Analysis from the crypto financial services platform Matrixport uncovered a Bitcoin Lunar New Year trading strategy that has worked every year since 2015.

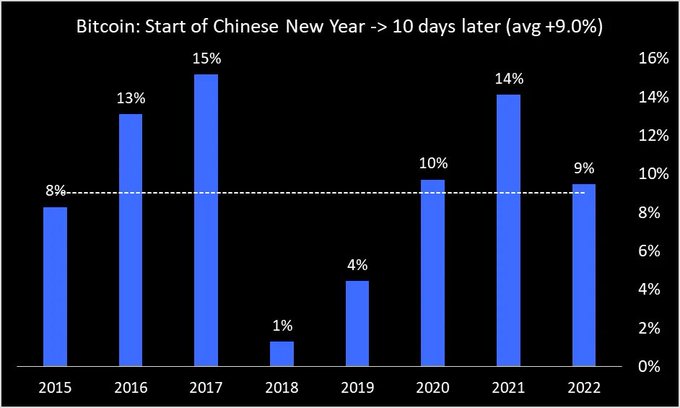

Twitter user @tier10k explained that buying Bitcoin on Lunar New Year day, then selling ten days later, has yielded an average 9% return between 2015 and 2022. Further, this strategy has a 100% hit rate of positive returns to date.

The chart below shows following this strategy in 2017 yielded the most significant return, at 15%. By contrast, 2018’s result, although a positive return, was relatively negligible, paying back just 1%.

It remains to be seen if this pattern will hold for 2023.

The Year of the Rabbit

The date of the Lunar New Year is determined by the second new moon after the winter solstice, meaning it varies from year to year.

This year, the Year of the Rabbit began on Jan. 22, kicking off 15 days of celebrations that will culminate with the Lantern Festival on Feb. 5. Incidentally, the rabbit represents wealth and prosperity.

Bitcoin closed Jan. 22 priced at $22,700. If the Lunar New Year pattern holds for 2023, a 9% gain will yield a $2,043 price increase by the end of Feb. 1.

Lunar New Year aside, the Gregorian New Year launched an encouraging run of form for Bitcoin, recording 38% gains year-to-date while sparking debate on the bear market ending.

Since Jan. 21, Bitcoin has been moving in a relatively flat pattern, with Lunar New Year recording a 3.3% swing in price to close the day marginally down from Saturday’s closing price.

The post Year of the Rabbit could signal a Bitcoin bull run appeared first on CryptoSlate.