The potential of losing your funds isn’t the only reason to secure your own bitcoin. It also ensures the price cannot be manipulated.

Are you keeping bitcoin on an exchange?

Let me tell you a story about what happens when you, and others, leave your bitcoin on exchanges. You might be surprised to hear what that means for your holdings. It might sound a lot like your own.

Let’s call our character Bill. Bill has been cautiously watching bitcoin for years, hearing about it in passing and reading a few articles. After inadvertently saving a lot of cash due to lockdowns, he decided to dive into bitcoin at last. A friend told him to check out Coinbase, Binance or another popular and “trusted” exchange in order to buy his first chunk of bitcoin.

So, Bill created an account and uploaded his face, ID, social security number, address and every other relevant detail about his life until he finally reached the “Buy Bitcoin” screen. He picked up a fraction of a bitcoin, but after all that trouble, he thought to himself:

“I don’t need to learn all these complicated technical details about hardware wallets and self custody — I just want my bitcoin safe.”

Bill reviewed the exchange’s website and decided that the security experts at the exchange, with their wiz-bang cold storage and state-of-the-art encryption, would be better at securing his bitcoin than he himself would be.

Bill was very pleased with himself after making that decision — not only did this exchange make investing in bitcoin simple, it gave him peace of mind knowing that someone else was responsible for keeping his assets safe from any kind of theft or malicious activity. After all, why should he have to worry about such things when there were professionals available who could handle them instead?

Bill has since become quite comfortable with the idea of trusting exchanges with his bitcoin — his coins are now safe from his own mistakes!

When Trust Disappears: The Fall Of FTX

When Bill turned on the news one morning and found out that the massive crypto exchange FTX had just paused withdrawals and seemed to “accidentally” lose $10 billion, roughly a third of its market cap, he was shocked.

How could a firm with its logo on the side of a major sports stadium and a CEO who appeared on CNBC, Bloomberg and in front of the U.S. Congress(!) to talk about digital assets and regulation have lost — or likely stolen — so much from right under everyone’s nose?

Now Bill was stuck between a rock and a hard place. He was suspicious of his own exchange, but setting up his own hardware wallet seemed so difficult and scary. It would require him to invest in a physical device, acquire the necessary knowledge to secure it properly and keep track of his seed phrase backup. Even if he figured out the basics, there was still the risk of misplacing his device or improperly storing his backup and losing access to his bitcoin.

FTX was shocking, but surely Bill’s exchange would never conduct itself the same way. People would see it before it was coming, and he’d have time to get out, right?

Reasons To Take Your Bitcoin Off Exchanges

It’s clear that trusting your bitcoin to an exchange brings with it the risk that you’ll log in one morning to find that your bitcoin just isn’t there. If you hold your bitcoin yourself using a hardware wallet, this can’t happen.

However, there’s another big reason it’s important to take your bitcoin off exchanges: the bitcoin price.

How could self custody affect bitcoin’s price? Everything in economics says that buying and selling affect the market price for a good, not who holds it. However, self custody is very important to price — and it has to do with something I’ll call “paper BTC.”

Introducing The Next Big Thing: Paper BTC

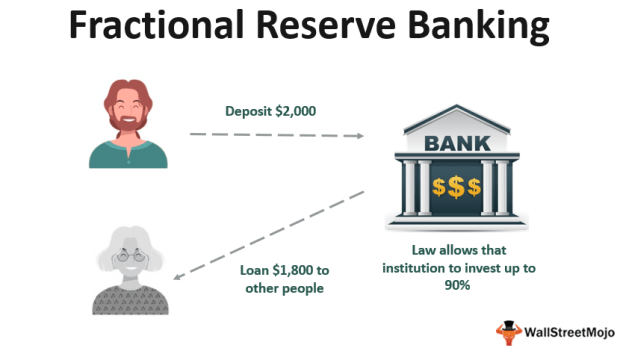

Let’s look at how an exchange works by considering a hypothetical exchange called ExchangeCorp, owned and operated by a jolly entrepreneur named Bernie. ExchangeCorp built an uncomplicated way to buy bitcoin, and hired a team of security experts to make sure hackers are kept at bay. Over time and through great marketing campaigns, ExchangeCorp built trust with traders and investors, drawing many in to store their bitcoin on the exchange.

When users keep their bitcoin with ExchangeCorp, the CEO Bernie and his team maintain control over those coins. Customers simply have a claim on their coins: they can log in and see their balance as well as request to withdraw their coins. However, if Bernie wants to transfer those coins owed to his customers to other Bitcoin addresses, he’s technically able to do so without any customer’s permission.

When Bernie kicks up his feet and looks at the balances in ExchangeCorp’s vault, he’s pleased to see tens of thousands of bitcoin that his customers have deposited sitting pretty. Since ExchangeCorp is doing well, more bitcoin are always coming in than going out.

So Bernie gets a wise idea. He could lend out some of those customer coins, earn some interest, and get the coins back without anyone noticing. He would get richer, and the risk of enough ExchangeCorp customers asking for withdrawals at one time to draw its vault’s massive balance down to zero is miniscule. So Bernie loans out thousands of coins here and there to hedge funds and businesses.

Now there’s another set of claims to consider. Customers have a claim on their bitcoin at ExchangeCorp, but ExchangeCorp no longer has the actual bitcoin — they only have a claim on the coin they lent out. What customers now have is a claim on Paper BTC held by ExchangeCorp, with the real bitcoin in the hands of borrowers.

This is where things get weird. All of ExchangeCorp’s customers still think they have a direct claim on real bitcoin held safely by ExchangeCorp. However, that real bitcoin is in fact in the hands of those who borrowed from ExchangeCorp, and those entities are selling it out in the market.

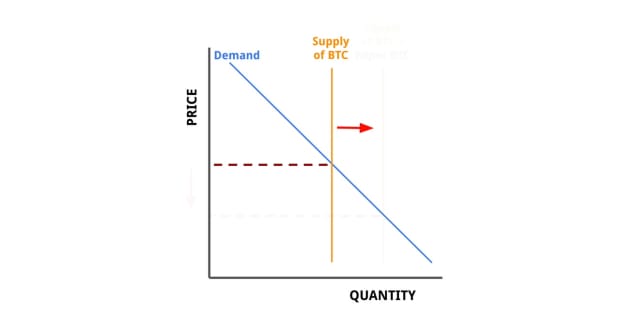

What happens when ExchangeCorp lends out a large quantity of the bitcoin its customers deposited? A lot of extra bitcoin starts to float around in the market, because investors who think they’re holding actual bitcoin are only holding paper BTC. All of that extra supply of bitcoin in the market absorbs buy pressure, which suppresses the price of bitcoin.

Let’s look at simple supply and demand here:

Does this hypothetical story sound anything like the recent news around FTX?

The Paper BTC At The Center Of The FTX Fraud

The story of ExchangeCorp and Bernie is exactly the story of FTX and its founder Sam Bankman-Fried, with some save-the-world complexes, study drugs and polyamorous orgies redacted.

By lending out customer funds, FTX essentially inflated the supply of bitcoin by taking advantage of the trust users placed in FTX to safeguard their funds. FTX created tons of paper BTC.

Just how much paper BTC might FTX have created? We cannot be sure of the exact amounts given its absolutely horrid bookkeeping, but the estimate below suggests FTX had 80,000 paper BTC on its books — bitcoin owed to customers that is not backed by real bitcoin.

That would represent a staggering 24% of the roughly 330,000 new bitcoin that were created over the past year through the predictable mining issuance process. That is a ton of extra bitcoin entering the market that nobody — aside from a small group of insiders at FTX — knew about!

It’s impossible to tell where the price would have gone without that extra bitcoin supply entering the market, but we can be almost certain that the price would have climbed higher than it did in 2021.

While the FTX collapse is recent and still unfolding, history has a few cautionary tales to tell about the dangers of paper assets and price manipulation. The story of gold’s failure to resist centralized capture, for instance, can tell us where Bitcoin is headed if we continue to trust exchanges and third parties to hold our bitcoin for us.

The Fall Of Gold

Gold was once used in daily transactions — it takes no more than a visit to a museum of ancient history to see the collections of old gold coins once circulating in local markets. The traditional view of the demise of gold as a transactional currency was that it became too cumbersome or too valuable to continue to function well as a means to buy groceries and beer.

However, this story omits a few key components that only reveal themselves when we trace the evolution that societies took from gold coins to paper bills and digital bank accounts.

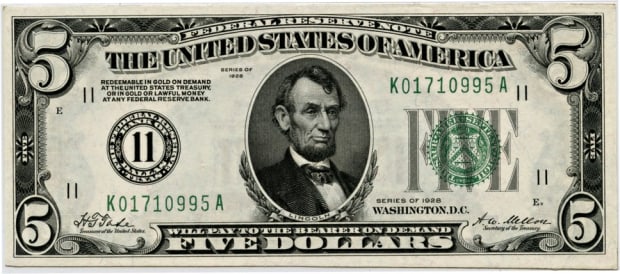

Centuries ago, banks started taking customer’s gold in exchange for bank notes — giving customers a measure of security for their gold and a more convenient means of transacting. However, entrusting a bank with your precious metal meant the bank was able to lend it out or make bad investments without the depositor’s consent. When a bank was caught between bad loans and a high rate of depositor withdrawals, they had to declare bankruptcy and shut down — leaving many depositors penniless, holding paper claims on gold now worth nothing at all.

Then central banks came along to “fix” the problem of bankrupt banks leaving depositors penniless. Central banks held gold for people and commercial banks, giving them banknotes from the central bank as receipts for their gold. By 1960, central bank official holdings accounted for about 50% of all aboveground gold stocks, with their banknotes circulating freely. Commercial banks and individuals didn’t mind, since each note was convertible to a set weight of gold by the central bank that issued it.

This would have worked well, except that central banks — especially the Federal Reserve in the U.S. — started creating more bills than they had gold to back. Creating more bills than the Fed had gold to back was essentially creating paper gold, since each bill was a claim on gold. Doing this in secret meant the Fed was manipulating the price of gold, given the extra circulating supply which the market was not aware of. When many depositors of gold at the Federal Reserve — like the French government — started questioning the Fed’s gold holdings and creating the threat of a run on gold in the U.S., the U.S. government had to intervene.

In 1971, this came to a head with the Nixon shock. One night, President Nixon announced the U.S. would temporarily stop allowing depositors to trade in their Federal Reserve notes for the gold they promised.

This temporary halt in withdrawals was never lifted. Since all currencies were connected to gold through the U.S. dollar under the Bretton Woods agreement, the Nixon Shock meant that the entire world went off the gold standard at once. All currencies were now just pieces of paper, instead of notes giving the holder a claim on a quantity of gold.

This was only achievable because gold, over time, was deposited into commercial banks and then to central banks. Once central banks held most of the gold, they could manipulate the price of gold and remove it entirely from daily commerce. Everyday people chose the convenience of paper notes over the security of holding gold, and paid the price.

Instead of a neutral money backed by a precious metal that is difficult to dig up and impossible to synthesize, currencies became easy to print and thus highly politicized. Keeping the dollar at the top of the food chain no longer required restraint and good stewardship to ensure its backing in gold. Instead, it required military expeditions and strong policing to ensure global governments and citizens continued to use the dollar to transact.

A return to gold at this point would be impractical — the world’s commercial networks span too great a distance with transactions happening at too high a speed. With paper currency and eventually digital banking systems, what we gained in speed and convenience we lost in soundness and neutrality. We lost our savings, our social cohesion and our political institutions as a result.

Preventing Bitcoin’s Fall

Taking your bitcoin off of your exchange is not just good practice for your own security, it’s protecting the price of your bitcoin as well. Our freedoms depend on individuals having control over their own wealth. When we entrust our wealth to companies or states, we go down the path we witnessed with gold.

Thanks to bitcoin’s divisibility and digital nature, it overcomes the hurdles that held gold back from supporting our modern, interconnected economy. Bitcoin can support a global marketplace, but it will only get there if we each hold our own bitcoin.

Don’t let the banksters and bureaucrats manipulate the price of your bitcoin: take it off the exchange and get it on your own hardware wallet.

This is a guest post by Captain Sidd. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.