Key Insights

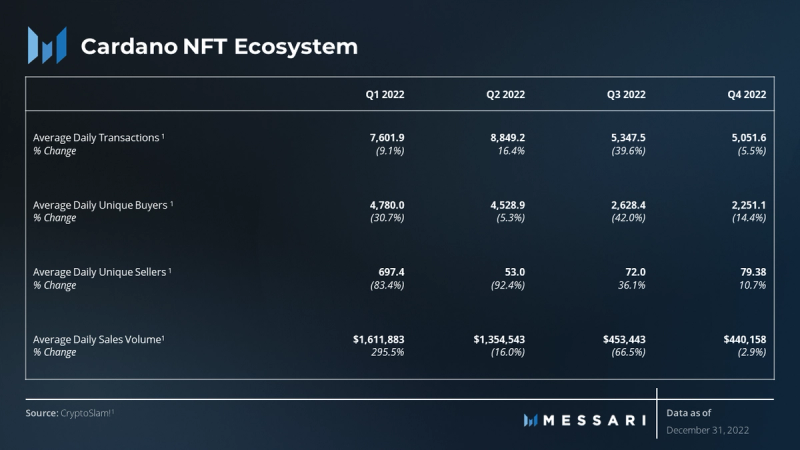

- Cardano totaled $40.5 million in NFT sales volume in Q4, making it the fourth largest NFT chain by sales volume over the entire quarter and the third largest over certain weeks in the quarter.

- Daily transactions increased 13%, and dapp transactions increased 16%, despite daily active addresses decreasing 24%. While some users were less active or left the ecosystem – something that is to be expected in a bear market – the users that stayed were much more active and dedicated to the ecosystem.

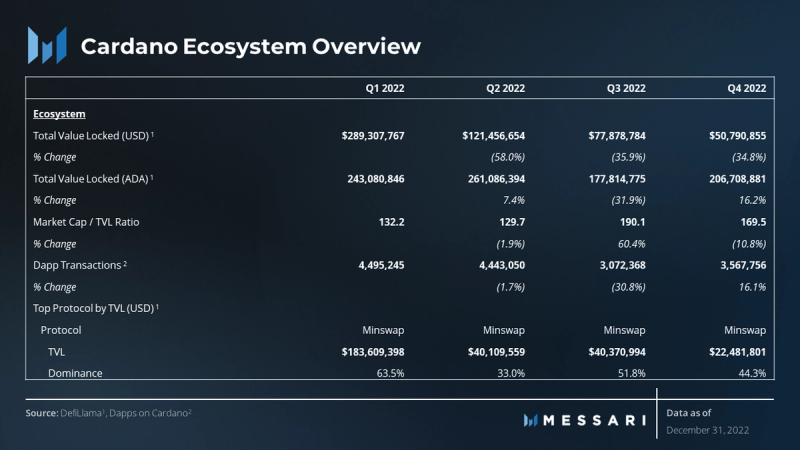

- Cardano’s financial metrics decreased amid the bear market. Market cap and total value locked (TVL) decreased 42% and 35% in terms of USD, respectively.

- Hydra Head, Midnight, and the EVM sidechain toolkit were announced. IOG’s suite of scaling solutions are being built to realize the vision of the Basho era.

- USDA and Djed stablecoins are in development. These new stablecoins were announced in Q4 and may help kick off new DeFi opportunities. (update: Djed stablecoin launched on Jan. 31, 2023)

- The Voltaire era has begun. The first Cardano Improvement Proposal (CIP) for the Voltaire era is live, and the Cardano network is now actively moving toward its self-sustainability and governance goals.

Primer on Cardano

Cardano is a Delegated-Proof-of-Stake (DPoS) Layer-1 smart contract network launched in 2017. Cardano aims to provide security, scalability, and sustainability to decentralized applications and systems building on top of the blockchain. In addition to the community of developers, node operators, and projects, Cardano is supported by three entities: Input Output Global (IOG), The Cardano Foundation, and EMURGO. They work together to support the network’s development, adoption, and finances while Cardano moves toward full decentralization of governance.

Cardano has taken a unique approach to development when compared to other smart contract networks:

- Cardano’s development is methodical, deliberate, and sometimes slower than the market would like — prioritizing sustainability and stability over speed.

- For example, smart contracts were not enabled until the Alonzo hard fork in 2021, over four years after the network launched.

- The eUTXO accounting model enables native token transfers, scalability, and decentralization.

- Cardano has offered liquid staking and economic models to incentivize decentralization on its Ouroboros PoS consensus model since inception.

With a dedicated community of users and developers, Cardano has demonstrated staying power. In 2022, Cardano began to compete in more traditional crypto markets such as DeFi and NFTs, while remaining focused on its core goals.

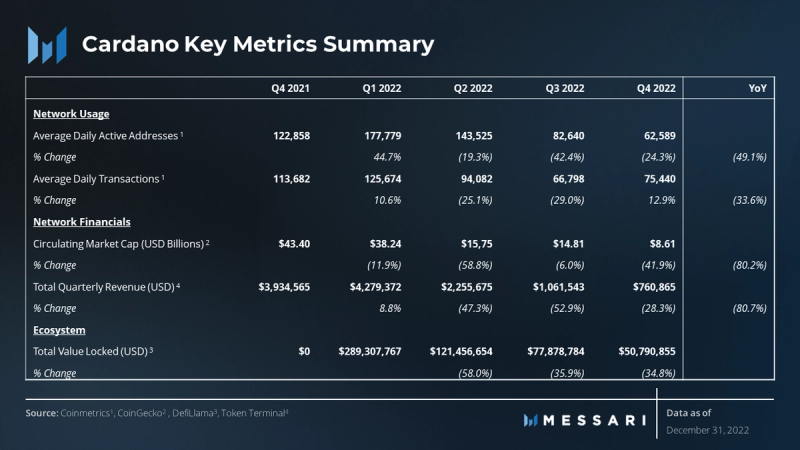

Key Metrics

The Fourth Quarter Narrative

Cardano largely followed the overall crypto market downward in Q4, accelerated by the collapses of FTX and Genesis. Financials, such as market cap and revenue, as well as activity metrics, such as active addresses and total value locked (TVL), all took hits in Q4. There were some brighter metrics, such as daily transactions and engaged stake, that managed to increase quarter-over-quarter (QoQ) despite the turmoil.

New projects continue to launch on Cardano despite the bear market. NFT projects such as OREMOB temporarily pushed Cardano up to the third highest NFT sales volume among all chains. In the DeFi realm, some projects, such as Ardana, collapsed in Q4; however, there were announcements of other stablecoin projects, such as USDA and Djed, to fill that gap.

The 2022 Cardano Summit featured development news for infrastructure, scaling solutions, and core protocol advancements. Plans were announced for improvements to consensus, time handling, cryptographic primitives, and staking variables.

Performance Analysis

Network and Financial Overview

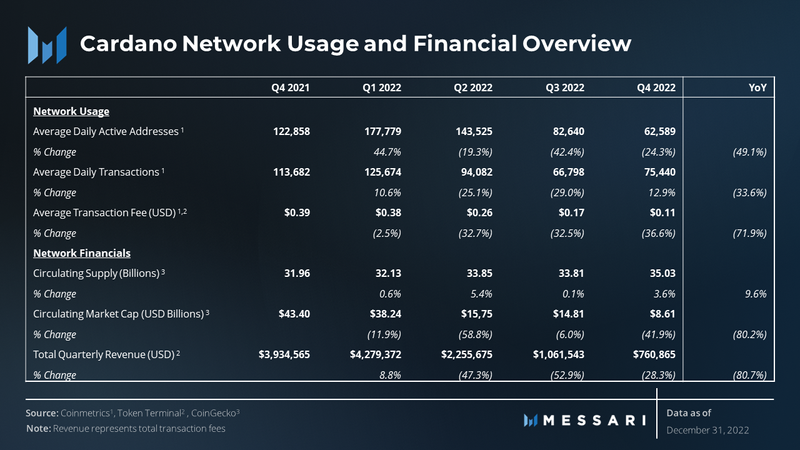

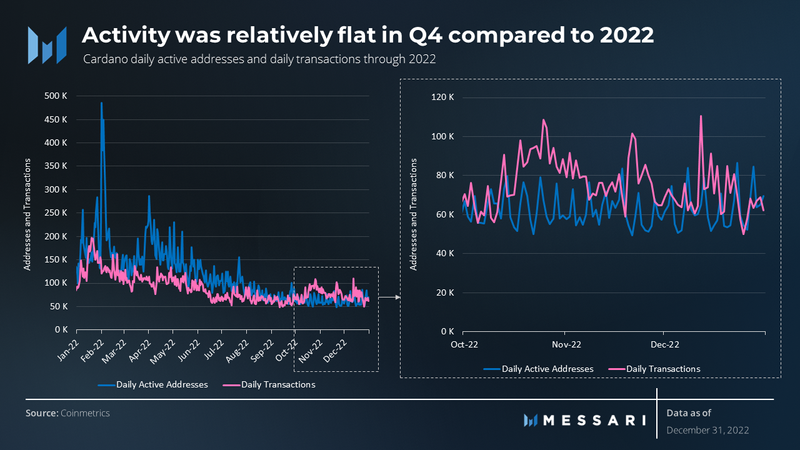

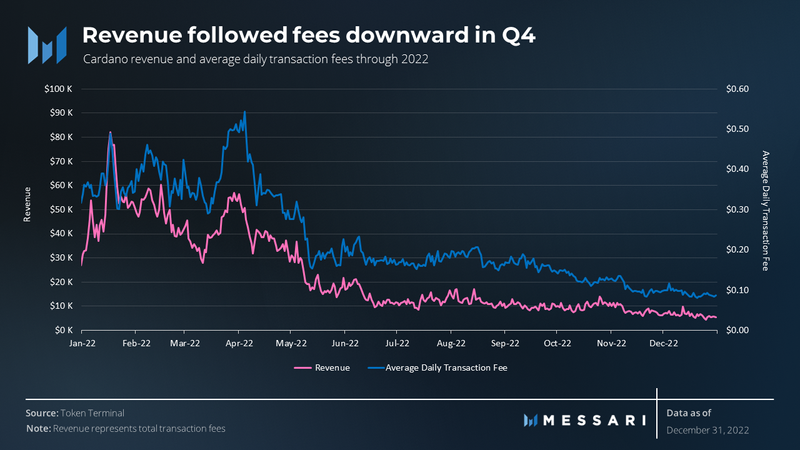

Cardano is the eighth largest cryptocurrency by market cap as of the end of Q4 2022. In Q4, revenue stayed positive relative to the decrease in transaction fees, likely due to increased transactions QoQ. Over the course of 2022, both daily active addresses and daily transactions fell 49.1% and 33.6%, respectively. Cardano’s market cap fell 80.2% year-over-year (YoY), more than the total crypto market cap that decreased 63.9% during the same period.

Compared to the highs in early 2022, little variation occurred in Q4 and a relatively stable amount of activity characterized the quarter in terms of daily active addresses and daily transactions.

Cardano experienced a 12.9% rise in daily transactions, even though daily active addresses declined 24.3%. Daily active addresses represents all addresses included in ledger transactions, which does not directly map to users in a UTXO system, like Cardano, where a single sender/recipient can be represented by multiple addresses. This indicates that while some users were less active or left the ecosystem – something that is to be expected in a bear market – the users that stayed were much more active and dedicated to the ecosystem.

The growing dapp ecosystem most likely caused this user retention and increased transactions per user – more on this in the Ecosystem Breakdown below. Additionally, the 36.6% decrease in average transaction fees from $0.17 to $0.11 continues to make the network more accessible to all users.

Declining fees on the network, down 36.6% QoQ and 71.9% YoY, are excellent for usability but decrease revenue. Revenue fell 28.3% QoQ and 80.7% YoY, remaining tightly coupled with fees as they are the source of revenue.

20% of all transaction fees go to the treasury, which can be changed via governance if needed. Currently, the treasury holds over 1.1 billion ADA ($290 million as of December 31) to be used for ecosystem development, which continued to evolve over Q4.

Ecosystem and Development Overview

Ecosystem Growth

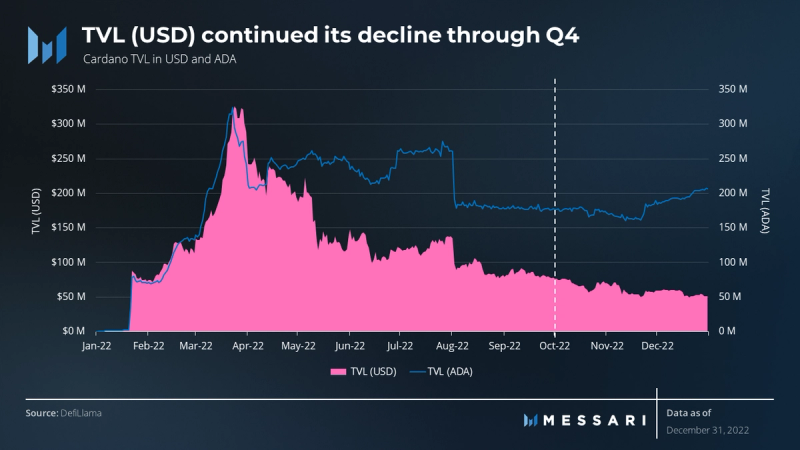

Cardano’s network utilization declined significantly in Q4, following the trend of the total cryptocurrency ecosystem. FTX and Genesis’s collapses negatively affected the broader industry, which caused mass exits and liquidations in all major ecosystems. Cardano’s DeFi TVL (USD) was already in decline through the 2022 bear market and took a further 34.8% decline in Q4.

Despite falling TVL amounts, users and developers stayed active. Dapp transactions increased by 16.1% QoQ. And developers continued to build in Q4, albeit with a slight decline in activity metrics. In Q4, development occurred in areas such as stablecoins, synthetic assets by Indigo Protocol, and new NFT projects. Cardano ecosystem incumbents, such as GameFi MMO Cornucopias, continued to grow but failed to see large adoption by the end of Q4, as is the case with crypto gaming as an industry. Cardano also hosts identity solutions such as Atala PRISM: a self-sovereign identity (SSI) platform on the Cardano blockchain that provides digital infrastructure for banking, healthcare, education, and more.

Development Activity

According to Electric Capital’s 2022 developer report, Cardano has 163 monthly full-time developers and 465 total developers, ranking ninth in terms of full-time developers (this report excludes pull requests, forked commits, and other indirect or copied activity). Electric Capital shows a slight ~3% dip in developers and commits over Q4 but a slight gain through 2022 as a whole. This might understate developer activity on Cardano compared to other chains as some popular dapps, such as Minswap, are not open-sourced.

DeFi

While TVL (USD) decreased 34.8%, TVL (ADA) increased 16.2%, indicating that the TVL (USD) decrease was partially from ADA’s price drop. However, the 24.3% decrease in daily active users – as highlighted above in the Network and Financial Overview – suggests that users exiting the ecosystem may have contributed to the decrease in TVL (USD).

Cardano’s market cap / TVL ratio decreased 10.8% to 169.5 in Q4. This ratio is still orders of magnitude larger than that of the main DeFi players, indicating Cardano’s DeFi ecosystem is smaller in both absolute terms and relative terms.

Cardano’s native liquid staking provides an advantage over competitors in the DeFi game as staked ADA can still be used for DeFi without passing through a competing group of liquid staking derivatives (LSDs). However, a fully fleshed out DeFi ecosystem is needed to capitalize on the liquidity benefits of liquid staking. Stablecoins are a glaring hole in the Cardano ecosystem; they have a combined market cap of over $130 billion on all chains combined but only ~$2 million on Cardano as of Q4 2022.

Stablecoins

Ardana Labs, which aspired to build the first stablecoin on Cardano before Indigo’s iUSD took the title, halted development of Ardana in November 2022. Ardana claimed its budget issues prevented it from completing this highly anticipated tool, but it is hoping for another team to pick up their open-source code where it left off. cFund, a Cardano ecosystem venture fund, helped the project raise millions in 2021.

Newer stablecoins are filling the community with new hope. At the Cardano Summit in November, EMURGO announced plans to launch USDA, which is set to be the first USD-backed stablecoin on Cardano. The summit also announced plans for another stablecoin: Djed. Powered by COTI and built by IOG, Djed is algorithmic rather than governed. Many algorithmic stablecoins have been sunset, depegged, or simply lost market share in the past year, but the root of those issues may have been due to collateral (specifically endogenous collateral), not algorithmic style pegs.

DEXs

Minswap, an automated market maker (AMM), remains the leading decentralized exchange (DEX) on Cardano, though its TVL dropped ~$18 million, and its dominance decreased from 51.8% to 44.3% in Q4. Other DEXs such as SundaeSwap and WingRiders are relevant players in the DeFi market with strong communities, which create competition and diversity among protocols that is healthy for an ecosystem.

NFTs

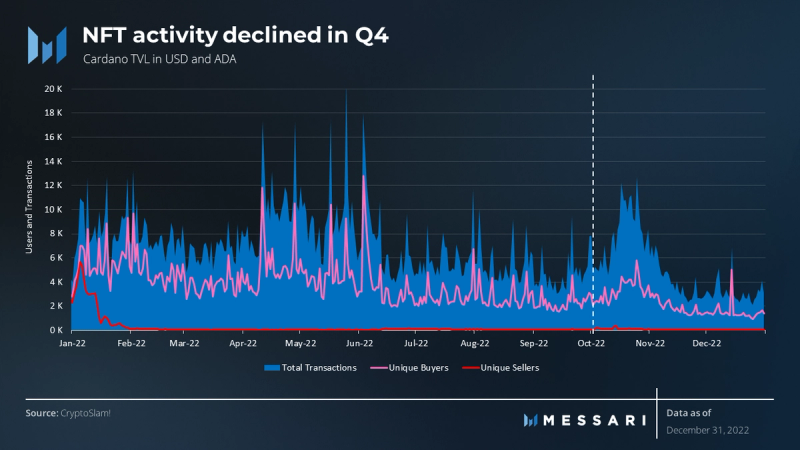

Cardano averaged $440,000 in NFT sales per day in Q4, with a maximum of $1.5 million on October 21. This totaled to $40.5 million in Q4, making Cardano the fourth largest NFT chain by sales volume behind Ethereum ($1.25 billion), Solana ($218.5 million), and Immutable X ($56.7 million).

Trading volume became relatively flat in Q4, far below 2022 highs. A large spike in activity occurred during October, partially due to the launch of OREMOB, an anime pfp project.

Although Cardano ranked fourth among all chains in secondary sales volume, in total transactions or unique buyers / sellers it ranked behind several others including Polygon, Flow, Wax, BSC, and Avax. In particular, Cardano’s number of unique sellers ranked lowest against the competition. Cardano and IMX traded places several times in Q4 in terms of daily sales volume, but IMX averaged 2-3x more transactions throughout. This highlights that no single metric conveys the entire story.

Cardano saw an average of 79 unique sellers per day in Q4. This was significantly lower than competitors Flow and Polygon, which saw ~3K unique sellers per day during the same time period. Unique buyers was a more comparable statistic to competitors.

Cardano’s relatively low number of daily transactions, but high sales volumes, demonstrates that NFTs on Cardano are, on average, trading for a much higher price than on competing chains. Additionally, the high ratio of unique buyers to unique sellers shows that many new users are entering the market and purchasing NFTs. Cardano’s NFT ecosystem is dominated by jpg.store, a marketplace with ~97% dominance by sales volume. Jpg.store has been a dominant player as a marketplace since its inception, but through Q4 it gained even more market dominance. Previously, marketplaces such as CNFT.io had up to 25% dominance.

SpaceBudz, the leading collection all-time with 41.8 million ADA in sales, was not the most popular project in Q4. Newer collections such as OREMOB had significant sales in Q4, boosting them ahead in rankings. Ada Handle, a digital identity NFT project, is developing new partnerships.

Out of ~8500 total NFT projects:

- 432 have crossed 100K ADA

- 117 have crossed 1 million ADA

- Only 10 have crossed 10 million ADA in trading volume

Staking and Decentralization

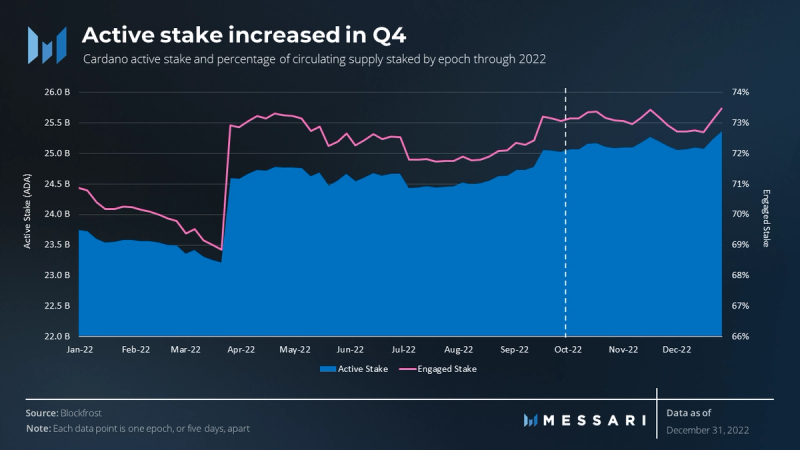

Cardano’s active stake is at an all-time high of almost 25.5 billion ADA. Engaged stake has increased QoQ and YoY, suggesting that the ADA issued to pool operators and delegators is being staked after it’s received. Engaged stake has peaked at the end of Q4 at nearly 74%.

The k parameter dictates the optimal size of a stake pool, encouraging stake pool operators and delegators to adjust to the amount desired by Cardano’s entities and community via economic incentives: better staking rewards. However, of the ~3,000 current stake pools, over 90% of them don’t have half of the optimal amount of ADA staked. Cardano may see some changes to minimum pool fee to make operating a smaller stake pool more attractive.

Regardless of whether stake pools hold an optimal amount of ADA, the raw number of pools largely determines the decentralization of block production. ~2,000 different stake pools have produced Cardano blocks.

There are many other lenses through which to look at decentralization, such as distribution of wealth. Large ADA holders have influence based on where their ADA is delegated. The top-100 ADA holders hold ~8 billion ADA out of the ~35 billion in circulation, or ~23%. However, there’s no way to know how many large wallets belong to a single actor or organization, so this is again an imperfect statistic.

As of now, there is no definitive methodology to compare or rank decentralization among cryptocurrency networks with such diverse consensus mechanisms and architectures. The University of Edinburgh is creating the Edinburgh Decentralization Index (EDI) to measure decentralization across various cryptocurrencies, and it may end up being a widely accepted rating system.

Qualitative Analysis

Key Events and Catalysts

Q4 was full of big news for Cardano’s community and its entities. Some of the standout events include:

- EMURGO announced a $200 million ecosystem fund.

- Cardano Foundation announced its blockchain education course.

- Project Catalyst continues to fund more projects, with 800 more funded in 2022.

- Midnight, Hydra, and Mithril were announced as part of Basho’s scaling efforts.

- Voltaire’s first CIP was proposed.

- Ardana and Orbis collapsed – detailed in the Stablecoin section of DeFi.

- Djed, EMURGO, and Indigo announced stablecoins.

Cardano Summit and Community

The Cardano Summit was the highlight of Cardano’s vibrant ecosystem in Q4. The summit was full of panels with speakers from ecosystem projects such as:

- IAMX, a self-sovereign identity solution.

- Charli3, a decentralized oracle network.

- Cornucopias, a metaverse MMO built with Unreal Engine.

- As well as new announcements such as:

- EMURGO’s USDA stablecoin

- Cardano Foundation’s collaboration with the United Nations High Commissioner for Refugees (UNHCR)

Multichain Approach

Orbis, a zk-rollup scaling project on Cardano sharing a founder with Ardana, collapsed in Q4 along with Ardana. However, the Basho era’s vision of scaling may not be most efficiently achieved through standard zk-rollups. Sidechains, off-chain L2s, and light clients are the scaling strategies being explored by IOG and other Cardano developers.

Sidechains

Milkomeda, Cardano’s first sidechain launched in early 2022, brings EVM compatibility to Cardano. Milkomeda continues to grow with dozens of dapps and even had its own hackathon in Q4.

Cardano announced a sidechain toolkit at IO ScotFest in November 2022 for devs to build their own special-purpose sidechains. IOG’s EVM sidechain, built with the sidechain toolkit, was also first demonstrated at this event.

IOG recently announced another sidechain: a special-purpose chain called Midnight. Midnight is a data protection-based sidechain of the Cardano blockchain. By leveraging zero-knowledge cryptography and other computation resources, Midnight will enable users to choose which data they wish to reveal publicly or keep private. Unlike Milkomeda, Midnight will have its own token: DUST. Use cases include working with:

- Sensitive data such as medical records

- End-user privacy preservation with advertisements

L2s and Hydra

Hydra is a set of scaling protocols, mostly L2s based on state channels. Hydra Head, the first solution from the set, saw its first functional demonstration in Q4. Hydra Head is an off-chain miniledger between a small group of participants, not unlike other popular state channels such as Lightning.

Hydra for Payments is an open-source toolkit for implementing payment solutions that will leverage Hydra Head. Hydra for Payments has its own discord where use cases and 2023 plans can be found.

Light Clients

Mithril is a stake-based signature scheme in development that creates a lightweight, efficient experience for users. By not requiring users to download the current state, clients can become thin enough for laptops, smartphones, and browsers. Mithril takes snapshots from the Cardano network to resolve chain synchronization, state bootstrapping, and chain validation.

Development

Cardano’s developers are working on a handful of new developments for Cardano and its CIP process, Plutus core, and Cardano ecosystem tools (such as stablecoins). EMURGO’s stablecoin is detailed above in the DeFi section of the Qualitative Analysis.

Prospective Determinism

Cardano’s developers and community have chosen to pursue full prospective determinism. As a result, non-deterministic aspects such as pointer addresses are slated to be removed. Prospective determinism allows for transactions to have known outcomes before execution, which is not the case on most other chains. Plutus determinism, an aspect of overall prospective determinism, allows gas costs to be known ahead of time, among other benefits with smart contract interactions and development.

Deterministic transactions can be processed in parallel, which is how Hydra plans to achieve massive scaling improvements. A downside of forcing prospective determinism is losing the ability to reference timestamps from blocks produced or other non-deterministic events that may be in the future or relating to a specific instance of an execution.

Ouroboros Chronos

A new iteration of Ouroboros, Chronos, will address timekeeping for Hydra. Conversion from slots (how Plutus scripts interpret time) to real-time is done by consensus. Assumptions based on slots are unreliable because slot times can change with a hard fork, making real-time preferable.

Cryptographic Primitives

A barrier between Cardano and the abundant EVM ecosystem is cryptographic primitives. The specific elliptic curves used for blockchains functions, and compatibility with other curves, directly affect the complexity of cross-chain interactions.

IOG is adding functions to support ECDSA and Schnorr signatures to the Plutus core, detailed in CIP-49. This will allow for compatibility with sidechains (such as an EVM sidechain) and other blockchains as soon as Q1 2023.

Staking Variables

A survey was made in the Cardano stake pool operator (SPO) community to change two variables related to staking:

- k parameter: the level at which a staking pool becomes saturated and experiences diminishing rewards.

- min pool fee: the flat amount paid to a pool before rewards are split among delegators, which is done automatically so there is no risk of delegators not being paid.

IOG suggests changing k from 500 to 1000, which would change the optimal pool size from 70 million ADA to 35 million ADA. A large or smaller k parameter is not objectively better than the other; the same goes for the minimum pool fee. They require balance to encourage decentralization, sybil resistance, and incentives for small pools.

Ecosystem Challenges and the L1 Landscape

Cardano has the disadvantage of being relatively late to the game, not having smart contracts until 2021. Both users and developers have been accustomed to using other chains for needs, such as DeFi, for years, and it’s going to take more time to fully flesh out Cardano’s ecosystem with tools and platforms.

Overall, crypto ecosystem development is heavily dominated by EVM languages such as Solidity and Vyper, although some other domain specific languages like Cairo are also beginning to take market share. Dapp developers can therefore implement their own protocols on other EVM chains with ease – or fork the code of other dapps. Cardano developers do not have this same advantage. Therefore, infrastructure and dapps must be built from the ground up. The Cardano ecosystem could not be bootstrapped by the work of other ecosystems, but it is still building itself up.

General programming languages such as Rust, and in Cardano’s case Haskell, are seeing adoption based on their chains’ adoption. Many Web2 developers are uninterested in getting into crypto, especially in a bear market, so general-use languages haven’t offered much, if any, advantage over domain specific languages for attracting ecosystem developers. This may change in the next bull market, with more developers entering the industry and possibly wanting to use a familiar language.

According to DefiLlama, Haskell has ~0.1% of smart contract dominance, a figure that hasn’t changed through Q4. Leading EVM language Solidity has ~90% dominance. Those solidity contracts generally are not compatible with Cardano. Cardano’s accounting model, the extended unspent transaction output (eUTXO) model, is fundamentally different from the account-based models of many popular chains, such as Ethereum and Solana. Unfamiliarity among many Web3 developers, which are mostly accustomed to the EVM, poses a disadvantage of the eUTXO model, but this is not a permanent disadvantage.

Closing Summary

Cardano is growing in key areas such as dapp activity, NFT sales volume, and engaged stake. This growth shows a dedicated user base that has stuck around, despite declining financials such as market cap. Cardano’s DeFi is just now over a year old – a short time relative to other chains.

Cardano’s Basho era is ramping up and Voltaire era is kicking off with the various aforementioned innovations, improvements, and developments in scaling and governance. 2023 will see sidechains, L2s, and new ecosystem infrastructure, such as stablecoins, launch and adopt its first users.

This report was commissioned by Input Output Global, Inc. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization does not influence editorial decision or content. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research, and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.