Key Insights

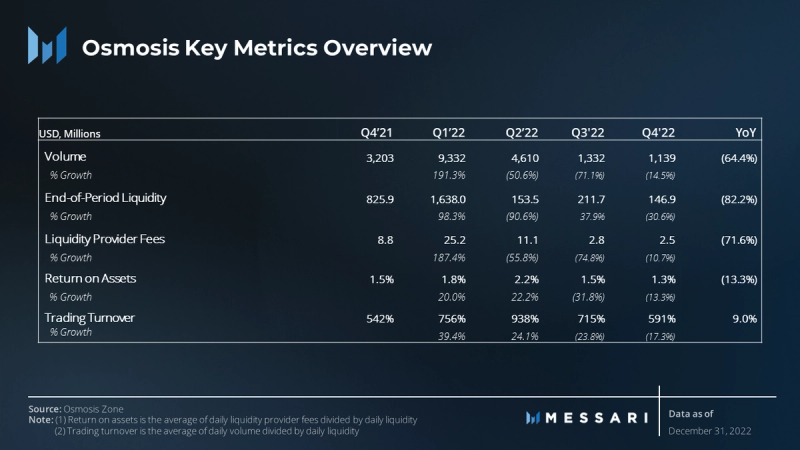

- Osmosis facilitated $1.13 billion in total trading volume in Q4, bringing in $2.5 million in fees for liquidity providers.

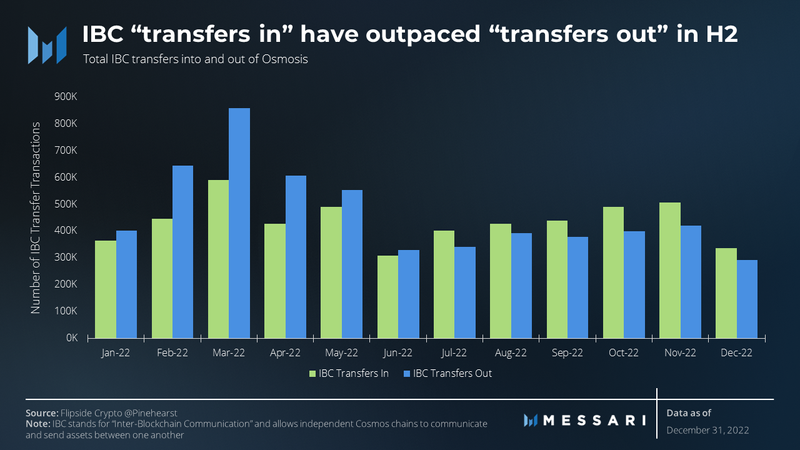

- The second half of 2022 saw IBC transfers into Osmosis outpace IBC transfers out, which may be a sign of greater dominance for Osmosis in the Cosmos ecosystem.

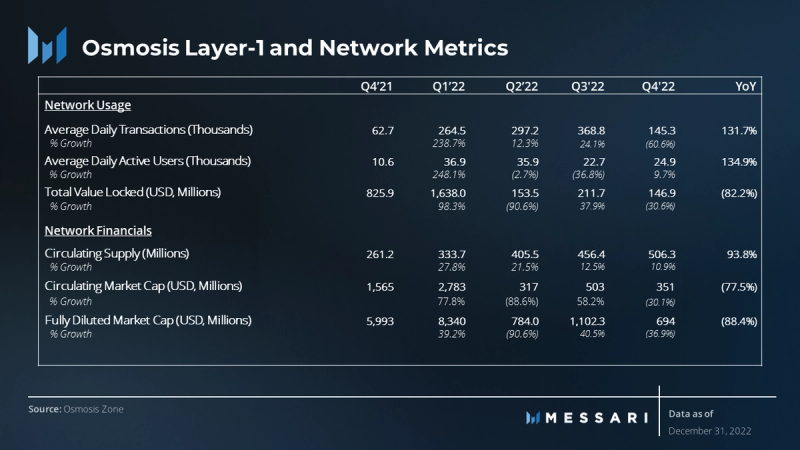

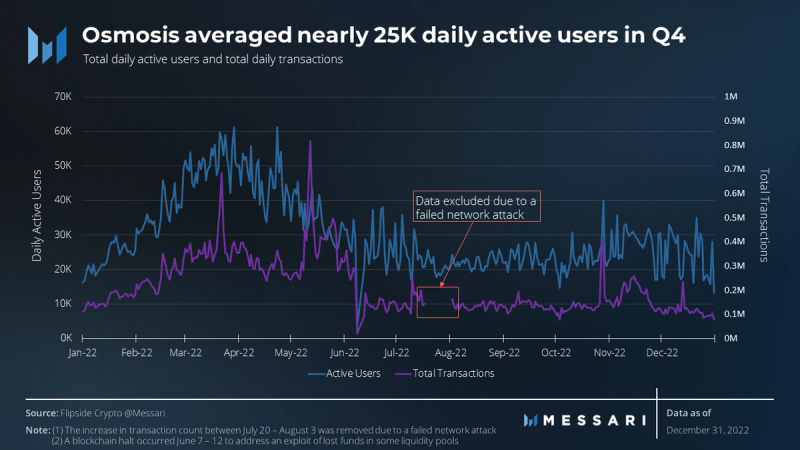

- Average daily users increased 9.7%, and average daily transactions decreased 60.6% QoQ. These metrics are up 134.9% and 131.7%, respectively, YoY.

- The V13 Fluorine Network Upgrade was released on December 8, introducing the Osmosis stableswap. This upgrade will support the trading of stablecoins or similarly priced assets like liquid staking derivatives with minimal price impact.

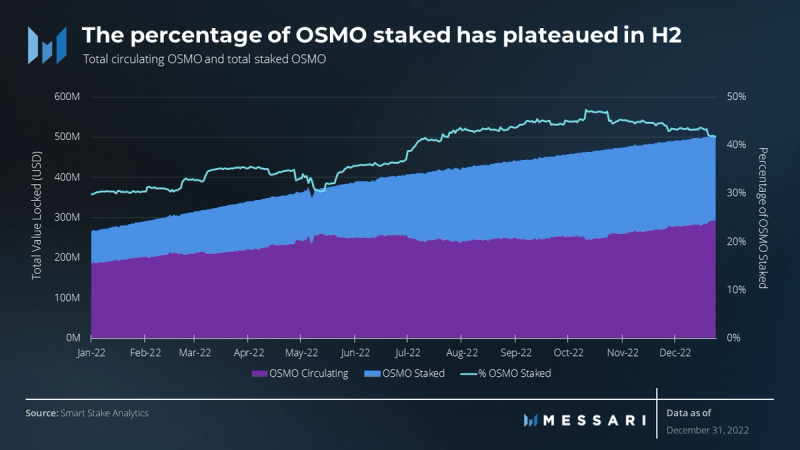

- 41.7% of the OSMO supply is currently staked, receiving a 23.7% APR to end Q4.

Primer on Osmosis

Osmosis is a sovereign decentralized exchange (DEX)-focused app-chain in the Cosmos ecosystem, meaning it simultaneously serves as a blockchain and an application. The application operates similarly to other automated market making (AMM) functioning DEXs – liquidity providers (LPs), which are responsible for supplying liquidity to asset pools where traders can make trades from. It’s the same model for Uniswap or Balancer, though more similar to the latter as Osmosis places a high priority on offering asset pool customization. Tweaks to market-maker functions, swap costs, token weighting, and more are all parameters that can be changed within the DEX. Additionally, Osmosis has introduced new features such as superfluid staking that allows users who provided liquidity in certain pools to also stake to help secure the network. In the future, Osmosis will also offer maximal extractable value (MEV) mitigation and capture, stable pools, and more.

Key Metrics

Performance Analysis

Layer 1 Metrics

Average daily active users (DAUs) on Osmosis grew 9.7% QoQ, rising from 22,700 in Q3 to 24,900 in Q4. This is a 32.5% decrease from the all-time high of 36,900 DAUs in Q1 2022. With that said, measuring the adoption of L1 networks should be done on a larger time scale; compared to a year ago the average DAUs have risen 134.9% from 10,600 in Q4 ’21 to 24,900 in Q4 ’22.

Average daily transactions on Osmosis decreased 60.6% QoQ, dropping from 368,800 in Q3 to 145,300 in Q4. Importantly, though, transactions in Q3 were inflated by the failed network attack. Not including the days of the attack, the average daily transactions were 144,900 in Q3, which would mean the 145,300 daily transactions in Q4 accounted for a 0.27% increase. Again, the time horizon should be expanded for the adoption of an L1 network; compared to Q4 ’21 average daily transactions have risen 131.7% from 62,700 to 145,300 in Q4 ‘22.

Osmosis continues to serve as a trusted destination for users to transfer assets into. Each month in 2022 saw over 300,000 IBC transfer transactions into Osmosis. Additionally, following the leverage wipeout in June, IBC transfers in began to outpace IBC transfers out. A possible interpretation is that within the Cosmos ecosystem, Osmosis began to be viewed as the most trusted destination for users and not just a location to swap assets. Currently, Osmosis has the most peers of any Cosmos chain with 50 peers. Osmosis’ top three peers by the number of transactions into Osmosis for Q4 are Evmos with 251,000, Cosmos Hub with 192,000 and Bostrom with 149,000.

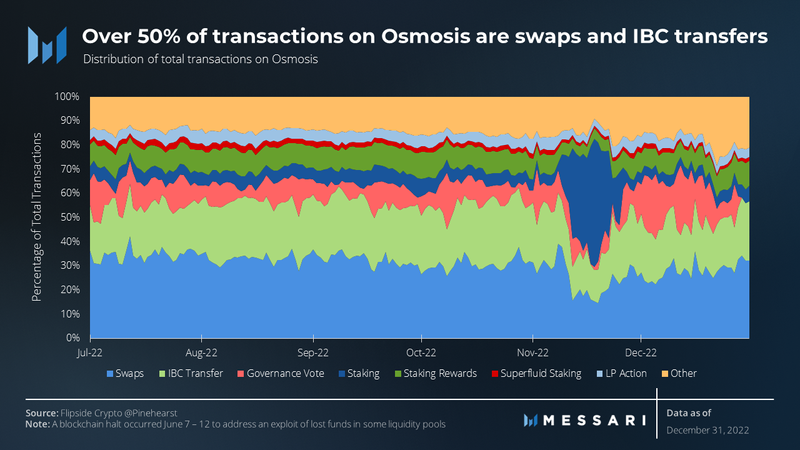

Over 50% of transactions on Osmosis are swaps and IBC transfers. To access the liquidity of Osmosis, users transfer assets into Osmosis and swap or users swap for their desired asset and transfer out of Osmosis.

Governance participation is also a significant proportion of the transactions on Osmosis. Accounting for 10-20% of the total transactions, this is not only due to high participation in governance but also a high number of proposals submitted – there were 54 proposals submitted in Q4, alone.

Surrounding the FTX collapse in early November, there was a significant surge in the number of transactions related to staking. On November 9, there were 8.5 million OSMO undelegated from validators. Given the volatility in the markets at the time, this jump in users undelegating could be explained by users wanting to sell their OSMO in the turmoil or wanting to capitalize on an increase in LP fees due to the volatility. Considering the volatility mostly subsided by the time the 14-day unstaking period ended, the former argument holds stronger.

As a percentage, LP actions, superfluid staking, and staking rewards are generally a smaller share of daily transactions, but they dramatically increase each day around UTC 17:30. This coincides with the time LP rewards are distributed each day, suggesting that users are still very highly incentivized by generating the highest yields possible and gaming the system.

QoQ, the number of OSMO staked increased by 9.6 million OSMO to 210.3 million total OSMO staked. This was an increase of 4.8% QoQ, and resulted in 41.7% of the total outstanding OSMO supply staked by the end of Q4.

As evinced by the chart above, for most of Q3 until the end of Q4, the percentage of OSMO staked plateaued in the range of 40-46% of the total OSMO supply. This metric will be worth monitoring as a number of factors are at play. For example, one tailwind that may further increase the percentage of OSMO staked is the introduction of stOSMO, a liquid staking derivative of OSMO. Since launching on October 29, stOSMO has grown to just under $1 million in liquidity by the end of Q4. Other tailwinds are the continued growth of superfluid staking and further developments with interchain security.

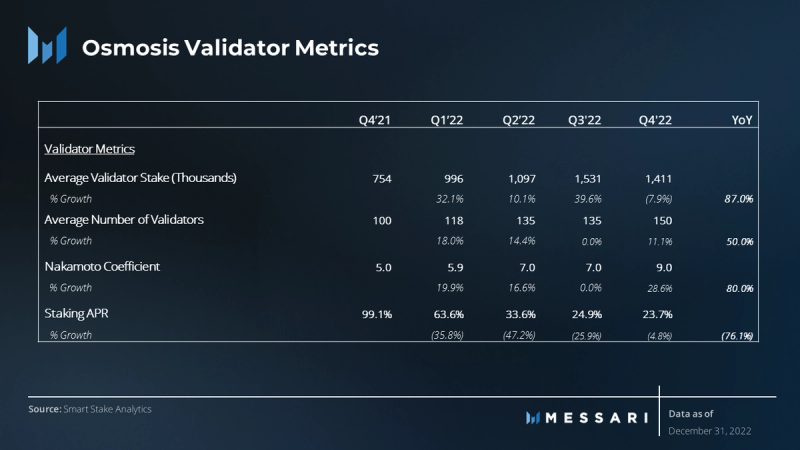

On the other hand, one headwind that may continue to decrease, or keep the total OSMO staking percentage consistent, is the reduction in staking APR. YoY, the staking APR has declined from 99.1% to 23.7% due to the reduced inflation rewards. With roughly 40 pools on Osmosis earning a higher APR on average, users may believe liquidity providing to be the more lucrative option.

The number of validators in the Osmosis validator set increased in Q4, from 135 to 150 following a passing governance proposal. This increase in validators resulted in an increased Nakamoto coefficient from 7 to 9 QoQ, the first increase since Q2’22. The average validator stake also decreased 7.9% QoQ to 1.4 million per validator. Although the average stake per validator is 1.4 million OSMO, in actuality the top validators hold a significant percentage of voting power. The top 10 validators control 36.8% of the total voting power, while the top-25 control 60.4% of the total voting power.

DEX Metrics

Total volume fell for the third consecutive quarter to $1.13 billion, down 14.5% QoQ. The total volume YoY is down 64.4%, but this is relatively on par with other DEXs. For example, Uniswap volumes were down 42% for the same period.

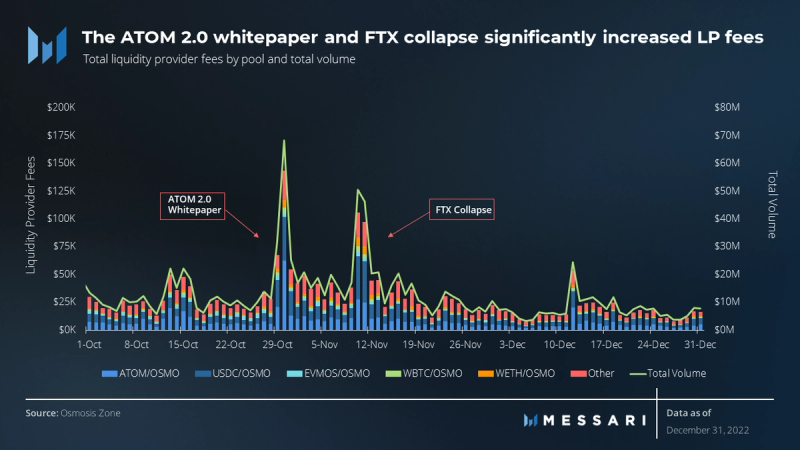

Liquidity provider fees were consistent for the second half of the year. Q3 generated $2.8 million in LP fees, while Q4 generated $2.5 million in LP fees for a 10.7% decrease. There were two notable spikes in trading volume and subsequently LP fees in Q4. The first increase can be attributed to the listing of OSMO on Binance on October 28 and the release of the ATOM 2.0 whitepaper on October 31. As a result, the ATOM / OSMO pool generated $62,000 in LP fees on October 30, while the average for the ATOM / OSMO pool was only $7,533 in Q4.

The second increase in volume and trading fees was a result of the FTX collapse and ensuing volatility in early November. Although the ATOM / OSMO and USDC / OSMO pools saw a large increase in volumes, volumes across all pools were elevated. Notably, the largest IBC transfers in and out of Osmosis since May 2022 occurred in November. This flight to Osmosis during times of volatility may further support the idea of Osmosis acting as the trusted “financial hub” of the Cosmos due to its deep liquidity for Cosmos assets.

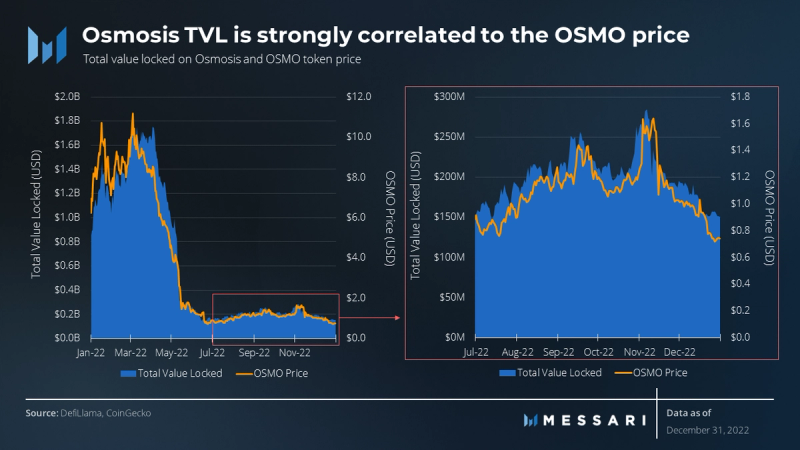

Total value locked (TVL) on Osmosis experienced a steep decline in the first half of 2022 and has continued to be volatile in the second half. In Q3’22, TVL increased 37.9%, and in Q4’22 TVL decreased 30.6% to end the year at $146.9 million. Comparatively, in Q3‘22 the OSMO price increased 44.3%, and in Q4‘22 the OSMO price declined 41.7%. Given that Q4 ended with OSMO accounting for 88.6% of the liquidity on the DEX, it has a strong correlation with the TVL in the system. Further integrations with stablecoins and other native Cosmos assets, such as the highly anticipated Mars Protocol can be an efficient way to increase liquidity while remaining unreliant on OSMO.

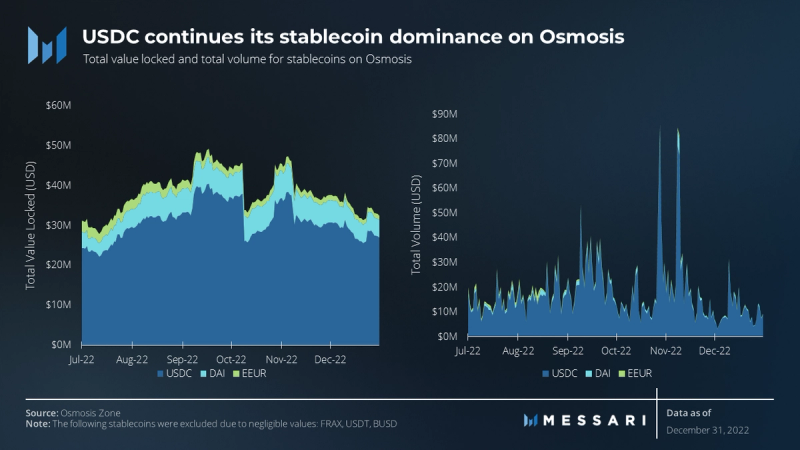

In Q4, stablecoins on Osmosis accounted for $32.6 million in TVL, down from $44.9 million in Q3. USDC on Osmosis continues to dominate the stablecoin market accounting for 82.5% of the stablecoin TVL and 91.5% of the stablecoin volume in Q4.

Notably, the USDC used on Osmosis is not a natively-issued Cosmos USDC, but rather a bridged version denoted by axlUSDC. There are plans to issue a Cosmos native USDC, and this could increase the USDC TVL, and ultimately, stablecoin volumes. The timing of this Cosmos native USDC also complements the Osmosis development team’s plans for stableswaps. Osmosis’ v13 Fluorine Upgrade released on December 8 introduced tableswap pools; low-slippage pools for two assets that are intended to be tightly correlated. Since then, BUSD arrived on Osmosis in late December and an official 3pool has launched with USDC, USDT, and BUSD.

Qualitative Analysis

Osmosis Proposals

Q4 2022 proved to be another busy quarter for the scientists at Osmosis with a plethora of proposals. While the majority of the proposals were related to token incentives and changes to different pools or tokens, three stood out:

- Proposal 337: Increase Validator Set Size to 150 – As mentioned earlier, Osmosis governance voted to increase the validator set from 135-150. Voting ended on October 3 with 82.5% of votes in favor. The reasoning behind the validator increase was to create additional opportunities for individuals and organizations to support the network as validators, while further decentralizing the network. Arguments against this increase were that it would slow network performance and that increasing the validator set doesn’t actually decentralize the network, as the top 15 validators continue to hold the majority of the voting power.

- Proposal 354: Implement a Minimum Transaction Fee (Signaling) – Initially published in September, voting concluded on November 10 with 99.6% of votes in favor. Prior to this proposal, Osmosis had no protocol-level minimum gas fee, which allowed users to transact on the network for no. This made it very intuitive for new users transacting on the network, as they did not need to bridge a native token. An unforeseen vulnerability of this was that Osmosis could be the victim of DDOS attacks (where malicious users clog the network with spam transactions). The minimum fee was eventually decided to be 0.0025 uOSMO and can actually be paid in an equal value of any token, not only OSMO. This protects the network from DDOS attacks, while still not costing the end user any significant amount.

- Proposal 362: Osmosis Grants Program (OGP) Renewal – Proposal 362 passed on November 21 with 43.8% of votes in favor. The proposal aims to renew the Osmosis Grants Program for an additional 12 months. The program lead, Reverie, initially requested a sum of $70,000 in USDC and 35,000 OSMO per month for leading the program, but this was ultimately decreased to $55,000 USDC and 25,000 OSMO per month. In the six months of the program’s history, they received over 250 applicants and approved 43 projects for grants, accounting for over $1.8 million in funding.

Network Upgrades

With Osmosis V12 covered in our previous quarterly, the other major network upgrade in Q4 was the V13 Fluorine Upgrade. This upgrade introduced several new features and improvements such as:

- IBC Rate Limiting: This upgrade puts limits, voted on by governance, on how much value can flow in and out of the chain for a specific time period, channel, and denomination.

- Cross-chain Cosmwasm Contracts: This upgrade allows for IBC messages between Cosmos chains to include metadata. By including this metadata, it opens the door for new use cases such as cross-chain swaps.

- Force Unlock: A new feature that allows governance-specified addresses that are permitted to unlock bonded liquidity instantly. This will enable new use cases such as the liquidation of bonded pools when used for collateral.

- Multi-hop OSMO Discount: This upgrade will reduce the fees associated with multi-hop transactions that consist of just two OSMO pools by 50%.

These features offer numerous advantages and applications, but the most noteworthy are the stableswap pools, discussed further in a blog post on December 7. Osmosis’s stableswap is a unique constant product market maker (CPMM) curve, influenced by stableswap curves from Curve Finance and Solidly. Osmosis Labs believes their version has improved computational efficiency due to changes in the curve and updated solving algorithms. The stableswap curve also includes “scaling factors,” allowing it to better accommodate the accrual of value in liquid staking derivatives. In simpler terms, the Osmosis stableswap curve should be more efficient with liquid staking derivatives compared to existing curves.

The introduction of this new stableswap curve should help to improve the liquidity for stablecoins on Osmosis. Additionally, with Circle planning to support a multi-chain ecosystem, there have already been plans to create an Osmosis “3pool” similar to the 3CRV token from Curve Finance. This could create an especially liquid pool of stablecoins that could then be paired with other tokens on the Osmosis DEX. Overall, this new feature puts Osmosis in a strong position to increase stablecoin liquidity and volumes.

Closing Summary

Osmosis faced a tumultuous year, but this was the case for the greater crypto ecosystem, as well. Despite the decreases in trading volumes, and TVL over the year, there was significant growth in the daily active users and daily transactions, which redounded to the benefit of the network. Within the Cosmos ecosystem, Osmosis has begun to cement itself as the trusted chain for users as shown by the increases in IBC transfer into the network, especially around times of market volatility. With continued developments being pushed forward from the Osmosis Labs team, such as stableswaps, MEV mitigation and capture, mesh security, and more, there is certainly a bright future ahead. There are also several teams outside of Osmosis Labs working on integrations like Mars Protocol, an autonomous credit protocol, and Circle, the issuer of USDC. Over the next quarter and year, monitoring the TVL outside of Osmosis’ native token OSMO, IBC transfers, and stablecoin liquidity are just a few metrics that will provide valuable insight into the state of the network.