In recent months, the NFT market has been a hot topic in the cryptocurrency world, with new marketplaces emerging and competition among them growing increasingly fierce. One such platform that has made waves in the industry is Blur, a four-month-old NFT marketplace that has surpassed the trading volume of former market leader OpenSea.

The data

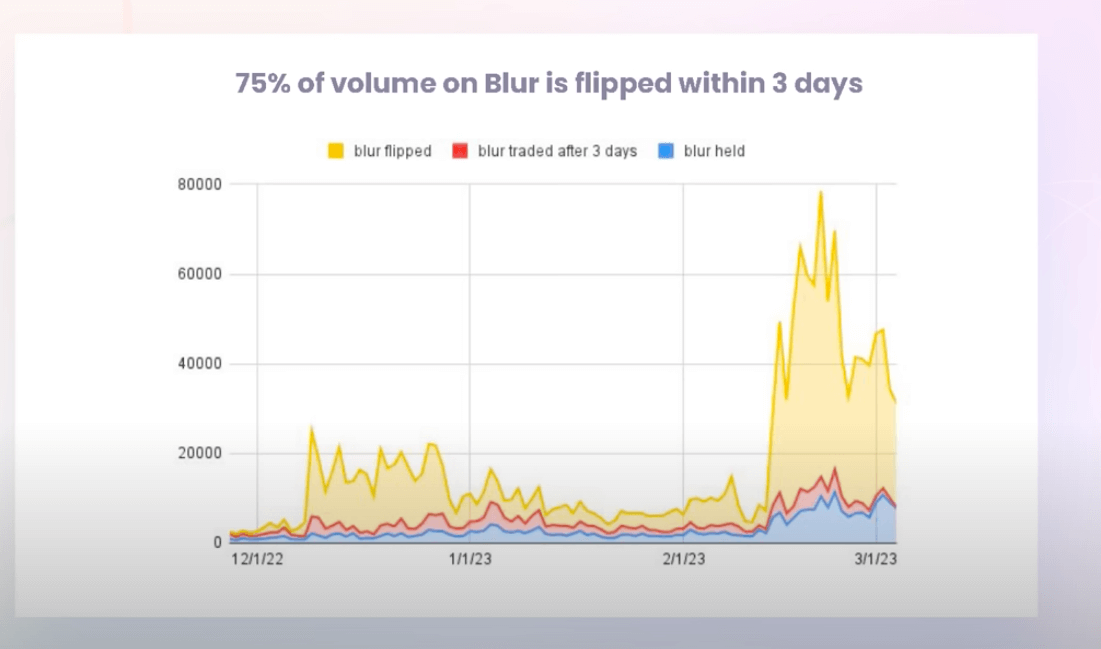

The NFT market has seen a surge in activity, with a particular uptick in the volume of NFT flips on the Blur platform.

However, there has also been a rise in the number of individuals buying and holding NFTs, represented by the blue area in the chart below comparing Blur and OpenSea.

While both platforms have experienced flat growth in this area, Blur’s trading community has contributed to a significant increase in volume, resulting in Blur surpassing OpenSea in trading volume.

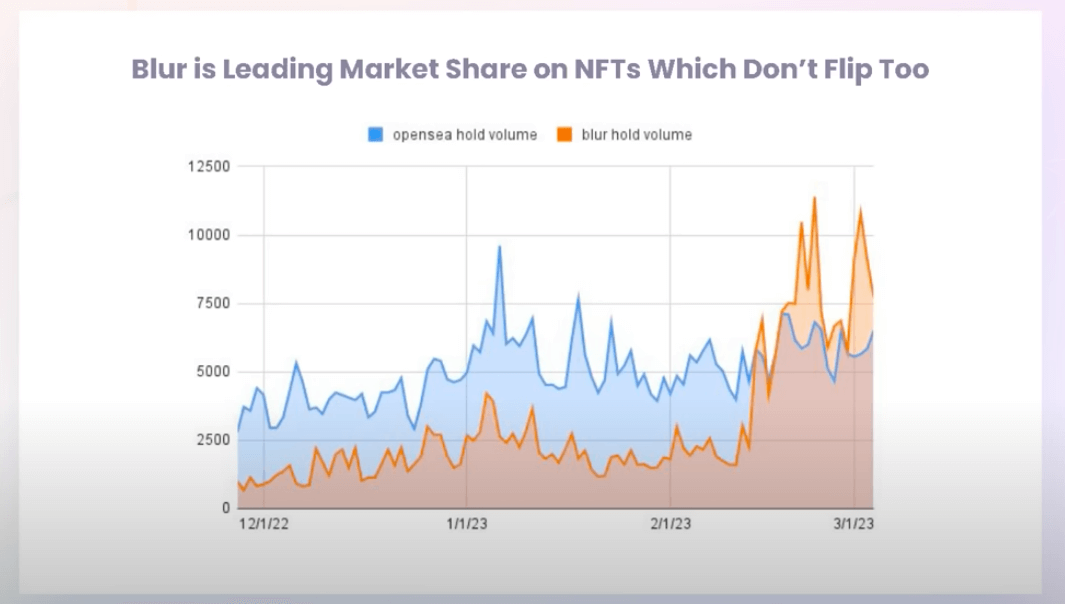

Notably, even long-term NFT holders are now contributing more volume on Blur compared to OpenSea, indicating a shift in the platform’s user base from primary flippers to more long-term investors.

However, Blur is also leading in market share on NFTs that are not immediately flipped.

What explains this?

In the last 30 days, Blur, which is only four months old, has achieved an impressive sales volume of $1.88 billion, as reported by Dapp Radar. In comparison, the former market leader, OpenSea, had volumes of $474.58 million. Blur’s triumph over OpenSea has made headlines, especially after a surge in activity following the launch of its native token on February 14th.

Blur has set itself apart as the go-to marketplace for professional traders with its polished interface, robust analytical tools, and swift trade execution capabilities. Additionally, Blur’s zero platform fees and optional royalties have made it a cost-effective option compared to its competitors, further solidifying its appeal to traders.

Despite its recent success, the journey for Blur to become the biggest NFT marketplace is far from over, and evaluating its current and future success is a complex matter.

NFT marketplaces are currently embroiled in fierce competition for customers, with companies lowering their fees and royalties to entice and keep users. This competition has resulted in the gradual weakening of royalty fees, a crucial revenue source for many NFT creators who feel abandoned by the marketplaces that once supported them. This “race to the bottom” is causing significant disruption to the entire NFT ecosystem.

Read more: Why we need more NFT royalties and better marketplaces

Is Blur’s volume real?

Blur has surpassed OpenSea in the overall value of sales made through its platform, but the data has sparked a debate about its true significance.

One factor contributing to Blur’s success is its rewards program, which awards points to traders for listing and bidding on NFTs. These points can be exchanged for BLUR tokens, with the number of tokens received based on the number of points accumulated.

Since there are no marketplace fees or royalties, the only obstacle preventing users from gaming the system and earning tokens by purchasing their own listings with a different wallet is the need to pay gas fees.

However, last month, CryptoSlam, a tracker of NFT sales data, claimed that this is precisely what was happening on Blur. In an email to its subscribers, CryptoSlam stated that only 1% of high-value traders were responsible for the bulk of trading activity on the platform.

As a result, CryptoSlam took action and removed hundreds of millions of dollars in Blur trades from its data, citing “market manipulation.” It has since implemented an updated algorithm that filters out “suspicious” sales.

During the period of February 14th to February 25th, CryptoSlam identified over $577 million in wash-traded NFTs on the platform.

According to CryptoSlam, sales data from Blur is “misrepresenting” the NFT market. The potentially artificial surge in sales has boosted the industry’s overall sales volume to its highest level since January 2022, leading some to believe that the market was rebounding after a significant drop in activity over the past year.

Data engineer Scott Hawkins from CryptoSlam stated in an interview with Forkast, “What we are finding is that this is artificially propping up sales volume in a very disingenuous way for the entire NFT market.”

In addition, OpenSea still has more users than Blur, with a user base that consists of a smaller group of more active traders. Blur has only 113,886 users in the last 30 days compared to OpenSea’s 294,146. Critics also claim that a small percentage of wallets on Blur are responsible for the majority of transactions.

The future of Blur

The specifics of how the BLUR token will be valued in the future are unclear, and it’s uncertain how it will gain value over time. Currently, BLUR operates as a governance token, but since Blur is a centralized entity, it will need to gradually cede control to token holders of a newly established DAO. This could be the reason why U.S. users were excluded from the airdrop, despite the fact that the token is available on major U.S. exchanges like Coinbase.

The Blur DAO will be responsible for governing important aspects of the platform, such as establishing the protocol’s value accrual and distribution. This could include determining the protocol fee rate (up to 2.5%) after 180 days and awarding treasury grants to develop the marketplace further. These choices will play a critical role in shaping the platform’s future growth and determining whether Blur can compete effectively in the marketplace both now and in the immediate future.

The post NFT market manipulation? CryptoSlam claims suspicious activity on Blur appeared first on CryptoSlate.