Key Insights

- Venus is a complete algorithmic money market protocol on BNB Chain.

- Venus offers users the ability to deposit assets as collateral for a loan, earn income from supplying liquidity, or mint VAI.

- Venus differentiates itself from other lending protocols through its revenue-sharing model.

- The proposed Venus V4 upgrade aims to optimize the protocol by introducing a stability fee, isolated markets, stable interest rates, additional price feeds, and shortfall coverage.

Introduction to Venus Protocol

Decentralized money market protocols are essential to the DeFi ecosystem because they enable users to lend and borrow crypto using overcollateralized, self-custodied arrangements. Protocols such as Compound on Ethereum or MakerDAO provide rapid access to capital without requiring credit approval or relying on other forms of trust. However, the majority of stablecoins injected into these markets are issued by centralized entities, such as Circle or Tether.

Building on the success of Compound and MakerDAO, Venus was launched in 2020 as a complete algorithmic money market protocol on BNB Chain. In addition to facilitating lending and borrowing, Venus enables collateralized debt positions (CDPs) to mint VAI, the protocol’s native synthetic stablecoin. By building on the codebases of established protocols, Venus offers users a familiar platform for lending and borrowing on BNB Chain.

How it works

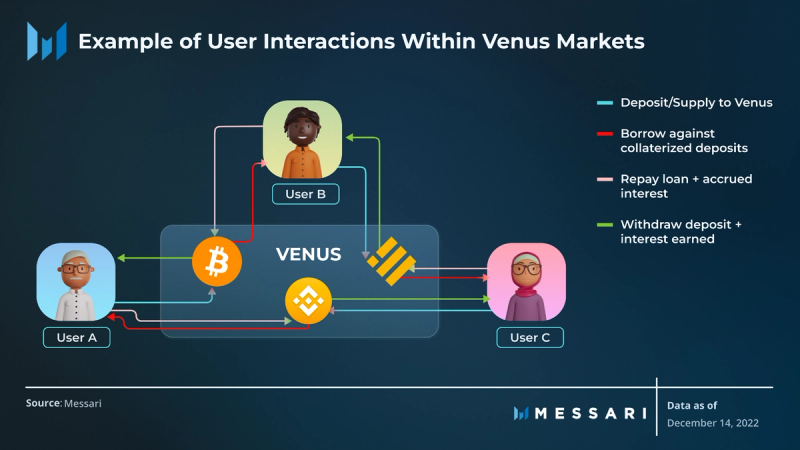

Venus offers three main services to its users: depositing assets as collateral for a loan, earning income from supplying liquidity, and minting VAI.

When a user deposits an asset, the protocol transfers the asset to the appropriate market and mints the corresponding “vToken” (such as vBTC) to the user. These vTokens accrue interest every block, based on a rate determined by supply and demand. As interest is accrued, the exchange rate between the vToken and the underlying asset increases linearly. When a user withdraws from the protocol, the minted vTokens and the earned interest are redeemed (burned) in exchange for the underlying asset.

As an additional way to earn income by supplying liquidity, users can participate as liquidators. Whenever the value of a loan plus interest exceeds the value of its collateral, liquidators can step in to repay part or all of the loan to bring it to a positive balance. In exchange for their service, liquidators are rewarded with a portion of the collateral. This overcollateralization model reduces insolvency risk by maintaining a healthy loan-to-value ratio.

For borrowing on Venus, users can collateralize their assets and borrow up to 80% of the value, depending on the specific collateral factor for the asset. The borrowed assets can be transferred freely, but the collateral is locked until the loan and accrued interest are repaid. If the value of the loan plus interest ever exceeds the value of the collateral, the loan is considered to be “underwater” and subject to liquidation.

Venus also enables users to mint VAI, provided they meet the collateral requirements. VAI provides additional utility to the billions of dollars flowing through the protocol. It offers users access to a USD-pegged asset, while also allowing them to earn interest income on the underlying collateral. However, the minting of VAI was paused last September due to an oversupply issue that caused the price to depeg from $1, despite being overcollateralized. Minting is expected to resume with the release of the proposed Venus V4 upgrade, which will introduce a stability fee mechanism for VAI.

Tokenomics

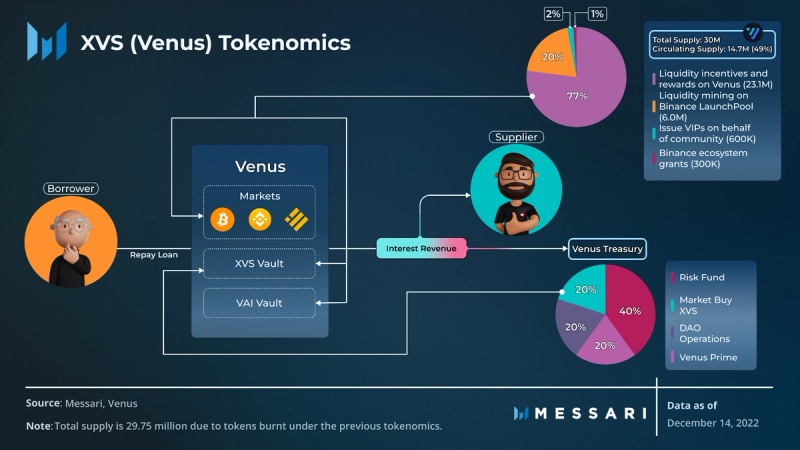

The Venus protocol is governed by the XVS token, which captures the primary value of the platform. The total supply of 30 million tokens was initially distributed through Binance LaunchPool. There, users could stake various tokens to earn a share of 6 million XVS tokens. The remaining XVS tokens were allocated three ways: a total of 23.1 million tokens were reserved for liquidity incentives and rewards; 600,000 tokens were set aside for Venus Governance to issue VIPs (Venus Improvement Proposals) on behalf of the community; and 300,000 tokens were set aside for ecosystem grants.

Under the current distribution schedule, the Venus protocol releases ~3,460 XVS tokens (0.01% of the total supply) to the markets per day, plus a base emission rate of 525 XVS per day to stakers in the XVS Vault and 250 XVS to stakers in the VAI Vault.

Holders of XVS tokens can draft and vote on governance proposals. These proposals cover topics such as adding markets for new tokens, adjusting distribution schedules and collateral factors, and directing new product updates.

Additionally, XVS stakers are entitled to a share of the protocol’s revenue. Depending on a supported asset’s “reserve factor,” 10-25% of interest income is retained by Venus as a protocol fee for facilitating lending and borrowing. At the end of each quarter, 20% of this protocol revenue is used to market buy XVS, which is then distributed daily to XVS Vault stakers in the following quarter.

Venus Prime

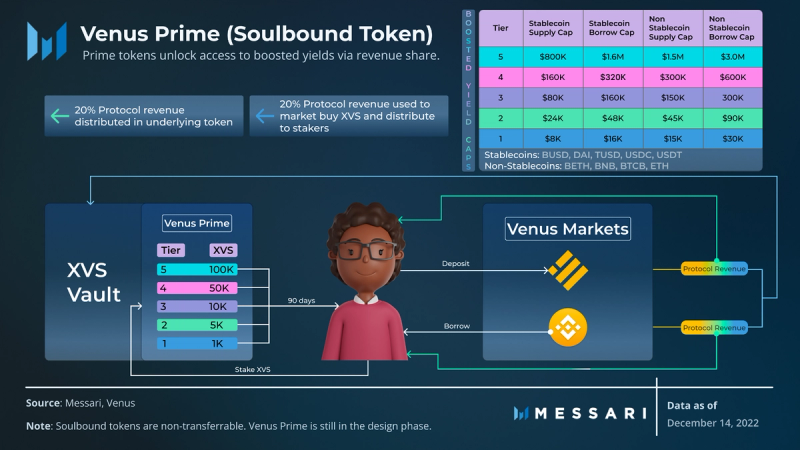

Venus Prime is a non-transferable “soulbound token” that will be claimable through the XVS Vault as part of the Venus V4 upgrade. Venus Prime tokens unlock access to variable boosted yields through revenue share and are issued in two forms: the Earned Revocable Token and the OG Irrevocable Token.

In addition to the staking yield received from the XVS Vault, Prime tokens grant users access to boosted yields through the protocol’s Qualified Value (QV) distribution system. Each Prime tier caps the amount of QV a holder can supply to or borrow from select markets. The tiers also determine the share of the protocol revenue each holder receives. A user may have additional assets in these markets, but they only receive boosted yield based on the QV of the eligible assets. This design is similar to cashback rewards systems, where boosted yield is paid in the asset supplied/borrowed and can be claimed directly from the markets.

According to the initial design, Earned Revocable Prime tokens can be claimed once a user has staked a minimum of 1,000 XVS for 90 days. If a user’s staked balance falls below 1,000 XVS, the token will be revoked and the 90-day clock will reset. Once issued, Prime tokens can be upgraded or downgraded to different tiers based on additional amounts of XVS staked or withdrawn from the vault. Upgrades to a new tier can be triggered after an additional 30 days of staked time.

OG Irrevocable Prime tokens will be issued to the top 1,000 borrowers by transaction count over a rolling 12-month period. This count will only include borrow transactions of at least $1,000. The OG tokens will automatically have the same qualifying balances as the highest tier and will be irrevocable once claimed, as their name implies.

Overall, Venus Prime aims to incentivize protocol loyalty. It will provide additional utility for XVS and simultaneously grow the total value locked in the ecosystem. It is currently in the design phase and subject to change through community governance. Holders of XVS tokens will be able to draft and vote on governance proposals, including changes to the Venus Prime distribution and benefits.

Venus Reward Token (VRT)

The Venus Reward Token (VRT) is another ecosystem token that was airdropped to XVS holders last year. The motivation behind VRT was to decrease XVS emissions without compromising on liquidity incentives. Tokenholders received 1,000 VRT per 1 XVS. In March 2022, VRT Swap was launched. It is a vehicle that allows users to swap VRT for XVS at a ratio of 12,000:1, with the swap vesting linearly over 365 days. The 365-day vesting period can be initialized until the end of March 2023, after which the utility of VRT will be deprecated.

Traction

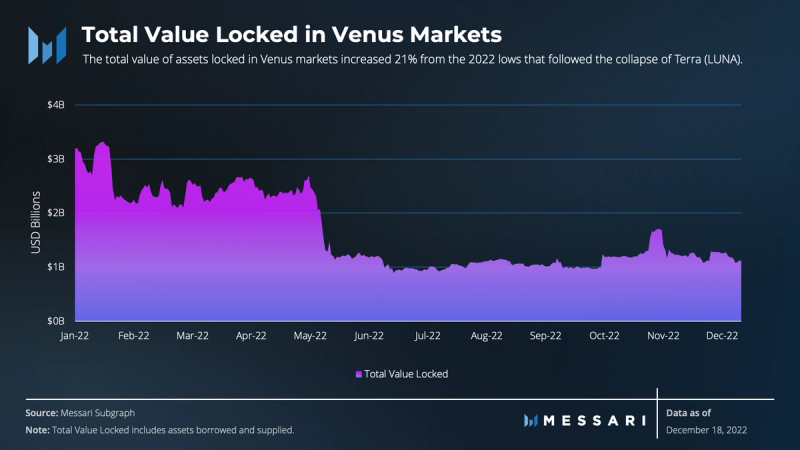

Venus is the second largest protocol on BNB Chain by total value locked (TVL), with only PancakeSwap ahead of it. In May 2021, the total value of assets supplied to the protocol peaked at just above $15 billion, before falling to $3 billion by the end of the month. The sharp drop was the result of users withdrawing funds in response to a large liquidation event. The event left the protocol with bad debt, which was further compounded by rapidly declining prices in the broader market. Average TVL stayed at around $3 billion until it fell as low as $925 million after a price feed issue mistakenly enabled undercollateralized loans to be made against Terra (LUNA). Despite lower market prices, Venus’ TVL has since trended upward, signaling trust in the team’s vision and ability.

Risk

As with other lending platforms and traditional banks, Venus users are subject to various risks, including protocol insolvency, liquidation risk, smart contract risk, and price oracle risk. Although Venus uses an overcollateralization model to reduce the risk of insolvency, this model does not always guarantee that individual assets are readily available for withdrawal.

As an asset’s utilization increases (i.e., an increasing share of the supply is being borrowed), the interest rate charged to all borrowers increases algorithmically. Higher rates can cause borrowers to reassess the value of their loans to see whether the increased cost of capital is worth the risk of losing their collateral in the event of a liquidation. As long as the collateral holds its perceived value, this dynamic generally leads to a natural equilibrium between supply and demand.

When collateralized assets do experience a sharp fall in price relative to the borrowed assets, the result is a large liquidation event. In such cases, liquidated borrowers would have no incentive to repay their outstanding debt, especially if their collateral has already been seized and sold in an attempt to recover the value of the loaned assets. The resulting bad debt can lead to a shortfall of assets available to repay lenders at full value.

In May 2021, price manipulation on Binance’s exchange caused the oracle-reported price of XVS to surge from $80 to $145 in three hours, before falling back to $80 four hours later. This surge led to large amounts of BTC and ETH being borrowed using XVS as collateral. However, as the price of XVS stabilized, over $200 million of liquidations occurred, leading to the sale of liquidated collateral and a further drop in the price of XVS. This left the protocol with around $58 million in bad debt at current prices.

In May 2022, Venus experienced another bad debt situation when the price of Terra (LUNA) crashed. LUNA was enabled as a collateral asset on Venus and relied on Chainlink price feeds to receive real-time pricing updates. The LUNA price feed contract had a hard-coded minimum value of ~$0.10, as well as a circuit breaker that paused pricing updates at the minimum value. The true market price of LUNA ended up falling well below the minimum value to ~$0.01, but the Venus market continued to handle transactions at ~$0.10. Before the Venus team could pause the protocol for security maintenance, users exploited the price feed discrepancy to create roughly $15 million in bad debt.

These events exemplify the risks associated with collateralizing native governance tokens and illiquid assets. They also highlight the risk of relying on a single source of truth without proper security checks. According to a dashboard by Risk DAO, Venus’ current bad debt is around ~$53 million. The proposed V4 upgrade introduces shortfall coverage, which will be used to make users whole and mitigate shortfalls in the future.

Conclusion

Venus differentiates itself from other decentralized money market protocols with its revenue-sharing model and ability to mint synthetic USD-pegged stablecoins. Despite facing challenges, the team has demonstrated its ability to adapt and find new ways to return value to tokenholders. In order to maintain its market-leading position, Venus will need to focus on the following solutions: limit exposure to long-tail assets, implement security fallback solutions, support VAI’s peg and expand its utility, and limit dilution from token emissions.

The protocol has taken steps to improve its risk management and plans to continue this trend. So far, it has disabled the XVS governance token as collateral, onboarded Gauntlet for additional risk management, and limited the collateral factor for long-tail assets. In the future, Venus plans to use the proposed introduction of isolated markets, cross-referenced price feeds, and shortfall coverage to further diversify risk and reduce the chance of insolvency.

For VAI to scale, its price must remain stable around its $1 peg during market volatility. The team plans to implement a stability fee to strengthen the peg. Once the stability fee is in place and minting is resumed, Venus will work to expand the utility of VAI, given that over 80% of the supply is currently staked in the VAI Vault earning XVS emissions. Stablecoins are still in a relatively early stage, so expansion can be achieved through innovative use cases and partnerships with other projects.

Venus and its investors should also consider the dilution from token emissions. Although many protocols distribute token rewards to incentivize users, the resulting high emissions rates can increase circulating supply and negatively impact price.

The Venus community recently passed a proposal to reduce daily emissions awarded to suppliers and borrowers by 50%, showing a commitment to the long-term health of the protocol. In the roughly one month since emissions were reduced, the total value of assets supplied to Venus increased by about 3% and the total value borrowed only decreased by about 3%. In other words, the reduced emissions have had little, if any, negative impact on user behavior thus far. With emissions reduced, a successful V4 launch could further solidify Venus’ position as a DeFi behemoth on the BNB Chain.