Key Insights

- Solana’s protocol layer technical initiatives are focused on improving speed, increasing market efficiencies, and implementing spam reduction. Jump’s new Firedancer validator client, Jito Labs’ Jito-Solana client, and the implementation of Multiple Slot Leaders are the top initiatives.

- Validators are distributed across more than 25 countries and 138 data centers around the world. FTX’s implosion did not seem to have significant knock-on effects on validator statistics – though the Hetzner shutdown in September did cause significant stake migration out of Germany and towards other locales.

- Developer data presents a stronger, stickier ecosystem of devs than the preeminent narrative would suggest. However, these statistics should be taken with caution, as the amount of data available cannot be considered fully robust.

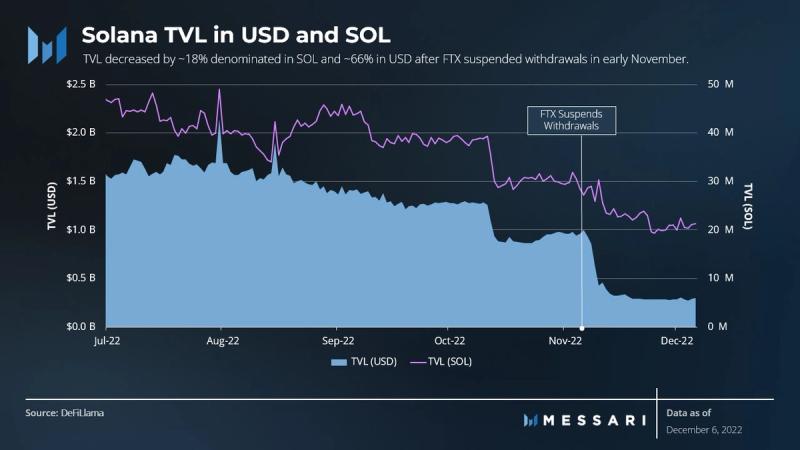

- With respect to DeFi, total value locked (TVL) has been decimated. However, several projects including Ellipsis Labs, Drift, Friktion, and others are creating new models in the DEX space, which have the potential to re-catalyze on-chain growth.

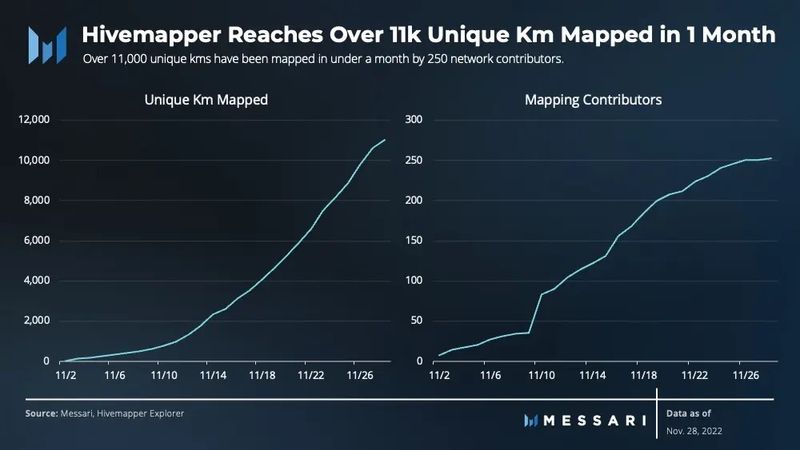

- Helium’s migration to Solana combined with the deployment of newer networks such as Hivemapper, Pollen Mobile, and Teleport indicate that Token Incentivized Physical Infrastructure Networks (TIPIN) are a burgeoning new subsector on Solana.

- The long-term success of the Solana ecosystem is to be determined. But claims of Solana’s outright dependence on SBF, of underwater validators, and of massive ecosystem flight to other chains are unfounded.

Let’s address the elephant in the room at the start: it’s true that SBF and FTX played an integral role in catalyzing the growth of the Solana ecosystem in its early days.

They’re gone now.

However, it’s also true that many other builders have and are still committed to expanding the ecosystem.

This report aims to provide context on the state of those individuals and teams that remain building the Solana Ecosystem.

The report is divided into two sections – analysis at the protocol layer and the application layer.

Movies put the credits at the beginning these days, so before we begin: special thanks to 0xMert_ at Helius Labs, 7layer at Overclock Validator, several Messari analysts and editors, and many others for their thoughtful feedback during the creation of this report.

Section I – Solana at the Protocol Level

Technical Initiatives

The primary theme of upgraded performance underlies Solana’s recently completed, short-term, and medium-term technical initiatives. Firedancer, Jito-Solana, and Multiple Leaders per Slot are some of the most highly anticipated initiatives within the developer community.

Network Health and Developer Landscape

Network health and infrastructure of Solana are relatively stable despite Hetzner’s terms of service pivot and FTX’s implosion. Smaller and unprofitable validators before FTX have faced some pressure, but most validators are still comfortably profitable. More details on stake, geographic, and data center distribution can be found below.

The TL;DR on devs is that the developer ecosystem looks strong. The caveat is that the amount of data collected on this topic is too small to be completely relied upon.

Protocol Infrastructure

These are the projects building out or extending components of Solana’s infrastructure that are not directly tied to the protocol itself – developer tooling, onboarding tools, experiments with different virtual machines, DAO tooling, and more.

Solana’s Road Ahead – Top Technical Initiatives

Solana has no explicit roadmap, but a number of initiatives have gained developer mindshare over others. Examining these initiatives provides the needed context to understand where Solana is headed on a technical level.

Firedancer (in testing)

Firedancer is an independent, C++ based validator client spearheaded by Jump Crypto. Once live, it will make Solana the second chain (after Ethereum) with multiple clients. Having multiple sets of code that can “run” the chain from scratch decreases the probability that a bug can cause significant damage to the network. If one implementation is buggy, it’s unlikely that a second, completely independent implementation will have the same bugs at the same time – ultimately benefitting the network.

Firedancer also has the potential to deliver massive improvements to performance (600k TPS has been live demoed). Look for Firedancer to deploy gradually over 2023.

Jito-Solana (deployed)

Jito-Solana is a modified validator client from Jito Labs optimized for facilitating MEV in a similar fashion to Flashbots’ MEV-boost on Ethereum. The client creates more efficient markets for MEV by introducing a specific marketplace for MEV-affected blockspace. In tandem with Jito-Solana is the JitoSOL liquid staking derivative, which will give validators running Jito-Solana the option (but not the obligation) to automatically distribute MEV profits on top of staking rewards to the JitoSOL pool.

QUIC (deployed on mainnet)

Solana replaced its old data transfer protocol, the user datagram protocol (UDP) with QUIC, a similar data transfer protocol that also allows for greater control over data flow. This allows validators to exercise more discretion in sending and receiving transaction data to and from slot leaders. In other words, validators will more easily be able to filter out the spammy transaction data that damaged the chain in times past.

Local Fee Markets (partially deployed)

Solana accounts have hard-capped compute limits – once reached, ensuing transactions cannot modify that account’s state during a given block. Local fee markets allow users to send priority fees to validators to express an urgency to modify a specific account’s state after that account has already reached its compute limit.

The result is less spam (as it can be outbid) and greater efficiency in blockspace markets (as users can now target and bid up specific account state as opposed to trying to overload the block with bids).

Stake-weighted Quality of Service (QOS) (deployed)

Instead of validators indiscriminately accepting and transmitting transactions regardless of source, stake-weighting guarantees that a validator with, e.g., 0.1% of stake will always have a right to transmit 0.1% of transaction packets to the leader. The previous indiscriminate approach left validators vulnerable to being washed out – that is, transmitting a total number of packets less than their stake weight. That’s bad – pushing out smaller validators leads directly to greater centralization.

Concurrent Merkle Trees / Account Compression (testing)

Concurrent Merkle Trees is a new method developed by Solana Labs enabling the compression of account data while maintaining the ability to modify the state of that data.

Account compression will significantly decrease costs and storage needs. Before compression, storing data for 10 million assets would cost $1.14 million and account for 3.8 GB of space. With compression, storing the same 10 million assets would only cost $250 and only take up 828 KB of space. Metaplex plans to use this to exponentially decrease NFT minting costs on the platform. Check out the Concurrent Merkle Trees whitepaper for more information.

“Fun Problems To Fix” – Medium-Term Initiatives

These are highlighted initiatives derived from an earlier thread put out by Anatoly. Several other developers also highlighted these as most integral to furthering Solana’s success.

Async block production

Asynchronous block production decreases the amount of work slot leaders (validators competing to verify the latest block) must do to pack blocks. Originally, leaders had to do two loads (queries of stored on-chain data, like transactions in the latest block) and two stores (instances of storing data on-chain). When implemented, that work will decrease to just one load.

The main benefit of this is reduced redundancies. By more efficiently delegating tasks among validators, the time to generate blocks may be shaved down by a few milliseconds. When you compete against the speed of light, a few milliseconds is important.

Diet / Light clients

“Diet” or light clients sample nodes for shreds (small transaction units) instead of downloading the full blockchain state. They rely on the assumption that the set of nodes they sample is honest. If the honesty assumption holds, light clients allow validators to contribute to network security by ensuring honest nodes aren’t eclipsed by a dishonest majority.

Multiple Leaders per Slot

Typically, one validator does the work of, well, validating each slot or block. Validators lucky enough to occupy that slot get roughly 400 milliseconds of glory as the “slot leader.” Multiple Leaders is a design change that would increase bandwidth for block production so multiple validators can occupy the leader slot.

Each leader proposes their own stream of transactions (effectively, a tree list of transactions), with the final order becoming the combination of these streams. This would increase competition and efficiency in the MEV market, as multiple leaders compete to include MEV-linked transactions into the finalized block.

Formal Verification

Formal verification utilizes Rust-based code verifiers such as Kani and Prusti to verify programs in the Solana Program Library and other important, widely used libraries like those found in Anchor.

The end goal would be to improve security of Solana programs. Code verifiers can automatically check for any issues or errors within a given program. Making strict use of them – especially on core contracts – should improve the security of those contracts.

Additional Smart Contract Languages

Solana is rolling out support for the smart contract language Move. This language is designed to be platform-agnostic, and once fully implemented, it may attract developers to Solana’s library of LLVM-compatible smart contract languages.

Notes on Solana Mobile

The short-term roadmap for Solana Mobile consists of three initiatives:

- Saga dev kits are scheduled to start shipping in mid December 2022.

- Solana Mobile dapp store applications open in January 2023.

- Saga phones will be available to the public in early 2023.

After these, the Mobile team will likely continue to iterate on the functionality and design of both the Saga phone and the mobile software development kit (SDK). As of today, Mobile is still an outside bet, more of a moonshot than a sure thing. But the scale of the opportunity should not be underestimated. Check out our research on the Solana mobile stack for a more detailed case on user, developer, and network adoption.

The full history of implemented proposals along with the list of accepted but not fully implemented proposals provide greater context and insight. Additionally, check out the network upgrades page for the latest proposal implementations.

Network Health

As of December 8, the Solana network has 2,306 total validators with a total stake of ~370 million SOL. Validators are distributed across more than 35 geographic locations around the globe and more than 138 unique data centers. Collectively, Solana’s Nakamoto coefficient (definition) stands above the industry average at 28.

The Solana Foundation released a network health report in August 2022 that goes beyond the Nakamoto coefficient to evaluate different aspects of decentralization. The report considers metrics such as geographic diversity, data center ownership, and entity control over validators to ensure more comprehensive network health. Although a high Nakamoto coefficient and growing validator set are beneficial, they are not enough to guarantee freedom from centralization risks.

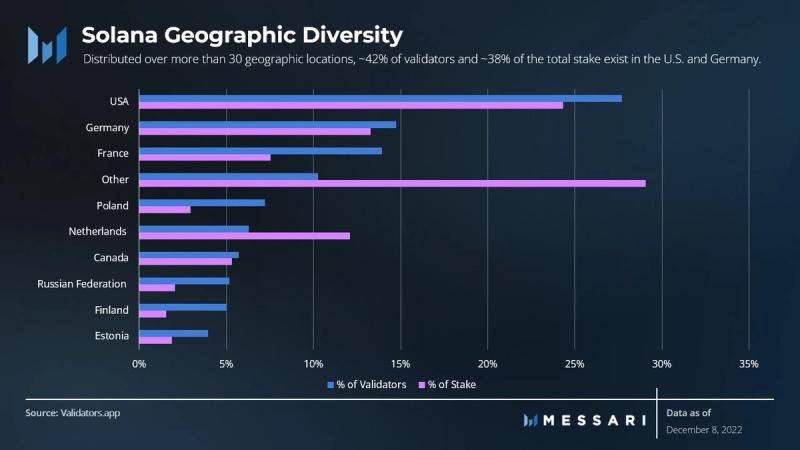

While distributed across more than 35 geographic locations, ~42% of Solana validators and ~38% of the total stake are located in the U.S. and Germany. The “other” locations make up just under 30% of total stake but consist of more than 25 different countries.

Geographical concentration is typical for Layer-1 networks and is an area of concern Solana aims to address. Too many validators in the same location could jeopardize the health of a network due to geopolitical risks, regulations, and acts of nature, among other reasons.

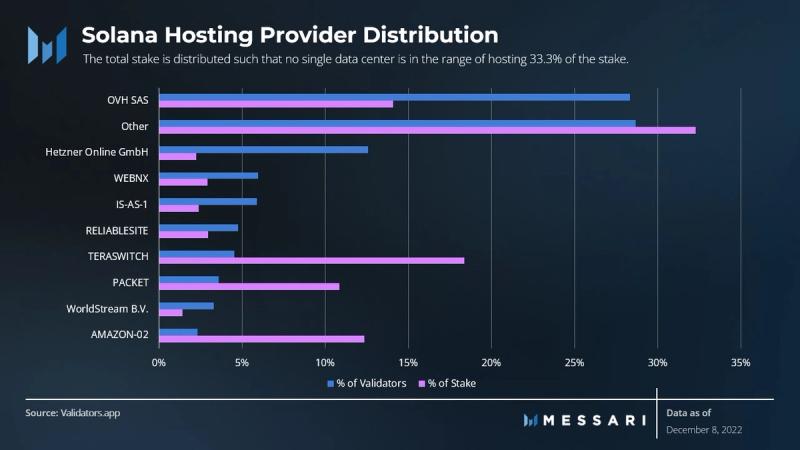

Data center concentration is another area of concern regarding decentralization. Using private data centers like AWS to run validators could give the owners of data centers disproportionate power over the network. As of December 15, the total stake on Solana has been distributed such that no single data center is in the range of hosting 33.3%. The “other” category that makes up more than 30% of total stake consists of more than 125 unique data centers.

However, at the end of September, the Solana network had a concentration of validators and stake in Germany and the U.S., with Hetzner Online, a German web-hosting company. Hetzner hosted over 40% of the network’s validators and over 20% of the stake. This relationship caused the network to be heavily concentrated in Germany, with a particular focus on one data center.

In early November, Hetzner removed all Solana-related activities on their server and stated that its policy forbids the use of its servers for crypto-related activities. Fortunately, the concentration was not enough to interrupt the network. Still, the event exemplifies the potential risks of too great a network concentration in a single geographic location and data center.

The Solana network is now more decentralized as a result. Hundreds of validators and millions in stake migrated from Germany and Hetzner to other countries such as France and Finland and to hosting providers such as OVH SAS and others.

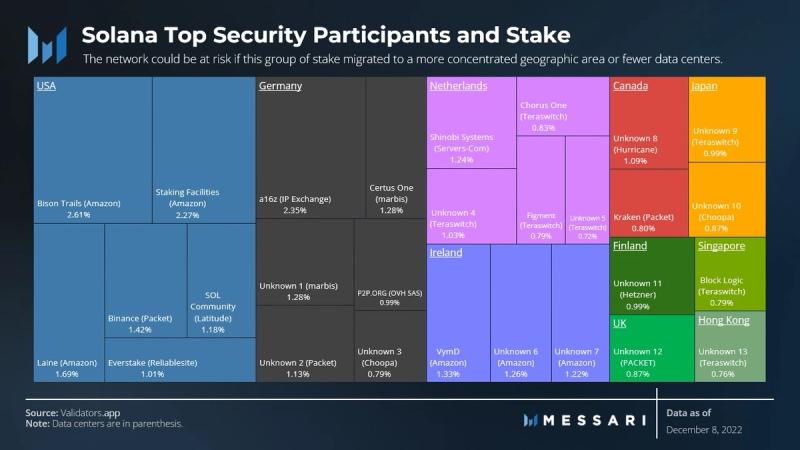

When evaluating the top 28 validators that make up the Nakamoto coefficient, a slightly different story unfolds compared to the apparent concentration in Germany, Hetzner, or even OVH SAS post-Hetzner migration.

Looking at the number of validators controlling more than 33% of the network stake, more than half is hosted by Amazon and Terraswitch. Further, a third of it is staked in the U.S. While these are not enough to collude against the network, evaluating the composition of stake across the top validators is essential. In this case, the network could be in jeopardy if this group of stake made its way to a more concentrated geographic area like the U.S. or a few data centers such as Amazon or Teraswitch.

Ultimately, the decentralization and health of the Solana network remains well intact and is in a better position after validators and stake migrated from Hetzner to dozens of other geographic locations and data centers.

Developer Landscape

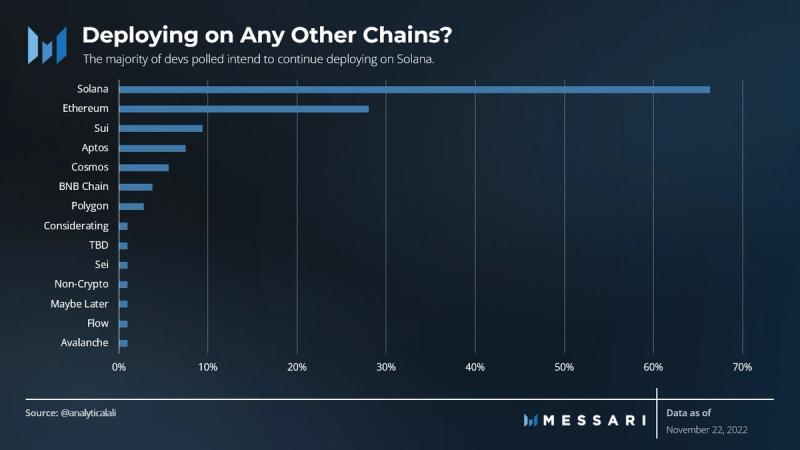

A popular narrative with respect to Solana developers has been ecosystem flight. A recent survey aimed to gather data to confirm or deny this narrative. There are two main takeaways:

A material number of developers are deploying on other chains, especially Ethereum. But the majority (66%) of devs polled are sticking exclusively with Solana.

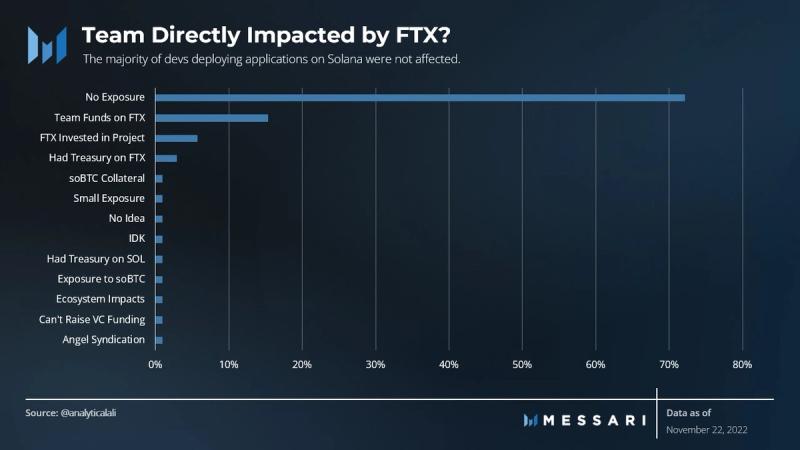

About 72% of devs reported that their team wasn’t affected at all by FTX. Around 20% had personal or project funds invested on FTX.

While surveys like these aren’t exactly rigorous enough to get published in Science Magazine, they do offer some much-needed data to better understand the broad reality of the situation.

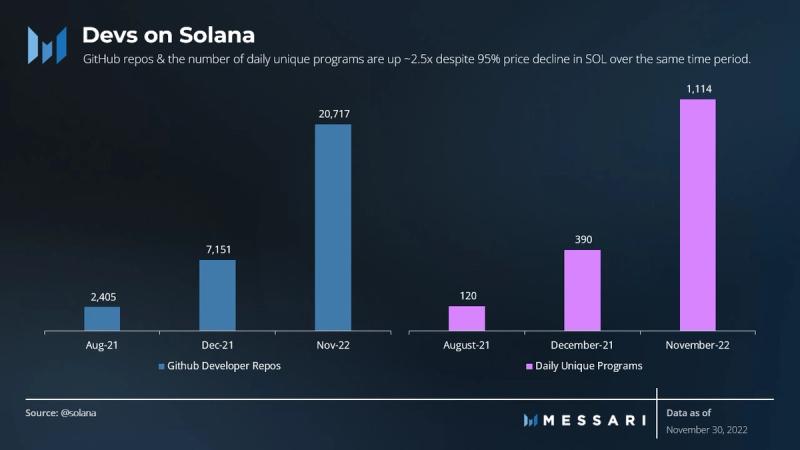

Moving on to some other stats, the number of Github developer repos and the number of daily unique programs are both up ~2.5x year-over-year despite SOL prices dropping -95% over the same time period.

Note that daily unique programs have been stagnant since May of 2022, hovering between 1,000 and 1,150 per day over that time period.

Alchemy released a Web3 developer report echoing a similar growth story as seen above. Per that report, Solana had over 10x growth in active developer teams and over 5x growth in API consumption year-to-date.

Source: Alchemy

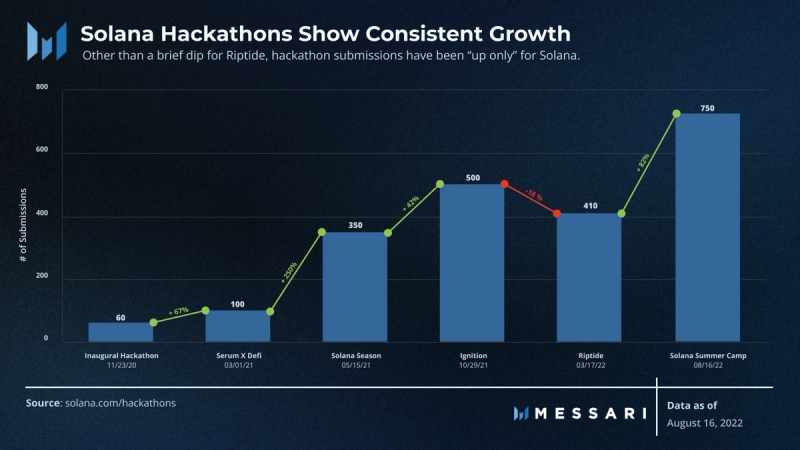

To discover what these new teams are building, watching hackathon activity and the Solana hacker houses are your best bet. The 2023 lineup has been released, featuring a diverse set of locations including Mumbai, Austin, Istanbul, NYC, and more. Hackathons to date have been a huge success for Solana, with activity trending up and to the right, despite price mimicking only one of those attributes (hint: it didn’t go up over the same timeframe!).

Protocol Infrastructure

These are some of the top projects building or extending out components of Solana’s infrastructure that are not directly tied to the protocol itself – think developer tooling, onboarding tools, experiments with different virtual machines, DAO tooling, and more.

Exploring MEV: Jito Labs

As mentioned above, Jito Labs creates validator software for the efficient transfer of MEV between validators, searchers, and stakers. The development of similar software on Ethereum (Flashbots) caused reductions in network congestion and boosted yields for stakers, especially in times of high network usage. The Jito client should have similar effects on Solana.

Source: Solscan

Developer Tooling: Coral, Helius, GenesysGo, Clockwork

Coral is the company behind two pieces of developer tooling infrastructure:

- Anchor Lang: Anchor is the preferred framework for writing programs (smart contracts) on Solana. Anchor simplifies the program building process by handling the more baseline tasks, leaving developers to focus primarily on business logic. Seahorse Lang is a community-led project built on top of Anchor enabling programmers to build smart contracts in Python. Other developments look to allow the creation of Solana programs using Typescript, another popular coding language.

- xNFT Backpack: xNFTs are a standard for “executable NFTs” enabling users to own the right to execute code. Backpack is the application of xNFTs to create a new type of wallet, in which apps run natively through one interface, as opposed to interacting with applications through browser views.

Helius provides RPC node management specialized for Solana, webhooks allowing devs to trigger actions in response to on-chain events, and a set of APIs for decoding on-chain data with more accessibility than standard block explorers. In its two months of mainnet operations, Helius secured just over 1,200 users.

GenesysGo also provides RPC services and storage and compute services. Per Step Data Insights, 3.5 TB of data had been stored with GenesysGo’s Shadow Drive storage solution as of October 2022.

Clockwork is another piece of dev tooling infrastructure, specifically for transaction scheduling and smart contract automation. Since launching at Solana Breakpoint in the beginning of November, they’ve scaled up quickly to 60,000 automated instructions per week.

Experimenting with Virtual Machines: Neon, Eclipse, & Nitro

A few projects are experimenting with importing and exporting different virtual machines to and from Solana. Neon Labs will launch a smart contract program porting the Ethereum Virtual Machine (EVM) onto Solana. This will allow EVM developers to deploy onto Solana with little to no changes to their original code. Look for them to deploy to mainnet in January 2023.

Eclipse and Nitro are exporting the Solana Virtual Machine (SVM) to Celestia and Cosmos, respectively. These projects seek to leverage the speed of the SVM with the modularity of chains like Celestia and Cosmos to reap the best of both worlds. Projects on Solana will be able to deploy their code onto Eclipse or Nitro with a similar ease as Ethereum projects who deployed on other EVM chains such as Avalanche or Polygon.

DAO Tooling, Wallets, and Fiat On/Off Ramps

Realms and Squads are the leading DAO governance and multisig solutions, respectively. Lastly, Phantom remains dominant in the wallet space – it’s one of the teams looking to parlay its early success into multi-chain expansion on Ethereum and Polygon.

The previously mentioned Backpack standard from Coral will also aim to grow the market and gain market share. Solflare, Glow, Spot, Ultimate, and Cashmere are a few of many other wallet competitors. Dialect is a protocol striving to provide messaging infrastructure for any and all of the above.

With respect to onramps, all eyes are on two teams within this ecosystem: Solana Pay and Stripe. Solana Pay recently had a partnership with STEPN and Asics which generated buzz, but the game here is really all about integrations at the point-of-sale level.

To that end, the new entrant Stripe may have an advantage. Its fiat-to-crypto onramp reveal featured 16 projects, 11 of which were based on Solana. One of the projects mentioned was Ottr Finance – a Venmo alternative built on Solana. Tiplink is another protocol taking a different approach

In privacy land, Light Protocol is utilizing zero-knowledge proofs (ZKPs) to enable privacy-protected payments and transfers on-chain. Otter Cash is another privacy solution available to Solana users.

Summarizing Section I – Solana at the Protocol Layer

Historically, one of the biggest critiques Solana faced was the gap in ecosystem maturity compared to Ethereum. That gap still exists, but the projects shown above indicate that this gap is closing. The rate of closing is up for interpretation, but it’s undeniable that Solana has an ecosystem working to improve its core infrastructure and functionality.

The description of Solana as merely an “SBF chain” seems largely unfounded.

Section II – Solana at The Application Layer

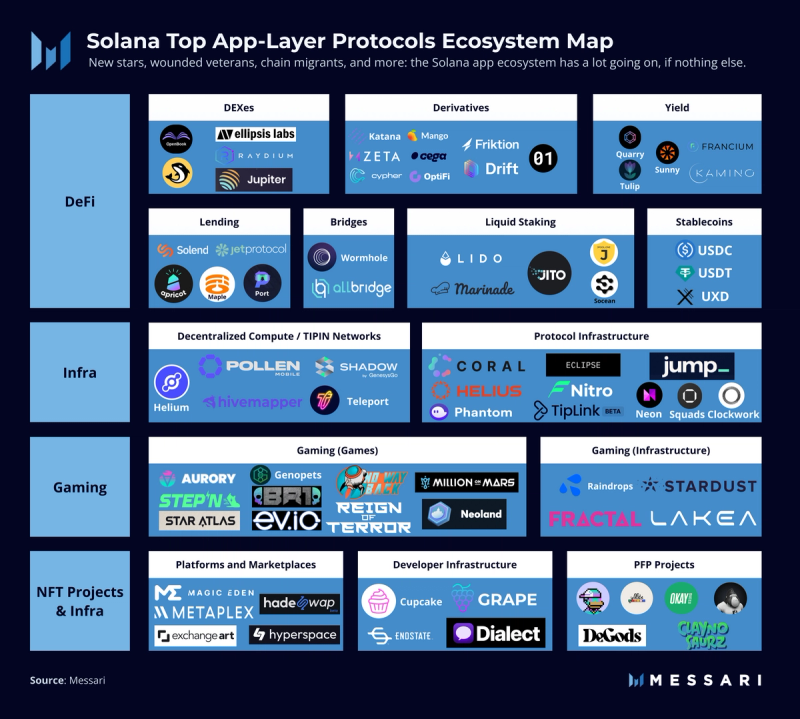

The best tech won’t matter if there are no applications built on top of it. Solana has a wide variety of applications across DeFi, Web3 Infrastructure, NFTs, and Gaming – too many to highlight every project in this report. We’ve instead created an ecosystem map covering the majority of the names in each subsector and highlights of top projects and narratives in each.

On to the highlights.

DeFi Applications

It’s fair to say Solana DeFi was the subsector hit hardest by FTX’s implosion. TVL across Solana DeFi took a massive hit from the elimination of Alameda’s on-chain activity and the price of SOL falling 67%.

That said, there are still innovators building for the future. Here are some of the highlights.

Spot DEXs

With respect to spot decentralized exchanges, two new names to watch out for are OpenBook and Ellipsis Labs. OpenBook is a community-run fork of Serum V3 that spun up in the wake of Serum’s upgrade keys potentially compromised status. Serum’s public Twitter handle has openly endorsed the new fork.

Ellipsis Labs’ Phoenix orderbook expands on Serum’s original central-limit-order-book (CLOB) vision with a set of design decisions geared for efficiency like removing operationally-intensive “cranking” (definition) from the DEX design.

Source: Solana Youtube

Derivatives and Structured Products

Plenty of teams are building in the derivatives, options, and structured products space: Drift, Zeta Markets, Mango Markets, Friktion, PsyOptions, 01, and Cega are a few of many. Teams have been trying to solve key problems such as sourcing liquidity, new asset support, cross-margin, and user onboarding.

Drift’s approach to enhancing on-chain liquidity uses Just-In-Time (JIT) Liquidity to allow market makers to provide tighter spreads. Source: Drift

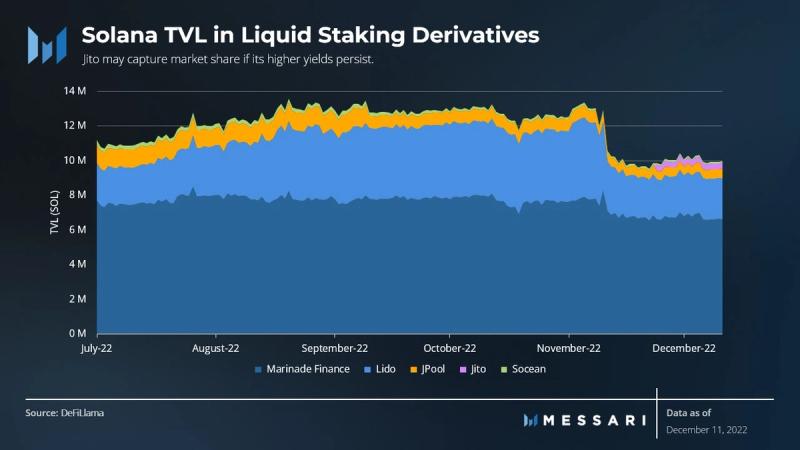

Liquid Staking Derivatives (LSDs)

Jito Labs’ JitoSOL may be grabbing all the headlines, but Marinade and Lido are still leaps ahead in terms of market share. That could change if higher yields for JitoSOL (9.10% versus 8.80% for Lido and 8.08% for Marinade as of December 7) persist.

Look for integrations throughout Solana DeFi as potential catalysts for additional demand.

TIPIN Projects

TIPIN, or Token Incentivized Physical Infrastructure Networks, are a lesser-known subsector of promise. Helium, the first protocol to use token rewards to incentivize individuals to complete real-world activities, recently made headlines by voting to migrate its network from its own blockchain to Solana. This move is intended to address the network’s scaling and throughput issues and allow the community to access Solana’s ecosystem of developers and infrastructure, including wallets, DeFi apps, and the Solana Mobile Stack. Other TIPIN networks to watch on Solana include:

- Pollen Mobile – a Helium competitor in the 5G space. They are already providing cheaper coverage than traditional competitors – sometimes up to 90% cheaper.

- Hivemapper – a drive-to-earn network incentivizing users to provide the network high-quality street view mapping data.

- Teleport – an Uber-like app incentivizing drivers and riders to join the network.

Source: Sami Kassab

If you’re new to TIPIN and have further interest, check out more of Sami’s research for market-leading thematic and data-driven insights on the topic.

NFT Projects and Infrastructure

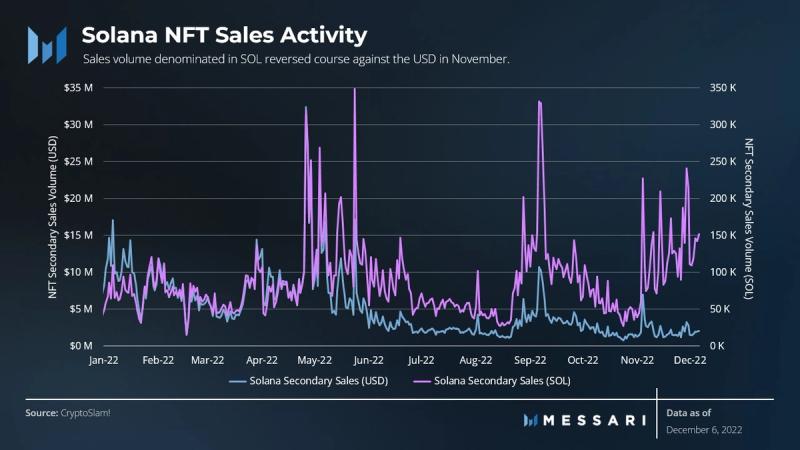

Amidst the chaos, “the JPEGs” remained relatively, and surprisingly, resilient. Daily SOL-denominated sales volume nearly hit an all-time high in November, as holders and traders alike rushed to adjust their NFTs’ valuations to cratering SOL prices.

The royalties debate has dominated the narrative in JPEG land. At first, aggregator adoption swung the pendulum toward evading royalties whenever possible.

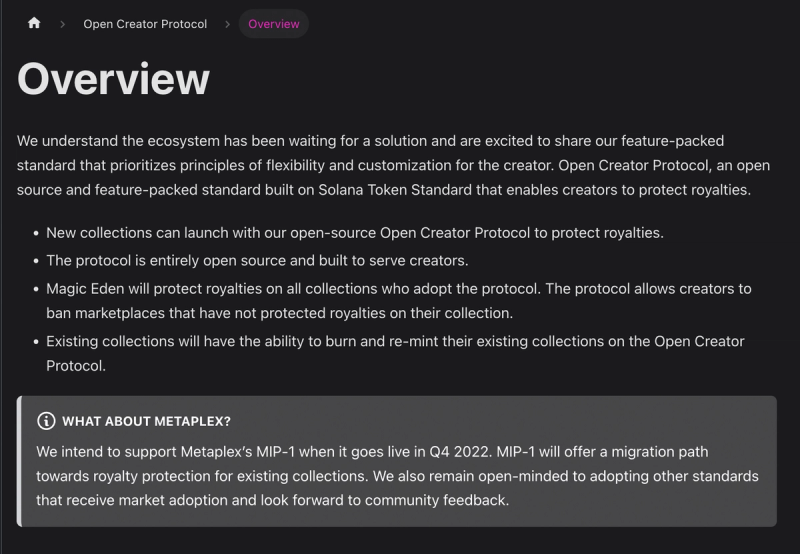

Now, leading platforms Magic Eden, Metaplex, and Cardinal have all announced a form of creator royalty protection at the protocol level. The pendulum has swung to the opposite end, with several designs enabling creators to ban marketplaces that don’t enforce royalties. Time will tell which design wins in the long run.

Source: Magic Eden Docs

Further, Solana’s NFT ecosystem has been fueled by the continued optimization of Metaplex’s Digital Asset Standard, which is the foundational token standard for all NFTs on Solana. Metaplex continues to iterate on its popular, open-source minting solutions such as Candy Machine, recently announcing no-code solutions for less technical creators. Collectively, Solana and Metaplex have continued to offer creators a place to launch NFTs efficiently.

Metaplex’s compression for NFTs will also likely support the NFT ecosystem. Compression will reduce the cost of on-chain storage of NFTs, enabling enterprise-level users like airlines and live events to store on-chain tickets and launch at scale. Compression will allow as many as 1 million NFTs to be minted simultaneously for ~6 SOL ($204) and 100 million for ~50 SOL ($1,700).

Additionally, recently launched NFT minting solutions, other marketplaces, and enhanced user experience applications will likely grow the NFT ecosystem. Phantom enabled users of its browser extension to directly list their NFTs on Magic Eden. Atomic Wallet rolled out support for Solana NFTs on its desktop and mobile versions. Solana NFTs also began to trade on additional NFT marketplaces such as Rarible.

Despite the bear market and recent macro events, Solana’s strategy and position in the NFT sector holds strong. Solana remains the second-largest network in terms of secondary sales volume and is narrowing its gap behind Ethereum.

Gaming Ecosystem

As the crypto space positions itself to support GameFi, Solana Ventures leads the way. Their $150 million fund to boost the network’s gaming ecosystem has attracted additional investment funds, and it has sparked traction in gaming.

Other efforts that have since followed include more investors such as Magic Eden’s Magic Ventures, infrastructure like Ancient8′s DoJo (a launchpad for gaming), and builders like Eternal Dragons.

Developments like these have placed GameFi on the cusp of catalyzing a wave of activity across the crypto space, and Solana is positioned to grow its GameFi ecosystem.

Most big games in the Solana ecosystem either aren’t live yet or are in early stages. Some of the top games to watch for are ev.io, BR1: Infinite, No Way Back, Aurory, and Star Atlas, among others.

If some subset of these do succeed, watch out – games have been proven to generate exceptionally high usage and revenue in the past.

Note: A Look at Solana Investors

A common critique from those outside the ecosystem was that FTX was one of a small set of investors who were only looking to extract value from projects building on Solana. The “Sam coins” – particularly Serum, Oxygen, MAPS, and others – were often pointed to as an example.

Non-FTX investors associated with that group – namely Jump, CMS, Sino, and Multicoin – have been and still are integral to supporting the Solana ecosystem, Sam coins aside. However, the set of investors on the venture side is wider than that group – investors such as Foundation Capital, Race Capital, and others were investors well before FTX ever came around.

Newer investors like Chris Burniske of Placeholder and Twitter personality R89 Capital have vocally offered fresh perspectives on Solana post-FTX collapse. If these and more names can all combine to fix some of this ecosystem’s long-standing problems – especially with respect to token economics – the private and public market venture landscape on Solana may emerge from FTX’s implosion stronger than ever before.

Conclusion

The Solana ecosystem is not without issues. TVL has been obliterated. One of the most central champions in SBF may have been an outright fraud. The tech isn’t complete yet. And yes, the price is down.

Yet, the ecosystem is not without promise. New apps may re-catalyze usage. Potential new champions can surpass SBF in terms of positive contribution to the network. Technical upgrades actively in development will likely continue to mitigate network issues and upgrade network performance.

As for the price?

Well, that’s for you all to decide.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form.

This report was commissioned by the Solana Foundation, a member of Protocol Reporting. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. Paid membership in Protocol Reporting does not influence editorial decisions or content. Author(s) may hold cryptocurrencies named in this report.

Crypto projects can commission independent research through Protocol Services. For more details or to join the program, contact ps@messari.io.

This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. The past performance of any asset is not indicative of future results. Please see our terms of use for more information.