The lure of leverage has created yet another major collapse within the wider cryptocurrency industry.

This is an opinion editorial by Josef Tětek, the Trezor brand ambassador for SatoshiLabs.

So FTX is rekt after all. As we’ve witnessed throughout the year, even the “reputable” industry actors are basically just high rollers who got lucky for some time — until reality catches up with them.

Bitcoin is an unforgiving phenomenon. The sheer reality of its 21 million limit and the intrinsic inability to print any more should put everyone’s ego on mute; but from time to time there come individuals who think they’re larger than bitcoin. Zhu Su and Kyle Davies. Alex Mashinsky. Do Kwon. Sam Bankman-Fried. The one factor they had in common is called leverage.

Leverage may sound like sophisticated financial lingo, but it’s essentially just borrowing money in order to buy financial assets. Since lenders in such transactions are taking on risk — the purchased assets may fall in value and the borrower might not be able to repay — they usually request some form of backing, a collateral. And this is the crux of the problem: the individuals named had very little of their own collateral, so it appears that they essentially did two things: (a) made up a thing — a “token” — and persuaded a sufficient amount of people that it has real value and can be used as a collateral; and (b) probably used their users’ deposits as collateral.

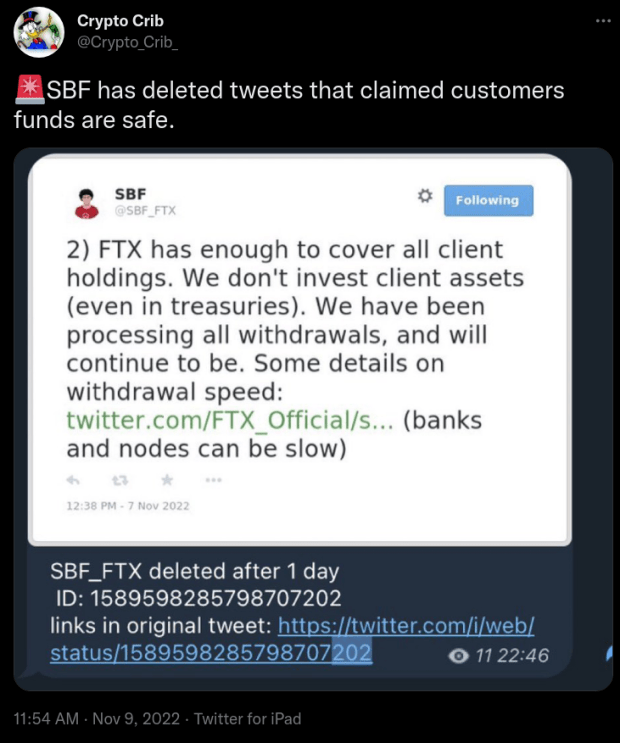

In FTX’s case, the most likely scenario seems to be that they did both: leveraged the thinly traded FTT token to undergo “investments,” while running a fractional-reserve operation with users’ funds. After Binance’s CZ popped the bubble with a single Twitter thread, it seems that both the FTT holders and FTX depositors are getting wiped out (depending on the details of Binance’s potential acquisition of FTX). Also out of their money are the equity investors, including Ontario’s Teachers Pension Fund.

Evading The Crossfire

The spectacular collapse of FTX has affected bitcoin markets as well, indicating that it’s not just those directly involved who can be hit hard by these games. At the time of writing, bitcoin has lost 14% of its exchange rate value over a seven day period; that might not affect serious long term HODLers, but it does affect many that try to leverage trade or speculate on short term moves.

This is to say that there are multiple ways how the recent events might have caused a significant loss:

Holding an exchange token. This one is obvious. Whoever holds a token of an exchange that is going under will be seriously harmed. At the time of writing, FTT has lost over 80% over a 24-hour period.

Holding an exchange balance. FTX account holders have seen their balances frozen and withdrawals suspended — this obviously affects holdings of any kind. Whoever thought they “owned bitcoin” while only holding a bitcoin account with FTX now knows better. I get it: some people simply feel more comfortable buying via an exchange than in a peer-to-peer setting; but if you do that, at least withdraw your bitcoin straight to your wallet!

Leverage trading bitcoin. Whenever a large exchange/crypto fund/crypto project goes under, bitcoin’s volatility increases. While the FTX events were unfolding, bitcoin’s exchange rate moved +5%, followed by a -13% drop, all within a span of several hours. Holding a leveraged position at the time would have very likely led to a liquidation.

Overexposure to bitcoin. This might sound like a heresy to some bitcoiners, but there is such a thing as owning too much bitcoin. Let’s face it: bitcoin can be very volatile in the short term, and if you hold all your funds in the orange coin, you might encounter trouble making ends meet. Always staying solvent is as important for long term holding as “Not your keys, not your coins,” is!

Simply put, the only way to evade the fallout of similar blow ups is to patiently hold bitcoin in your own wallet (preferably of the open-source hardware variety), and simply to get on with your life: have a positive cash flow from a productive job and stack sats regularly. Besides the significant financial advantages that this strategy will likely bring over the coming years, you’ll enjoy peace of mind, knowing that your bitcoin cannot ever be frozen, leveraged or liquidated, and its exchange rate is not dependent on any individual’s decision.

Bitcoin is an unforgiving phenomenon, and the longer one is exposed to it, the more humble one becomes. At times, bitcoin almost feels like a living organism, choosing where to linger and when to move on. Zhu Su and Kyle Davies, Alex Mashinski, Do Kwon and now Sam Bankman-Fried — they all thought they dominated bitcoin, but bitcoin deemed otherwise. They, along with their followers, were not worthy.

Are you?

This is a guest post by Josef Tětek. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.