Bitcoin Analysis

Bitcoin’s price made its lowest daily candle close since December 31st of 2020 on Wednesday and when traders settled-up for the daily session, BTC’s price was -$2,636.1. At the conclusion of Wednesday’s trading session BTC’s price was -$4,696.6 over its prior 48 hours of trading.

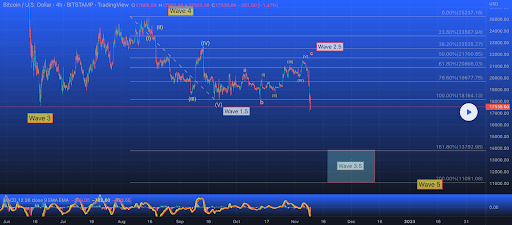

We’re kicking-off our price analyses for this Thursday with the BTC/USD 4HR chart below by Trade_Your_Way. BTC’s price is trading between the 161.80% fibonacci level [$13,792.98] and 100.00% fib level [$18,164.13], at the time of writing.

Bullish market participants have lost numerous key levels over the last 3 days but none were as critical as BTC’s 2017 all-time high of $19,891. The targets overhead for bulls on the road to reclaim that level are the 100.00% fib level and 78.60% fib level [$19,677.76]. Above that level the targets for traders expecting a reversal are 61.80% [$20,866.03], 50.00% [$21,700.65], and 38.20% [$21,700.65].

Bearish traders that have clearly been controlling BTC’s price action this week want to go down and test the 161.80% fib level. If they succeed there then their secondary target becomes the focus of bears at the 200.00% fibonacci level [$11,091.08].

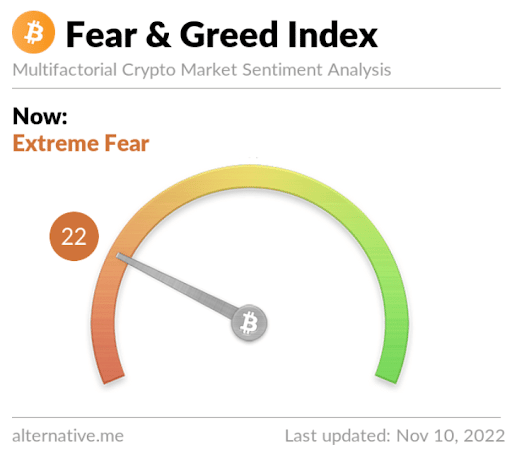

The Fear and Greed Index is 22 Extreme Fear and is -7 from Wednesday’s reading of 29 Fear.

Bitcoin’s Moving Averages: 5-Day [$19,694.87], 20-Day [$19,789.38], 50-Day [$19,719.86], 100-Day [$20,779.95], 200-Day [$28,818.01], Year to Date [$30,048.21].

BTC’s 24 hour price range is $15,588-$18,645.9 and its 7 day price range is 15,588-$21,417.69. Bitcoin’s 52 week price range is $17,611-$69,044.

The price of Bitcoin on this date last year was $64,920.

The average price of BTC for the last 30 days is $19,748.7 and its -11.4% over the same interval.

Bitcoin’s price [-14.23%] closed its daily candle on Wednesday with double digit losses by percentage for a second consecutive session. The world’s premier digital asset finished the day worth $15,892.2 and in red figures for a fourth day in a row.

Ethereum Analysis

Ether’s price finished more than 17% lower than where it began Wednesday’s trading session and when the day’s candle was printed, ETH’s price was -$234.55.

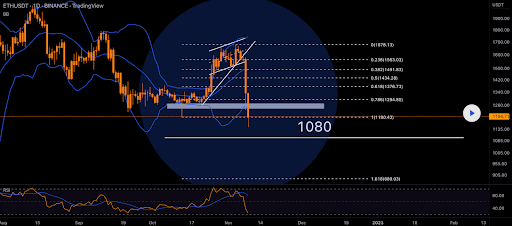

The ETH/USD 1D chart below by MonoCoinSignal is the second chart we’re looking at for this Thursday. ETH’s price is trading between the 1.618 fib level [$889.03] and 1 fib level [$1,190.43], at the time of writing.

Ether’s price is also trading below its 2018 cycle peak [at the time of writing] and has lost integral levels of inflection for bullish market participants. To regain ETH’s 2018 ATH, bullish Ether traders need to overcome the 0.786 [$1,294.8], 0.618 [$1,376.73], 0.5 [$1,434.28] and finally 0.382 [$1,491.83].

Ether’s Moving Averages: 5-Day [$1,466.95], 20-Day [$1,428.67], 50-Day [$1,434.29], 100-Day [$1,463.27], 200-Day [$2,006.29], Year to Date [$2,11.89].

ETH’s 24 hour price range is $1,073.53-$1,337.16 and its 7 day price range is $1,073.53-$1,659.61. Ether’s 52 week price range is $883.62-$4,878.

The price of ETH on this date in 2021 was $4,633.95.

The average price of ETH for the last 30 days is $1,412.61 and its -12.57% over the same period.

Ether’s price [-17.57%] closed its daily candle on Wednesday worth $1,100.68 in negative digits for a fifth consecutive frame.

Solana Analysis

Solana’s price has been one of the worst performers this week and arguably the closest linked victim to the FTX and Alameda Research contagion that’s swept over the entire cryptocurrency sector. The ties that FTX and Alameda have to Solana’s protocol have done market participants that were long SOL no favors and when Wednesday’s trading session closed, SOL was -$10.3.

The SOL crypto token has been impacted so adversely this week that at times SOL’s price was down more than 60% over a 24 hour span.

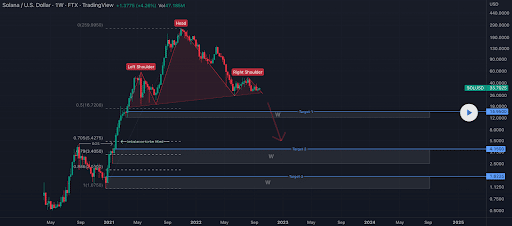

The SOL/USD 1W chart below from MichaelL200 will conclude this week’s price analyses. SOL’s price is trading between the 0.705 fibonacci level [$5.42] and the 0.5 fib level [$16.72], at the time of writing.

Those that believe the Solana platform will survive and SOL’s price will bounce have targets above on the weekly time frame of the 0.5 fib level followed by a secondary target of a full retracement on this daily chart of 0 [$259.99].

Contrariwise, the traders that believe further downside is imminent have targets of 0.705, 0.79 [$3.4], 0.886 [$2.01], and the 1 fib level [$1.07].

SOL’s Moving Averages: 5-Day [$26.69], 20-Day [$29.55], 50-Day [$31.57], 100-Day [$34.94], 200-Day [$57.91], Year to Date [$65.11].

Solana’s 24 hour price range is $12.37-$23.97 and its 7 day price range is $12.37-$38.03. SOL’s 52 week price range is $12.37-$246.4.

Solana’s price on this date last year was $233.64.

The average price of SOL over the last 30 days is $30.28 and its -58.97% over the same time frame.

The pain may not be over yet for Solana market participants as roughly 50 million SOL tokens are set to be unstaked at the conclusion of another vesting period on Thursday. The exact total can’t be determined since more validators have chosen over the last 24 hours to unstake their SOL.

Solana’s price [-42.30%] closed its daily session on Wednesday valued at $14.05 and in red figures for a fourth straight day.