Key Insights:

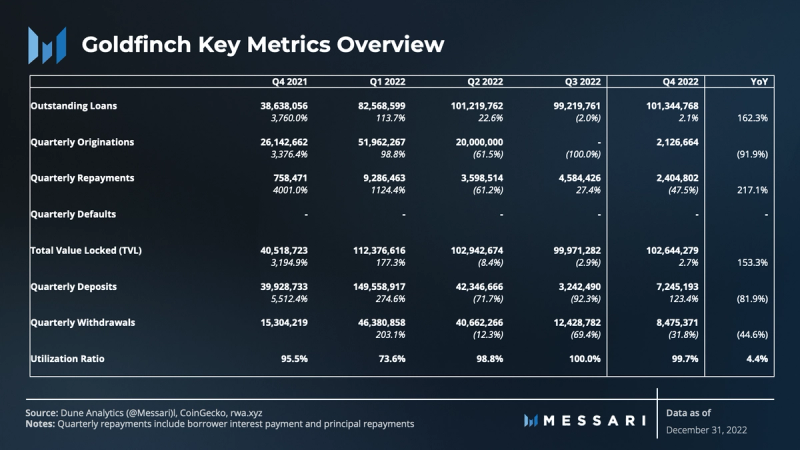

- Goldfinch grew outstanding loans by 162% YoY, without any loan defaults since its inception.

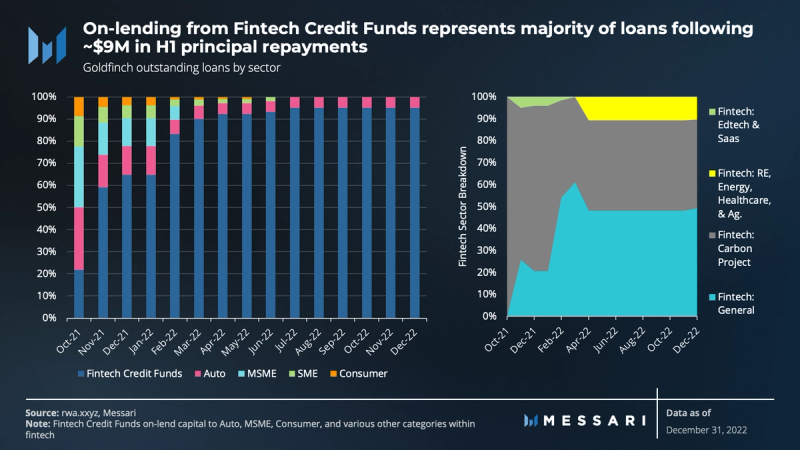

- The composition of loans by sector was skewed towards Credit Funds that on-lend broadly in fintech, representing 95% of the portfolio by year-end.

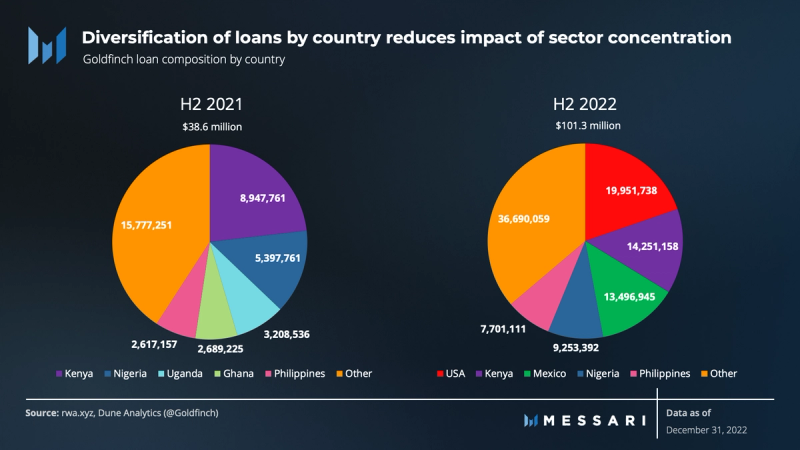

- Since inception, loan originations were extended to borrowers (e.g. Credit Funds) who were geographically diversified over 25 countries.

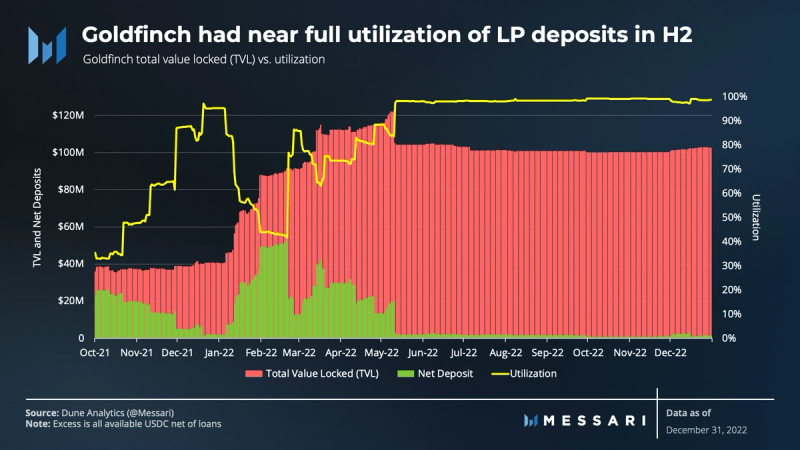

- Utilization remained very strong in H2 2022 due to high borrower appetite and low supplier appetite.

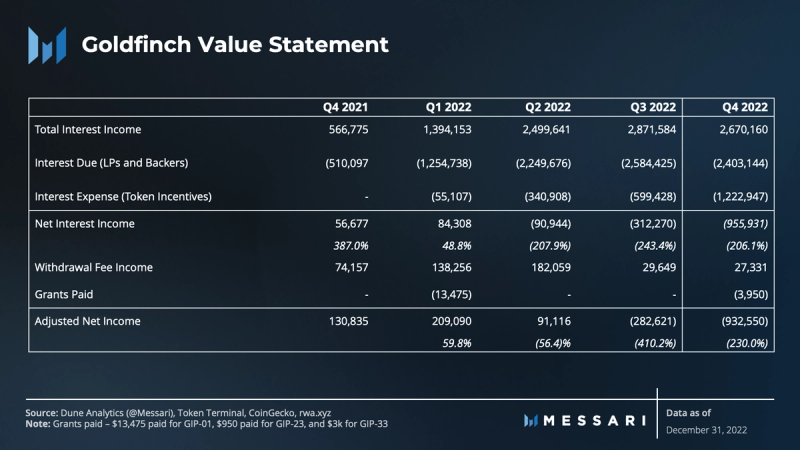

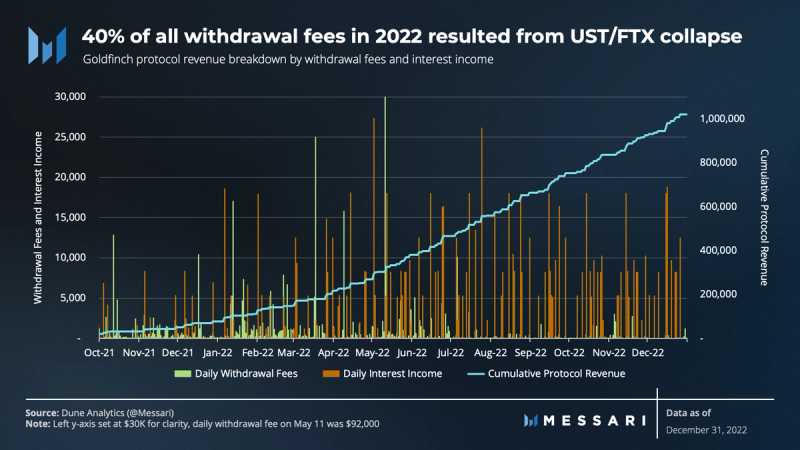

- About 40% of all withdrawal fees generated in 2022 were incurred in the days following the UST and FTX collapse. Total revenue, comprising interest income and withdrawal fees, grew by 7.5% QoQ.

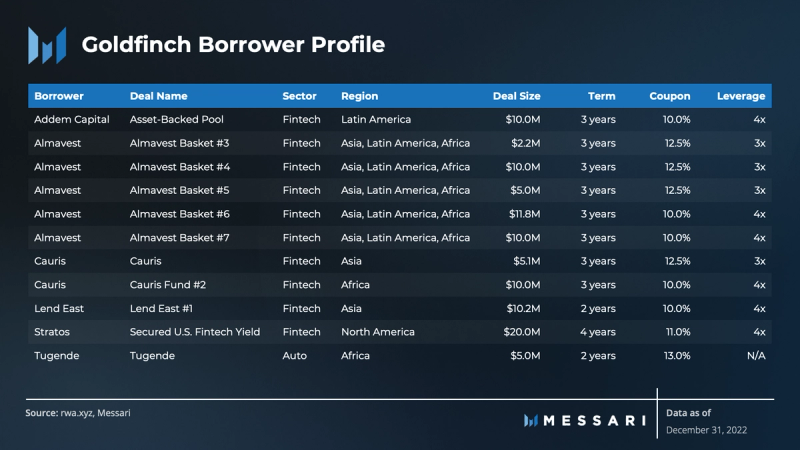

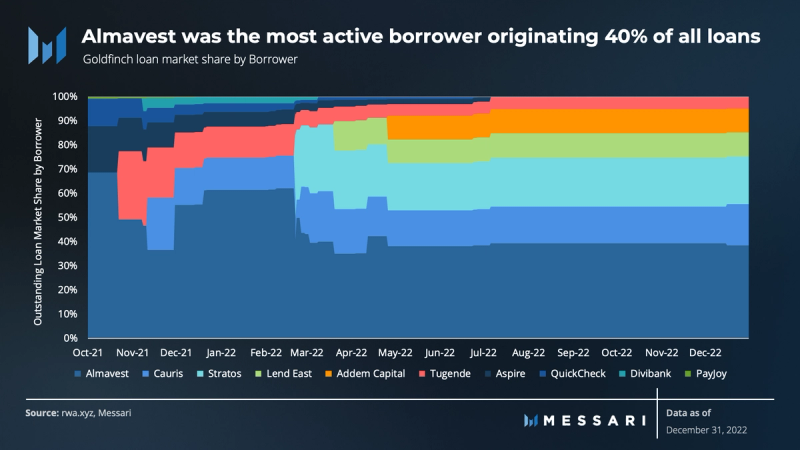

- Alma (f.k.a. Almavest) was the most active borrower on Goldfinch, originating 40% of all loans.

Primer on Goldfinch

Goldfinch is an open-source credit protocol built on Ethereum. It was launched in January 2021 to enable decentralized lending focused on emerging credit markets. The protocol’s business model is to originate loans using collateralized real-world assets (RWA), insulating them from crypto volatility. The protocol enforces Compliance standards such as know your customer (KYC), anti-money laundering (AML), and on-chain reputations using Goldfinch’s novel soul-bound Unique Identity (UID) which incentivizes users to maintain credibility and accountability.

The participants in Goldfinch include Liquidity Providers (LPs), Backers, and Borrowers. The lending pool either aggregates USDC deposited by LPs and Backers in two tranches (senior/junior) or more recently has created pools that are “unitranche” and are only Backers. LPs represent a second-loss reserve depositing into a Senior Pool (Sr. tranche), whereas Backers represent a first-loss reserve (Jr. tranche). Backers perform due diligence on prospective Borrowers and inherit more risk than LPs. Borrowers on Goldfinch are financial institutions (e.g., asset managers or fintech lenders) that submit term sheets for loan approval before accessing any liquidity. They then extend loans to businesses.

Key Metrics

Performance Analysis

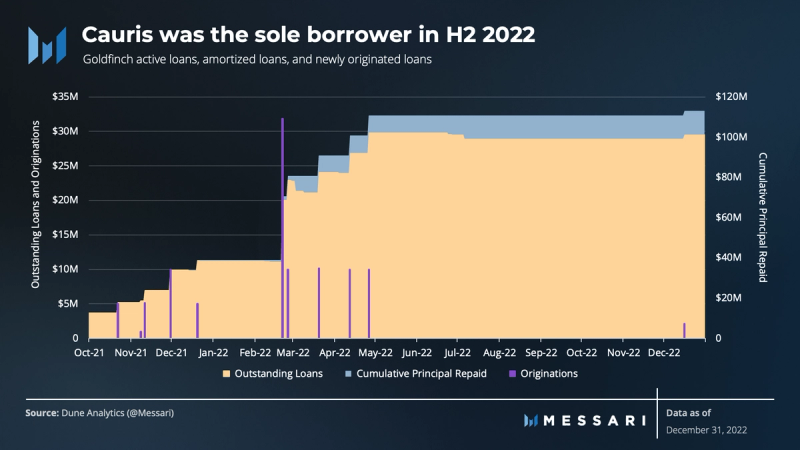

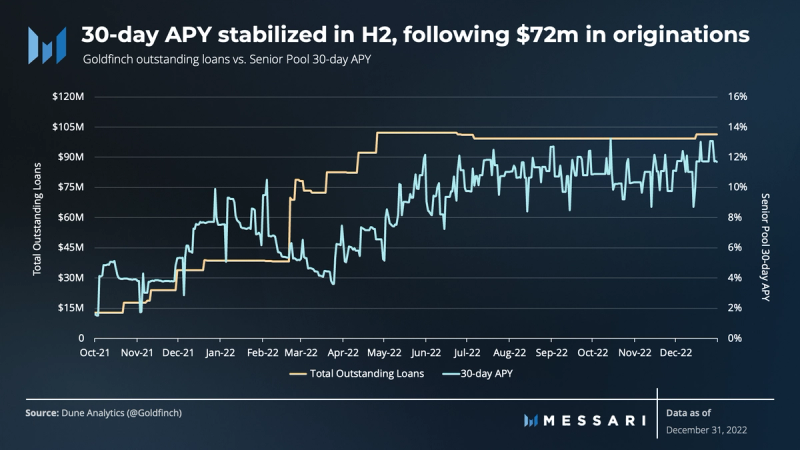

Outstanding loans grew slightly by 2.1% in H2 2022, going from $99.2 million to $101.3 million. However, the YoY growth was significant, with a 162% increase. There was $74 million in loan originations and $11.4 million in principal repayments in 2022. On December 16, 2022, the Cauris Fund #4: Africa Innovation Pool deployed $2.1 million in funding which contributed to the increase in H2. About $72 million, or 63% of total current outstanding loans, originated in H1 2022 — the largest being $20 million to Stratos, the first North American borrower.

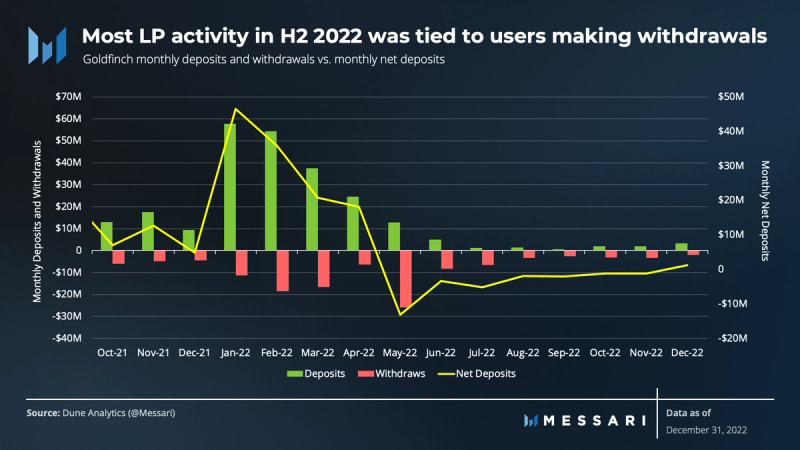

The year ended with a strong demand for capital from LPs, evidenced by the removal of excess deposits on Goldfinch. As a result, utilization increased from 40% to 98% since H1 2022. The total value locked (TVL) on the protocol is made up of USDC deposits. In exchange for LP deposits, users receive FIDU, an ERC-20 token representing principal and a pro-rata share of accrued interest payments in the Senior Pool redeemable for USDC. Due to the nature of the borrower loans which tend to be 1-4 years, LPs have recently had to rely on borrower repayments for liquidity. As such, the TVL on Goldfinch can be quite sticky.

Net deposits, represent total USDC deposits net of outstanding loans in the Senior Pool. This is the available USDC available for withdrawal to LPs. In May, liquidity dried up after ~$20 million was withdrawn from the protocol following the collapse of UST.

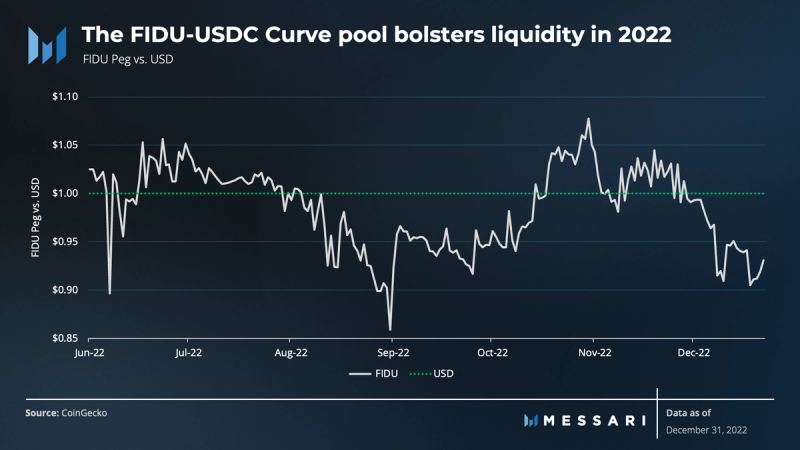

In February 2022, Goldfinch governance passed GIP-01 which introduced the FIDU-USDC Curve pool. The goal was to provide a fee-free way of moving in and out of FIDU. This approach would relieve the Senior Pool from withdrawals and allow greater exposure to FIDU. Since the Curve pool launch, the FIDU tokens have shown significant fluctuations in their price, likely due to a liquidity risk premium or discount. In addition to the liquidity improvement, Curve users can purchase FIDU outside of the Goldfinch dApp, gaining exposure on the Senior Pool. However, in order for users to claim principal and interest from the Goldfinch protocol, they must undergo KYC and mint a UID identity token in order to redeem USDC for FIDU (e.g., the Senior Pool token).

Goldfinch’s revenue is generated from interest payments from borrowers and withdrawal fees incurred by LPs. The protocol takes 10% of all interest payments and applies it to the DAO treasury reserves. In addition, LPs incur a 0.5% withdrawal fee when withdrawing from the Senior Pool that is also applied to the DAO treasury reserves.

In H2, the protocol generated $554,000 in interest revenue and $57,000 in withdrawal fees. These metrics were up 42% and down 82% HoH, respectively. In H2 2022, the average proportion of protocol revenue was 91% interest and 9% withdrawal fees. However, during H1, these figures were 54% and 46%, respectively. The decrease in withdrawal fees in H2 is likely a combination of the Terra collapse in May and the new FIDU-USDC Curve pool, which does not incur a fee to users for withdrawing.

Following the collapse of Terra UST, approximately $92,000, or 29% of total withdrawal fees in 2022, was generated on May 11, 2022. As users scrambled to secure their assets, it became common for protocols to lose liquidity. In fact, nearly 12% of withdrawal fees incurred in H2 resulted from the FTX collapse.

Goldfinch introduced new withdrawal mechanics in Q4 2022 to address the high utilization by replacing the previous system with a bi-weekly withdrawal system. This new system requires LPs to deposit their FIDU into a withdrawal request and allows them to receive some of their position every period, making the Senior Pool revenue fairly distributed to those seeking to withdraw. When withdrawals are processed, they are distributed pro-rata based on available excess USDC remaining in the Senior Pool.

The 30-day annual percentage yield (APY) is denominated in USDC and based on the actual interest payments received. A decline in APY towards the end of H1 2022 was a result of ~$9 million in loan repayments between February and March, which then impacted interest income into April. During the same period, over $52 million in originations resulted in a new stream of interest income driving growth in APY. An additional $20 million in originations during April strengthened Goldfinch’s APY, which eventually stabilized by year-end.

The active borrowers on the Goldfinch platform are primarily institutional asset allocators operating globally. They tend to have expertise in extending credit across various regions and sectors. Since borrowers in different regions convert USDC into native fiat currency, allocators are always required to hedge FX risk. Although deal sizes vary based on scope, fixed-rate term loans have an average maturity of 3 years, which is consistent with maturities found in traditional private credit markets.

Borrower Profile

The protocol enabled 10 borrowers, mostly asset managers, to access 24 unique credit lines since its launch. These credit lines, also known as borrower pools have been used to on-lend to more than 50 (e.g., 1 Goldfinch asset manager on-lends to ~5 companies) Venture Capital (VC) -backed lending businesses across +25 countries. Goldfinch Borrowers originated ~$114 million in loans since inception. Due to many full loan repayments in H1, the number of borrowers and pools fell by nearly half. Approximately 11% of all loans originated were repaid by the end of 2022.

Sector Analysis

In H1 2022, the composition of loans was more diversified, comprising various sectors such as small and mid-size enterprises (SME); micro, small, and mid-size enterprises (MSME); automotive, consumer, and fintech Credit Funds. These credit funds are local credit experts who on-lend to various sectors using fintech to operate their businesses. As loans were repaid, the loan portfolio in H2 shifted towards a 95% concentration in Fintech Credit Funds, as intended.

Fintech borrowers have four unique mandates within the sector. These are categorized as Fintech: General; Fintech: Carbon Projects; Fintech: Edtech & Saas; and Fintech: Real Estate, Energy, Healthcare & Agriculture.

Region Analysis

In addition to the fintech credit funds on-lending to various sectors (eg. SME, auto), the loans are distributed across various countries which introduce additional diversification benefits. The USA represented over half (54%) of loans by the end of 2022, followed by Kenya and Mexico with 39% and 38% of total loans, respectively.

The composition of outstanding loans by sector shifted drastically following the large repayments in H1 2022. Notably, loans with exposure to Kenya and the Philippines grew by 59% and 194%, respectively YoY. Goldfinch has facilitated over $112 million in loans to borrowers in over 25 countries since its inception.

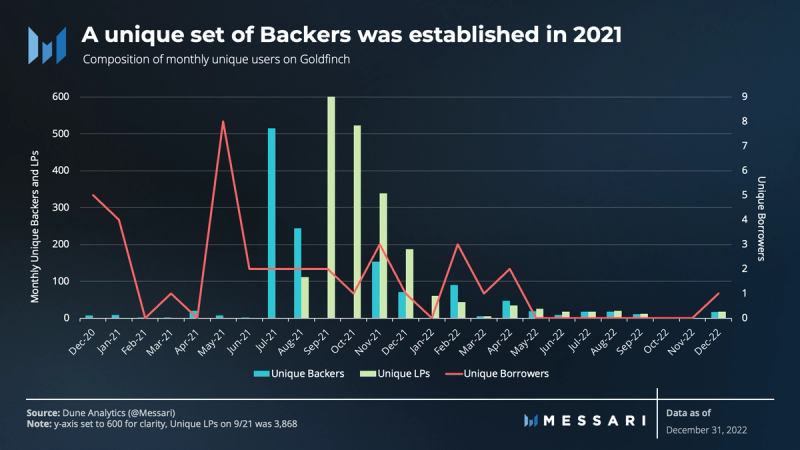

User Analysis

According to the user data, a large set of unique Backers was established in 2021. These users are responsible for performing due diligence on Borrowers, which ultimately bring yield-generating private credit deals to LPs. Backers perform routine credit monitoring and are actively involved throughout the life cycle of the loan. In 2022, there were 231 new unique Backers added to the cohort, in addition to the 1,023 backers in 2021.

Despite LPs being the majority of active users in 2022, the number of active unique LPs declined by 57% from H1 2022. There were approximately 255 unique LPs in H2. Most of their activity was tied to LP withdrawals in H2 2022, largely due to borrower pools being fully utilized and likely deterring new LPs.

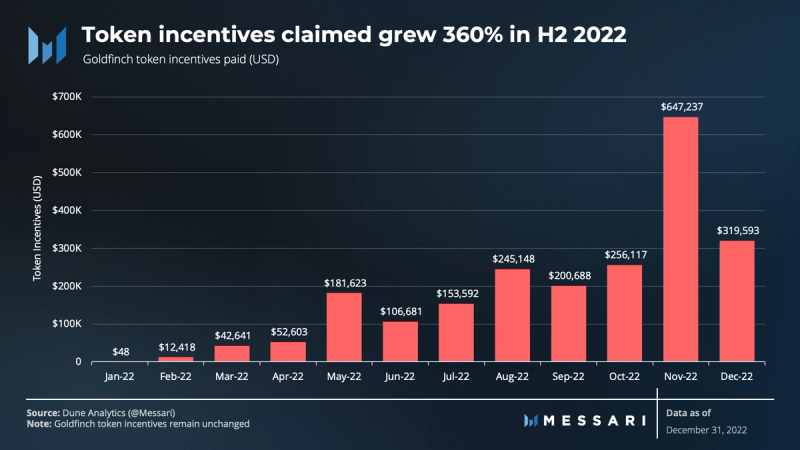

Token incentives denominated in the Goldfinch token (GFI) are available to LPs who stake FIDU on the Goldfinch application and Curve pool. Backers are entitled to rewards through participation. These rewards are meant to enhance existing USDC yields derived from loans. Each month on average, there was $185,000 in incentives distributed during the year. Goldfinch incentives grew in H2 by 360% to $1.8 million, compared to $396,000 in the prior half of 2022, largely a result of more users making claims.

Qualitative Analysis

Key Events

Various improvements took place in H2 2022 including upgrades, integrations, improved withdrawal mechanics, and tooling.

Goldfinch Membership launched in H2 to further align user incentives with the long-term success of the protocol. In order to become members, users put GFI and their receipt of capital supply (FIDU or a Backer NFT) into a Membership Vault. In turn, members receive USDC yield enhancements and access to exclusive communication channels.

The integration with AlloyX, a liquid staking protocol for capital markets, provides Backers access to liquidity by staking backer assets on the protocol.

Goldfinch also implemented new withdrawal mechanics to distribute excess Senior Pool liquidity more fairly for LPs seeking to withdraw. LPs can now submit Withdrawal Requests that are fulfilled every two weeks. If there is enough USDC available in the Pool to honor all outstanding withdrawal requests at the end of the distribution period, all withdrawers will receive 100% of the value of the FIDU they requested to withdraw, in USDC. Otherwise, LPs receive a pro rata amount of their request and the unfilled portion of the request will roll over.

Goldfinch also introduced a Unitranche deal structure (Borrower Pools with zero leverage ratio from the Senior Pool) in order to continue introducing new Borrower Pools despite limited Senior Pool capital. This new structure is what enabled Cauris to launch their $2.1 Borrower Pool in H2.

A token-gated Discord channel (e.g., min. 10,000 FIDU/sFIDU) and password-gated dataroom were implemented for each Borrower Pool, to improve transparency. These measures will streamline critical communication channels and act as a central repository for all important documentation.

Governance

The community has steadily increased its participation in the protocol by proposing almost 40 Governance Improvement Proposals (GIP) and at the end of Q4 had over 142 unique wallets voting on a single GIP . Governance uses quadratic voting (QV) by weighing votes and taking the square root of the amount of GFI used, QV helps level the field for smaller participants. Additionally, QV uses Unique Identity (UID) as a way to prevent Sybil attacks.

Through governance, the community voted to implement several key Goldfinch Improvement Proposals (GIP), in addition to important proposal discussions.

- GIP-10 removed the 12-month linear vesting requirement for Liquidity Providers. This immediately unlocked liquidity rewards which are denominated in Goldfinch (GFI).

- GIP-14 introduces credit memos, which are expected to go live in Q1 2023. The pilot will help synthesize the data available to the community to evaluate borrower pools, further the decentralization of the protocol, and strengthen the engagement of the Goldfinch community by compensating members for their contributions.

- GIP-26 allows the Goldfinch reserve to purchase FIDU from the Curve pool using USDC when FIDU is at a discount (e.g., threshold currently at 15% discount). However, the recent strain on available liquidity invoked an amendment to the strategy with GIP-34 which has since been passed.

- GIP-39 significantly enhances Goldfinch’s ability to manage credit and operational risk to the protocol via adopting common recognizable structural features such as amortization.

Closing Summary

In the face of a tumultuous year, Goldfinch made strong strides by growing its outstanding loans and offering LPs strong uncorrelated yields. The protocol insulated itself from the volatility of the crypto markets while maintaining zero defaults. Users searching for sustainable yields in DeFi could achieve that with Goldfinch. However, the enforcement of KYC, AML, and requirements of non-U.S. or U.S. accredited investor status will create friction and prevent onboarding the masses.

There have been substantial improvements to liquidity for both LPs and Backers following the integration of the FIDU-USDC Curve pool and AlloyX. These implementations should foster growth and bring new financial instruments on-chain, creating a more efficient DeFi credit market.

At first glance, overconcentration in VC backed tech lending (e.g., credit funds) could be alarming for new and existing LPs looking for broader credit exposure. However, by design, Goldfinch leverages the diversification and risk management capabilities of experienced credit funds to maximize sector and geographical credit exposure.

According to McKinsey, as of 2022, private debt was the only private asset class to grow fundraising yearly over the last decade. With this in mind, Goldfinch could be well-positioned to capitalize on the growth of the private debt asset class in the new year.