Crypto markets are flying as banks and traditional finance stocks get hammered by investors grappling with the collapse of several large banking institutions.

As a new trading week begins, bank stocks are proving to be the biggest losers, with some of them suffering as much as 75% in losses mere hours into the open.

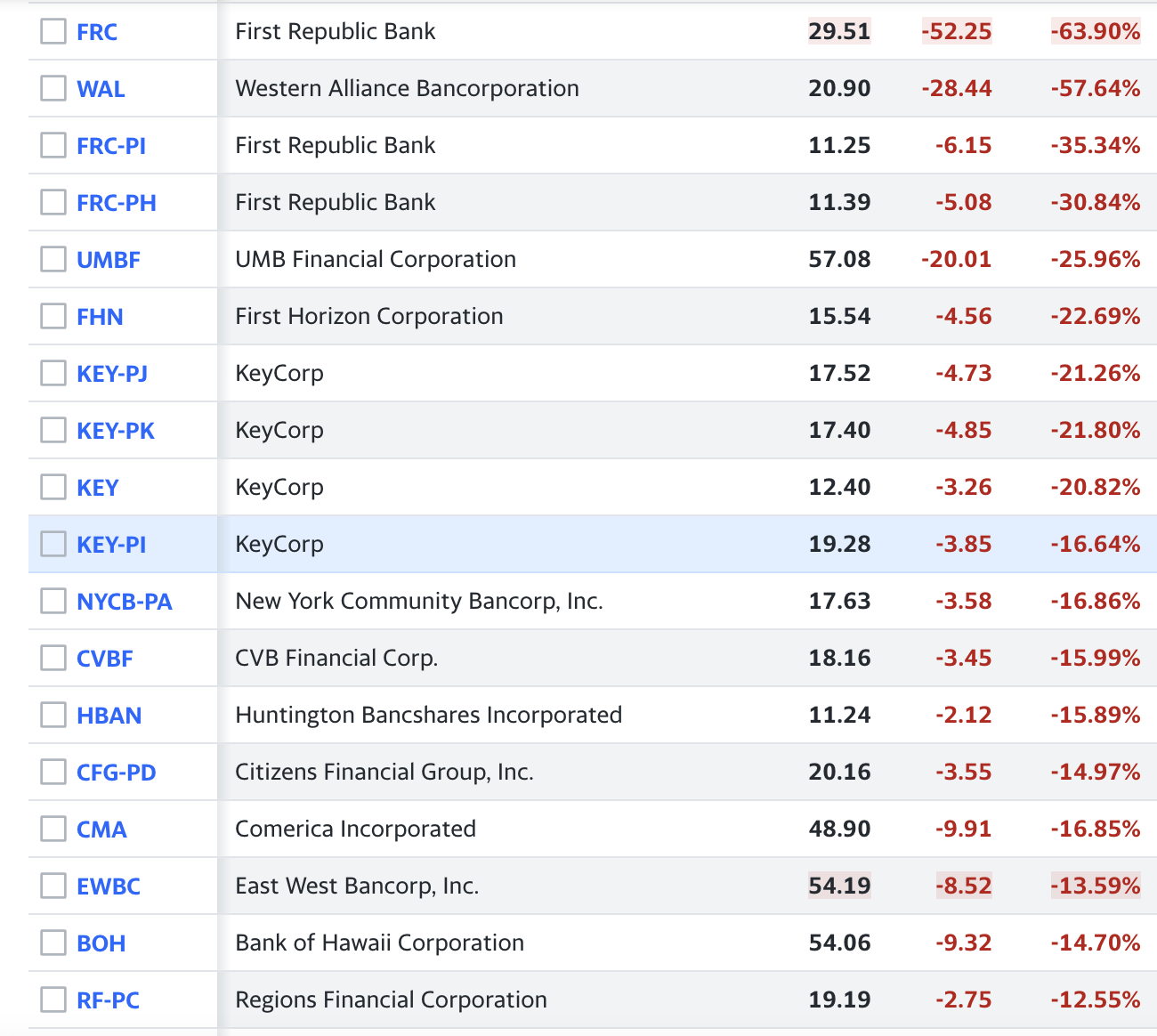

A look at Yahoo Finance’s list of top losers shows a long list of banking stocks bleeding out badly.

Following the recent closure of Silicon Valley Bank, Silvergate Bank and Signature Bank, fears of a spreading banking contagion have rocked the sector as investors look to see who could be next on the chopping block. At time of writing, First Republic Bank (FRC) and Western Alliance (WAL) are taking the worst hits from the market turmoil, both down roughly 60%.

Bitcoin (BTC) bull and head of ARK Invest Cathie Wood warns that if the Federal Reserve doesn’t pivot on interest rates, more banks will be destroyed.

“If the Fed continues to focus on lagging indicators like the CPI, and does not pivot in response to the deflationary forces telegraphed by the inverted yield curve, then this crisis will devour more regional banks and further centralize, if not nationalize, the US banking system.

As a result, [ARK Invest is] not surprised that BTC and ETH appreciated as US regional bank stocks imploded. Their blockchains are decentralized, transparent, and auditable. Banks are not and, in the last few days, have become less so.”

BitMEX founder and crypto veteran Arthur Hayes is also expecting the Fed to flip dovish again and print more money, presumably boosting risk assets like crypto.

That’s a… savage move in the 2yr. In case you think this is something other than what it is. The bond market is saying it’s back to print dat money mode. Don’t fight the Fed!!!!”

Banking giant Goldman Sachs has reportedly forecasted that due to the crisis, the Fed will pause rate hikes this month rather than go ahead with the previously expected 25 basis point rise.

Says Goldman economist Jan Hatzius,

“In light of the stress in the banking system, we no longer expect the FOMC to deliver a rate hike at its next meeting on March 22.”

With the banking issues that plagued crypto as of late no longer on center stage, Bitcoin, Ethereum (ETH) and altcoin markets are rallying hard.

At time of writing, Bitcoin is trading at $24,220, up 20% in the last 24 hours, while ETH is priced at $1,685, up 15% in the last 24 hours.

Altcoins are also ripping, with many well above 30% in the last day.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Mia Stendal/Sensvector

The post Bank Stocks Implode, Bitcoin (BTC) and Ethereum (ETH) Soar As Fed Faces Rate Hike Decision appeared first on The Daily Hodl.