Bloomberg Intelligence senior macro strategist Mike McGlone says Bitcoin’s (BTC) road to recovery comes with big challenges.

McGlone tells his 54,400 Twitter followers that Bitcoin may be forming a bottom similar to 2018, but he warns the macroeconomic conditions are now less favorable than they were back then.

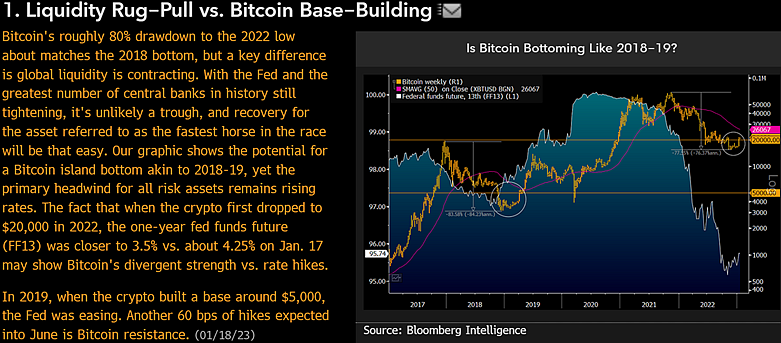

“Bitcoin’s roughly 80% drawdown to the 2022 low about matches the 2018 bottom, but a key difference is global liquidity is contracting. With the Fed and the greatest number of central banks in history still tightening, it’s unlikely a trough, and recovery for the asset referred to as the fastest horse in the race will be that easy.”

McGlone says the Fed is likely to remain hawkish through June and that will create downward pressure on risk assets like Bitcoin. But he says Bitcoin may be showing strength against rate hikes.

“Our graphic shows the potential for a Bitcoin island bottom akin to 2018-19, yet the primary headwind for all risk assets remains rising rates. The fact that when the crypto first dropped to $20,000 in 2022, the one-year fed funds future was closer to 3.5% vs. about 4.25% on Jan. 17 may show Bitcoin’s divergent strength vs. rate hikes.

In 2019, when the crypto built a base around $5,000, the Fed was easing. Another 60 bps [basis points] of hikes expected into June is Bitcoin resistance.”

Other crypto analysts have also said Bitcoin is mirroring the bottoming in 2018-2019 that preceded a huge rally.

Pseudonymous analyst Smart Contracter told his 218,100 Twitter followers that Bitcoin is likely to dominate the crypto markets in a repeat performance of its 2019 burst.

Another pseudonymous analyst, Altcoin Sherpa, has forecasted Bitcoin will soar to $38,000.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post Bitcoin (BTC) Recovery Unlikely To Be Easy, Warns Bloomberg Strategist Mike McGlone – Here’s Why appeared first on The Daily Hodl.