Key Insights

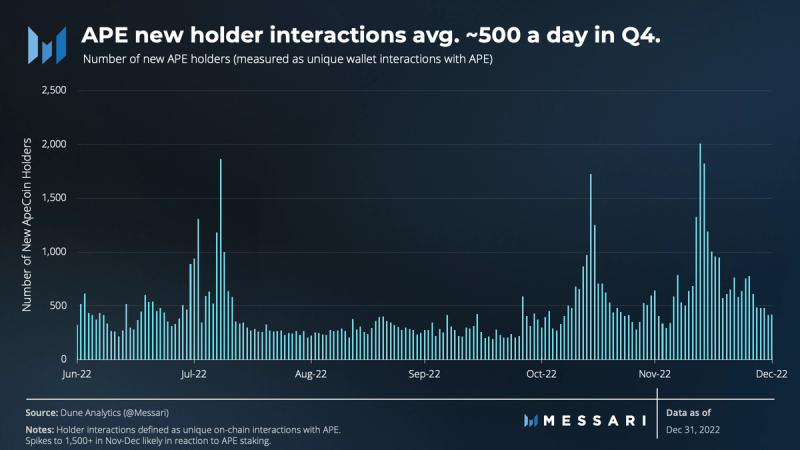

- The ApeCoin DAO ecosystem experienced spikes in new users and token velocity before the launch of ApeCoin staking in mid-Q4.

- These spikes quickly subsided, indicating that more product development is needed to create long-term demand for the APE token.

- Governance forums remained diverse in input and outcome during Q4’22, giving a promising sign of real decentralization within the community.

- Additionally, unique voters maintained an uptrend throughout Q4 despite declining token prices.

- The DAO Ecosystem Fund continued to fund third-party initiatives around IRL drops, security, and more. To catalyze more sustainable growth, the community will need to hit on bigger developments like Yuga Labs’ Otherside.

Primer on ApeCoin

ApeCoin is the adopted token of the APE Foundation, a legal entity that administers the decisions of the ApeCoin DAO. The DAO is a separate entity from Yuga Labs, creators of the Bored Ape Yacht Club (BAYC) and associated NFTs. The two entities collaborate to further the adoption of ApeCoin, BAYC, and surrounding IP in a number of ways.

Incentives in the Yuga ecosystem and the ApeCoin DAO are aligned via:

- A 15% airdrop allocation for BAYC and MAYC holders

- A 16% allocation directly to Yuga Labs (6.25% marked for charity donation), and

- An 8% allocation to Yuga Labs founders.

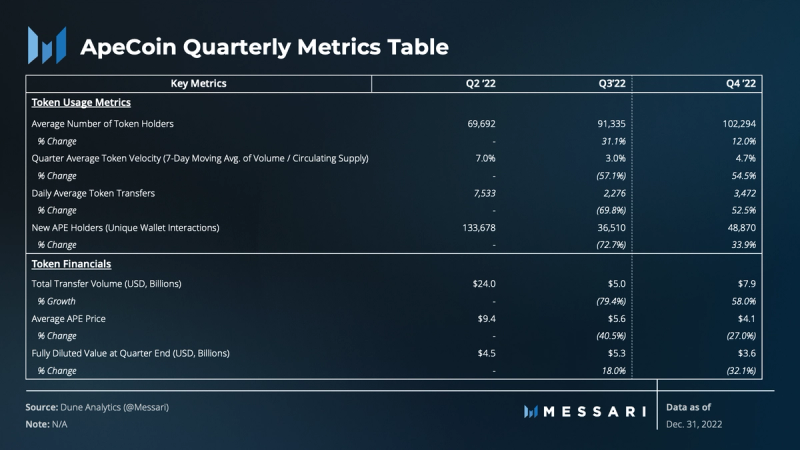

Key Metrics

The Fourth Quarter Narrative

DAO decentralization took several steps forward in Q4’22 with the launch of APE staking and the first-ever DAO special council elections. Special council nominees are community members elected via token governance to take on more integral roles in governing the DAO. Q4’22 saw ApeCoin DAO formalize a process for the onboarding, potential re-election, and ensuing replacement of council nominees.

Performance Analysis

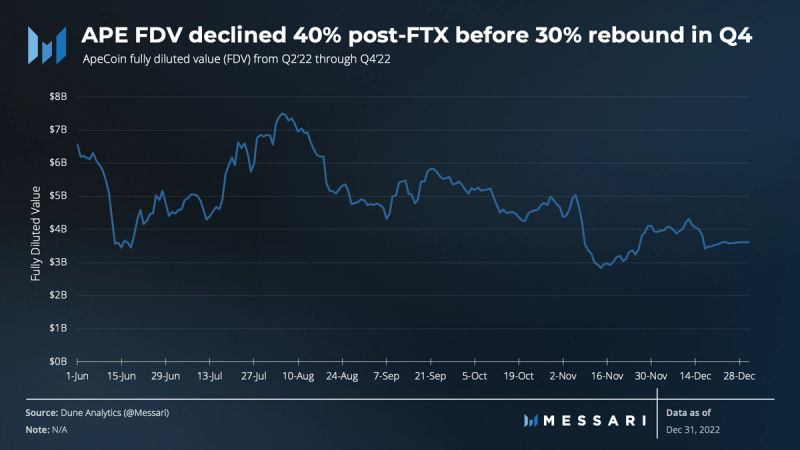

FDV

The APE price largely followed the broad market downturn going into Q4. Selling was then amplified by the implosion of FTX in early-mid November. During that period, the majority of long-tail crypto assets declined -40% or more, with APE falling 40% on the dot. Post-crash, APE rebounded around 30%. Value-wise, the token is still down -80% from all-time highs (ATHs).

There were a few potential catalysts for token price appreciation. Crypto gaming continued to develop, APE became a medium of exchange (i.e., gas token), and the protocol reclaimed mainstream cultural prominence. A good indicator that the above catalysts are taking hold can be seen in Google Search data in the last 12 months. The main risk to APE that could catalyze downward price pressure is sell pressure from airdrops, staking rewards, and potential unlocks.

Staking Rewards Claimed

The steady increase in the percentage of staking rewards claimed indicated a greater coin distribution in the community. The DAO issued staking rewards after the passing of a community proposal through DAO governance. Yuga Labs’ ecosystem projects like BAYC, the Mutant Apes (MAYC), and the Bored Ape Kennels (BAKC) received staking allocations in addition to APE holders. These actions are consistent with the ApeCoin DAO’s stated goal to “steward the growth and development of the APE ecosystem in a fair and inclusive way.”

The issuance of staking rewards also invites more potential selling pressure. As more of the maximum rewards unlock from the staking pool, this chart should continue to trend upwards.

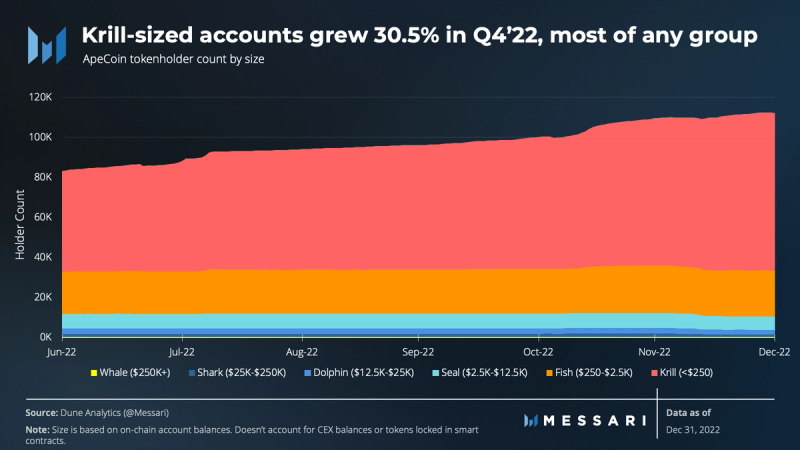

Holder Count by Account Size

We have defined account size in this Dune dashboard. The definition varies with APE prices – using the Q4 average APE price of approximately $4, the size denominations are split as follows:

- Krill: Less than $250

- Fish: $250 < X < $2,500

- Seal: $2,500 < X < $12,500

- Dolphin: $12,500 < X < $25,000

- Shark: $25,000 < X < $250,000

- Whale: $250,000+

As of the end of Q4’22, 112,323 unique wallets collectively held ApeCoin’s total supply, distributed as:

- Krill: 78,683 wallets (70.5% of holders)

- Fish: 23035 wallets (20.51% of holders)

- Seal: 6,647 wallets (5.92% of holders)

- Dolphin: 2,276 wallets (2.03% of holders)

- Shark: 1,313 wallets (1.17% of holders)

- Whale: 369 wallets (0.33% of holders)

Krill holders experienced a relatively large QoQ increase, growing their share by almost 8% of the total holder count. The middle tiers — Fish, Seal, and Dolphin — all lost share. Potential reasons include larger investors staking more (concentrating their holdings into “one” staking account, i.e., the staking smart contract) and bigger investors capitulating their positions during the FTX-induced last leg down in Q4.

Note that 369 wallets hold 97.5% of the total supply, but this metric doesn’t tell the whole story. The wallets holding the highest concentration of tokens are locked (i.e., unvested) tokens, tokens deposited onto centralized exchanges, and tokens deposited into the staking contract. While these tokens are owned by a large number of entities, they are represented by a small number of on-chain accounts.

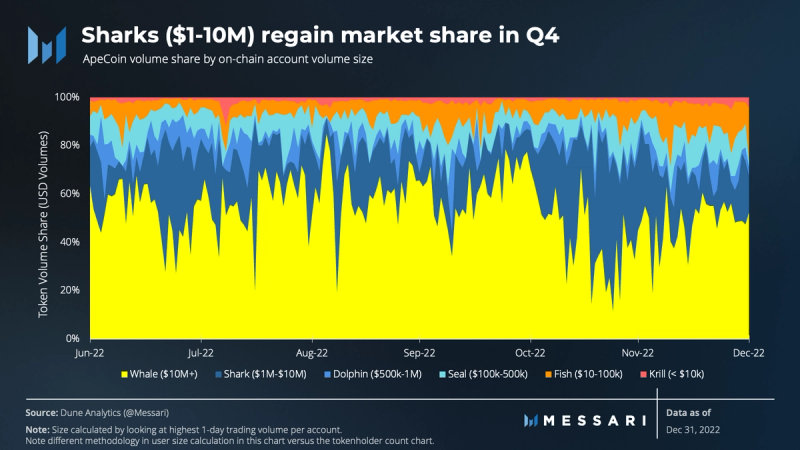

Volume Share by User Size

Volume Whales (defined as accounts with the highest 1-day transaction volumes > $10 million) remained the largest cohort by dollar-denominated volume share in Q4. After a brief disappearance to end Q3, Sharks ($1-10 million) regained market share, finishing Q4 at around 20% market share. ApeCoin as a medium of exchange within game economies like Otherside would be the most significant case for smaller accounts to gain volume share.

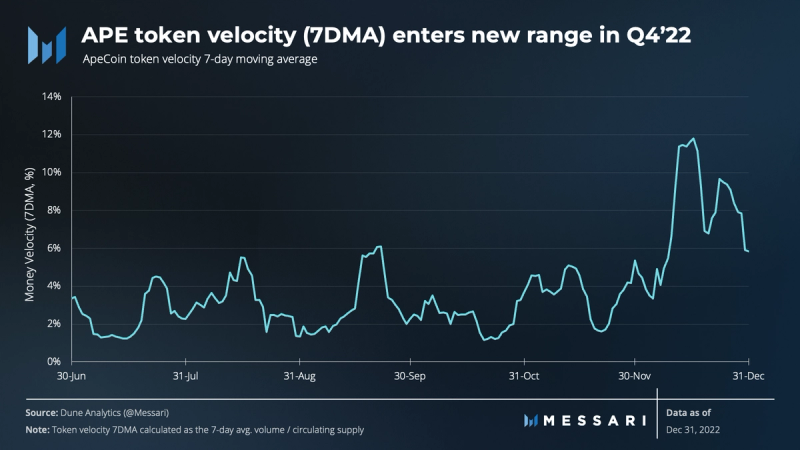

Token Velocity

Token velocity, defined as trading volume divided by circulating supply, skyrocketed in Q4 after oscillating in a 2-6% range for all of Q2 and Q3. The most likely catalyst was the heightened speculative interest in APE due to the launch of staking. Both prospective stakers and momentum traders had a greater incentive to participate in APE markets.

In the short run, this level is unlikely to persist. In the medium to long run, token velocity could trend much higher if APE is successfully integrated into Otherside and other games.

New Ape Holders

About 500 new holders joined the ecosystem per day in Q4, as measured by unique wallet interactions. In addition, there may have been new holders who may be using centralized exchanges. The story continues to be one of heightened interest in mid to late Q4 likely in anticipation of the launch of APE staking.

ApeCoin Unique Voters

The ApeCoin DAO’s governance stands out in comparison to most DAOs. With increasing unique voter participation amidst declining vote power, a greater number of smaller voters are contributing an increasing influence on the DAO, indicating a degree of real decentralization. It’s possible that some entities could be splitting up their vote between a smaller number of accounts, but with no known incentive to do that, the most likely explanation is the presence of more unique small voters.

Moreover, votes are not at all one-sided, as often seen in other DAOs. Proposals have regularly been rejected by margins of 60% against and 40% in favor, even when backed by notable teams.

Qualitative Analysis

Governance Update: Update on ApeCoinDAO Improvement Proposals (AIPs)

The ApeCoin DAO is unique in crypto in that its governance forum is both more active and more split than typical crypto governance forums — a sign of actual decentralization. While there is a fair share of near-unanimous decisions, proposals on ecosystem fund spending in particular are often close to 50/50.

Approximately 30 proposals reached voting in Q4. We have included the highlights in order from newest to oldest. For a full overview of ApeCoin governance, including preliminary discussions, see the Messari Governor page on ApeCoin here.

December 29

AIP-196: BORED AIP: Bringing Order and Reliability via Ecosystem Decentralization: (Succeeded)

This proposal requested over $730,000 in ApeCoin to extend the DAO established in AIP 1 for three months. The proposed funding would be used to maintain core DAO continuity and processes and represents a saving to the DAO of up to approximately $225,000 over the three months.

The proposal also recommended the following initiatives:

- Extending the contract with the APE Foundation administrator (Cartan Group, LLC) for three months to maintain continuity and compliance

- Implementing a transparent Request for Proposals process to identify future APE Foundation administrators during the extension period

- Forming an interim working group composed of key DAO stakeholders to develop DAO working group structures and internal capabilities

December 1

AIP-133: Boring Security – For The Long Haul! (Succeeded)

This proposal represents a double-down investment in security in the ApeCoin ecosystem. Boring Security provides educational materials to keep investors safe in Web3 – a key initiative considering the extensive history of hacks against the Yuga Labs’ created Bored Ape Yacht Club as well.

The proposal approved a request for $420,696.9 in funding for various initiatives including $380,000 in UNI V3 strategy funds, $26,109.41 in reimbursements for out-of-pocket expenses, and $13,987.49 in partnership funding.

November 17

AIP-121: Transparency Act for Ecosystem Fund Allocation: (Succeeded)

This proposal aimed to increase the transparency of AIPs that involve Ecosystem Fund Allocation, adjust the voting process, and standardize periodic reporting. All AIPs marked with an “Ecosystem Fund Allocation” would be required to follow a standardized approach when requesting funding, with the goal being to increase transparency in funding recipients.

It passed with flying colors: 2.1 million APE in favor and a meager 10 APE against.

November 3

AIP-97: ApeCoin Marketplace with 0% fees, Built by Rarible: (Failed)

This proposal from Rarible sought approval to build a full-featured custom NFT marketplace for ApeCoin DAO on the Rarible Protocol. The marketplace would charge a 0% fee on APE transactions and a 0.5% fee on ETH transactions. All collected ETH fees would be converted to APE and transferred to the community multisig. It failed, with 85% voting against. Potential reasons include heavy competition in the marketplace space, capability for the community to build the marketplace, and others.

October 27

AIP-137 & 138: ApeCoin DAO Special Council Nomination and Election Processes: (Succeeded)

These two documents outlined the process for the fair nomination and election of capable communities to the ApeCoin DAO special council. The council includes five seats. Members may serve a maximum of two 1-year long terms in a row before having to sit out for an election cycle (6 months) before running again. For more details, check out the full-length nomination and election proposals.

Three top candidates were elected to the council via a final vote at the conclusion of the process: BoredApeG, veratheape, Gerry, and Degentraland.

AIP-134: Bug Bounty for AIP-21 (APE Staking): (Succeeded)

This proposal created a 1 million APE bug bounty for any bugs discovered on the APE staking contract which was deployed later in Q4. This was one of the more contentious votes, only passing with 58% in favor compared to 42% against.

Those against the proposal cited timing and cost concerns, as the proposal came just two weeks before staking was set to launch and cost ~$4 million at the time. Ultimately, those concerns were superseded by the desire to maximize security ahead of a pivotal moment for the DAO.

Closing Summary

Q4 contained two major events impacting the quantitative overview of the ApeCoin ecosystem: FTX’s collapse and the launch of staking. Neither event will make or break the DAO in the long run. Eventually, its growth will hinge on the success of the DAO’s larger gaming initiatives. Smaller third-party initiatives like a no-code NFT drop marketplace, an ApeCoin community talent marketplace, and free luxury clothes for APE holders are all helpful, but they are unlikely to drive significant structural demand on their own.

Going forward, ApeCoin’s strategy revolves around capitalizing on further development in the competitive crypto gaming space to accelerate its adoption.