Key Insights

- Volumes dropped 87% in Q4 as atomic swap volume exploded in Q3 and then was reigned in to be reconfigured in Q4. The debt pool fell to $100 million.

- The fourth quarter saw a flurry of activity in terms of daily active users and an increased number of stakers, but likely because of incentives related to Optimism Quests.

- SNX, Synthetix’s native token, inflation decreased to an annualized rate of 10% by the end of Q4 as the target staking ratio was reduced to 55%. The excessive inflationary rewards in Q2 and Q3 2022 have the dual effect of reducing yields for stakers until tokens are vested and creating a supply cliff for potential buyers.

- Debt shares drastically outperformed SNX in 2022, showing the downside of the reflexivity of the protocol and tokenomic design.

- Perps V2 successfully launched at the end of 2022 and should be a growth driver for Synthetix in 2023. The launch of V3 is highly anticipated for 2023 as well.

Primer on Synthetix

Synthetix is a decentralized synthetic asset issuance and liquidity protocol that allows users to trade synthetic cryptocurrencies, fiat currencies, and commodities. Each synthetic asset tracks the price of an external asset through the use of Chainlink, Pyth, or Uniswap V3 TWAP oracles. Users can either trade in spot or in perpetual futures markets for synthetic assets. SNX is the native protocol token, responsible for governance as well as the primary collateral that backs the liquidity of the network. SNX can be staked as collateral for sUSD, the Synthetix stablecoin, which can be traded on Synthetix for any other synth (sAsset). The DAO uses a novel V3 Governance Module (V3GM), which uses councils of appointees who are voted on by SNX holders.

Key Metrics

Performance Analysis

Network Overview

Falling prices and risk appetite took a toll on the debt pool serviced by Synthetix stakers. As a share of the debt pool, sUSD rose from 15% on Jan. 1, 2022 to 46% by the end of 2022, despite the amount of sUSD falling 63% from $129 million to $47 million. The consolidation of assets is not unique compared to most lending or CDP protocols. Despite the smaller debt pool, the number of unique active stakers increased throughout 2022 and by 4.2% in Q4. The number is likely aided by Optimism Quest, the liquidity mining operation that incentivized users to use applications on Optimism by offering OP token rewards.

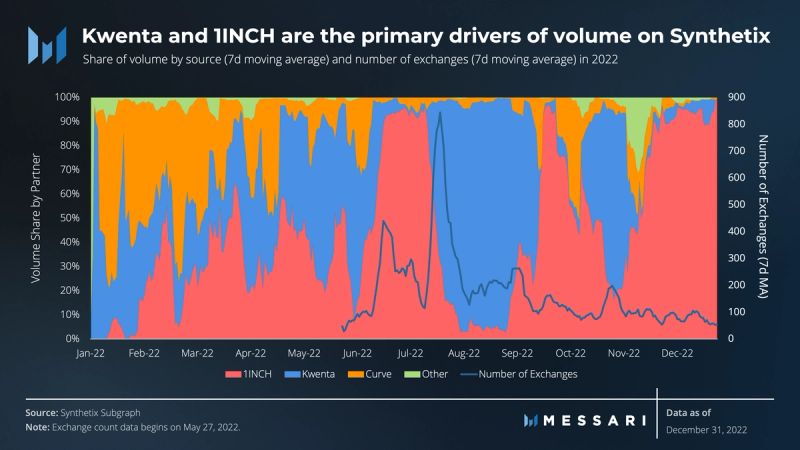

Volumes peaked in Q3 2022, led by atomic swaps. After some early success, the program was reduced to manage toxic flow that was asymmetrically bad for stakers and insufficiently protected by fees, which were raised with SCCP 226 on September 4. The approach since has been more nuanced, integrating atomic swaps for 1inch and lowering fees on those to 5 bps. So far, all atomic swaps on Synthetix since the 1inch fusion have been beneficial to stakers, with more integrations coming soon. Fourth quarter volume was just under $623 million, down 86.5% from Q3. Perps V2 was launched on December 20 and is still in alpha (only ETH perps trading on select front-ends). However, in the final 11 days of the year, it accounted for 15% of volumes.

Synthetix is a liquidity solution. The protocol and collateral pool can be infrastructure for partners to use. The partnership with 1INCH drove tremendous volume to Synthetix in 2022 as the leading solution for large trades to avoid slippage on traditional DEXs. Kwenta is the leading perpetual futures protocol that uses Synthetix, and in times of volatility, Kwenta tends to dominate volumes driven to Synthetix. Decentrex is a recently launched perps protocol that will be leveraging Synthetix Perps V2. Synthetix also created pools on Curve to help increase the liquidity of sUSD and sETH.

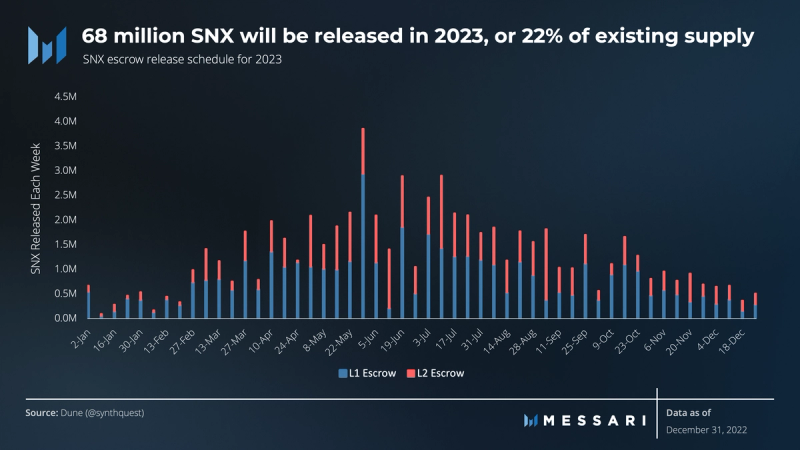

With SCCP-208 in July, the DAO lowered the target staking ratio. When the actual staking ratio is above target, as per the mechanism design, inflation falls by 10% each week. After increasing over 34% in 2022, the SNX inflation rate is now below 10% on an annualized basis. The claims will be paid out next year after their one-year escrow. In 2022, 42 million SNX entered circulation after completing their vesting period.

A mirror of the inflation rate above, SNX rewards to stakers is escrowed for one year after claiming. Given the increase in the inflation rate in the middle of the year, 24 million and 23 million SNX will be released in Q2 and Q3, respectively – more than all of 2022. After the Q3 cliff, the lower inflation rate will mean fewer SNX entering the market with 11 million expected in Q4.

Staker Perspective

In 2022, users paid $37.5 million in fees to access liquidity on Synthetix. In aggregate, the fees were split nearly perfectly 50/50 between Synthetix’s L1 and L2 instances. However, in Q4’22, Synthetix’s Optimism instance earned 83% ($2.8 million) of all trading fees on the platform, likely aided by the launch of perps V2 on Optimism and Optimism Quests. Trading fees were dwarfed by the $231 million of SNX incentives paid out in 2022.

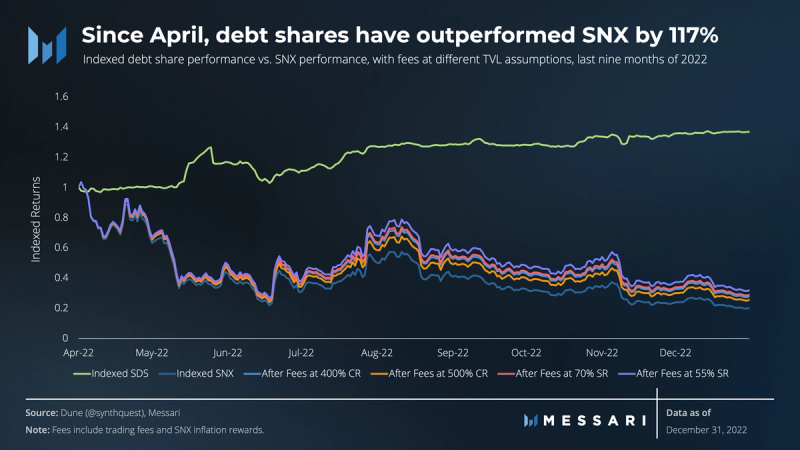

Yields for SNX stakers likely fell to single digits at the end of 2022, as the annual inflation rate dropped due to SCCP-208 and rewards from earlier in the year stayed staked while in escrow. The ability to stake escrowed SNX rewards can also drive price down, as staking increases the amount of total staked SNX and therefore drives down yields from the same amount of revenue. For the yield to recalibrate without an increase in trading fees, either stakers need to unstake or SNX price must drop. Given the required escrow period for inflation rewards, the market has instead repriced the collateral.

After $22 million in liquidations in the first half of the year, the second half of 2022 saw $11 million in liquidations of Synthetix. Liquidations on Synthetix reward other stakers by dispersing a percentage of the collateral staked (SNX) to active and healthy stakers. In December, the DAO increased the liquidation collateral ratio and the penalties for being liquidated.

Stakers in Synthetix are long SNX, their collateral, versus short the global debt pool. For this reason, it is critical as a staker to stay hedged against the debt pool to isolate the performance of SNX and the fees earned from staking. In February 2022, Synthetix partnered with Chainlink to launch an oracle that tracks the performance of the debt pool, or Synthetix Debt Shares (SDS). The staking position performance, when left unhedged, is measured by the relative performance of the two. In the past nine months, the debt pool has performed very well, up nearly 37%. The relative volatility of the two assets also shows one reason why the debt ratio for Synthetix is so high: SNX has nearly 10x the daily price volatility as Synthetix Debt Shares.

Qualitative Analysis

In June 2022, Synthetix launched a new governance structure, Synthetix V3GM. For info on the governance process and many of the initiatives, please see our State of Synthetix Governance report.

Perps V2

Synthetix Perps V2 is a protocol to trade perpetual futures using the liquidity provided by the Synthetix protocol. It was designed with risk management for the debt pool as a primary concern. Recall that the debt pool is the pool of synthetic assets (synths) created by SNX stakers providing their capital on loan (as a CDP) in exchange for minting sUSD. SNX stakers collectively are short the debt pool, meaning they take the other side of all trades on Synthetix. Furthermore, as discussed below, a design that reduces risk for stakers also enables for more capital efficiency in the form of larger or more flexible open interest (OI) limits.

To protect the debt pool and incentivize traders to take the other side of existing orders, Perps V2 will use a premium / discount mechanism depending on the positioning skew. V1 expressed this incentive in the form of funding rates; if the position skew was long the funding rate would increase and vice versa. V2 explicitly creates a price premium or discount to the oracle price depending on the position skew. This simulates a bid / offer spread in the market, enabling market makers to balance the market, reducing the burden on LPs and reducing the need for restrictive OI limits. V2 does not ignore funding rates either, which are the second significant change after the price premium / discount. In V1, a perp funding rate was only related to the skew position in the market. This means a trader could never have a long skew market with zero funding or a flat skew market with positive funding. In that system, liquidity providers (LPs) never pay funding, but the downside is that the funding rate is tied to skew rather than to the funding cost of the asset. In V2, the skew position informs the change in the funding rate. Therefore, rather than the skew determining the funding rate, it simply determines the adjustment to the funding rate. The small mathematical change has big implications for the protocol, as perp markets now can find a market-based funding rate without requiring LPs to take positional risk.

A primary issue with Perps V1 was latency of oracle pricing, which enabled the front-running of trades. This was largely countered by creating a delay in exchange execution to ensure oracle prices do not deviate from observed prices by a large amount. Raising fees also helps reduce the opportunity set for attackers and is partially why most oracle-dependent solutions like Perps V1 and GMX have such high fees. Other decentralized perp solutions make other trade-offs. dYdX, for example, uses an order book, but it must be run off-chain because the computational expense to run an order book on-chain would be prohibitively expensive. Synthetix Perps V2 uses a hybrid oracle solution to achieve lower latency and lower fees. The solution was created by Pyth, and Chainlink is also launching a similar mechanism to add redundancy. The oracle updates prices off-chain, then data is pulled on-chain and verified by the oracle’s decentralized network. This reduces price latency from 10-12 seconds to 2-3 seconds. The hybrid oracle solution reduces costs because most of the price updates are happening off-chain and also because faster price updates mean less opportunity for variation between oracle price and observed price.

Synthetix launched Perps V2 on December 20, beginning with just an ETH perp option. Proposals have been approved to add assets. Thus far, the launch has been successful, with lower fees and strong uptake (more than 35% of perps volume between January 1 and January 28).

Synthetix V3

In 2023, the Synthetix DAO is primarily focusing on the launch of Synthetix V3, an updated architecture for the liquidity provisioning protocol. Currently in drafts, SIPs 300 to 315 are all related to V3, while SIP 299 has already been approved and implemented.

V3 is a drastic change to the protocol and implementation, with no change at all to the intention or service to be provided. It strives to give lenders (SNX stakers) control over what they collateralize along with permissionless asset listing. The transition will include migrating sUSD to snxUSD and turning the current V2 protocol into a pool on V3.

Based on the current outline of the vision for V3, it is a much more permissionless derivative layer than the current implementation. Synthetix uses a CDP-mechanism like many lenders. The difference is lenders determine which assets can be collateral and which can be loans. Maker, for example, allows many types of collateral but only one loan asset, their stablecoin DAI. Synthetix’s current version is unique to its CDP peers because it allows only one type of collateral, SNX, in exchange for any synth as a loan (note, the loan is always sUSD initially, but that can be exchanged for any other synth).

V3 will enable much more decentralized use of the protocol. Pools will have managers that can set rules on which assets are accepted as collateral, known as vaults. They can choose which markets they offer the liquidity to – perps, spot, atomic, etc. Pools can also target rewards to different collateral types depending on their preference or on the debt pool. There is no launch date for V3 yet, but updates will likely come throughout Q1’23.

Source: Synthetix

Closing Summary

Synthetix had a roller coaster 2022, with many exciting and promising launches rounded with some mishaps and lessons learned. Getting inflation under control will pay benefits in the long run, but the debt from escrowed SNX is likely going to weigh on the token for the next few quarters. The early lessons from atomic swaps and perps offer propitious use cases for the liquidity protocol. Perps V2 has had a successful alpha launch and could provide the backbone to the leading decentralized perp protocols on Optimism. Synthetix V3 will be the biggest upgrade to the protocol coming this year, and it could re-ignite the opportunity for Synthetix to be the liquidity infrastructure for many other protocols and designs.