Bitcoin’s price Analysis

Bitcoin’s price made its highest daily candle close since August 18th, 2022 on Wednesday and finished the day’s session +$418 en route to a bullish engulfing candle on the daily time frame.

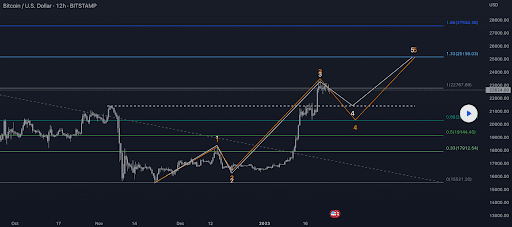

The BTC/USD 12HR chart below by BWCPT is where we’re leading-off this Thursday’s price analyses. At the time of writing, BTC’s price is trading between the 1 fibonacci level [$22,767.69] and the 1.33 fib level [$25,159.03].

Bullish traders firstly want to regain the 1.33 fib level with a secondary target after that level of 1.66 [$27,550.38].

From the bearish perspective they’re aiming to usher in a larger move to the downside on wave 3 on the 12HR chart. Their targets to the downside are the 1 fib level, 0.66 [$20,303.89], 0.5 [$19,144.45], 0.33 [$17,912.54], and a full retracement at 0 [$15,521.20] to Bitcoin’s multi-year low on the BITSTAMP chart.

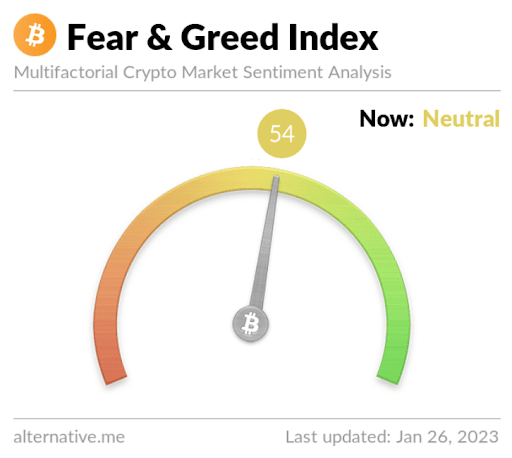

The Fear and Greed Index is 54 Neutral and is +3 from Wednesday’s reading of 51 Neutral.

Bitcoin’s Moving Averages: 5-Day [$22,348.11], 20-Day [$19,149.96], 50-Day [$17,740.34], 100-Day [$18,601.08], 200-Day [$22,274.37], Year to Date [$19,434.97].

BTC’s 24 hour price range is $22,324-$23,812 and its 7 day price range is $20,678-$23,812. Bitcoin’s 52 week price range is $15,505-$48,162.9.

The price of Bitcoin on this date last year was $36,786.7.

The average price of BTC for the last 30 days is $18,844.7 and its +34.9% over the same span.

Bitcoin’s price [+1.85%] closed its daily candle worth $23,045 on Wednesday.

Ethereum Analysis

Ether was the top performer of the assets covered today and finished Wednesday +$55.25.

The ETH/USD 1D chart from MillennialInvestmentsPros is the second chart we’re examining today. Ether’s price is trading between the 0 fibonacci level [$933.60] and 0.236 fib level [$1,552.36], at the time of writing.

Bullish Ether traders have targets to the upside of the daily time frame of 0.236, 0.382 [$1,935.16], 0.5 [$2,244.54], 0.618 [$2,553.92], 0.786 [$2,994.40] and the 1 fibonacci level [$3,555.48].

The chartist posits that if ETH is unable to regain the 0.236 fib level that a retracement back to the $1,279.65 is forthcoming.

Ether’s Moving Averages: 5-Day [$1,591.58], 20-Day [$1,406.08], 50-Day [$1,297.50], 100-Day [$1,351.92], 200-Day [$1,555.67], Year to Date [$1,429.41].

ETH’s 24 hour price range is $1,518-$1,641 and its 7 day price range is $1,511.24-$1,641. Ether’s 52 week price range is $883.62-$3,579.96.

The price of ETH on this date in 2022 was $2,461.30.

The average price of ETH for the last 30 days is $1,378.37 and its +27.01% over the same duration.

Ether’s price [+3.55%] closed its daily session on Wednesday worth $1,611.22 and in green figures for the first time in three days.

XRP Analysis

Ripple’s price also climbed higher during Wednesday’s trading session and when the day concluded, XRP was +$0.0101.

The final chart for analysis this Thursday is the XRP/USD 1D chart from XRP-Jonny. Below we can see XRP’s price action during the bull market of 2017 on the left and on the right we can see the daily time frame, at the time of writing.

The chartist is alluding to the fact that these structures are similar and that market participants could see something play out in the future like 2017. The targets for bullish XRP traders to the upside if price action mimics 2017’s price action are 0.382 [$0.453], 0.5 [$0.512], and the 0.618 fibonacci level [$0.579].

Bearish traders conversely are targeting the 0.236 fibonacci level [$0.389] and 0 [$0.305].

XRP’s Moving Averages: 5-Day [$0.412], 20-Day [$0.0.373], 50-Day [$0.376], 100-Day [$0.406], 200-Day [$0.404], Year to Date [$0.376].

Ripple’s 24 hour price range is $0.3965-$0.4245 and its 7 day price range is $0.3788-$0.4245. XRP’s 52 week price range is $0.2876-$0.9126.

Ripple’s price on this date last year was $0.618.

The average price of XRP over the last 30 days is $0.369 and its +17.52% over the same interval.

Ripple’s price [+2.48%] closed its daily candle on Wednesday worth $0.418.