Key Insights

- Overshadowed by the FTX drama and soured price action, Q4 reflected that Avalanche’s network and ecosystem continue to grow and remain strong.

- Avalanche-native projects were seemingly insulated from the FTX plague, and the Avalanche Foundation confirmed minimal exposure to FTX.

- Several subnet upgrades including Elastic Validation and Avalanche Warp Messaging (AWM) went live during the quarter.

- Integrations with partners like GREE, OpenSea, Shopify, and Alibaba set the stage for more ecosystem expansion.

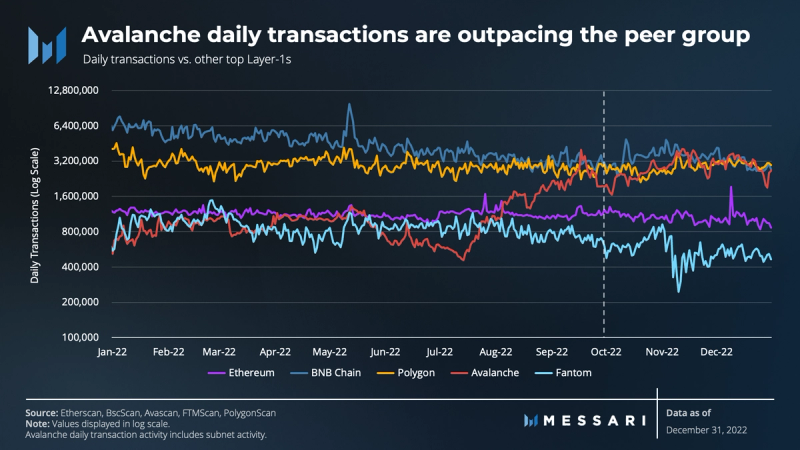

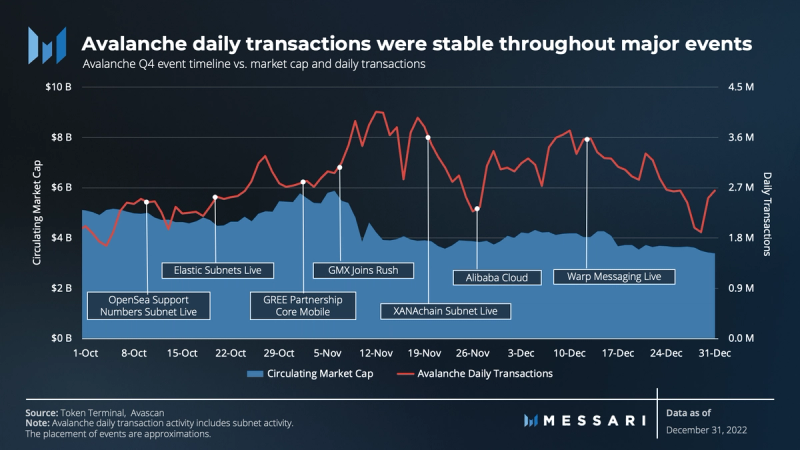

- While daily active addresses were flat, the overall Avalanche network continued to experience an increase in average daily transactions, finishing the year with about 1.9 million transactions per day.

- Sustained stake amounts, a growing validator set, and more delegators suggest that the network is healthy and progressing toward a more decentralized state.

- Over the coming months, many of the subnets on the Fuji Testnet will begin transitioning onto the Avalanche mainnet. Expect an increase in the validator set and demand for network security.

Primer on Avalanche

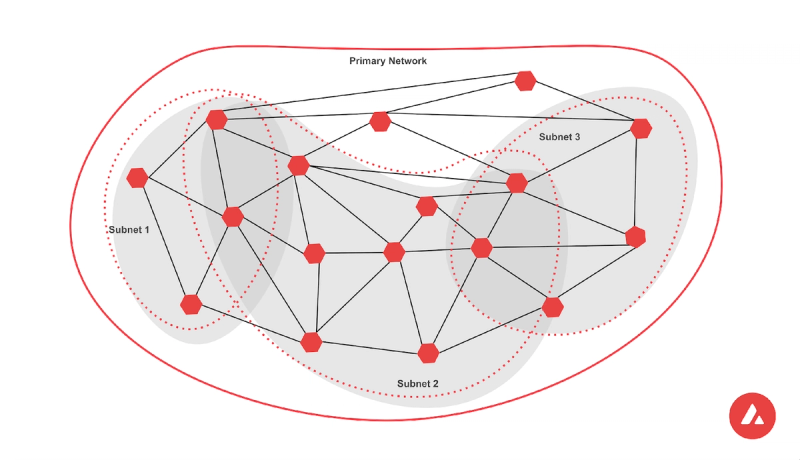

The Avalanche network is a Proof-of-Stake (PoS) smart contract platform for decentralized applications. Avalanche differentiates itself by creating and implementing a consensus family known as “Avalanche consensus.” Following years of research, the Avalanche mainnet was launched in September 2020 and featured the release of a multichain framework utilizing three chains: the P, X, and C chains. Each chain plays a critical and unique role within the Avalanche ecosystem while providing the same capabilities of a single network, often called the Primary Network. Avalanche consensus and the Primary Network are designed to support sovereign, interconnected blockchains known as subnets. Subnets are subclasses of Primary Network validators that run the same Virtual Machines (VMs) with their own rules. Subnets enable different properties of reliability, efficiency, and data sovereignty. They provide the ability to create custom blockchains for different use cases while isolating high-traffic applications from congesting activity on the Primary Network.

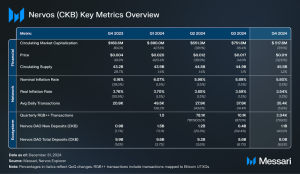

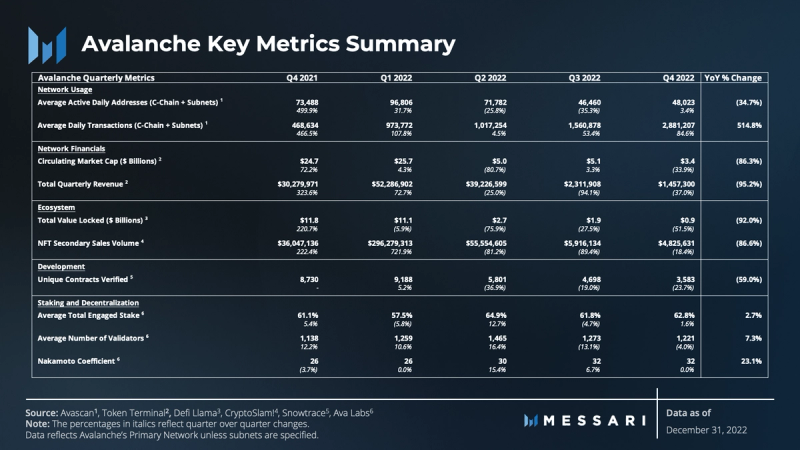

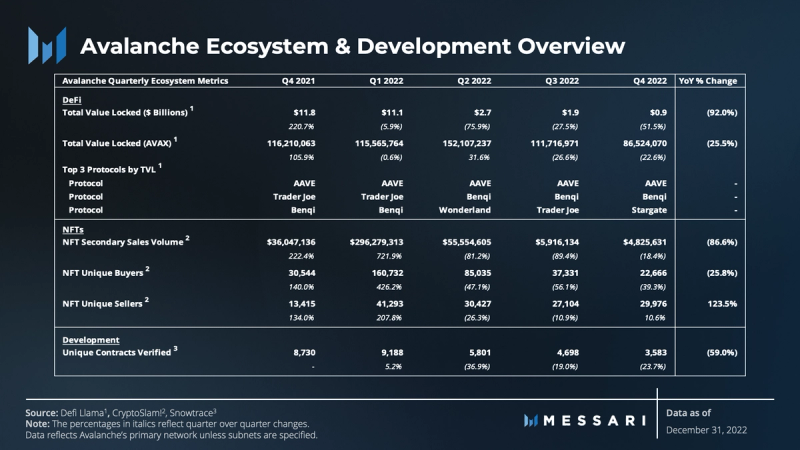

Key Metrics

The Fourth Quarter Narrative

2022 was a rollercoaster of a year for the crypto industry. Macroeconomic forces sparked a bear market in January that was perpetuated by the collapse of LUNA and UST in the spring. Q4 brought one of the final twists of the year with the failure of FTX and the contagion that followed. Despite the FTX drama and soured price action, Q4 reflected that Avalanche’s network and ecosystem continue to grow and remain strong.

As the year rounded out, Avalanche’s mission toward adoption remained intact, as evidenced by several subnet upgrades; integrations with partners like GREE, OpenSea, Shopify, and Alibaba; and ecosystem expansion into DeFi, NFTs, GameFi, and beyond. Advancements in user experience also continued with upgrades to Avalanche’s flagship non-custodial multichain wallet, Core.

As a follow-up to the State of Avalanche Q3 2022 report, this report will dive into the quantitative performance over 2022 and Q4 and the qualitative evidence that Avalanche is continuing to progress through adverse market conditions and usher in catalysts for growth.

Subsequent events will be covered in the State of Avalanche Q1 2023 report.

Performance Analysis

Financial and Network Overview

The data used to evaluate the quantitative aspects of the Avalanche network are based on the Primary Network (includes P, X, and C-Chains) and seven Avalanche Subnets including:

- DFK (launched Q1 2022)

- Swimmer (launched Q2 2022)

- WRAPTAG (launched Q2 2022)

- STEPNETWORK (launched Q3 2022)

- Numbers (launched Q4 2022)

- XANACHAIN (launched Q4 2022)

- DEXALOT (app coming Q1 2023)

Because subnets are plugged into the overall Avalanche architecture, each subnet contributes to and utilizes Avalanche consensus and security. Therefore, each subnet contributes to overall network activity in terms of transactions and users.

Each subnet operates as an independent blockchain with its own design and economic rules for accumulating value. Because these subnets grow their own ecosystems and connect to those of other subnets, they would require separate in-depth reporting.

The financial and ecosystem-specific metrics throughout the report focus on the Avalanche Primary Network, as the economic activity occurring on the C-Chain is currently driving the most value to the AVAX token.

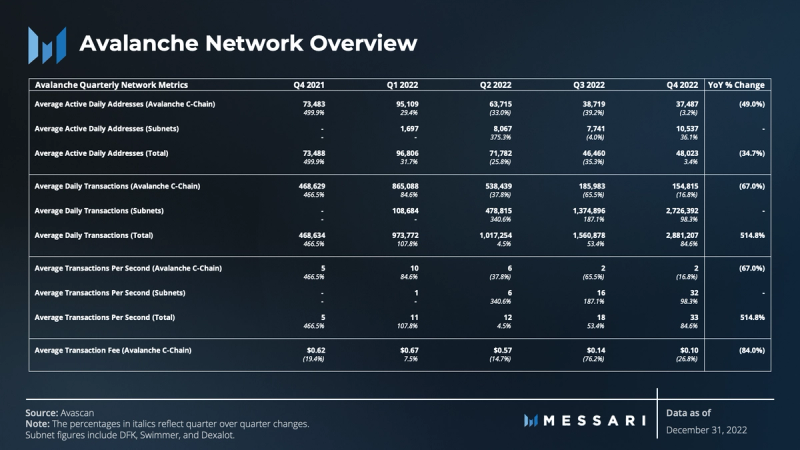

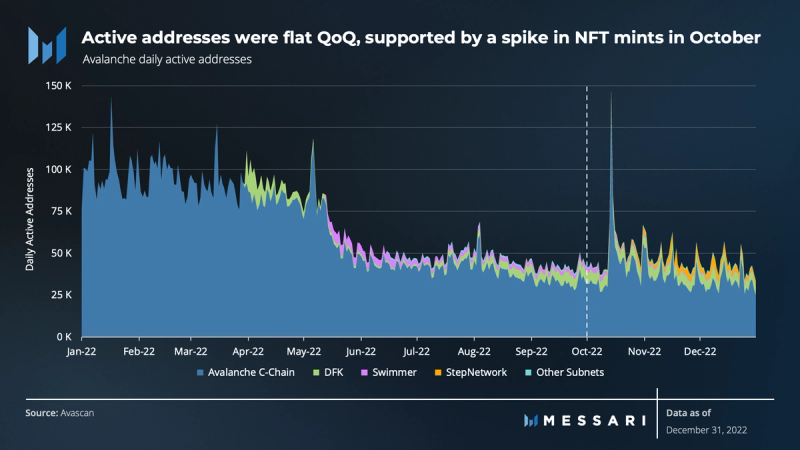

Despite the headwinds stemming from the FTX debacle, daily active addresses were flat throughout the quarter, except for a spike on the C-Chain in October. The spike came from a surge in NFT minting as new projects deployed. While total active addresses were flat QoQ, market sentiment likely contributed to the 34.7% decline YoY. This decline, however, was partially offset by the address activity on subnets. The continued growth in address activity on subnets indicates demand for those network’s applications and that subnet functionality is healthy.

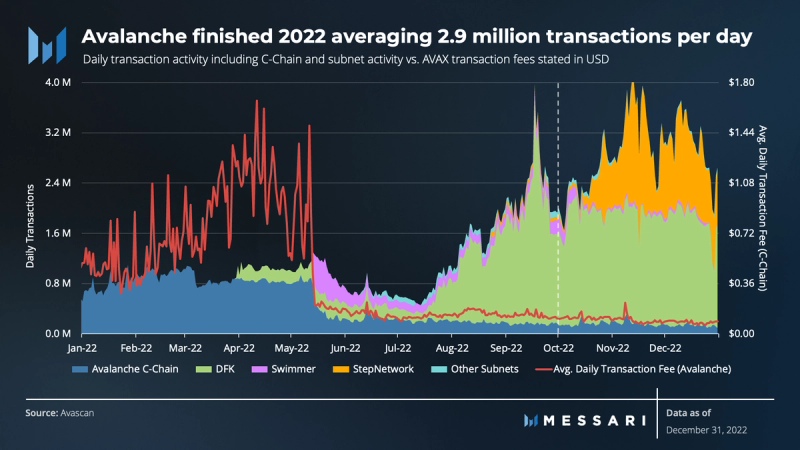

During Q4, as was the case throughout 2022, the overall Avalanche network continued to experience an increase in average daily transactions, finishing the year averaging ~2.9 million transactions per day across the C-Chain and subnets. While market sentiment likely continued to put downward pressure on user activity regarding active addresses, having more transactions per address suggests that users are becoming power users, mainly of the DFK and StepNetwork subnets.

Like daily active addresses, average daily transactions were relatively flat QoQ on the C-Chain. While flat QoQ, transactions on the C-Chain declined 67% YoY. This decline was also likely due to market sentiment and the migration of activity from the C-Chain to subnets. Overall, the C-Chain’s decrease in average daily transactions was dramatically offset by the transaction activity on subnets.

So why does the relationship between the Avalanche Primary Network, the C-Chain, and subnets matter in this context?

Their relationships intertwine network security and performance, revenue generation, and value accrual.

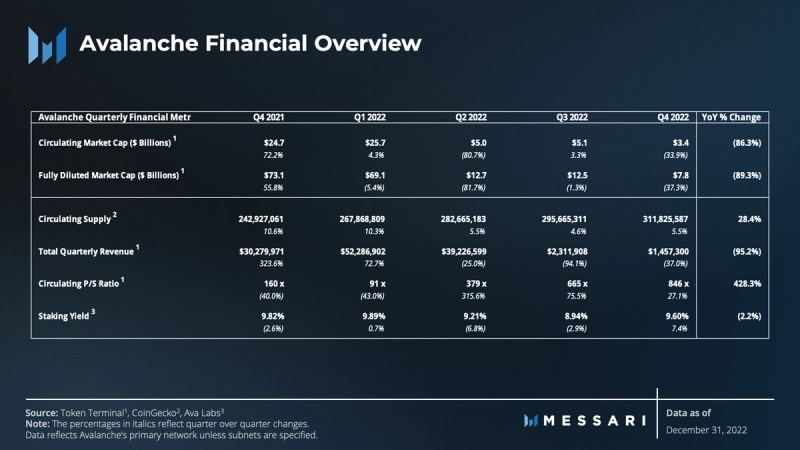

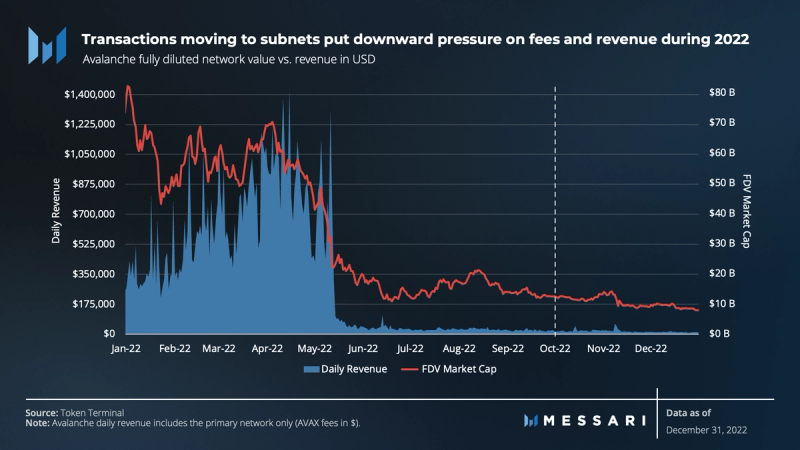

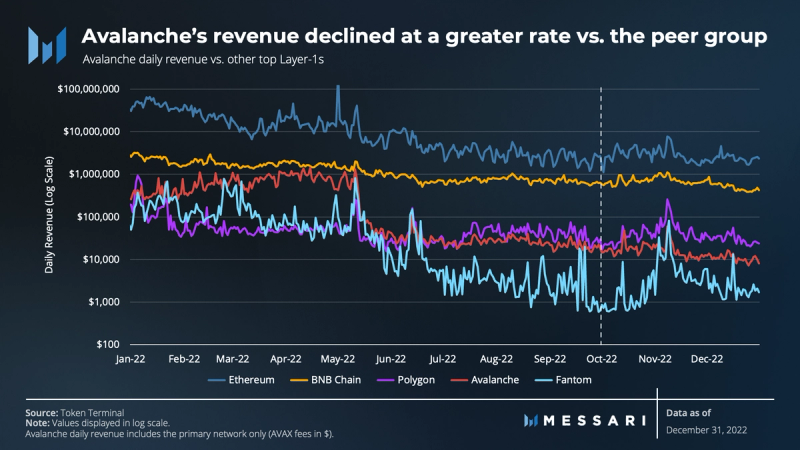

Previously, DFK and Swimmer were the C-Chain’s top transaction and revenue drivers. However, the migration of transactions from the C-Chain to individual subnets put downward pressure on Avalanche transaction fees (by design) and, therefore, revenue. For perspective, average transaction fees in USD declined over the last three quarters of 2022 and finished the year down 84%. The decline in transactions from migrating to subnets and the decline in transaction fees contributed to the 95.2% decline in AVAX revenue YoY. Since Avalanche burns 100% of transaction fees, the reduction in transaction fees also puts downward pressure on the burn rate of AVAX. Just over 2 million AVAX had been burned as of December 31, 2022.

Revenue, therefore, continues to be a focus for many participants in the ecosystem. In theory, by increasing scarcity, value is created for all AVAX tokenholders.

As a result of the burning mechanism, C-Chain revenue directly influences AVAX’s market value. As evidenced throughout the last year, spikes and declines in daily revenue were accompanied by spikes and declines in fully diluted valuation (FDV).

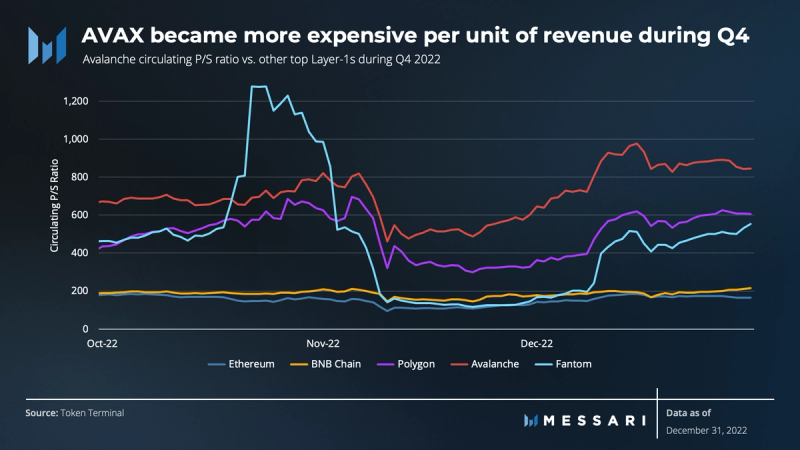

From a valuation perspective, the relationship between network value and revenue is also in line with the direction of the P/S ratio. The P/S ratio has grown from 91x to 846x since Q1, suggesting that the network is overvalued compared to historical levels.

That said, a simple P/S ratio may not be enough to evaluate blockchain assets. As an unprecedented asset class, blockchain assets may need several unique valuation techniques. One such technique recently introduced is the Expected Demand for Security Model. This model proposes that the key driver for the value accrual of a blockchain asset is the gross demand for security by all present and future infrastructure.

With this model in mind, demand for security has largely become the value accrual mechanism for the Avalanche network and AVAX.

Source: Avalanche Documentation

Several considerations of value accrual were highlighted in the Q3 2022 report. With subnets, however, value doesn’t just come from their benefits to scaling the entire network — subnets are a value proposition for developers. They allow decentralized applications to leverage Avalanche infrastructure and easily spin up uniquely tailored blockchain environments.

When the hundreds of subnets under development on the Fuji Testnet go live, the value will come from two sources:

- Each subnet will contribute to the security of the entire network (expanding infrastructure). Every subnet must stake 2,000 AVAX and validate on the Primary Network. If 100 subnets go live in 2023, the financial capital deployed to secure the network would come to ~$2.75 million at the $10.87 year-end price of AVAX.

- Each subnet will demand security for their sovereign subnets. In addition to providing one validator, each subnet must also tap into anywhere from three to all P-chain validators. These validators could overlap between different subnets or could be unique to a subnet. If 100 subnets go live in 2023, it would generate demand for 800 validators (or $17 million in security), assuming that each subnet utilizes (demands) ~8 validators to secure their network (as DFK and Swimmer currently do). However, because of overlapping validators, this demand does not correlate one to one with new, distinct validators. Thus, a lower number of validators and amount staked could satisfy this demand. Nonetheless, the addition of thousands of subnets would increase demand for security (a larger validator set), driving up demand for AVAX.

Ultimately, the value accrual from expanding the validator set is much different and may take longer than what comes from revenue and burning transaction fees on the C-Chain. It is also significantly dependent on the value proposition and success of subnets.

With that in mind, several developments pushed forward the value proposition of subnets during the back half of 2022, especially in Q4.

On October 18, 2022, the Banff upgrades and Elastic Validation went live. Elastic Subnets allows creators to activate Proof-of-Stake validation and uptime-based rewards using their native subnet token. As a result, anyone can become a subnet validator by staking the subnet’s token on the Avalanche P-Chain. This opens up a multitude of incentives and security benefits.

The Avalanche team also released its second SDK for building Avalanche Virtual Machines (AVM), the Rust SDK. Developers can leverage the SDK to launch blockchains utilizing the Rust language on an Avalanche subnet. This update introduces more flexibility when developing a subnet.

Finally, Avalanche Warp Messaging (AWM) went live. Before the launch of AWM, projects that wanted to transfer assets or data between subnets had to deploy and manage their own bridges. AWM allows subnets to communicate with each other by producing a BLS Multi-Signature. The mechanism verifies the validity of an arbitrary message, such as a transfer or contract data, which any other subnet can then prove. Cross-subnet communication should theoretically catalyze network effects.

The subnet landscape is well-positioned to grow. These recent developments will be bolstered by those coming in the future, along with the inherent value proposition of building a subnet. If all goes well, the subnet landscape will generate network effects and accrue value throughout the Avalanche ecosystem.

While subnets tend to steal the spotlight, there are several other strategies to grow the C-Chain’s adoption. Many applications may choose to build on the C-Chain exclusively because it’s a better fit. Others begin on the C-Chain and then migrate to a subnet later. Nonetheless, regardless of the chain, the Avalanche ecosystem continues to expand according to its core strategies.

Ecosystem and Development Overview

DeFi

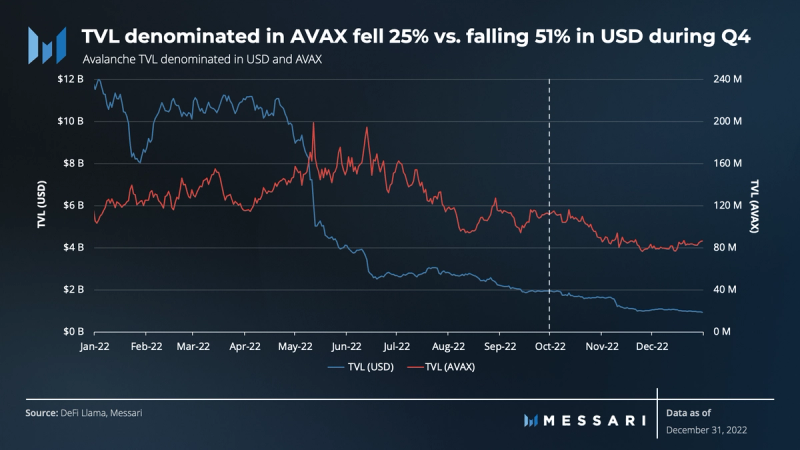

There is no doubt that early 2022 was the end of the last bull cycle and that a bear market was underway. The macroeconomic climate, the collapse of LUNA and FTX, and the contagion that followed only exasperated the bear through the end of the year. As market sentiment shifted and incentive programs slowed, TVL fell 51% in USD over Q4 and finished the year down 92%. Although TVL in USD was down, TVL denominated in AVAX was less drastic. TVL in AVAX was down only 25.5% YoY compared to 92% in USD. From this perspective, TVL stated in USD is merely the result of the decline in AVAX price and not so much the utilization of cryptoassets in Avalanche DeFi.

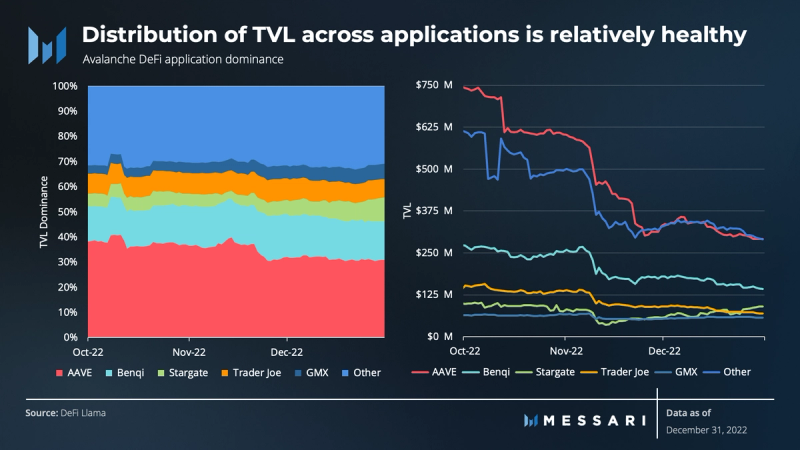

None of the DeFi applications on Avalanche have been entirely immune to the macro climate of 2022 or the FTX debacle. However, the composition between the top five DeFi protocols and the smaller, long-tailed protocols remained relatively stable. All “other” smaller protocols comprise ~32% of all TVL on Avalanche. This relatively healthy distribution of TVL across applications results in a greater level of diversified TVL that mitigates overall ecosystem risk.

Comparatively, some other networks have 50% or more of their TVL in a single application. If said application were to collapse, it would have a significantly negative impact on their ecosystems.

This diversity is partly due to the ongoing developments in the Avalanche DeFi ecosystem and application launches. Existing applications continued to roll out upgrades, and dozens of DeFi applications were launched during Q4.

Trader Joe, Avalanche’s leading multi-functional DeFi trading platform, introduced Liquidity Book, a next-generation AMM protocol. Liquidity Book is efficient, flexible, and built for DeFi infrastructure.

Another catalyst for growth emerged when GMX joined the Avalanche Rush liquidity mining incentive program with $4 million in incentives. GMX is a decentralized spot and perpetual exchange that has moved up the ranks to one of Avalanche’s top five DeFi protocols.

Another anticipated development is the first DEX subnet, Dexalot. Dexalot implements an on-chain central limit order book (CLOB) for its trading pairs and allows users to trade against AVAX with ERC-20 tokens supported on the C-Chain. The Dexalot subnet went live during Q4, but the Dexalot application is set to go live in Q1 2023. Dexalot could potentially drive network effects across other subnets and the C-Chain.

Other notable developments in the Avalanche DeFi space include:

- Aboard Exchange – An order-book decentralized derivatives exchange went multichain and launched on Avalanche.

- DeltaPrime – An undercollateralized lending protocol that launched in November.

- ODOS – A DEX aggregator integrated with Chainlink and Avalanche.

- KKR – Institutional money manager that tokenized part of its Health Care Strategic Growth Fund.

- INX – SEC registered broker-dealer integrating Token-as-a-Service (TaaS) platform designed for capital raise purposes.

- Enclave Markets – A fully encrypted exchange (FEX) aimed at mitigating front running, MEV, and slippage.

- Acumen Network – Lending and borrowing protocol aimed at microfinance prepared for its launch in early 2023.

Ultimately, despite the bear and FTX contagion, developments are underway throughout Avalanche DeFi and are positioned to prop up and service additional demand.

NFTs

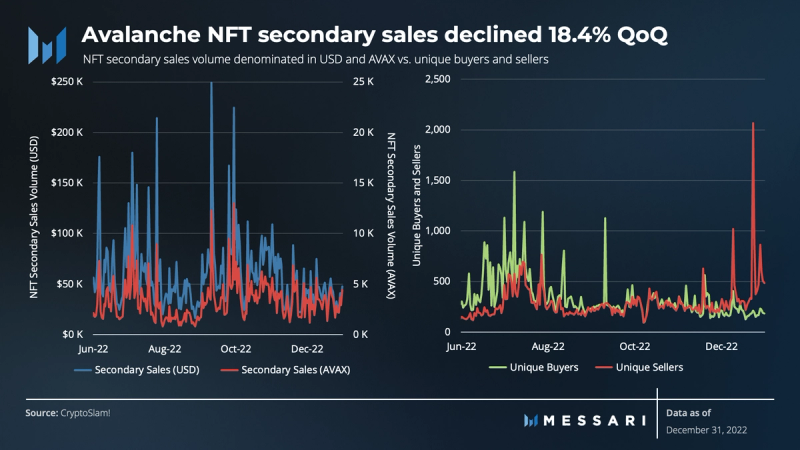

The downturn in TVL wasn’t isolated to DeFi. Avalanche’s nascent NFT market experienced declines in secondary sales volume (-18.4%) and unique buyers (-39.3%), while unique sellers increased by 10.6%.

Like the DeFi ecosystem, developments in the NFT space continued to roll out during Q4.

The Joepegs NFT marketplace that launched in Q2 renewed NFT activity on Avalanche, raising $5 million in a deal led by Avalanche and FTX Ventures (the deal was done before FTX imploded). This is a bullish sign for Joepegs as it continues to invest in its operations to work with merchants, projects, and artists.

Further, OpenSea launched support for Avalanche and now runs on the blockchain alongside other platforms such as Joepegs.

Finally, the Venly NFT Minter application launched in Q4. This application allows any merchant to start selling NFTs from their own Shopify store. It was built to make it easy for merchants, to design, create, mint, and sell NFTs on the Avalanche blockchain.

Other notable developments in the Avalanche NFT space include:

- Airbus – Chose Avalanche to mint its RACER Series.

- Coolkicks – The platform raised $6 million from the Avalanche ecosystem fund for Blizzard and NFL superstars Odell Beckham Jr. and Kyler Murray to launch MynaSwap. MynaSwap is a trading and vaulting platform for collectibles, such as sneakers, sports cards, and watches.

- LODE – Announced its launch of Bullpen.pro. Bullpen.pro is designed to provide peer-to-peer trading access to fully allocated, securely vaulted, and insured silver and gold bullion in the form of an NFT.

While Avalanche’s NFT sector is still in the early stages, developments and partnerships like these continue to roll out and catalyze additional demand.

GameFi

Blizzard, one of Avalanche’s ecosystem funds, is still in motion and attracting creatives and GameFi. GameFi subnets are also notably on the horizon as more partnerships are forming.

GREE, one of Japan’s largest gaming and media companies with over 30 million monthly active users (MAU), announced its partnership with Avalanche in October. GREE Games is advancing Web3 gaming through ecosystem investments, subnet development, and validating the Avalanche network. GREE now runs more than a dozen Avalanche validators in its broader plans to participate in the Avalanche Primary Network and gaming subnets.

Other notable developments in the Avalanche GameFi space include:

- Crypto Royale – Initially built on Harmony, migrated to the Avalanche C-Chain.

- Pulsar – A real-time strategy (RTS) game that launched its subnet in November.

- Monsterra – A multichain NFT game initially on BNB Chain that launched on Avalanche C-Chain.

- TimeShuffle – A play-to-earn web-based RPG game that released its alpha version.

- Swimmer Subnet – Ushered in Snake City to utilize Swimmer network infrastructure and run alongside Crabada.

Swimmer also integrated with Celer’s C-Bridge to support bridging Crabada assets from the C-Chain to Swimmer Subnet.

GameFi is clearly becoming a larger part of the Avalanche ecosystem, following the success of DeFi Kingdoms.

For perspective, the DFK Chain, with its low fees and gameplay, generates 1-2 million transactions per day. After its subnet launch earlier this year, DeFi Kingdoms’ initial user base had about 1,000 unique active wallets (UAW) interacting with it. In Q4, that metric grew to over 5,000.

SHRAPNEL, a AAA first-person shooter game, also demonstrates Avalanche’s GameFi potential as it was awarded the Most Anticipated Game at the inaugural GAM3 Awards event held in December.

Frontier Use Cases

In addition to DeFi, NFTs, and GameFi, Avalanche catalyzed additional use cases like Initial Litigation Offerings (ILOs), Film Finance Offerings (FFOs), and others throughout the year. These types of unique use cases are continuing to emerge.

At the start of Q4, Blizzard made a strategic investment in Space and Time, a decentralized data platform. This platform raised $20 million from investors like Microsoft’s M12, Avalanche, and Polygon to build a decentralized data warehouse for smart contracts. Connected to Startup with Chainlink, Space and Time will work closely with the Oracle network to broaden the possibilities of smart contracts. Their goal is to enable blockchain developers to create decentralized applications and analytics at a low cost.

Further, the StepNetwork Subnet experienced traction during Q4, averaging ~900,000 transactions per day, with its initial fitness application, Step App.

Q4 also ushered in use cases ranging from tokenized reinsurance (RE), Digital Media Subnet development (Numbers Protocol), and DeSocial applications (dua.com and Galxe) to the International Chess Federation (FIDE) building an Avalanche Subnet.

FIDE is developing Web3 products on Avalanche for over 500 million chess players globally. These include calculating official player ratings and releasing a FIDE game explorer, powered by on-chain game data.

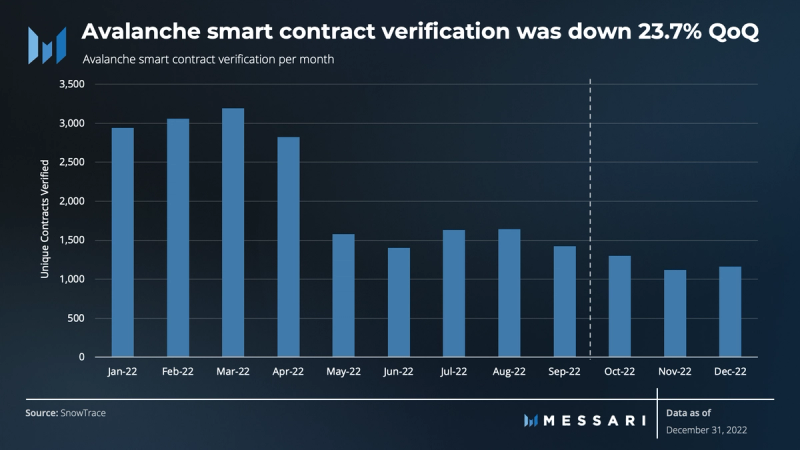

Development Activity

Development engagement, as measured by unique smart contract verifications, has yet to catch up to the developments across the ecosystem. Smart contract verification is triggered by the developer to translate their code into a higher-level language. This metric followed a similar pattern to most other quantifiable metrics QoQ, with the quarterly total being down 23.7% and 59% YoY. Furthermore, similar to address and transaction activity, smart contract verifications have been rising across the DFK and Swimmer networks.

In previous reports, core developer involvement was also measured by data sources tracking the events in the Ava Labs’ GitHub repository.

However, the current data sources on developer data are imperfect. Not all commits are created equal, which can result in an incomplete picture of core developer activity.

Nevertheless, evidence from data sources such as Token Terminal suggests that the number of GitHub developer repos has been steady YoY despite the 2022 market headwinds.

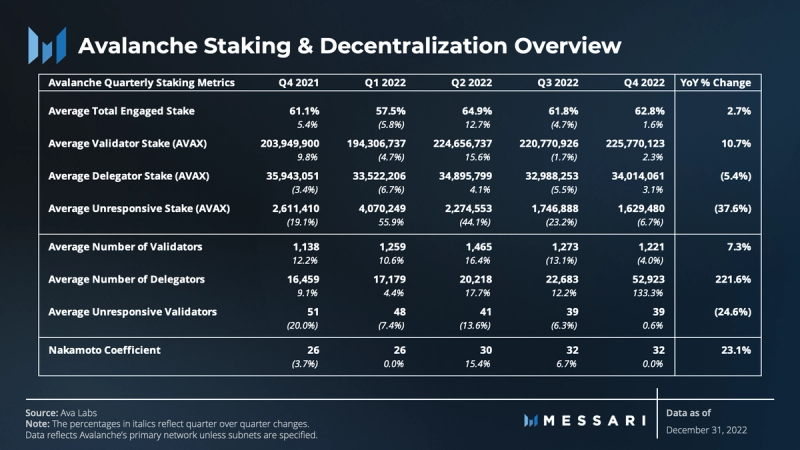

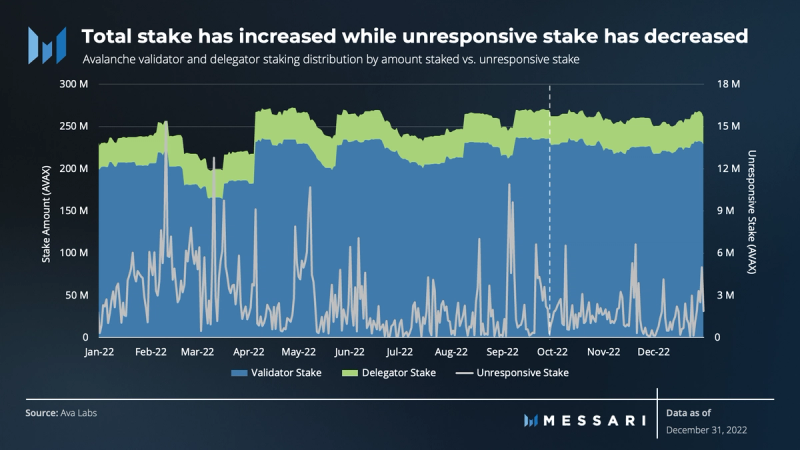

Staking and Decentralization Overview

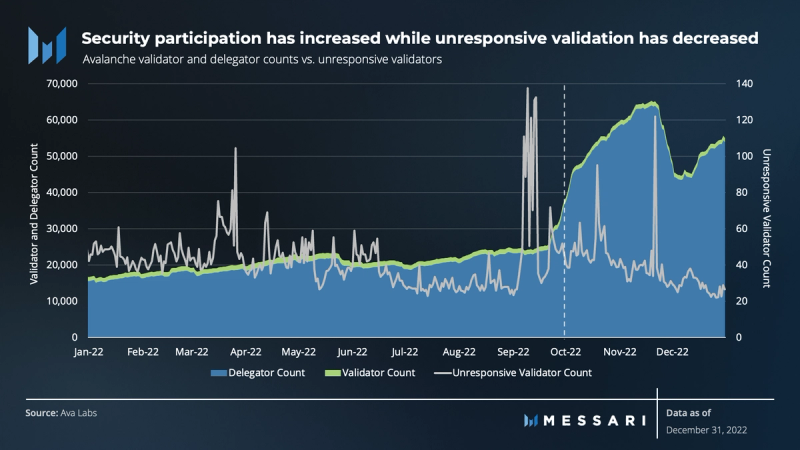

One of the bright spots across Avalanche’s key metrics was the network’s health. Staking and decentralization of the network remained strong despite the rollercoaster of 2022. The average engaged stake stayed stable at ~62% and grew slightly (~2%) QoQ and YoY. Total stake also gradually increased while offline stake (unresponsive stake) declined.

Staking participation is expected to remain strong with further developments such as those with Bitgo. Bitgo offers regulated custody, borrowing, and lending services. It rolled out an Avalanche staking solution for its institutional clients in December.

Unlike average stake amounts, there was a significant shift in the average number of validators and delegators, both QoQ and YoY. While there were occasional spikes of unresponsive validators, such as in September during mandatory security upgrades, there were far fewer overall occurrences of unresponsive validators.

Ultimately, the evidence of sustained stake amounts, a growing validator set, and more delegators suggest that the network is healthy and progressing towards a more decentralized state.

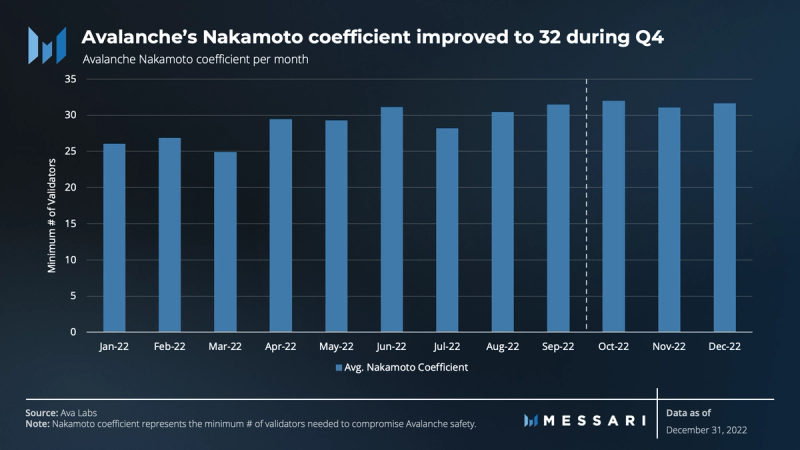

Avalanche’s Nakamoto coefficient continues to hover around 30 but slowly improved to 32 by the end of Q4. With this improvement, Avalanche continues to be above the industry average compared to other Layer-1 networks.

This measure should continue improving as more subnets come online and validate on the Primary Network. Mainstream interest is also entering the fray with Alibaba choosing Avalanche as their first blockchain partner. Alibaba Cloud now offers services to host validator nodes and offers Avalanche developers credits toward any of their services.

Competitive Analysis

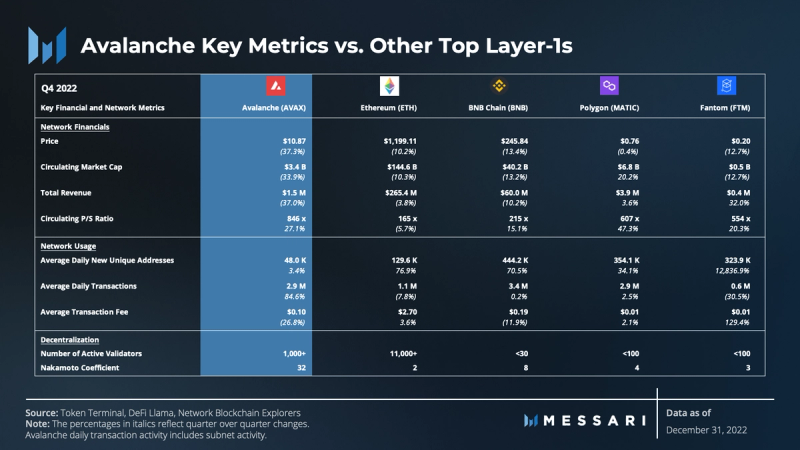

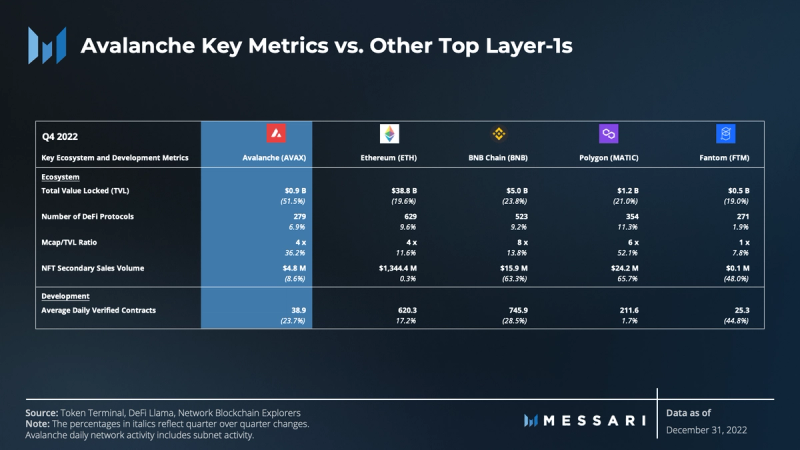

Architecturally, Avalanche may be more comparable to Cosmos (appchains) and Polkadot (parachains). However, we evaluate Avalanche’s key metrics versus the top five chains (including Avalanche) with the largest number of DeFi protocols and TVL because DeFi is still the sector driving the most economic activity on base layers.

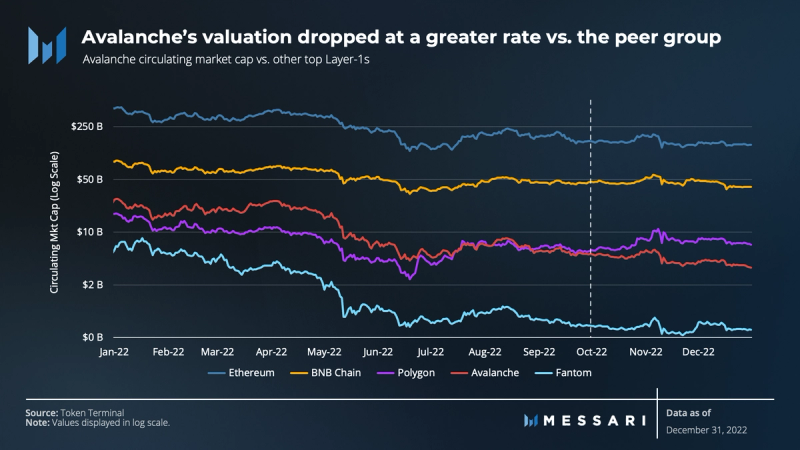

Avalanche’s valuation dropped at the onset of FTX’s undoing. The peer group was also impacted, but less significantly, with Polygon being the least affected.

With the decrease in average transaction fees and daily transactions on the C-Chain, Avalanche’s daily revenue continued to trend downward. The rest of the peer group (minus Polygon and Fantom) experienced only modest declines throughout the quarter.

Avalanche’s P/S ratio increased compared to the peer group. The change in P/S gauges a protocol’s revenue and gives a sense of the amount and cost of transactions processed by the protocol. Because Avalanche’s value change was more significant than its revenue, AVAX became more expensive per unit of revenue.

While Avalanche’s financial metrics underperformed the peer group during Q4, its total network activity strengthened with the adoption of subnets. With the fundamental differences in architecture, it is not quite an apples-to-apples comparison when evaluating network activity and financial metrics. Because subnets are plugged into the overall Avalanche architecture, they each contribute to and demand Avalanche consensus and security. As highlighted earlier, this drives network activity but not necessarily immediate financial value accrual.

Although Q4 affected the crypto DeFi market, Avalanche’s TVL declined the most QoQ compared to the peer group. As highlighted earlier, declines in TVL are generally evaluated in USD, so the native asset’s decline in value represents the shift in TVL versus the actual utilization of the native assets. While TVL in USD was down 51.5%, the amount locked denominated in AVAX only declined by 22.6%.

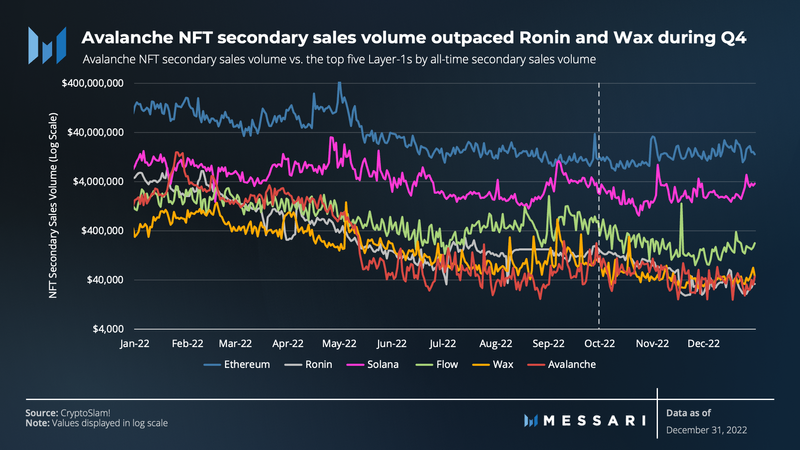

In early 2022, Avalanche was on a path to establishing a strong position relative to a peer group of the top L1s by all-time secondary NFT sales volume.

However, secondary sales dropped in May, around the time of the Swimmer subnet launch and LUNA’s demise. Nonetheless, Avalanche NFT activity went on to stabilize and secure a spot as one of the top 10 in terms of all-time sales volume. With the launch of Joepegs and all of the aforementioned developments in the Avalanche NFT space, NFT sales volume is poised for an upward trajectory from what appears to be a current bottom.

Qualitative Analysis

Key Events, Catalysts, and Strategies for Ecosystem Growth

With the bear market continuing and the FTX catastrophe unfolding, Avalanche expansion strategies and upgrades appeared to be overshadowed throughout Q4. As highlighted in this report, network upgrades continued to improve functionality, especially related to Avalanche subnets. More DeFi protocols were rolled out, and the NFT landscape of Avalanche continued to emerge with integrations, notably OpenSea. GameFi and unique use cases continued to march toward catalyzing a new wave of activity.

Aside from these ecosystem developments, other aspects of the Avalanche strategy were running in the background. Many L1 networks are adopting similar strategies for growth. Avalanche’s strategic elements during Q4 can be generalized into three areas:

- Technical Developments — Integrate, decentralize, and improve efficiency and functionality.

- User access and experience — Captivate users with greater user access and experience.

- Community — Acquire developers and drive adoption through community building.

Technical Developments

As highlighted earlier, much of the technical developments over Q4 were centered around subnet development. This includes Elastic Subnets, the Rust SDK, and Warp Messaging.

Beyond subnet development, Avalanches Core wallet went through several critical upgrades. Core is focused on serving as a command center for Avalanche and other chains while improving user access and experience. The technical integrations during Q4 were included:

- Core browser extension integrated with Coinbase Pay, providing users with a fiat onramp.

- Ava Labs released Core web. Core web brings a web experience and is optimized for use with the Core browser extension.

- Ava Labs also released Core Mobile with Android support. iOS support is planned to go live in production in 2023.

User Access and Experience

Access to the network improved with Coinbase’s support of Avalanche USDC. As USDC remains one of crypto’s most dominant stablecoins, it has become a critical component of the Avalanche ecosystem. To that end, Avalanche now ranks second behind Ethereum in terms of the amount of USDC minted on it.

Meson, which enables low-fee, zero-slippage stablecoin cross-chain swaps, announced its launch on the Avalanche C-Chain. Its cross-chain transfer SDK (Meson.to) allows users to send USDT, USDC, and BUSD to Avalanche from 15 different chains. The integrations with Coinbase Pay and Meson as well as the continued adoption of Avalanche-native USDC may renew activity on the C-Chain.

In addition to exchange listings on Gemini and Coinbase Japan, AVAX also became more accessible with the integration with THORSwap. THORswap is a multichain DEX aggregator built on THORChain’s cross-chain liquidity protocol. The integration will connect directly to Avalanche C-Chain long-tail assets and facilitate swaps for more than 4,800 ERC-20 tokens and 180 Avalanche ERC-20 tokens directly between nine major blockchains.

Finally, LayerZero, an Omnichain interoperability protocol that enables cross-chain applications, launched support for BTC.b. BTC.b is a token representing Bitcoin on Avalanche that can be automatically bridged in Core. As an Omnichain Fungible Token (OFT), it can quickly and securely transfer to and from Avalanche, Ethereum, Polygon, or any other blockchain supported by LayerZero in the future. Compared to other natively bridged Bitcoin assets, BTC.b allows users to freely transfer native Bitcoin without relying on custodians.

Community

During Q4, community engagement continued with a slew of meetups and Hackathons. Avalanche hosted Avalanche House in Bogota, Colombia, during Devcon Week and Avalanche Creates, a five-day event culminating in a pitch day with investors.

Avalanche Summit will also be returning to Barcelona, Spain. The first summit was held in early 2022. Announced in Q4, the next (Avalanche Summit II) will be the community’s second annual conference in May 2022.

Ecosystem Challenges

Q4 did not present any material adverse outcomes from technical or ecosystem-specific challenges. However, the fallout of FTX reverberated through the Avalanche ecosystem, as was the case with many networks and ecosystems.

While Avalanche-native projects were seemingly insulated from the FTX plague, the incident still prompted a response from the Avalanche Foundation. The Foundation confirmed that it did not custody any significant amount of assets with FTX. Less than 0.02% of the treasury’s assets, comprising some illiquid tokens, were on the exchange. Additionally, the Foundation never sold tokens to FTX as part of the private token sale at genesis.

The Road Ahead

As of now, Avalanche does not provide a roadmap for its development that is publicly accessible. However, announcements are regularly communicated regarding plans. Much of the road ahead continues to reflect what the Avalanche ecosystem has been outwardly working on for several quarters.

Over the coming months, many of the subnets on the Fuji Testnet will begin transitioning onto the Avalanche mainnet. Ava Labs has indicated that many of the 100+ subnets in the pipeline will go live in 2023. Expect an expansion of the P-Chain validator set and demand for network security to accompany these migrations.

Subnet development and the Banff upgrade cycle will likely continue to ramp up. Banff will unlock value across the Avalanche ecosystem in terms of interoperability, similar to the completion of IBC on Cosmos. It will enable cross-subnet asset transfers, permissionless subnets, and subnet validator rewards in their native tokens, which may catalyze network effects and value accrual.

Other subnet developments will be centered around advancing their existing value proposition. Similar to the additional flexibility offered by the Rust SDK for building Avalanche Virtual Machines (AVM), Avalanche will continue exploring custom VM solutions for subnets, such as the HyperVM, which aims to optimize high throughput.

Avalanche continues to improve user experience through enhancements to Core, such as Core Mobile and iOS support.

At the end of 2022, Kevin Sekniqi, Co-founder and COO of Ava Labs, highlighted optimizations coming to AvalancheGo over the next year. The main focus will be enhancing database, execution, and consensus engines to produce about 100 blocks per second without any rejections.

Finally, Emin Gün Sirer, Co-founder and CEO of Ava Labs, emphasized in a recent interview that Ava Labs will focus more on community engagement. With greater community initiatives rallying around Avalanche Summit II, the quest for growing a community of devs may also ramp up.

Closing Summary

2022 was a tumultuous year for the crypto industry. The year was marked by the start of a bear market in January, the collapse of LUNA and UST in the spring, and the failure of FTX in the fourth quarter. Despite the market volatility, Avalanche’s network and ecosystem showed considerable strength and development through Q4.

Avalanche made significant strides towards adoption. It made several upgrades to subnets, integrated with strategic partners, and expanded into DeFi, NFTs, GameFi, and beyond.

On the network side, daily active addresses were flat, but average daily transactions increased to ~2.9 million from ~460,000 YoY, suggesting power users are emerging. Sustained stake amounts, a growing validator set, and more delegators suggest that the network is healthy and progressing toward a more decentralized state.

The DeFi sector on Avalanche saw TVL drop 51% in USD terms over Q4 due to the FTX debacle. Despite this, the NFT sector continued to progress, forming partnerships with OpenSea, Shopify, and other projects to catalyze demand. GameFi is poised for significant growth thanks to collaborations with enterprises like GREE.

Avalanche is anticipating the migration of more than 100 subnets over the coming months. These migrations will increase the validator set and demand for security, thereby accruing network value back to Avalanche.

The Banff upgrade cycle is also progressing and unlocking value across the Avalanche ecosystem. It has brought cross-subnet asset transfers, permissionless subnets, and subnet validator rewards in their native tokens. Core Mobile and iOS support will further improve user experience as well.

After a dramatic year with many challenges, progress looks to be on the horizon for Avalanche heading into 2023.