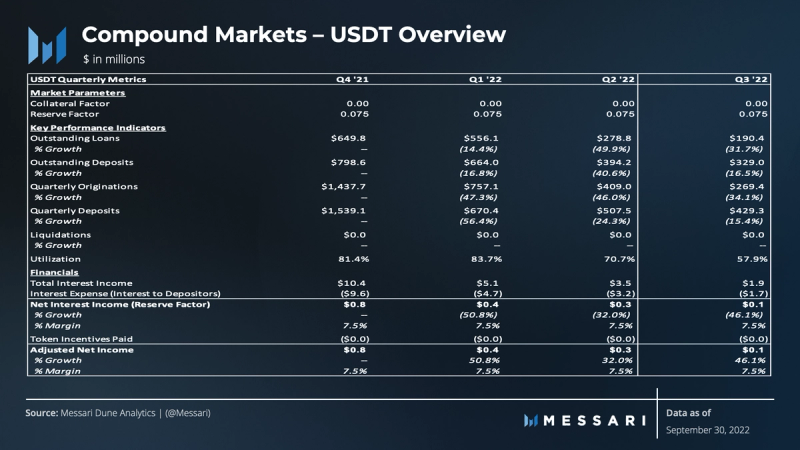

Unlike DAI and USDC, USDT saw a decline in all of its key metrics. Outstanding loans and deposits fell by $88 and $65 million, respectively. USDT’s utilization ratio fell toward lows seen in Q2 of last year.

The decline in loans is likely a result of the higher cost of borrowing. However, USDT offers strong depositor rates compared to other assets. In other words, a decline in deposits relative to USDC and DAI suggests more attractive yields for USDT elsewhere.

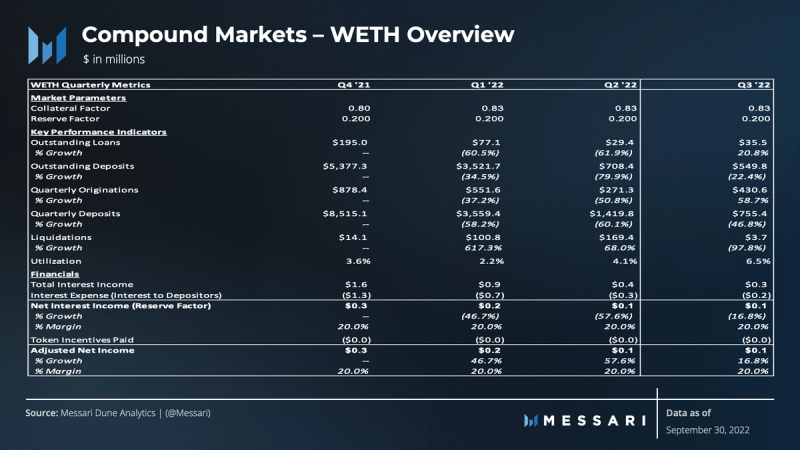

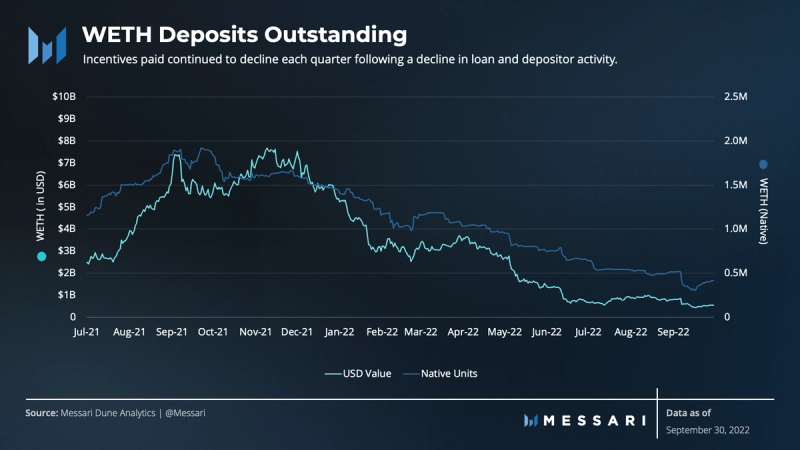

Outstanding loans in WETH grew by 21% QoQ. The $6 million increase followed a tumultuous H1 2022, wherein market prices fell sharply and liquidations steamrolled the ETH markets. Liquidations fell by -98% QoQ, a result of increased market stability felt in the quarter. The loan growth signaled a change in confidence as users levered up for the second half of 2022. In contrast, the 22% decline in deposits coincided with little incentive for depositors due to the unattractive yields of ~0.15% in Q3.

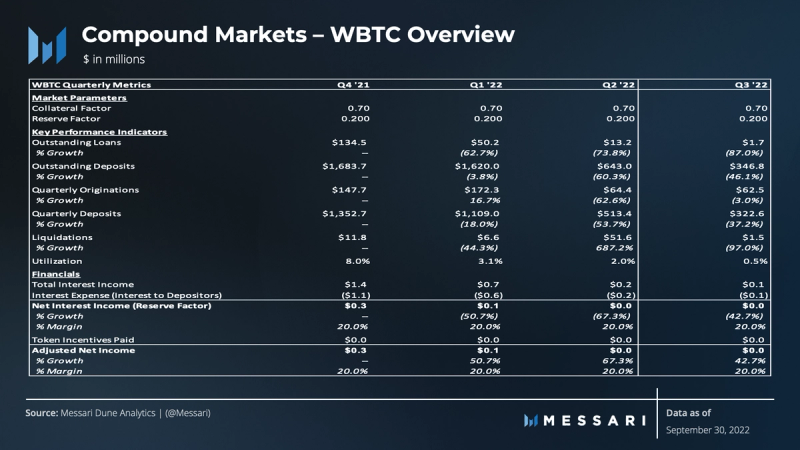

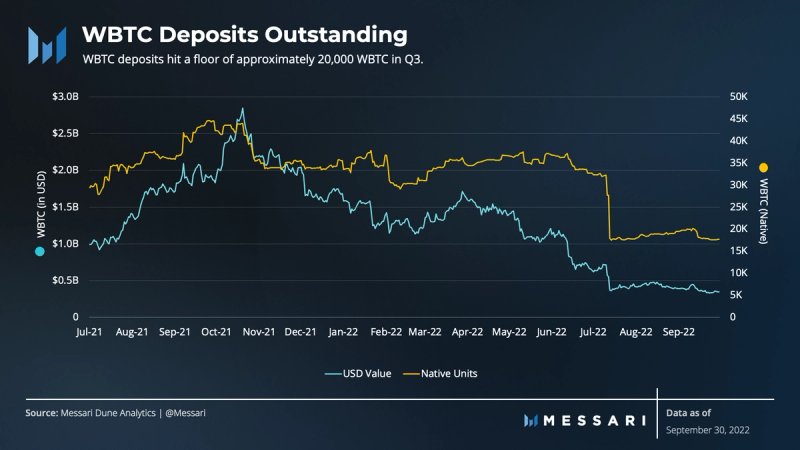

Key metrics on WBTC fell across the board in Q3. Outstanding loans and deposits declined by 87% and 46%, respectively. Loan demand fell by 99% since its peak in early 2021. The lack of demand resulted in WBTC’s utilization hitting all-time-lows as supply dynamics of WBTC markets continued to deteriorate. Outstanding deposits hit a floor in native terms of approximately ~20,000 WBTC in Q3.

Compound III launched at the end of August, featuring a single borrowable asset within each deployment. There are five deployments: ETH, BTC, LINK, UNI, and COMP. These assets can be used as collateral to borrow USDC. Although users can no longer earn interest on deposits in Compound III, users can now benefit from greater borrowing and reduced risk of liquidations and penalties.

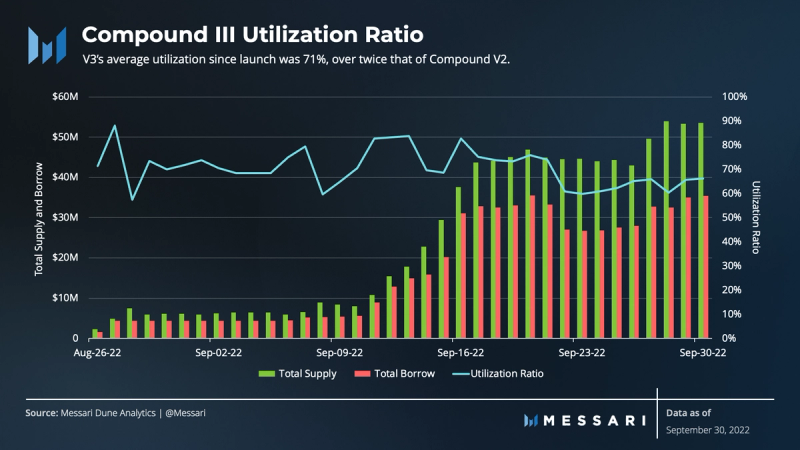

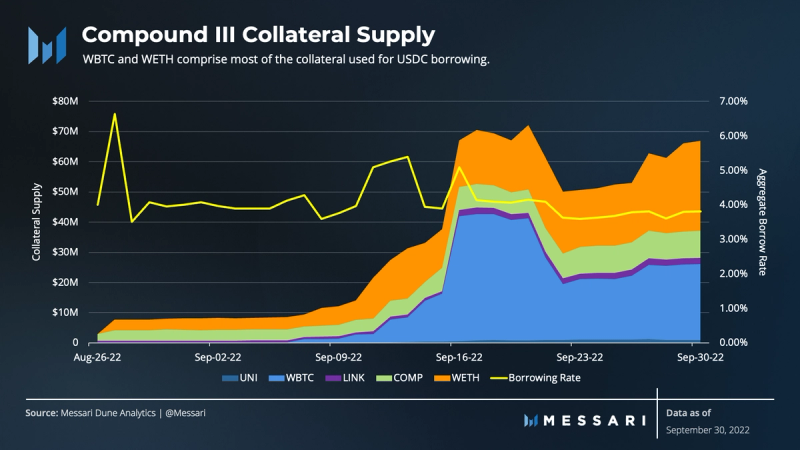

Since the launch on August 22, 2022, users have pledged $53.5 million in collateral and borrowed $35 million. The quarter ended with a 66% utilization ratio, maintaining an average of 71% since launch. For reference, Compound V2 had a utilization ratio of 34% in Q3. Although the aggregate borrow in V3 only represents ~6% of the total borrow between the two, the greater utilization ratio results from more favorable borrowing terms.

The borrower rate exceeded 6% at launch, and it improved significantly as more users pledged collateral throughout Q3. Additionally, collateral denominated in WETH and WBTC accounted for 88% of total collateral, with COMP reflecting roughly ~10%.

There were ~500 V3 users by the end of September, and 57% of those users had used V2 in the past. Approximately 9% of the deposits into V3 came from users who also had withdrawal activity on Compound V2 in Q3.

Qualitative Analysis

Governance & Key Events:

Compound governance was very active in Q3, with 12 executed proposals, one of which was the monumental launch of Compound III.

Compound III

Proposal 116 – USDC on Ethereum to be the first market on Compound III. This also creates supply caps for five collateral assets and transfers 500,000 USDC controlled by Compound Governance into the market as initial reserves. The five collateral assets are COMP, WBTC, WETH, UNI, and LINK.

Proposal 124 – Compound III users in the COMP distribution by reallocating 161.42 COMP per day from V2 markets. In addition, 25,000 COMP will be transferred from the Comptroller to the Compound III Rewards contract, representing 154 days of distribution before governance intervention is required.

Parameter Optimization

Gauntlet released risk parameter updates with Proposal 111 to change the collateral factors for cUSDC and cDAI to 85.5% and 83.5%, respectively.

The Tribe DAO decided to unwind FEI, so Proposal 123 takes the initial steps to deprecate the FEI market.

In preparation for the Ethereum Merge, Proposal 122 placed a 100,000 ETH borrow cap and updated the interest rate model to a jump rate model. These steps were taken to avoid an excessive disruption that could’ve been caused by Ethereum’s transition from PoW to PoS and any potential forked ETH tokens.

Partnerships

To address market volatility, Proposal 110 enables OpenZeppelin to receive its next quarterly payment in a lump sum rather than a continuous stream.

Gauntlet renewed a 12-month engagement with Proposal 125. Gauntlet’s Risk Management platform has worked to maximize the protocol’s capital efficiency over the past three years.

Updates

Following the launch of Compound III, a bug effectively caused the cETH market to freeze. GFX Labs’ Proposal 117 aimed to upgrade the protocol’s oracle contract from V2 to V3, switching the anchor market from Uniswap V2 to V3. Despite a review from three auditors, the price feed update contained an error causing transactions to revert for both ETH borrowers and suppliers. Proposal 119 resolved the issues caused by the previous oracle update.

Long-time contributors Getty and GFX Labs announced their departure in Q2. The execution of Proposal 113 formally brought closure by ending the contributor grant.

Grants Program Overview

Version 1.0 of the Compound Grant Program successfully funded over $1 million across 30 grants. Discussions around CGP 2.0 started gaining traction at the end of Q2 and into Q3 as a temperature check made its rounds in the governance forums. Questbook is currently spearheading the initiative. It will help create and delegate domain allocators to be in charge of managing their respective domains. These allocators will be chosen by the community based on their expertise. A formal vote should take place in Q4.

Closing Summary

Last quarter established that DeFi was resilient. Following a tumultuous H1 2022 of deleveraging and global economic uncertainty, Compound’s increase in loan activity in Q3 could suggest a possible shift in sentiment.

The deployment of Compound III did kick off with some challenges, but it has since been running smoothly. Users can now access a simple but effective lending platform, which could attract a wider audience.

Revitalized conversations around CGP 2.0 and positive feedback from the community helped steward the concept of delegated domain allocators, which could attract further development to the protocol if implemented.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form.

Looking to dive deeper? Subscribe to Messari Pro. Messari Pro memberships provide access to daily crypto news and insights, exclusive long-form daily research, advanced screener, charting & watchlist features, and access to curated sets of charts and metrics. Learn more at messari.io/pro.