Key Insights

- Aave Protocol experienced bad debt on Nov. 22, 2022, due to ineffective market risk management.

- Gauntlet provides risk management services to the Aave Protocol, including risk analysis and recommendations for risk parameter optimizations. An initial proposal to renew its service for the Aave DAO proposal failed.

- The failed proposal would have included risk modeling and optimization for Aave V2 and V3 markets, an insolvency fund, and optimization of interest rate parameters and GHO stablecoin. The proposal failed due to communication issues, market turbulence, and the targeting of the Aave CRV market.

- An updated proposal submitted on Dec. 14, 2022, to the Aave DAO has passed the temperature check, but there are key lessons for B2DAO players.

Introduction

In decentralized finance (DeFi), the stakes are always high, and prevention is always better than cure. With a TVL of ~$6 billion and a market capitalization of over $800 million, Aave is one of DeFi’s largest lending protocols. Its recent failure to proactively manage risk left it with $1.6 million of bad debt and sparked community attention.

Gauntlet Network, a provider of risk management services to Aave, recently proposed renewing its services for the Aave DAO, the community responsible for governing the protocol. Despite little opposition during the proposal discussion and a high level of voter participation, the proposal ultimately did not pass.

Gauntlet faced scrutiny when an attacker exploited market volatility, launching an attack that jeopardized the stability of the CRV lending market and raised doubts about Gauntlet’s services. This incident occurred as the Aave DAO was preparing to roll out its latest protocol upgrade, Aave V3, which requires precise adjustments to risk parameters for its new features.

Gauntlet Network and Aave DAO

Gauntlet is a DeFi risk management service provider founded in 2018 by Tarun Chitra and Rei Chiang. As one of the major players in the Business-to-DAO (B2DAO) space, Gauntlet provides financial modeling platforms that simulate risk parameter optimizations for some of the largest protocols in DeFi, including Aave, Maker, Compound, and Synthetix. The company has built a reputation for leveraging the power of statistics to advance decentralized economies.

Gauntlet’s initial risk assessment of Aave Protocol dates back to its Economic Safety Grade launch in 2020 in partnership with DeFi Pulse. The firm has since worked closely with the Aave team, providing risk analysis reports and a risk management dashboard to monitor and recommend changes to the protocol parameters.

Gauntlet Network Proposal

On Nov. 24, 2022, Gauntlet’s proposal to renew a 12-month engagement with Aave DAO was not approved. The proposal would have allowed Gauntlet to offer asset listing monitoring, risk modeling, and dynamic risk parameter optimization for Aave V2 markets deployed on the Ethereum, Polygon, and Avalanche networks. Gauntlet would have also provided services for Aave Arc, the Aave permissioned protocol for institutional lenders, and the deployment of Aave V3 on Ethereum, Optimism, Arbitrum, Polygon, and Avalanche.

Gauntlet also offered to create an insolvency fund that would return a portion of its compensation to the DAO in cases of insolvency resulting from its services. The company would additionally optimize the protocol’s interest rate parameters and native stablecoin, GHO.

These services would have amounted to an annual compensation of approximately $2.57 million, with 70% paid in stablecoin and 30% in AAVE tokens (according to Gauntlet’s fee structure formula, which accounts for protocol usage in addition to an upfront fee).

Despite initial community support, the proposal ultimately failed. This was likely due to significant market turbulence in the wake of the FTX collapse, particularly the targeting of the Aave CRV market for exploitation during the period leading up to the vote. The incident illustrates how events in the wider crypto space can affect proposal sentiments.

Why the Proposal Failed

Nick Cannon, Gauntlet’s VP of Growth, identified six issues in a proposal post-mortem that strained the company’s relationship with the Aave DAO community and impacted its performance. These issues included poor communication, outdated risk appetite, lack of a framework for risk changes, misaligned priorities, mistakes leading to forced liquidations, and a failure to promptly address the Ethereum Merge risk.

These issues were legitimate and demonstrated Gauntlet’s effort to seek feedback and improve. However, perhaps the simple reason the proposal failed was due to bad timing and Gauntlet’s risk management decisions during the November crypto market turbulence following the FTX collapse. Specifically, the 0x57e0 CRV market on-chain short resulted in ~$1.6 million in protocol bad debt.

Cause of the Aave $1.6 Million CRV Bad Debt

One of the great things about decentralized finance (DeFi) is how openly accessible it makes financial information. This transparency has allowed for insightful analyses and post-mortems on the events that created Aave’s $1.6 million bad debt. However, open access to data also gives an advantage to bad actors. Using information from EigenPhi Research (2022) and Warmuz, Chaudhary, & Pinna (2022), we can revisit what happened on Nov. 22, 2022, to understand what Gauntlet and Aave could have done differently.

Avraham Eisenberg’s (aka Avi Eisen) Exploits

Before the CRV market exploit, Avraham Eisenberg had already taken advantage of a lack of liquidity to exploit $116 million from the MNGO market on Mango, a Solana-based DEX. He even tweeted about executing a similar trading strategy on Aave’s REN market. This tweet prompted Aave to make risk parameter adjustments for the REN and other markets and discuss reducing long-tail asset risk in borrowing on the Aave protocol. It was a quick and proactive response by the Aave community.

However, on November 13, the 0x57e0 address linked to Avraham initiated the CRV short events. They deposited $38.9 million USDC collateral into the Aave V2 market, borrowed ~17 million CRV in different increments, and offloaded them across 1inch and other CEXs between November 13 and 21. 0x57e0’s persistent dump slowly grew their short position with the proceeds as the CRV market price decreased from $0.61 to as low as $0.41. By then, Avraham had accumulated up to $63.596 million in USDC collateral with up to 92 million of CRV borrowed from Aave.

As the CRV token price lingers around $0.40, an all-time low, a resulting short squeeze attack. The attack was encouraged by the CRV release of the crvUSD stablecoin whitepaper and ended up costing 0x57e0 his position as CRV price spiked to $0.60 in two price surges. The liquidation caused Aave to have $1.6 million in bad debt because of the low liquidity of CRV on-chain. When it came time to liquidate Avraham’s position, Aave liquidators could only buy back some of the CRV he borrowed. Akham reported no liquidity on-chain to pay back more than 20% of the position. There were 385 liquidations by 21 unique addresses to empty Eisen’s $63.59 million in USDC collateral. These liquidations left 2.45 million CRV unpaid to the Aave system, resulting in bad debt.

Root Cause and Slow Oracles

Aave used price quotes from on-chain oracles to calculate whether the liquidation threshold was triggered. However, these oracles lag compared to Binance’s price information, providing enough time for arbitrageurs to benefit from price movement. In the time between the two price surges, before the price of CRV stabilized above $0.60, there were more than three hours when the liquidation condition was not triggered due to a temporary price drop. This may have caused Aave to miss the best opportunity to adopt a contingency strategy. To prevent similar situations in the future, lending protocols must be designed with risk control mechanisms that consider timely price adjustments and liquidity information. EigenPhi Research has suggested implementing a feedback control system based on cushions and liquidity sensors.

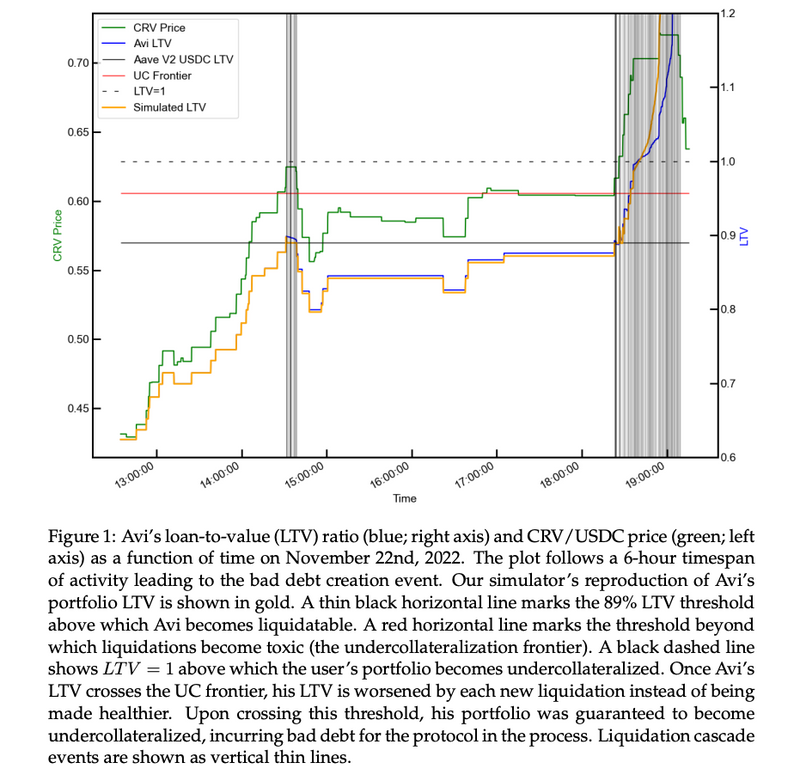

Toxic Liquidation: Flaw in Liquidation Logic, Not Price Volatility

According to Daniele Pinna, the bad debt of Aave was not solely caused by the volatility in the CRV/USDC market. Instead, he and his co-authors explained in their paper (Warmuz, Chaudhary, & Pinna, 2022) that a flaw in the liquidation logic caused the bad debt. When Avraham’s position was liquidated due to price swings, the bad debt was created because a series of liquidations resulted in an increase (opposed to a decrease) in Avraham’s loan-to-value ratio (LTV). This shows that while liquidation is an essential aspect of DeFi, it can become toxic and harm protocols at certain thresholds, effectively demonstrating the law of diminishing returns.

The paper showed how the bad debt was caused by toxic liquidation and recommended ways to fix it. While liquidation is usually effective at reducing risk to the lender, it can become toxic if done too quickly. This is because the loan becomes undercollateralized, and liquidation can bring down the price of borrowed assets. As a result, the borrower’s LTV ratio increases instead of decreases.

To fix this issue, lending platforms can tweak the liquidation logic. One option is to pause all further liquidations once a user’s LTV surpasses their UC frontier —a threshold when liquidations become detrimental to the system. Another option is to implement dynamic parameters for liquidation incentives and closing factors. This would allow for a softer liquidation process instead of terminating it abruptly (as in the first option) which is similar to what Gauntlet offers. According to Pinna, who is also on the team behind 0vix Protocol (a lending market on Polygon), the second option more effectively avoids toxic liquidations.

Limitations of Simulations and Lessons for DeFi

It is worth noting that the paper by Warmuz, Chaudhary, and Pinna (2022) is based on a simulation of historical price action. As The3D argued, it shows what could work under certain assumptions, not necessarily what will work in DeFi’s unregulated and highly adversarial environment where historical price action is only partially reliable for predicting future events.

Deepa affirmed that Gauntlet based their simulations on borrowing/lending actors acting rationally. However, there was nothing rational about Avraham’s actions in the CRV market. It was an audacious attempt to not only benefit from shorting CRV, which he successfully brought to its lowest value of $0.40, but also to attack Michael Egorov, the co-founder of Curve Finance, who had a $48 million CRV long position with a liquidation price of $0.259. If the price of CRV had fallen below $0.242, a total of 185 million CRV tokens, or 10% of Curve’s circulating supply, would have been liquidated on Aave. This could have resulted in up to $100 million in bad debt for Aave and further driven down the price of CRV, which may have been part of Avraham’s strategy. Egorov may have released the crvUSD whitepaper in the middle of the short squeeze as retaliation, or to save his position. These events were likely not accounted for in any simulations.

Source: Chaindebrief

The Possibility of Multiple Strategies and Shorting AAVE

It is also worth considering that Avraham may have had a different strategy on a centralized exchange (CEX) or multiple CEXs to profit from the short squeeze, crvUSD whitepaper release, and his liquidation event itself. Barry Fried postulates that Avraham could have been shorting AAVE under the speculation that, whether the CRV short was successful or not, it would create bad debt for Aave, which would eventually get covered by stkAAVE in the safety module, creating downward price pressure to profit from. The true end game may be unclear, but the misdirection is crystal.

Gauntlet’s Reaction Proposal

The aftermath of the CRV market bad debt led Gauntlet to propose freezing 17 assets on Aave V2 on the Ethereum network. Nick Cannon, Aave’s VP of Growth, said these assets constituted 5% of Aave’s total value locked (TVL). While the proposal was understandable as a risk treatment measure, it needed to be better received by key community stakeholders.

While Pinna may have identified issues with the liquidation process, it is still important to manage it effectively. Avraham and other actors like him can benefit DeFi, even if their actions lead to protocol losses. This is because they incentivize DeFi developers and risk managers to improve liquidation system designs, risk parameters, and controls. DeFi remains resilient and transparent, with traceable and auditable transactions, compared to centralized entities in the crypto space, which lack transparency. This is why Gauntlet is well compensated for developing risk mitigation strategies for exceptional events involving rational, irrational, benevolent, or malevolent actors.

Community Feedback on Gauntlet’s Failed Renewal

After the vote failed, key community members provided feedback on the reasoning behind the failure.

- Marc Zeller, a former Aave team member, suggested that Gauntlet base its compensation formula on Aave’s revenue rather than the percentage of borrowed assets.

- Andrew Allen, a protocol specialist at Coinbase, pointed out that Gauntlet could improve its communication with the Aave community.

- Francis Gowen, a protocol specialist from Flipside Crypto, also emphasized the importance of transparency and collaboration with Aave’s other risk managers, specifically Chaos Labs.

- Aave’s former CTO Ernesto Boado, and Co-founder of Bored Ghosts Developing (BGD) Labs— an Aave DAO service provider, highlighted three issues as reasons for opposing the proposal:

- Gauntlet’s failure to support important V2 pools in its previous engagement.

- Subpar handling of the CRV situation that caused reputational damage to the protocol.

- Reactive rather than proactive recommendations for managing market risk.

Gauntlet’s Re-Evaluation

After identifying issues that had strained its relationship with the Aave DAO community, Gauntlet Network’s Deepa Talwar presented a plan to improve its services and increase transparency. The Gauntlet team pledged to provide regular updates, talks, and an updated dashboard to help the community better understand their methods. The dashboard could also enable the team to work with a proposed Risk Council to enhance situational awareness and create a faster response to market risks. To be more proactive, Gauntlet is committed to overhauling its incident response procedures, streamlining and formalizing processes, and developing an updated risk management framework that aligns with the community’s needs and risk appetite.

Gauntlet’s revised proposal, which incorporated feedback from the Aave community and revised the fee to a fixed $2 million per year payment, has been preliminarily approved. The variable debt-based model has been denounced as unsustainable and detrimental to the predictability of the Aave DAO’s budget for its service providers. With these changes in place, Gauntlet aims to strengthen its relationship with the Aave DAO and better serve the Aave Protocol.

Overview of the Voting Results

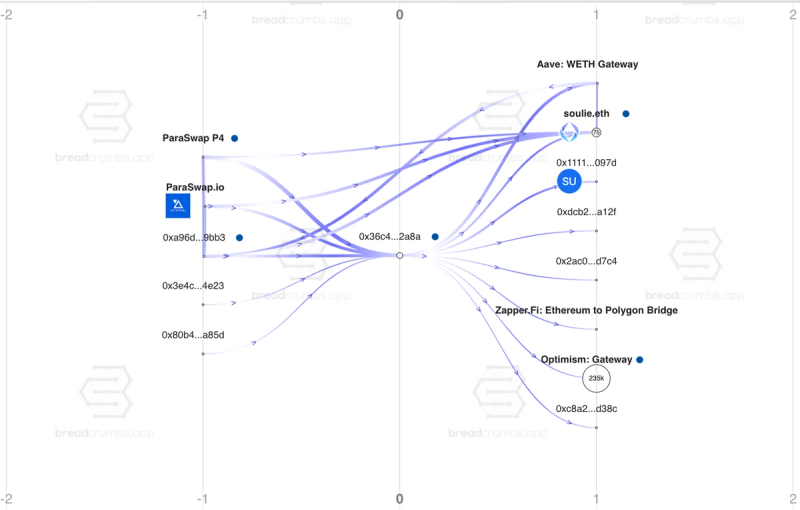

An analysis of the voting results reveals some interesting findings. The data shows that a small group of voters who opposed the Gauntlet proposal had a disproportionate amount of influence on the outcome of the vote. Of the top 20 voters ranked by voting power, 12 voted against the proposal to renew the Gauntlet. The voter with the address 0x36C4… had the greatest impact, holding 15.96% of the total voting power.

Source: Messari

Source: Messari

Notably, this was also 0x36C4’s first vote, and they did not participate in the follow-up vote.

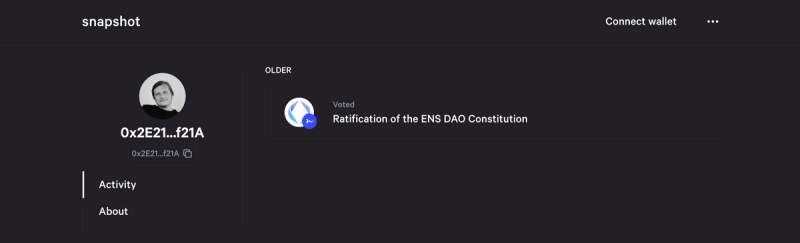

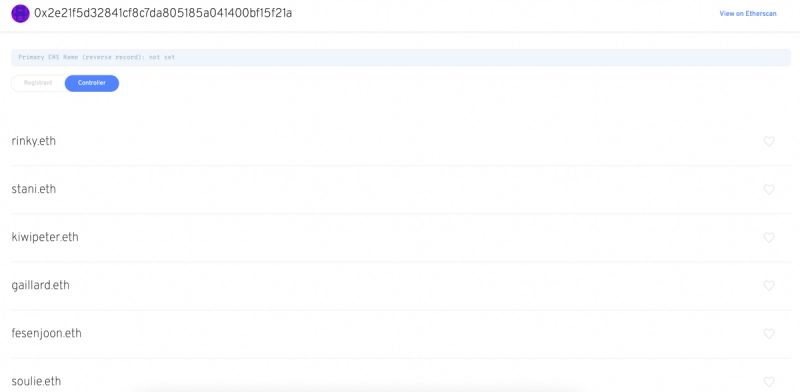

Further investigation discovered that 0x36C4 is connected to an address linked to Stani Kulechov, the CEO and founder of Aave.

The ENS name “Soulie.eth” is associated with the address 0x2E21, which can be found on the Snapshot profile with a photo of Stani and controls the name “Stani.eth.”

This connection is unsurprising, as Ernesto, Aave’s former CTO, has also admitted to voting against the proposal. This experience highlights the importance of not only gaining support from the general DAO community but also from key stakeholders. After all, DAOs are hybrid organizations and can be both top-down and bottom-up.

Lessons for B2DAO Providers

Effective risk management is crucial for the success of a lending protocol such as Aave. However, the cost of thorough risk assessment and management should not outweigh its benefits. Simultaneously, DAOs should hold their service providers accountable for any problems under their jurisdiction. In November 2022, the Aave community was presented with the opportunity to evaluate its risk management practices, hold a key service provider accountable, and implement safeguards to ensure high-quality service from all of its service providers. Some members of Aave DAO have also complained about one of their service providers, Llama, for its alleged poor work. Losing Aave as a client could seriously harm Gauntlet’s reputation and income, especially since Balancer and Sushi ended their partnerships with Gauntlet in February and June 2022, respectively.

Gauntlet is known as a reliable risk manager in the cryptocurrency industry. However, having Chaos Labs as an additional risk manager benefited the Aave community during a volatile market in November and negotiations regarding fees. It is important to encourage competition to improve security in the crypto industry. For example, Llama and Chaos Labs worked together to present an alternative recommendation to Gauntlet’s recommendations during the market volatility.

Despite initial criticism for not being proactive, Gauntlet has demonstrated professionalism, as evinced by community representatives’ support and a proposal to use a portion of its compensation to cover bad debt through an insolvency fund. This shows the company’s willingness to take on risks and prioritize strong relationships with clients and a reputation for high-quality services, which are important for businesses operating in the B2DAO space.

Conclusion

Effective risk management is crucial for DAOs to ensure the security and stability of their protocols. The recent incident with Aave serves as a reminder of the importance of proactively managing market risks and holding service providers accountable when things go wrong. It is essential for businesses entering the B2DAO space to align their priorities with the DAO community, communicate effectively about their processes, and be willing to take on risks to build strong relationships and maintain a reputation for high-quality services. As the B2DAO sector continues to grow and competition increases, it is also important for DAOs to maintain a range of options regarding risk management providers and to make informed decisions based on the needs of their community.

Here are some risk management proposals on Governor that DAOs have approved with B2DAO service providers over the past year:

- Gearbox DAO and Risk DAO — Extend the Engagement with Risk DAO (GIP 31), $200,000 per annum fee.

- Gro Protocol and Community Contributors — Risk Pod (Vote 022), estimated cost $200,000 – $500,000 per annum (Failed).

- Goldfinch DAO and Warbler Labs — Goldfinch Risk Management Framework (GIP 31)

- Goldfinch DAO and Warbler Labs — Goldfinch Risk Appetite Statement (GIP 32)

- EulerDAO and Warden Finance fka Shippooor — Grant proposal for Euler Risk Tooling (eGP 3), $80,000 grant.

- EulerDAO and IntoTheBlock Research — Risk Management Tools for Euler (eGP2), $85,000 grant.

- Compound DAO and Gauntlet Network — Gauntlet x Compound Renewal (125), quarterly Performance Fee based on Gauntlet’s fee structure formula at ~$1.45 million per annum.

- Gro Protocol DAO and Exponent — Real-Time DeFi Risk Metrics, $53,000 and 350,000 vested GRO tokens.

- Frax DAO and DAO contributor — Development of Liquidity Risk Dashboard (FIP 103), $80,000 one-time fee (Failed).

- Vesper DAO and Gauntlet Network — Engage Gauntlet for On-chain Risk Management (VIP 007), 1.5% of protocol revenue to Gauntlet.

These proposals aim to help DAOs manage and mitigate risk, ensuring their organizations’ long-term stability and success.

References

EigenPhi Research. (2022, Dec. 13). An in-depth analysis of how AAVE’s $1.6 million bad debt was created. Report on code at risk. Retrieved from https://drive.google.com/file/d/1u3vtcsQ1qfclt6Od8aZx5DkvuQRE4GMH/view on December 20, 2022.

Warmuz, J., Chaudhary, A., & Pinna, D. (2022). Toxic Liquidation Spirals: Evidence from the bad debt incurred by AAVE. arXiv preprint arXiv:2212.07306.

—

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.