Failed crypto exchange FTX disclosed the names of various shareholders and investors in a recent bankruptcy court filing dated Jan. 9.

VC firms led funding rounds

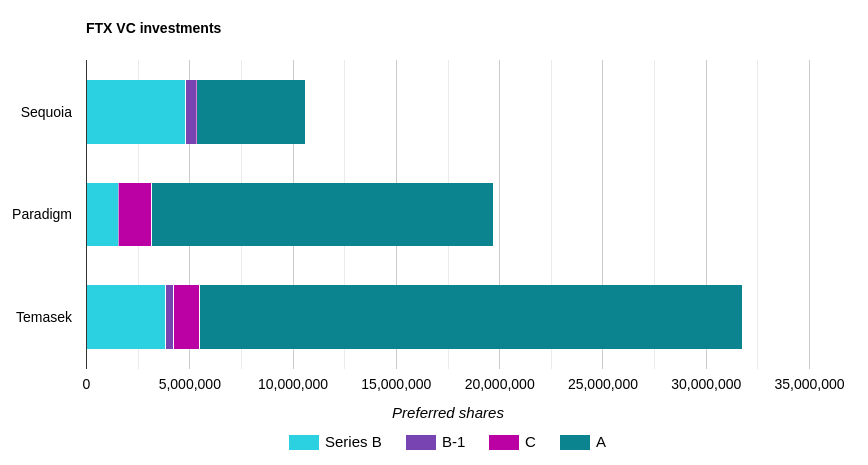

FTX carried out four rounds of fundraising between July 2021 and January 2022, labeled Series B, Series B-1, Series C, and Series A.

Those fundraising rounds were largely led by VC firms known for their involvement in the crypto industry, including Sequoia and Paradigm, according to analysis by CNBC.

Sequoia Capital made two large investments in series B and series A, through which it obtained 4.8 million preferred shares and 5.3 million shares, respectively. It also gained just over 572,000 shares in Series B-1. Despite obtaining relatively few shares overall, it was the largest investor in Series B and was responsible for 16% of that round.

Paradigm made its largest investment in Series A and obtained 16.5 million shares. However, it only led Series C, where it obtained just 1.6 million shares but was responsible for 20% of all funding. It also obtained 1.5 million shares in series B.

Temasek — a Singapore state-owned investment company that recently moved into crypto VC investment — led FTX’s ambitious series A funding round. Temasek obtained 26.3 million shares and accounted for 16% of that investment round. It also gained approximately 5.4 million additional shares in the other three funding rounds.

Crypto firms and individuals invested in FTX

FTX’s shareholder filing also disclosed a number of other smaller investments of interest. Coinbase held 1.3 million preferred shares and 4 million common shares — a notable investment, as the two exchanges were direct competitors.

Various other crypto-adjacent entities invested in FTX as well. Huobi or one of its executives, held 247,700 common shares. The Japanese crypto bank Softbank, the Bitcoin ETF applicant Van Eck, and the investment firms Multicoin Capital and CoinFund held combinations of preferred shares and common shares.

FTX’s filing revealed ties to the billionaire hedge fund manager and crypto advocate Paul Tudor Jones. Though family trusts, Jones owned 476,918 preferred shares, making him the 15th largest investor in FTX’s Series B funding round.

Other individual investors of note include celebrity trainers Denise and Katie Austin, “Shark Tank” host Kevin O’Leary (through O’Leary Productions), and New England Patriots owner Robert Kraft (through KPC Venture Capital).

Kraft is perhaps the most noteworthy of those names due to FTX’s earlier connections to the New England Patriots. In June 2021, the exchange struck a deal with team quarterback Tom Brady. Brady had 1.1 million common shares, according to the shareholder filing. His ex-wife, supermodel Gisele Bündchen, had 686,761 shares. Kraft had 155,144 preferred shares plus 479,000 common shares.

Certain FTX associates, including former FTX CEO Sam Bankman-Fried and former Alameda Research CEO Caroline Ellison, were also named in the shareholder filing.

It should be noted that many of the above investments were previously disclosed by those involved. However, the filing provides precise data on the matter and reveals whether investors were highly — or only slightly — invested in FTX.

The post FTX shareholder filing reveals New England Patriots owner, Coinbase, others invested in firm appeared first on CryptoSlate.